Powell also said a CBDC would need Congress’ approval before the Federal Reserve will act.

Bitcoin Set For Weekend Rally Amid New Banking Crisis: Arthur Hayes

Arthur Hayes, the founder of BitMEX, has offered an in-depth analysis of the current financial landscape and its potential impact on Bitcoin, especially in light of the recent challenges faced by New York Community Bancorp (NYCB) and the broader banking sector.

Hayes’s analysis draws on the complex interplay between macroeconomic policies, banking sector health, and the cryptocurrency market. His comments are particularly insightful given the recent developments with NYCB. The bank’s stock plummeted by 46% due to an unexpected loss and a substantial dividend cut, which was primarily attributed to a tenfold increase in loan loss reserves, far exceeding estimates.

This incident raised red flags about the stability and exposure of US regional banks, particularly in the real estate sector, which is known to be cyclically sensitive and vulnerable to economic downturns. The stock market reacted negatively to these developments, with regional US bank stocks also declining due to NYCB’s performance.

Weekend Rally Ahead For Bitcoin?

Hayes explicitly stated, “Jaypow [Jerome Powell] and Bad Burl Yellen [Janet Yellen] will be printing money very soon. NYCB annc a ‘surprise’ loss driven by loan loss reserves rising 10x vs. estimates. Guess the banks ain’t fixed.” This comment underscores the persisting fragility of the banking sector, still reeling from the shocks of the 2023 banking crisis. He added, “10-yr and 2-yr yields plunged, signaling the market expects some sort of renewed bankster bailout to fix the rot.”

Furthermore, Hayes highlighted the impending conclusion of the Federal Reserve’s Bank Term Funding Program (BTFP), which was introduced in response to the 2023 banking crisis. The BTFP was a critical instrument in providing liquidity to banks, allowing them to use a wider range of collateral for borrowing.

Hayes anticipates market turbulence leading to the Fed possibly reinstating the BTFP or introducing similar measures. In a recent statement, he noted, “If my forecast is correct, the market will bankrupt a few banks within that period, forcing the Fed into cutting rates and announcing the resumption of the BTFP.” This scenario, he argues, would create a liquidity injection that could buoy cryptocurrencies like Bitcoin.

In his latest post on X, Hayes drew parallels to the cryptocurrency’s performance during the March 2023 banking crisis. He predicts a similar trajectory, suggesting a brief dip followed by a significant rally:

Expect BTC to swoon a bit, but if NYCB and a few others dump into the weekend, expect a new bailout right quick. Then BTC off to the races just like March ’23 price action. […] I think it might be time to get back on the train fam. Maybe after a few US banks bite the dust this weekend.

During the March crisis, Bitcoin’s value jumped over 40%, a reaction attributed to its perceived role as a digital gold or a safe-haven asset amid financial instability. On a longer time horizon and with the Great Financial Crisis from 2008 in mind, he further argued, “What did the Fed and Treasury do last time US property prices plunged and bankrupted banks globally? Money Printer Go Brrrr. BTC = $1 million. Yachtzee.”

