Fantom’s Cronje is the latest in a line of blockchain teams that are open to directly engaging with memecoins.

Fantom Supply On Exchanges See Drastic Increase, A Cause For Alarm?

The Fantom (FTM) supply on exchanges has been rising in recent times, leading to speculations for what this might mean for the price of the cryptocurrency. Going by trends in the crypto market of when the exchange balances of a particular coin goes up, there might be some pain ahead for FTM investors.

Fantom Supply On Exchanges Rise By 16 Million

The Fantom price had increased over the last month to reach a new three-year high above $1.2. However, this rally was only short-lived and the altcoin has begun to eliminate its gains from the month of March gradually in the past week.

One culprit for this decline in price is the high level of selling that have been taken place among FTM holders, majority of which have been holding their coins for a rather long time. As a result, the available supply of Fantom on centralized exchanges continued to balloon as investors rush to sell off their tokens and capitalize on gains.

Data from the on-chain tracking website Santiment shows that in the last week of March, there was a considerable number of FTM flowing into centralized exchanges. This saw their available balance go from around 654 million to over 670 million in the space of a week, with over 16 million flowing into exchanges.

This inflow trend coincides with the drop in the Fantom price from above $1.1 to $0.84, suggesting that it is indeed the selling pressure from these FTM investors that is responsible for the price decline. Given this, there would have to be a reversal in this selling trend is the FTM price is to recover from here.

Bullishness On FTM Not Dead

The inflow of millions of FTM into centralized exchanges is bearish, but this could only last for the short term. As a rule of crypto, eventually, these sellers will run out of coins to sell, leaving room for demand to catch up with the available supply. At this point, the FTM price will begin to see a reversal in the trend.

There is also the fact that adoption has been increasing on the Fantom chain as founder Andre Conje has been actively talking about it on X (formerly Twitter). Santiment’s data shows that the FTM holder base also grew alongside the price in March. In the week of March 17 and 28 alone, the chain’s holder BASE jumped from 109,000 to over 111,000.

This shows that while the trends are bearish right now, there could be a change soon as the price could resume another leg up. The Fantom price has also established support at $0.8 which could serve as the bounce point for another rally.

Presently, the FTM price is sitting at $0.84, with a 5.48% and 18.2% decline on the daily and weekly charts, respectively. Its market cap is at $2.37 billion, making it the 51st largest cryptocurrency in the space.

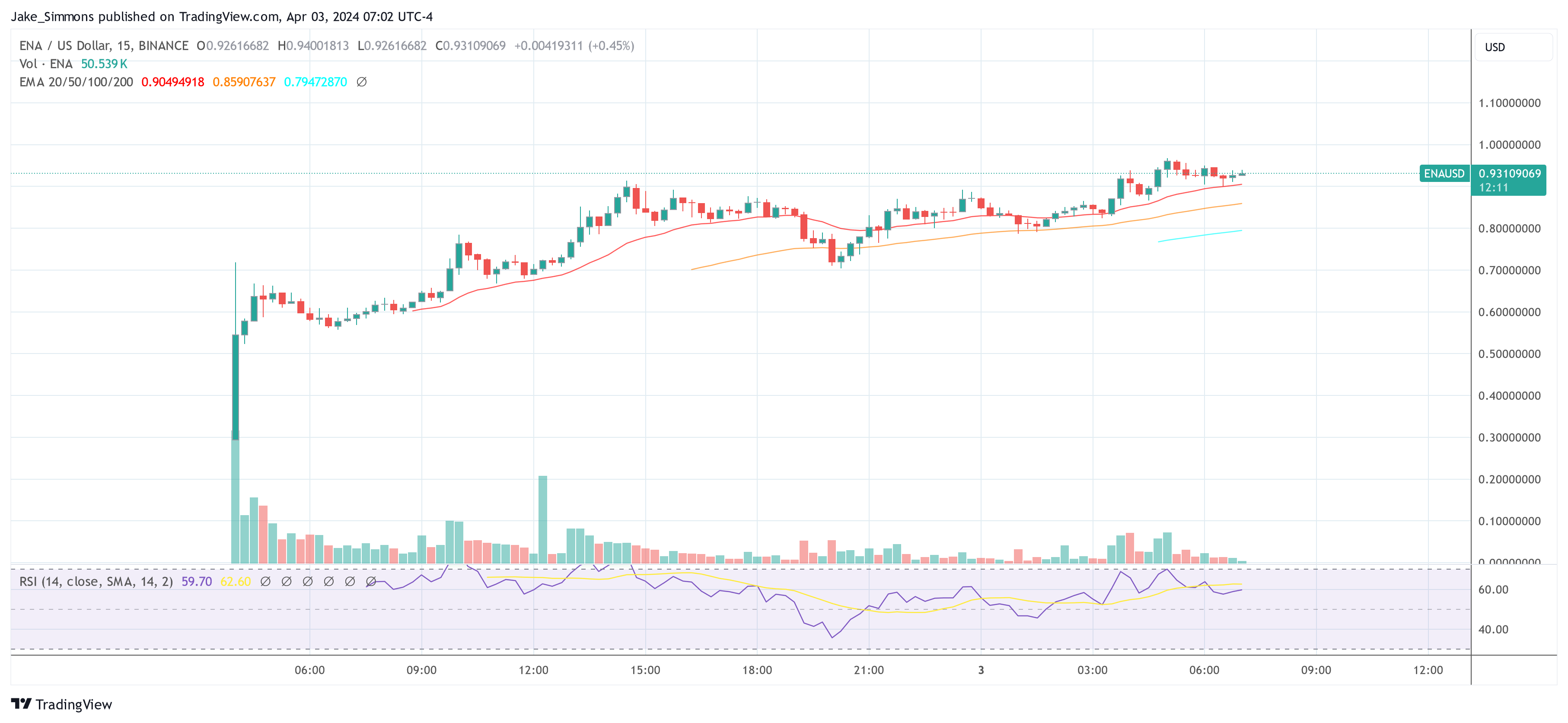

Ethena (ENA) Surges 60%, But Fantom Co-Founder Warns Of Luna-Like Demise

Ethena Labs’ new governance token, ENA, is witnessing a staggering 60% increase in its value, shortly after its introduction to the market. The spike in ENA’s price to approximately $0.96 has catapulted its market capitalization to nearly $1.34 billion, ranking ENA as the 80th largest cryptocurrency by market cap.

