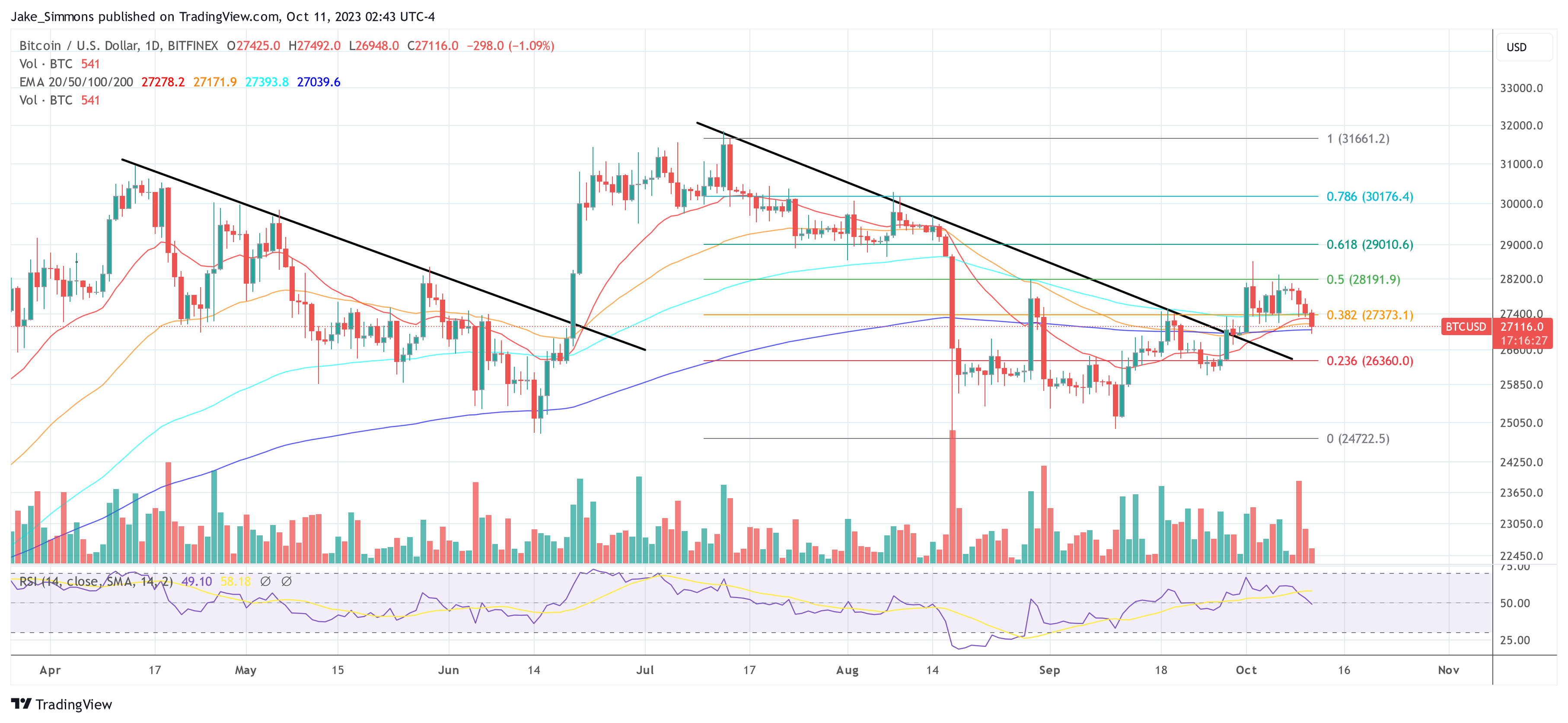

Bitcoin has encountered a critical resistance level going into the weekend and could move sideways following a massive rally. According to an expert, the cryptocurrency has been breaching every major obstacle, making it one of the best-performing assets.

As of this writing, Bitcoin (BTC) trades at $43,600 with sideways movement in the last 24 hours. Over the previous seven days, BTC recorded a 14% increase, with Ethereum following its footsteps, recording a 13% rally.

