MicroStrategy and Coinbase’s stock prices could shoot up if short sellers bail out, according to a report by data analytics firm S3 Partners.

Coinbase Plans $1B Bond Sale That Avoids Hurting Stock Investors, Copying Michael Saylor’s Successful Bitcoin Playbook

The convertible notes Coinbase wants to sell include provisions aimed at aiding its stock investors.

Coinbase Upgraded to Neutral as Goldman Sachs Ends Bearish Stance

The bank lifted its rating on the stock after bitcoin hit record highs and the crypto exchange’s trading volume reached levels not seen since 2021.

Coinbase Custody Accounts For 90% Of All Bitcoin ETFs – Details

Coinbase Custody reportedly now holds over 90% of all Bitcoin ETFs in the United States. This development was revealed by the crypto exchange’s CEO, Brian Armstrong, while appraising the company’s performance in the fourth quarter (Q4) of 2023.

Coinbase Emerges As Major Player In Bitcoin ETF Market

In an X post on February 16, Brian Armstrong shared specific highlights of Coinbase’s achievement in Q4 2023. In particular, He noted that the American crypto exchange has played a crucial part in facilitating the adoption of cryptocurrencies by traditional financial firms (TradFi).

A major part of this adoption is the Bitcoin ETF market which is worth $37 billion, ranking as the second largest commodity ETF market after Gold. Armstrong noted that Coinbase has played a significant role in this development, serving as custodian for 90% of the investment funds in the Bitcoin ETF market.

A few thoughts on our Q4 Earnings yesterday:

2023 was a great year for Coinbase and we’re in a strong financial position. We cut costs by 45% y/y and shipped products faster with a leaner team driving $95 million of positive net income for 2023, $964 million in positive Adj.… pic.twitter.com/XK8f0EQBdP

— Brian Armstrong

(@brian_armstrong) February 16, 2024

For context, a custodian is a regulated financial institution that holds customers’ securities and assets, providing protection against any form of loss or theft. Notably, Coinbase is listed as the custodian for eight of the 11 recently launched Bitcoin spot ETFs. These include BlackRock’s IBIT, Ark Invest’s ARKB, Bitwise’s BITB, and Grayscale’s GBTC, among others.

These statistics indicate that Coinbase is well placed to record larger milestones as the top traditional financial institutions are tipped to finally invest in Bitcoin ETFs, especially upon the proven success and stability of the Bitcoin spot ETFs.

According to Armstrong, other notable Coinbase achievements in Q4 2024 include the launch of the exchange’s international wing, and the layer-2 blockchain solution Base. The crypto exchange also claimed to slash its annual costs by 45% while generating a total income of $3.1 billion.

Looking Forward To 2024

In retrospect to 2024, Armstrong stated that Coinbase will maintain focus on its international expansion and new derivatives products. In addition, they will aim to promote the adoption of crypto payments by transforming the Coinbase wallet into a super app.

Finally, the exchange CEO states that Coinbase will continue to advocate for a clear regulatory framework applicable to the crypto space. Armstrong says that Coinbase is committed to this course and is willing to explore all means, including legal processes as well as engaging the federal legislators.

COIN trading at $180.28 on the trading chart | Source: COIN chart on Tradingview.com

4 Surprising Insights From Coinbase’s Earnings, COIN Sees Bullish Surge

The foremost crypto exchange in the United States, Coinbase, released its earnings report on February 15th. As expected, there were major takeaways from the financial report, highlighting the crypto company’s performance in the fourth quarter of last year.

Coinbase’s Trading Volume Exceeds Expectations

Coinbase maximalist Coinbase Duck noted in an X (formerly Twitter) post how the crypto exchange defied expectations in the fourth quarter of 2023. Coinbase recorded $170.6 billion in spot trading volume, exceeding the estimated $168.

Specifically, a considerable influx of retail investors accounted for 18% of the total spot trading volume against the estimated 16% that the crypto exchange was projected to record. The return of these retail investors is believed to have been partly due to the resurgence that Bitcoin and the broader crypto market experienced towards the end of the year.

Meanwhile, consumer transaction revenue ($492.5 million) was way below the estimate of $570.9 million. However, Coinbase Duck noted that this wasn’t necessarily bad, as some investors started using advanced trading.

