The SEC alleged Geosyn Mining’s co-founders misappropriated $1.2 million of its investors’ funds, spending it on holidays, nightclubs and firearms.

Cryptocurrency Financial News

The SEC alleged Geosyn Mining’s co-founders misappropriated $1.2 million of its investors’ funds, spending it on holidays, nightclubs and firearms.

The price of Bitcoin fell drastically towards the $60,000 mark in the days leading up to the just concluded halving. On-chain data has shed light on what could very well be the reason for this price dip in the middle of all the excitement around the halving.

Particularly, data has revealed that some miners have been selling their holdings in the days leading up to the halving event, with the entire BTC holdings of miners hitting a 12-year low.

On-chain analytics platform IntoTheBlock noted this interesting trend amongst Bitcoin miners. According to the platform’s “Miners’ Bitcoin Holdings,” the collective BTC reserve across various miners has now dropped below 1.9 million BTC, its lowest in over 12 years.

Interestingly, the metric shows that miner reserves have been on a continued trend of outflows since the beginning of the year, just after the approval of Spot Bitcoin ETFs. This means the outflow from miner wallets can be linked to increased demand from the various Bitcoin ETF wallets, with the latter now controlling over 4.27% of the total circulating wallets.

As Bitcoin goes into the halving, miners’ BTC holdings hit 12 year low. This indicates that miners have been net sellers leading up to the halving. pic.twitter.com/WNi74RkluG

— IntoTheBlock (@intotheblock) April 19, 2024

At the time of writing, CryptoQuant data puts the total number of miner reserves at 1.818 million BTC, a decrease of 22,000 BTC from 1.84 million on January 3. Additionally, this outflow from the miner reserves was exacerbated in the days leading up to the halving, as noted by IntoTheBlock.

“This indicates that miners have been net sellers leading up to the halving,” IntoTheBlock said in a social media post.

The persistent selling pressure exerted by miners may have been a contributing factor in Bitcoin’s stagnant pace between $65,000 and $70,000 over the past weeks. This outflow of BTC from miner wallets into the market seems to have flooded the market with more than enough BTC, which in turn contributed to a crash to $60,000 during the week.

The practice of Bitcoin miners selling their holdings in the days leading up to the halving is not unusual, as demonstrated by their actions in past halving events. At the time of writing, Bitcoin is trading at $64,978, up 8% after rebounding up at $60,000. The much anticipated fourth Bitcoin halving has now been completed and the industry looks forward to its effect over the next few months.

The halving is ultimately a balancing act for miners. Although miners’ revenues are cut in half, the reduced Bitcoin supply and possible price increase can help offset some of the losses over time. According to a report, Bitcoin miners could sell up to $5 billion worth of BTC after the halving, with the price of the cryptocurrency potentially falling to $52,000.

Featured image from Pexels, chart from TradingView

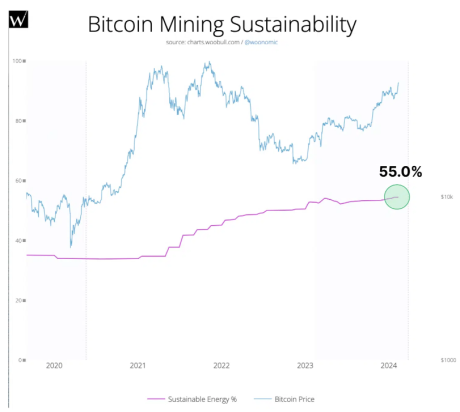

Bitcoin, the enigmatic cryptocurrency known for its volatile price swings and digital gold status, is making a surprising play for a new title: sustainability champion.

A recent analysis by Bitcoin environmental impact expert Daniel Batten reveals a remarkable surge in renewable energy use for mining, reaching a staggering 55%. This marks a significant shift from just four years ago, when the figure languished below 40%, and paints a picture of an industry undergoing a green metamorphosis.

Bitcoin’s mining process, essential for creating new coins, has historically been a lightning rod for environmental criticism. The sheer computing power required gulps up massive amounts of electricity, often sourced from fossil fuels. This led to accusations of Bitcoin being a climate villain, spewing greenhouse gases and contributing to global warming.

However, the narrative is evolving. Companies like Luxor Technology are harnessing Ethiopia’s hydroelectric bounty, while Argentina’s Unblock Global repurposes wasted natural gas from oil reserves.

Even domestic players like CleanSpark are upping their game with low-carbon solutions. These efforts, coupled with an overall decline in mining emissions intensity, suggest a genuine commitment to going green.

Despite the positive strides, the sustainability of Bitcoin is far from over. The ever-growing network demands more energy, and ensuring enough renewable sources to keep pace is critical.

Furthermore, the environmental impact extends beyond energy consumption. The mountains of discarded mining hardware raise concerns about e-waste, another hurdle on the path to true sustainability.

The Future: Doubling Down On Green

The success of Bitcoin’s green gamble hinges on several factors. Continued investment in renewable energy infrastructure is paramount, and regulatory frameworks that incentivize sustainable practices could play a vital role.

Ultimately, the industry needs to demonstrate a long-term commitment to environmental responsibility, moving beyond individual success stories to ensure widespread adoption of green solutions.

