Dogecoin’s open interest saw the steepest decline among the top ten cryptocurrencies by market cap, falling 64% since the start of April.

Cryptocurrency Financial News

Dogecoin’s open interest saw the steepest decline among the top ten cryptocurrencies by market cap, falling 64% since the start of April.

Ethereum has, for the most part, established a foothold above the $3,500 price level throughout the week as investors continue to anticipate a return to the $4,000 mark. Interestingly, the optimism has seen the open interest of Ethereum surging to new highs. The surge in open interest, although a bullish sentiment indicator, can also serve as a bearish signal of an impending change in market trend.

Ultimately, this metric added to the current dynamics of the Ethereum ecosystem, including regulatory uncertainty and scalability concerns hinting at a complicated price trajectory for the price of Ethereum.

Open interest is an efficient method for tracking the total number of open positions in a particular contract. Recent market dynamics and institutional investor interest have seen the total open interest in Ethereum futures surging above records set in the 2021 bull market phase.

According to data from Coinglass, the open interest on Ethereum futures, which has been on a surge since February 5, recently set a new high of $14.11 billion on March 15. This wasn’t particularly surprising, as a strong buying momentum from the bulls in the prior days saw the price of Ethereum surging past the $4,000 mark for the first time in two years.

However, Ethereum has since reversed from the $4,000 price level and is currently trading below $3,600. On the other hand, the total open interest on Ethereum contracts has maintained around its all-time high level, which allowed it to cross over $14.10 billion again on March 28. The open interest weighted average also went up to 0.0462%, indicating an increase in the demand for leveraged ETH long positions.

The majority ($4.55 billion) in the Ethereum futures market were registered on cryptocurrency exchange Binance. Bybit and OKX came in second and third, with $2.39 billion and $1.94 billion respectively. Interestingly, CME’s Ether futures also surged to $1.3 billion. At the time of writing, the CME’s Ether futures now sit at $1.31 billion, reiterating the committed bullishness among institutional investors.

Ethereum has been trading flat since the beginning of the week and is currently on a 0.78% gain in the past seven days. All eyes are now on reports of the SEC looking into Ethereum’s security status, the industry awaits an official ruling similar to the one that was handed down in the XRP case that will finally provide clarity to the regulatory landscape.

At the same time, investors continue to await the SEC’s decision regarding the applications of Spot Ethereum exchange-traded fund (ETF) in the US. According to a Bloomberg senior analyst, the likelihood of approval is only 25%.

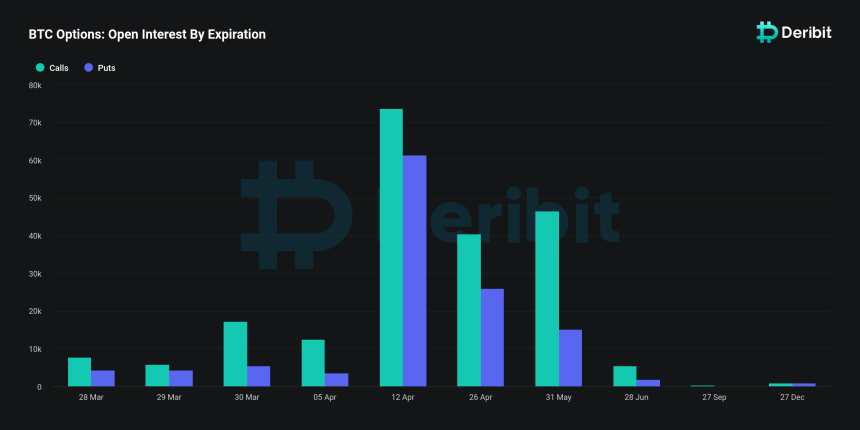

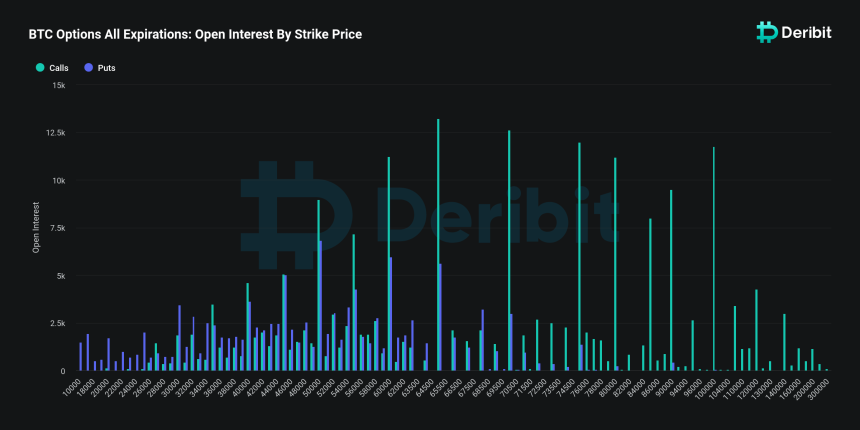

This Friday, the spotlight is turned to Deribit, the leading crypto derivatives exchange, as it gears up for a notable event in its trading history. Particularly, the exchange is poised to witness the expiration of over $9.5 billion in Bitcoin options open interest.