In a letter to its shareholders, the crypto exchange also revealed that some existing users traded significantly higher volumes, which could have necessitated the move to advanced trading.

Coinbase also recorded a total operating expense of $838 million, which happened to be below the projected estimate of $878 million. Specifically, the crypto exchange did a great job in its transaction expenses, recording an expense of $126 million compared to the estimate of $163 million.

However, the company’s sales and marketing expenses ($106 million) exceeded the estimate of $90 million. Coinbase revealed that this growth was “primarily driven by higher seasonal NBA spending, higher performance marketing spending due to strong market conditions, and increased USDC reward payouts due to growth in on-platform balances.”

Coinbase Had A Profitable Fourth Quarter

Coinbase recorded a net income of $273 million, beating the estimate of $104 million. Interestingly, going by figures from its Shareholder letter, the fourth quarter of 2023 was the only one in the year in which the crypto exchange didn’t record a loss for its net income. Meanwhile, the company also recorded its largest net revenue during that period.

Coinbase suggested that the excitement around the Spot Bitcoin ETFs and the expectations of more favorable market conditions in 2024 had contributed to its success in Q4 of 2023. Coinbase is a primary custodian for most Bitcoin ETFs, including BlackRock’s iShares Bitcoin Trust (IBIT).

Meanwhile, the crypto exchange earned $1.13 per share, beating the forecast of $0.43. This is without the crypto exchange accounting for the FASB change, which Coinbase Duck revealed could bring its earnings per Share (EPS) to $2.1.

Chart from Tradingview

Bitcoin ETFs Boosts Coinbase (COIN) Shares As JPMorgan Upgrades Rating

The recent Bitcoin rally, propelling its price to the $52,000 level, has positively impacted the stock of US-based cryptocurrency exchange Coinbase (COIN). After experiencing a notable dip to $115 at the start of February, Coinbase’s stock rose to $172 on Thursday, following a significant upgrade by a JPMorgan analyst.

Improved Prospects For Coinbase Amid Crypto Rally

According to a Bloomberg report, JPMorgan analyst Kenneth Worthington abandoned his bearish view on Coinbase weeks after downgrading the stock.

As Bitcoin traded higher, Coinbase shares gained as much as 7.8% following the upgrade. Worthington believes the exchange will likely benefit from the recent rally in digital asset prices, prompting him to shift his rating back to neutral.

This change in stance comes after Worthington’s January downgrade, where he predicted a potential deflation of enthusiasm for Bitcoin exchange-traded funds (ETFs).

However, contrary to his previous forecast, Bitcoin ETFs have been successful in terms of trading measures, and the price of Bitcoin has surged beyond $52,000, reaching its highest level since 2021. In a note to clients on Thursday, Worthington explained:

Given the acceleration in recent days of flows into Bitcoin ETFs and the significant price appreciation of Bitcoin and now Ethereum, we are returning to a Neutral rating on Coinbase as we see the higher cryptocurrency prices not only sustaining but improving activity levels and Coinbase’s earnings power as we look to 1Q24.

Coinbase’s stock experienced an 8% dip at the beginning of the year, following an impressive 400% surge in 2023. Analyst opinions on the stock remain divided, with buy, hold, and sell recommendations being roughly evenly split.

Worthington maintained his $80 price target on the stock ahead of the company’s earnings report, which is scheduled to be released after the market closes on Thursday.

Worthington emphasized that Coinbase’s business is closely tied to token prices, with its core revenue being transaction-based. As the value of tokens increases and trading activity gains momentum, fees based on the value traded are expected to drive higher trading volumes, ultimately contributing to improved revenue for Coinbase.