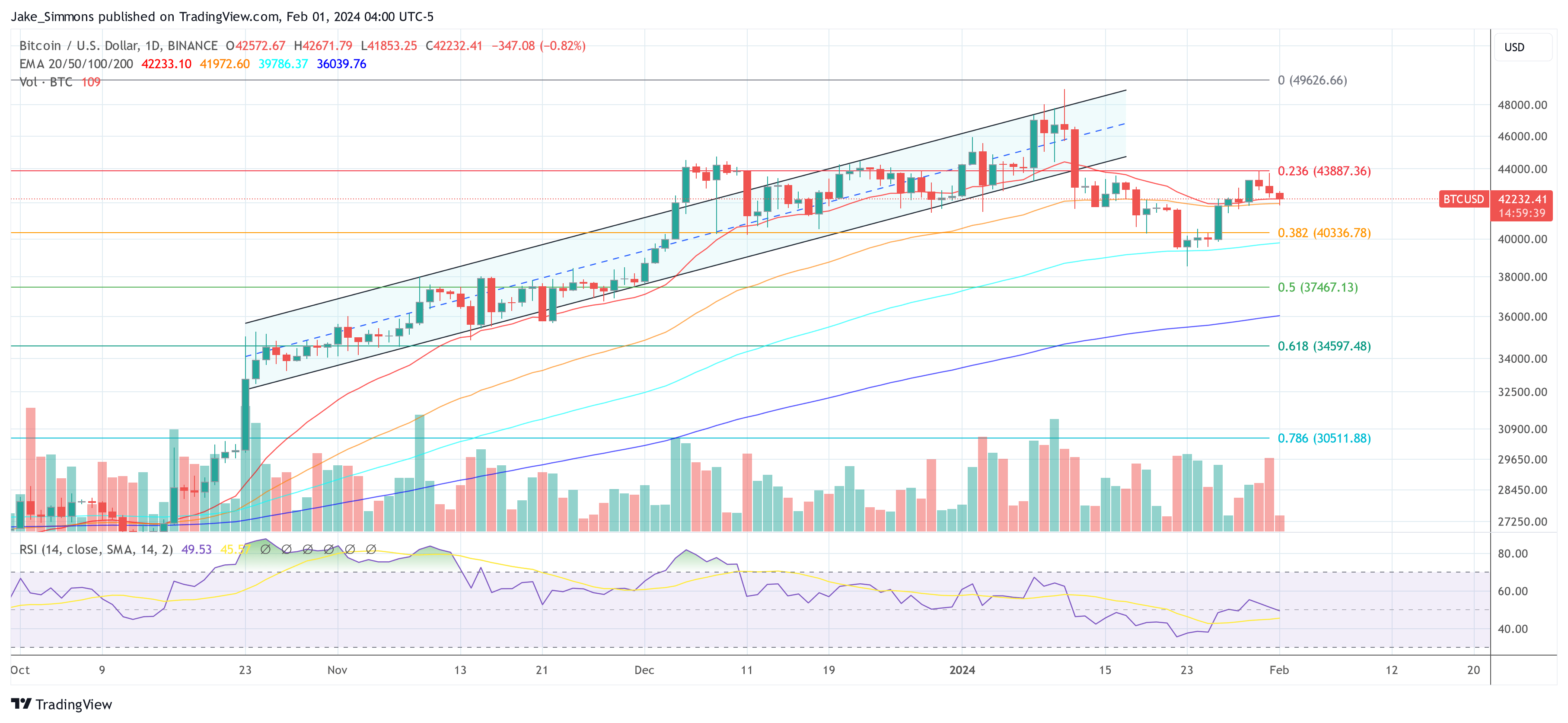

At press time, BTC traded at $42,232.

Bitcoin Dips to $42.4K as Fed’s Powell Pours Cold Water on March Rate Cut

Bitcoin dipped to $42,300, while crypto majors ETH, ADA, DOT fell 3%-4% with Solana’s SOL tumbling over 6%.

Fed Leaves Rates Unchanged, Sounds Hawkish Note on March

Bitcoin investors have mostly been focused on spot ETFs and the upcoming halving, but central bank monetary policy is also likely to play a sizable role in the 2024 price outlook.

Bitcoin Eyes $45,000 Amid Anticipation Of FOMC Decision

After a challenging two weeks resulting in a 21% drop, the Bitcoin (BTC) price rebounded emphatically, closing last week on a strong note. The premier cryptocurrency witnessed a surge that saw it end with a Doji Hammer candle on its weekly chart, signaling a potential bullish reversal. Notably, this uptick has propelled Bitcoin’s value back into its previous range of $41,300 to $45,000.

Keith Alan, the co-founder of Material Indicators, highlighted the significance of this pattern, stating, “Looks like we have a Doji Hammer candle forming on the BTC Weekly chart. That typically indicates a bullish reversal is coming. […] If we do indeed print a Hammer, Bitcoin bulls will need to overcome resistance at the bottom range of the Golden Pocket to have a chance at a meaningful move to retest the $44k – $45k range.”

Bitcoin has also reclaimed its position above the 20- and 50-day Exponential Moving Averages (EMAs), hinting at the potential for further gains. However, the anticipation surrounding the first Federal Open Market Committee (FOMC) meeting of 2024 adds a layer of complexity to Bitcoin’s trajectory.

FOMC Preview

The upcoming Federal Open Market Committee (FOMC) meeting, is anticipated to be a major determinant in the short-term movement of Bitcoin’s price, as it could signal significant shifts in the United States Federal Reserve’s monetary policy approach.

