Bull flags are historically associated with more upside momentum, but Bitcoin price could still use a catalyst before rallying to new highs.

Cryptocurrency Financial News

Bull flags are historically associated with more upside momentum, but Bitcoin price could still use a catalyst before rallying to new highs.

Shiba Inu, the meme coin sensation, is making headlines once again. With its sights set on a major achievement – a staggering $100 billion market cap – Shiba Inu has captured the attention of the crypto community.

This audacious ambition has been fueled by data from IntoTheBlock, shedding light on the coin’s potential. Additionally, renowned investor Jake Gagain has made a bold prediction, further igniting excitement within the crypto community.

$SHIB Will Be The First 100 Billion MC Memecoin. pic.twitter.com/YogeSb2E7q

— JAKE (@JakeGagain) March 15, 2024

According to analysis from IntoTheBlock, SHIB has witnessed a surge in the number of addresses holding the token. This surge indicates a growing interest and adoption of Shiba Inu among retail investors, who are eager to partake in the meme coin revolution.

Moreover, there has been a notable increase in the number of large transactions involving Shiba Inu tokens, suggesting institutional investors and whales are actively engaging with the coin.

IntoTheBlock’s data reveals a concentration of wealth among the top holders of Shiba Inu. Approximately 50% of the total supply is held by the top 100 addresses, indicating the potential influence these large holders may have on the market dynamics and price movements of Shiba Inu. This concentration of wealth can play a significant role in shaping the future trajectory of the coin.

Trading activity surrounding the memecoin has also been a focal point of the analysis. The data highlights the volatility of Shiba Inu’s trading volume, with periods of intense fluctuations followed by relative stability. This volatility can be attributed to various factors, including market sentiment, news events, and overall market conditions.

In the midst of this excitement, renowned investor Jake Gagain has made a bold prediction: He firmly believes that Shiba Inu has the potential to surpass Dogecoin and reach a remarkable $100 billion market cap. This prediction has sparked both enthusiasm and skepticism, as the rivalry between Shiba Inu and Dogecoin intensifies.

Taking all these factors into account, the journey towards the billion-dollar market cap for Shiba Inu is not without its challenges. While the recent surge in market cap and the accumulation by large holders are positive indicators, the volatility and concentration of wealth present potential risks that need to be navigated.

Nevertheless, the resilience and determination exhibited by the memecoin, coupled with the growing interest from retail and institutional investors, provide a strong foundation for its pursuit of the $100 billion milestone.

Shiba Inu’s quest for a $100 billion market cap represents a paradigm shift in the world of meme coins. Backed by data from IntoTheBlock, which highlights growing adoption, concentration of wealth, and trading activity, as well as the bold prediction from Jake Gagain, SHIB has positioned itself as a formidable contender in the cryptoverse.

Featured image from Pixabay, chart from TradingView

The recent market plunge has sent shockwaves through the crypto industry, resulting in hundreds of millions in dollars being wiped out in a matter of hours.

The price of Bitcoin has retreated violently to a weekly low of $67,500 after a few days of showing remarkable advances and setting new all-time highs.

The altcoins have experienced a significant decline as well, resulting in nearly 200,000 traders making liquidations during the last 24 hours.

The weekend brought a tremor to the cryptocurrency market, with a sudden price correction causing short-term panic and hundreds of millions in liquidated positions.

However, despite the wobble, analysts are divided on whether this signifies a broader market shift or a mere blip on the bullish radar.

Over a 24-hour period ending Friday, March 15th, the global cryptocurrency market capitalization shed a cool 6%. This triggered a wave of automated liquidations, particularly for investors holding leveraged long positions – essentially large bets on rising prices.

According to Coinglass, a crypto data analysis platform, over $800 million worth of long positions were liquidated across the market. Bitcoin itself bore the brunt of the selling pressure, dipping as low as $67,000 – its lowest point in over a week.

The pain wasn’t evenly distributed. Over one third of the liquidations, a total of $660 million, came from long positions on Bitcoin.

The tremors weren’t confined to Bitcoin. The correction spilled over to the altcoin market, with popular tokens like Cardano, Dogecoin, Shiba Inu, and XRP all experiencing significant price drops.

This, in turn, triggered further liquidations for long positions held on these altcoins. XRP traders alone saw over $10 million liquidated, with nearly $11 million coming from long positions.