Bitcoin ETFs Witness Significant Trading Volume

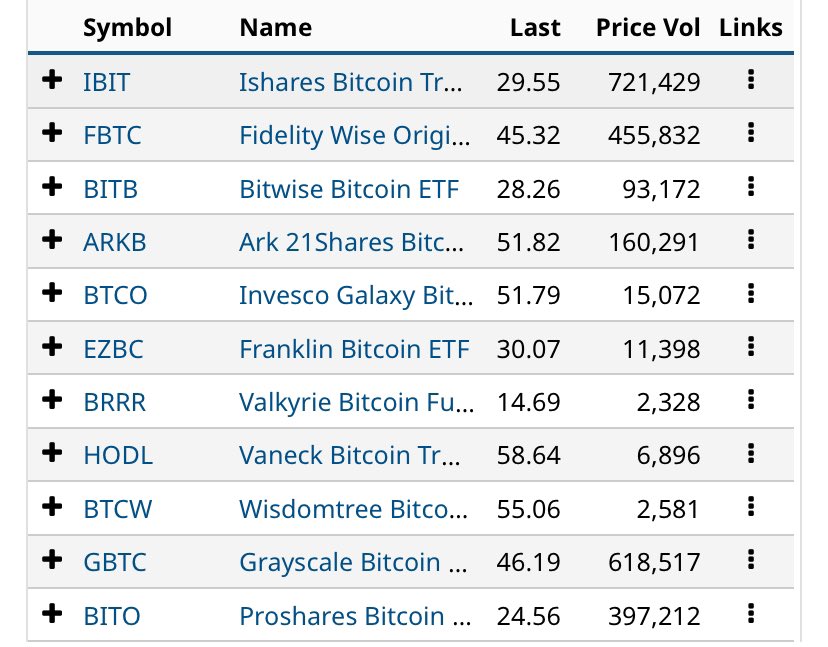

On February 14th, the trading volume of Bitcoin ETFs showcased notable figures, with Blackrock’s IBIT recording the lead with $721 million in volume.

Grayscale’s Bitcoin Trust (GBTC) followed closely with $619 million, while Fidelity’s FBTC secured the third spot with $456 million. On the other hand, Ark Invest accumulated a volume of $169 million.

The nine ETFs’ total trading volume amounted to approximately $1.5 billion. Notably, the largest ETFs experienced higher trading volume than the previous day, with IBIT surpassing $700 million and GBTC exceeding $600 million.

Intriguingly, before the trading session, GBTC sent less than half of the Bitcoin it sent to Coinbase the previous day. Despite this decrease, GBTC’s total trading volume was 50% higher.

As the demand for Bitcoin continues to surge, ETFs play a crucial role in facilitating institutional and retail investors’ participation in the cryptocurrency market. The increased trading volume of Bitcoin ETFs highlights investors’ growing interest and confidence in digital assets.

Currently, Bitcoin is trading at $51,900 and encountering a critical resistance level at $52,000.

Featured image from Shutterstock, chart from TradingView.com

Coinbase Upgraded by Oppenheimer as Crypto Exchange Is ‘Stronger Than Many People Realize’

Analyst Own Lau noted higher trading volume, the recent approval of the spot bitcoin ETFs, and a potential win in the company’s lawsuit against the SEC as the main drivers for the upgrade.

Coinbase Falls After JPMorgan Downgrades Stock to Underweight on Disappointing Bitcoin ETF Catalyst

The bitcoin ETF catalyst that pushed the ecosystem out of its crypto winter last year will disappoint investors in 2024, the report said.

Crypto Stocks, Bitcoin Miners Sell-Off as Profit-Taking Caps Explosive Year-End

Bitcoin slipped below $42,000 on Friday, stalling below its yearly high.

Coinbase co-founder Fred Ehrsam sells $13 million COIN shares as ARK continues to divest

Major Coinbase shareholders have sold over $14 million of stocks over the past 48 hours.

Coinbase co-founder Fred Ehrsam sells $13 million COIN shares as ARK continues to divest

Major Coinbase shareholders have sold over $14 million of stocks over the past 48 hours.

Coinbase co-founder Fred Ehrsam sells $13 million COIN shares as ARK continues to divest

Major Coinbase shareholders have sold over $14 million of stocks over the past 48 hours.

Coinbase Introduces New Features For Global Remittances

Coinbase, an American-based cryptocurrency exchange, has revealed its latest wallet features for transferring money internationally without going through the traditional hurdles.

Significance Of Coinbase New Transfer Features

On Tuesday, Coinbase announced its latest feature for its wallet to simplify and hasten global money transfers. The new feature is presented as a user-friendly procedure.

According to the crypto firm, the new initiative is described as “Send money with a link.” Within the Coinbase Wallet, users can generate a link to distribute via their favorite social media platforms.