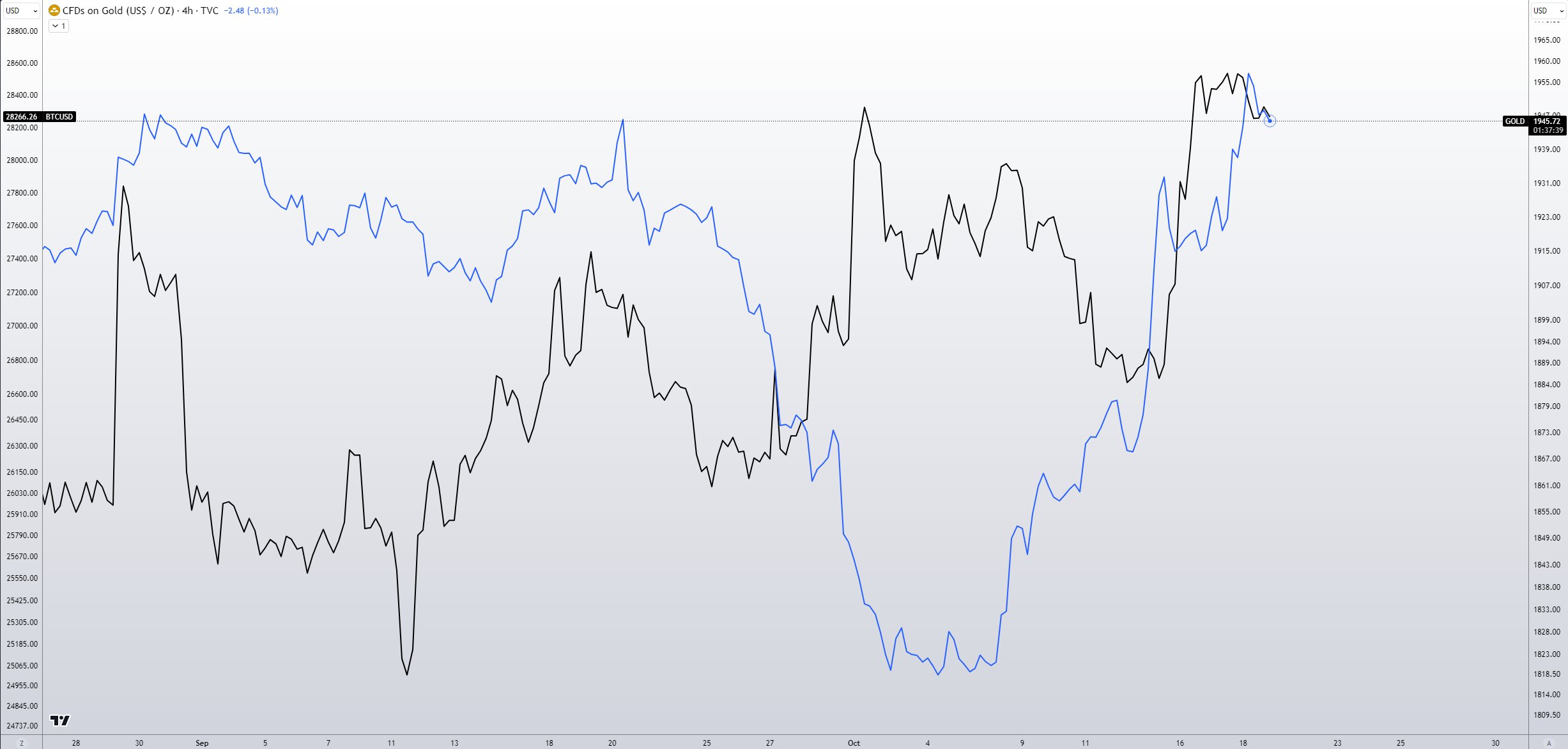

Bitcoin vs. Gold: The Digital Currency’s Journey to $40,000

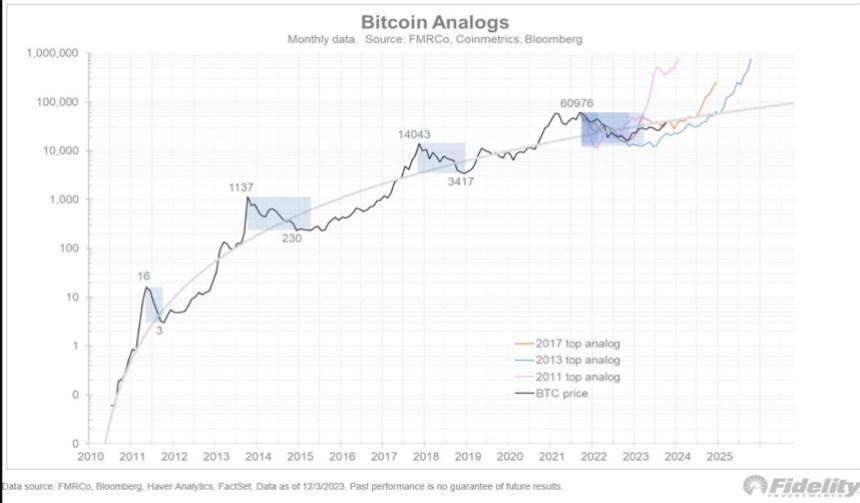

Jurrien Timmer, Director of Macro for Fidelity, offers insightful analysis of Bitcoin’s trajectory, likening it to “exponential gold.”

His thesis suggests that Bitcoin, much like its elder counterpart, gold, holds value in times of structural inflation, yet it boasts an added venture twist. In that sense, Timmer believes both assets are prime to capture attention from investors looking to protect themselves from “reckless monetary inflation.”

As seen in the chart below, if Bitcoin follows a similar trajectory to the previous, its price could target $100,000 and $1,000,000 by early 2025.

2020 was pivotal for Bitcoin and gold, with fiscal and monetary stimulus bolstering their appeal. However, Bitcoin differentiates itself with its capped supply of 21 million coins, contrasting gold’s continual but modest annual supply growth.

This limited supply has propelled Bitcoin’s “stock-to-flow” (S2F) ratio significantly higher than gold’s. Moreover, Bitcoin’s journey reflects the classic S-curve path of technological innovations. Its exponential growth trajectory mirrors historical trends in technology from railroads to cell phones.