While the jury is still out on whether Bitcoin can truly shed its carbon-intensive past, the recent surge in renewable energy use is a promising sign. This green gamble, if played with transparency, scalability, and a holistic approach to sustainability, could pave the way for a future where Bitcoin and the environment coexist in harmony.

The question remains: will Bitcoin’s green hand win the game, or will it fold under the weight of its own growth and environmental concerns? Only time, and the industry’s commitment, will tell.

Featured image from Karolina Grabowska/Pexels, chart from TradingView

Conifex, a B.C.-based cryptocurrency mining company, challenged B.C. Hydro’s 18-month moratorium on mining.

In recent developments, two California school district officials have admitted guilty to stealing up to $1.8 million and misappropriating electricity to finance and operate a clandestine crypto-mining operation.

The United States Department of Justice (DOJ) disclosed that Jeffrey Menge, former Assistant Superintendent and Chief Business Officer of Patterson Joint Unified School District, and Eric Drabert, the district’s IT Director, pleaded guilty to charges of theft concerning programs receiving federal funds.

According to the DOJ’s statement, Menge, as Assistant Superintendent, hired Drabert as the school district’s IT director around 2020.

Together, they orchestrated a series of illicit activities to siphon funds from the district. Menge reportedly utilized a Nevada-based company called CenCal Tech LLC, which he controlled, as a front for the crypto scheme.

The investigation revealed that to circumvent restrictions on conducting interested party transactions, Menge created a fictitious executive, “Frank Barnes,” to represent CenCal Tech.

Through this setup, it is alleged that Menge and Drabert executed fraudulent transactions worth over $1.2 million, involving practices such as double billing, overbilling, and billing for undelivered items.

Diversifying their criminal activities, Menge and Drabert went beyond financial embezzlement, according to the US Department of Justice.

The law enforcement agency stated that the individuals utilized “high-end graphics cards,” school district property, and electricity to establish and operate a crypto mining farm within the school district.

The illegally mined crypto assets were then redirected to wallets under their control. Additionally, Menge is alleged to have exploited school district-owned vehicles, acquiring a Chevy truck at a discounted price and selling it for personal profit while using a Ford Transit van as his vehicle.

The overall magnitude of the embezzlement was staggering. Menge misappropriated funds between $1 million and $1.5 million, while Drabert was found guilty of stealing between $250,000 and $300,000.

The DOJ revealed that the ill-gotten gains were used for “lavish” personal expenses. Menge indulged in remodeling his residence, purchasing luxury vehicles, including a Ferrari sports car, and funding other personal endeavors. Drabert, on the other hand, utilized stolen funds to renovate his vacation cabin and for various personal expenses.

The guilty pleas by Jeffrey Menge and Eric Drabert, former officials of Patterson Joint Unified School District, shed light on a shocking case of embezzlement and crypto mining fraud within the education system.

Featured image from Shutterstock, chart from TradingView.com

Mining Bitcoin is the cornerstone of the BTC network, providing both security and new Bitcoins into circulation. This essential process involves powerful computers solving complex mathematical problems to validate transactions on the network. As a reward for this computational work, miners receive new bitcoins, making it a potentially lucrative endeavor.

In this guide, we will explore the key aspects of “How to mine Bitcoin.” From understanding the basic mechanisms of how mining Bitcoin works to evaluating its economic feasibility, including the costs, potential earnings, and the time it takes to mine a single BTC. We’ll also guide you through the practical steps of setting up a mining operation, including choosing the right Bitcoin mining rig and the necessary software.

Moreover, for those looking to expand their mining activities beyond Bitcoin, we’ll cover the essentials of mining cryptocurrencies. We’ll introduce various crypto mining software and tools, providing a comprehensive view of the wider crypto mining landscape.

Mining Bitcoin is the process through which new bitcoins are released and transactions are added to the blockchain. At its heart lies the Proof of Work (PoW) algorithm, which requires miners to solve complex mathematical problems to validate transactions. Miners compete to complete these problems first, and the winner receives Bitcoin rewards.

This process inherently involves the difficulty adjustment, which ensures that the rate of block creation remains constant, and the hash rate, which is a measure of the processing power of the Bitcoin network. These elements combine to form the backbone of Bitcoin mining, securing the network and enabling the decentralized control that Bitcoin is renowned for.

Bitcoin mining is a complex and multifaceted process, crucial for both the creation of new Bitcoins and the maintenance of the network’s integrity and security. Here’s an in-depth look at its key aspects:

Proof Of Work

Proof-of-Work (PoW) is a critical blockchain consensus mechanism that dates back to 1993 when Cynthia Dwork and Moni Naor first conceptualized it to deter email spam and DoS attacks. Adam Back’s Hashcash in 1997 advanced this concept by incorporating computational difficulty to combat email spam. These early forms of PoW laid the groundwork for Bitcoin’s implementation by Satoshi Nakamoto in 2009, which effectively solved the double-spending problem in digital currencies without the need for a centralized authority.

Bitcoin’s PoW operates like a computational lottery, with miners vying to solve cryptographic puzzles using the SHA-256 hash function. The more computational power a miner contributes, the higher their chances of solving the puzzle and receiving the block reward in Bitcoin. This mining process is fundamental to Bitcoin’s decentralized security and transaction validation.

