Bitcoin’s range-bound price action could lead traders to focus on NEAR, AR, CORE and BONK.

Cryptocurrency Financial News

Bitcoin’s range-bound price action could lead traders to focus on NEAR, AR, CORE and BONK.

As the crypto industry navigates the waves of this bull run, projects like NEAR Protocol (NEAR) are edging forward with new partnerships and developments. NEAR’s remarkable performance has crypto analysts considering that the toke is getting underway for a massive surge.

At the beginning of the week, crypto analyst World of Charts recognized a bullish flag pattern formed on NEAR’s monthly chart. According to the analyst, a successful breakout could be followed by a 60-65% bullish wave in the coming days.

On Thursday, NEAR tested the $7.00 resistance level, reaching above the $7.50 mark before retracing as the day ended.

Affirming his previous forecast, the analyst stated that if the token successfully holds above the breakout level, investors could expect the price to move towards $14-$15. Since then, the token has remained above the $7.00 mark, hovering between $7.3-$7.1.

Another crypto analyst has been following NEAR’s performance this week similarly. According to Bluntz, the token “has been one of the strongest movers from the lows and will probably be one of the first to make fresh highs.”

Moreover, he considers NEAR “one of the better performers” in the top 20 cryptocurrencies. Previously, the trader displayed a chart identifying an ABC zigzag pattern followed by a still-forming impulse wave pattern.

As NEAR broke out of the $7,00 resistance, the analyst reaffirmed his prediction for the token’s movements, considering it “a market leader right now.”

Bluntz added that the token kept “plodding along making fresh highs while everything else has stalled out and continued accumulating.”

The NEAR Protocol is a Layer-1 “user-friendly and carbon-neutral” blockchain focused on performance, security, and scalability. According to its team, the “blockchain for everyone” was built with “usability in mind.”

NEAR’s total value locked (TVL) of $309 million makes it the 16th largest blockchain by this metric. Notably, the network has doubled its TVL since Q4 2023, when it sat in the 25th spot with $128 million.

The protocol collaborates with other projects constantly to continue “expanding financial horizons.” Projects like NodeKit and TrueZK have recently integrated NEAR’s solution designed for Ethereum rollups, NEAR DA.

Similarly, on Thursday, it announced its partnership with Colombian fintech Lulo X and Peersyst Technology “to redefine the parameters of digital finance.” These collaborations have been seemingly well-received by the NEAR community.

Despite being down by 6.25% in the monthly time frame and 65% below its all-time high (ATH) of $20,44 set in January 2022, the blockchain’s token has shown a remarkable performance during this bull run. In the last three months, NEAR has soared over 146%.

Moreover, the token’s daily trading volume has increased by 6.5% in the past day, with over $800 million traded. Likewise, its market capitalization has risen 5% during the same timeframe, making it the 17th biggest cryptocurrency by this metric.

As of this writing, NEAR is trading at $7.2, representing a 7.3% jump in the last 24 hours and a 26% rise in the past week.

The price of Near Protocol’s native token, NEAR, has been on an upward momentum recently, with a crypto analyst projecting further price increases and suggesting that the coin could see a surge to more than $10 soon.

Popular crypto trader and analyst, identified as Bluntz on X (formerly Twitter) has unveiled a major price prediction for NEAR. The analyst disclosed that the price of NEAR is exhibiting historical patterns indicative of a bullish rally, potentially surpassing $10.

$near turbo sends here imo pic.twitter.com/4o28UEsfE1

— Bluntz (@Bluntz_Capital) April 3, 2024

Bluntz, a pseudonymous analyst known for his eerily accurate prediction of Bitcoin (BTC) in June 2018, forecasted that the price of BTC would hit a bottom out at $3,200 after reaching an all-time high of $20,000 at the time. True to his foresight, Bitcoin dropped to around the projected price target by December of the same year.

Now, using technical analysis based on the Elliott Wave principle, Bluntz has shared a price chart displaying Near protocol’s potential rally to over $10.

The Elliott Wave theory, developed by Ralph Nelson Elliott is a technical methodology that analyzes recurrent and long-term price patterns related to persistent changes in investor sentiment and psychology. This technical tool is used to predict the price movements of cryptocurrencies based on greed and fear.

Bluntz provided two charts depicting Near Protocol’s price movements against Tether (USDT) and another against Bitcoin.

In both charts, Near Protocol had undergone a sequence of price fluctuations, moving between green and red zones before exhibiting strong price fundamentals that could potentially propel its price above $10. The crypto analyst has pinpointed a projected timeline for this price surge around mid April, specifically before the 15th.

Over the past month, the price of Near Protocol has been on a steady upward trend, boasting an impressive 26% increase. Moreover, the cryptocurrency’s total market capitalization has risen by over 6%, accompanied by a 25% increase in its 24-hour trading volume.

