Binance is paying one of the largest fines in corporate history to the U.S. Department of Justice, while its founder and CEO, Changpeng “CZ” Zhao, stepped down from his role running the platform as part of a settlement with multiple federal agencies. Meanwhile, Kraken is facing a lawsuit from the U.S. Securities and Exchange Commission that echoes the SEC’s previous wave of suits.

Binance Founder Changpeng ‘CZ’ Zhao Released on $175M Bond, Will Be Sentenced in February

Binance founder and former CEO Changpeng “CZ” Zhao has been released from custody on a $175 million personal recognizance bond.

What’s Next for Ex-Binance CEO CZ? Passive Investing, DeFi

The former Binance CEO will remain a shareholder and a consultant for the company.

After CZ Quits as Binance CEO, Richard Teng Looks Like the Heir Apparent

Binance Freezes $11.8 Million In Stolen Assets Following Kidnapping Incident – Details

Chief Executive Officer of Binance, Changpeng “CZ” Zhao, has shared a report in which the exchange intervened in the theft of millions of dollars worth of crypto assets. Through a fast response operation, the Binance Global Head stated they were able to prevent the bad actors from making away with over 90% of the stolen loot.

Binance Confiscates $11.8 Million In Assets Belonging To Kidnapped Clients

In a Friday post on X, CZ stated that executives from one of Binance’s client companies were deceived into going on a business trip to Montenegro, during which they were kidnapped and forced to forfeit all assets in their crypto wallets.

Executives from a client were lured on a ‘business trip’ to Montenegro, where they were abducted and forced to empty their wallets. Total loss ~$12.5m.

We investigated the on chain activities and reached out to our partners earlier today to have the wallet frozen, as all of the…

— CZ

Binance (@cz_binance) November 10, 2023

In total, the Binance CEO stated that the bad actors were able to obtain approximately $12.5 million dollars worth of digital assets from their victims, which were all converted to USDT and moved to a TRON wallet.

However, Binance was able to quickly intervene in the matter, alerting their partners to the situation, who were then able to freeze the wallet. In doing so, Binance foiled the kidnapper’s access to $11.8 million of the $12.5 million loot.

The incident recounted by CZ is not a new occurrence in the crypto space, as sometimes bad actors resort to such brazen methods to steal crypto assets from investors.

In 2020, Le Duc Nguyen, a Vietnamese investor, was kidnapped and robbed of about VND 35 billion ($1.5 million) worth of crypto assets by another Vietnamese man named Ho Ngoc Tai with the help of 15 gang members.

Tai claimed that he lost 1,000 Bitcoins valued at VND 100 billion by investing in other tokens based on financial advice. The crypto investor felt cheated and proceeded to obtain a “refund” via forceful means.

Albeit, Tai and his hired hands were eventually apprehended by the police and faced trial in May 2023, during which 14 of the 16 culprits were given sentences ranging from 9 to 19 imprisonments.

CZ Faces Questions On Crypto’s Decentralization

Following Zhao’s account of the successful crypto asset recovery, some crypto enthusiasts raised concerns over Binance’s ability to freeze users’ assets at will, a feature synonymous with the fiat banking system.

I really condemn this loss and happy coz most of the money is safe but I have a question @cz_binance

In fiat banks, everyone say that those guys can freeze money at any time without any reason

How crypto is better if someone can still freeze our personal wallet??Simple…

— Crypto Eagles (@CryptoProject6) November 10, 2023

However, the Binance boss stated that crypto users have a choice to avoid such occurrences, as assets can only be frozen on centralized exchanges (CEX). Using other forms of storage, such as non-custodial wallets, users’ assets are bound to remain inaccessible to any third party.

Binance used ‘tortured’ interpretation of law in bid to toss suit, says SEC

The SEC derided Binance’s request to have the regulator’s suit thrown out, claiming the crypto exchange hasn’t correctly applied the law.

