Wyoming has established a new legal framework for in-state decentralized autonomous organization (DAO) nonprofits that has crypto investment giant Andreessen Horowitz (a16z) calling the state an “oasis.”

Uniswap’s UNI Gains 20% as Token Reward Proposal Inches Closer to Approval

Uniswap’s UNI gained 20% as a governance proposal to distribute protocol revenues among token holders gets overwhelming support in a temperature check before voting.

USDR Issuer Tangible Plans to Redeem Itself as a Layer-2 for Real-World Assets

First came the literal redemption for failed stablecoin USDR. Now comes the metaphorical redemption as Tangible changes its name to re.al.

Risk Manager Gauntlet Terminates Relationship with Aave, Citing DAO Dysfunction

Gauntlet co-founder John Morrow said his team “found it difficult to navigate the inconsistent guidelines and unwritten objectives” of Aave’s “largest stakeholders.”

MIM Stablecoin Suffers Flash Crash Amid $6.5M Exploit

The stablecoin issued by decentralized platform Abracadabra.money {MIM}, suffered a flash crash to $0.76 after reports emerged of a $6.5 million exploit.

dYdX Foundation Requests $30M Budget, Pledges to Issue Annual Spending Report

The Foundation wants to preserve an 18-month runway through at least mid-2026.

dYdX Foundation Requests $30M Budget, Pledges to Issue Annual Spending Report

The Foundation wants to preserve an 18-month runway through at least mid-2026.

DeFi Insurer Nexus Mutual Requests $153K for 6-Month Budget

The crypto insurance protocol is anticipating growth stemming from a recent partnership.

DeFi Insurer Nexus Mutual Requests $153K for 6-Month Budget

The crypto insurance protocol is anticipating growth stemming from a recent partnership.

Japanese Lawmakers Want To Carve Out New Web3 Policies: CoinDesk Japan

“We would like to grasp the current situation in areas other than decentralized autonomous organizations and identify new important points for policy,” Congressman Hideto Kawasaki said.

PancakeSwap Proposes to Reduce CAKE Token Supply by 300 Million

More than 99.95% of the community, representing 70,000 votes from CAKE holders, favored the proposal shortly after it went live.

SEC Blasts ‘Purportedly Decentralized’ DAOs in $1.7M Settlement with BarnBridge

BarnBridge failed to register its structured crypto product with the SEC, regulators alleged.

ATHDAOx: Building the future of Web3 in physical-digital with DAOs

The DAO-centric event took place in Athens, Greece over two days and focused on everything from governance and legal issues to community building and security.

What Is A DAO

Decentralized Autonomous Organizations (DAOs) represent a revolutionary concept in the blockchain and crypto world, reshaping how we think about governance and collaborative decision-making. This article dives deep into the world of DAOs, providing a comprehensive understanding of ‘What is a DAO’, their meaning, mechanics, and significance in the crypto ecosystem. You’ll also explore the intriguing history of DAOs, including insights into Nick Szabo‘s pioneering role in their invention.

What Is A DAO?

A Decentralized Autonomous Organization (DAO) is an innovative organizational structure that operates on blockchain technology, embodying principles of decentralization, autonomy, and consensus-driven governance. At its core, a DAO is an entity without central leadership, governed by a set of rules encoded in smart contracts. These contracts, running on blockchain platforms such as Ethereum, automate decision-making and enforce the rules of the organization.

Key to understanding ‘what is a DAO‘ is grasping its reliance on blockchain technology. DAOs utilize smart contracts to create a transparent and incorruptible framework for organizational operation. These contracts are programmed to execute automatically when certain conditions are met, ensuring that operations are not only transparent but also free from human error or manipulation.

DAOs fundamentally alter traditional governance structures by enabling token holders to vote on proposals directly, thereby democratizing decision-making processes. This contrasts sharply with traditional organizations where decisions are often made by a select few at the top. Every token holder can have a say proportional to their stake, aligning the interests of the organization with those of its members.