The difficulty of mining adjusts approximately every two weeks or every 2,016 blocks, maintaining an average block time of around 10 minutes. This adjustment is crucial for the network’s stability, ensuring a steady rate of new block creation and coin issuance despite changes in network hash rate. The Bitcoin block reward, initially 50 BTC per block, halves every 210,000 blocks, a mechanism known as Bitcoin halving. This built-in deflationary aspect of Bitcoin is designed to gradually reduce the issuance of new coins.

PoW’s significance lies in its ability to secure the Bitcoin network through decentralization. By incentivizing miners across the globe to contribute computational power, it replaces the traditional role of central authorities in validating transactions.

Hash Rate

The hash rate, a critical metric in mining Bitcoin, refers to the total processing power utilized by miners on the network. It indicates how many calculations per second the network can perform, where a higher hash rate reflects greater security and mining difficulty. The hash rate directly influences the competitiveness among miners and the overall efficiency of the mining process. As Bitcoin’s price increases, more miners are encouraged to join the network, pushing the hash rate higher and making the mining process more competitive and energy-intensive.

Difficulty Adjustment

Bitcoin’s protocol includes a dynamic mechanism called difficulty adjustment, ensuring that new blocks are discovered approximately every 10 minutes. This adjustment occurs every 2,016 blocks, or roughly every two weeks, based on the total hashing power of the network.

If blocks are mined too quickly, the difficulty increases, making it harder to find new blocks. Conversely, if the block interval is slower than expected, the difficulty decreases. This self-regulating system maintains a stable block discovery rate, balancing the network against fluctuations in miner numbers and equipment efficiency.

Bitcoin mining economics encompass various factors such as computational power, energy costs, and market dynamics. Understanding these factors is crucial for any miner or investor who wants to know “how to mine Bitcoin.”

How Do You Mine Bitcoin?

Mining Bitcoin involves two major steps: building a block and proving the block. The former includes selecting and processing transactions for inclusion in the new block, while the latter involves solving a cryptographic hashing puzzle. This puzzle, part of the Proof-of-Work consensus, requires miners to generate a hash below the network’s target hash using high-powered computer hardware, typically ASIC miners. Once a miner successfully solves the puzzle, they broadcast the new block to the network, which is then verified by other miners.

Can You Still Mine Bitcoin?

Yes, individuals can still mine Bitcoin. However, it has evolved into a highly competitive and resource-intensive endeavor, with public listed companies taking the lead. Among the top mining companies are Marathon Digital (MARA), Riot Blockchain (RIOT), Canaan (CAN), Hut 8 (HUT), Cipher (CIFR), Core Scientific (CORZ), Bitfarms (BITF), Iris Energy (IREN), CleanSpark (CLSK) and Bitdeer Technologies.

The block reward, which includes both the block subsidy and the transaction fees, is the core incentive for miners. Currently, the block reward is higher than the transaction fees, but this will eventually change with one of the next Bitcoin halvings, but also depends on the evolution of the Bitcoin price.

How Long Does It Take To Mine A Bitcoin?

The time it takes to mine a Bitcoin is not fixed and depends on several factors, including the miner’s hash rate, the total network hash rate, and the current mining difficulty. The protocol is designed to adjust the difficulty to maintain an average block time of about 10 minutes.

However, for an individual miner, especially one with limited resources like one mining rig, mining a single Bitcoin can take years. This often leads solo miners to join mining pools to increase the chances of earning rewards more frequently.

Research by environmentalist Daniel Batten suggests that mining Bitcoin can become carbon negative by utilizing waste methane as an energy source. Around 30% of the global temperature rise is attributed to methane, which has 80 times the warming power of carbon dioxide. Notably, 11% of global methane emissions come from landfills. Bitcoin mining can convert this waste methane into carbon dioxide, significantly reducing its environmental impact. Batten himself aims to generate 32 megawatts of power from landfills, offsetting about 4 million tonnes of carbon dioxide, which equates to 10% of Bitcoin’s carbon footprint.

In their latest research, the Bitcoin Mining Council’s (BMC) highlighted significant strides in sustainability and efficiency within the Bitcoin mining industry. The BMC, representing 45.4% of the global Bitcoin Mining Network, reported that its members are utilizing electricity with a 67.8% sustainable power mix. This figure reflects an estimated global average of 59.4% for the industry, marking an approximately 3% year-on-year increase from 2021. This progress positions the Bitcoin mining industry as one of the most sustainable globally.

Embarking on the journey of mining Bitcoin requires a strategic approach, starting with the selection of the right equipment.