Chainlink leads the market with 61% weekly gain — What’s driving LINK price?

LINK price pulled off a shocking double-digit rally over the past week, but exactly what is behind the move?

Binance Founder CZ’s Wealth Falls About $12B as Trading Revenue Slumps: Bloomberg

Changpeng Zhao’s wealth dropped to $17.2 billion from a previous estimate of $29.1 billion.

Binance founder CZ’s fortune gets slashed $12B, while SBF is still at $0

Binance CEO Changpeng Zhao’s crypto empire has fallen over 80% from its January 2022 peak of almost $97 billion.

Bitcoin price chases after $35K as BTC derivatives data signals fresh inflow

Bitcoin options and futures data suggests the current BTC price movement could have longevity.

Binance Says It Has Onboarded New Euro Fiat Partners for Deposits, Withdrawals

Paysafe, the crypto exchange’s former service provider for euro transfers ended support last month.

Binance CEO Foresees Monumental Bitcoin Price Shift Following Halving

As the crypto community’s anticipation heightens for the upcoming Bitcoin halving, Changpeng Zhao (CZ), CEO of Binance, recently elucidated his observations around the historical patterns tied to this quadrennial event. Highlighting the evolving sentiments and speculations, CZ spotlighted the dominant themes before and after the halving events.

CZ observed that the preceding months to the halving are generally characterized by heightened discourse, diverse sentiments, and amplified expectations within the cryptocurrency sphere. “The few months leading up to the Bitcoin halving, there will be more and more chatter, news, anxiety, expectations, hype, hope, etc.,” he stated.

Addressing the commonly held belief that Bitcoin’s price will witness an immediate uptick post-halving, CZ dispelled such notions based on historical patterns. “The day after the halving, the Bitcoin price won’t double overnight. And people will be asking why it didn’t,” he remarked, addressing the immediate aftermath expectations.

While the short-term reactions post-halving may be tempered, CZ shed light on a longer-term trend where Bitcoin often reaches new all-time highs (ATHs) within the year that follows. In reference to the market’s ability to quickly transition from skepticism to marvel, he quipped, “People have short memories.”

However, CZ urged caution, emphasizing that historical patterns should not be construed as definitive indicators for future behaviors, noting, “Not saying there is proven causation. And history does NOT predict the future.”

A More In-Depth Analysis Of Bitcoin Halving

As Bitcoinist reported, renowned crypto analyst Rekt Capital recently published an in-depth analysis of the Bitcoin halving, offering a more granular view of the potential phases surrounding the event which is only 197 days and a few hours away according to Binance’s estimates.

