AERO, the native token of liquidity protocol Aerodrome Finance, jumped by 77% on Tuesday after it was selected by the Base Ecosystem Fund, which is led by CB Ventures.

Bitcoin Rally: Crypto Analyst Says New Peak Is Within Arms’ Reach

With the price movement of Bitcoin becoming less volatile and the markets becoming unstable once more, some people think a crash is imminent for BTC, while some believe and anticipate a potential for further upward surge.

New All-Time High For Bitcoin Is Within An Arms Reach

In a recent development on the social media platform X (formerly Twitter), Cryptocurrency analyst and investor, Crypto Jelle, has shared a bold prediction regarding Bitcoin – the leading crypto asset.

The crypto expert’s analysis came in light of the bearish speculations within the community around the price action of BTC. According to him, many people are discussing the bearish signs, pullbacks, and corrections that BTC could witness in the near future.

However, Crypto Jelle has asserted that despite the negative sentiments it “does not change anything about the bigger picture” for BTC. Furthermore, he has urged investors to “stick to the plan,” noting that a new all-time high is just “within arms reach.”

The post read:

Lots of people talking about bearish signs, pullbacks, and corrections, but these things change nothing about the bigger picture. Stick to the plan, all-time highs are within an arms reach.

Jelle has also highlighted another reason why he is bullish on Bitcoin and sticking with the digital asset. In another X post, Jelle stated that BTC is still holding above $50,000, with the entire crypto market cap approaching $2 trillion.

Nonetheless, the “average Joe still does not care,” prompting him to believe that “the cycle is not over” yet. He further pointed out that there will be lucid indications that retail is about to flood the market.

As a result of this, Bitcoin is set to witness higher adoption as search interest for BTC will surge higher. Jelle anticipates that during this time, American-based crypto exchange Coinbase will return to its top spot in the app store.

BTC Compared To Warren Buffett’s Berkshire Hathaway Stock

Lately, a lot of market experts have appeared to be bullish about Bitcoin. One of these is Max Keiser, a BTC advocate, who has compared the crypto asset to the well-known Warren Buffett’s Berkshire Hathaway Stock.

According to Max Keiser, acquiring BTC today is just like buying Berkshire Hathaway shares in its initial days. It is noteworthy that during its earlier days, the stocks were sold for $1,500 each, which is now being sold for $628,000. With this comparison, Keiser advocates that BTC could potentially rise by over 41,000% at its present price of $51,000.

This price of Bitcoin is down by over 2% in the past 7 days, currently trading at $51,147. CoinMarketCap’s data shows that its market cap is down by 0.86%, while its trading volume is up by over 6%.

Analyst: Bitcoin Has Never Been This Bullish, What’s Next?

While Bitcoin treads water around $50,000, with some predicting a slump, one analyst on X is swimming against the current, claiming the coin has “never been this bullish.” The coin is bullish despite cooling off from 2024 highs above $54,000.

Analyst: Bitcoin Is Bullish, Here’s Why

The analyst Mags argues that Bitcoin is, at spot rates, defying historical patterns and showing bullish signals, especially looking at the candlestick arrangements. Specifically, Bitcoin recently closed a weekly candle above the 0.618 Fibonacci level before the next halving event. Mags said this is the first time in the four-year cycle.

Therefore, though Bitcoin prices have been moving horizontally in the past few trading days, with fears of price slumps, the development in the weekly chart is overly bullish. Further bolstering their optimism, Mags points to the increasing demand for Bitcoin from institutional investors following the launch of spot Bitcoin exchange-traded funds (ETFs).

Wall Street heavyweights, including Fidelity, issue some of these products. BitMEX Research data shows that spot ETFs continue to siphon more and more coins from circulating supply, sending them to custodians, like Coinbase Custody, for safekeeping. These coins will likely be released in the coming years, not months.

Besides institutional interest, optimism for more price gains also stems from the absence of retail interest at spot rates. Data from Coinbase shows that unlike the spike in interest that drove Bitcoin to $70,000, mainly at the back of retailers, BTC prices are up, but the dynamics are changing.

Will Retailers Take BTC To New Levels?