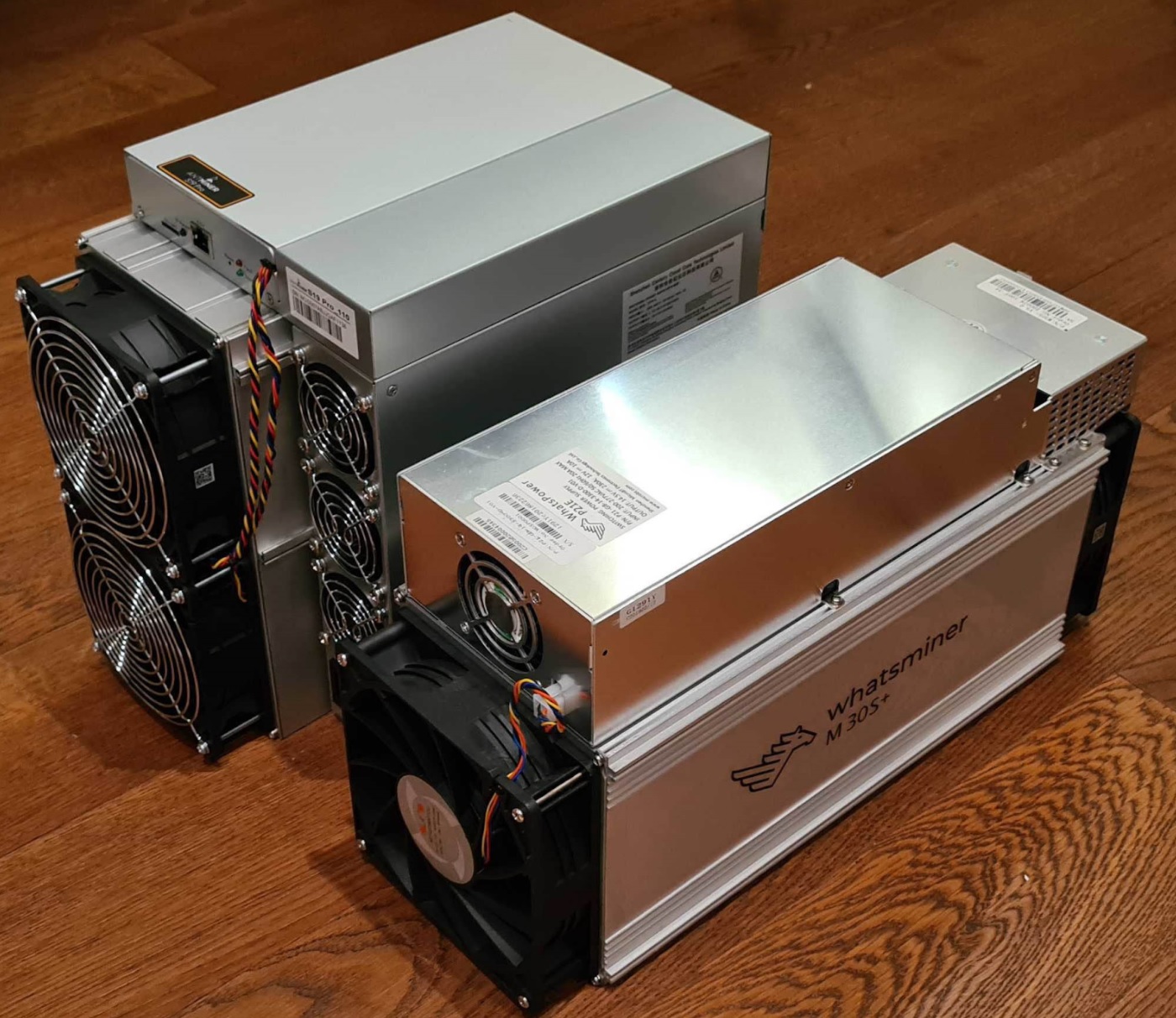

Selecting the Right Bitcoin Mining Rig

Choosing the appropriate Bitcoin mining rig is critical for efficiency and profitability. The ideal rig should balance power, energy consumption, and cost. ASIC miners are the standard in mining Bitcoin due to their superior hash rates and energy efficiency compared to GPUs or CPUs.

When selecting an ASIC miner, consider factors like hash rate, energy consumption (measured in watts), cost, and the miner’s longevity. Higher hash rates increase the chances of successfully mining a block, but they also come with higher energy demands and costs. Balancing these factors based on your budget and the current Bitcoin mining landscape is key to a successful mining operation.

Comparison Of The Best Bitcoin Mining Rigs

Here’s a comparison of some of the best Bitcoin mining rigs in 2023:

Mine Bitcoins Software: Installing And Configuring

Selecting the right software is crucial for efficient Bitcoin mining. Here are some of the best Bitcoin mining software options in 2023:

Bitcoin Mining At Home: Worth It?