The concept of DAOs gained significant attention following the launch of projects like MakerDAO and The DAO. MakerDAO, for instance, is a decentralized lending platform that allows users to borrow and lend cryptocurrencies. The DAO, one of the earliest examples, was a venture capital fund without a traditional management structure, though it faced challenges that highlighted the need for rigorous security protocols in DAOs.

In Short: DAO Meaning And DAO Definition

DAO Meaning: A Decentralized Autonomous Organization (DAO) is a novel form of organization governed by digital rules and operated on a blockchain. The term captures the essence of a system where organizational decisions and protocols are encoded in smart contracts, ensuring operations without centralized authority. DAOs epitomize a shift towards decentralized decision-making, leveraging blockchain technology to facilitate transparent, autonomous, and democratic governance processes.

DAO Definition: DAOs are defined as entities where governance and decision-making are conducted by a collective of stakeholders rather than centralized leadership. These stakeholders typically hold tokens or digital assets that grant them voting rights within the organization.

The defining characteristic of a DAO is its reliance on smart contracts to automate administrative functions and enforce the rules set forth by its members. This automation not only minimizes the need for intermediaries but also ensures that the organization’s operations are immutable, transparent, and aligned with the interests of its token holders. DAOs, therefore, redefine organizational management by embedding trust, integrity, and collective intelligence at their core.

The Mechanics Of Decentralized Autonomous Organizations

The mechanics of Decentralized Autonomous Organizations (DAOs) represent a paradigm shift in how we conceive and execute organizational structure and governance. Rooted in blockchain technology, DAOs offer a framework for orchestrating collective action and decision-making in a decentralized, transparent, and automated manner. This approach challenges traditional hierarchical models, providing a blueprint for a more democratic and equitable form of organizational governance.

How DAOs Work

DAOs operate on a blend of technological innovation and organizational principles. The foundation of a DAO is its smart contract, which resides on a blockchain platform, most commonly Ethereum. These contracts are self-executing and contain the rules of the organization. Once deployed, only the consensus of the organization’s members can alter these contracts, guaranteeing immutability and transparency.

The process initiates with setting up a DAO by deploying smart contracts that define the organization’s rules. This includes the decision-making process, fund management, and member participation guidelines. Typically, participation in a DAO is token-based, with members holding tokens that denote their voting rights. The more tokens a member holds, the greater their influence in decision-making processes.

