Accepting crypto payments may sound daunting, but with the right tools and knowledge, it’s a game-changer for businesses. This article simplifies the process, from understanding the basics of crypto payments to seamlessly integrating them into your business operations. We’ll explore how to accept crypto payments, the most effective cryptocurrencies for transactions, highlight businesses leading the charge which accept Bitcoins as payments, and unveil the advantages of adopting this futuristic payment method.

Crypto Payments For Businesses Explained

For businesses, adopting crypto payments is not just a nod to modernity; it’s a strategic move towards cost-efficiency and broader market access. One of the most significant advantages of crypto payments is the substantial savings on fees typically imposed by centralized point-of-sale (POS) service providers and credit card companies like Visa and Mastercard.

Cryptocurrencies operate on decentralized networks, which means transactions do not require intermediaries. This absence of middlemen significantly reduces transaction costs, a benefit that can be particularly impactful for businesses with high sales volumes or those dealing with international transactions, where traditional fees can accumulate quickly.

Moreover, crypto payments provide an alternative to the delay often associated with bank processing times. Transactions can be completed at a much faster rate, enhancing the cash flow for businesses. This speed, coupled with the reduced cost, presents a compelling case for businesses to integrate crypto payment options.

Another crucial aspect is the security and fraud prevention inherent in blockchain technology, the foundation of cryptocurrencies. The encrypted and immutable nature of blockchain transactions adds a layer of security that is challenging to achieve with traditional payment methods.

By accepting crypto payments, businesses not only align themselves with a tech-savvy consumer base but also leverage a global payment system devoid of geographical boundaries and currency conversion issues. This global reach can be particularly beneficial for online businesses looking to expand their market.

