HBAR, Hedera’s native token, saw a sharp correction following clarification that the world’s largest asset manager, BlackRock, was not directly involved in the tokenization of its ICS Treasury Fund on the Hedera network.

HBAR Token Crashes By Almost 35%

Data from CoinGecko shows that the HBAR token has declined by almost 35% since its price rose by over 100% on the back of the announcement, which many misinterpreted to mean that BlackRock tokenized its fund on the Hedera network. On April 24, the Hedera Foundation shared that Blockchain trading firm Archax and Infrastructure firm Ownera had collaborated to tokenize BlackRock’s ICS US Treasury money market fund (MMF) on Hedera.

Members of the crypto community, including influencers like CrediBULL Crypto and Mason Versluis, misconstrued this as meaning that BlackRock had tokenized its fund on Hedera. This assumption immediately created a bullish narrative for the ecosystem, leading to HBAR’s price rallying by over 100% and peaking at $0.176.

However, the crypto token has since been on a downtrend, with BlackRock denying any involvement with Hedera. Specifically, a BlackRock spokesperson told Cointelegraph that the world’s largest asset manager “has no commercial relationship with Hedera nor has BlackRock selected Hedera to tokenize any BlackRock funds.”

Meanwhile, Archax’s co-founder had also clarified on his X (formerly Twitter) platform that BlackRock wasn’t directly involved in the whole move. He claimed that tokenization of the fund can usually be done without the permission of the asset manager. However, he revealed that BlackRock knew they were tokenizing on the network.

Why The News Is Still Bullish For The Hedera Ecosystem

Despite BlackRock not being directly involved in this development, crypto analyst CrediBULL Crypto offered some perspective on why this news is still bullish for Hedera and its HBAR token. He revealed that BlackRock is the fourth largest shareholder of ABRDN, a firm that is a primary investor in Archax.

Therefore, the crypto analyst believes that BlackRock must have signed off on this move, something he considers a “de-facto endorsement of the product.” Meanwhile, he also alluded to an interview that revealed that BlackRock chose Hedera, although ABRDN introduced them to the network.

CrediBULL Crypto noted that even if BlackRock wasn’t building on the network, it is clear that “major enterprises are using Hedera.” They are “actively involved with building on the network and are constantly pushing to move it forward behind the scenes,” he added. He suggested that this puts Hedera above 99% of networks that can’t boast of such achievements.

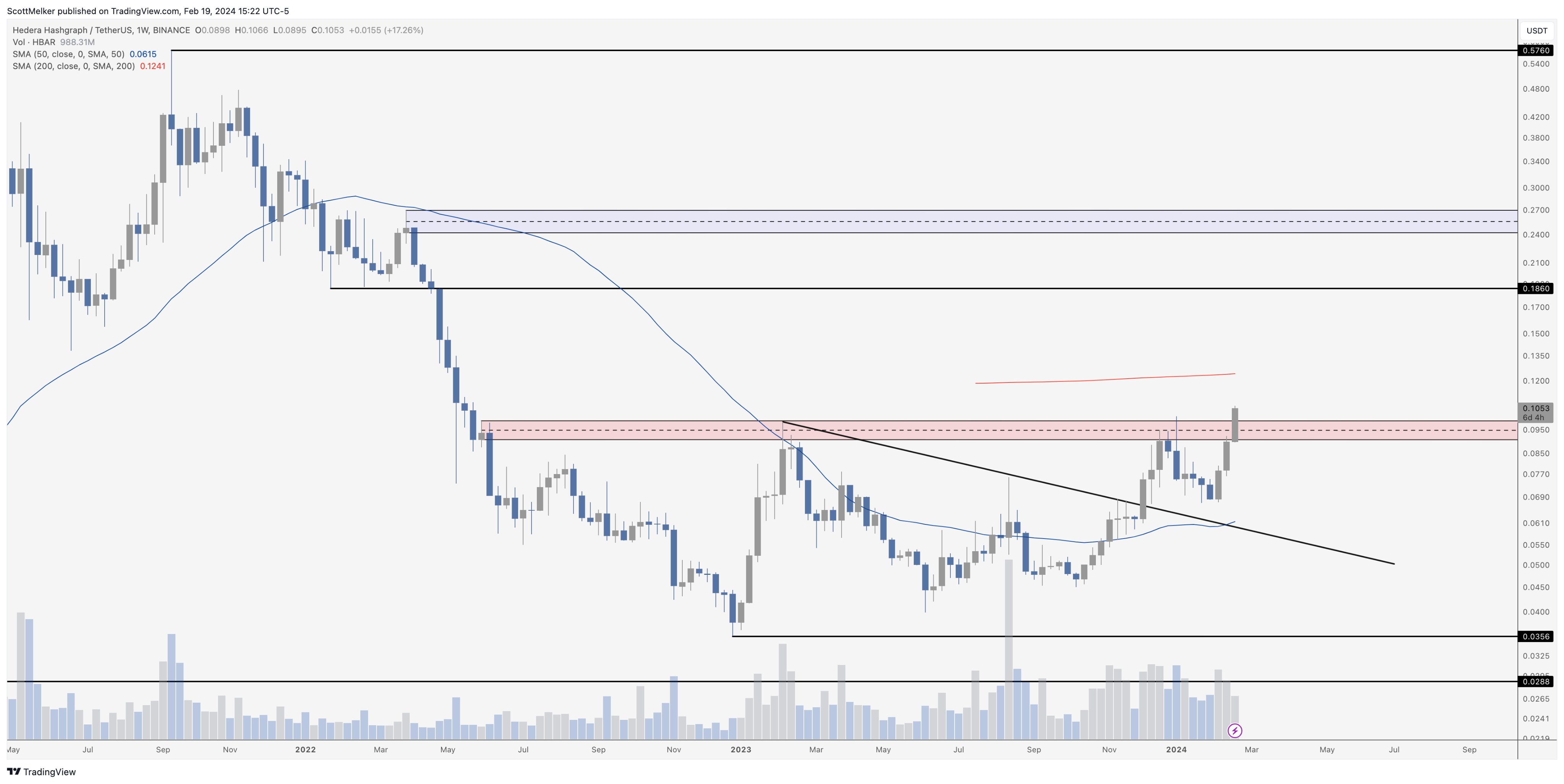

Source: TradingView

Source: TradingView