This ascent followed Ethena’s strategic distribution of 750 million ENA tokens, representing 5% of its total supply, through an airdrop to holders of its USDe token. The USDe, a synthetic dollar, is central to Ethena’s offering, leveraging a blend of ether liquid staking tokens and short Ether (ETH) perpetual futures positions to maintain a target value near $1.

The Ethena Labs airdrop went live 2 hours ago, with $450M of ENA to distribute.

The largest $ENA recipient so far has been 0xb56, who received 3.30M ENA worth $1.96M.

Track ENA on Arkham:https://t.co/coFsTcBUCa https://t.co/RSZwXLhCB6 pic.twitter.com/l6c7bqKghG

— Arkham (@ArkhamIntel) April 2, 2024

At the heart of Ethena’s value proposition is the ENA token, engineered to facilitate a digital dollar platform on the Ethereum blockchain. This platform seeks to provide a viable alternative to conventional banking mechanisms through its innovative ‘Internet Bond’. By harnessing the potential of derivative markets and staked Ethereum, the Internet Bond offers a dollar-denominated savings instrument accessible globally, independent of traditional banking infrastructure.

The total supply of ENA tokens is capped at 15 billion, with an initial issuance of 1.425 billion tokens. The distribution plan prioritizes ecosystem development (30%), core contributor rewards (30%), investor engagement (25%), and foundation support (15%), embodying a holistic approach to tokenomics. Notably, Binance’s endorsement of ENA as the 50th project on its Binance Launchpool, enabling users to farm ENA tokens by staking BNB and FDUSD, underscores the token’s appeal.

At press time, ENA traded at $0.93, up 60% in the past 24 hours.

Fantom Co-Founder Warns Of Luna-Like Collapse

Andre Cronje, co-founder of the Fantom Foundation, issued a warning on X, recalling the concerns that preceded the collapse of Terra Luna. Cronje dissected the structure of perpetual contracts (perps), a derivative product that enables traders to speculate on the price movement of an asset without holding the actual asset.

This mechanism operates on a system of funding rates meant to tether the perpetual price closely to the underlying asset’s spot price. However, Cronje highlighted a critical vulnerability in this system: the reliance on yield-generating assets, such as staked Ethereum (stETH), as collateral.

This approach theoretically allows for a “neutral” position, where the gains from yield should offset losses from the short position if the asset’s price drops. Yet, this equilibrium is precarious, as negative shifts in funding rates can erode the collateral, leading to liquidation.

“The mechanism – the theory here is that you can generate a ‘stable’ $1000, by buying $1000 of stETH, using this as collateral to open a $1000 stETH short, thereby achieving being ‘neutral’, while getting the benefit of the stETH yield (~3%) + whatever is paid in funding rates,” Cronje explained.

Cronje’s concerns are not unfounded. The crypto industry witnessed the dramatic implosion of Terra’s algorithmic stablecoin UST in 2021, a debacle that resulted in significant financial losses across the board. By drawing a parallel between the structural weaknesses he perceives in Ethena’s framework and the mechanisms that led to Terra’s downfall, Cronje raises a red flag about the sustainability of complex financial products that lack transparent risk mitigation strategies.

Every so often we see something new in this space. I often find myself on the mid curve for an extensive amount of time. I am comfortable here. That being said, there have been events in this industry I wish I was more curious about, there have also been events I definitely did…

— Andre Cronje (@AndreCronjeTech) April 3, 2024

Responding to Cronje’s critique, the founder of Ethena Labs Guy Young aka Leptokurtic, acknowledged the validity of the concerns raised. “These aren’t mid curve concerns at all Andre Cronje, you rightly point out risks that absolutely do exist here. Will work on a longer form response for you by end of this week with some thoughts,” Young stated on X.

Fantom: Market Slowdown Chops Off 10% From Gains – Here’s Why

Leading the downturn today, Fantom (FTM) contributes to the 2% drop in the crypto market after weeks of growth.

Fantom is one of those altcoins that followed the broader momentum of the market. The latest market data shows that the token is down 10% in the past 24 hours, but is still on the green in the bi-weekly timeframe at 14%. However, Fantom has a trick up its sleeve to curb this brewing bearishness potentially.

Fantom CEO Michael Kong Unveils Sonic Launch

Sonic is the brand-new technology that the Fantom has been developing in the past 2 years. According to their latest blog post, Sonic was able to surpass the network’s 200 transactions per second metric. Although 200 TPS was already impressive compared to Ethereum’s 12 TPS, the network was quickly congested, and user experience deteriorated.

Kong said in the blog post:

“Sonic will be used to create a new best-in-class shared sequencer for L1 and L2 chains, capable of processing over 180 million daily transactions with real, sub-second confirmation times, and serve as the foundation to relaunch Fantom as an entirely new community-centric brand.”

This brand-new tech will cover all parts of the Fantom network, from bridging to a stablecoin launch, Sonic has it all.

Sonic Labs will also gain a slice of the pie as the foundation ultimately adds grant programs alongside the network upgrades.

“We will continue to significantly scale and accelerate our Sonic Labs grant program for developers who build unique and valuable applications and public goods in categories including gaming, DeFi, social media, streaming, and now distributed AI,” Kong added.

This will significantly increase the size of Fantom’s user base, boosting investor confidence, and giving more room for developers to innovate.

Furthermore, the advancements brought forth by Sonic Labs in covering all aspects of the Fantom network, from bridging to the launch of a stablecoin, are poised to have a notable impact on Fantom’s market dynamics.

By streamlining processes, enhancing interoperability, and introducing new functionalities, these developments are likely to enhance the network’s attractiveness to investors and users alike.

We are thrilled to announce the first of many angel investors that have joined our round!

Sam Kazemian (@samkazemian ) is the founder of @FraxFinance ✦, one of the largest DeFi protocols with over $1.6bn in assets such as sfrxETH and the FRAX stablecoin.