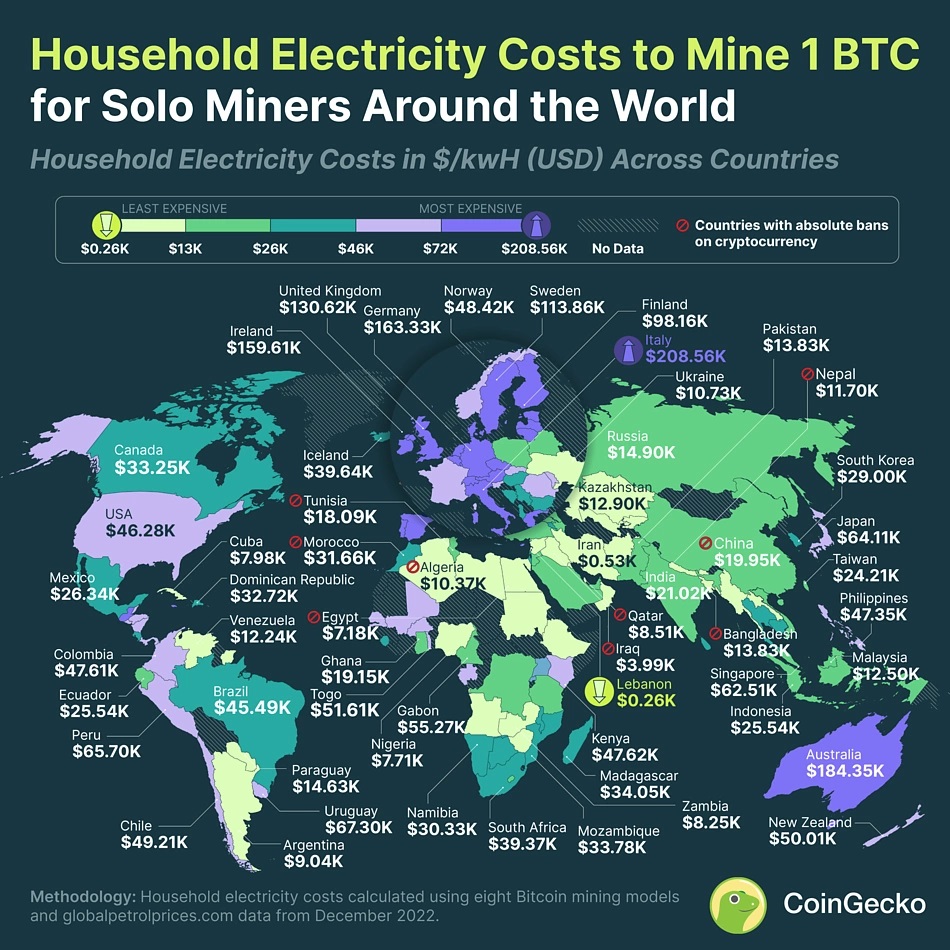

Bitcoin mining at home can be challenging due to factors like hardware costs, high energy consumption, noise, and heat. While it offers a way to participate in the Bitcoin network, the profitability largely depends on electricity costs, hardware efficiency, and Bitcoin’s market price. For hobbyists or those with access to cheap electricity, it can be a viable option. However, for most individuals, joining a mining pool or cloud mining may be more practical and cost-effective.

Notably, the estimated electricity cost of mining one Bitcoin varies globally. The following map by CoinGecko shows the estimated cost, based on the average price of electricity.

Mining cryptocurrency extends far beyond Bitcoin, offering opportunities to mine a variety of altcoins. Altcoins, or alternative cryptocurrencies, have different technical underpinnings, mining mechanisms, and market dynamics compared to Bitcoin.

Mining Cryptocurrency: Which Altcoins You Can Mine

While Bitcoin remains the most well-known and mined cryptocurrency, several altcoins present attractive alternatives for miners. Here are some notable altcoins that use a Proof-of-Work and are popular in the mining community:

Crypto Mining Software

Crypto mining software is essential for connecting your hardware to the blockchain or mining pool. Different cryptocurrencies often require specific software due to their unique algorithms and mining processes. Here, we’ll focus on the recommended mining software for Litecoin, Dogecoin, and Monero, three popular altcoins in the mining community.

Litecoin And Dogecoin Mining Software

Monero Mining Software

Best Crypto Mining Tools

In addition to mining software, there are various tools that can enhance the mining experience, improve efficiency, and manage your mining operations effectively. These tools include:

The economics of mining Bitcoin and other cryptocurrencies is a critical area for anyone considering entering this field. It involves understanding the costs associated with mining and the potential returns. This section will cover the fundamentals of calculating these costs and returns, providing insights into the financial aspects of cryptocurrency mining.

Calculating the Costs and Returns of Mining

To understand the economics of mining, one must first be able to calculate both the costs involved and the potential returns. Here are the key factors to consider:

The return on investment (ROI) is calculated by comparing the total costs (including the initial investment and ongoing expenses) against the revenue generated from mining. Calculators like CoinWarz and CryptoCompare can help estimate profitability based on current conditions.

How Much Does Mining Make?

The earnings from mining can vary greatly and are influenced by several factors:

On average, the daily earnings for a miner can range from a few dollars to several hundred, depending on these factors. It’s crucial to conduct thorough research and calculations based on current market conditions and individual circumstances to get a realistic estimate of potential earnings from mining.

This section addresses some of the most frequently asked questions about Bitcoin and cryptocurrency mining, offering clear and concise answers for both newcomers and experienced miners.

How to Mine Bitcoin?

To mine Bitcoin, acquire specialized mining hardware (ASIC miners are recommended), choose and install suitable mining software, and either set up a solo mining operation or join a mining pool. Additionally, create a secure Bitcoin wallet for receiving mining rewards.

How To Start Mining Bitcoin?

To start mining Bitcoin, you need to invest in appropriate hardware (like ASIC miners), choose mining software, join a mining pool if desired, and set up a Bitcoin wallet to store your rewards. Ensure you have a reliable power source and internet connection.

How Do You Mine Bitcoin?

Mining Bitcoin involves using specialized hardware to solve complex mathematical problems. Successful miners receive Bitcoin as a reward for adding new blocks to the blockchain. The process requires significant computational power and electricity.

Can You Still Mine Bitcoin?