However, the exchange noted that the wallet must be owned by both the receiver and the sender of the money. Furthermore, users who do not have the wallet, when emailed a link, will be prompted to download it from Apple or Android app stores.

The crypto company further asserted the safety of the new initiative. Coinbase noted that failure to retrieve sent funds within weeks will automatically send the money back to the sender. The company stated:

When your recipient clicks the shared link, it’ll take them into the Coinbase Wallet app to claim or direct them to download the Coinbase Wallet app on iOS or Android and create a new wallet in just 1-click. It’s that simple. And if the funds are not claimed within 2 weeks, they will automatically be returned to the sender.

Coinbase has highlighted several situations where this new feature is “very efficient and helpful.” These include paying off debts with friends, giving last-minute gifts, and tipping tour guides and other service providers.

In addition, the feature sparks a swift money-sending procedure. This eliminates downloading different apps or sorting through many usernames and profiles. Furthermore, the crypto firm asserted that the new feature is vital for people in high-inflation economies.

Latest Feature To Eliminate Payment Irregularities

The procedure eliminates the expenses and complications of using traditional methods to send money globally. Traditionally, sending money globally has required sifting through a complex web of bank account and routing details.

In addition, these transactions take longer to process, mostly up to five working days. However, the Coinbase wallet boasts instantaneous settlement and zero-fee transactions.

Coinbase wallet is supported by over 170 countries worldwide and is available in 20 languages. This guarantees the ability to send and receive money virtually anywhere.

Furthermore, it currently supports local fiat onramps from more than 130 countries. These include top payment processors like Pix in Brazil, Instant P2P Bank in Nigeria, and GCash in the Philippines.

Coinbase rolls out crypto transfers via links sent on WhatsApp, Telegram

Recipients need to download a Coinbase Wallet to receive the funds, but the crypto exchange says they’ve simplified the process for less tech-savvy users.

Coinbase rolls out crypto transfers via links sent on WhatsApp, Telegram

Recipients need to download a Coinbase Wallet to receive the funds, but the crypto exchange says they’ve simplified the process for less tech-savvy users.

Coinbase rolls out crypto transfers via links sent on WhatsApp, Telegram

Recipients need to download a Coinbase Wallet to receive the funds, but the crypto exchange says they’ve simplified the process for less tech-savvy users.

Coinbase (COIN) Up By 250% – Here’s Why It’s Outperforming BTC And ETH

The shares of Coinbase Global (COIN) have been on a tear in recent weeks, emphasizing its positive performance in 2023. While the recent resurgence experienced by the exchange’s shares coincides with the climate shift in the general cryptocurrency market, the latest price data reveals that COIN might actually be doing better than the market leaders, Bitcoin and Ethereum, since the turn of the year.

Here’s Why Coinbase (COIN) Is Up By 250% In 2023

A recent report by crypto intelligence platform IntoTheBlock has revealed that COIN is amongst the crypto-related stocks enjoying the overall positive trend in the cryptocurrency space. This positive momentum recently pushed the price of the Nasdaq-listed Coinbase stock to an 18-month high of around $115.

$COIN is up by approximately 250% this year, outpacing Bitcoin and Ether's growth of 130% and 75%, respectively. One key factor driving Coinbase's valuation is its trading volumes, with Q4 volumes already surpassing their figures for the last quarter with one month to go pic.twitter.com/71yl38jyeK

— IntoTheBlock (@intotheblock) December 1, 2023

According to data from IntoTheBlock, the COIN shares have surged in value by more than 60% in the past three months. A look at the broader price chart shows that the stock has increased by approximately 250% year-to-date (YTD), outperforming Bitcoin’s and Ether’s YTD upswing of 130% and 75%, respectively.

In their report, the crypto analytics firm highlighted that one of the crucial factors behind Coinbase’s increasing valuation is likely to be its trading volumes. Notably, the company’s trading volumes in the fourth quarter have already surpassed the figures recorded in the third quarter, even though there is still December to go in the current quarter.

Additionally, IntoTheBlock cited the recovering market cap of the USDC stablecoin as one of the potential factors driving Coinbase’s valuation. The continued adoption of Coinbase-incubated Ethereum layer 2 network Base was also mentioned as another possible reason behind the resurgent COIN price.