Crypto Market Fights Back: Buying The Dip

Despite the week’s fright, the overall sentiment in the crypto market remains surprisingly bullish. This is primarily fueled by the swift buying activity observed at key support levels as prices dipped.

Bitcoin, the world’s most sought-after crypto asset, for example, has already staged a partial recovery, bouncing back to a little over $69,000 at the time of writing.

Similar rebounds have been observed across several altcoins, suggesting that investors might be viewing this as a buying opportunity.

This correction can be seen as a healthy market reset after a strong rally, some analysts say. While some leveraged positions got burned, the fact that investors are stepping in to buy the dip indicates continued confidence in the long-term potential of cryptocurrencies.

A Continued Balancing Act

The weekend’s events serve as a microcosm of the ongoing struggle within the crypto market. On one hand, there’s a growing sense of institutional adoption and mainstream acceptance, fueling a bullish sentiment.

On the other, the inherent volatility of crypto assets continues to pose a challenge, with sudden price swings capable of inflicting significant losses on unsuspecting investors.

Featured image from Pexels, chart from TradingView

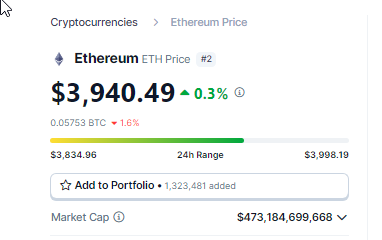

Ethereum (ETH) has been showing a solid performance lately, leaving investors both ecstatic and wary. The world’s second-largest cryptocurrency, boasting a market capitalization of nearly $480 billion, recently surpassed the coveted $4,000 mark for the first time since December 2021, igniting a flurry of bullish predictions. But is this a genuine resurgence, or are we witnessing a temporary blip before a potential correction?

Let’s dissect the forces at play. Proponents of a sustained uptrend point to a confluence of positive factors. The long-awaited approval of a US-based Ethereum ETF is a hot topic, with speculation swirling that a green light could trigger a significant influx of institutional capital, potentially injecting billions into the Ethereum ecosystem.

Additionally, the upcoming Bitcoin halving, an event that cuts Bitcoin’s mining reward in half, is expected to have a positive spillover effect on the entire cryptocurrency market, potentially propelling Ethereum further.

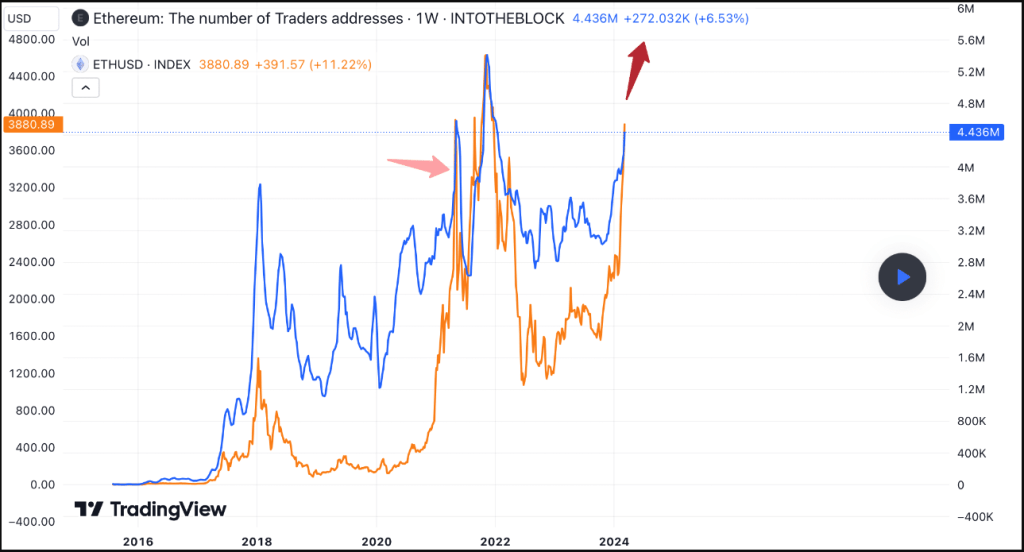

This optimistic outlook is bolstered by a surge in on-chain activity. Data from IntoTheBlock reveals a significant increase in the number of short-term Ethereum holders.

Historically, this trend, with its 60% monthly price surge for ETH, aligns with bull markets, signifying an influx of new users entering the crypto space and actively participating in the network. Think of it as a crowded party – the more people show up (currently approaching the highs of the last bull cycle), the livelier the atmosphere becomes (and potentially the higher the price goes).