Yes, you can still mine Bitcoin, but you’ll face fierce competition and a resource-intensive process. It necessitates significant investment in hardware and electricity.

What Is The Bitcoin Generator?

The term “Bitcoin generator” is often associated with scams. Legitimate Bitcoin mining is the only way to generate new Bitcoins, and it involves computational work using mining hardware.

How Do You Mine For Bitcoin?

You mine for Bitcoin by setting up mining hardware, running mining software, and participating in the network to validate transactions and discover new blocks. This process often involves joining a mining pool.

How To Make Bitcoin?

Besides mining, you can make Bitcoin by trading, participating in affiliate programs, offering goods or services for Bitcoin, or through Bitcoin faucets, although the latter often provides minimal returns.

How To Start Bitcoin Mining?

To start Bitcoin mining, research and purchase efficient mining hardware, decide between solo mining and joining a pool, download and configure mining software, and set up a secure Bitcoin wallet for payouts.

How Do I Generate Bitcoins?

Mining produces Bitcoins. This involves using computational power to solve cryptographic puzzles, thereby validating transactions and creating new blocks on the Bitcoin blockchain.

How To Bitcoin Mine?

Bitcoin mining requires specialized hardware (ASICs), mining software, and a stable electricity and internet supply. You can mine independently or join a pool to increase your chances of earning rewards.

How To Mine For Bitcoin?

To mine for Bitcoin, acquire suitable mining hardware, select and configure mining software, ensure a stable power and internet connection, and consider joining a mining pool to improve your chances of earning rewards.

How Are Bitcoins Created?

During the mining process, miners tackle complex mathematical problems to validate transactions and bolster the network’s security, thereby generating new Bitcoins as rewards for their work.

How To Generate Bitcoins?

The only legitimate way to generate Bitcoins is through mining. Be wary of any service claiming to generate Bitcoins without mining, as these are likely scams.

What Is A Bitcoin Mine?

A Bitcoin mine refers to a setup where Bitcoin mining takes place. It typically involves a series of computers (miners) working to solve mathematical puzzles that validate transactions and create new Bitcoins.

How Do You Mine Bitcoins?

Mining Bitcoins involves setting up mining hardware, installing mining software, solving cryptographic puzzles to validate transactions, and being part of the network that maintains the blockchain.

How Do You Mine Cryptocurrency?

Mining cryptocurrency generally involves setting up a computer system with specialized hardware and software to solve mathematical puzzles, validate transactions, and secure the network of a specific cryptocurrency.

How Is Crypto Mined?

Crypto mining involves using computers to solve complex puzzles, validating transactions on the blockchain. Miners who successfully solve cryptographic puzzles receive Proof of Work based cryptocurrencies as a reward.

How Is Cryptocurrency Mined?

To mine cryptocurrency, individuals solve cryptographic puzzles, thereby securing a blockchain network. In Proof of Work (PoW) systems, this requires powerful computing resources, whereas Proof of Stake (PoS) systems involve validators staking cryptocurrency to earn the right to validate transactions and create new blocks.

The Bitcoin mining industry has risen steadily in the past few years thanks to the widespread adoption and increasing interest in the Bitcoin blockchain. This growth has led to a vast increase in Bitcoin’s hash rate, causing concerns regarding the carbon footprint left behind by mining activities.

A recent Bloomberg study has shown, however, that the carbon footprint left behind by the Bitcoin blockchain has stalled in recent years.

It’s no news that Bitcoin mining is now a big industry on its own, with some mining firms even contributing to the economy and grid of their locations. Major BTC mining companies have also turned years of profits, which have attracted many investors, including large investment firms.

The issue of climate change and rising temperature have been the focus of many activists for years, with many accusing the energy-intensive activities of BTC mining of contributing negatively. As a result, regulatory agencies have been more insistent that mining corporations investigate safer and cleaner alternatives to fossil fuels for their energy needs.

To this end, Jamie Coutts, an analyst for Bloomberg, revealed that the percentage of Bitcoin transactions that use sustainable energy has increased steadily since 2021 and is now over 50%.

A new report has dropped on the Bloomberg @TheTerminal this morning – a further examination of this symbiosis between #Bitcoin mining and the global #EnergyTransition

— Jamie Coutts CMT (@Jamie1Coutts) September 20, 2023

This rise was particularly kickstarted by China’s ban on Bitcoin Mining in 2021 and Kazakhstan’s cap on the energy used by domestic crypto miners. Since then, the overall hash rate has increased by 286%, yet carbon dioxide emissions have decreased from 600 grams of CO2 per KWh to 296.5 grams of CO2 per KWh.

Bitcoin mining’s energy requirements take up around 50% of a miner’s operational cost. Cheaper clean energy is a way to offset these costs while simultaneously reducing the industry’s emissions or carbon intensity.

The Cambridge Centre for Alternative Finance (CCAF) also recently lowered its Bitcoin electricity consumption estimates by 25% from 105.3 TWh to 95.5 TWh, showing the transition is having better effects.

A transition into cleaner energy methods speaks well for BTC and the crypto industry as a whole, considering the blockchain has been heavily criticized in the past by environmentalists. This leaves room for companies to accept Bitcoin as a payment method without facing any kind of backlash.

