As the crypto industry navigates the waves of this bull run, projects like NEAR Protocol (NEAR) are edging forward with new partnerships and developments. NEAR’s remarkable performance has crypto analysts considering that the toke is getting underway for a massive surge.

Is NEAR Protocol A “Market Leader”?

At the beginning of the week, crypto analyst World of Charts recognized a bullish flag pattern formed on NEAR’s monthly chart. According to the analyst, a successful breakout could be followed by a 60-65% bullish wave in the coming days.

On Thursday, NEAR tested the $7.00 resistance level, reaching above the $7.50 mark before retracing as the day ended.

Affirming his previous forecast, the analyst stated that if the token successfully holds above the breakout level, investors could expect the price to move towards $14-$15. Since then, the token has remained above the $7.00 mark, hovering between $7.3-$7.1.

Another crypto analyst has been following NEAR’s performance this week similarly. According to Bluntz, the token “has been one of the strongest movers from the lows and will probably be one of the first to make fresh highs.”

Moreover, he considers NEAR “one of the better performers” in the top 20 cryptocurrencies. Previously, the trader displayed a chart identifying an ABC zigzag pattern followed by a still-forming impulse wave pattern.

As NEAR broke out of the $7,00 resistance, the analyst reaffirmed his prediction for the token’s movements, considering it “a market leader right now.”

Bluntz added that the token kept “plodding along making fresh highs while everything else has stalled out and continued accumulating.”

Network Expansion And Price Surge

The NEAR Protocol is a Layer-1 “user-friendly and carbon-neutral” blockchain focused on performance, security, and scalability. According to its team, the “blockchain for everyone” was built with “usability in mind.”

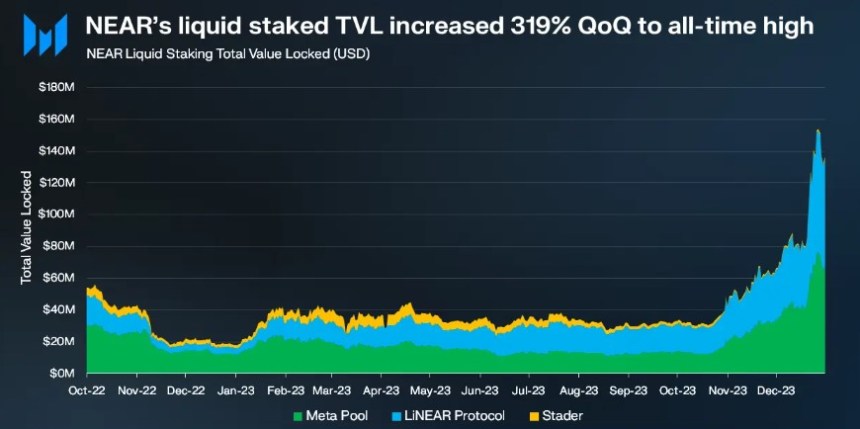

NEAR’s total value locked (TVL) of $309 million makes it the 16th largest blockchain by this metric. Notably, the network has doubled its TVL since Q4 2023, when it sat in the 25th spot with $128 million.

The protocol collaborates with other projects constantly to continue “expanding financial horizons.” Projects like NodeKit and TrueZK have recently integrated NEAR’s solution designed for Ethereum rollups, NEAR DA.

Similarly, on Thursday, it announced its partnership with Colombian fintech Lulo X and Peersyst Technology “to redefine the parameters of digital finance.” These collaborations have been seemingly well-received by the NEAR community.

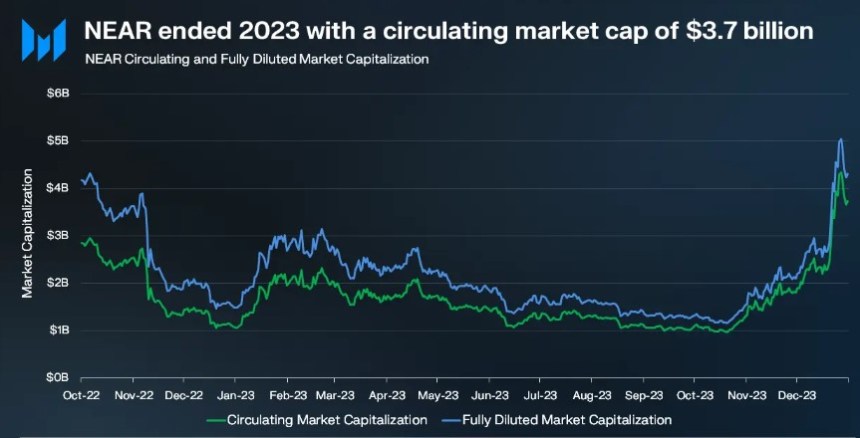

Despite being down by 6.25% in the monthly time frame and 65% below its all-time high (ATH) of $20,44 set in January 2022, the blockchain’s token has shown a remarkable performance during this bull run. In the last three months, NEAR has soared over 146%.

Moreover, the token’s daily trading volume has increased by 6.5% in the past day, with over $800 million traded. Likewise, its market capitalization has risen 5% during the same timeframe, making it the 17th biggest cryptocurrency by this metric.

As of this writing, NEAR is trading at $7.2, representing a 7.3% jump in the last 24 hours and a 26% rise in the past week.