Frax is committed… pic.twitter.com/zSL1XFNHYR

— Fantom Foundation (@FantomFDN) March 27, 2024

The Fantom Foundation X account announced today that Frax Finance Founder Sam Kazemain is the first angel investor for Sonic, stating that Frax will deploy natively issued assets on Sonic on its eventual launch.

Short-Term Gains Slashed In Favor Of The Long-Term

Meanwhile, the bears have completely taken over the FTM market in the short to medium term. Investors in FTM could only hope that the broader market downturn will reverse in the coming weeks.

Featured image from Pexels, chart from TradingView

Fantom (FTM) Jumps 180% In 4 Weeks: Just The Beginning?

Over the past 24 hours, Fantom (FTM) has emerged as the standout performer among the top 100 cryptocurrencies by market capitalization, registering a remarkable 13.5% gain. This surge is part of a broader rally that has seen the FTM price soar by 180% over the last four weeks, propelling it from $0.42 to $1.20. This upward trajectory has significantly boosted Fantom’s market capitalization to $3.3 billion, positioning it as the 41st largest digital asset worldwide. Here’s why this might be just the beginning:

#1 Sonic Upgrade: The Catalyst for Fantom’s Rally

The anticipated Sonic upgrade is central to Fantom’s recent success. Designed to enhance the Fantom technology stack, Sonic introduces major scalability improvements without necessitating a disruptive hard fork. Key components of the Sonic upgrade include:

- Fantom Virtual Machine (FVM): Aims to significantly boost transaction throughput.

- Carmen Database: Promises to reduce storage requirements by up to 90%.

- Optimized Lachesis Consensus: Improves upon the existing consensus mechanism for enhanced performance.

With these enhancements, Fantom targets a throughput of over 2,000 transactions per second (TPS), marking a substantial leap in scalability. Importantly, the upgrade ensures that existing Fantom Opera smart contracts and tools remain fully compatible with the Sonic mainnet, which is scheduled to launch in Spring 2024.

Recent testnets have demonstrated Sonic’s potential. The closed testnet, focused on ERC-20 swaps, achieved an impressive ~4,000 TPS with ~1.3-second finality. Furthermore, a reconfiguration to process only ERC-20 transfers led to a groundbreaking ~10,000 TPS at ~1.6-second finality, showcasing the capabilities of next-generation decentralized exchanges (DEXs) and wallets.

10k tps achieved. Publicly verifiable. Can test for yourself, on public infrastructure. No need for "trust me bro". Available today, no need to wait. And we havent even started with the parallel execution meme. https://t.co/q2QRKM9WXe

— Andre Cronje (@AndreCronjeTech) March 15, 2024

Reflecting on Sonic’s impact, Reflexivity Research highlighted, “Fantom Sonic unlocks new possibilities for the Fantom ecosystem, particularly in decentralized finance (DeFi) platforms, blockchain games, high-frequency applications, and the Internet of Things (IoT).”

The research firm added that another cornerstone for Fantom is its exemplary 99.9% uptime. “Fantom’s novel solutions position it as a frontrunner in the development of decentralized networks,” Reflexivity Research stated.

#2 Andre Cronje: The Innovator’s Promise

Andre Cronje, the founder of Fantom and one of the brightest minds in the crypto industry, has been instrumental in driving innovation within the ecosystem. Cronje recently underscored his commitment to advancing the crypto space, stating, “The number 1 dex on Base, and the number 1 dex on Optimism are both built with code I wrote and pioneered. Stick to where the innovators are, post Sonic I will be adding some new primitives to crypto.”

#3 Coinbase Announcement: A New Milestone

Another factor driving today’s price rally is probably today’s Coinbase International announcement that it will launch Fantom perpetual futures on Coinbase International Exchange and Coinbase Advanced, set to commence on or after 9:30am UTC on March 28, 2024. This move by Coinbase is expected to further enhance Fantom’s liquidity and accessibility, contributing to its growing appeal among investors.

@CoinbaseIntExch will add support for Fantom and THORChain perpetual futures on Coinbase International Exchange and Coinbase Advanced. The opening of our FTM-PERP and RUNE-PERP markets will begin on or after 9:30am UTC on 28 MAR 2024. pic.twitter.com/CHBVF58ISc