At the time of writing, Near Protocol is trading at $7.09, reflecting a significant increase of 5.89% in just one day, according to CoinMarketCap. These developments highlight the increasing appeal and demand for the popular token within the dynamic crypto space.

Illia Polosukhin, co-founder of Near Protocol has also commended the NEAR team’s consistent efforts in maintaining the cryptocurrency’s steady growth and development over the past few months. Polosukhin noted that due to the team’s dedication, Near Protocol’s capacity has surged by 50%, ensuring a more effective network to serve users.

Featured image from Pexels, chart from TradingView

Cryptocurrency analysts are abuzz with chatter surrounding NEAR Protocol (NEAR) as the token experiences a meteoric rise in value. The past month has been nothing short of phenomenal for NEAR, with its price leaping by an impressive 130%.

This surge, which translates to an impressive $7.91 per token at the time of writing, has not gone unnoticed, igniting a firestorm of interest and speculation within the investment community. But is this a genuine upswing or simply a fleeting fad?

While some analysts, like the prominent Rekt Capital, view this surge as a potential reversal of a multi-year downtrend, others urge caution. The cryptocurrency market, after all, is notorious for its wild fluctuations. A token’s price can reach dizzying heights only to come crashing down just as quickly.

Finally – Near Protocol has revisited its multi-year Macro Downtrend

Now #NEAR will try to break this to further build on its current bullish momentum

Breaking this Macro Downtrend would likely see price revisit the old All Time High resistance area

#BTC #NEARprotocol… https://t.co/VmcLjkWFPn pic.twitter.com/wboVljOJsc

— Rekt Capital (@rektcapital) March 11, 2024

Analysts have forecasted a bullish trend for NEAR in the immediate future. Their prediction suggests a 10% increase, placing the price at around $7.48 by March 13, 2024.

This projected increase comes with a market capitalization of $7.65 billion and a notable 24-hour trading volume of $2.2 billion. However, forecasts, as some experts point out, should be viewed with a critical eye. The market is an intricate web of factors, and unforeseen events can easily derail even the most meticulously crafted predictions.

Technical Indicators, Market Sentiment

Technical indicators, while offering valuable insights, should not be the sole basis for investment decisions. The Fear and Greed Index, currently hovering at an “extreme greed” of 82 for NEAR, paints a picture of a market potentially fueled by euphoria rather than sound judgment.

Investors piling in solely based on such sentiment, with NEAR having already surged 8.06% in the last 24 hours, might be setting themselves up for disappointment if a correction were to occur.

Beyond The Hype: Examining NEAR’s Potential

However, dismissing NEAR’s potential entirely would be unwise. To understand this, we need to examine thoroughly. NEAR Protocol is a blockchain platform designed to address scalability issues that have plagued older blockchain technologies like Ethereum.

NEAR boasts features like sharding, a method for distributing processing power across a network of computers, to facilitate faster transaction speeds and lower fees.

This focus on scalability has attracted the attention of developers seeking to build decentralized applications (dApps) on a platform that can handle high volumes of traffic. Several promising dApps are already being built on NEAR, including DeFi (decentralized finance) protocols and NFT (non-fungible token) marketplaces.

A thriving ecosystem of dApps could be a key driver of long-term growth for NEAR. Crypto experts, drawing insights from the price fluctuations observed at the onset of 2023, have formulated an average projected NEAR rate of $10.06 for March 2024.

While this average is a benchmark, fluctuations within the market suggest potential variations, with the minimum expected price hovering around $9.8 and the maximum reaching $10.2. Considering these forecasts, investors may be enticed by the potential return on investment (ROI) of 35%, indicative of the promising growth prospects for Near Protocol in the coming months.

Featured image from Pexels, chart from TradingView

NEAR, the native token of the Layer 1 (L1) public blockchain NEAR Protocol, has substantially risen during this bull run after registering remarkable gains since the end of 2023.

As the price of Bitcoin continues to soar, NEAR has recorded an over 130% price surge in the past month, and analysts forecast that the bullish momentum isn’t over yet.

At the end of 2023, the NEAR token showed a remarkable performance by doubling its price in mid-December. Since then, the crypto market has been propelled to heights like those seen during the last bull run.

NEAR continued its growth alongside the market, and crypto analyst Altcoin Sherpa considers that the gains for the token are far from over.

$NEAR: Consolidation for the next leg up soon IMO. #NEAR pic.twitter.com/pII6Uanwaz

— Altcoin Sherpa (@AltcoinSherpa) March 12, 2024

In an X (former Twitter) post, the analyst shared a chart showing NEAR’s performance in the last few days. This performance displays the token has oscillated between two levels since yesterday.

NEAR hovered between the $6.7- $7.17 price range for the past 24 hours, Altcoin Sherpa’s chart shows. As the analyst highlights, this is the “consolidation for the next leg up” coming soon.

Previously, Sherpa warned about the $6.9 price level being a “danger area approaching.” However, the token broke that resistance level over the weekend.

