BNXA UK VASP is the first firm to land on the Financial Conduct Authority’s crypto register this year.

UK’s Planned Stablecoin Rules Need Reworking, Crypto Advocates Say

Crypto industry groups in the U.K. say local regulators’ proposals for supervising stablecoins need reworking.

UK FCA crypto skills gap is causing slow enforcement, says National Audit Office

The National Audit Office emphasized that it took nearly three years for the UK Financial Conduct Authority to address illicit activity in crypto ATMs across the country.

UK regulator advocates for asset managers to tokenize funds

The United Kingdom’s financial regulator has endorsed a blueprint model designed to facilitate the tokenization of funds for asset management firms.

UK Crypto Firms Can Apply for 3-Month Reprieve to Comply With Tough New Ad Rules

Bans on aggressive marketing were set to take effect in October, but companies can apply to delay some aspects until January.

Crypto Exchange Kraken’s UK Derivatives Unit Looking to Expands Its Service: Bloomberg

The firm is looking move into a void in the crypto derivatives market left when FTX collapsed last November.

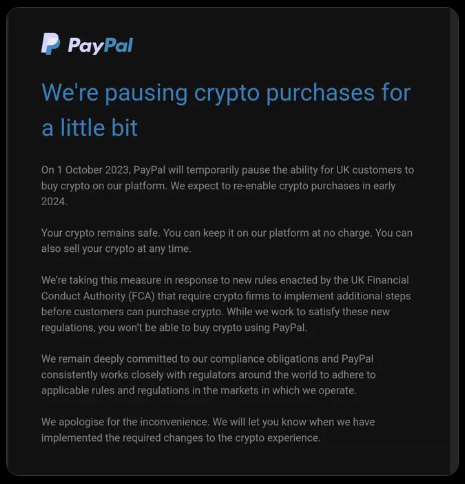

PayPal And The Crypto Conundrum: Understanding The UK Sales Suspension

PayPal has announced a temporary suspension of cryptocurrency sales within the United Kingdom for a minimum of three months, commencing on October 1. This decision is in direct response to the recent regulatory reforms introduced by the Financial Conduct Authority, Britain’s financial regulator.

The FCA is set to implement more stringent guidelines aimed at curbing the advertising of cryptocurrencies to British consumers, which includes the mandatory inclusion of risk warnings and the discontinuation of “refer a friend” incentives.

Adapting To Regulatory Landscape

In an email to customers, PayPal UK explained that customers who currently hold cryptocurrency in their PayPal accounts will be able to retain their holdings on the platform without incurring any fees. Furthermore, the option to sell their cryptocurrency at any time will remain available.

PayPal will ‘pause’ crypto purchases in UK

pic.twitter.com/NPkj7F61cC

— Crypto Crib (@Crypto_Crib_) August 16, 2023

However, the ability to purchase cryptocurrencies using PayPal will be temporarily suspended during the company’s efforts to ensure compliance with the new regulations set forth by the FCA.

This move comes against the backdrop of the impending enforcement of the “Travel Rule” in the UK. As of September 1, 2023, all cryptocurrency firms registered under the FCA will be obligated to adhere to the Travel Rule guidelines, a series of crucial Anti-Money Laundering and Know-Your-Customer regulations established by the Financial Action Task Force (FATF).

This mandate was introduced following governmental amendments to relevant legislation in July 2022.

PayPal: Foray In The Crypto Landscape

PayPal, which has rapidly solidified its reputation as a crypto-friendly platform, introduced a notable addition to its offerings with the launch of its PayPal USD (PYUSD) stablecoin early this month.

The company originally unveiled its foray into the cryptocurrency realm within the United States in late 2020, positioning itself as a key player in the ever-evolving landscape of financial technology.

As the financial industry grapples with the ongoing integration of cryptocurrencies, PayPal’s response to regulatory changes highlights the evolving nature of the relationship between traditional financial platforms and the burgeoning world of digital currencies.

While the company navigates these challenges, users and industry stakeholders alike are keenly observing how this temporary pause in cryptocurrency sales will shape the future of PayPal’s engagement with the crypto market within the UK.

PayPal’s decision to temporarily suspend cryptocurrency sales in response to new FCA regulations underscores the complex interplay between regulatory developments and the cryptocurrency industry.

As the company strives to align with evolving standards, the trajectory of its cryptocurrency ventures will continue to influence the broader financial landscape.

Featured image from Francois Poirier/Shutterstock.com.

