When Ethereum (ETH) exploded past $2,000 on November 9, Erik Smith, the Chief Investment Officer of 401 Capital, observed that the platform’s average daily revenue surged to the highest level in four months.

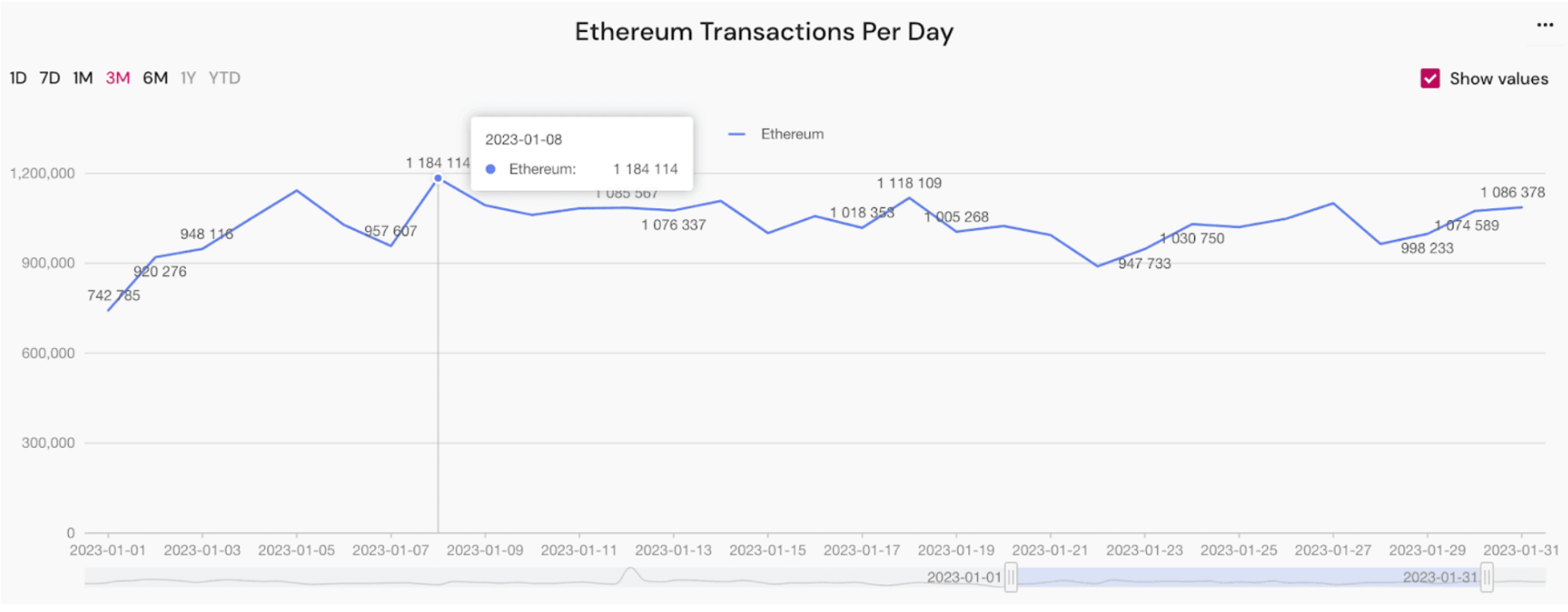

According to data, Ethereum generated $10 million in daily revenue, extending gains registered on the previous day and pushing the metric to the highest point since July.

Ethereum Prices Above $2,000, Revenue Rising In November

For now, ETH prices remain muted but are trading around November 9 highs and remain within a bullish formation backed by decent trading volumes. Prices are still trending above the $2,000 psychological support, a critical reaction level.

A look at the Ethereum candlestick arrangement in the daily chart shows that while there is a notable spike in daily revenue, prices are still below July 2023 highs. Then, the coin soared to as high as $2,100 before pulling back as the momentum triggered by the broader crypto’s expectation of a Bitcoin Exchange-Traded Fund (ETF) approval faded. However, prices have since sharply recovered, adding roughly 40% from October lows and shaking off the weakness registered on August 17 when the coin plunged by 14%.