— Coinbase International Exchange

(@CoinbaseIntExch) March 21, 2024

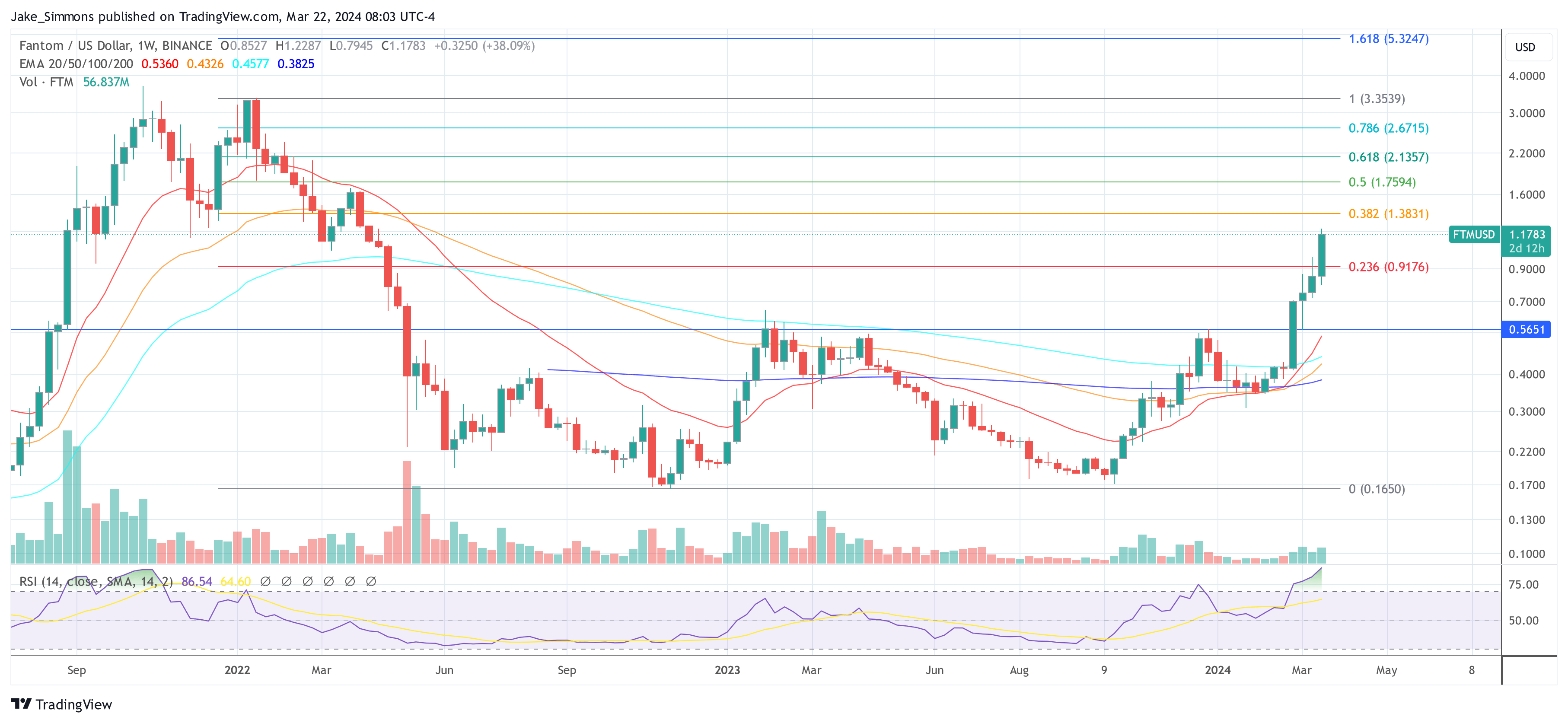

#4 Technical Analysis: FTM/USD

The bullish momentum of Fantom price is apparent in the weekly FTM/USD chart on Binance, signified by the latest candlestick closure above the key exponential moving averages (EMAs) of 20, 50, 100, and 200 periods. This week’s candlestick represents a notable increase of approximately 50% from the intra-week low.

Fantom’s ascent has propelled its value beyond the 0.382 Fibonacci retracement level, situated at $0.9176. This bullish breakout suggests the market may target subsequent Fibonacci levels, with $1.38 (0.382 Fib) acting as an intermediate psychological and technical resistance, followed by $1.76 (05 Fib), and potentially extending towards the golden ratio at $2.13, which corresponds with the 0.618 Fibonacci level.

On the flip side of this bullish scenario, should a correction occur across the broader crypto market, immediate support for FTM can be anticipated at the $0.92 level. Stability at or above this threshold could reaffirm bullish market control. Conversely, a downward breach could intensify selling pressure, possibly leading to a retest of support around the $0.56 mark.

Fantom’s FTM is the Best Performing Non-Meme Token of the Past 30 Days

Fantom’s impending Sonic upgrade, expected to boost transaction processing speeds, may have galvanized investor interest in the cryptocurrency.

Fantom (FTM) Bull Run: Can FTM Hit $2 After 20% Price Spike?

Fantom (FTM), a cryptocurrency known for its high-speed smart contract platform, has been making headlines recently with its price movements and market predictions.

As of the latest data, Fantom is ranked #43 by market cap at $2.9 billion, with a trading volume of $863 million in the last 24 hours. The current value of Fantom stands at $1.06, reflecting an increase of 6.5% in the last 24 hours.

Recent Developments

Just recently, Fantom announced a significant reduction in the minimum staking requirements for validators from 500,000 FTM to 50,000 FTM. This move aimed to enhance participation and engagement within the Fantom ecosystem.

Despite facing challenges like a sell-off of assets and a hacking incident in 2023, Fantom managed to recover and close the year with a notable 130% increase in value.

Fantom: Social Interest Up

The increase in Fantom’s social volume indicated that the price surge had caused the cryptocurrency market to start talking about it. As the token’s weighted sentiment surged, so did bullish emotion surrounding it.

Fantom’s network activity remained high as the token’s price gained positive momentum. According to NewsBTC’s examination of Artemis data, there were comparatively more daily active addresses on the blockchain last month.

Bull Run Speculation

Recent reports suggest that Fantom is gearing up for a potential bull run, fueled by the overall positive sentiment in the cryptocurrency market and the increasing demand for altcoins.

The price trend of Fantom indicates preparations for a bullish phase, aligning with the broader market movements that have seen Bitcoin surpassing the $70,000 mark. The anticipation of a bull run is further supported by a 120% rally in Fantom’s price in the last month, hinting at a strong upward momentum.

Price Outlook

While the possibility of a bull run is on the horizon, the question of whether Fantom can hit $2 after a 20% price surge remains speculative. The current trajectory of Fantom’s price movement suggests a potential for growth, but reaching the $2 mark would require sustained positive market conditions and increased investor confidence.

Achieving such a milestone would signify a significant milestone for Fantom and could attract further attention to its platform and ecosystem.

Meanwhile, an analytical forecast provided by Anton Kharitonov, a Traders Union analyst, suggests a relatively optimistic outlook for the price of Fantom (FTM) by the end of 2024.

Kharitonov anticipates FTM reaching $1.3951. However, it’s important to note that this forecast is not isolated, as it aligns with the expectations of other TU analysts, who project a range of $1.2556 to $1.5346 for FTM’s price by the end of the same year.

This analysis indicates a consensus among TU analysts that Fantom’s price will likely experience moderate growth throughout 2024. The range provided reflects the inherent uncertainty in predicting cryptocurrency prices, considering the volatile nature of the market and the multitude of factors that can influence price movements.

Featured image from , chart from TradingView

Fantom Launches Recovery Plan For Funds Lost In Multichain’s $200M Exploit, FTM Soars

The Fantom (FTM) Foundation has taken decisive steps to recover assets lost in the Multichain exploit that devastated various chains, including its own, resulting in a staggering $210 million loss.

After failed attempts to engage with the Multichain Foundation, the Protocol has announced that it filed a lawsuit for “breach of contract” and “fraudulent misrepresentations.”

Fantom Foundation Takes Legal Action Against Multichain

The exploit, which occurred in July 2023, targeted the Multichain bridge and affected multiple chains, including Fantom, Ethereum (ETH), Binance’s BNB, Cronos (CRO), Polygon (MATIC), Arbitrum (ARB), zkSync, Optimism (OP), and Moonbeam (GLMR).