UK FCA Chief Warns Against Judging Crypto Firms by Size for Approval Decisions

The FCA has turned down some of the largest crypto firms in the world in the last 18 months, its CEO Nikhil Rathi told lawmakers at a hearing.

Even Unpaid Social Media Crypto Promotions May Breach UK Ad Rules: Financial Regulator

The Financial Conduct Authority (FCA) gained oversight of crypto promotions with the approval of the Financial Services and Markets Act in June.

a16z opening London crypto office citing ‘predictable’ environment

The expansion came following a “productive dialogue” with the U.K. Prime Minister and “months of constructive conversations” with UK policymakers, a16z’s general partner said.

UK’s FCA Continues Crackdown on Unregistered Crypto ATMs

The regulator, alongwith the local police raided sites in Exeter, Nottingham and Sheffield, saying that the cash-to-crypto converters are unlawful and a money laundering threat.

UK financial watchdog to crypto industry: ‘Let’s work together’

The Financial Conduct Authority wants input from crypto companies on moving forward with regulations.

UK uses Love Island star to warn finfluencers on crypto and investment schemes

The financial and advertising regulators posted a seven-part checklist to ensure these social media stars stay within the bounds of the law.

FCA’s incoming chair calls for further crypto regulation

The new chair of the UK’s FCA makes condemnatory comments about cryptocurrencies ahead of his tenure in 2023.

Ep06- DealShaker – Companion Guide For BBC’s “The Missing Cryptoqueen” Podcast

Believe it or not, the DealShaker marketplace is still working. The commerce arm of the OneCoin empire, DealShaker provided a clear and verifiable use case for OneCoin as a currency. The token was real because you could use it to buy things in a specific e-commerce store. Oh, those were the days. The greatest thing about exploring OneCoin and Dr. Ruja’s story is that it reflects how naive the crypto world actually was just a few years ago. In many ways, it still is.

In “The Missing Cryptoqueen’s” sixth episode, we travel to the past. It’s titled “The Überflieger” referring to a “high-flying” person. That’s how teachers of the past described Dr. Ruja, who was definitely the star in all of her classes and was respected and hated for it. What else can Jamie and Georgia learn about Ruja Ignatova by tracing her steps? Let’s find out.

Remember, you can download episodes directly from the BBC, or listen to “The Missing Cryptoqueen” through Apple, Spotify, or iVoox.

About “The Missing Cryptoqueen,” Episode Six – “The Überflieger”

Our blast from the past episode starts in 2009, five years before OneCoin and DealShaker. Bitcoin was entering the scene and so was Dr. Ruja, who bought a factory in Germany. Jamie and Georgia visit the site in 2019 and interview the survivors of that story. They tell them that Ruja Ignatova got there, impressed everybody, and made a lot of promises that she didn’t keep. After that, she disappeared, effectively rug-pulling everybody. Interesting fact, both her father and her mother worked at the factory. Which suggests Ruja Ignatova is a family woman.

When Dr. Ruja disappeared, the factory offices were broken into and a lot of documents went missing, along with her. The factory workers that the podcast interviewed all seem to think that this was staged and that Dr. Ruja took and destroyed some important documents. “It’s exactly the same story,” one of them says comparing OneCoin and DealShaker to the factory in question. When things got tough, Ruja Ignatova sold the company and disappeared. The factory remains closed to this day.

In the next section’s second quote, you’ll sense the magnitude of that first case against Dr. Ruja. She paid the fine and kept it pushing. And, according to the factory workers, she learned that the next time she was going to have to disappear for real.

Quotes From “The Missing Cryptoqueen,” EpisodeSix – “The Überflieger”

In what appears a diary entry, we learn about the young Ruja Ignatova:

“Ruja was always friendly to everyone. She was always well behaved and cheerful, and the teachers were deeply fond of her. She doesn’t drink and she would never degrade herself to eating pizza. Her favorite classes were “p,” she was faultless, and now and then she likes “ari.” Generally, she got on very well with her colleagues. Stop. Maybe we should stick to the truth. Okay, fine. Maybe I did take pleasure in tormenting some students. I was always looking for the chance to spread new amusing stories about them.”

This quote summarizes the consequences of Ruja’s first fraud:

“This time, the law caught up with Dr. Ruja. In 2016, she was convicted in a German court for several crimes. Intentional breach of duty in the event of insolvency, fraud, withholding an embezzlement of employees’ wages, and violation of accounting duties, She received a 14-month suspended sentence and an €18,000 fine. The local newspaper reported that Ruja reappeared to attend the ruling and showed no emotion when the judgment was passed down. She quietly slipped out and returned to Bulgaria, and carried on with OneCoin as if nothing had happened.”