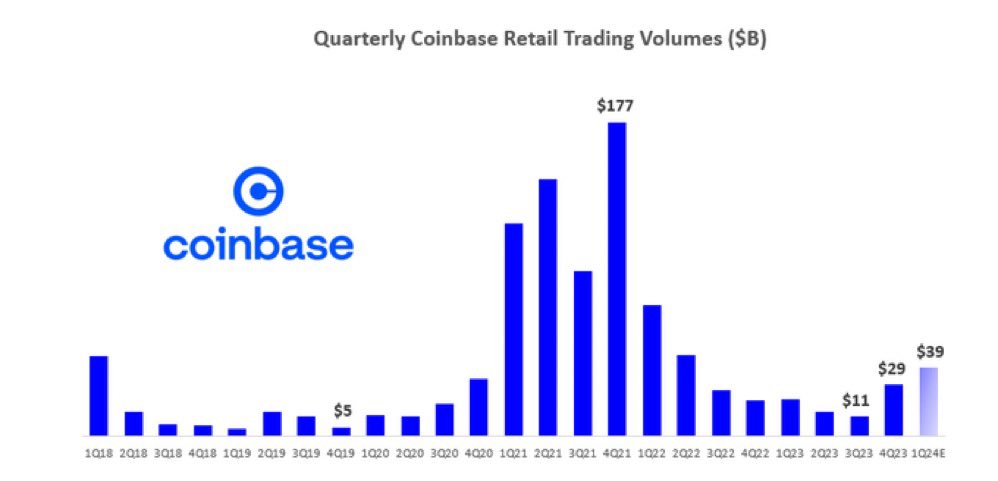

Solid data reveals that retailers are mostly not interested in the coin at spot rates, looking at the amount retailers have been spending on the coin. By Q4 2021, retailers acquiring Bitcoin via Coinbase spent roughly $177 billion. However, this figure sharply fell throughout 2022 during the bear market, finding support in H2 2023.

Then, according to exchange data shared by Will Clemente on X, retailers began loading the coin from Q3 2023. The figure has risen to around $39 billion in Q1 2024–less than 25% of Q4 2021 volumes.

How retailers will impact the price of Bitcoin in the future is yet to be seen. In the past, retail fear of missing out (FOMO) has been a critical price driver. Presently, CoinStats sentiment tracker, Fear & Greed indicator, stands at 74, at “greed” territory, down from “extreme greed” on February 22.

This reduction could be possible because of the fake breakout that lifted Bitcoin above $53,000. The coin has support at $50,500 but generally remains in a bullish pattern.

Coinbase Pushes Back on Reports It’s Blocked in Nigeria

Multiple outlets have reported other platforms such as Kraken and Binance have also been blocked under government orders.

Where Coinbase Canada Goes, so Does the World

Canada, quicker to adopt ETFs than the U.S., may offer a signal to where the U.S. goes next.

Bitcoin Bulls Persists: Analyst Identifies Trend As Catalyst To $60,000

As the entire cryptocurrency market is currently experiencing a notable upward trajectory, several market analysts are anticipating more gains for Bitcoin, the leading cryptocurrency asset, as they predict the token’s price to go even higher.

Historical Trend That Will Send Bitcoin To $60,000

Crypto Jelle, a cryptocurrency analyst and investor, has expressed his optimism toward Bitcoin’s price action. Jelle recently shared a positive prediction for BTC in the near future on the social media platform X (formerly Twitter).

The expert’s projections delve into the present price movement of Bitcoin and its potential to increase even further. He highlighted a trend which serves as a catalyst for a price increase.

Jelle’s X post was accompanied by a chart that shows that the crypto asset has formed a “Bullish Megaphone” pattern. According to him, this is “yet another bullish megaphone pattern,” suggesting the price will go higher, putting his price target at $60,000. If Bitcoin manages to maintain its current momentum amid the crypto market’s rally, it is possible that BTC’s price might reach $60,000.

In another X post, Jelle also pointed out that the token is presently in an area in which it normally sees the best gains. Jelle revealed that the BTC always experiences the best return when its “weekly Relative Strength Index (RSI) is above 70.” Due to this, he has urged his thousands of followers to invest significantly in the token to position themselves for more gains.

