Singapore-based digital asset trading platform Crypto.com has received a preparatory license from Dubai’s Virtual Digital Assets regulator.

Crypto.com Struggles to Maintain Fiat On-Ramps in the Face of Crypto Banking Crisis

The exchange’s current banking partner is only accessible to users based in the European Economic Area (EEA).

Protocol Labs, Chainalysis and Bittrex add to crypto layoff season

Crypto execs suggested that the “extremely challenging” times forced them to cut jobs in order to “weather this extended” crypto winter.

UK’s FCA hints at why its given only 15% of crypto firms the regulatory nod

The UK financial watchdog has received 300 crypto firm registration applications but has approved only 41 applicants.

Crypto.com Decides To Let Go 20% Of Its Current Workforce

The crypto industry continues to stagger under a massive wave of layoffs that have been occurring in recent times. Among the recent companies from the sector, Crypto.com has planned on axing 20% of its workforce.

The Singapore-based company, Crypto.com, has confirmed its decision via a blog post. According to Co-Founder and CEO Kris Marszalek, the platform must let go of 20% of its current employees.

Crypto.com has faced significant criticism after attempting to reassure investors that the crypto exchange is in good financial health and has nothing to worry about.

The reason for the layoffs is the current economic headwinds and industry situation. This will be the second major layoff carried out by the company. Crypto.com laid off nearly 260 employees in 2022, accounting for nearly 5% of its workforce.

Crypto.com CEO Kris Marszalek stated:

We grew ambitiously at the start of 2022, building on our incredible momentum and aligning with the trajectory of the broader industry. That trajectory changed rapidly with a confluence of negative economic developments.

The exchange platform has not specifically mentioned the positions that were laid off. The decision to fire employees has been attributed to broader market weakness and the FTX crash. The crash caused a misappropriation of customer funds and eventually bankruptcy, which has gone on to affect the industry considerably.

Crypto.com Says That It Continues To Perform Well

Kriz Marszalek had initially mentioned that the exchange platform maintained adequate reserves for every single coin which the platform held. Two months after that statement, the exchange could not withstand the collapse of FTX without adopting measures to cut costs.

Marszalek quoted:

Today we made the difficult decision to reduce our global workforce by approximately 20 per cent. All impacted personnel have already been notified. These reductions were in no way related to performance, and we extend our deepest gratitude for all their contributions to Crypto.com.

He additionally stated:

Several factors played into our decision to reduce headcount. While we continue to perform well, growing to more than 70 million users worldwide and maintaining a strong balance sheet, we’ve had to navigate ongoing economic headwinds and unforeseeable industry events.

Crypto.com Admits To Not Navigating Well After FTX Crash

The Founder of Crypto.com has mentioned that even though Crypto.com was doing well, there has been a change in trajectory with a ‘confluence’ of negative economic developments.

He spoke about the layoffs in July last year as the exchange could not navigate the macroeconomic downturn. It also could not gauge the damage the FTX collapse would have caused to the industry.

The fall of FTX has been terrible for investors’ sentiments. The exchange now wants to focus on making prudent financial decisions to manage the company better, and layoffs are among such necessary measures.

The exchange states that these additional reductions were mandatory to ensure that the company’s position remains profitable in the long term. At the moment, Crypto.com has 2,450 employees, and a 20 percent layoff from that population will mean that close to 490 employees lose their jobs.

Crypto.com CEO announces 20% staff cut, ‘did not account’ for FTX collapse

“While we continue to perform well, growing to more than 70 million users worldwide and maintaining a strong balance sheet, we’ve had to navigate ongoing economic headwinds and unforeseeable industry events. “

Crypto.com delists USDT for Canadian users following OSC ban

Registered cryptocurrency exchanges in Ontario, Canada cannot list USDT due to regulatory prohibition.