Fantom’s ecosystems suffered losses of approximately one-third of the total damage. In addition, the Fantom Foundation claims that the recovery process has faced numerous challenges due to legal complexities, jurisdictional issues, uncooperative former directors, and ongoing police investigations.

To pursue justice, the Fantom Foundation initiated several measures. They filed a police report in Singapore, where the Multichain Foundation is incorporated, and in Kunming, China, where Multichain and its founder are under investigation.

Legal counsel was engaged in the United States, China, Hong Kong, and Singapore to navigate the diverse jurisdictions involved. Additionally, Fantom partnered with the blockchain intelligence firm TRM Labs to conduct a comprehensive forensic analysis of the asset flow. As a decisive move, legal action against the Multichain Foundation for losses incurred by Fantom was commenced in Singapore.

Empowered To Liquidate Multichain

The Fantom Foundation has also disclosed that a recent default ruling by Judge Tan Boon Heng of the General Division of the High Court of Singapore has ruled in favor of the Protocol’s claim.

According to the foundation’s blog post, the ruling paves the way for the protocol to petition the court to dissolve the Multichain Foundation and appoint a court-appointed liquidator.

The liquidator, equipped with specialized expertise, legal powers, and authority to act on behalf of Multichain, will reportedly assist in the tracing, recovering, and distributing of missing or frozen assets.

However, it is worth noting that while the current ruling addresses explicitly the Fantom Foundation’s losses, it sets an important precedent for all affected users to pursue their claims against Multichain.

Ultimately, the Foundation intends to use this legal victory to facilitate the appointment of “suitably qualified” experts to recover and distribute assets on behalf of all creditors. This milestone marks a significant step forward in the ongoing legal saga and underscores the team’s approach to righting the wrongs caused by the exploit.

Riding The Bull Market

Despite the ongoing legal battle faced by the protocol, its native token, FTM, has experienced significant gains across all time frames, taking advantage of the current bullish sentiment in the overall market.

In the year-to-date period, the FTM token has recorded a remarkable increase of 67%, followed by gains of over 92% in the past thirty days. Furthermore, in the past seven and fourteen days alone, the token has seen gains of 50% and 57%, respectively.

This continuous upward trend propelled FTM to reach a 20-month high of $0.751 on Monday. However, it has since retraced and is trading for $0.681, with a modest recovery of 1.8% in the past few hours.

Featured image from Shutterstock, chart from TradingView.com

Fantom Seeks Money Back From Multichain’s $200M Exploit

The move aims to enable victims to “partially recover” assets lost in one of the biggest exploits of 2023.

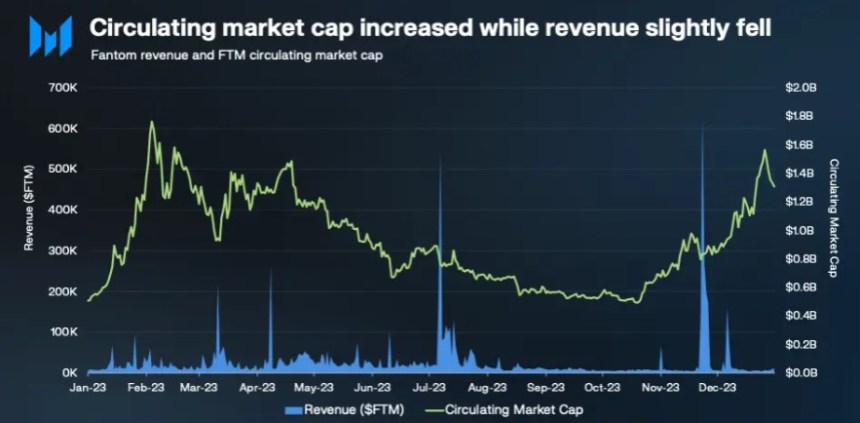

Q4 Triumph For Fantom (FTM): Circulating Market Cap Outpaces All Cryptos With 140% Surge

In the fourth quarter of 2023, the cryptocurrency market experienced a notable resurgence, accompanied by the anticipation of a potential Bitcoin ETF approval. Among the standout performers during this period was Fantom (FTM), a Layer-1 protocol launched in 2018.

According to a recent report by Messari, Fantom witnessed significant growth, with its circulating market cap soaring by 140% quarter-over-quarter, from $0.5 billion to $1.3 billion.

This performance surpassed all cryptocurrencies’ overall market cap growth at 54% in Q4. Additionally, Fantom climbed up the market cap rankings, ascending five spots from 63 to 58 by the end of the quarter.

FTM’s Potential For Future Growth

The circulating supply of FTM remained relatively stable quarter-over-quarter, with changes in supply dynamics between Q4 2022 and Q1 2023.

Notably, Fantom introduced the Ecosystem Vault and Gas Monetization program during Q4 2023, reducing the burn rate of transaction fees and reallocating a portion of fees to the Gas Monetization program and Ecosystem Vault.

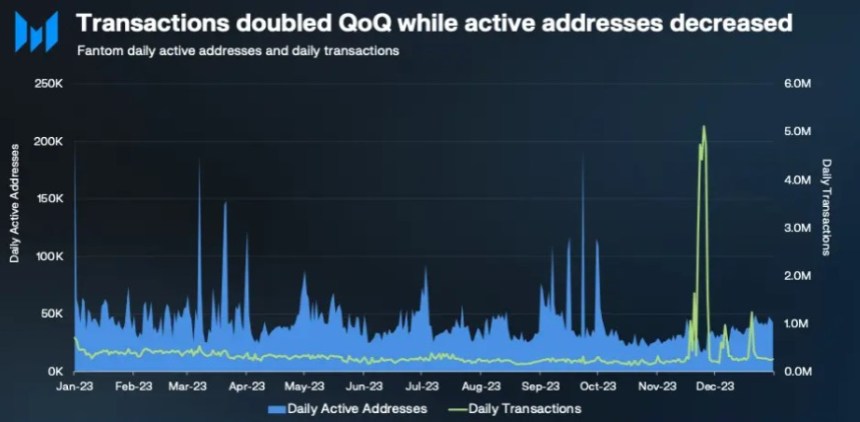

The number of daily active addresses on the Fantom network experienced a 27% decline quarter-over-quarter, averaging 32,700 in Q4’23. However, a steady increase in daily active addresses throughout December indicates potential future growth as the crypto market emerges from the bearish phase.