BTC finished the previous week on a bullish note, staying put above the $52,000 threshold in the face of strong opposition. This simply suggests a strong faith and dependency on the digital asset from investors.

After going past the $52,000 level, it set a new weekly culmination record spanning two years. Because of Bitcoin’s tenacity and upward movement, investors and market watchers are anticipating what lies ahead.

Massive Whale Moves Amid Price Rally

In light of BTC’s rally, Whale Alert has reported massive whale transactions carried out hours ago. Whale Alert revealed that around 18,484 BTC valued at about $962 million were taken out of the decentralized exchange Coinbase.

The on-chain tracker reported that the aforementioned withdrawals were carried out in two distinct transactions. Whale Alert noted that the first transaction saw 9,322 BTC worth approximately $485 million being withdrawn from Coinbase.

Meanwhile, the second transaction witnessed 9,162 BTC valued at about $476 million being extracted from the same exchange. Both wallet addresses involved in the withdrawal appear to be new ones, as they had no previous transaction history.

As of the time of writing, Bitcoin was trading at $52,336, indicating an increase of over 9% in the past 7 days. Despite the price rise, its trading volume appears to be down by over 10% in the past 24 hours.

Cathie Wood’s ARK Offloads $90M Coinbase Shares Amid Slew of Analyst Upgrades

ARK offloaded Coinbase shares from ARK Innovation ETF, ARK Next Generation Internet ETF, and ARK Fintech Innovation ETF.

Coinbase Custody Accounts For 90% Of All Bitcoin ETFs – Details

Coinbase Custody reportedly now holds over 90% of all Bitcoin ETFs in the United States. This development was revealed by the crypto exchange’s CEO, Brian Armstrong, while appraising the company’s performance in the fourth quarter (Q4) of 2023.

Coinbase Emerges As Major Player In Bitcoin ETF Market

In an X post on February 16, Brian Armstrong shared specific highlights of Coinbase’s achievement in Q4 2023. In particular, He noted that the American crypto exchange has played a crucial part in facilitating the adoption of cryptocurrencies by traditional financial firms (TradFi).

A major part of this adoption is the Bitcoin ETF market which is worth $37 billion, ranking as the second largest commodity ETF market after Gold. Armstrong noted that Coinbase has played a significant role in this development, serving as custodian for 90% of the investment funds in the Bitcoin ETF market.

A few thoughts on our Q4 Earnings yesterday:

2023 was a great year for Coinbase and we’re in a strong financial position. We cut costs by 45% y/y and shipped products faster with a leaner team driving $95 million of positive net income for 2023, $964 million in positive Adj.… pic.twitter.com/XK8f0EQBdP

— Brian Armstrong

(@brian_armstrong) February 16, 2024

For context, a custodian is a regulated financial institution that holds customers’ securities and assets, providing protection against any form of loss or theft. Notably, Coinbase is listed as the custodian for eight of the 11 recently launched Bitcoin spot ETFs. These include BlackRock’s IBIT, Ark Invest’s ARKB, Bitwise’s BITB, and Grayscale’s GBTC, among others.

These statistics indicate that Coinbase is well placed to record larger milestones as the top traditional financial institutions are tipped to finally invest in Bitcoin ETFs, especially upon the proven success and stability of the Bitcoin spot ETFs.

According to Armstrong, other notable Coinbase achievements in Q4 2024 include the launch of the exchange’s international wing, and the layer-2 blockchain solution Base. The crypto exchange also claimed to slash its annual costs by 45% while generating a total income of $3.1 billion.

Looking Forward To 2024

In retrospect to 2024, Armstrong stated that Coinbase will maintain focus on its international expansion and new derivatives products. In addition, they will aim to promote the adoption of crypto payments by transforming the Coinbase wallet into a super app.

Finally, the exchange CEO states that Coinbase will continue to advocate for a clear regulatory framework applicable to the crypto space. Armstrong says that Coinbase is committed to this course and is willing to explore all means, including legal processes as well as engaging the federal legislators.