But, there’s more to the story. A closer inspection of technical indicators paints a slightly different picture. The Relative Strength Index (RSI) and Chaikin Money Flow (CMF) are currently hovering in overbought territory, with RSI specifically nearing the 70 mark.

In simpler terms, this suggests that Ethereum’s price at slightly above $4,000 might be stretched a bit thin and due for a potential pullback. Imagine a jump rope competition – if you’re swinging too hard and fast (like an RSI over 70), eventually you’ll trip yourself up.

Adding a layer of intrigue, the sentiment among investors seems geographically divided. While the “Coinbase Premium,” a metric reflecting buying pressure, is thriving in the US, its Korean counterpart indicates ongoing selling activity.

This regional disparity could be attributed to diverse market dynamics and investor preferences. Perhaps American investors, with a green Coinbase Premium, are more optimistic about the regulatory landscape surrounding crypto, while their Korean counterparts, with a red Korea Premium, are taking a more cautious approach.

So, what does this all mean for Ethereum’s future? The answer, unfortunately, isn’t as clear-cut as we’d like. The confluence of positive factors like potential ETF approval, increased network activity with a surge in short-term holders, and a potential Bitcoin halving boost paint a bullish picture.

However, technical indicators hinting at an overbought market and contrasting investor sentiment across regions introduce a note of caution. Ethereum is currently walking a tightrope – will it maintain its momentum or face a reality check in the form of a price correction? It’s anybody’s guess.

Featured image from Pixabay, chart from TradingView

Cryptocurrency enthusiasts are celebrating a bullish weekend for Ethereum (ETH), the world’s second-largest cryptocurrency by market capitalization. With a price surge of 4.31% in the last day, ETH is inching closer to a critical resistance point: $4,000. This climb comes amidst a wave of optimism surrounding the Ethereum network, fueled by a confluence of factors.

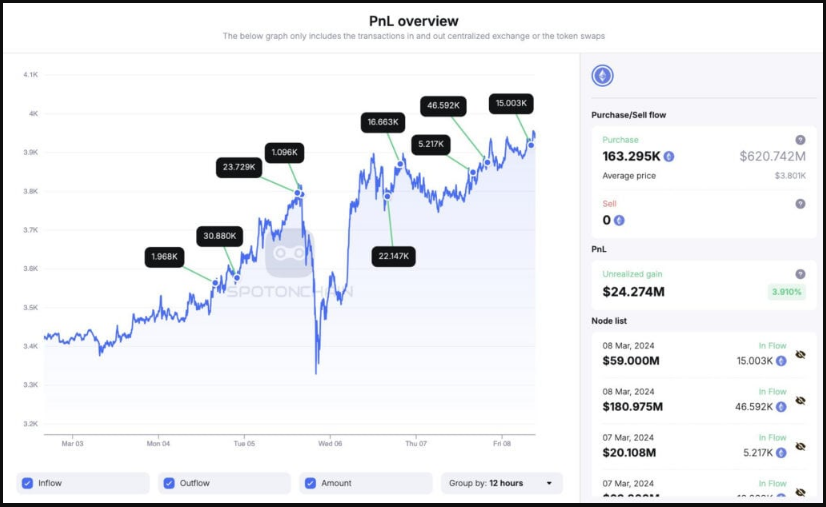

Market analysts are attributing the recent surge to a significant rise in Ethereum accumulation. According to data from blockchain tracking company Spot On Chain, wallets linked to PulseChain and PulseX have been aggressively buying ETH, accumulating a staggering 163,295 ETH in just four days. This substantial buying pressure, totaling nearly $621 million DAI, suggests a strong foundation for a potential price increase.

Furthermore, more than $10 billion whale trade volume recorded overnight indicates a shift in sentiment among major investors. This hefty trade volume is seen as a bullish signal, suggesting that whales are accumulating ETH in anticipation of a price upswing.

Adding fuel to the fire, over 94% of ETH addresses are currently in profit. This translates to a significant number of investors holding onto their ETH, creating low selling pressure and potentially paving the way for a price increase.

Data from IntoTheBlock (ITB), a cryptocurrency analytics platform, indicates that at this point, ETH is at its best level in nearly a year, but it is clearly trailing the upward trend that Bitcoin experienced once its spot Exchange-Traded Fund obtained approval.