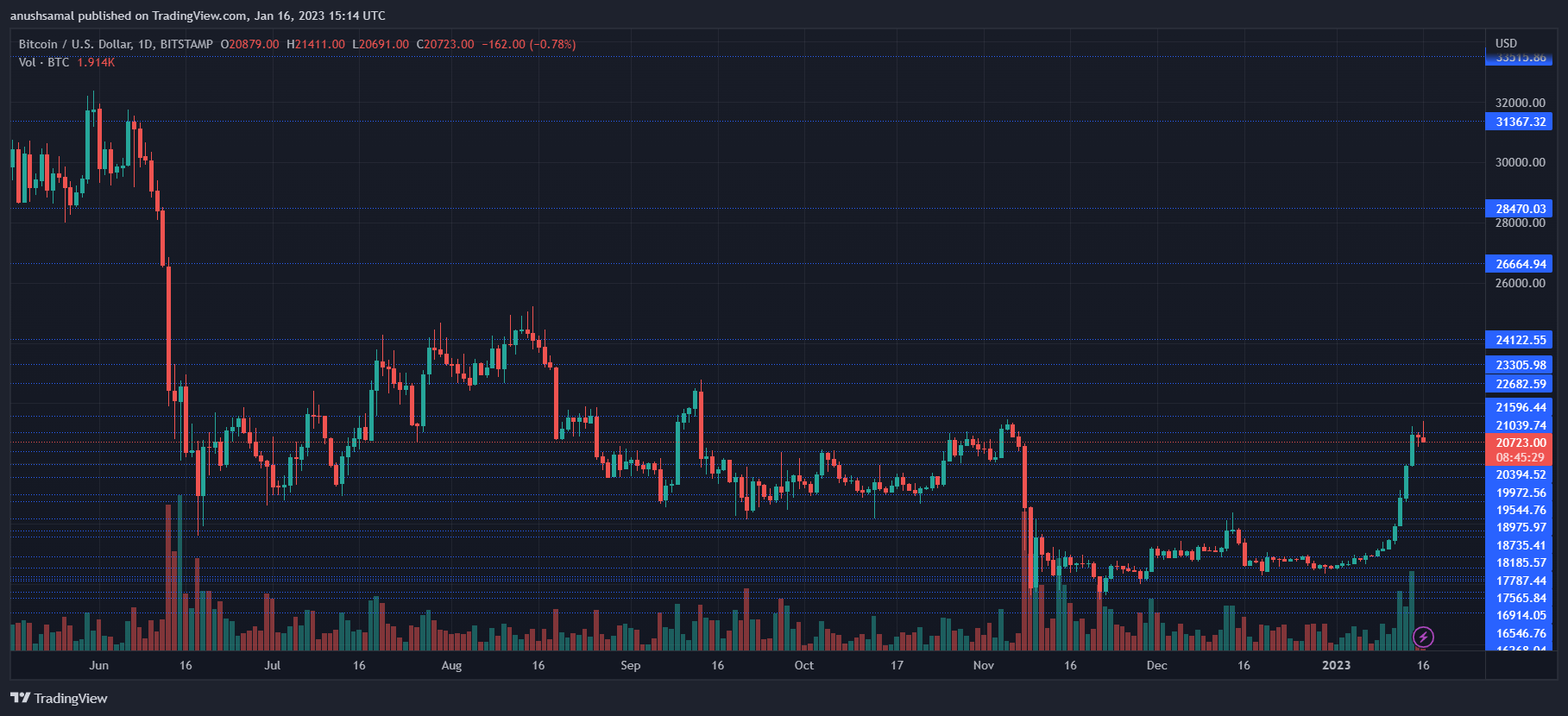

Cronos (CRO) Up 4% In Last Week Amid Recession Fears

Crypto.com is one of the centralized exchanges that survived the market tribulations of 2022. Recent analysis done by CryptoCompare shows that the CEX had an average market share of 4.6% last year. Its native token Cronos, despite the challenges, was able to withstand the beating.