Moreover, crypto trader and analyst Rekt Capital shared a chart showing that NEAR revisited its multi-year macro downtrend. Breaking above it would further fuel the bullish momentum that could drive the price to revisit its all-time high (ATH) resistance area of $20.

Finally – Near Protocol has revisited its multi-year Macro Downtrend

Now #NEAR will try to break this to further build on its current bullish momentum

Breaking this Macro Downtrend would likely see price revisit the old All Time High resistance area

#BTC #NEARprotocol… https://t.co/VmcLjkWFPn pic.twitter.com/wboVljOJsc

— Rekt Capital (@rektcapital) March 11, 2024

NEAR has been closely following Bitcoin’s price performance during the past week. As the chart below shows, in the last 24 hours, the token’s price has closely followed the trajectory of the flagship cryptocurrency.

At writing time, NEAR is trading at $7.3, a 4.2% surge in the past hour. The token registered a stellar 67.8% and 83.1% price surge in the weekly and bi-weekly timeframe.

Crypto trader Doctor Profit foresees NEAR to reach $10 soon, as his previous prediction of the token reaching this price by the end of the year seems closer than expected.

That the token’s price of $3 was easily doubled in a matter of days. This suggests to the analyst that NEAR’s next goal of $10 will come very soon.

As optimistic predictions continue, the token’s market cap of $7.74 billion shows a 7.7% growth in the last day. By this metric, NEAR is inside the top 20 largest cryptocurrencies, currently being the 19th, according to CoinMarketCap data.

However, the daily trading volume has dropped 20% in the last 24 hours, with $993.5 million traded. This hints at a recent decline in market activity despite the positive performance and community support.

Layer-1 blockchain NEAR’s native token {{NEAR}} has experience doubled since March 5, with hype surrounding Nvidia’s upcoming annual conference driving AI-related tokens to the upside.

With zero knowledge (ZK) proofs expected to be a game changer for blockchain scaling, Polygon may be on the brink of a major rally. Taking to X on February 2, crypto market commentator Polynya, asserts that ZK technology is the “endgame” as its “1,000x efficiency upside is irresistible for networks.”

This forecast on ZK adoption is massive for Polygon and its native token, MATIC, which has been under significant selling pressure in the past few trading months. As it is, Polygon Labs, the developer of the Ethereum sidechain, has been at the forefront, advocating for the development of ZK scaling solutions.

In 2021, Polygon began assembling a team to develop zkEVM, a technique relying on zero knowledge to scale Ethereum cheaply while being compatible with the EVM. Recent Polygon Labs documentation shows that their zkEVM is in beta and being tested.

However, this hasn’t stopped the team from striking deals with layer-1 protocols interested in harnessing this technology.

In mid-January, NEAR Protocol’s Data Availability (DA) solution was integrated with Polygon’s custom blockchain development kit (CDK). The goal was to make it easier for developers to create ZK rollup solutions suitable for their needs while leveraging NEAR Protocol‘s infrastructure. All this is when ensuring the integration lowers cost and improves performance.

Polygon Labs has also partnered with other platforms, including Immutable–a layer-2 web3 solution for NFTs; Ankr–an infrastructure provider; and QuickSwap–a decentralized exchange (DEX). Most of these platforms plan to operate as layer-2s for Ethereum.

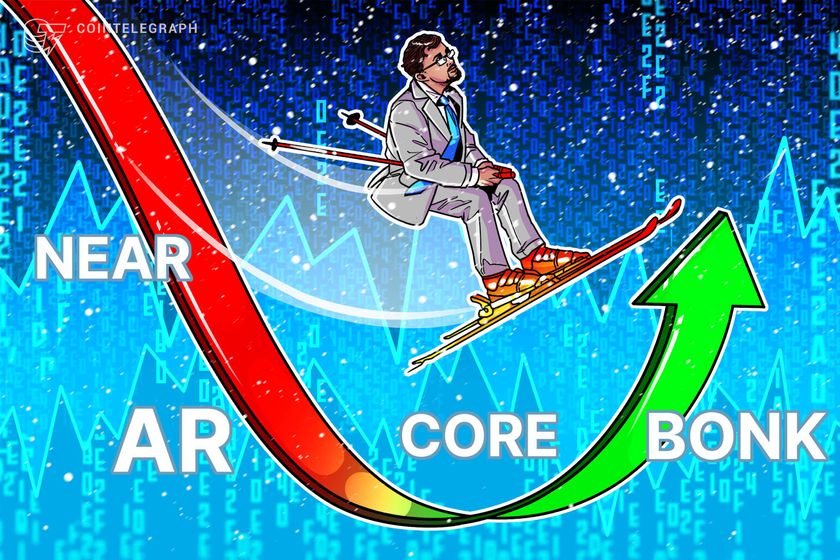

The total value locked (TVL) in layer-2 protocols remains in an uptrend, according to L2Beat. These platforms command over $21 billion. So far, the largest layer-2 protocols, Arbitrum, Optimism, and Base, use Optimistic Rollups.