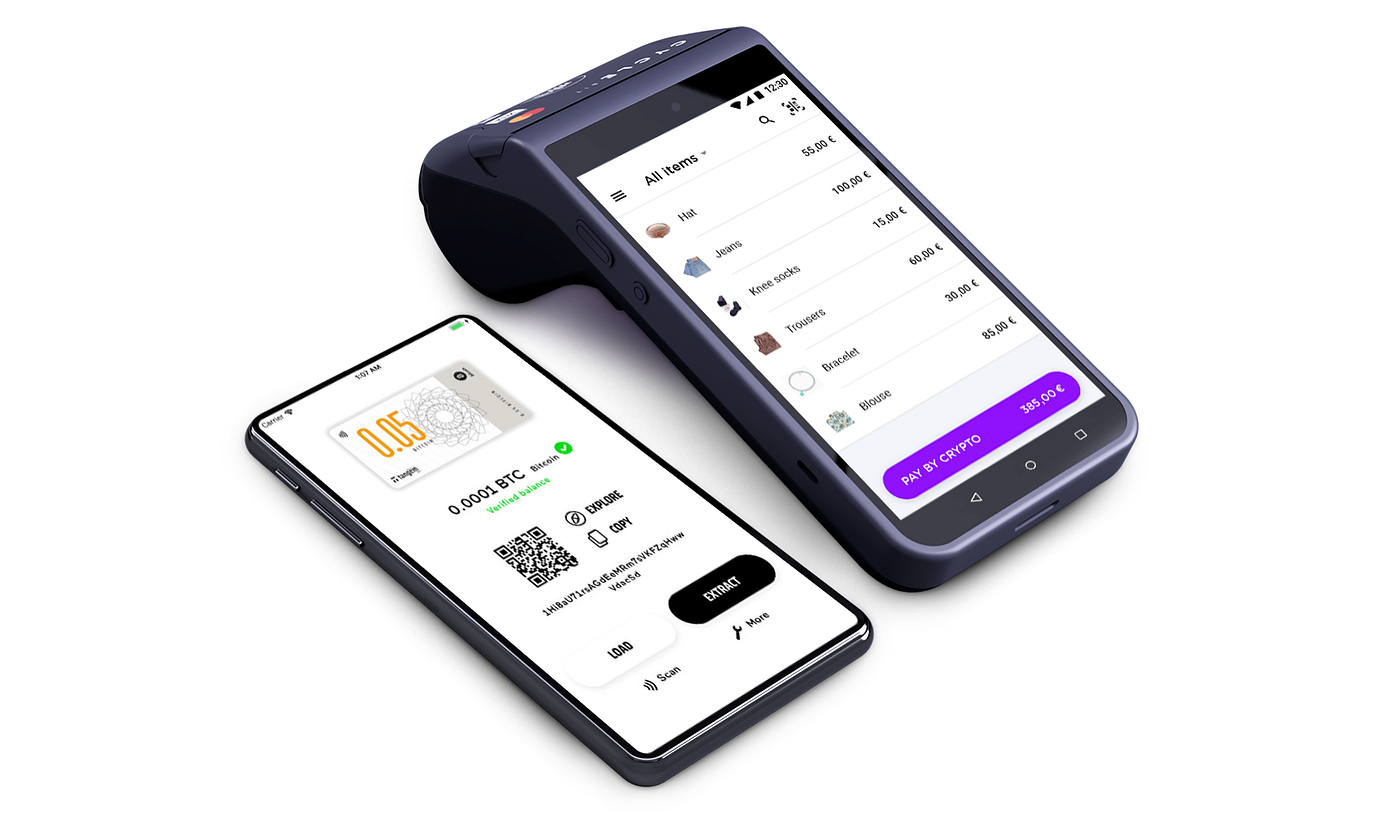

Providers Of Crypto Payment Systems

Crypto payment gateways are essential for businesses looking to accept cryptocurrency transactions. These platforms provide the necessary infrastructure, such as point-of-sale (POS) systems and shopping cart integrations, for seamless crypto transactions. They also offer additional conveniences like protecting merchants from the volatility inherent in cryptocurrencies and facilitating currency conversions and invoicing.

Each of these gateways has its unique strengths, catering to different business needs and preferences. Choosing the right provider depends on factors like the range of cryptocurrencies you wish to accept, the ease of integration with your existing systems, the level of exposure to crypto volatility you’re comfortable with, and the specific features you need to streamline your crypto transactions.

Coinbase Commerce

Known for its easy integration with major US cryptocurrency exchanges, Coinbase Commerce offers a flexible solution for businesses. It provides custom checkouts, a connection to the Coinbase crypto exchange, crypto wallets, invoicing, refunding, reporting tools, and an API for developers. Importantly, it offers volatility shielding under its managed plan. Coinbase Commerce supports a range of cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and others, with a transaction fee of 1%.

BitPay

One of the early entrants in the crypto payments sector, BitPay is known for its robust infrastructure and integration capabilities. It provides volatility protection, invoicing, mass payouts, and the option for a prepaid Mastercard. BitPay supports multiple cryptocurrencies, including Bitcoin, Ethereum, and Litecoin. It charges a transaction fee of 1% + $0.25, which may be higher for certain high-risk industries.

CoinGate

Particularly suitable for companies outside the US, CoinGate supports an impressive array of over 70 cryptocurrencies. It integrates well with various eCommerce platforms and offers features like crypto conversions, invoicing, and a developer sandbox. CoinGate’s transaction fee is 1%, with additional charges for settlements in fiat currencies like the Euro.

NOWPayments

This gateway stands out for its low transaction fees, starting at 0.5%, and supporting a wide range of over 70 cryptocurrencies. NOWPayments is ideal for businesses looking for straightforward solutions without custodial features. It offers services like cryptocurrency conversions, fiat settlement options, invoicing, mass payouts, and POS software. The platform’s pricing model is attractive, although additional costs for services like fiat settlement and volatility shielding can add up.

AlfaCoins

AlfaCoins distinguishes itself with flexible payment options and competitive fees. It supports a more limited range of cryptocurrencies, including Bitcoin, Ethereum, and Litecoin. The transaction fee is slightly lower than its competitors at 0.99%, and it offers unique features like the CoinSplit option, which allows for partial payments in different currencies. AlfaCoins is particularly advantageous for non-profit organizations, offering lower fees for donations and even zero-fee plans.