For context, Open interest refers to the total number of outstanding derivative contracts, such as futures or options, that have not been settled or closed. It represents the number of contracts market participants hold at the end of each trading day.

This surge in open interest recorded by Deribit reflects increased market participation and signals heightened liquidity, marking a notable milestone in the crypto derivatives landscape.

Notably, this event is significant in two ways: It underscores the growing interest in Bitcoin as an asset class and highlights the increasing “sophistication” of the cryptocurrency market. This is because Open interest can also serve as a critical indicator of market health and trader sentiment.

As such, the record levels of open interest set to expire on Deribit suggest a “vibrant” trading environment, with more investors engaging in complex financial instruments like options.

According to Deribit data, the exchange is set to host one of its largest option expiries ever, with $9.5 billion worth of Bitcoin options poised for expiry at the end of the month. This figure represents a substantial portion, approximately 40%, of the exchange’s total options open interest, which stands at $26.3 billion.

The magnitude of this expiry event eclipses previous months, with January and February end-of-month expiries totaling $3.74 billion and $3.72 billion, respectively. This trend indicates a large increase in market activity and investor engagement on the platform.

The upcoming expiry has notable implications for the market, especially considering the current pricing dynamics of Bitcoin.

With Bitcoin’s spot price hovering below $70,000, an estimated $3.9 billion of the open interest is expected to expire “in the money,” according to Deribit analysts, presenting profitable opportunities for holders of these options contracts.

The “max pain” price, which represents the strike price at which the highest number of options would expire worthless, thereby causing the maximum financial loss to option holders, is identified at $50,000.

According to the analysts, this scenario suggests that a significant number of traders are positioned to benefit from the current market conditions, potentially leading to “increased buying activity” as these options are exercised.

Additionally, Deribit analysts speculate that the high level of “in-the-money expiries” could exert upward pressure on Bitcoin’s price or amplify market volatility. They added that as traders “hedge their positions” or “speculate on future price movements,” the market may witness a flurry of activity, impacting Bitcoin’s price trajectory in the short term.

This comes at a time when Bitcoin has experienced a slight retracement from its recent all-time high above $73,000, with the price adjusting to approximately $68,946, at the time of writing

Featured image from Unsplash, Chart from TradingView

The Dogecoin open interest (OI) is surging after a week of remarkable price action. The meme coin which rose over 100% has continued to enjoy the attention of investors and traders alike, leading its open interest to reach a new all-time high.

Data from Coinglass shows that there was an exponential growth in the Dogecoin open interest in the first five days of March. The open interest had closed out the month of February $870.22 million. However, only five days later, Dogecoin’s OI has risen to $1.49 billion. This rapid increase in less than one week translates to an over 70% increase in the open interest, reaching a brand new all-time high.

The increase did not come out of nowhere, as the DOGE price had begun to recover during this time. It closed out February at a price of $0.09, but by March 5, the price has already seen an 100% increase, briefly hitting $0.2 before correcting back downward to its current price of $0.18.

The open interest represents the interest in the meme coin as it is a total of all of the open derivatives positions in DOGE at any given time. This means that crypto traders are betting more on the price of Dogecoin and taking short and long positions in DOGE at an unprecedented rate.

Three exchanges currently control the vast majority of the DOGE OI, namely ByBit, Binance, and OKX. ByBit takes the lead, commanding $584.13 million of 3.25 billion DOGE OI. Binance takes the second position with $511.22 million or 2.85 billion DOGE, and OKX comes in third with $194.17 million or 1.08 billion DOGE.

Presently, the Dogecoin price seems undecided on where it is headed next, which has led to almost equal liquidations across the camps of bulls and bears. As mentioned above, the DOGE price had briefly touched $0.2, leading to liquidations across shorter. However, its downward correction has been just as detrimental to long traders.