Elon Musk’s Tesla, for instance, pledged in 2021 to resume allowing BTC payment for its cars when there’s a confirmation of 50% clean energy usage by miners.

Additionally, Climate technology venture investor and activist Daniel Batten argues that this metric is more than 50%.

Bloomberg Intelligence recently concluded that Bitcoin sustainable energy use has now surpassed 50%, contradicting Cambridge’s model.

Here’s a deep dive on why:

Cambridge’s model of Bitcoin emissions, which stopped updating in Jan 2022, states that Bitcoin is 37.6% from… pic.twitter.com/CP4QPmQvsb

— Daniel Batten (@DSBatten) September 18, 2023

On-chain analyst Willy Woo also estimates that the carbon footprint of the Bitcoin mining sector can be turned negative by an investment of around $450 million.

The storage platform turned to metered storage after discovering its Advanced plan was being used by some for crypto mining and other resource-intensive tasks.

Miners are now offering high performance computing services to the rapidly evolving artificial intelligence market, the report said.

The crypto mining industry is getting a dedicated lobby group aimed at opening up discussions with lawmakers in Washington.

Bitcoin mining has been up by a considerable fraction this year, as the blockchain network recorded a new all-time high in hash rate in the second quarter of the year. Mining revenue is also up, as the bitcoin Bitcoin recorded a spike in transaction volume.

As a result, Riot Blockchain, one of the largest publicly traded Bitcoin mining companies in the US, has recorded an increase in operations in the second quarter. According to its 2023 second-quarter financial results, the mining company recorded a new all-time record hash while ramping up its Bitcoin mining operations.

According to its financial report, Riot has seriously ramped up its Bitcoin mining operations. As a result, the mining company produced 1,775 BTC during the second quarter of 2023, a 27% increase compared to the 1,395 BTC it produced during that same period in 2022.

In May 2023 alone, the company produced 676 BTC at an average of 21.8 BTC per day. The average cost to mine each bitcoin was $8,389, beating Q2 2022’s average of $11,316.

Riot also witnessed an increase in mining revenue, as Bitcoin miners generated a remarkable total revenue of $2.4 billion. Although the price of Bitcoin during the quarter was 15% less than what it was in Q2 2022, Riot saw a total revenue of $76.7 million, as compared to $72.9 million in Q2 2022. Mining revenue ($49.7 million), engineering revenue ($19.3 million), data hosting revenue ($7.7 million), and power curtailment credits ($13.5 million) were also higher than in Q2 2022.

Not only has RIOT’s revenue from bitcoin mining increased, but their actual bitcoin holdings have also grown substantially. As of June 30, Riot held 7,264 BTC with the price of each BTC at $30,477.

In total, Riot finished the quarter with $408.4 million in working capital, including $289.2 million in cash on hand and $221.4 million in Bitcoin, while also reducing its net loss to $27.7 million compared to $353.6 million in Q2 2022.

Riot Blockchain also drastically increased its hash rate throughout the quarter, reaching an all-time record hash rate capacity of 10.7 EH/s. However, the company is also looking to enhance its computational power.

During the quarter, the company signed a long-term purchase agreement with MicroBT to acquire 33,280 next-generation miners. With an expanded mining fleet and facility, Riot believes it can see its hash rate grow to 20.1 EH/s by the second quarter of 2024.

Bitcoin mining is an energy-intensive process. However, Riot’s power strategy contributes to the stability of the energy grid in Texas at times of high demand by selling extra power back to the grid. At the time of writing Riot’s stock is up by 1.53% in a daily timeframe and 158.14% in the past six months.

Popular animated science fiction show Futurama gave a glimpse into what it thinks the future of crypto could look like in its latest episode called “How the West Was 101001” by mocking crypto miners.

The UAE-based firm is developing one of the region’s largest mining facilities.

Bitcoin, the world’s largest cryptocurrency network whose coin, BTC, is the most valuable, seems to have been invaded by an unknown miner. And the community has the new guest on their radar.

In the last few hours, the entity has not only plugged into the network but has proceeded to mine several blocks, getting rewarded with the precious 6.25 BTC.

What’s intriguing is that trackers cannot pick out the true identity of the miner who has usurped the established pools such as Binance Pool, AntPool, and even giant mining farms like Foundry USA.

For the last day, the miner has verified over 10 Bitcoin blocks, earning over 65 BTC worth over $1.7 million at spot rates.

While there is a chance that a “big” player is new to Bitcoin and has plugged in possibly thousands of mining rigs to stay competitive and verify blocks successfully, it is almost likely that the “unknown” entity is a mining pool.

In proof-of-work networks like Bitcoin, a group of miners, that is, retail individuals operating mining nodes, can join hands and merge their computing power called hash rate in “pools.” Whenever they do this, they stand a chance of verifying a block of BTC transactions.

In return, the network automatically rewards them with not only the block rewards of 6.25 BTC but also fees associated with the block. Although rare, fees accumulated in a block may be over 50% of the block reward distributed from the protocol level.

With the Bitcoin hash rate constantly rising and more miners pouring in, mining pools dominate. However, several pools are tailored to meet the needs of various miners. Applicable fees, reliability, and the size of their hash rate are some considerations that may also affect reputation. However, over the years, some of the biggest include AntPool and ViaBTC.