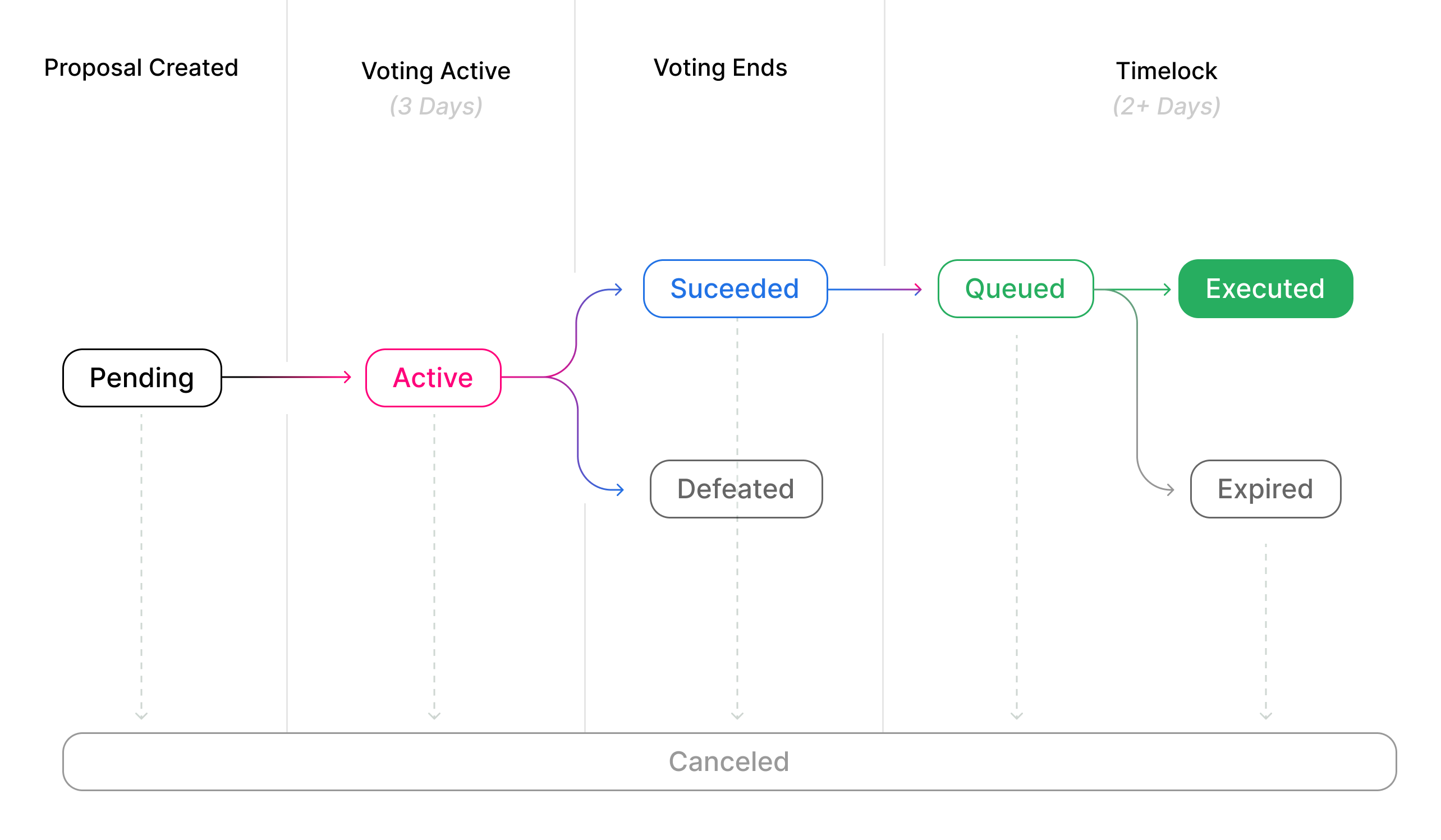

Voting in a DAO is a critical aspect. Members propose changes or actions, and these proposals are put to a vote. The smart contract automatically executes the decision based on the outcome of the vote, ensuring that the process is transparent and tamper-proof. This structure allows for a decentralized governance model, where no single entity has control over the organization, and decisions are made collectively by its members.

The Unique Characteristics Of DAO Crypto

DAO crypto refers to the use of cryptocurrency within DAOs for governance and transactional purposes. This aspect of DAOs presents several unique characteristics:

- Token-Based Governance: In DAOs, governance is primarily exercised through tokens. These tokens are not just a currency but a means of participating in the decision-making process. They can represent voting power, membership rights, or even a share in the DAO’s profits.

- Decentralization: DAOs function on a decentralized model, diverging from traditional organizations. Without CEOs or boards, the community collectively makes decisions. Blockchain technology facilitates this decentralization, preventing any single point of failure or control from compromising the organization.

- Transparency and Immutability: DAOs record all transactions and decisions on the blockchain, ensuring unmatched transparency. The immutable nature of these records means that once a decision is made and logged, it cannot be changed, fostering a trustless environment for member interaction.

- Automation And Efficiency: The use of smart contracts in DAOs automates various processes, from governance to financial transactions. This automation reduces the need for intermediaries, cuts down on bureaucratic overhead, and increases efficiency.

- Global Participation: DAOs operate on the internet, enabling anyone, regardless of location, to participate. This global reach expands the potential for innovation and collaboration, transcending geographical and political boundaries.

The combination of these characteristics makes DAO crypto a powerful tool for creating and managing decentralized, transparent, and efficient organizations, poised to revolutionize how we think about and participate in collective decision-making and governance.

The Evolution Of DAOs

The concept and evolution of Decentralized Autonomous Organizations (DAOs) mark a significant milestone in the realm of digital governance and blockchain technology. The beginning can be traced back into the 1990s, even before Bitcoin and blockchain existed.