Moreover, the excitement surrounding Ethereum is palpable as the price approaches its all-time high (ATH) of $4,890. With minimal resistance anticipated, a retest of the ATH seems like a realistic possibility in the near future. This prospect is further amplified by the dwindling number of addresses holding ETH at a break-even point or at a loss.

Dencum Upgrade And ETF Speculation Stoke Investor Confidence

Beyond the immediate price action, the Ethereum community is buzzing with anticipation about the upcoming Dencum upgrade. This highly anticipated upgrade is designed to address scalability issues, reduce transaction fees on layer networks, and decongest the Ethereum network.

A successful Dencum upgrade is expected to significantly improve the overall user experience and potentially attract new investors, bolstering confidence in the long-term viability of the Ethereum network.

Adding another layer of optimism is the ongoing speculation surrounding a potential Ethereum ETF. While regulatory approval from the SEC is still pending, the very possibility of an ETF has buoyed investor sentiment. An ETF would allow traditional investors to gain exposure to Ethereum without the complexities of directly owning and managing cryptocurrency, potentially leading to a wider investor base and increased demand for ETH.

A Look Ahead: Ether Trajectory Hinges On Multiple Factors

While the outlook for Ethereum appears bright, there are still factors to consider. The price of ETH remains roughly $1,000 shy of its ATH, and the success of the Dencum upgrade and the approval of an Ethereum ETF are not guaranteed. As with any investment, conducting thorough research and maintaining a cautious approach is crucial.

However, the confluence of rising on-chain activity, whale accumulation, and a profitable investor base paints a promising picture for Ethereum. With the Dencum upgrade on the horizon and the possibility of an ETF, Ethereum appears poised for a potential price rally in the coming months.

Featured image from Pexels, chart from TradingView

Exchange data has revealed continued bullish sentiment from Ethereum traders. According to IntoTheBlock, $906 million worth of Ethereum was withdrawn from crypto exchanges last week, indicating a holding mentality among investors. This massive exodus of ETH from exchanges could indicate that traders are anticipating higher prices and moving their holdings into private wallets for long-term storage.

The holding attitude has emerged amid a wider spike in the price of cryptocurrencies throughout the market and numerous demands for Ethereum to cross over $4,000 and beyond.

Exchange data typically helps give an overview of the supply and demand dynamics of crypto assets. When the supply of an asset declines on exchanges, it indicates holders have a long-term view.

In this vein, exchange data from IntoTheBlock concerning Ethereum has shown the dynamics tipping to the demand side as investors have increased their accumulation of the industry’s second-largest cryptocurrency since the beginning of the year.

More importantly, outflows of Ethereum from exchanges totaled $906 million last week to mark eight consecutive weeks of outflows.

$906M of $ETH left exchanges this week, making it the eighth consecutive week of net outflows for the second-largest crypto asset pic.twitter.com/v7VuqFUSCf

— IntoTheBlock (@intotheblock) March 1, 2024

This outflow pattern has been reaffirmed by a comparable exchange metric on CryptoQuant. Since January 10, the total amount of Ethereum on exchange reserves has decreased by more than 1 million ETH, and it currently stands at 13.7 million ETH.

The massive outflow from exchanges can be attributed to Ethereum bulls looking to push the crypto to new highs. Ethereum has gone on a sustained upward trend in the past few months to outperform majority of altcoins.

At the time of writing, the crypto is trading at $3,392, up by 46% in the past 30 days. If anything, the increase in outflow from exchanges is a signal for a continued uptrend and ETH is now on its way to reaching the $3,500 mark again after a brief crossover on February 29.

The bullish action has prompted investors to look forward to Ethereum breaking into $4,000 again towards its all-time high of $4,878. With decreasing supply on exchanges, the price of ETH is poised to rise. A breach of the $4,000 level seems imminent, and from there, a run-up to $4,900 could happen quickly.

A crypto analyst known as Trader Alan pointed out that recent price action has seen Ethereum perfecting a bullish breakout and retest on the monthly chart. According to the price chart shared by the analyst, a strong bullish movement could see ETH reaching $7,000 by the end of 2024, as well as exceeding $10,000 and $15,000 in the coming years.

Featured image from Pexels, chart from TradingView

Several analysts have expressed optimism, suggesting that Cardano (ADA) is poised for a bullish market surge in the near term.

ADA recently went on an impressive spike on the last day of February, registering a 14% gain to push its price above $0.7 for the first time since May 2022.

