The current intellectual property laws are adequate to deal with concerns about copyright and trademark infringement associated with non-fungible tokens (NFTs).

Shiba Inu: Shibarium Transaction Activity Spike Amid Market Growth

Shiba Inu layer 2 blockchain platform Shibarium, has witnessed a notable surge in transaction activity carried out on the platform, with its daily transaction performance reaching a new monthly high.

Shibarium Daily Transactions Skyrocket

The number of transactions on the layer 2 blockchain has skyrocketed since Shibarium was introduced, surpassing multiple noteworthy benchmarks. Recent data from Shibariumscan has revealed an uptick in daily transactions, soaring to about 3 million.

The rise in daily transactions to the coveted 3 million milestone marks the highest the network has seen this month. This comes weeks after the number of daily transactions on the network plummeted to about 1.07 million.

Consequently, the notable rise showcases how quickly Shibarium has spread and gained widespread recognition in the past few weeks. This appears to be a significant development. However, it is still below the highest level it recorded in December.

Shibarium has seen large increases in network activity before when its daily transactions reached a peak of around 7.5 million. After crossing the 7 million mark, it managed to maintain above this level for a month before dropping by almost 50% in January.

Data from the Shibarium tracker also shows that the network has reached a major milestone in its overall transactions. According to Shibariumscan, the total number of transactions recorded on the platform since its launch has surpassed 357 million.

It is worth noting that Shibarium’s performance goes beyond the network’s transactions. There have been over 3.27 million blocks processed on the blockchain, suggesting a crucial increase in demand for scalable features.

Furthermore, the overall number of interacting wallet addresses recorded in the network has now crossed 1.35 million. In addition, the network utilization is up by over 51%, indicating an increase in adoption.

Due to this sharp rise in Shibarium network activity, investors’ interest in Shiba Inu is expected to increase. Hence, it buttresses all other projects and crypto assets in the SHIB ecosystem.

Shiba Inu Team To Burn Top Shibarium Tokens

Lucie, Shiba Inu’s head of marketing, has revealed the team’s plan to burn SHIB and several other top Shibarium tokens. She took to the X platform to share the development with the SHIB community.

Lucie noted that funds made from the sale of the new NFT collection Shiboshis will be used to burn the tokens. These include Shiba Inu (SHIB), Bone ShibaSwap (BONE), LEASH, TREAT, and SHI.

Specifically, any Shiboshis that the holders fail to claim will be sent to Uniswap for sale. Then, the Shiba Inu team will use 10% of the total realized funds from those sales to burn the tokens. 4% of the funds will be set aside to burn BONE, LEASH, TREAT, and SHI, while 6% will be used to burn SHIB.

How To Create And Mint Your Own NFTs On The Ethereum Network

The allure of creating your own NFTs and BRC-20 tokens is undeniable. For artists, owning and monetizing their digital creations through NFTs offers a new level of control and potential financial reward. Beyond the realm of art, NFTs can foster passionate communities, grant exclusive access to events, and even act as fundraising tools.

However, stepping into the world of token creation isn’t without its challenges. It demands both a technical understanding of blockchain technology and smart contracts, along with a careful consideration of financial risks and potential regulatory implications. Before diving in, it’s crucial to assess your goals, resources, and risk tolerance. While the possibilities are vast and exciting, responsible and informed action is key to navigating this rapidly evolving landscape.

NFTs, or Non-Fungible Tokens, are digital assets that represent ownership or proof of authenticity for specific items or content. Unlike fungible cryptocurrencies like Bitcoin or Ethereum, NFTs cannot be exchanged on a one-to-one basis due to their unique nature.

NFTs are typically created and traded on blockchain platforms such as Ethereum, Binance Smart Chain, and decentralized marketplaces like OpenSea. These platforms utilize smart contracts to establish ownership and enable transparent and immutable transactions for NFTs.