COIN trading at $180.28 on the trading chart | Source: COIN chart on Tradingview.com

JPMorgan Analyst Criticizes Coinbase’s Lack of Insights Into Its ETF Business

Coinbase reported strong fourth-quarter earnings on Thursday, partly driven by the launch of the ten spot bitcoin exchange-traded funds (ETFs).

4 Surprising Insights From Coinbase’s Earnings, COIN Sees Bullish Surge

The foremost crypto exchange in the United States, Coinbase, released its earnings report on February 15th. As expected, there were major takeaways from the financial report, highlighting the crypto company’s performance in the fourth quarter of last year.

Coinbase’s Trading Volume Exceeds Expectations

Coinbase maximalist Coinbase Duck noted in an X (formerly Twitter) post how the crypto exchange defied expectations in the fourth quarter of 2023. Coinbase recorded $170.6 billion in spot trading volume, exceeding the estimated $168.

Specifically, a considerable influx of retail investors accounted for 18% of the total spot trading volume against the estimated 16% that the crypto exchange was projected to record. The return of these retail investors is believed to have been partly due to the resurgence that Bitcoin and the broader crypto market experienced towards the end of the year.

Meanwhile, consumer transaction revenue ($492.5 million) was way below the estimate of $570.9 million. However, Coinbase Duck noted that this wasn’t necessarily bad, as some investors started using advanced trading.

In a letter to its shareholders, the crypto exchange also revealed that some existing users traded significantly higher volumes, which could have necessitated the move to advanced trading.

Coinbase also recorded a total operating expense of $838 million, which happened to be below the projected estimate of $878 million. Specifically, the crypto exchange did a great job in its transaction expenses, recording an expense of $126 million compared to the estimate of $163 million.

However, the company’s sales and marketing expenses ($106 million) exceeded the estimate of $90 million. Coinbase revealed that this growth was “primarily driven by higher seasonal NBA spending, higher performance marketing spending due to strong market conditions, and increased USDC reward payouts due to growth in on-platform balances.”

Coinbase Had A Profitable Fourth Quarter

Coinbase recorded a net income of $273 million, beating the estimate of $104 million. Interestingly, going by figures from its Shareholder letter, the fourth quarter of 2023 was the only one in the year in which the crypto exchange didn’t record a loss for its net income. Meanwhile, the company also recorded its largest net revenue during that period.

Coinbase suggested that the excitement around the Spot Bitcoin ETFs and the expectations of more favorable market conditions in 2024 had contributed to its success in Q4 of 2023. Coinbase is a primary custodian for most Bitcoin ETFs, including BlackRock’s iShares Bitcoin Trust (IBIT).

Meanwhile, the crypto exchange earned $1.13 per share, beating the forecast of $0.43. This is without the crypto exchange accounting for the FASB change, which Coinbase Duck revealed could bring its earnings per Share (EPS) to $2.1.

Chart from Tradingview

Coinbase Analysts Turn More Bullish on Crypto Exchange After Earnings Beat; Shares Climb

Higher crypto prices will have a positive effect on the exchange’s revenue, the analysts said.

Bitcoin ETFs Boosts Coinbase (COIN) Shares As JPMorgan Upgrades Rating

The recent Bitcoin rally, propelling its price to the $52,000 level, has positively impacted the stock of US-based cryptocurrency exchange Coinbase (COIN). After experiencing a notable dip to $115 at the start of February, Coinbase’s stock rose to $172 on Thursday, following a significant upgrade by a JPMorgan analyst.

Improved Prospects For Coinbase Amid Crypto Rally

According to a Bloomberg report, JPMorgan analyst Kenneth Worthington abandoned his bearish view on Coinbase weeks after downgrading the stock.

As Bitcoin traded higher, Coinbase shares gained as much as 7.8% following the upgrade. Worthington believes the exchange will likely benefit from the recent rally in digital asset prices, prompting him to shift his rating back to neutral.

This change in stance comes after Worthington’s January downgrade, where he predicted a potential deflation of enthusiasm for Bitcoin exchange-traded funds (ETFs).