This is a bullish development for Polygon. Moreover, at this pace, it is likely to cement Ethereum, the pioneer layer-1 and smart contract platform, as a dominant settlement layer despite on-chain scaling concerns and relatively high fees.

From a price point perspective, MATIC will likely benefit as more platforms adopt Polygon’s zkEVM solutions. So far, MATIC is stable but firm when writing on February 2. From the daily chart, MATIC has support at around $0.70. On the upper end, the immediate resistance level is at $1.

Spurred by partnerships as more platforms use zkEVM, fundamental developments might drive MATIC even higher in the coming sessions. If MATIC finds momentum, the medium- to long-term target will be $3, or a 2021 high.

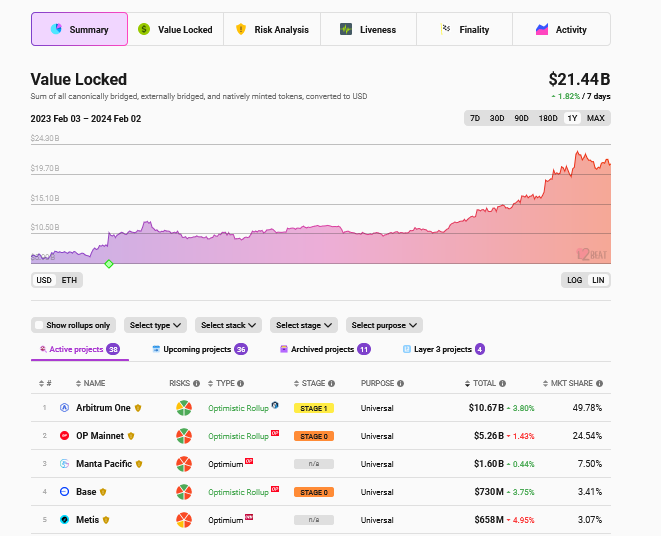

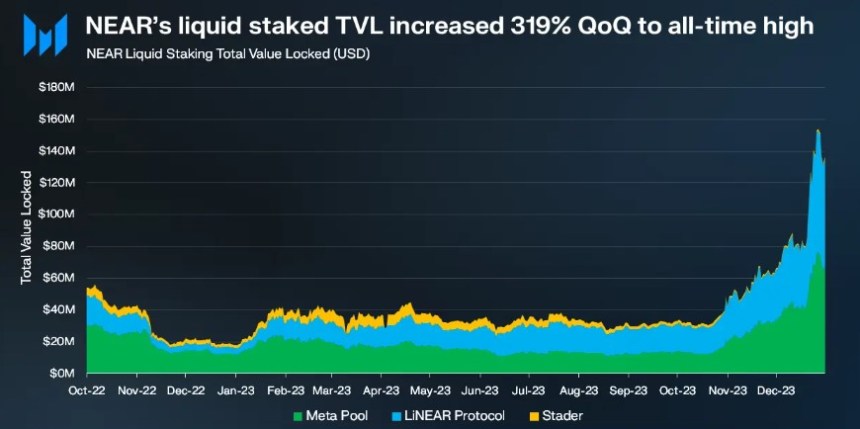

NEAR Protocol, the Blockchain Operating System (BOS), experienced significant growth in key metrics during the fourth quarter (Q4) of 2023. The protocol’s native token, NEAR, recorded a remarkable 16% year-to-date growth and witnessed a surge in adoption.

According to a Messari report, the entire crypto market cap increased in Q4 2023, largely driven by the anticipation surrounding the introduction of spot Bitcoin exchange-traded funds (ETFs).

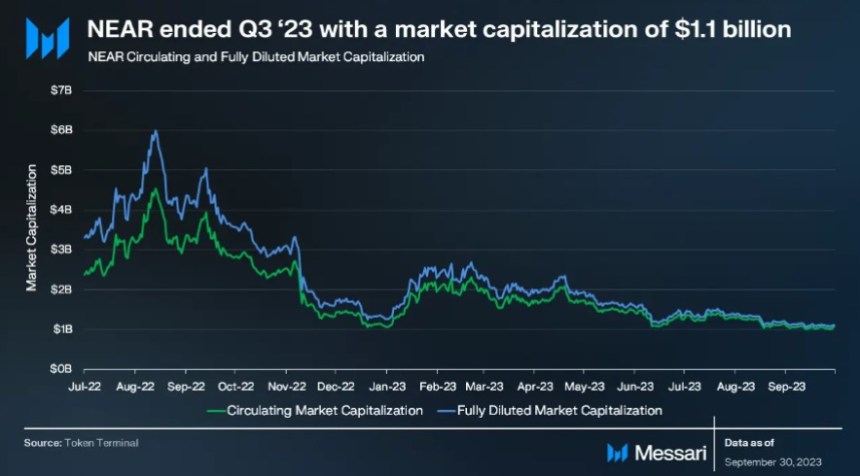

NEAR actively participated in the overall market rally and achieved additional gains due to its heightened network activity and significant announcements. As a result, NEAR’s circulating market cap for the end of 2023 reached $3.7 billion, marking a 245% increase quarter-on-quarter (QoQ) and a 246% increase year-on-year (YoY).