However, predicting Bitcoin’s future based on these S-curves is complex, as slight deviations in these growth phases can “dramatically” alter outcomes, the expert claims.

SEC Deliberations And Institutional Interest Shape Bitcoin’s Future

Timmer’s observations include a potential impact of the SEC’s anticipated decisions on the Bitcoin spot Exchange Traded Fund (ETF). He theorizes that pending product applications could attract new investors, yet he remains cautious about whether this will trigger a “sell-the-news” event and a large drawdown.

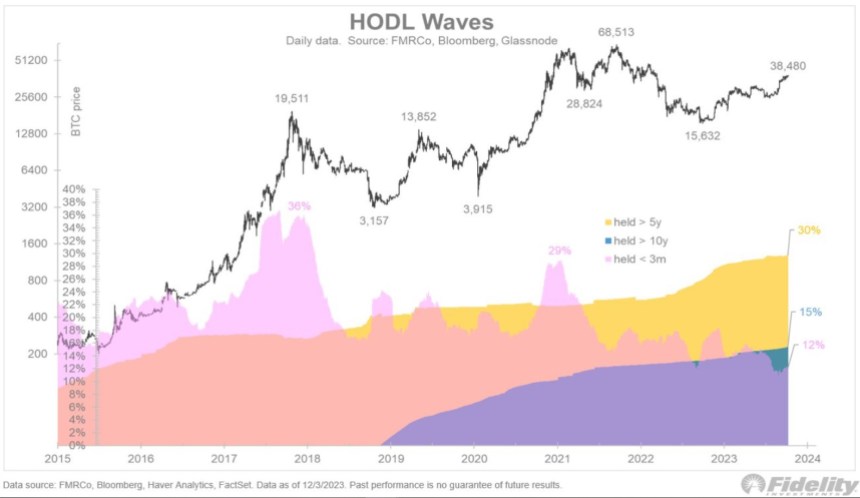

Interestingly, a small percentage of Bitcoin is held for under three months, suggesting that the recent price surge is not merely “speculative,” offering support for a longer bullish trend.

The true believers in Bitcoin, as indicated by the growing percentage held for over five or ten years, are unlikely to be swayed by short-term news. However, there is notable activity in the Bitcoin futures market, particularly among asset managers, which could suggest anticipation of the SEC movement.

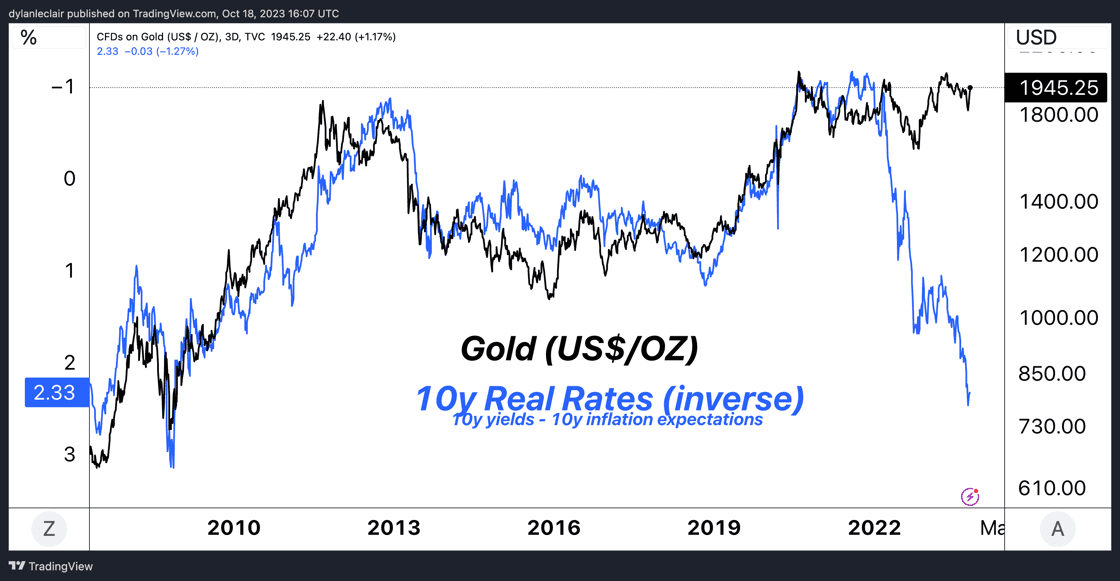

Any updates from the SEC would arrive in a transformed macroeconomic environment. Unlike the liquidity-rich period of 2020-21, the US Federal Reserve’s (Fed) recent policy shifts have reversed the surge in monetary inflation.

This shift aligns the current situation more with the post-World War II era than the inflationary 1970s, impacting the urgency of the value proposition for gold and Bitcoin.

As BTC matures, its relationship with traditional financial markets and global economic trends becomes increasingly intricate. With the SEC’s decision and a shift in the macro-arena, the coming months are poised to exercise influence over the premier cryptocurrency and the nascent sector.

Cover image from Unsplash, chart from Tradingview