However, contrary to his previous forecast, Bitcoin ETFs have been successful in terms of trading measures, and the price of Bitcoin has surged beyond $52,000, reaching its highest level since 2021. In a note to clients on Thursday, Worthington explained:

Given the acceleration in recent days of flows into Bitcoin ETFs and the significant price appreciation of Bitcoin and now Ethereum, we are returning to a Neutral rating on Coinbase as we see the higher cryptocurrency prices not only sustaining but improving activity levels and Coinbase’s earnings power as we look to 1Q24.

Coinbase’s stock experienced an 8% dip at the beginning of the year, following an impressive 400% surge in 2023. Analyst opinions on the stock remain divided, with buy, hold, and sell recommendations being roughly evenly split.

Worthington maintained his $80 price target on the stock ahead of the company’s earnings report, which is scheduled to be released after the market closes on Thursday.

Worthington emphasized that Coinbase’s business is closely tied to token prices, with its core revenue being transaction-based. As the value of tokens increases and trading activity gains momentum, fees based on the value traded are expected to drive higher trading volumes, ultimately contributing to improved revenue for Coinbase.

Bitcoin ETFs Witness Significant Trading Volume

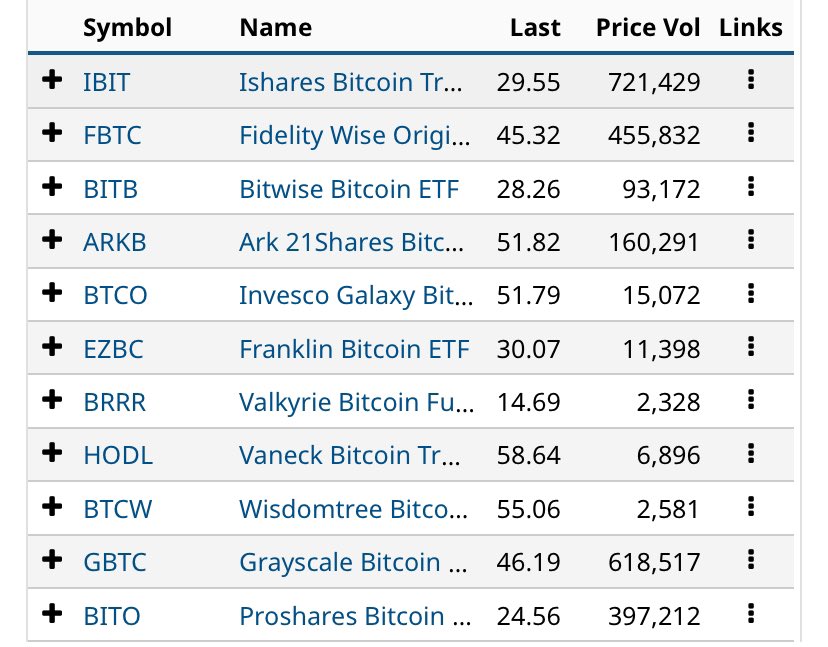

On February 14th, the trading volume of Bitcoin ETFs showcased notable figures, with Blackrock’s IBIT recording the lead with $721 million in volume.

Grayscale’s Bitcoin Trust (GBTC) followed closely with $619 million, while Fidelity’s FBTC secured the third spot with $456 million. On the other hand, Ark Invest accumulated a volume of $169 million.

The nine ETFs’ total trading volume amounted to approximately $1.5 billion. Notably, the largest ETFs experienced higher trading volume than the previous day, with IBIT surpassing $700 million and GBTC exceeding $600 million.

Intriguingly, before the trading session, GBTC sent less than half of the Bitcoin it sent to Coinbase the previous day. Despite this decrease, GBTC’s total trading volume was 50% higher.

As the demand for Bitcoin continues to surge, ETFs play a crucial role in facilitating institutional and retail investors’ participation in the cryptocurrency market. The increased trading volume of Bitcoin ETFs highlights investors’ growing interest and confidence in digital assets.

Currently, Bitcoin is trading at $51,900 and encountering a critical resistance level at $52,000.