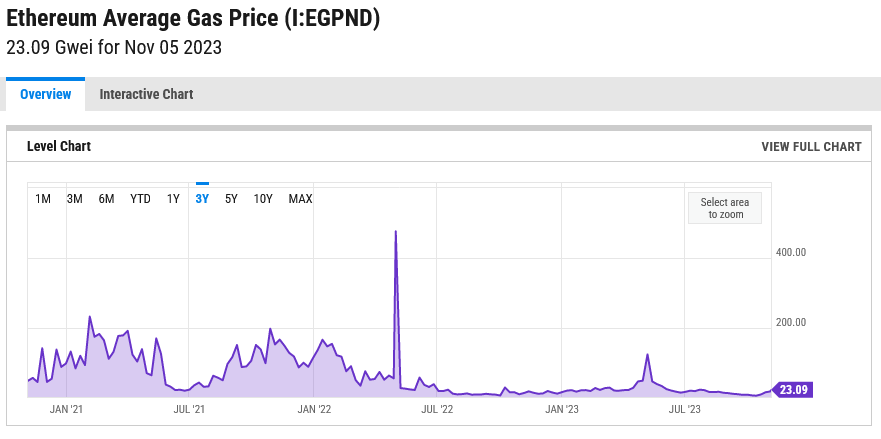

Token Terminal data shows that Ethereum’s daily revenue has steadily risen in the first ten days of November. Looking at trends, the average daily income has doubled from $5 million in the first five days of the month. Usually, an uptick in daily average revenue in a network points to increasing on-chain activity either through smart contract deployment or simple transfers, which necessitates the payment of gas fees.

Improving Scalability In The Long Term

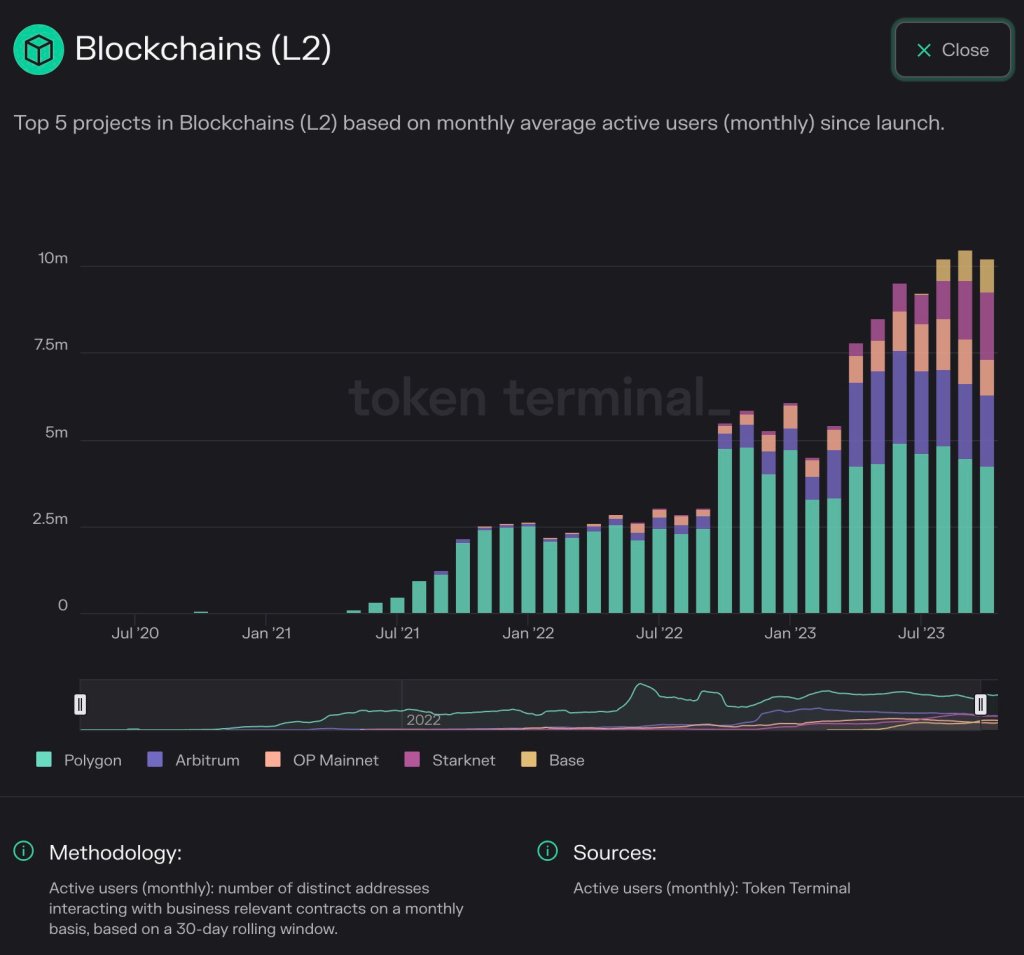

How the widespread adoption of Ethereum layer-2 and sidechain scaling solutions will impact the network revenue is not immediately apparent. }

What’s clear is that the more protocols leverage the protocol, deploying multiple solutions, the more revenue the network will generate for validators and stakers. Staking rewards are drawn partly from transaction fees paid as gas, new issuance, and burned miner extractable value (MEV).

Still, the dollar value of ETH minted as revenue depends on spot rates. If the uptrend is sustained, this figure will continue expanding. Even so, there might be more demand for the network, which is still struggling to scale on-chain.

Ethereum 2.0 aims to resolve these challenges in the coming years by increasing the general throughput via solutions like Sharding. Sharding will split Ethereum into small but interconnected networks called shards. Each shard will independently process each set of transactions and maintain its state, allowing the mainnet to scale.