Despite these gains, there have been concerns from some investors of ADA potentially falling behind in its performance relative to Bitcoin in the last bull cycle. Popular crypto analyst Dan Gambardello addressed some of these concerns in a recent video posted on X. He mentioned that Cardano is currently within a typical trend and that a bull indicator which is expected to welcome a parabolic price spike would soon be triggered.

Gambardello’s recent video analysis came mostly to address concerns about ADA’s underperformance in this bull cycle. Particularly, parallels were made to the last time Bitcoin reached $60,000 in March and ADA was trading around $1.30 to $1.98.

However, this hasn’t repeated itself and traders are beginning to wonder if ADA will attract the same bullish sentiment. Bitcoin has now broken past the $60,000 mark again and ADA finds itself in the $0.66 to $0.7 region.

Gambardello emphasized Ethereum’s past action as a comparison, noting that the cryptocurrency is one cycle ahead of Cardano. In that context, when Bitcoin neared its former all-time high of $17,000 in the last cycle in 2021, Ethereum was at $500. This seemingly underperformed its previous performance without raising a cause for concern from investors, as ETH was at $700 when BTC reached an all-time high of $17,000 in 2017.

He remarked that since ADA is currently mirroring Ethereum’s last cycle, the current price movement is normal. He also noted that most altcoins are getting ready to power through.

Ultimately, the analyst noted that a bullish break of structure just occurred on ADA’s weekly chart. The last time this happened in 2021, ADA went on a price surge from $0.15 to $1.5.

Gambardello noted in his analysis that while the break of structure indicator got triggered above $0.7, ADA saw a minor correction shortly after. In light of this, he made the observation that a significant disruption of structure might take place within the next three days.

Remarkably, ADA has in fact broken out of the $0.7 price level since the analyst posted his video online. At the time of writing, ADA is trading at $0.74, up by 10% in the past 24 hours. Particularly, ADA reached above $0.76 in the past 24 hours.

The Cardano blockchain recently crossed over 10 million blocks. ADA is now on its way to continue on massive gains along with the rest of the crypto market.

Featured image from Pexels, chart from TradingView

The total market cap of the listed miners in the bank’s coverage has increased 131% since the end of September.

Bitcoin is likely to reach $1 million quickly due to a “torrent of money” coming from institutional investors in 2024, according to the JAN3 CEO.

History shows there’s likely a bright year ahead for BTC’s price.

In the last month, Dogecoin (DOGE) has observed a notable upswing in transactions surpassing the $100,000 mark, coinciding with a substantial surge in the price of this meme-based cryptocurrency.

The abrupt increase in both transaction volume and price suggests a heightened level of interest in Dogecoin, particularly from major financial entities recognized as “whales” and institutional investors.

Billy Markus, an IT engineer, co-created the prominent meme-based cryptocurrency alongside Jackson Palmer in 2013. Originally conceived as a satirical imitation of Bitcoin, Markus has recently offered his perspective on the significant surge in daily DOGE transactions, which surpassed 1 million earlier this week.

The increase in transactions on the Dogecoin blockchain has been formally ascribed to an upsurge in trading of meme coins and an escalation in activity associated with Doginals, as verified by Markus, known as Shibetoshi Nakamoto on X.

In response to a community member’s concern over the abrupt surge, Markus provided clarification that the upswing in blockchain transactions is causally connected to the heightened trading activity of meme coins and the active participation of Doginals inside the Dogecoin ecosystem.

Dogecoin transactions are going parabolic

Does anyone know why? pic.twitter.com/qBRQGiLhOp

—

(@itsALLrisky) November 24, 2023

#Dogecoin | There’s a notable surge in $DOGE transactions exceeding $100,000 in the past month, consistently hitting new highs.

This uptick suggests increased interest in #DOGE from institutional players and whales, potentially gearing up for a significant price spike. pic.twitter.com/UpxVkfu9hW

— Ali (@ali_charts) November 23, 2023

Meanwhile, the data presented by Blockchair substantiates the record achieved by DOGE. Markus suggested that the primary rationale behind this phenomenon is the active utilization of the Dogecoin blockchain for the purpose of transferring Ordinals and low-value cryptocurrencies.

The Doginals experiment was initially introduced in the month of May. During that period, the developers expressed their intention for it to function as a faithful replication of Bitcoin Ordinals. The experiment yielded successful results, which is of notable interest. Users possessed the capability to engrave both images and textual content onto the Dogecoin blockchain.