NFTs can represent a wide range of digital items, including artwork, music, videos, virtual real estate, and collectibles. Each NFT has metadata describing the item it represents and a unique identifier that sets it apart from other NFTs

Creating NFTs On The Ethereum Network

The primary stage in the creation of NFTs involves identifying the content you wish to associate with your NFT. Consider the specific representation you desire for your NFT, whether it be digital artwork, collectibles, virtual real estate, or any other distinct digital item.

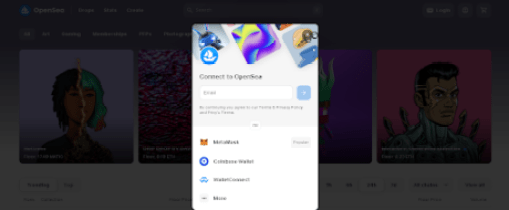

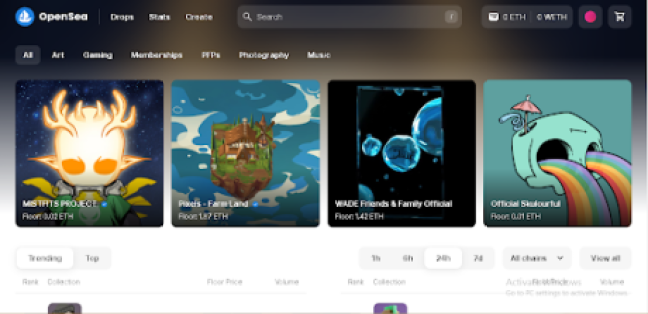

In this article, we will use illustrations from OpenSea to guide you on the steps you need to create your own NFTs. OpenSea stands as a leading decentralized marketplace built on the Ethereum blockchain, dedicated to NFTs. It creates a space where users can engage in buying, selling, and discovering an extensive array of digital assets, encompassing artwork, virtual real estate, collectibles, and more.

OpenSea delivers a user-friendly interface, showcasing a vast selection of NFT listings curated from diverse creators and projects. Through OpenSea, users gain the ability to explore the NFT community, partake in auctions, and securely manage their digital assets. With a commitment to fostering the expansion and accessibility of the NFT market, OpenSea ensures a seamless experience for enthusiasts and collectors alike.

This step-by-step guide covers how to create an NFT collection and mint directly to your wallet.

First, visit the original OpenSea website, and click on the “Login” button at the top to connect your preffered wallet.

To figure out the best wallet to use on the Ethereum network, check here.

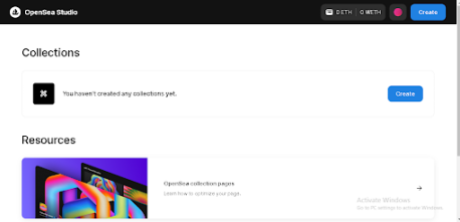

Next, click on your “Profile Icon” at the top right of your OpenSea interface in order to deploy a smart contract and select “Studio” through the pop-up options.

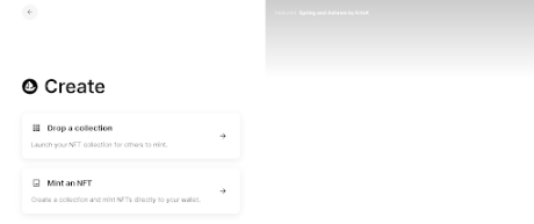

To initiate the creation of a fresh NFT, simply click the “Create” button located at the top right corner.

When you explore the options, you will find the choice to either Drop a collection or Create/Mint an NFT. Selecting “Create an NFT”. This will enable you to mint an NFT directly into your wallet.