Furthermore, NEAR’s fully diluted market cap reached $4.3 billion. The protocol’s market cap ranking also soared, climbing 10 places to reach approximately 30th by the end of 2023.

In Q4 2023, NEAR’s revenue grew substantially, primarily generated from network transaction fees, reaching $750,000. The increase in revenue was attributed to the heightened activity generated by projects such as KAIKAINOW and NEAR Inscriptions.

During the Inscriptions craze, revenue surged due to a transaction spike, driving up transaction fees. Notably, NEAR employs a fee-burning mechanism, where 70% of all fees are burned, while the remaining 30% is directed to the contract from which the transaction originated.

Another key metric demonstrating the protocol’s growth in Q4 2023 is that NEAR experienced significant growth in its user base.

Average daily active addresses increased by 1,250% YoY, reaching 870,000 in Q4 2023. In addition, the number of daily new addresses grew by a remarkable 550% YoY to 170,000 in Q4 2023.

According to Messari, this expansion comes after the successful launch and adoption of projects such as KAIKAINOW and contributions from the Sweat Economy, Aurora, and Playember, which further supported this positive trend.

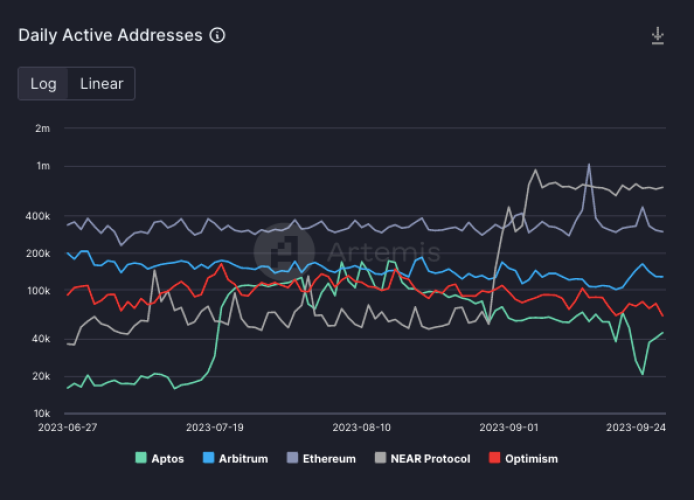

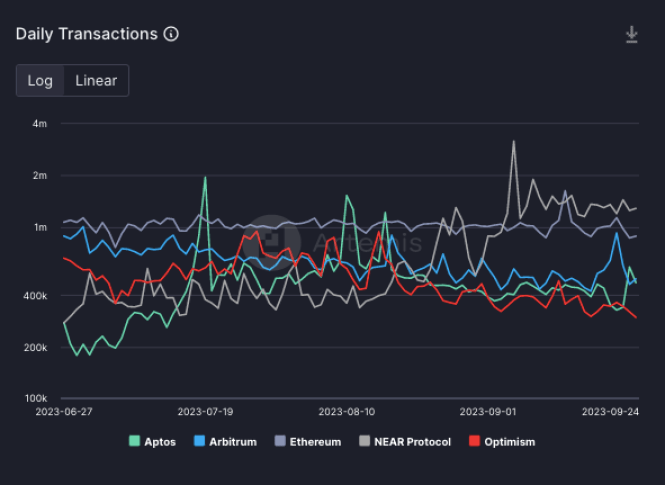

NEAR’s daily active addresses were notably higher than those of other leading blockchain networks. For example, Optimism averaged 72,000 daily active addresses, Arbitrum 150,000, Polygon PoS 375,000, and Aptos 60,000 in Q4 2023.

NEAR Inscriptions significantly drove network activity, reaching a yearly high of 14 million transactions in December. Despite this substantial increase, transaction fees remained stable, staying below $0.01 for the quarter.