Strike

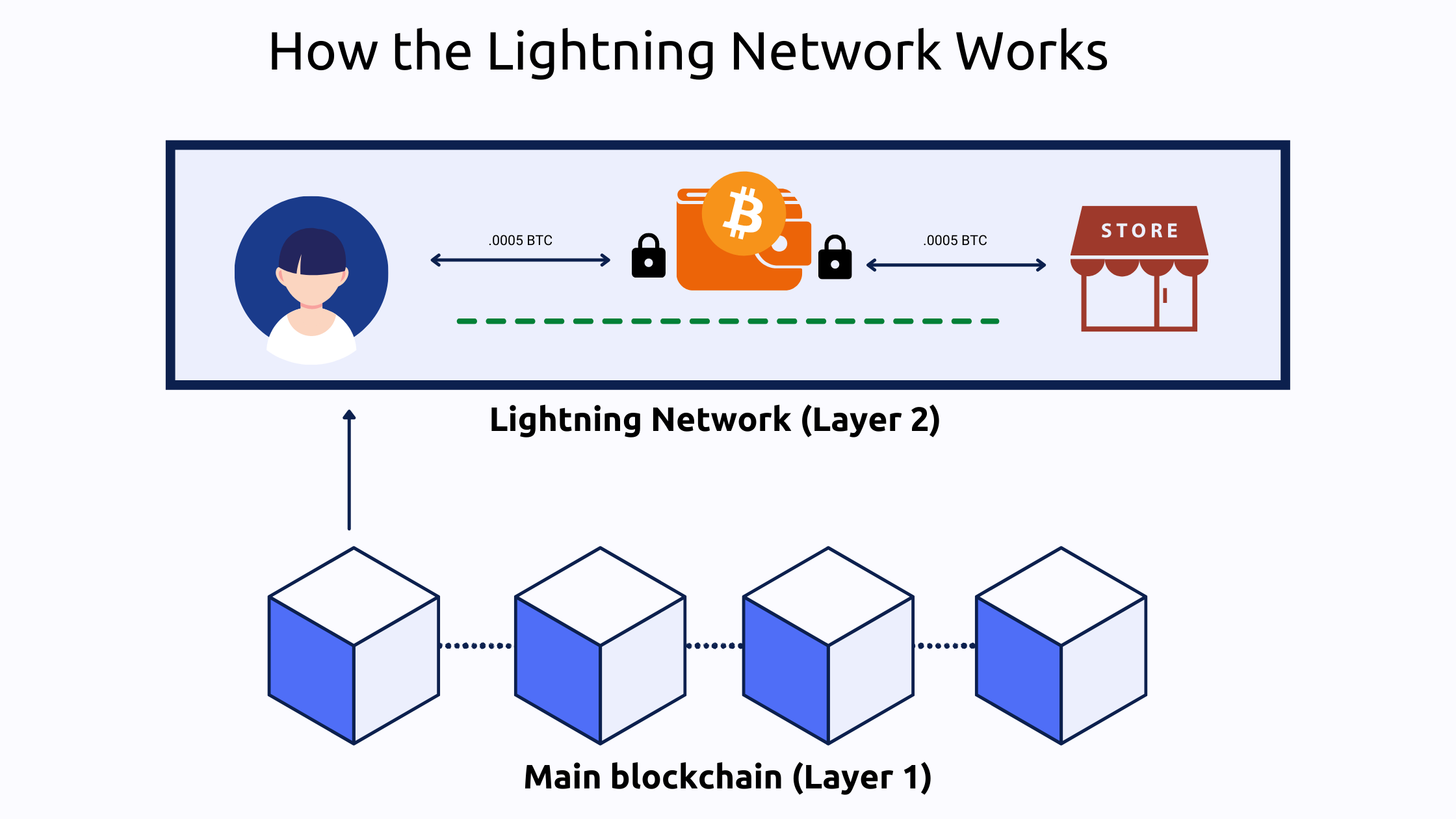

Strike stands out as a unique player in the realm of crypto payments, primarily leveraging the Bitcoin Lightning Network. The Lightning Network is a layer 2 payment protocol layered on top of the Bitcoin blockchain, designed to facilitate faster and more cost-effective transactions. This is particularly beneficial for handling microtransactions, which are impractical with traditional Bitcoin payments due to higher fees and longer processing times.