It is speculated that the “unknown” entity is F2Pool. The error is displayed on trackers because “Mempool’s attribution logic is just missing them.”

Whether this will also turn out to be true or false will later be verified.

This is because attribution “depends on who the miner says they are. It’d be easy to impersonate another pool and not guaranteed that that pool would notice and deny it was them”.

F2Pool is one of the oldest and largest mining pools in the world.

According to data from mempool.space, the pool controls 8.19% of the total Bitcoin hash rate.

While it is popular, recent data shows there could have been a hitch in the attribution logic. Trackers show that the last time F2Pool mined was in late May 24.

The investment includes a $2 million loan and $12 million in equity.

Marathon Digital Holdings Inc, a crypto mining company, recently announced its partnership with digital assets firm Zero Two.

This announcement marks a major milestone in Marathon Digital’s plan for global expansion. The creation of the “Abu Dhabi Global Markets JV Entity” will involve joint ownership between both companies, with Zero Two holding 80% ownership and Marathon Digital holding 20%.

Marathon plans to capitalize on the advantageous climate and energy costs in Abu Dhabi while forging valuable partnerships through its expansion efforts.

The newly formed joint venture with Zero Two will develop and operate two digital mining sites with a combined capacity of 250 megawatts.

The sites will be located at two different places in Abu Dhabi. The larger 200MW site will be located at a feasible hub in Masdar City. The second site of 50MW will be located in the port zone of Mina Zayed, Abu Dhabi.

Marathon and Zero Two anticipate leveraging the excess energy in Abu Dhabi to power the sites. According to the firms, this approach will increase the base load and sustainability of the Abu Dhabi power grid.

In the past, the two firms ran a trial project to see if Abu Dhabi, where the desert temperature has historically made air-cooled digital asset mining unattainable, might be a viable location for a large-scale operation.

As such, Marathon Digital and Zero Two developed a custom-built immersion solution that’ll cool the ASIC miners and also developed the right mining software. Notably, the infrastructure and mining equipment needed has already been requested, and construction is underway.

These mining sites are projected to be among the most technologically advanced and energy-efficient mining hubs globally. According to the current construction timelines, both sites might be operational by 2024, with a total hash rate of about 7 EH/s.

The news of the mining operation surfaced as executives from Coinbase visited the UAE to assess the region’s potential as a “strategic hub” for its global operations. The CEO of Coinbase, Brian Armstrong, spoke at the Dubai FinTech Summit and met decision-makers in UAE.

Several U.S.-based crypto companies, including Coinbase and Ripple, are considering relocating their operations abroad due to the unfavorable regulatory environment in the United States. The UAE appears to be a favorable jurisdiction for crypto companies seeking a more welcoming regulatory climate.

Marathon Digital’s Crypto Mining Operations Might Boost Local Economies

The latest advancement in immersion technology, coupled with the expertise of those involved, will be a significant benefit to the companies involved and the local economy.

As Marathon partners with local businesses, it can create new job opportunities and enhance economic growth in the region. With immersion technology, the firm can help minimize the worries about the negative effect of cryptocurrency mining.

Featured image from Pexels and chart from Tradingview.com

Several US authorities have raised concerns regarding the environmental impact of crypto mining. Previously, US lawmakers probed the crypto mining energy use and environmental impact.

Biden’s administration is taking these concerns to another level. Biden’s Council of Economic Advisers (CEA) announced a 30% digital asset mining tax to offset its environmental impact. The new tax rule tagged DAME will take effect after a phase-in period.

Crypto mining electricity consumption and carbon emission have been a bone of contention in the United States over the past years. A recently published New York Times article claimed Bitcoin has a voracious appetite for electricity, sparking several reactions among crypto community members.

Related Reading: Bitcoin Analysis: How To Prepare For Today’s FOMC Meeting

The CEA announced plans to impose a 30% tax on all crypto-mining activities. The council believes the crypto mining industry’s operations negatively impact the environment and is ready to counter them.

The proposed tax, tagged Digital Asset Mining Energy (DAME), aims to make crypto mining firms take responsibility for their environmental impact. According to the CEA’s announcement, the new tax rules will have a phased-in period before taking its course.

Under the new tax guidelines, all mining firms in the US would pay taxes on 30% of their total electricity usage. The CEA feels crypto miners must take responsibility for the environmental pollution they impose on the local community from the increased greenhouse gas emissions.

Also, the CEA believes the crypto firms aren’t fully paying the cost of these pollutions, considering their energy consumption rate. The council cited the recently published New York Times (NYT) article, which criticized the digital asset industry for the environmental impact of its mining operations.

The proposed DAME tax sparked reactions among members of the crypto community. Many tagged the tax as unfair, criticizing the government for the high tax without incentivizing clean energy usage.

Pierre Rochard, Riot Platforms’ VP of Research, who previously criticized the NYT’s article, condemned the DAME tax.

According to Rochards, the White House targets Bitcoin at the wrong time. To Rochard, the US government should instead focus on the failing banking system.

Featured Image/Pexels, chart/ TradingView

New Mexico is the cheapest US state to mine Bitcoin in terms of average electricity cost, while Hawaii is the by far the most expensive.

Crypto hosting and mining company Core Scientific (CORZ) has appointed crypto veteran Adam Sullivan as its new president, a court filing shows.