Top 25 Blockchain By TVL In Q4 2023

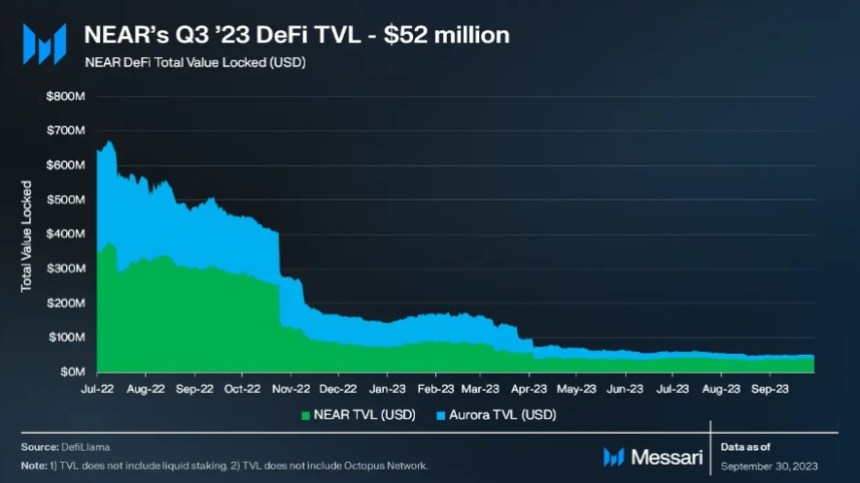

NEAR’s Total Value Locked (TVL) reached $128 million by the end of Q4 2023, marking a remarkable 147% increase from the previous quarter. Among blockchains, NEAR positioned itself at approximately 25th place regarding TVL.

Within the NEAR Network’s TVL, NEAR contributed $59 million, accounting for nearly 46% of the total TVL on the network. The remaining TVL was distributed across various decentralized finance (DeFi) applications, including Aurora, Ref, Berry Club, and Flux.

Additionally, NEAR announced partnerships with projects such as Chainlink and decentralized exchange (DEX) SushiSwap.

According to Messari, the integration with Chainlink’s decentralized oracle network provided NEAR developers with access to real-world data and external Application Programming Interfaces (APIs), enhancing the functionality and usability of NEAR-based applications.

On the other hand, the collaboration with SushiSwap allowed NEAR users to access a wide range of token swaps, liquidity pools, and yield farming opportunities, enabling developer adoption and increased usage within the ecosystem.

Ultimately, looking ahead to 2024, Messari said the protocol’s vision is to iterate the technology roadmap, attract more developers, and attract more leading protocols.

Featured image from Shutterstock, chart from TradingView.com

In this issue of CoinDesk’s weekly newsletter on blockchain technology, we bring you Sam Kessler’s scoop on MetaMask’s in-development “intents” feature that could revolutionize how users interact with blockchains. Also: a post-mortem on Ethereum’s unexpectedly ugly Dencun testnet upgrade – and a glimpse of one of the new data blobs.

Bitcoin price range trades as SOL, LINK, NEAR and THETA play catch up.

The NEAR Foundation has announced a strategic partnership with Eigen Labs, a startup focused on building the Ethereum restaking protocol Eigen Layer.

While addressing the challenges of liquidity fragmentation between Layer 2 (L2) solutions, the collaboration aims to reinvent Ethereum (ETH) roll-up transactions, making them “more cost-effective and efficient.”

In a joint statement released on November 10, the NEAR Foundation and Eigen Labs unveiled their plans to develop a “fast finality layer” to power rapid and inexpensive transactions for Ethereum rollups, including cross-rollup transactions.

Per the announcement, the collaboration seeks to significantly reduce transaction processing times to a mere 3-4 seconds, a notable improvement compared to the minutes, hours, or even days it currently takes. Moreover, it aims to make transactions 4000 times cheaper than existing options, providing a cost advantage for users.

Furthermore, one of the partnership’s key objectives is to establish “secure and low-latency” cross-rollup communication, resolving the challenges faced by developers and founders working with rollups.

As announced, the Fast Finality Layer will maintain the “security guarantees” of Ethereum while introducing additional guarantees from the NEAR and EigenLayer technologies.

Both protocols believe this solution promises to enhance liquidity by reducing fragmentation between Layer-2 solutions, empowering developers to make informed decisions regarding the sequencers they prefer for transaction processing.

Illia Polosukhin, co-founder of NEAR Protocol, expressed pride in partnering with Eigen Labs, emphasizing that the fast finality layer showcases the technological strengths of NEAR while making the Open Web more user-friendly. Polosukhin further stated:

NEAR Foundation is proud to partner with such an excellent team as Eigen Labs to offer a fast finality layer for ETH rollups. The fast finality layer showcases the strengths of NEAR’s technology while making the Open Web more usable, which has always been the core goal for NEAR. It will also help defragment liquidity for Ethereum rollups and make all of Web3 more interoperable as a result.

For his part, Sreeram Kannan, founder of Eigen Labs, shared his enthusiasm for the partnership and highlighted the mutual benefits it brings. In his words, the collaboration will leverage the innovative technologies of both NEAR and EigenLayer, enabling faster, cheaper, and easier development on the Ethereum network.

The collaboration between NEAR and Eigen Labs marks a significant milestone for EigenLayer, as it enables fast settlement for cross-rollup transactions and demonstrates wider adoption of restaking across the Ethereum ecosystem and beyond.