Macro analyst @tedtalksmacro provided an in-depth perspective: “This week’s FOMC meeting is pivotal.” Currently, the market is expecting the Fed to maintain the status quo, with a 97% probability against any policy change.

“However, there’s a 46% chance of a rate cut by the March meeting. Investors should closely monitor for signs of the Fed moving towards a data-dependent approach, any recognition of inflation nearing their 2% target, and potential adjustments to Quantitative Tightening (QT) policies,” Ted remarked.

After this week, the Committee will meet again on March 19-20. Thus, this week’s FOMC meeting could lay the foundation for the critical decisions in March, which could have immediate and pronounced effects on market dynamics.

The Federal Reserve has forecasted that it will reduce interest rates three times this year. The market anticipates a possibility of five or more cuts. There is a general agreement that the initial reduction in rates might occur in the second quarter, though there is substantial support for the possibility of it happening at the March meeting.

Goldman Sachs has been consistently predicting a rate cut by the Fed in March. Their analysis is grounded in the significant progress observed in inflation control.

The post-FOMC meeting press conference will be a focal point, as investors seek clarity on the collective view of the FOMC members, including the newly rotated regional Fed bank presidents. These officials, known for their cautious approach towards rate cuts, will play a significant role in shaping the committee’s decision-making process.

December’s inflation report indicated a 3.4% year-on-year increase, with core prices rising more rapidly than many economists had projected. However, the Department of Commerce’s personal consumption expenditures (PCE) index, the Fed’s preferred inflation measure, showed more promising signs of inflation cooling down to 2.9%, aligning closer to the Fed’s target.

Implications For The Bitcoin Price

Renowned crypto analyst @ColdBloodShill drew attention to the historical inverse correlation between the DXY (Dollar Index) and Bitcoin. He shared the following chart and stated: “Heard you needed some hopium. The last two FOMC events have marked the pico top of the DXY. Next one on Wednesday.”

A potential drop in the DXY following the FOMC meeting could act as a catalyst for Bitcoin to rise towards the $45,000 mark. In addition, there are possible changes in QT policy that could indicate an increase in the supply of money. Such developments could serve as a major catalyst for the Bitcoin price as the hardest asset of the world.

Real Reasons For Bitcoin Price Crash Revealed, Not GBTC: Arthur Hayes

In his latest essay, Arthur Hayes, the founder of BitMEX, articulates a contrarian perspective on the recent downturn in Bitcoin’s price, refuting the mainstream narrative that attributes the decline to outflows from the Grayscale Bitcoin Trust (GBTC). Instead, Hayes points to macroeconomic maneuvers and monetary policy shifts as the real drivers behind Bitcoin’s volatility.

Monetary Policy And Market Reactions

Hayes kickstarts his analysis by shedding light on the US Treasury’s recent strategic shift in borrowing, a decision announced by Janet Yellen on November 1. This pivot towards Treasury bills (T-bills) has triggered a substantial liquidity injection, compelling money market funds to reallocate their investments from the Fed’s Reverse Repo Program (RRP) to these T-bills, offering higher yields.

Hayes articulates the significance of this move, stating, “Yellen acted by shifting her department’s borrowing to T-bills, thus adding hundreds of billions of dollars’ worth of liquidity so far.” However, he contrasts this tangible financial maneuver with the Federal Reserve’s mere rhetoric about future rate cuts and the tapering of quantitative tightening (QT), pointing out that these discussions have not translated into actual monetary stimulus.

While the traditional financial markets, particularly the S&P 500 and the Nasdaq 100, responded positively to these developments, Hayes argues that Bitcoin’s recent price trajectory serves as a more accurate barometer of the underlying economic currents. He remarks, “The real smoke alarm for the direction of dollar liquidity, Bitcoin, is throwing a cautionary sign.”

He notes the cryptocurrency’s decline from its peak and correlates it with the fluctuations in the yield of the 2-year US Treasury, suggesting a deeper economic interplay at work. “Coinciding with Bitcoin’s local high, the 2-year US Treasury yield hit a local low of 4.14% in mid-January and is now marching upwards,” Hayes remarked.

Dissecting True Reasons Behind The Bitcoin Dip

Addressing the narrative surrounding GBTC, Hayes emphatically dismisses the notion that outflows from GBTC are the primary catalyst for Bitcoin’s price movements. He clarifies, “The argument for Bitcoin’s recent dump is the outflows from the Grayscale Bitcoin Trust (GBTC). That argument is bogus because when you net the outflows from GBTC against the inflows into the newly listed spot Bitcoin ETFs, the result is, as of January 22nd, a net inflow of $820 million.”

