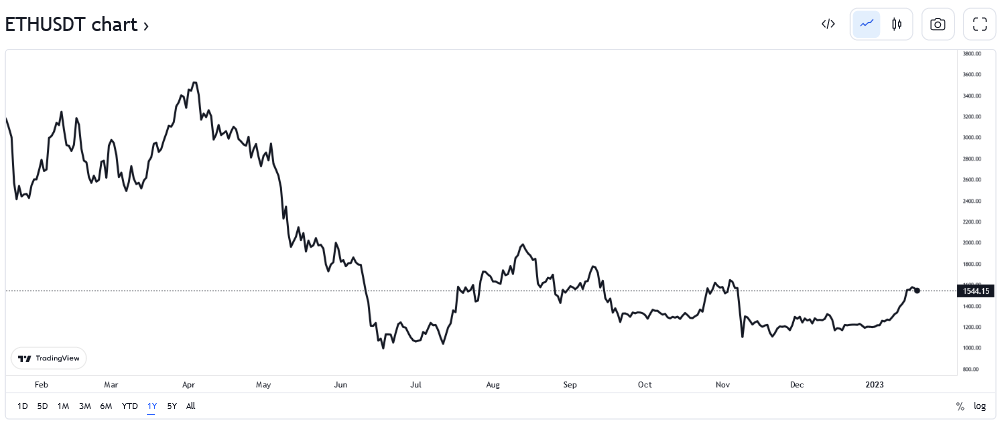

While the DeFi market has continued to mirror the crypto market rally, more innovations have been introduced to the ecosystem. In today’s news, SushiSwap, the sixth-largest decentralized exchange (DEX) by 24 hours trading volume, has passed a proposal to relocate 100% of its trading fees to the SushiSwap treasury for maintenance and expenses.

Related Reading: SushiSwap Head Chef Suggests Cooking Up New Token Model – Will The DEX Survive 2023?

SushiSwap Introduces New Update

This new update comes after CEO Jared Grey voiced warnings that the exchange treasury stability is numbered as it has “only 1.5 years of treasury runway left,” despite having cut down the annual operating expenses from $9 million to $5 million during the ongoing crypto winter.

According to a presented governance proposal by the developers of the SushiSwap decentralized exchange, which was passed on January 23, the SushiSwap exchange will now extend the usage of trading fees by redirecting them to the exchange’s treasury to enhance the operation and maintenance of the exchange over the next one year.

The proposal noted, “Revenue to the treasury will be 50% ETH and 50% USDC, with a projection of ~$6m being earned over the next year if this proposal were to pass.” In another proposal passed the same day, approximately 99.85% of voters voted in favor of “clawing back” 10,936,284 unclaimed SUSHI ($14.8 million) tokens to be rewarded to early liquidity providers during the DEX’s launch in 2020.

SushiSwap Painful Loss And Recovery

Undoubtedly the crypto winter hit most projects in the industry, including DeFi platforms such as SushiSwap. Last December, SushiSwap CEO Jared Grey revealed that the DEX experienced a $30 million loss over the past 12 months on incentives for liquidity providers (LPs).

To counter that loss and initiate recovery, Grey revealed plans to refine SushiSwap’s tokenomics so that LPs are no longer bankrolled with emissions and redesign the complete model of bootstrapping liquidity on the exchange.

The “Kanpai” governance proposal, which aims to relocate trading protocol fees to the treasury, was also referred to by Grey when illustrating the plans to update the SushiSwap exchange.

“Put simply, it (Kanpai) allows the protocol to rebuild its cash reserves to continue to pay competitive wages, pay for critical infrastructure, & to diversify its Treasury with funds collected in the base pairs of assets, like ETH, stablecoins, etc. Kanpai is a temporary solution,” Grey stated.