Although this is incredibly small compared to the big shots of the market, its mere survival could mean big things for its growth.

CRO And Macroeconomic Trends

The crypto market saw its value drop sharply as the bear market gripped the broader financial market. With major crypto institutions collapsing and the crypto market learning the mistakes of the 2008 financial crash, the industry is ready for a new start this year.

The Federal Open Market Committee (FOMC) Meeting Minutes that kicked off yesterday certainly had an effect on Cronos (CRO) as a whole. After dropping in price in the past days, the minutes gave new hope to investors as Cronos traded at $0.0597 and gained 2.4% in the past 24 hours.

Major cryptocurrencies like Bitcoin and Ethereum also rose after news of a seemingly dovish macroeconomic stance by the U.S. Federal Reserve.

This dovish stance can be a sign that the consumer price index (CPI) might be lower than that of November’s. A strong sign that the previous year’s interest hikes have a strong effect on managing the inflation problem. However, it remains to be seen whether it did lower or not.

Investors Should Watch This Level…

Good macros aside, the central bank is still hawkish on the acceptance of crypto on the financial system. But with that said, the crypto market and the traditional financial space are increasingly intertwined with one another and with the International Monetary Fund pushing for regulation.

Although the markets should anticipate the introduction of legislation, CRO investors should still focus on the macro trends that will have an effect on the market right now. Next week, the Fed is expected to release the CPI data that would have an effect on the markets.

Meanwhile, investors and traders should watch a breakthrough on the current CRO resistance at $0.0607 which would be a bullish indicator of things to come.

But with the CPI data incoming, holding off any major decision could be the wisest choice to do.

Monitoring how Bitcoin and Ethereum move will also be crucial. Even though Cronos correlation is low right now, major market movements made by these two top cryptos would determine where the entire cryptocurrency market might go.

However, with the fears of a recession gripping the markets, gains higher than $0.0638 might be impossible for Cronos as investor sentiment is dampened.

As the situation unfolds, investors and traders will have an answer as to what to do with their Cronos holdings.

Crypto.com releases proof of reserves, showing above 100% for BTC, ETH

The new disclosure page allows skeptical users to self-verify that their assets are included in the report.

Nifty News: Winamp adds NFT support, Atari gets physical and more

Atari has teamed up with Pixels.com for physical NFT artworks and Investopedia has given a rundown on NFT tax law.

FTX collapse could see crypto sector layoffs accelerate

While the full impact of FTX’s collapse is still unfolding, some have already warned of an increase in layoffs to come “in the months to follow.”

Bitcoin derivatives data reflects traders’ mixed feelings below $17,000

Derivatives data shows increased demand for margin longs contradicts traders’ perception that further downside in store for Bitcoin.

Crypto.com CEO addresses whereabouts of $1B in stablecoins sent to FTX

CEO Marszalek says the firm has recovered much of the funds and has less than $10M in exposure to FTX.

Crypto.com’s CRO is in trouble, but a 50% price rebound is in play

Short CRO traders were paying as much as 3% premium to long traders on Nov. 14, reflecting extreme bearishness in its futures market.

CZ and Saylor urge for crypto self-custody amid increasing uncertainty

Binance CEO Changpeng Zhao said self-custody is a “fundamental human right,” while Michael Saylor said self-custody is necessary to prevent powerful actors from accumulating and abusing power.