Meanwhile, Binance’s troubles in the United States have also somewhat benefited its biggest competitor, Coinbase. Last week, the world’s largest exchange admitted to being guilty of violating anti-money laundering policies in the US, leading to the payment of $4.3 billion in fines and the resignation of founder Changpeng (CZ) Zhao.

As of the close of trading on Friday, December 1, the price of COIN stood at $133.76, marking a 7.25% increase in a single day.

Bitcoin And Ethereum Price

According to CoinGecko data, the prices of Bitcoin and Ethereum currently stand at $38,744 and $2,090, respectively. Ether has not witnessed any significant changes in price over the past week, while Bitcoin swelled by more than 2.5% in the last seven days.

With market caps of $757 billion and $250 billion, Bitcoin and Ethereum continue to maintain their positions as the largest cryptocurrencies in the market.

South Korea’s Pension Fund Bought $20M Coinbase Shares in Q3, Made 40% Profit: Report

The fund snapped up COIN at an average price of $70.5 in the third quarter, achieving a 40% profit from investment.

Cathie Wood’s ARK Sells Grayscale Bitcoin Trust Holdings, Coinbase for Second Day

Cathie Wood’s fund is continuing to sell crypto-related stocks as the market hits a high not seen since early 2022.

Coinbase (COIN) And Bitcoin-Related Stocks Soar Following Grayscale’s Victory

Coinbase and other crypto-related companies witnessed a significant rise in stock prices following reports that Grayscale has emerged victorious in its lawsuit against the United States Securities and Exchange Commission (SEC).

On Tuesday, August 29, the US District of Columbia Court of Appeals ruled that the SEC did not provide a “consistent justification” for rejecting Grayscale’s request to convert its Bitcoin Trust (GBTC) into a spot exchange-traded fund (ETF). This decision brings the asset management firm closer to offering a spot Bitcoin ETF in the US.

The price of Bitcoin reacted positively to this development, breaking above and beyond the $26,000 mark. According to CoinGecko data, the premier cryptocurrency is currently valued at $27,136, reflecting a 3.8% price gain in the past week.

Coinbase (COIN) Rally 15% After Grayscale’s Win

The value of Coinbase’s stock COIN stood at $84.70 by the close of the trading session on Tuesday, representing a 15.2% increase from the day’s opening price.

The crypto company’s stock surged by nearly $13 per share, climbing from $73.5 per share to almost $86 during the day, according to Coinbase’s stock information. Coinbase, the largest cryptocurrency exchange in the United States, became publicly listed on Nasdaq in 2021.

This price jump is believed to have been triggered by the success of Grayscale’s appeal against the United States SEC, as mentioned above. While the court’s decision doesn’t automatically convert the asset manager’s Bitcoin Trust to a spot ETF, it is still perceived as a significant milestone in launching the financial product in the North American country.

If spot Bitcoin ETFs receive approval from the Securities and Exchange Commission, Coinbase could become one of the biggest winners due to its surveillance-sharing agreements with some applicants, including the world’s largest asset manager, Blackrock.

These arrangements aim to mitigate potential market manipulation risks – a concern raised by the SEC after the initial Bitcoin ETF submissions.

Marathon and Riot Witness Surge In Stocks Price

Coinbase was not the only cryptocurrency company that enjoyed the ripple effect of Grayscale’s legal triumph. Bitcoin mining companies, like Marathon Digital Holdings (MARA) and Riot Platforms (RIOT), also felt a positive impact on their stock prices.

Favorable judgments, such as the latest Grayscale victory, often boost the interest and optimism of investors in the cryptocurrency industry and crypto-related products. As a result, companies operating in the cryptocurrency space, including Bitcoin mining firms, are likely to receive increased attention from investors.

According to TradingView, the value of MARA soared by about 30% on Tuesday, closing at $13.69 per share by the end of the day’s trading session. Likewise, the RIOT price experienced an 18.2% rally, climbing from $10.39 per share to almost $12.3 at the end of the day.

As of this writing, the Marathon Digital Holdings stock is trading at $12.94 per share, reflecting a 5.2% decrease since the opening of Wednesday’s (30th of August) trading session. Meanwhile, Riot Platforms’ stock has currently declined by 4% to trade at $11.8 per share.