Coinglass data shows that in the last 24 hours, DOGE traders have lost $33.92 million. Interestingly, long traders have actually lost more during this time as they account for $17.44 million in liquidations. While short traders have lost $16.32 million during the same time period.

On the shorter time frame, long traders are still suffering more losses with $2.26 million lost in the last four hours compared to $453,280 in short positions. However, while this shows bulls are taking a beating, it is also proof that bullish sentiment among traders when it comes to the DOGE price remains strong.

At the time of writing, DOGE’s price is siting $0.18 with a 7.49% increase in the last 24 hours, and an 85.98% increase in the last week.

Chainlink has seen its open interest spike significantly in the month of February, so much so that it has reached new all-time highs. This trend has not waned despite the decline in the price of the cryptocurrency, which could paint a rather bullish picture for the LINK price going forward.

The Chainlink open interest ended the month of January on a high note and carried this trend into the month of February. A major jump was seen between January 31 and February 3 when the open interest went from below $250 million to more than $320 million.

In the days following this, the open interest continued to rise, and eventually hit a peak of $533 million. This was significant because it was not just the highest point for the year but it is the highest that the open interest has ever been for the asset.

As expected, the price would quickly rise to keep up with the open interest as investors continued to place their bets on the price. There has been a retracement in the open interest. However, Chainlink has continued to maintain more than $450 million in open interest since February 12.

Currently, Coinglass data shows that the Chainlink open interest is $456 million as of February 23, continuing to maintain a high level. Given this, it might be prudent to look at how the LINK price has reacted in the past when open interest remained elevated.

While the Chainlink open interest is at record levels, there have been times in the past where the open interest had been elevated for a period of time like it is now. So, how the price reacted during those periods could provide a pointer for how it might perform now.

The last time that the open interest was this elevated for a long period of time was back in October-November 2023 when open interest more than doubled. It would maintain this elevated level for almost a month, but at the end of it, the LINK price would react positively and saw a price surge from $11 to $15, which was a 36% increase in price.

If this scenario were to repeat now, then a 36% increase would send the LINK price to $24. This is not particularly hard to believe, given that the LINK price had topped out at $52 in the last bull market. So, such a move would still leave it 50% below its all-time high levels.

On the flip side of this, the open interest levels could also taper off, as was seen in November 2023. This could see the LINK open interest lose its hold on the $450 million that it maintained in February and fall toward $400 million before recovering again.

The Bitcoin open interest has been on the rise over the last few weeks as the price has climbed continuously. This sustained rise in the open interest is a reflection of the heightened interest in the cryptocurrency since the United States Securities and Exchange Commission (SEC) approved Spot Bitcoin ETFs for trading. The BTC open interest has now climbed to historical levels, reaching 2021 all-time high levels.

According to data from Coinglass, the Bitcoin open interest has risen to more than $24 billion. This growth represents around a 50% jump in the open interest since the year 2024 began. But more importantly, the open interest has risen to levels not seen since 2021.

Looking at the open interest chart, the last time that the Bitcoin OI was this high was back in November 2021, when the cryptocurrency reached its all-time high price of $69,000. This rise in the OI has been consistent across crypto exchanges, with CME, Binance, and ByBit leading the charge and commanding more than 50% of the open interest.

The continuous rise has also come with a rise in the greed levels among crypto investors. Currently, the Crypto Fear & Greed Index is sitting firmly in Greed, suggesting that crypto investors are in a place where they are willing to take more risks than usual.

With the Bitcoin open interest this high, it could end up being negative for the BTC price. This is because past performances where the open interest has risen so rapidly have often ended in a market crash. The same was the case in 2021 when the Bitcoin OI had set its previous record.

In 2021, when the BTC price crossed $69,000 and the open interest crossed $22 billion, the euphoria was incredibly high as it is now. However, this would be short-lived, with a market crash happening shortly after. The BTC price would eventually go from $69,000 to $46,000 by December, dropping by almost 40% in the space of one month.

If this same trend were to repeat itself in the current trend, then there could be a massive crash in the cards for Bitcoin. A similar decline would see Bitcoin fall back toward $41,000, which would wipe out the gains of the last few weeks.

However, there are different factors at play in the current market, such as Spot Bitcoin ETF issuers seeing massive interest in their exchange-traded products. Just last week, inflows into Spot BTC ETFs reached a new record of $2.2 billion. So if these large institutions continue buying BTC to meet the demand of their customers, then the BTC price could continue to rally.

