Bitcoin wakes up to near $28,000 ahead of a jump to a new BTC mining difficulty record as billionaire investor Ray Dalio conjures the chilling thought of “World War III.“

Cryptocurrency Financial News

Bitcoin wakes up to near $28,000 ahead of a jump to a new BTC mining difficulty record as billionaire investor Ray Dalio conjures the chilling thought of “World War III.“

Bitfarms, one of the largest Bitcoin miners in the world, believes that many of its best growth opportunities will arise from the upcoming BTC halving.

Bitcoin miners may see “severe” economic consequences from BTC price action staying below $30,000 after the 2024 halving, Glassnode warns.

Bitcoin network fundamentals have never looked better, as optimism trickles back when it comes to BTC price strength in a key Fed rate decision week.

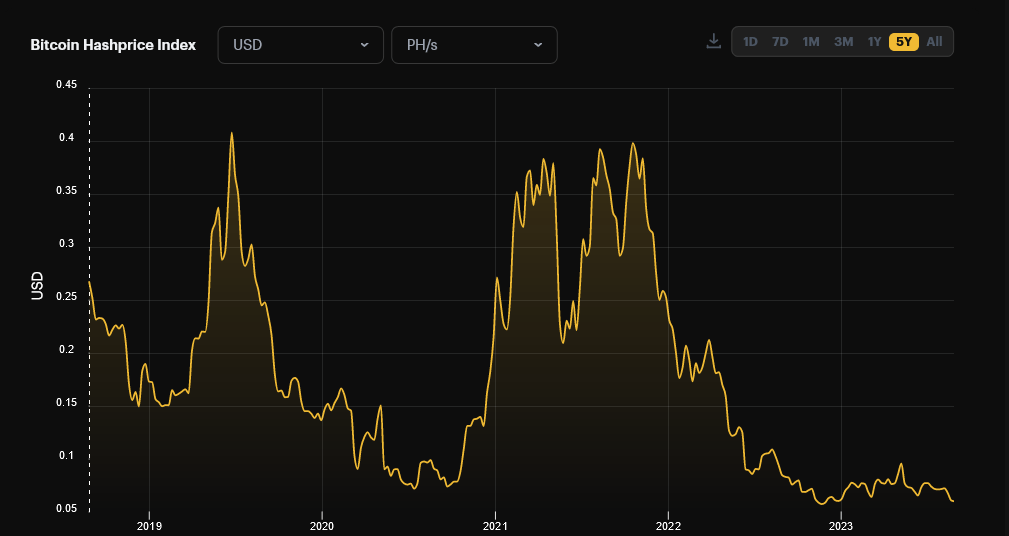

Bitcoin miners are churning less in revenue, looking at trackers on August 28. According to Hashrate Index data, a platform that tracks the correlation between hash rate and revenue accrued by miners over time, income generated from Bitcoin mining operations is at near record lows.

At $0.059 per Tera Hash (TH) daily, the trend doesn’t look exciting for Bitcoin miners as it is cents away from $0.056, a level recorded in late November 2022.

At the depth of last year’s crypto winter when prices fell, cracking below $16,000, hash price, which measures the potential revenue expected from deploying 1 Tera Hash of hash rate to the Bitcoin network per day, crumbled to the lowest point in three years.

While BTC supporters are optimistic, expecting prices to recover in the second half of 2023, miners must contend with lower revenue. How this impacts their operations is yet to be seen because miners depend on income generated from deploying hash rate to cater for operational expenses and sometimes pay shareholders.

On May 8, the hash price rose to $0.095, the highest level in 2023, but has since contracted, dropping by over 40%. As the hash price falls, it could mean miners are having a hard time competing. The trend, as it is visible, comes when the hash rate has been rising to record levels as more miners power up their mining rigs.

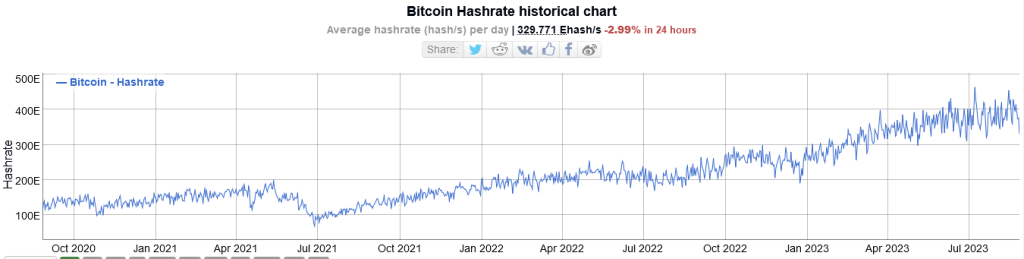

Throughout 2023, the total Bitcoin hash rate, a metric measuring the computing power channeled to the network, rose from 269 EH/s in early January 2023 to 465 EH/s in early July 2023. The hash rate has since dropped around 329 EH/s, a level that’s still higher than 2022 highs.

With a rising hash rate, the Bitcoin network automatically adjusted the mining difficulty to the highest level last week. Trackers show the network’s difficulty is now at 55.62 T, following a 6% increment.

For the better part of the year, difficulty levels have been rising amid an increase in hash rate. As prices recovered in January and the hash rate rose, the network increased difficulty levels by 10%, the highest spike this year.

Hash rate will likely continue rising in the months ahead. Tether Energy, an affiliate of Tether Holdings, issues USDT, plans to connect their rigs in Latin America. Their launch translates to more competition for existing miners, including Riot Blockchain.

As the Bitcoin network hash rate tops 414 EH/s, miners are struggling to stay afloat amid plummeting profitability.

