On-chain data shows large Maker holders have accumulated recently, a sign that the rally could extend soon.

Maker Large Holders Have Continued To Expand Their Holdings Recently

According to data from the market intelligence platform IntoTheBlock, inflows to the wallets of the large MKR investors have been taking place for a while now. The “large holders” here refer to those investors who hold at least 0.1% of the cryptocurrency’s circulating supply.

In Maker’s case, this value would equal about $1.2 million. Thus, the only holders who would clear these criteria would be the sharks and whales, the largest entities on the network.

These investors generally hold some influence in the market, as they can move many tokens at once. Thus, the behavior of this cohort could be worth watching, as it may reveal answers about where the asset might be heading next.

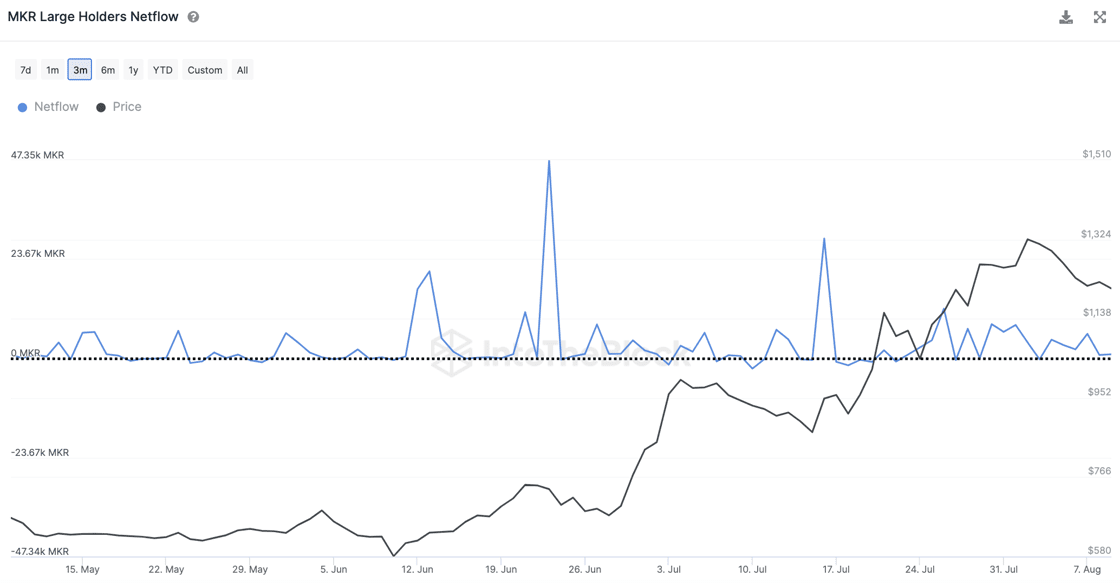

One way to track the behavior of these humongous holders is through the “netflow” metric, which measures the net amount of MKR that these large investors are adding into or moving out of their combined holdings right now.

When the value of this metric is positive, it means that a net number of coins is entering into the supply of these investors currently, suggesting that they are participating in buying.

On the other hand, negative values could imply that this group may be selling as its members are transferring a net amount of the asset away from their wallets.

Now, here is a chart that shows the trend in the Maker large holders netflow over the last few months:

The above graph shows that the Maker large holders’ netflow has been almost entirely positive during the past few months. There were a few dips into the negative territory, but the net outflows weren’t significant in scale then.

In the past few weeks, there haven’t been any drops below the zero mark, suggesting that the large holders have only continued accumulating more MKR recently.

Something to note here is that a positive netflow doesn’t mean that there isn’t any selling taking place at all. Instead, it simply suggests that the accumulation is enough to cancel any distribution.

In the past couple of months, the cryptocurrency has seen an overall uptrend, which could be a consequence of the net buying these investors have been participating in.

Since this month has started, though, the asset has declined. Nonetheless, as the netflows have only remained positive throughout this decline, the large holders have been buying regardless.

This conviction from these large holders can naturally be a positive sign for Maker, as the asset could potentially continue its rally soon.

MKR Price

At the time of writing, Maker is trading around $1,200, up 4% in the last week.