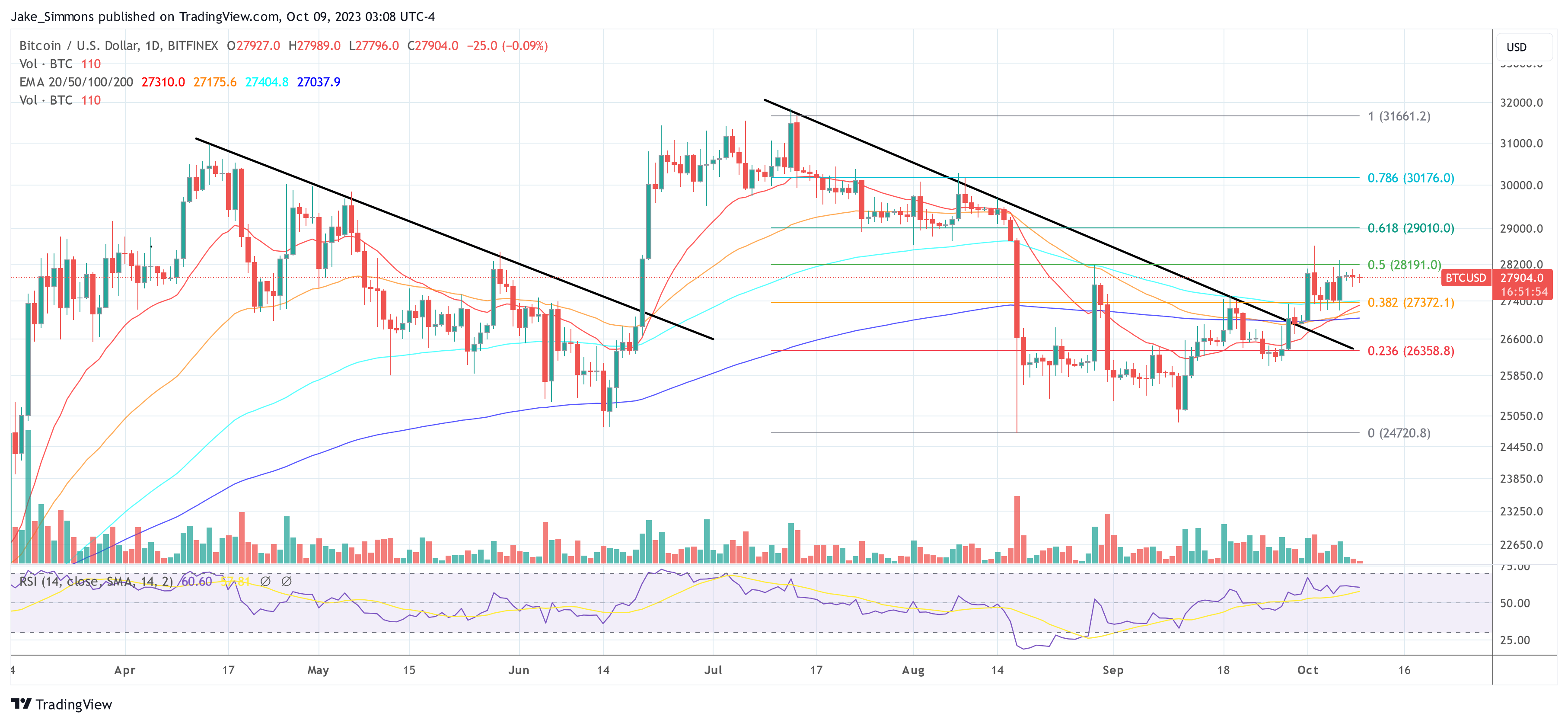

Reflecting on historical patterns, the analyst suggested a possible deeper retrace for Bitcoin in the 140 days leading up to the halving. Drawing historical parallels, Rekt Capital emphasized, “You can debate whether 2023 is more like 2015 or more like 2019… Doesn’t change the fact that BTC retraced -24% in 2015 and -38% in 2019 at this same point in the cycle (i.e. ~200 days before the halving).”

Anticipating market dynamics as the halving nears, Rekt Capital postulated that roughly 60 days before the event, historically a pre-halving rally will likely emerge. This phase, marked by investor enthusiasm and elevated expectations as CZ puts it, is often characterized by buying into the halving anticipation.

But this enthusiastic phase doesn’t last. Around the halving event, the market often shows pullback behavior under the motto “buy the rumor, sell the news”. Highlighting this trend, the analyst cited the -38% dip witnessed in 2016 and the -20% decline in 2020, moments when the market re-evaluated the halving’s short-term implications.

Subsequent to this, Rekt Capital predicts a multi-month re-accumulation phase, often marked by investor fatigue due to stagnation. However, breaking out of this phase typically heralds Bitcoin’s entry into a parabolic uptrend, potentially culminating in new all-time highs.

At press time, BTC traded at $27,904.

Bitcoin price drops its early week gains — Here is why

Bitcoin price gave up its recent gains as concerning signals from the US economy continue to weigh on investor sentiment.