Average daily transactions on Fantom reversed their declining trend, surging by 126% to 531,000. This increase was primarily attributed to the emergence of Fantom Inscription FRC20s, with November 25 marking an all-time high of 5.11 million transactions, including 4.99 million inscriptions.

In terms of new addresses, Q4’23 saw a 10% increase to an average of 21,100 daily new addresses. Messari suggests that the surge in daily new addresses can be attributed to the launch of Estfor Kingdom, a popular blockchain-based game on Fantom that gained traction in late Q3’23. December also witnessed an uptick in daily new addresses, likely influenced by improved market conditions.

Fantom DeFi Ecosystem

Per the report, Fantom’s Total Value Locked (TVL) denominated in USD increased by 58% quarter-over-quarter, from $51 million in Q3 to $81 million in Q4. However, TVL denominated in FTM decreased by 29% in the same period, primarily due to asset price fluctuations.

Q4’23 also witnessed shifts in the top DeFi applications on Fantom, with new entrants such as Equalizer Exchange, WigoSwap, and SpiritSwap gaining market share. Notable protocols by TVL included Spookyswap, Beethoven X, Equalizer Exchange, WigoSwap, Tomb Finance, and SpiritSwap.

These protocols collectively gained $29 million in TVL, accounting for nearly 100% of Fantom’s TVL growth in Q4. Equalizer and WigoSwap experienced the most significant market share increases.

The average daily decentralized exchange (DEX) volume on Fantom declined by 10% to $10.2 million in Q4 2023. Still, emerging new DEXs like Equalizer Exchange and WigoSwap contributed to the ecosystem’s overall growth.

In summary, Fantom’s performance was notable in the fourth quarter of 2023. The protocol experienced a surge in market cap, robust revenue growth, and an expanding DeFi ecosystem. However, its native token has declined significantly.

Despite the recent sharp correction across the cryptocurrency market, Fantom’s native token FTM has not been an exception. Presently, the token is trading at $0.3306, reflecting a decline of over 3% within the last 24 hours, 37% over the past 30 days, and a year-to-date decrease of 18%.

Featured image from Shutterstock, chart from TradingView.com

Fantom Slashes Validator Staking Requirements by 90%, FTM Prices Unchanged

The move could help improve network security as validators are more widely distributed across the world, developers said.

Fantom (FTM) To Rocket Up To $1.60 If This Happens: Analyst

Fantom appears to be forming a double bottom pattern currently, a confirmation of which could lead to a break towards $1.60 according to an analyst.

Fantom Might Be Forming A “W” Pattern In Its Weekly Chart

As explained by analyst Ali in a new post on X, FTM’s weekly price chart has appeared to have been forming a “W” pattern recently. A W or double bottom refers to a pattern in technical analysis that ends with a bullish resurgence for the asset.

The pattern forms when the price forms two consecutive bottoms after going through some significant downtrend and finally reverses its direction with a sharp bullish move.

While the pattern is known for its resemblance to the letter “W” from the English alphabet, the pattern can still form even if the “W” shape doesn’t quite look as symmetrical.

Like this pattern, there is also the “M” or double top pattern, which forms when two consecutive tops follow an uptrend and the price subsequently shifts towards a downwards trajectory.

Now, here is the chart shared by the analyst that shows how a potential W pattern may be forming for the weekly price of Fantom:

As is apparent in the above graph, the Fantom weekly price formed its second bottom in October and has since been sharply going up. The pattern is indeed starting to resemble a W now, but it’s still not fully confirmed yet.

In the chart, Ali has also highlighted the $0.57 level at which the coin hit the top between the two bottoms and it seems like the weekly price has been approaching this line recently. “If $FTM sustains a weekly close above $0.57, it will confirm this bullish formation and march toward $1.60!” notes the analyst.

From the current spot price of the cryptocurrency, a rally towards this level would mean an increase of almost 192%. It now remains to be seen if the asset can confirm this pattern and go on a run like this or not.

A few days back, the same analyst had discussed about the on-chain support and resistance levels for Fantom, revealing that the coin has little in terms of obstacles until the $0.66 level.

In the above chart, the data for each FTM price range in terms of the number of investors or addresses who bought their coins at them is displayed. The $0.45 to $0.47 range was filled with investors, but the asset has already cleared it.

Generally, investors tend to show a selling reaction whenever the price of the asset retests their cost basis from below, as they might be tempted to just exit at their break-even point, rather than risk going into losses again.

Ali had noted that with the dense zone clear, there were no more supply walls in sight for the cryptocurrency. The asset has been making its way up since then, mowing through these centers of relatively weak resistance.

With the path appearing clear in terms of on-chain resistance and a W pattern beginning to form, a move towards higher levels may be coming for the asset.

FTM Price

At the time of writing, Fantom is trading around the $0.548 level, up 34% in the past week.

Bullish Trend Ahead: Fantom (FTM) Rise Signals Potential For Powerful Rally Towards $0.65

Fantom (FTM) has recently displayed remarkable performance, surpassing several leading digital assets such as Bitcoin (BTC), Ethereum (ETH), and Binance Coin (BNB) among others.

Over the past 24 hours, FTM has experienced a notable surge of 9%, propelling its price to the $0.4950 level. This upward momentum has sparked optimism within the market, with the potential to drive FTM towards its yearly high of $0.65.

Fantom Poised For Upward Surge?

Crypto analyst Ali Martinez has shared insights into the promising outlook for Fantom. Martinez emphasizes that FTM trading above the critical resistance level of $0.47 signifies a significant bullish turning point.

Furthermore, the analyst notes that there are no major obstacles in sight until the $0.65 level. As long as FTM remains above this crucial level, Martinez predicts a strong rally for the token.

With FTM’s breakthrough above the $0.47 resistance level, the stage is set for further gains. The absence of significant barriers until the $0.65 mark provides an encouraging backdrop for FTM’s potential upward trajectory.