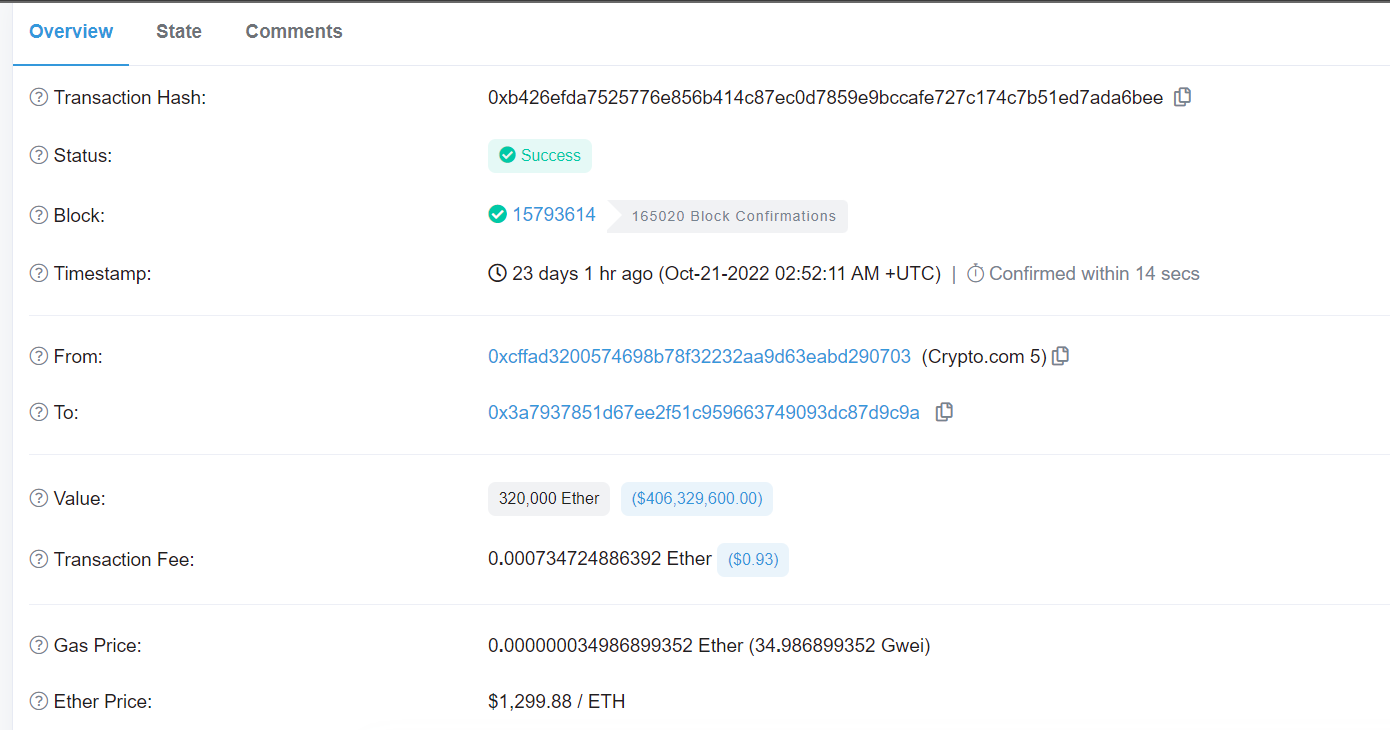

Crypto.com accidentally sends 320k ETH to Gate.io, recovers funds days after

Crypto.com CEO confirmed the return of the funds and reassured the investors that new processes and features were implemented to prevent a reoccurrence.

Middle East, Asia and Africa blockchain association launches in Abu Dhabi

A new blockchain body has been launched with the backing of industry leaders in the Middle East region including figures from Binance, Crypto.com, and the largest crypto exchange in the region.

Fortune did not, in fact, favor the brave: Matt Damon’s Crypto.com TV spot turns one

Many in and out of the crypto space have parodied Matt Damon’s appearance promoting the crypto exchange following the market downturn in May.

Fidelity to beef up crypto unit by another 25% with 100 new hires

The Digital Assets division within Fidelity Investments will have around 500 total staff members by the first quarter of 2023, according to a spokesperson.

Crypto Biz: $470B bank enters crypto — Probably nothing, right?

Another major financial institution has signaled its intent to offer Bitcoin and Ether services to its clients.