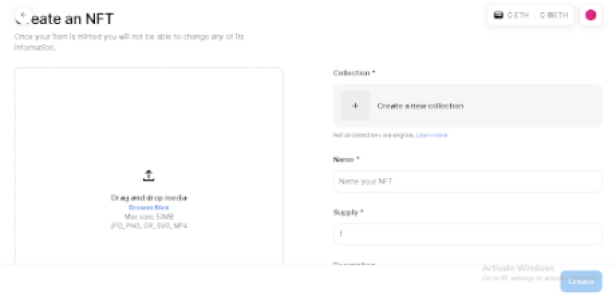

Once you proceed, a fresh “Create an NFT” screen will be presented. If you are using OpenSea Studio tools for the first time to create an NFT, select “Create a new collection.” You will be able to add one NFT to this collection initially, with the option to include more NFTs at a later stage.

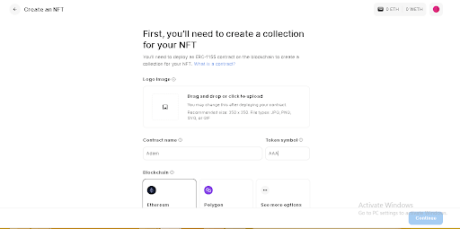

After selecting “Create a new collection,” you will be guided through the steps on your screen to deploy a smart contract. This process will enable you to create NFTs for your newly created collection.

To customize your contract, you need to add a logo image, choose a contract name, and designate a token symbol. Additionally, you will need to choose an EVM blockchain. It’s important to note that deploying a smart contract incurs gas fees, and the estimated fees for each blockchain will be displayed. If the fees are higher than anticipated, you can revisit the process at a later time, as they are subject to change based on network activity.

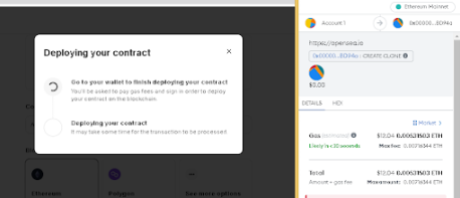

When you are prepared, proceed by clicking on “Continue”. This action will prompt a transaction signature request in your wallet, which will necessitate gas.

Once the process is finalized, you will receive a confirmation message. Proceed to the next step by selecting “Create an NFT” as shown below. :

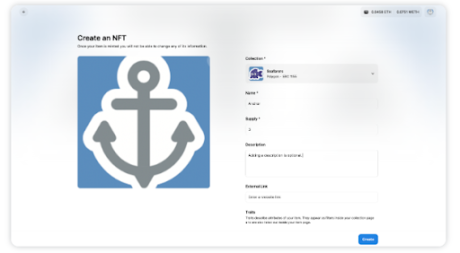

Having successfully created a smart contract, you are now prepared to generate an NFT. It is important to note that once your item is minted, further editing becomes impossible as it permanently resides on the blockchain. In this case, you will be creating an ERC-1155 NFT, which allows for the creation of multiple copies of the same item.

To begin this phase, upload the media for your NFT, which represents the artwork associated with it. Next, choose the collection in which you wish to mint your NFT.

Subsequently, provide a name for your item and set the desired item supply. The item supply determines the number of copies you wish to mint for the NFT. If you choose 1, then the item will be a one-of-one.

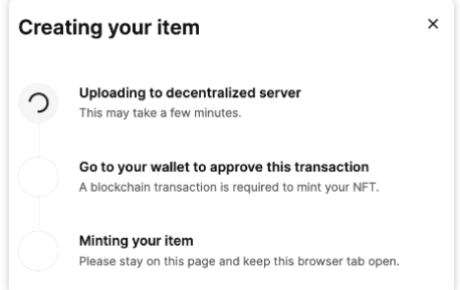

Next, click on the “Create” button at the bottom right, as shown in the above image. A loading message will appear as the item is being minted. To proceed with the minting process, you will need to approve the transaction using your wallet.

Congratulations! You have successfully minted your very first NFT!

Conclusion

Although NFTs and BRC-20 tokens have distinct functions and operate on separate blockchains, they both contribute to the growing realm of blockchain-based digital assets. NFTs have captured widespread interest for their exceptional nature and capacity to represent ownership of digital assets.