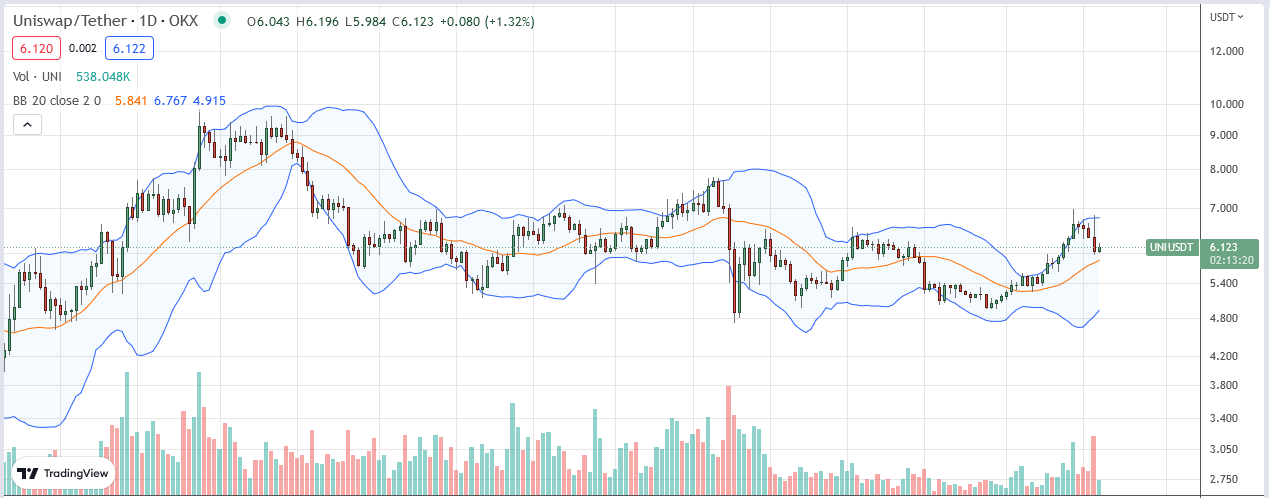

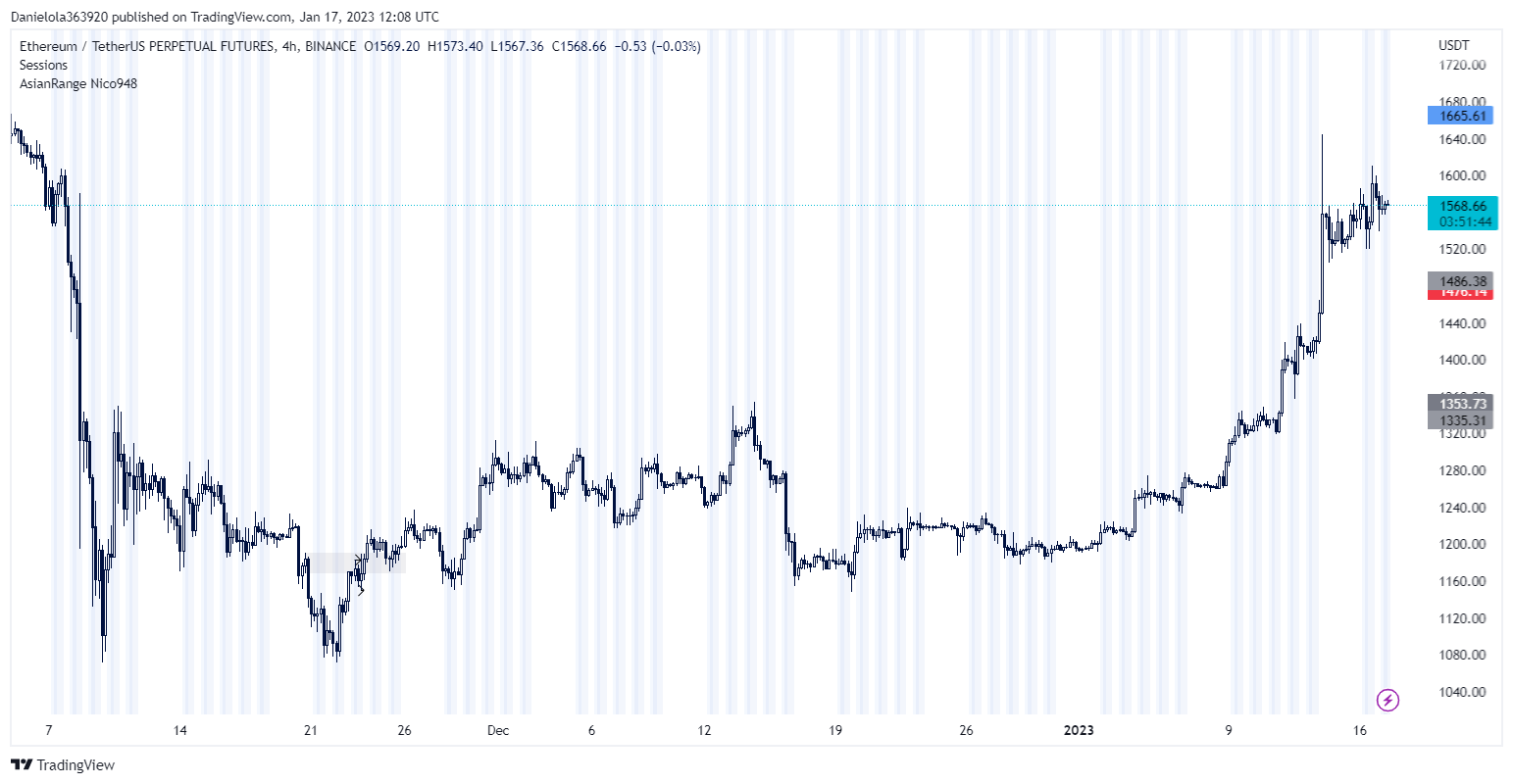

Speaking of SushiSwap, the protocol’s native token, SUSHI, has been in a rally, following the rest of the DeFi sector.

SUSHI has surged by over 40% in the last 30 days; meanwhile, at the time of writing, SUSHI trades at $1.34, down by 1.4% in the previous 24 hours and with a trading volume of $58.6 million in the same period.