History: Nick Szabo Invented DAOs

The historical roots of DAOs can be traced back to the visionary ideas of Nick Szabo, a pioneering cryptographer and computer scientist. Szabo, who coined the term ‘smart contracts’ in the 1990s, laid the foundational concepts that would eventually lead to the creation of DAOs.

Szabo is credited with pioneering smart contracts in a 1996 paper. Remarkably, his ideas also influenced Bitcoin’s development. In 1998, Szabo created BitGold, considered by some as a precursor to Bitcoin.

His vision of automating contract and transaction protocols on a digital platform paved the way for the first DAOs. Although Szabo himself did not create a DAO, his work on smart contracts and digital currency greatly influenced their development. The principle of decentralized control and automation in DAOs is a direct extension of Szabo’s foresight in using blockchain technology for more than just creating digital currency.

Most Famous Decentralized Autonomous Organizations

Over the years, several DAOs have gained prominence, showcasing the potential and diversity of this organizational form. Some of the most notable DAOs include:

The DAO

The DAO, also known as Genesis DAO, stands as a landmark in the history of decentralized organizations. Launched in 2016 on the Ethereum blockchain, it was envisioned as a decentralized venture capital fund, enabling investors to vote on which projects to fund.

The DAO quickly garnered significant attention, raising over $150 million in Ether, making it one of the largest crowdfunding campaigns at the time. However, a vulnerability in its smart contract code led to a significant hack, resulting in the loss of a substantial portion of the funds.

This event not only exposed the security risks associated with smart contracts but also influenced the subsequent hard fork of the Ethereum blockchain, leading to the split between Ethereum (ETH) and Ethereum Classic (ETC). The DAO’s story is a seminal chapter in DAO history, highlighting the importance of security and governance structures in decentralized organizations.

UniswapDAO

UniswapDAO governs Uniswap, one of the leading decentralized exchanges (DEXs) in the crypto space. It represents the community-driven aspect of the Uniswap platform, allowing token holders to vote on key decisions and proposals concerning the platform’s development and governance.

The creation marked a significant step towards decentralized governance in DeFi, empowering users to shape the platform’s future. Through a transparent and democratic process, UniswapDAO handles various aspects such as protocol upgrades, treasury management, and even community initiatives, illustrating the power of collective decision-making in decentralized finance.

MakerDAO

MakerDAO is a prominent DAO in the decentralized finance sector, primarily known for creating and managing DAI, one of the first decentralized stablecoins pegged to the US dollar. It operates on the Ethereum blockchain and uses a dual-token system consisting of DAI and MKR tokens.

While DAI is used as a stable medium of exchange, MKR tokens represent governance rights within the system. Holders of MKR tokens can vote on critical decisions like risk management, collateral types, and fee adjustments, making MakerDAO a pioneer in decentralized governance and stablecoin implementation. Its innovative approach to collateral-backed stablecoin issuance and governance has set a standard in the DeFi industry.

Stable DAO

Stable DAO is a decentralized cross-chain reserve currency protocol, inspired by the model of OlympusDAO. It aims to provide a reliable and consistent income stream, functioning as a semi-passive source of profits without depending on active involvement.

Stable DAO introduces features like a Universal Basic Income and referral rewards for early adopters. However, some experts raise concerns about its legitimacy. It’s essential to exercise caution and conduct thorough research before considering involvement with Stable DAO.

DAO Governance And DAO Token

The concepts of DAO governance and DAO tokens are central to the functionality and success of Decentralized Autonomous Organizations. They collectively represent the democratic and decentralized ethos of DAOs, setting them apart from traditional organizational structures.

DAO Governance

At the heart of every DAO is a governance system that is both transparent and inclusive, ensuring that every member has a voice in the decision-making process. This system is typically enacted through a voting mechanism, where token holders submit and vote on proposals concerning the DAO’s operation, policy changes, and other crucial decisions.

The voting power is generally proportional to the number of tokens a member holds, embedding a democratic structure into the DAO’s operations. This method of governance ensures that the direction of the DAO aligns with the interests of its community, as decisions are made collectively rather than by a centralized authority.