More About Dr. Ruja’s Past

Later in the episode, Jamie and Georgia confirm that Ruja really got a PHD. “She’s smart,” Georgia says. Then, Multi-Level Marketing makes a second appearance. We learn that in 2014, Ruja Ignatova tried to sell… wait for it… bitcoin using MLM techniques. The producers introduce Sebastian Greenwood, a Multi-Level Marketing expert that seems to have created the Dr. Ruja character with Ignatova. She had the charisma, he had the technique. They just needed a product they could control.

Last but not least, we meet Duncan. He once was an integral part of the OneLife organization and it’s the mind behind DealShaker. He says everything in there is rubbish and challenges Jamie to find five things he wants and can pay in OneCoin only. Jamie goes through DealShaker and realizes the already shady characters that sell products through the platform mostly want Euros. Is DealShaker really a OneCoin market?

At the end of the episode, a private detective that the production hired apparently found a lady that could be Ruja Ignatova in Athens. Could it be?

BTC price chart for 11/03/2022 on Bitstamp | Source: BTC/USD on TradingView.com

Extra Material: OneCoin Responds To The FCA

Approximately six years ago, the Financial Conduct Authority of the United Kingdom issued a warning against OneCoin. The company responded and NewsBTC reported the story:

“In the statement, OneCoin has called itself a global software and technology company with offices in Bulgaria, Hong Kong, and the United Arab Emirates. The company has also described OneCoin has a digital currency sharing few features with existing cryptocurrencies. These similarities are confined to the maintenance of all transaction records on a database.

The digital currency company, in the last paragraph of the statement, expresses its full cooperation,

“OneCoin is committed to following good business practices and the relevant rules and regulations in the countries in which it operates. It will co-operate fully with the authorities in pursuit of this objective.”

Episode Credits

Presenter: Jamie Bartlett

Producer: Georgia Catt

Story consultant: Chris Berube

Editor: Philip Sellars

Original music and sound design: Phil Channell

Original music and vocals: Dessislava Stefanova and the London Bulgarian Choir

Previous Companion Guides For BBC’s “The Missing Cryptoqueen” Podcast:

Featured Image: The Missing Cryptoqueen logo by BBC | Charts by TradingView

Hong Kong securities regulator CEO to lead UK financial watchdog

Ashley Alder said the FCA would help “chart the UK’s post-Brexit future as a global financial centre which continues to support innovation and competition.”

Bank of England and regulators assess crypto regulation in raft of new reports

A bundle of interrelated documents remind financial institutions of their responsibilities and look at the state of crypto regulation in the U.K.

Did US Regulators Began Offensive Against Crypto Platforms? CFTC Fines Kraken

One of the biggest cryptocurrency exchanges, Kraken, received a $1.25M fine. The Commodity Futures Trading Commission imposed the “civil monetary penalty” plus a cease and desist from “further violations of the Commodity Exchange Act (CEA)” on September 28th. According to the CFTC, Kraken provided margin for commodity transactions to retail clients in the U.S. who were not suitable to use those products.

Related Reading | How the CFTC fine on Coinbase could affect future crypto company listing

The fine, however, seems like a slap on the wrist for a gargantuan company like Kraken. They’re a private company and their annual revenue is not on the public domain, but they raised $100M at a $4B valuation in 2019. And, reportedly, Kraken was seeking a $20B valuation this year following an IPO that didn’t happen. For a company that size, a $1.25M fine is not much, but maybe the punishment just fits the violation.

ETH price chart on Kraken | Source: ETH/USD on TradingView.com

What Did Kraken Do Exactly?

The violation occurred between June 2020 and July 2021 approximately. During that period, “Kraken illegally operated as an unregistered FCM.” And, what did the unregistered futures commission merchant offer? Well, U.S. customers could acquire digital assets using margin, and Kraken provided said asset or the fiat money “to pay the seller for the asset.” Of course, users had to provide collateral and pay for the received asset within 28 days.

If they didn’t pay in the established period, “Kraken could unilaterally force the margin position to be liquidated.” They could also liquidate “if the value of the collateral dipped below a certain threshold percentage of the total outstanding margin.” In short, Kraken was selling derivatives and extending credit without registering as an FCM. “These transactions were unlawful because they were required to take place on a designated contract market and did not.”

The CFTC’s Acting Director of Enforcement, Vincent McGonagle, said in the press release:

“This action is part of the CFTC’s broader effort to protect U.S. customers. Margined, leveraged or financed digital asset trading offered to retail U.S. customers must occur on properly registered and regulated exchanges in accordance with all applicable laws and regulations.”