Bored Ape creators and other NFT projects investigated by SEC probe

A source familiar with the matter said the SEC is looking into whether certain NFTs from Yuga Labs could be “more akin to stocks.”

Nifty News: Zilliqa teases Web3 gaming console, Funko teams up with Warner Bros. and more…

Specifications on Zilliqa’s “user-friendly” console are yet to be revealed, but a prototype design resembling an Xbox console has been released.

Get ready for the feds to start indicting NFT wash traders

Securities and Exchange Commission regulators should move to protect investors from traders who distort the NFT market with manipulative trades — and they probably will soon.

NFT market worth $231B by 2030? Report projects big growth for sector

Continued adoption of nonfungible tokens across a variety of industries from video gaming, music, art and digital collections could see the sector valued at $231 billion by 2030.

U.S. trademark and copyright offices to study IP impact of NFTs

The U.S. Patent and Trademark, and Copyright offices will explore the impact of NFTs on intellectual property rights as lawsuits begin to stack up.

British Army’s social media accounts hacked by crypto scammers

Hackers had access to multiple official social media accounts of the British Army for nearly four hours, when they posted crypto phishing links and scams.

NFT flipping not so profitable for more than half of buyers: Survey

Though a majority are down on their NFT purchases, there are signs which point to a healthy and robust market in the long term.

Twitch co-founder raises $24M for Web3 gaming firm Metatheory

The funding round led by Web3-focused venture capital firms will be used for upcoming nonfungible tokens, comics and a play-to-earn game slated for late 2022.

Fidelity Says What We’ve Been Thinking: Countries & Central Banks Will Buy BTC

Surprising the world, Fidelity predicts what Bitcoin’s game theory implies. It’s as Satoshi Nakamoto said, “It might make sense just to get some in case it catches on.” That’s the exact same conclusion that Fidelity reaches in its “Research Round-Up: 2021 Trends And Their Potential Future Impact” report. Take into account that Fidelity is a multinational financial services corporation, it doesn’t get more mainstream than this.

I agree with @Fidelity, of course, but still astonishing to read this on Bitcoin adoption game theory in such a mainstream financial report: pic.twitter.com/7zRO9rEele

— Alex Gladstein

(@gladstein) January 13, 2022

(@gladstein) January 13, 2022

What did Fidelity say about Bitcoin adoption at the nation-states and central bank level?

They put it very clearly:

“We also think there is very high stakes game theory at play here, whereby if bitcoin adoption increases, the countries that secure some bitcoin today will be better off competitively than their peers. Therefore, even if other countries do not believe in the investment thesis or adoption of bitcoin, they will be forced to acquire some as a form of insurance. In other words, a small cost can be paid today as a hedge compared to a potentially much larger cost years in the future.”

In other words, It might make sense just to get some in case it catches on. And, as Stacy Herbert said, “First mover advantage goes to El Salvador”. At least if we’re talking out in the open, because other countries might be accumulating Bitcoin on the down-low. For example, Venezuela seized a lot of ASICs from private miners. Chances are those are active in a warehouse somewhere. And, of course, there are rumors that the USA is already mining.

Fidelity is one of the biggest asset managers in the world

They see what ID-10ts fail to understand

First mover advantage goes to

Game over for fiat, game on for #bitcoin

pic.twitter.com/I0Jlp8baVY

pic.twitter.com/I0Jlp8baVY

— Stacy Herbert  (@stacyherbert) January 13, 2022

(@stacyherbert) January 13, 2022

In any case, what does Fidelity conclude?

“We therefore wouldn’t be surprised to see other sovereign nation states acquire bitcoin in 2022 and perhaps even see a central bank make an acquisition.”

If those players do it in the open, it will probably trigger a race like no other. A race in which it will be too risky not to participate.

Speaking About Bitcoin Mining…

Fidelity’s report summarized 2021, it goes through most of the major stories that NewsBTC has covered ad nauseam. The company doesn’t try to figure out why did China ban Bitcoin mining, but it highlights how fast the hashrate recovered.