Setting Up Crypto Payment Systems

Integrating a crypto payment system into your business involves several key steps to ensure a smooth and secure transaction process. Here’s a guide to getting started:

- Choose A Crypto Payment Gateway: Select a provider that aligns with your business needs. Popular options include Coinbase Commerce, BitPay, CoinGate, NOWPayments, AlfaCoins, and Strike via the Bitcoin Lightning Network.

- Create A Merchant Account: Once you’ve chosen a provider, you’ll need to create a merchant account on their platform. This typically involves providing business details, setting up security measures, and linking bank accounts for fiat settlements if needed.

- Integration With Your Business Platform: Integrate the crypto payment gateway with your existing business infrastructure. This could be through plugins or APIs.

- Set Up A Digital Wallet: To receive and store cryptocurrency payments, you’ll need a digital wallet. Some gateways offer their own wallets, while others may require you to set up an external wallet.

- Configure Payment Options: Configure your payment gateway settings according to your preferences.

- Implement Security Measures: Ensure that robust security measures are in place to protect against fraud and hacking.

- Educate Your Team: Educate your staff about how crypto payments work, how to process them, and how to troubleshoot common issues.

- Testing: Before going live, thoroughly test the crypto payment system to ensure that it works seamlessly.

- Launch And Marketing: Once testing is complete, launch the crypto payment system. Use marketing strategies to inform your customers, highlighting the benefits.

Best Crypto For Payments

Selecting the best cryptocurrency for business transactions is crucial for ensuring efficiency, security, and customer satisfaction. Here are some of the best cryptos for payments:

- Bitcoin (BTC): As the first and most well-known cryptocurrency, Bitcoin is widely accepted. However, its transaction times and fees can be higher compared to other cryptocurrencies, when not choosing a Lightning Network based solution.

- Ethereum (ETH): Known for its flexibility and the support of smart contracts, Ethereum is a popular choice for businesses. It’s particularly suitable for businesses involved in digital services and products. However, fees can be quite high on the base layer as well.

- Litecoin (LTC): Often considered as the silver to Bitcoin’s gold, Litecoin offers faster transaction times and lower fees.

- Stablecoins (USDT, USDC, DAI): Pegged to stable assets like the US dollar, stablecoins offer the benefits of cryptocurrency without the volatility. This makes them ideal for businesses concerned about the fluctuating value of other cryptocurrencies.

- XRP: Known for its low cost and fast transaction times, XRP is becoming a preferred choice for international transactions and businesses with a global customer base.

- Dogecoin (DOGE): Initially started as a joke, Dogecoin has gained popularity and is now used by some businesses, especially in the retail and entertainment sectors.

When selecting the best cryptocurrency for payments, consider factors like transaction speed, fees, market acceptance. It’s also important to decide if you want to keep Bitcoin or crypto on your company’s balance sheet. Then, Bitcoin is probably the less riskiest bet as “digital gold.”

Who Accepts Bitcoins As Payment?

Bitcoin’s acceptance as a payment method has seen a significant rise, with a diverse range of companies integrating it into their payment options.

Businesses That Accept Crypto

Below is a list of some notable companies that accept Bitcoin:

Tech Companies

- Microsoft: Allows Bitcoin for Microsoft account top-ups.

- AT&T: First major U.S. mobile carrier accepting crypto through BitPay.

- Namecheap: Bitcoin payment for domain management and registration.