Featured image from Shutterstock, chart from TradingView.com

Coinbase Shares Surge After Beating Fourth-Quarter Profit Estimates

US Banks Rally For Updated Crypto Guidelines As Digital Asset Prices Surge

Amidst a significant surge in cryptocurrency prices, which propelled the total crypto market capitalization to a high of $1.93 trillion on Thursday, influential interest groups are urging the US Securities and Exchange Commission (SEC) to revise accounting guidance that imposes higher costs on US banks for holding digital assets on behalf of their customers.

Banking Trade Groups Urge SEC To Revise Crypto Accounting Rules

According to a Bloomberg report, a coalition of trade groups, including the Bank Policy Institute, the American Bankers Association, the Securities Industry and Financial Markets Association, and the Financial Services Forum, sent a letter to the SEC on Wednesday outlining their desired changes.

The existing guidance requires public companies, including banks, to treat cryptocurrencies they hold in custody as liabilities on their corporate balance sheets. Consequently, banks must allocate assets of a similar value to comply with capital requirements and protect against potential losses.

According to Bloomberg, the trade groups have requested the SEC to consider the following key changes:

- Exclude certain assets from being classified under the broad crypto umbrella. This includes traditional assets recorded or transferred using blockchain networks, such as tokenized deposits, as well as tokens underlying SEC-approved products like spot Bitcoin exchange-traded funds (ETFs).

- Grant regulated lenders an exemption from the current balance sheet requirement while maintaining the disclosure of crypto activities in financial statements.

The trade groups argued that if regulated banking organizations are unable to provide digital asset-safeguarding services at scale, it would negatively impact investors, customers, and the broader financial system.

However, the SEC has defended its accounting guidance, citing the “unique risks” and uncertainties posed by cryptocurrencies compared to other assets held by banks.

Limiting Custody Expansion?

The specific guidance in question, known as Staff Accounting Bulletin No. 121, has faced criticism from banks since its publication in 2022.

Lenders argue that the bulletin limits their ability to expand digital asset services for customers due to the associated high costs. Consequently, banks missed out on providing custody services for recently approved Bitcoin exchange-traded funds, with Coinbase emerging as the preferred custodian for the majority of ETF issuers.

The trade groups also highlighted additional challenges resulting from the guidance, including a “chilling effect” on plans to utilize blockchain technology for traditional assets. While the SEC described SAB 121 as non-binding staff guidance, it acknowledged that following it enhances disclosure to investors regarding firms safeguarding crypto assets for others.

As the SEC faces mounting pressure, there have been efforts by lawmakers to repeal the guidance. A resolution was introduced in the House Financial Services Committee, spearheaded by Representatives Mike Flood and Wiley Nickel, while Senator Cynthia Lummis sponsored identical legislation in the Senate. These measures aim to remove the SEC’s authority in making rules that impact bank custody.

The outcome remains uncertain, as the legislation’s success depends on garnering sufficient support, particularly among Democrats and within the White House.

However, the collective efforts of trade groups, lawmakers, and industry stakeholders could potentially lead to regulatory changes that alleviate the burden on banks holding digital assets, facilitating their participation in the evolving cryptocurrency landscape.

Furthermore, the recent endeavors undertaken by US institutions exemplify a growing interest and eagerness to adopt and invest in cryptocurrencies, particularly Bitcoin.

This heightened institutional involvement has significantly contributed to the swift success of Bitcoin spot ETFs, which gained regulatory approval merely a month ago.

Featured image from Shutterstock, chart from TradingView.com

Bitcoin’s Rise to $52K Is Driven by Strong U.S. Demand, the Coinbase Price Premium Suggests

Massive inflows into spot bitcoin ETFs made headlines recently, but there are other metrics that showcase U.S. investors’ appetite for the asset.

Coinbase Upgraded to Neutral Ahead of Earnings at JPMorgan as Shares Surge

The bank lifted its rating on Coinbase stock to reflect rising crypto prices following the approval of spot bitcoin ETFs in the U.S.

Cathie Wood’s ARK Invest Sells Coinbase Shares for First Time in a Month

ARK sold $34.3 million of shares in the crypto exchange, which is due to report earnings after the U.S. market closes.