The governance structure in a DAO is codified in its smart contracts, which lay out the rules for proposing and voting on decisions. These rules can vary widely among different DAOs, tailored to their specific needs and goals. Some DAOs may require a simple majority for a proposal to pass, while others might have more complex mechanisms involving various types of votes or quorums. This flexibility allows DAOs to adapt their governance models to suit their evolving requirements.

DAO Token

DAO tokens play a crucial role in governance. They are not just a medium of exchange but also represent voting rights and membership within the DAO. These tokens are often distributed during the DAO’s formation, either through a public sale, airdrop, or as rewards for contributions to the DAO. The distribution method impacts the decentralization of the DAO; for instance, a broad distribution of tokens can lead to a more decentralized governance structure.

In addition to voting rights, DAO tokens can also have other utilities, such as profit-sharing rights, access to specific services within the DAO, or staking opportunities. The specific functions and rights associated with DAO tokens vary based on the DAO’s structure and objectives.

The integration of DAO tokens into governance mechanisms is a critical innovation in the blockchain space. It provides a tangible way to align the incentives of the participants with the success of the DAO. This alignment ensures that members are motivated to act in the best interest of the DAO, fostering a collaborative and effective ecosystem.

Practical Guides

How To Create A DAO?

Creating a Decentralized Autonomous Organization (DAO) involves a series of strategic, technical, and community-building steps, each crucial to the DAO’s success.

- Define The Purpose And Structure: Start by clearly defining the DAO’s purpose, goals, and governance structure. This includes deciding on the voting mechanisms, membership criteria, and the role of the DAO tokens.

- Develop The Smart Contracts: The core of a DAO is its smart contracts. These need to be meticulously coded, tested, and audited to ensure they execute as intended and are secure from vulnerabilities. These contracts should encapsulate the rules, voting mechanisms, and other operational aspects of the DAO.

- Deploy On A Blockchain Platform: Choose a suitable blockchain platform (Ethereum is a popular choice) and deploy the smart contracts. This step officially launches the DAO on the blockchain.

- Token Creation And Distribution: Create DAO tokens for governance and voting and distribute them through methods such as public sales, airdrops, or rewards for early contributors.

- Build A Community: A DAO is only as strong as its community. Engage with potential members, promote your DAO’s vision, and encourage participation and voting.

- Establish Legal Compliance: Ensure that your DAO complies with relevant legal and regulatory frameworks, a step often overlooked but crucial for long-term viability.

- Continuous Development And Adoption: A DAO should evolve with its community’s needs and the broader blockchain ecosystem. Regular updates and improvements to the smart contracts and governance models may be necessary.

DAOs In Web3

In the web3 space, DAOs are more than just governance mechanisms; they are fundamental building blocks for decentralized applications (dApps) and services. They enable collective decision-making and resource allocation in a trustless environment, crucial for the decentralized ethos of web3. DAOs in Web3 can govern anything from content platforms to financial protocols, providing a transparent and democratic way to manage decentralized networks.

NFT DAO

NFT DAO is an innovative organization focused on enhancing and expanding the use of Non-Fungible Tokens (NFTs). Their mission is to develop open-source tools and components for building NFTs, applications, and marketplaces. A significant part of their work involves educating the next generation, offering Web3.0 project apprenticeships to college students.

Key initiatives of NFT DAO include developing NFT related open-source frameworks and standards, particularly for the Cardano blockchain. They have created their own NFT marketplace and are working on additional tools such as NFT Minting APIs and an auction API. Additionally, their payment gateway supports both fiat and cryptocurrency transactions.

Funded initially through votes from the Cardano community via Project Catalyst, NFT DAO also engages in consulting for projects aligned with their NFT technology expertise. They emphasize the development of open-source software components and actively support student involvement in blockchain and NFT projects through apprenticeships and scholarships.

List Of DAOs

Here’s a non-exhaustive list of notable DAOs, each exemplifying different aspects and use cases of DAOs:

- Compound: Autonomous interest rate protocol for lending and borrowing.

- MakerDAO: Decentralized lending platform and stablecoin issuer.

- Aragon: Platform for creating and managing DAOs.

- MolochDAO: Focused on Ethereum development funding.

- Curve Finance DAO: Governs the Curve decentralized exchange.