Analyst Ali Martinez’s assessment reinforces the belief that as long as FTM maintains its position above $0.47, investors should prepare for a robust rally in the token’s price.

Social Media Buzz Surrounding FTM

In recent weeks, Layer 1 (L1) blockchain protocols have taken center stage in the cryptocurrency community. Tokens such as Injective (INJ), Kaspa (KAS), Avalanche (AVAX), and Solana (SOL) have outperformed major cryptocurrencies.

However, amid this L1 surge, Alpha Scan highlights that Fantom has emerged with impressive sentiment strength, capturing the attention of market participants and further bolstering the protocol’s native token price surge.

According to a recent post on X (formerly Twitter) by the sentiment analytics firm, an analysis of social media conversations reveals that a staggering 61% of all monthly mentions of FTM have occurred within the last seven days.

This sudden surge in mentions commenced on December 9th, indicating a heightened interest and positive sentiment surrounding the token.

Over the past 30 days, 28 key accounts have actively discussed FTM, further emphasizing its growing significance.

Notably, 20 of these key accounts have specifically highlighted FTM within the last seven days, reflecting a heightened level of attention and engagement within a relatively short period. This ratio of key account engagement during the past week indicates a distinct rise in interest and potential market influence.

Annualized Increase Reinforces Positive Outlook

According to Token Terminal data, in addition to the social media buzz surrounding the protocol and its native token, Fantom’s market capitalization has reached approximately $1.38 billion, with a remarkable increase of 18.47%. This surge reflects the growing demand for FTM and its expanding market presence.

In terms of revenue, the token has witnessed substantial growth, with a 30-day revenue increase of 734.11% to $171.73k. Moreover, the annualized revenue has surged to $2.09 million, representing a significant rise of 813.75%.

Moreover, Fantom’s fully diluted market capitalization stands at around $1.57 billion, indicating a substantial increase of 43.39%. This growth further reinforces the market’s confidence in the protocol’s prospects.

When considering performance ratios, the P/F ratio (fully diluted) is calculated at 203.80x, while the P/S ratio (fully diluted) is reported at 679.33x. Although both ratios have dipped by 82.8%, they still suggest a strong valuation for Fantom relative to its performance.

Featured image from Shutterstock, chart from TradingView.com

Market Watch: These 5 Altcoins Are Poised For Breakouts, Says Crypto Expert

A recent analysis by a Crypto Banter pinpointed new notable price levels for prominent altcoins such as XRP, Solana (SOL), Chainlink (LINK), Fantom (FTM), and Polygon (MATIC).

These insights provide a fresh perspective on potential entry points for bullish positions in the current market.

Altcoins At Crossroads: Key Price Levels To Watch

In this analysis, Crypto Banter singles out Solana (SOL) and notes that $48 is an “intriguing” level to watch for any pullback. Additionally, historical data consolidating around this price point on the SOL/USD weekly chart indicates it could be an “optimal” buying zone should prices drop to this mark.

In the case of Chainlink (LINK), Crypto Banter identifies $13.3 down to $12.2 as a “hot zone.” A drop below this range might shift focus to the $9 level as a critical reversal point.

Polygon (MATIC) also comes under scrutiny, with the analyst observing a break in the 200-day moving average on its weekly chart timeframe. According to the host, this development suggests a potential bounce back at the $0.68 zone, possibly preluding a rally.

For clarity, “moving average,” or MA, is a widely used indicator in technical analysis that helps unravel price data by creating a constantly updated average price. This average is typically calculated over a specific period, like 10 days, 20 minutes, 30 weeks; in the case of the Crypto Banter analysis, they based their analysis on the 200-day MA.

Fantom’s Surge And XRP’s Pivotal Turnaround

On the other hand, Fantom (FTM), Crypto Banter, revealed that the altcoin has shown a significant pump of over 50% since late October.

Yet, the analyst suggests a possible retraction towards the 200-day moving average, making the $0.25 region attractive, particularly for those employing a dollar-cost averaging (DCA) strategy.

XRP is not left out of this analytical purview. The host points out that XRP is nearing a critical juncture from a technical standpoint.

The analyst reveals that the 12-hour chart for XRP shows a recent rebound off the 50-day MA. A turnaround around the $0.54 price region could occur if the ongoing pattern along the downward trendline persists.

The analyst further disclosed that this level gains importance due to the convergence of key moving averages that form a support zone around it.

Interestingly, among the altcoins highlighted by Crypto Banter as primed for a breakout, SOL and FTM stand out with significant gains. Over the past two weeks, Solana has seen a 13.8% increase, while FTM has climbed by 8.3%.

Contrastingly, XRP, LINK, and MATIC have experienced declines during the same period. XRP’s price fell by 5.5%, LINK by 5.6%, and MATIC by 6.6%, signaling a diverse performance landscape among these notable altcoins.

Featured image from iStock, Chart from TradingView

Fantom Foundation awards $1.7M bounty for preventing $170M drain

In the aftermath of Fantom’s $550,000 hack in October, a security researcher found that the attacker could have stolen as much as $170 million.

Is Fantom (FTM) About To Explode Like Solana (SOL)? This Analyst Thinks So

FTM, the native currency of the Fantom ecosystem, might be the next coin to follow and perhaps outperform Solana (SOL). This optimistic preview is by one technical analyst, “Magnate,” who, in an X post on October 3, said traders who missed the SOL rally may have a chance with FTM.

Solana Is Exploding: Reverses Post-FTX Losses

At press time, SOL is trading at new 2023 highs and has reversed all post-FTX losses. Changing hands at $39 as of writing on November 3, the SOL uptrend remains, looking at the candlestick arrangement in the daily chart. Specifically, SOL is up 125% from September lows and 190% from June 2023 highs.

At this pace, SOL has outpaced Bitcoin (BTC) and Ethereum (ETH), two of the world’s largest cryptocurrencies. This is despite Bitcoin, buoyed by the broader crypto’s optimism of the United States Securities and Exchange Commission (SEC) approving the first spot Bitcoin exchange-traded fund (ETF) in the coming weeks. The general confidence is despite the SEC laying out a potential timeframe for when this product will go live.