For NEAR, the partnership extends to enhancing the NEAR-Ethereum Rainbow Bridge by transitioning it to an actively validated service (AVS). This transition is expected to enhance bridging capabilities between NEAR and Ethereum, enabling faster transaction finality, increased security guarantees, and improved decentralization.

The collaboration is expected to launch a testnet in Q1 2024, and further details will be shared then. This partnership between the NEAR Foundation and Eigen Labs holds great promise for advancing Ethereum rollup transactions, improving liquidity, and driving the broader adoption of Web3 technologies.

Featured image from Shutterstock, chart from TradingView.com

Polygon Labs (MATIC) and the NEAR Foundation have recently announced their collaboration on the development of a zero-knowledge (ZK) prover for the WebAssembly (Wasm) blockchain.

The alliance aims to “bridge the gap” between Wasm-based chains and the Ethereum ecosystem, providing customization and options for developers building with the Polygon CDK (Chain Development Kit).

According to Polygon Labs’ announcement, introducing a zkWasm prover will enable developers utilizing Polygon CDK to choose from various provers when building their projects.

This can be leveraged in various scenarios, including launching or migrating an Ethereum Virtual Machine (EVM) chain or constructing a Wasm chain for closer alignment with Ethereum and access to liquidity.

The zkWasm prover will serve as a new runtime, generating zero-knowledge proofs that validate the correctness of native Wasm runtime execution. This advancement is expected to enhance scalability and decentralization, bringing the NEAR protocol closer to Ethereum.

As part of this partnership, the NEAR Foundation is set to become a core contributor to Polygon CDK, expanding the toolkit’s capabilities for developers.

Sandeep Nailwal, the co-founder of Polygon, expressed pride in collaborating with NEAR on this research and emphasized the value of the zkWasm prover in providing developers with increased customization options.

To provide further context, WebAssembly is a widely used framework for running complex programs in web browsers, offering performance comparable to native computer applications. In the context of Web3, the Wasm Virtual Machine serves as a runtime for blockchains like NEAR and Polkadot, differing from the Ethereum Virtual Machine.

Per the announcement, in the future, an in-development interop layer will allow chains to join a unified ecosystem of Layer 2 solutions deployed through Polygon CDK.

This ecosystem will encompass alternative layer-1 chains, EVM layer-2 solutions, and Wasm chains, providing interoperability and defragmentation of liquidity across different chains.

Illia Polosukhin, co-founder of NEAR Protocol, expressed optimism about the collaboration, emphasizing that it will bring the benefits of zero-knowledge proofs not only to NEAR but to the entire Web3 ecosystem. Polosukhin stated:

We are very excited to work with Polygon Labs to bring all the benefits of zero-knowledge proofs not just to NEAR but all of Web3. NEAR is integrating more with Ethereum by innovating in new research frontiers, and the shared expertise of these two teams will bring a much-needed expansion of the ZK landscape and defragmentation of liquidity across chains. And by creating and using the zkWasm prover, NEAR will also improve the scalability and decentralization of the NEAR L1.

Overall, the collaboration between Polygon Labs and the NEAR Foundation holds significant implications for both protocols. Integrating the zkWasm prover will enhance the capabilities of Polygon CDK, providing developers with more options in building “custom blockchains.”

Additionally, it will bring NEAR Protocol closer to Ethereum, expanding its interoperability and liquidity opportunities.

As of the latest update, MATIC, the native token of Polygon, is on the verge of reaching the $0.800 level, a milestone that has not been attained since July. The token currently trades at $0.7903, showcasing a noteworthy upward trajectory.

This positive movement is further bolstered by an impressive 11% uptrend recorded over the past 24 hours.

Featured image from Shutterstock, chart from TradingView.com

The project’s new “NEAR DA” aims to provide an alternate venue that could handle data produced by Ethereum’s fast-growing network or auxiliary blockchains or “layer-2 networks.”

Bitcoin recaptured a key price level and a handful of altcoins look poised to breakout.

NEAR Protocol, a Blockchain Operating System (BOS), demonstrated notable growth in the third quarter of 2023, defying the challenging conditions of the overall cryptocurrency market.

According to a recent report by Messari, key metrics for NEAR Protocol surged significantly over the past month, buoyed by recent price increases across the crypto market.

Per the report, despite a moderate downturn in the crypto market, with XRP and Grayscale facing court rulings in their favor, NEAR Protocol showcased resilience. The total crypto market capitalization dipped by 5.8%, with Bitcoin (BTC) and Ethereum (ETH) experiencing declines of 7.5% and 10.0% respectively.

Within this context, NEAR’s circulating market capitalization decreased by 14% quarter-over-quarter (QoQ) to $1.08 billion, while its fully diluted market capitalization decreased by 17% QoQ to $1.12 billion.

Nevertheless, NEAR Protocol maintained its position as the 40th largest crypto protocol by market capitalization by the end of the quarter.