TV’s Kevin O’Leary: ‘All the Crypto Cowboys Are Going to Be Gone Soon’

O’Leary, an entrepreneur and television personality, was paid $15 million by FTX for “20 service hours, 20 social posts, one virtual lunch and 50 autographs,” according to Michael Lewis’ new book “Going Infinite.”

Bitcoin price eyes $28K as Binance legal battle spurs bullish momentum

Discover how margin and option metrics hint at Bitcoin’s path to $28,000 amid the Binance legal battle.

Binance CEO CZ forecasts DeFi outgrowing CeFi in the next bull run

Binance CEO Changpeng “CZ” Zhao declares the more decentralized the industry becomes, the better.

DOJ Action Against Binance: A Hidden Blessing For Bitcoin And Crypto Markets?

The looming prospect of a U.S. Department of Justice (DOJ) action against Binance, the largest crypto exchange, may hold a silver lining for Bitcoin and the broader markets. Even if this sounds crazy at first, there are good arguments for it.

Rumors have been swirling for weeks about a potential DOJ action against Binance, a threat that has cast a long shadow over the markets, leading to increased volatility and uncertainty among investors. Yesterday’s report by Semafor has rekindled the rumor, but also gave it a new perspective, hinting that these developments may be a blessing in disguise for Bitcoin and crypto markets.

According to the Semafor report, the DOJ is contemplating fraud charges against Binance but is also weighing the potential repercussions to consumers and the crypto market at large. Citing sources familiar with the matter, the report suggests that federal prosecutors are concerned that an indictment could trigger a “bank run” similar to the calamitous fate that befell the now-bankrupt FTX platform.

This fear arises from the concern that a potential indictment could lead to a rapid withdrawal of funds, causing consumers to lose their money and potentially trigger a wider panic in the Bitcoin and crypto markets. To circumvent such a catastrophe, the prosecutors are exploring other options like levying fines or establishing deferred or non-prosecution agreements.

What Does This Mean For Bitcoin And Crypto Markets?

Interestingly, some crypto market analysts and commentators view this ongoing saga as a potential boon. Macro analyst Alex Kruger, in a recent Twitter post, speculated, “Too Big to Jail? Call me crazy but this seems bullish if true.” This statement captures the sentiment that if Binance is considered too important to be hit with crippling charges, the DOJ could explore less harmful alternatives.

A similar view is held by renowned analyst Pentoshi, who said, “It doesn’t mean they won’t drop the hammer either. I think calling it “bullish” is a bit extreme since they are considering dropping the hammer. And if not billions in fines and CZ likely gone. But I def don’t think it’d as bearish as headlines first said at all. Bullish would be no DoJ involvement.”