- The Internet Archive: Accepts Bitcoin donations.

- ExpressVPN: Bitcoin payments accepted via Bitpay.

- DishNetwork: Subscription payments with Bitcoin and Bitcoin Cash.

- Grooveshark: Bitcoin payments via Stripe.

- SEOclerks.com: Accepts Bitcoin for its SEO-focused job marketplace.

- Substack: Pay newsletters in Bitcoin.

- WordPress.com: Bitcoin payments through Bitpay.

- Tesla: The electric car giant briefly accepted Bitcoin, but still accepts Dogecoin.

Fintech Companies

- Paypal: Buy, sell, and hold cryptocurrencies.

- Intuit Quickbooks: Accepts Bitcoin.

- Mint.com: Tracks Bitcoin since 2015.

- Coinfuel: Gas Gift Cards with Bitcoin.

- ForexTime (FXTM): Cryptocurrency trading.

- AvaTrade: Cryptocurrency trading options.

- FBS: Foreign exchange trading with cryptocurrencies.

- eToro: Cryptocurrencies on a traditional trading platform.

- Ecommerce Companies

- NewEgg: Hardware and electronic gadgets.

- Shopify: Thousands of merchants accepting Bitcoin.

- eGifter and Gyft: Buy gift cards with Bitcoin.

- BitPlaza: Wide range of products.

- Etsy: Merchants can accept crypto.

- Fancy.com: Global shopping site.

Gaming and Entertainment Companies

- Twitch: Streaming platform accepts Bitcoin and Litecoin

- BigFishGames.com: Casual games creator.

- HumbleBundle: Games, ebooks, software.

- Xbox: Subscriptions with Bitcoin.

- Zynga: Social gaming platform.

- Movietickets.com: Online movie ticketing.

- Lionsgate films: Hollywood studio.

- AMC Theaters: Movie tickets with Bitcoin.

Food Companies

- Subway: Some locations accept Bitcoin.

- Burger King: Germany and Venezuela.

- KFC: Special Bitcoin bucket deal.

- The Pink Cow – Japan: Bitcoin ATM.

- Pemburry Tavern: Britain’s first Bitcoin pub.

- Old Fitzroy: Sydney pub.

- Bitcoin Coffee: Prague cafe.

- Dominoes In The Netherlands: Employee payments.

- WholeFoods: Via Spedn app.

- Coupa Cafe: Silicon Valley early adopter.

- JustEat: In some countries via BitPay.

Travel Companies

- CheapAir: Flights and hotels.

- Travala.com: Hotels, flights, activities.

- More Stamps Global: Flights, hotels, travel services.

- BTCTrip: Bitcoin-supported flights.

- Webjet: Australian online travel agency.

- Alternative Airlines: BTC Travel and vacations.

- Peach Aviation: Japanese carrier accepting BTC.

- Virgin Galactic: Space flight venture.

- Expedia: Airline tickets with Bitcoin.

Jewelers And Precious Metal Companies

- REEDS Jewelers: Luxury watches and jewelry.

- Vaultoro: Precious metals and Bitcoin.

- Menlo Park: High-end jewelry.

- Luxe Watches: Luxury brand watches.

- Saving Pearls: Handmade jewelry shop.

- American Bullion: Gold investor company.

- SchiffGold: Precious metals.

Other Companies Who Accept Bitcoin As Payment

- Wikipedia: Open encyclopedia accepting Bitcoin donations.

- SavetheChildren: Nonprofit accepting cryptocurrency.

- European School of Management and Technology Berlin: Education institute.

- University of Cumbria: UK university.

- Juliette Interiors: Luxury UK-based furniture retailer.

- Mobler Design: Furniture company.

- Red Cross: Nonprofit accepting Bitcoin.

- UnitedWay: Community of nonprofits.

- BitGive: First Bitcoin nonprofit.

- McLaughlin & Stern: Law firm.

- Central Texas Gunworks: Firearms dealer.

- Inguard: Insurance company.