Doginals refer to the constituent components of Dogecoin, wherein every element represents a distinct entity known as a “Shibe” within the underlying Dogecoin network. These components are further distinguished by the inclusion of additional data, such as textual information or visual imagery.

The recently introduced Doginals DRC20 standard enables Dogecoin nodes to encode data onto individual Shibe entities, resulting in the creation of a Doginal. The term “Shibe” has a parallelism with the Bitcoin counterparts “Satoshi” or “Sat”.

In contrast to Doginals, DRC-20 tokens possess the capability to be exchanged in a manner consistent with conventional cryptocurrencies. The aforementioned S-coins were the subject of Markus’ discourse in his online publication.

The initial development of enabling non-fungible tokens (NFTs) and tokens through the ERC-21 and ERC-20 standards by Ethereum was a significant milestone in the blockchain industry.

This innovative capability has since been embraced by other blockchain networks, such as Solana.

At the time of writing, DOGE was trading at $0.080, up 2.8% in the last day, and gained 0.2% in the last seven days, data from Coingecko shows.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Pexels

XRP could witness a massive selloff in the coming days, as shown by on-chain transfer data. According to transaction alerts from crypto whale tracker Whale Alerts, two whale-sized transactions involving XRP have recently made their way onto cryptocurrency exchanges Bitso and Bitstamp, prompting investors to ponder the reasons behind the transactions and speculate on possible outcomes.

Massive transfers by whales can often increase selling pressure if they sell and take profits, which could cascade into the price of the asset, even if only temporary.

XRP has gone through consolidation for the past two weeks in the midst of a market lull. According to Coinmarketcap, the altcoin’s trading volume is also down by 43.59% in the past 24 hours. Before this period however, a whale made a transfer of 50 million XRP worth approximately $31 million to exchanges, prompting investors to wonder if this is a part of the ongoing consolidation and if the transfers are a selloff.

According to Whale Alerts, a transfer of 25.2 million XRP tokens worth $15.66 million was made to crypto exchange Bitstamp on November 23. Shortly after, 25 million XRP tokens worth $15.55 million were sent to crypto exchange Bitso. Looking into the details of the two transactions on blockchain explorers reveal they were made from the same address “r4wf7e”.

A deeper look reveals address “r4wf7e” received 55.87 million tokens from address “rJgpQR” and then went on a spending spree in the hours after. The next few hours would be full of transactions ranging from 20,000 to 25 million XRP tokens to Bitstamp, Bitso, Independent Reserve, and some private addresses.

The transfers into various exchanges have signaled that the whale intends to sell its holdings. However, there could be other reasons for the transfers, which could just be the whale wants to have their XRP readily available on the exchanges without even selling yet.

Of course, this is all speculation. There’s no way to know the whale’s exact intentions or how much token they plan to buy or sell, if any. But when amounts this large move onto exchanges, it often signals volatility ahead.

On the other hand, data from on-chain analytics platform has shown whales purchased 11 million tokens worth $6.82 million in the just concluded week. The buying spree suggests there could still be a bullish sentiment among some whales.

#Ripple | On-chain data shows that #XRP whales have purchased around 11 million $XRP over the past week, worth roughly $6.82 million! pic.twitter.com/VnWpaMoOYR

— Ali (@ali_charts) November 25, 2023

XRP is trading at $0.62 at the time of writing. The cryptocurrency crossed over $0.7 again earlier this month but has struggled to continue this momentum. However, according to crypto analyst CryptoInsightUK, the token has a good chance of replicating the 61,000% gain it enjoyed back in 2017 before the SEC lawsuit.

Another analyst, Edward Farina, predicted Ripple has the potential to replace the current SWIFT system, at which point XRP could surge to $10,000.

Featured image from Pixabay

On Sept. 22, one of Nansen’s third-party vendors suffered a security breach, which exposed the email addresses of 7% of the system’s users.

TVL, fee revenue and wallet activity are just three metrics investors can use to assess the health of the DeFi sector.

3 key data points highlight the 60-day strength shown by altcoins.

Eth price trades at a key resistance level, but data highlights why the altcoin could struggle to hold $1,900.

CME Bitcoin futures hit a 2-year high, but options market data reflects investors’ hesitancy.

ETH price continues to lose ground against Bitcoin. Cointelegraph takes a closer look at the factors behind the weakening ETH/BTC pair.

Bitcoin started the week with a bang, but the real question is, what is driving the move and is it sustainable?