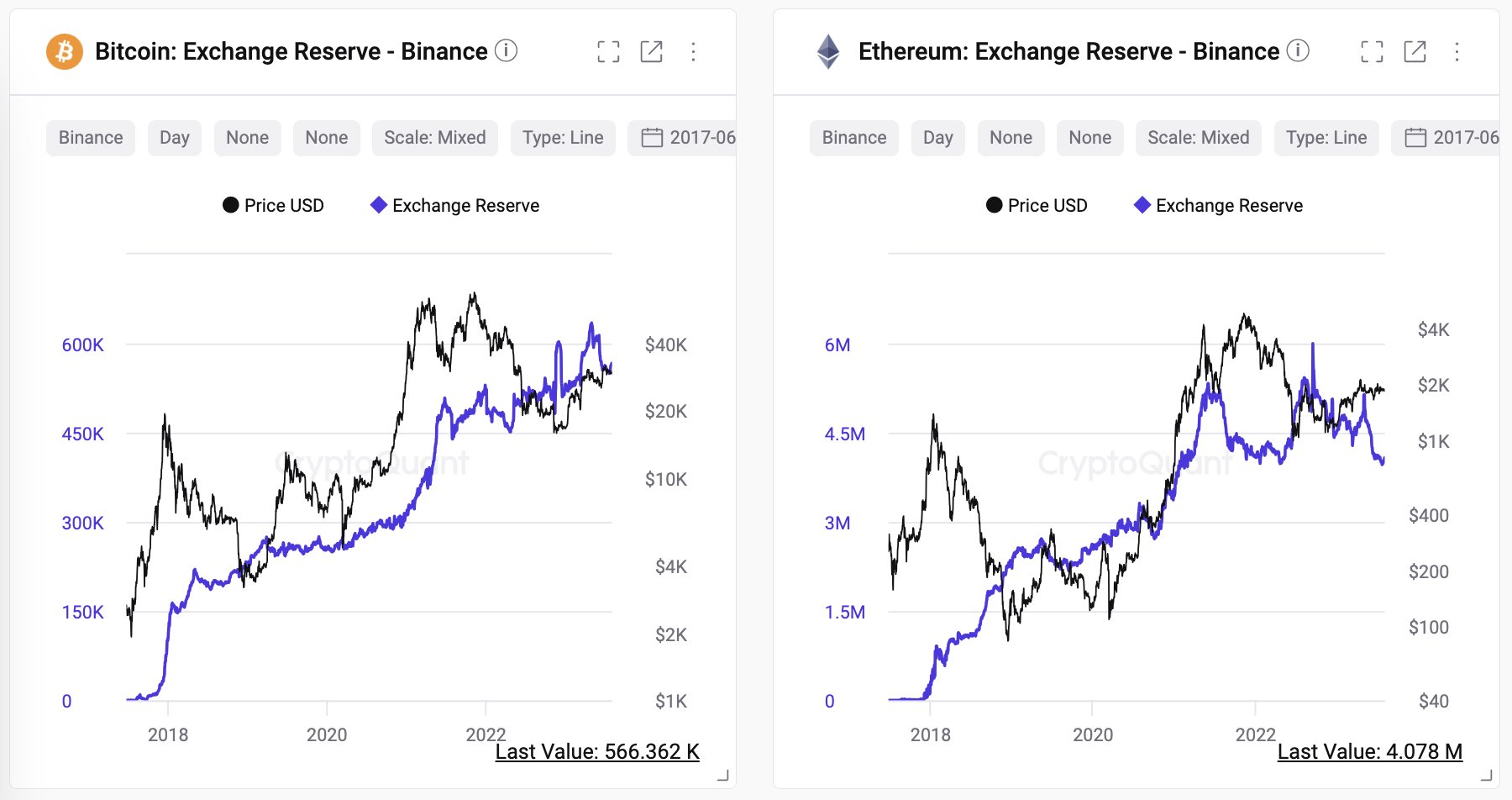

The prospect of the DOJ acting against Binance could also provide a much-needed clarity to the market. If Binance were indeed vulnerable to a bank run, it would quickly become apparent whether the exchange holds sufficient reserves.

However, so far, Binance has impressively weathered previous “stress tests”, as highlighted by CEO “CZ” in a Twitter post in mid-December last year after the Mazars audit rumors, stating, “We saw some withdrawals today (net $1.14b ish). We have seen this before. Some days we have net withdrawals; some days we have net deposits. Business as usual for us.”

This sentiment is echoed by CryptoQuant CEO Ki Young-Ju who shared data supporting the strength of Binance’s user balances despite constant rumors of insolvency. He stated:

I’ve heard about the ‘bank run/insolvency risk on Binance’ a hundred times for years, but their user balances always tell a different story.