- Managego: Platform for rent payment with Bitcoin.

- Dallas Mavericks: Accepts Bitcoin as a payment method for game tickets and merchandise, processed through BitPay.

Bitcoins As Payment: Using The Lightning Network

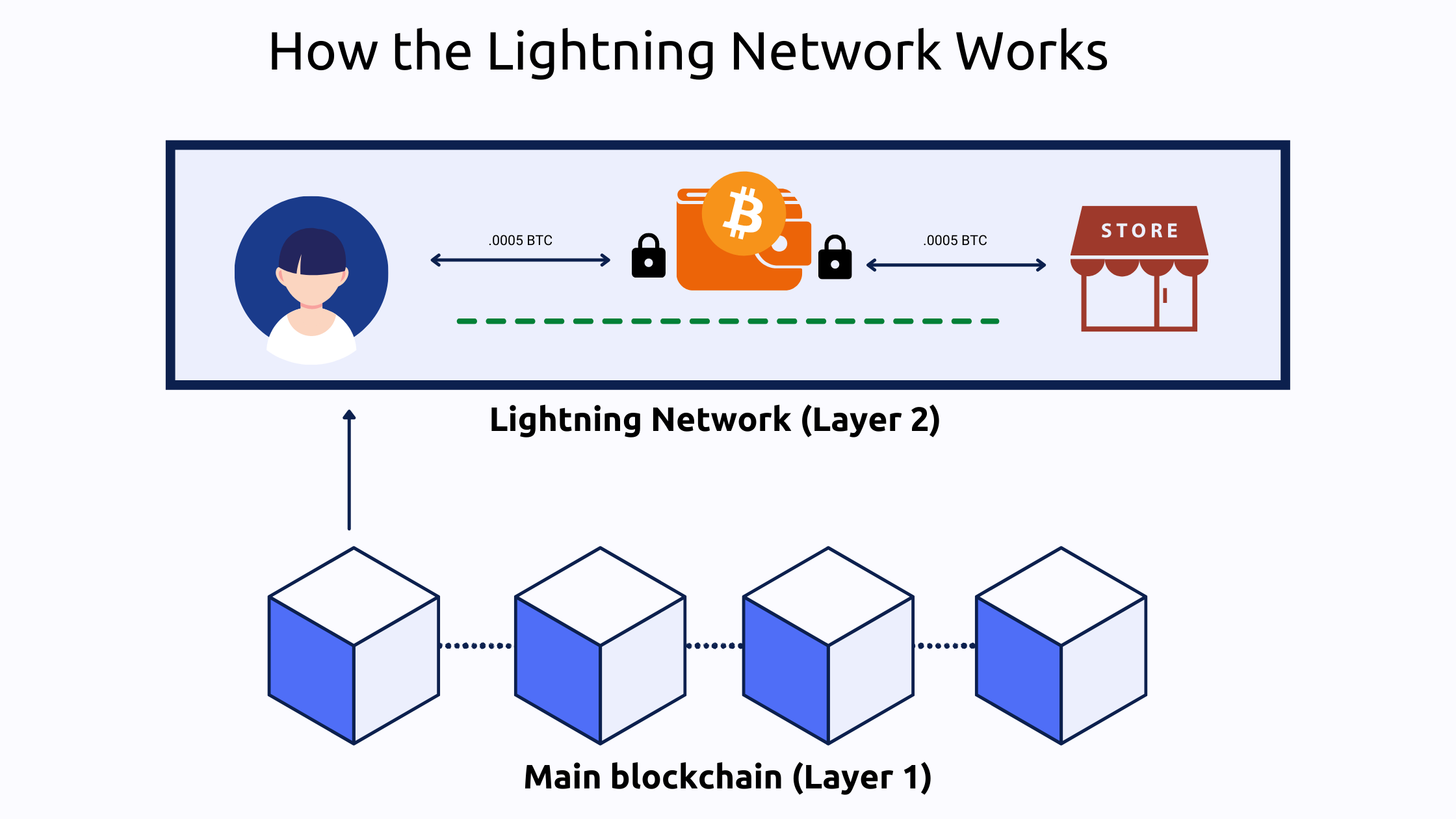

The Lightning Network represents a significant advancement in the use of Bitcoin as a payment method. It’s a “layer 2” payment protocol layered on top of the Bitcoin blockchain, designed to enable faster and more cost-efficient transactions.