This realization shifts the focus to economic mechanisms at play. The crux of Hayes’s argument lies in the anticipation surrounding the Bank Term Funding Program (BTFP)‘s expiration and the Federal Reserve’s hesitancy to adjust interest rates to a range that would alleviate the financial strain on smaller, non-Too-Big-to-Fail (TBTF) banks.

Hayes elucidates, “Until rates are reduced to the aforementioned levels, there is no way these banks can survive without the government support provided via the BTFP.” He predicts a looming mini-financial crisis in the event of the BTFP’s cessation, which he believes will compel the Federal Reserve to pivot from rhetoric to tangible action—namely, rate cuts, a tapering of QT, and potentially a resumption of quantitative easing (QE).

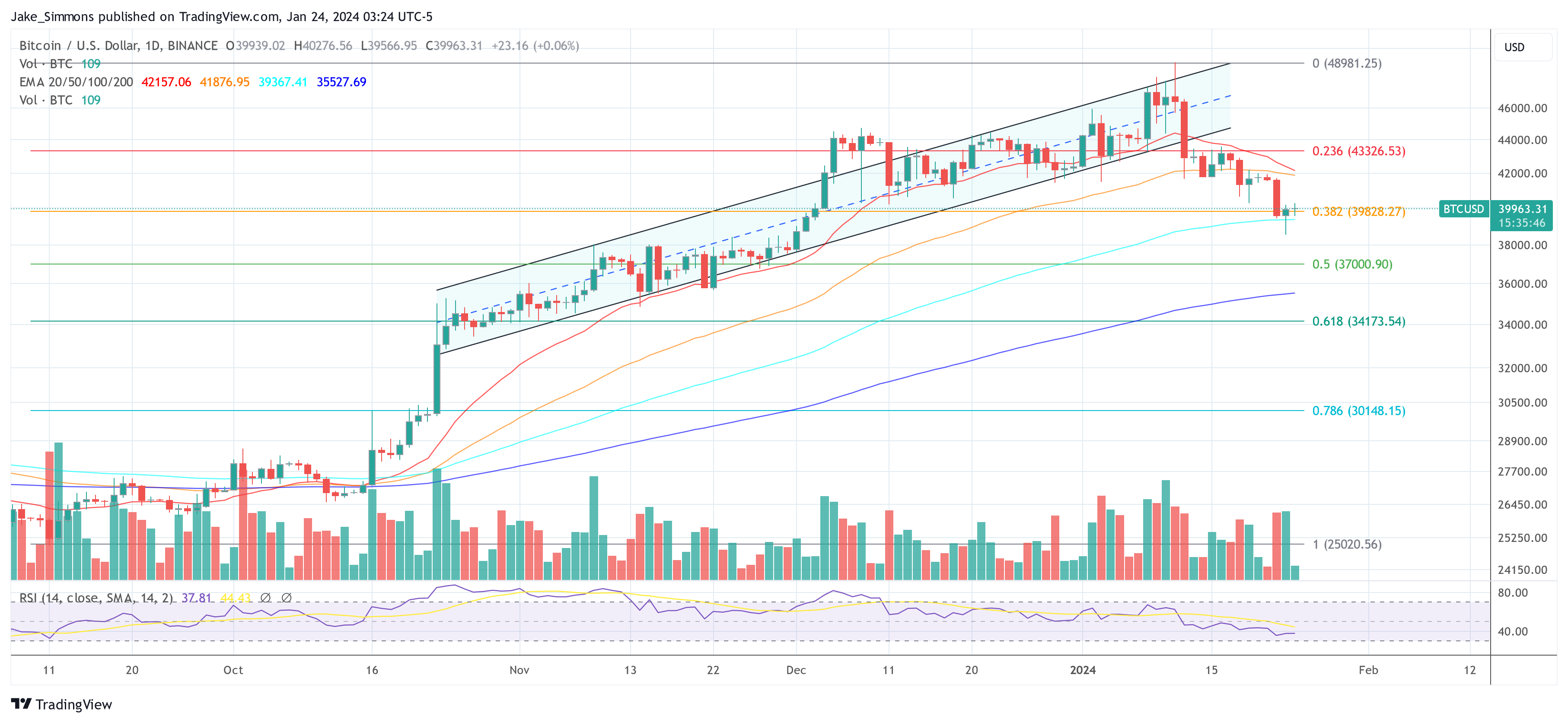

“I believe Bitcoin will dip before the BTFP renewal decision on March 12th. I didn’t expect it to happen so soon, but I think Bitcoin will find a local bottom between $30,000 and $35,000. As the SPX and NDX dump due to a mini financial crisis in March, Bitcoin will rise as it will front-run the eventual conversion of rate cuts and money printing talk on behalf of the Fed into the action of pressing that Brrrr button,” Hayes writes.

Strategic Trading Moves In A Turbulent Market

In a revealing glimpse into his tactical trading strategies, Hayes shares his approach to navigating the tumultuous market landscape. He discloses his positions, including the purchase of puts and the strategic adjustment of his BTC holdings. He concludes:

A 30% correction from the ETF approval high of $48,000 is $33,600. Therefore, I believe Bitcoin forms support between $30,0000 to $35,000. That is why I purchased 29 March 2024 $35,000 strike puts. […] Bitcoin and crypto in general are the last freely traded markets globally. As such, they will anticipate changes in dollar liquidity before the manipulated TradFi fiat stock and bond markets. Bitcoin is telling us to look for Yellen and not Talkin’.

At press time, BTC traded at $39,963.

Bitcoin Halts at $41K as Traders Eye Fed Rate Decision; AVAX Flips Dogecoin as Altcoins Jump

Bitcoin remained steady around $41,000 after Monday’s dramatic flush.

Bitcoin Halts at $41K as Traders Eye Fed Rate Decision; AVAX Flips Dogecoin as Altcoins Jump

Bitcoin remained steady around $41,000 after Monday’s dramatic flush.