- PleasrDAO: A collective that acquires culturally significant NFTs.

- Friends With Benefits (FWB): A social DAO focused on culture and networking.

- Gitcoin DAO: Funds open-source development projects.

These DAOs, among many others, showcase the diverse applications and potential of decentralized autonomous organizations in various sectors of the digital economy.

The Future and Challenges of DAOs

The future of Decentralized Autonomous Organizations (DAOs) is both promising and laden with challenges. As DAOs evolve, they stand ready to make a significant impact across various sectors, ranging from finance to governance. However, realizing this potential involves carefully navigating a set of challenges.

Future Prospects

- Wider Adoption In DeFi And Beyond: Anticipation is high for DAOs to take on a more integral role in decentralized finance (DeFi). The have the potential to provide a transparent and democratic framework for financial transactions and decision-making.

- Expansion Into Mainstream Business: Beyond the blockchain sphere, DAOs have the potential to transform traditional business models. They offer a more collaborative and equitable approach to corporate governance.

- Integration With Emerging Technologies: As technologies like AI and IoT advance, DAOs could integrate these to enhance automated decision-making and operational efficiency.

- Legal Recognition And Frameworks: The future may see more countries recognizing DAOs as legal entities. This could provide them with a more stable and recognized operational framework.

Challenges To Overcome

- Regulatory Uncertainty: The biggest challenge facing DAOs is the lack of clear regulatory frameworks. This creates uncertainty and potential legal challenges, especially in cross-border operations.

- Security Risks: DAOs, being largely dependent on smart contracts, are susceptible to security risks. Ensuring the integrity and security of these contracts is paramount.

- Scalability Issues: As DAOs grow, they face scalability challenges, both in terms large numbers of transactions and in decision-making processes.

- Complexity In Governance: Balancing decentralization with efficient decision-making can be complex. DAOs must navigate the intricacies of collective governance while maintaining operational efficiency.

- Technological Barriers: For wider adoption, DAOs need to address the technological barriers that might prevent non-tech-savvy individuals from participating fully.

The coming years will likely see innovative solutions to these challenges. This will pave the way for more widespread adoption and impact of DAOs across various sectors.

FAQ

What Is A DAO Meaning?

DAO stands for Decentralized Autonomous Organization. It refers to an organization governed by its members under transparent rules encoded in a computer program, operating independently of central government influence. DAOs embody decentralized governance models implemented on blockchain technology.

How Does DAO Governance Work?

In DAO governance, members democratically make decisions through collective voting. Each member’s voting power typically corresponds to their stake or token count. Smart contracts encode governance rules, ensuring transparency and compliance with established processes.

What Does DAO Mean?

DAO stands for Decentralized Autonomous Organization. It signifies an organizational structure that operates autonomously and decentralized, without central leadership, through smart contracts on a blockchain.

Who Made DAO?

Various entities and communities create DAOs to establish a decentralized governance body. Nick Szabo, in the 1990s, coined the term ‘smart contracts,’ a core component of DAOs.

What Are DAOs?

In DAOs, organizations decentralize and automate governance and decision-making using smart contracts on a blockchain. They operate without traditional management structures, and their rules and transactions are transparent and verifiable.

Whats A DAO?

A DAO is a blockchain-based system that enables collective decision-making or governance in a decentralized and automated manner. It stands for Decentralized Autonomous Organization.

What Is DAO Crypto?

DAO crypto refers to the use of cryptocurrencies and tokens within the DAO for governance, transactions, or incentivization. These tokens often represent voting rights and are key to the participatory governance model of DAOs.

What Is DAO Web3?

In the context of Web3 a DAO is a form of organization that operates on these principles. It represents a shift from traditional centralized internet services to a decentralized, user-governed approach.

What Is An Example Of A DAO?

An example is MakerDAO, a decentralized organization that manages the DAI stablecoin and operates on the Ethereum blockchain. It uses smart contracts to enable token holders to vote on decisions like risk management and development proposals.

What DAO Means In Crypto?

In the crypto world, DAO stands for Decentralized Autonomous Organization. The concept revolves around decentralizing and automating organizational governance and decision-making using smart contracts on a blockchain.