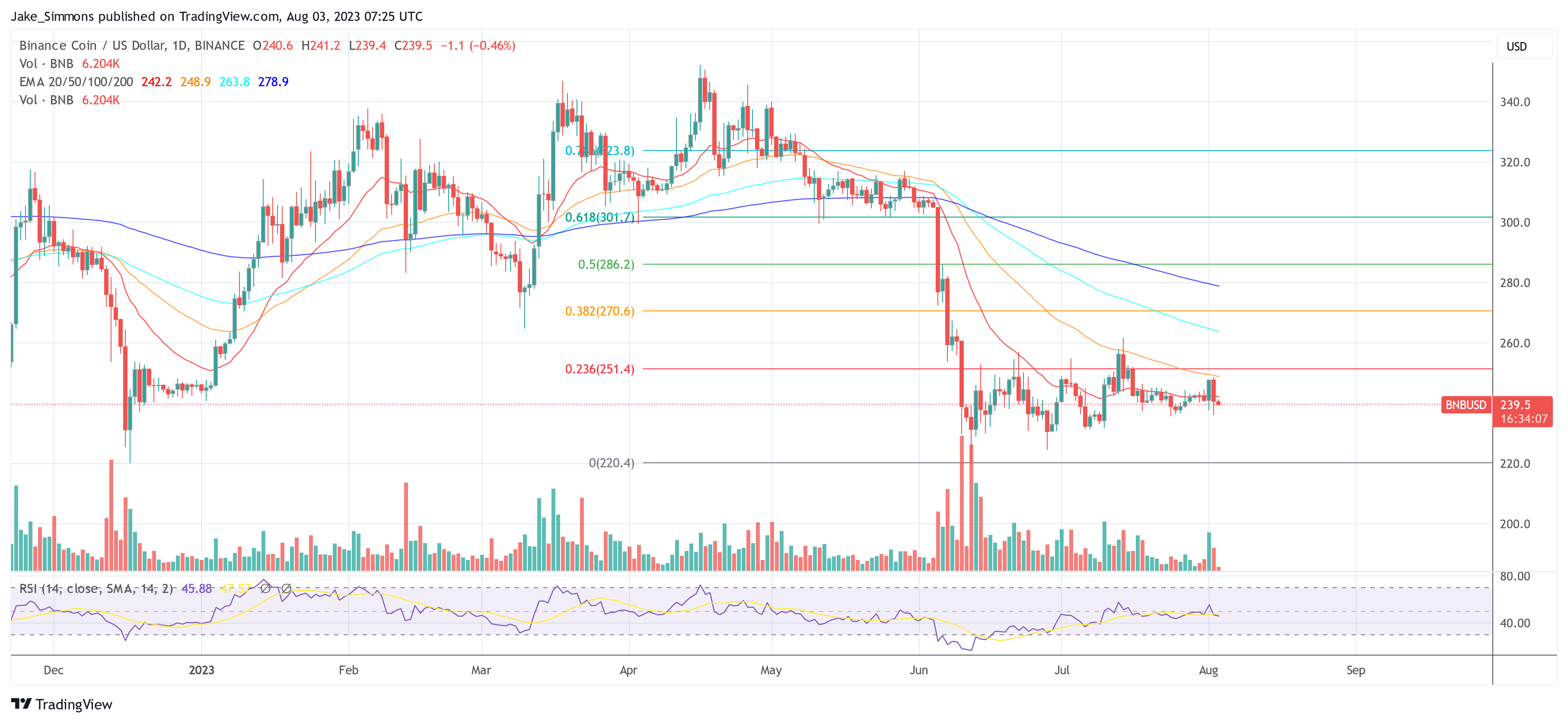

At press time, the BNB price stood at $239.5.

Binance Nearly Shuttered U.S. Exchange to Protect Global Operations: The Information

As investigations loomed, the board of directors of Binance.US voted on whether to liquidate the company but could not come to a unanimous decision, The Information reported.

Binance to Reenter Japan in August 2 Years After Regulator’s Warning

Leading cryptocurrency exchange Binance will be launching its full service in Japan in August. The return was made possible by Binance’s purchase of regulated crypto exchange Sakura Exchange BitCoin last November.

Miami Heat’s Jimmy Butler seeks dismissal from Binance promo class suit

Lawyers for the basketball star claim he did not mention any alleged securities but instead warned of celebrities promoting crypto investments.