“The recovery in hash rate this year was truly astounding and one that we think demonstrates several issues that will be important to keep in mind for 2022 and beyond.”

The Fidelity report also highlighted how well the network responded. “This has now been tested and bitcoin’s network performed perfectly.”

BTC price chart for 01/17/2022 on Eightcap | Source: BTC/USD on TradingView.com

What Does Fidelity Say About The Ecosystem In General?

The report wasn’t exclusively about Bitcoin, they also identified the biggest trends in the wide crypto sphere.

“The biggest non-Bitcoin themes put on display this past year included the massive issuance of stablecoins, the maturation of decentralized finance, and the early days of non-fungible tokens.”

And about those trends, Fidelity predicted:

-

“The growth in interconnectivity between siloed blockchains”

-

“Traditional fintech companies partnering or building capabilities to interact with DeFi protocols”

-

“The dawn of decentralized algorithmic stablecoins has officially begun.” Responding to the “growth in demand for more regulated, centralized stablecoins.”

-

“While the long-term value of these NFTs is not known, the impact of increased digital property rights for art, music, and content is likely to be meaningful in some form.”

In general, Fidelity thinks that investment in digital assets will keep growing:

“Allocating to digital assets has become far more normalized over the past two years for all investors. The Fidelity Digital Assets 2021 Institutional Investor Survey found that 71% of U.S. and European institutional investors surveyed intend to allocate to digital assets in the future. This number has grown across each individual region of the survey for the past three years, and we expect 2022 to show another year of higher current and future asset allocations to digital assets amongst institutions.”

However, something has to happen to catalyze widespread institutional adoption. “The key to allowing traditional allocators to continue to pour capital into the digital asset ecosystem revolves around regulatory clarity and accessibility.”

Is 2022 the year of regulatory clarity? What will happen first, institutional adoption of cryptocurrencies or nation-states adoption of Bitcoin? What central bank will earn first-mover advantage? Burning questions for the year ahead.

Featured Image by Damir Spanic on Unsplash | Charts by TradingView

Global search interest for ‘NFT’ surpasses ‘crypto’ for the first time ever

Cointelegraph Research predicts that nonfungible token sales could eclipse $17.7 billion by the end of 2021.

Sorare CEO shares bold vision on NFTs during Web Summit 2021 opening night

The co-founder of the French tech unicorn discussed major innovations that could come as a result of developments in the NFTs industry.

Bragging rights: Twitter previews verification badge for NFT profile pics

Users will have the option to set crypto collectibles as their profile pic to impress everyone.

NFT Project To Donate 100% Of Income To Help Afghan Women Access Education

Bookblocks.io, an NFT company has partnered with a New York-based company, Women for Afghan Women to help women in Afghanistan have access to education.

Under the new Taliban-run government, women in Afghanistan have had their rights to education restricted by the fundamentalist militants. Since this development, Afghan women have taken to the streets to protest. Over a dozen women protested outside the premises of what used to be the Afghan Women’s Affairs Ministry – until the Taliban turned it into the department for the “propagation of virtue and the prevention of vice.”

Bookblocks.io NFT

Bookblocks.io announced that it would be releasing a non-fungible token on October 5, and the proceeds of its sales would be given to Women for Afghan Women (WAW). Women for Afghan Women is a grassroots civil society organization dedicated to protecting and promoting the rights of disenfranchised Afghan women and girls in Afghanistan and New York.

According to the company, the inspiration for the NFT was Louisa May Alcott, who was a pioneer for women’s rights. “Not only did her many famous writings seek to lift women in society, but she was an ardent feminist, abolitionist, and supporter of women’s suffrage. As such, she seemed a perfect inspiration for our charity focus this month, which is dedicated to helping the woman and girls of Afghanistan find equality in all aspects of life.”