Bitcoin Halts at $41K as Traders Eye Fed Rate Decision; AVAX Flips Dogecoin as Altcoins Jump

Bitcoin remained steady around $41,000 after Monday’s dramatic flush.

Bitcoin price hits $39K as Powell stirs bets Fed rate hikes are over

Bitcoin reaches levels not seen since May 2022 amid an excited market reaction to the latest Fed inflation commentary.

Bitcoin beyond 35K for Christmas? Thank Jerome Powell if it happens

Led by Chairman Jerome Powell, the Federal Reserve has halted the rise of interest rates. Will it be enough to fuel the surging market through Christmas?

Federal Reserve Leaves Rates Unchanged; Bitcoin Flat at $34.5K

Market participants will now turn to Fed Chair Jerome Powell’s post-meeting press conference to glean insight into the future path of U.S. central bank policy.

BTC price climbs above $28.6K as Bitcoin awaits ‘very dovish’ Fed Powell speech

Bitcoin may witness a “very dovish” move from Powell as high U.S. bond yields cause a stir, while BTC’s price passes $28,600.

Bitcoin Dips Below $26K, Smaller Cryptos Head Lower on Fed’s Powell’s Hawkish Remarks

Federal Reserve chair Powell speaking at Jackson Hole doubled down on keeping financial conditions tight, including hiking interest rates further if needed.

Bitcoin Gives Up Gains, Returns to $26K Ahead of Fed’s Jerome Powell at Jackson Hole

The Kansas City Federal Reserve’s annual Jackson Hole Symposium is underway, and Powell will deliver his keynote address Friday morning.

‘We’ve Seen Enough’: Battered Bitcoin at $26K Can’t Stay Down Much Longer, Pantera’s Morehead Says

By one measure, bitcoin’s price performance this cycle is the worst in the asset’s history.

Why is Jerome Powell gaslighting us about the odds of recession?

Economic data seems to indicate an economic slowdown is inevitable. So why is Fed Chairman Jerome Powell trying to gaslight Americans?

Bitcoin Hovers Over $30.3K Despite Renewed Inflation Worries

In comments Thursday at a Madrid event on financial stability, Fed Chair Jerome Powell said that “it will take time for the full effects of monetary restraint to be realized.”

Bitcoin price clings to $30K as Fed’s Powell stresses more rate hikes

There’s no room for slacking when it comes to monetary policy tightening, Powell says, as Bitcoin takes a breather from yearly highs.