U.S. miner TeraWulf expanded its Bitcoin mining capacity in 2023, resulting in 70% more BTC mined in Q2.

One week after the highly anticipated Litecoin halving event on August 2, on-chain data reveals that the network’s hash rate, a key measure of computing power channeled to the network, is steady but erratic.

As of August 9, trackers indicate that the Litecoin network’s hash rate is hovering around 760 TH/s, a notable decrease from the all-time peak of 816 TH/s recorded in late July 2023.

Litecoin prices, on the other hand, are firm but down in the previous week of trading. CoinMarketCap data on August 9 shows that LTC is changing hands at $83, down 5% over the past week. What’s clear is that prices are moving tightly inside a consolidation range.

Despite this dip, LTC is relatively resilient, up 17% from June 2023 lows. However, from a top-down preview, the coin is down 26% from the 2023 highs. In the medium term, LTC remains bullish since bears have failed to unwind gains posted from mid-June to mid-July 2023. Whether bulls will maintain control after halving, however, is also unclear.

If past performance guides, there is a glimmer of hope for bulls. The previous Litecoin halving in August 2019 was several months before LTC ripped to $400 in 2021. Even so, before this spike, LTC prices nearly halved from $66 to $35 in December 2019.

Unlike previous halvings, the crypto space has matured, and regulatory clarity has improved, particularly concerning Bitcoin—the foundational protocol from which Litecoin emerged. For instance, while most US regulators consider Bitcoin a commodity, the Securities and Exchange Commission (SEC) is cautious toward other altcoins.

Considering the above challenges and regulatory uncertainty, the interconnection between hash rate and spot prices is actively monitored. Litecoin relies on decentralized miners for security and transaction confirmation.

The network’s security is evaluated via the hash rate metric, which risks crashing since miners must allocate more resources after the network halved rewards to 6.25 LTC. A potential price decline could trigger a corresponding reduction in hash rate, forcing the network to adjust the difficulty.

How this evolves remains to be seen, and the network remains stable at spot rates. Besides the hash rate near all-time highs, the network’s activity seems unaffected. According to IntoTheBlock data, the network’s average growth is steady despite sentiment on LTC being generally negative.

Bitcoin prices have been stagnant, trading below the psychological $30,000 level. The coin is technically under pressure, declining from its peaks of around $31,800 recorded in early July 2023. Amid this development, on-chain data reveals that the Bitcoin miner reserve has been increasing, notwithstanding prevailing market conditions, bouncing back from May 2023 lows. According to data from CryptoQuant, the BTC miner reserve stands at 1.841 million as of July 30, up from 1.826 million on May 27.

The increasing BTC miner reserve and relatively stable and steady coin prices suggest a sense of optimism among miners. This could improve sentiment and confidence among miners, possibly boosting prices and preventing sellers from pressing the coin even lower. Presently, as mentioned earlier, BTC is trending below $30,000.

In crypto, the Bitcoin miner reserve measures all BTC in the hands of all miners and mining pools. It shows the total number of BTC that is yet to be liquidated. Price-wise, this is important. Miners frequently sell their coins to cover operational costs and realize profits. Therefore, trackers often monitor their trading patterns for valuable insights into market sentiment.

Bitcoin miner reserve trends are important for traders. However, other critical factors could influence prices in future sessions, some of which might have adverse effects. One key consideration is how different countries decide to regulate cryptocurrencies, including Bitcoin, as their move can impact liquidity and investor perception.

In the United States, for instance, the approval or rejection of a Bitcoin Spot ETF by the Securities and Exchange Commission (SEC) could significantly affect Bitcoin’s price in the months ahead. The approval of a Bitcoin ETF would enable institutional players to include Bitcoin in their portfolios, injecting capital into the crypto markets and potentially increasing liquidity. Currently, Grayscale’s GBTC, a close-ended trust, allows institutions to get exposure to Bitcoin without directly buying BTC.

Beyond price-related factors, Bitcoin’s proof-of-work network has faced criticism for its substantial energy consumption to power its operations. In response to environmental concerns, China banned Bitcoin and crypto mining activities, resulting in a drop in the network’s hash rate and negatively impacting BTC prices. Whether the US and Europe will follow a similar path in the future could also have implications for Bitcoin’s price trajectory.

Bitcoin miners have been selling BTC since the start of June, potentially adding further pressure to the BTC price.

Crypto mining firm CleanSpark has been aggressively expanding its fleet of mining machines this year, despite mining profitability being far from its all-time highs.

While the Bitcoin hash rate briefly touches new highs, Bitcoin Ordinals are a contributing factor to daily transactions exceeding 500,000.

Bitcoin difficulty and hash rate stop at nothing in their quest to surge to new levels never seen before.

Bitcoin faces a battle for key BTC price support to start the week, while market participants stay optimistic about trend continuation.

Analysts are speculating that the Bitcoin hash rate has seen a big spike recently as miners come back online to reap the rewards of the BTC price hike.

Argo’s daily Bitcoin production rate in February surged 7% despite a 10% month-over-month increase in average network difficulty.

Don’t be fooled by its emptiness: Block 776,339 plays as important a role as busier blocks in the Bitcoin blockchain.

Core Scientific, Riot, and CleanSpark led the way in increasing Bitcoin production in January helped by better weather conditions and stable electricity prices.

Bitcoin miners have been under duress for more than a year and even with BTC price trading at $24,000, BTC mining stocks could still face challenges throughout 2023.

As Bitcoin remains well-positioned for a steady recovery, the mining industry witnessed a 50% growth in revenue in terms of US dollars.