Looking at the SOL daily chart, primary support is around the November 2022 high at around $36–a key reaction line traders are closely monitoring. As it is, there has been a cool-off, but traders are confident of a pullback, pushing the coin back higher in a bullish breakout formation.

Is Fantom (FTM) Preparing For A 100% Surge?

Magnate, sharing the daily and weekly charts of FTM, noted that the coin appears to be bouncing off a critical support zone. In the weekly chart, the uptrend is defined. FTM is picking momentum, edging higher as confidence, partly due to fundamental events and the recovery across the board, is changing sentiment, propping bulls.

From the daily chart, FTM found support at 2022 lows before edging higher to spot rates. This leg up has catalyzed demand, lifting the coin 35% from October lows. Still, FTM is down approximately 65% from February 2023 highs.

Even so, only time will tell if FTM will track SOL, lifting off by over 100%, as the technical analyst predicts. Although there have been some challenges, there are also some positive developments taking place. One such development is that Messari, an analytics platform, recently observed a surge in Fantom’s on-chain activity.

According to their findings, the average number of new addresses added to the network daily increased by 106% in the last quarter. In comparison, the average number of active addresses per day rose by 3% in the same period.

Fantom Foundation Wallets Drained, More Pain For FTM Holders As Prices Tank

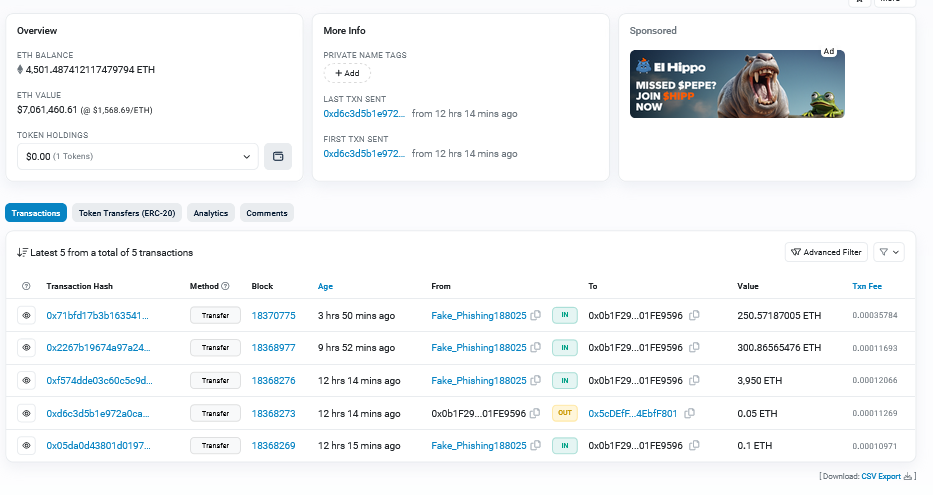

Two Fantom Foundation wallets on Ethereum and the Fantom Network have fallen victim to a phishing attack, losing over $650,000, according to reports from CertiK, a blockchain security firm. Another report by “Spreakaway” on X alleges that one of Fantom’s team members also lost $3.4 million.

Fantom Foundation Falls Victim To Phishing Attack

Fantom Foundation is a non-profit organization dedicated to supporting the growth and development of the Fantom ecosystem. On the other hand, Fantom is a scalable, layer-1 blockchain that is compatible with Ethereum. Like the world’s most valuable network, the platform supports the deployment of smart contracts. For clarity, Fantom’s network was not hacked; the foundation’s wallets were compromised.

According to CertiK, the Fantom Foundation lost $470,000 on Fantom and at least $187,000 on Ethereum. Following the attack, Etherscan data show that the scammers consolidated funds into one account, holding at least $7 million of various coins. The address has already been marked and identified as a facilitator of multiple phishing campaigns impacting crypto and decentralized finance (DeFi) projects.

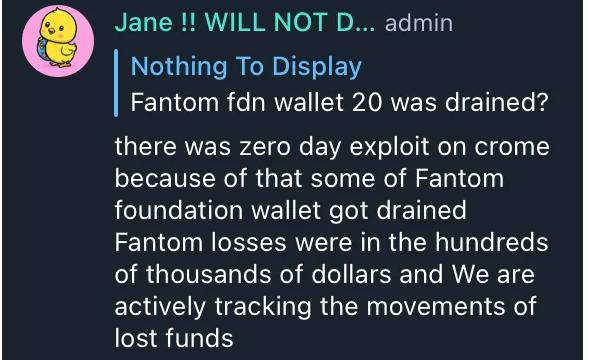

Reports on Reddit show that Fantom Foundation fell victim to a “zero day” exploit on Chrome, a web browser, resulting in the loss of hundreds of thousands worth of FTM. In a screenshot of a Telegram conversation said to have been shared by a Fantom admin, the foundation acknowledged that “some” of their wallets were “drained.” They are actively tracking the movement of stolen funds.

Zero Day Exploit, FTM Sinks Even Lower

A zero-day exploit is a vulnerability unknown to the developer or its tech team, who might be able to fix it. Because the flaw isn’t known to the team, the threat actor can exploit it until it is patched. This is why zero-day exploits can be consequential, especially for DeFi protocols whose infrastructure relies on flawed software.

In the same screenshot shared on Reddit, a representative of Fantom Foundation said they didn’t update their browser to the latest version. The latest Chrome browser update, version 118.0.5993.70, was released on October 11.

Following this news, FTM fell roughly 5% and is now rocking close to multi-month lows. If bears press on, the coin may drop below 2022 lows.

As such, it will reverse all gains made in the first half of 2023. At this year’s peaks, FTM prices rose to as high as $0.65 in February 2023 before contracting to spot rates. The coin is trading at approximately $0.17 and under intense selling pressure.

Fantom Foundation Wallets Drained; $657K Stolen

The foundation wallets of the Fantom blockchain have been drained on both Ethereum and Fantom, according to blockchain security analyst Certik.

Fantom Foundation hacked for an estimated $6.7M: Report

Fantom Foundation’s wallet was reportedly drained of funds by a “Fake_Phishing” account.

Google Cloud adds 11 blockchains to data warehouse ‘BigQuery’

Google’s BigQuery added 11 new public datasets for blockchain networks, allowing users to obtain a variety of data from these networks.