Total crypto market cap drops to $1.93 Trillion | Source: Crypto Total Market Cap from TradingView.com

The NFT is a portrait of Louisa May Alcott with two different butterfly wings. It signifies the hopeful emergence of Afghan women and girls from the restrictions that impede their freedoms. The background colors of each NFT are also different, signifying the diversity of backgrounds that make up the women and girls that Women for Afghan Women serve. There are also four different versions of this illustration to represent the 40% of Afghan children who suffer from malnutrition.

The company says it will mint 2200 copies of this NFT to represent the reported 2.2 million girls currently excluded from school in Afghanistan. 100% of the money raised from the sale of the NFTs will go towards Women for Afghan Women, with a 5% residual for each subsequent sale. The price starts at 0.025 Ether (ETH).

Other NFT And Crypto Donations To Afghanistan

There are several ongoing projects in the digital assets space that are focused on charity work towards Afghanistan. About a month ago, Jack Butcher, the founder of Visualize Value, launched a series of NFT “care packages,” that cover one Afghan family’s emergency needs for one month. This care package is still accepting donations via The Giving Block.

Related Reading | An NFT “Care Package”: Tokens That Deliver Humanitarian Aid In Afghanistan

Other organizations are also accepting crypto donations through The Giving Block to provide humanitarian aid in Afghanistan. They include: Save the Children. International Medical Corps, Direct Relief, and Code To Inspire.

Featured image from dw.com

Mastercard UK Partners With José Mourinho For First-Ever NFT Giveaway

Mastercard, a multinational financial services corporation, has jumped on the NFT bandwagon. Non-fungible tokens (NFT) have continued to gain popularity among mainstream industries. The most recent addition to the NFT world is the global payments leader.

Related Reading | Visa Describes NFTs As Promising Means To Engage With The Fans

On Thursday, September 16, the company announced that it had created its first-ever NFT in partnership with the renowned football coach José Mourinho, who is also a Mastercard global ambassador. This unique NFT is an animated digital football with José’s signature on one of the panels.

The company’s U.K. branch made this announcement. It included a raffle for cardholders in the United Kingdom to win the company’s first NFT.

According to the company, the experience will be in English and is free to book, and is available until September 30. Cardholders based in the U.K. can sign up from now till that date for a chance to win.

Additionally, only one winner will be selected as there will be only one NFT. Details of how to receive the NFT will be shared by Mastercard’s sponsorship team, via email after the prize draw.

The NFT will be hosted on a server owned by the company and backed by their proprietary technology.

MasterCard And Its Digital Assets Journey

The Financial Services company entered the crypto space last year. Since then, it has made big moves in crypto and blockchain integrated services. The company acknowledged that digital assets are becoming a more important part of the payments world.

Related Reading | Real Adoption: How Will Mastercard’s Crypto Acceptance Affect Bitcoin Price?

In 2020, Mastercard announced the expansion of its cryptocurrency program, making it simpler and faster for partners to bring secure, compliant payment cards to market. This effort was to aid adoption and create innovative experiences in the crypto space. The company teamed up with Wirex and BitPay to create crypto cards that allow people to transact using their cryptocurrencies.

In a bid to make crypto more accessible to everyone, in March 2021, Mastercard and Wirex officially launched the Mastercard debit card in the U.K. and EEA, as well as the rewards program across the globe.

Total crypto market cap rises to $2.17 Trillion | Source: Crypto Total Market Cap from TradingView.com

In July this year, Mastercard announced the launch of a corporate program, Start Path, for Blockchain and crypto startups. Start Path started with seven global crypto and digital assets startups that focused on solving a unique industry challenge. It has a location in every region.

Still, in July, it announced the creation of a simplified payments card offering for cryptocurrency companies. It said that it will “enhance its card program for cryptocurrency wallets and exchanges, making it simpler for partners to convert cryptocurrency to traditional fiat currency.”