Who Owns A DAO?

Members or token holders collectively own a DAO. Unlike traditional organizations with a clear hierarchy, DAOs distribute ownership and decision-making power among their members. This aligns with the ethos of decentralization.

Pyth Oracle Network Brings Industry Heavyweights Into Governance Post-Airdrop

The low-latency oracle network’s new “strategic partners” include Castle Island Ventures, Multicoin Capital and Wintermute Ventures. They could play a major role in shaping how the platform evolves.

Arbitrum DAO passes $23M extra budget to fund all grant applicants

The Arbitrum community is expanding its grant program budget to over $70 million, supporting a total of 56 projects.

Bankless controversy forces founders to burn tokens and separate from DAO

The co-founders of crypto media Bankless are seeking to separate their brand from BanklessDAO two years after its launch.

Arbitrum Voters Polarized Over ‘Research’ Pitch With $2M Price Tag

Proposed coalition of professional researchers could help “accelerate decision-making” at the Ethereum layer-2 project, but complaints have surfaced over the cost and potential conflicts of interest.

What’s Next For Aragon? Association Set To Dissolve, 86,000 ETH Up For Grabs

Swiss non-profit Aragon Association has announced its dissolution, offering users the opportunity to redeem its native token, ANT, for ETH (Ethereum). This strategic move marks a crucial shift in the organization’s path and aims to address challenges that have arisen in recent times.

As part of this dissolution process, ANT token holders will have a one-year window to redeem their tokens. The association will deploy a total of 86,343 Ether into a redemption contract, offering a redemption rate of 0.0025376 Ether per ANT, according to a statement released on Thursday. This initiative is designed to provide a fair and efficient way for ANT holders to transition from their existing tokens into Ethereum.

Aragon’s Financial Provisions And Future Plans

To ensure a smooth dissolution process and mitigate potential regulatory uncertainties, the Aragon Association will retain $11 million in funds. These funds will be earmarked to cover any outstanding costs related to the dissolution and to serve as a safeguard against unforeseen regulatory challenges.

In the event that unused funds remain after the dissolution, they will be directed towards a “product-focused structure,” signifying the association’s commitment to continuing its mission.

We have an important update for all stakeholders of the @AragonProject. We passed a resolution to:

– Deploy most of the treasury to allow all ANT holders to redeem their ANT for ETH

– Dissolve the AA

– Continue the mission in a product-focused structurehttps://t.co/S0GjRtzhZJ— Aragon Association (@AragonAssoc) November 2, 2023

The Aragon Association cited several challenges that have led to this decision, including bureaucratic complexity, misaligned stakeholder interests, and unsuccessful attempts to modify governance structures.

The organization attempted to rescue itself through a hurried endeavor to place control of the treasury directly in the hands of ANT holders. However, the association encountered a significant discrepancy between the value of the treasury and the token market cap, preventing the success of this approach. Faced with these complexities, the association made the difficult choice to return funds to investors and formally dissolve.

Aragon’s Innovative Contributions

Aragon is renowned for its groundbreaking contributions to the blockchain ecosystem. It has developed aragonOS, a set of developer tools that empower users to create decentralized autonomous organizations (DAOs) seamlessly. Furthermore, the Aragon App, a product of the association, allows developers to create DAOs without the need for extensive coding expertise.

Token Redemption Timeline

Users who hold ANT tokens will have until November 2, 2024, to take advantage of the redemption program. Following the completion of the redemption process, all ANT tokens will be permanently removed from circulation. As the association emphasized, there will be no further purpose in holding ANT tokens beyond this point.

The Aragon Association’s decision to dissolve itself and provide a redemption program for ANT token holders reflects its commitment to addressing challenges and maintaining the project’s integrity.

This strategic move ensures a transparent and fair transition for users, while preserving the organization’s mission to foster innovation in the blockchain space.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Shutterstock

Abu Dhabi pioneers DLT regulation for DAOs, Web3 innovations

Abu Dhabi aims to become a crypto hub alongside Dubai in a move that’s part of a larger goal to foster initiatives in the blockchain and digital asset realm.