The Cryptocurrency Exchange’s Latests Plays

Over the last few months, Kraken representatives went hard on the traditional financial system. From their Director Dan Held calling the whole thing “a cartel,” to CEO Jesse Powell predicting that cryptocurrency companies would replace them within a decade. In Held’s tweet, he attached a graphic that showed how the consolidation of the US banking sector advanced through the years. Nowadays, just four institutions control it all:

The traditional banking system is a cartel.#Bitcoin fixes this. pic.twitter.com/LEFCTb6g93

— Dan Held (@danheld) July 1, 2021

Related Reading | Bitcoin Slides 5% From Recent Highs Amidst Binance CFTC Probe Revelation

For his part, the last day of March, Powell told Bloomberg:

“Most of these guys haven’t done the work these last ten years to make sure they are current with the crypto technology. So I think there’s a very real risk that over the next ten years, for those legacy businesses to be simply replaced.”

In more recent news, Kraken is trying to re-enter the European market. The company was licensed to operate through the UK’s Financial Conduct Authority. Thus, since Brexit happened, they have to find a new home for their license. When NewsBTC covered the news, we said:

“Powell added that the Kraken exchange seeks to re-enter Europe by the end of 2021. It will go with the Republic of Ireland, Malta, and Luxembourg, among possible countries, to award such a license. However, they are yet to fix an official date as the talk still goes on.”

Will the $1.25M fine the CFTC imposed throw a wrench on those, or any of Kraken’s plans? Certainly not. Not by a long shot.

Featured Image by Erik Tanghe from Pixabay – Charts by TradingView

PayPal To Facilitate UK Customers With Cryptocurrency Trading Feature

PayPal users with accredited identities will start accessing cryptocurrency trading soon. However, cryptocurrency transactions for its business account are not supported yet.

Starting from this week, U.K residents will have initial access to buying, holding, and selling cryptos via PayPal. This development will make a remarkable milestone for a firm that started providing digital asset services within one year.

PayPal is an American multinational financial technology company that operates an online payments system. It’s a global payment provider with services accessed in most countries that support online money transfers.

PayPal serves as an electronic alternative to traditional payment methods such as checks and money orders.

Related Reading | 37% Of U.S. Investors Decline To Liquidate Cryptocurrency Assets in Bearish Situations

On Sunday, the popular payment provider declared its intent to allow U.K customers access to cryptos. The cryptos are Ether (ETH), Bitcoin Cash (BCH), Litecoin (LTC), and Bitcoin (BTC). Of course, you can always access them via mobile app or website.

The Sunday announcement marked PayPal’s first expansion of crypto services outside the U.S and was initially launched last year November.

PayPal Aims To Boost Cryptocurrency Exposure In U.K.

Jose Fernandez da Ponte cited money digitization during COVID-19 as one of the main motivations for embracing crypto. Jose Fernandez is a high-ranked executive for PayPal’s cryptocurrency division. He added that;

“Our expertise on global digital payments provides us with the opportunity and responsibility of helping U.K. residents to explore cryptocurrency. This adds to our businesses and consumers knowledge combined with various security and compliance controls.”

By making its crypto services available to U.K. residents, the online payment giant plays a role in increasing the country’s cryptocurrency exposure.

After a sudden pullback, the market is back on bullish track | Source: Crypto Total Market Cap on TradingView.com

According to reports, the payment giant has the highest penetration among other European countries in U.K.with over 2 million active users monthly.

Rumors on PayPal’s crypto expansion proposal have been in circulation since the past month after Dan Schulman’s speech. Dan Schulman’s CEO had earlier informed investors on the soon coming PayPal services to the U.K. residents.

Reports further show that PayPal’s eye development in Defi is a precursor to integration plans in the future. The Financial Conduct Authority (FCA) on regulation in the U.K. goes down on some crypto exchanges. These are exchanges that have not met their registration demands.

Related Reading | Facebook Officials Claim Novi Received Approval From Major U.S. States

For example, FCA shuttered the operations of Binance U.K. after warning them against providing regulated trading activity in the country this summer.

PayPal’s da Pote Jose gave assurance that his company will keep working with U.K. regulators and others to roll out its cryptocurrency services.

Featured image from Pixabay, chart from TradingView.com

UK FCA will spend £11M to warn people about investing in crypto

U.K. financial regulators have announced an 11 million pound digital marketing war chest to warn people about the dangers of crypto investments.