One of the highlights in Q3 ’23 for the protocol was the revenue growth, which increased by 9% QoQ from $98,000 to $108,000. The average transaction fee remained at a low $0.001 throughout the quarter.

Regarding network activity, NEAR recorded substantial growth in addresses during Q3 ’23. Active addresses increased by 350% QoQ, reaching 260,000 daily active addresses, while new addresses saw a 274% QoQ increase, totaling 51,000 daily new addresses.

This growth was primarily fueled by the launch of KAIKAINOW, NEAR’s leading application, and supported by contributions from the Web3 health and fitness app, Sweat Economy, and Aurora, a solution that allows the execution of Ethereum contracts in a “more performant environment” in the NEAR ecosystem.

According to Messari, NEAR’s Total Value Locked (TVL) experienced a 13% QoQ decrease, amounting to $52 million by the end of the quarter. NEAR ranked approximately 35th among blockchains in terms of TVL.

Within the NEAR Network’s TVL, NEAR’s contribution accounted for $41 million (80%), while Aurora contributed $11 million (20%).

Regarding DEX trading volume, NEAR reported an average daily volume of $1.3 million, maintaining stability compared to the previous quarter. NEAR ranked approximately 30th among DEX trading volumes.

NEAR’s stablecoin market capitalization experienced a 27% QoQ decline, primarily driven by reductions in USDC and USDT. However, the native USDC was launched on NEAR during this period, while USN, the winding-down stablecoin from Decentral Bank, remained unchanged.

NEAR Token’s Bullish Momentum Continues

Regarding price action, as observed in the 1-day chart below, NEAR Protocol’s token, NEAR, has broken a prolonged downtrend that commenced on July 20 and concluded on August 18, leading to a phase of accumulation.

However, on October 19, the token initiated an uptrend, resulting in significant gains of 12% over the last 30 days, 22% within the fourteen-day timeframe, and 22.3% in the past week. Presently, the token continues its rally, exhibiting a 2.6% surge in the past 24 hours, bringing the current trading price to $1.23.

When considering the year-over-year period, the token remains significantly below its high in 2022, experiencing a decline of 60% over this duration. Furthermore, for NEAR to reclaim its 2023 yearly high, which stood at $2.83 and was achieved in April, the bullish momentum must persist.

It remains to be seen whether the token can sustain its current bullish momentum and establish a new yearly high, capitalizing on the rallies witnessed by the largest cryptocurrencies in the market in the upcoming months to generate further profits.

Featured image from Shutterstock, chart from TradingView.com

Hindustan Petroleum, one of India’s largest oil and gas companies, is launching a blockchain system to enable automated verification of purchase orders.

The International Cricket Council will leverage Near’s Blockchain Operating System to power a Web3 fan engagement app during the 2023 Cricket World Cup in India.

In the past month, there have been more daily active addresses on the NEAR Protocol than in Ethereum and its layer-2 protocols, including Arbitrum and OP Mainnet, Artemis data from September 25 reveals.

Artemis, an institutional data platform for digital assets, shows that the number of daily active addresses on NEAR Protocol has been consistently above the 400,000 level in September.

Looking closer at the data confirms that the number of daily active addresses on Ethereum, the pioneer smart contract platform that hosts most decentralized finance (DeFi) and non-fungible token (NFT) activity, has been dropping.

To illustrate, the number of daily active on Ethereum rose above 1 million in mid-September but has since more than halved to below 400,000. The same trend can be seen in Arbitrum, which dropped from around 200,000 in late June to 150,000 when writing on September 25.

During this time, NEAR Protocol’s daily active addresses have rapidly spiked from around 40,000 in late June to above 400,000, outperforming Ethereum in this metric. With rising daily active addresses, there has been a spike in daily transactions over the past month. According to trackers, the NEAR Protocol processes more transactions than Ethereum.

Public ledgers like NEAR Protocol and Ethereum depend on a community of users who actively transact—moving value or running protocols—or validators- to secure the network. However, the number of daily active addresses can provide valuable insights into the level of adoption, user engagement, and the network’s overall health.

Besides user engagement, rising daily active addresses might also point to changing market sentiment, which could significantly impact prices.

When writing, NEAR, the native token of the NEAR Protocol, is trading at around 2023 lows. Changing hands at $1.107, the coin is down 61% from 2023 highs and remains under pressure.

The candlestick arrangement in the daily chart points to consolidation and stability above the primary resistance level at $1. Bears have the upper hand if prices remain below $1.23, a critical resistance level marking the August 17 highs.

As evidence shows, the network activity and price action diverge. Although the transaction count also rose, the number of unique addresses interacting with NEAR Protocol decentralized exchanges has mostly been stable. Looking at the numbers, DEX volume on the platform is significantly lower than those registered in Ethereum and its popular layer-2 platforms.

The $200 million decline was mostly due to a drop in the price of Near tokens, in line with the crypto bear market.

The partnership will offer multi-chain indexing to provide data query API to developers.