Related Reading | Mastercard Furthers Investment Into Crypto Card Integration

Also, just this month, the company made a big bet on crypto by buying blockchain analytics startup CipherTrace. On September 9, the payments giant announced it entered into an agreement to buy CipherTrace for an undisclosed amount.

“Digital assets have the potential to reimagine commerce, from everyday acts like paying and getting paid to transforming economies, making them more inclusive and efficient,” said Ajay Bhalla, president, Cyber & Intelligence at Mastercard. “With the rapid growth of the digital asset ecosystem comes the need to ensure it is trusted and safe. Our aim is to build upon the complementary capabilities of Mastercard and CipherTrace to do just this.”

The creation of this NFT is Mastercard’s most recent move in the digital assets space.

Other financial services providers are also making moves in the space. Last month, Visa purchased its first NFT. It later went on to release its NFT whitepaper.

Featured image by Mastercard’s priceless.com, Chart by TradingView.com

Axie Infinity (AXS) axes almost half its value following 971% bull run

The governance token earlier rallied exponentially despite dull price actions in the broader cryptocurrency market.

Nifty’s Inc. Partners With Warner Bros To Roll Out A Social NFT Platform

The inaugural kick-off of Nifty’s social NFT platform took a new wave of excitement on Monday. This unusual wave came from announcing Warner Bros as the principal collaborator with Nifty’s Inc.

There’s also a backup of seed investment worth about $10 million from some big venture firms of the blockchain.

The partnership with Warner Bros influences Nifty’s to launch a collection of NFTs limited-edition. According to the company’s announcement, the collection will feature characters from ‘Space Jam: A New Legacy,’ a future movie.

Related Reading | Binance CEO Changpeng Zhao States, “Compliance Is A Journey.”

ConsenSys, the Ethereum software company, developed the NFT’s for Space Jam using Palm NFT Studio’s technology.

Backup Investors On The New NFT Platform

The investment of $10 million came from prominent investors like Palm NFT Studio, Samsung Next, and BBTV Holdings Inc.

Other investors include Coinbase ventures, A&T Capital Ventures, Forerunner Ventures, Topps, Dapper Labs, Liberty City Ventures, and HENI.

In addition, some pre-seed investors supported Nifty’s platform launch by topping their stake in Nifty’s. Some of the pre-seed investors include Draper Dragon Fund, Ethereal Ventures, and Polychain Capital.

The Executive Vice President at Samsung, David Lee, through his speech, praised and publicized Nifty’s innovation in NFT confinement.

Related Reading | Russia Plans To Impound Unlawfully Acquired Cryptocurrencies

He explained that their business is committed to harnessing the future by identifying the necessary ideas, trends, and technologies. Lee commended Nifty’s for its latest development within a concise time. He also expressed his anticipation of how the Non-Fungible Tokens will influence the future.

An NFT Focused Platform

Earlier in March this year, Nifty’s made its first announcement concerning its social media platform, NFT-focused. The announcement mentioned that its big investors would include Joseph Lubin and Mark Cuban.

The vision for the project was to develop a social media platform that will brew a community for digital collectibles. Also, the platform is to increase personal interactions among users and support the latest art scene.

Related Reading | Allied Payment Partners NYDIG, Adds Bitcoin To Corporate Treasury

The Non-Fungible Tokens market recently in this year 2021 has experienced tremendous growth in its journey.

One of the major contributing factors is the increasing acceptance in the mainstream for digital assets. But, unfortunately, this adoption has also robbed off to inculcate digital collectibles.

According to reports, the sale of Non-Fungible Tokens increased to $2.5 billion within the first half of the year. There’s also a surge in the trade volume of NFT’s. This reflects through an estimation that indicates a volume doubling between May and October.

Featured image from Pixabay

Nifty News: Kevin Smith sells horror flick rights as NFT, Megadeth’s ETH, farming MEMEs …

MEME NFT farming platform launches the new and improved v2, Megadeth NFT nets $18K, and Kevin Smith tokenizes the rights to “Killroy Was Here”.