This is particularly beneficial for microtransactions, which can be impractical on the main Bitcoin network due to higher fees and longer processing times. Key features include:

- Speed: Transactions are almost instantaneous, drastically reducing waiting times.

- Reduced Fees: Much lower than traditional Bitcoin transactions, making it economical for small purchases.

- Scalability: Can handle a massive volume of transactions, which the main Bitcoin network might struggle with.

- Enhanced User Experience: Provides a smoother and more efficient transaction process, ideal for everyday purchases.

- Increased Adoption: Its efficiency makes Bitcoin more practical for mainstream use, encouraging wider adoption.

Businesses using the Lightning Network can offer customers a quick and low-cost way to pay with Bitcoin, making it an attractive option for both small-scale and large transactions. This technology is particularly appealing for online businesses and retailers, where speed and efficiency are crucial.

Advantages Of Crypto Transactions

Crypto transactions, particularly at the point-of-sale (POS), present several advantages over traditional methods like Visa, Mastercard, or other payment service providers. The decentralized nature of cryptocurrencies means lower transaction fees, as there are no intermediary institutions such as banks or credit card networks charging for their services. This can result in substantial savings for businesses, especially those with high transaction volumes.

Moreover, crypto transactions often process faster than conventional methods, a significant advantage for both merchants and customers. They enhance security, leveraging blockchain technology’s inherent encryption and immutability, which minimizes fraud risks. Unlike traditional payment methods, cryptocurrencies are not bound by national borders or subject to the same regulatory constraints, offering a more seamless experience for international transactions.

Additionally, accepting cryptocurrencies can enhance a business’s market appeal, especially to tech-savvy customers who prefer using digital currencies. By adopting crypto payments, businesses position themselves as forward-thinking and adaptable to emerging financial technologies.

FAQs On Crypto Payments

How To Accept Bitcoin As Payment?

To accept Bitcoin as payment, businesses need to set up a digital wallet and choose a payment gateway like Coinbase Commerce or BitPay. Integration with existing POS systems or online platforms is typically required, followed by configuring the payment settings to accept Bitcoin.

Who Takes Bitcoin As Payment?

Numerous businesses, including tech companies like Microsoft, retailers like Overstock, and various food outlets and travel companies, accept Bitcoin. The acceptance is growing, encompassing a wide range of industries.

How To Accept Crypto Payments?

Accepting crypto payments involves selecting a crypto payment processor, setting up a cryptocurrency wallet, integrating the payment system into your business infrastructure, and deciding on the cryptocurrencies you wish to accept.

Who Accepts Bitcoins As Payment?

Businesses across different sectors accept Bitcoin. This includes tech companies like Microsoft, AT&T, various eCommerce platforms, and service providers like ExpressVPN.

Who Accepts Bitcoin As Payment?

Numerous renowned companies across various sectors accept Bitcoin as a form of payment. These include major tech companies like Microsoft and AT&T, eCommerce giants like Overstock, and notable travel companies such as Expedia and Virgin Galactic. The list also features entertainment and food service providers like AMC Theaters and Subway.

How To Accept Crypto Payments As A Business?

Businesses can accept crypto payments by choosing a suitable crypto payment gateway, integrating it with their sales system, setting up a crypto wallet, and educating their staff about handling crypto transactions.

What Are The Best Cryptos For Payments?

The best cryptocurrencies for payments include Bitcoin, Ethereum, Litecoin, XRP and stablecoins like USDT and USDC due to their wide acceptance, relative stability, and lower transaction fees compared to traditional payment methods.