Coinbase Suspends PlayDapp Trading After Hack, PLA Price Reacts

Coinbase has temporarily suspended the gaming platform PlayDapp’s token trading and transfer activities after the recent hack that resulted in the theft of 200 million PLA tokens. Recent updates from the Web3 platform have shared some insight into the investigation process.

Suspension Of Trading Activity On Coinbase

On Thursday, the news of the hack was first informed by the security platform Cyvers Alerts on X (formerly Twitter). PlayDapp’s team later confirmed the security breach and immediately contacted partnered exchanges to take measures to protect the holder’s assets.

The gaming platform contacted major centralized exchanges (CEXs) to request deposit and withdrawal suspensions due to the hacking incident and promptly reported to the authorities about the case.

On Monday, the team shared an urgent notice post detailing the state of the investigation and the temporary measures it would take to minimize the hack’s impact on PLA holders.

Following this request, Coinbase announced the suspension of PLA’s trading and transfers across their website, Coinbase Prime, Advanced Trade, and Coinbase Exchange. The exchange expressed its intention to continue monitoring the developments from PlayDapp before giving new updates to customers.

We will continue to monitor developments related to PLA from the issuer and update our customers as more information becomes available.

Learn more: https://t.co/PoDxz71eAp

— Coinbase Assets

(@CoinbaseAssets) February 14, 2024

In the notice post, the team informed of its current collaboration with exchanges, blockchain intelligence, security firms, and law enforcement agencies to investigate and resolve the issue further. It has now extended its petition to temporarily pause all liquidity and pool activities related to PLA to decentralized exchanges (DEXs).

According to the circular, decentralized exchanges (DEXs) have hindered the hacker’s attempts at dispersing the stolen tokens.

Migration Process And Price Reaction

PlayDapp tried to negotiate with the hacker to retrieve the stolen funds. However, the attempts failed as the hacker “showed no willingness to help recover holders’ losses,” which resulted in an additional attack that led to the issuance of an additional 1.59 billion PLA tokens.

Subsequently, the team continues investigating the hacker’s intrusion methods to prevent further attacks, and they’re currently tracking the minted and swapped tokens by the hacker. Due to this, PLA Holder’s assistance has been requested, asking users for “the halt of transactions because we will conduct a migration based on the snapshot shortly.”

The platform has been discussing with exchanges to assess the best migration solution. The most recent update further details the attack’s damages and the coming migration process:

We are estimating the scale of damage for the initially minted 200 million tokens, while it’s confirmed that there is minimal damage from the secondary minting of 1.59 billion tokens. Currently, the transactions associated with the hacker are being tracked by security firms, so most of the invalidly minted tokens will be filtered out during the migration process.

Loss of ownership over the token smart contract opens the possibility for further attacks on PLA tokens.

As the update explains, PDA is an upgraded version of the new token. It introduces multi-signature implementation, snapshot, pause, and burn authority separation for management while removing minting authority for stability.

PDA will also introduce a DAO voting system, and it can only be swapped at a 1:1 ratio using wallets not associated with the hacker.

PlayDapp will coordinate with CEXes to reimburse PDA to PLA-holding users during the migration. Affected users will be reimbursed using the “current user balance holdings as per the snapshot timing” and receive the full token holdings at a 1:1 ratio. The team will announce the snapshot time in a future update.

According to CoinMarketCap data, the PLA price dropped from $0.1823 to $0.1498 after the attack. Since then, the token price has hovered around $0.14-$0.16.

The price dropped to $0.1383 after the Coinbase announcement, a 13.35% drop in the last seven days. PLA’s daily trading volume at writing time is $5,786,268, representing a 23.4% decrease in the previous 24 hours.

However, after the most recent migration plan update, PLA’s price surged 1.2% in the last hour and 3.7% in the previous 24 hours, as the token trades at $0.1524, perhaps signaling a change in holder sentiment after the recent development.

Tiger Global Exited Coinbase Stake Late Last Year, Filing Shows

Tiger sold 38,850 shares during the fourth quarter.

Coinbase to Report Strong Earnings, ETF Benefits May Surprise Wall Street, Analysts Say

Coinbase is expected to report strong revenue numbers, given an uptick in crypto trading volume towards the end of 2023.