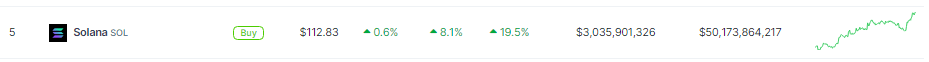

Solana (SOL), a leading cryptocurrency known for its fast transaction speed, is currently experiencing a surge in investor confidence. According to recent market data, the open interest in Solana has increased by over 108%, reaching a new high of $1.75 billion.

This surge indicates a significant rise in investor activity and market participation across major exchanges such as Binance, Bybit, and OKX. In addition, Solana’s price has risen by over 8% in a single day, reaching $114, accompanied by an 88% increase in trading volume, which has reached nearly $3 billion.

These indicators reflect heightened investor interest and increased liquidity for Solana. The positive momentum surrounding Solana is part of a broader trend in the cryptocurrency market, which was initially sparked by Bitcoin’s recent surge above $50,000.

As Bitcoin’s performance often influences sentiment towards alternative coins like Solana, the current bullish trend is further supported by some analysts’ projection of a potential price target of $140 for Solana, representing a further 25% increase from its current level.

However, it is important to recognize the inherent volatility of the cryptocurrency market. While the current indicators present a positive outlook for Solana, past performance does not guarantee future results.

External factors such as regulatory changes, broader economic conditions, and unforeseen news events can significantly impact the market. Therefore, conducting thorough research and considering risk tolerance is essential before making any investment decisions.

Despite the inherent volatility, the recent developments in Solana’s open interest, price, and trading volume paint a promising picture for the future. These metrics serve as valuable indicators of investor confidence and potential market trends.

Solana’s performance not only underscores its own strengths and appeal among investors but also highlights the interconnected nature of the cryptocurrency market, where positive sentiment in one sector can spill over to others.

The volatility of Solana is a point of consideration for investors. Solana has a volatility rank of 44, placing it in the bottom 40% of crypto assets on the market.

The cryptocurrency market is known for its sharp volatility, and Solana has experienced notable price fluctuations in the past. Therefore, while the current surge in investor confidence is evident, it is essential for investors to carefully assess the risks associated with the high volatility of Solana before making investment decisions.

Solana’s recent surge in investor confidence, as evidenced by the increase in open interest, price, and trading volume, reflects a positive outlook for the cryptocurrency.

Featured image from Pexels, chart from TradingView

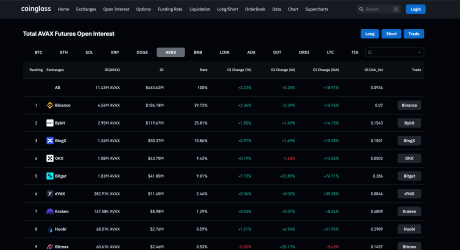

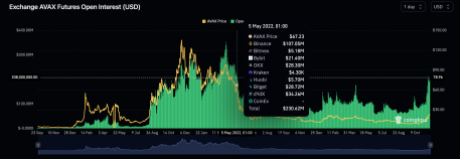

Avalanche has seen its native token AVAX rise rapidly over the last 30 days to make its way into the top 10 tokens by market cap. This rally was not exactly out of the blue as activity had begun to pick up once more on the Avalanche network. During this time, the open interest has risen rapidly as well, eventually touching a new all-time high.

On Tuesday, the Avalanche open interest rose to the highest level since its launch following AVAX’s surge to $40. The open interest reached $413 million on December 12 after continuously rising for over a month. The surge happened in tandem with the price surge and has made daily highs almost every day in December.

The surge began in October after trailing around $70 million for the better part of a month. However, in November, there was a noticeable change in the open interest as traders began to take their positions in the digital asset.

Between November and December, the AVAX open interest has risen by over 400%. On Tuesday alone, the open interest grew another 19%, bringing the total Avalanche open interest across all exchanges to 11.43 million AVAX.

73% of the total open interest is actually coming from only two exchanges; Binance and ByBit. According to data from Coinglass, Binance accounts for 44% of the total OI at $184 million (4.54 million AVAX), while ByBit accounts for 28.8% of the OI with $119.67 million (2.95 million AVAX). BingX, OKX, and Bitget make up the rest of the top 5 with $50.37 million, $43.7 million, and $41.8 million, respectively.

While the Avalanche open interest has soared to a new all-time high, there is still a long way to go for the AVAX price before it reaches its all-time high of $146. Nevertheless, the rise in open interest is still incredibly bullish for the price.

As proven by historical performance, the price of AVAX has often risen whenever the open interest has been on the rise. This was the case between 2021 and 2022 when the price of the altcoin rose above $100 before eventually crashing in 2022.

If the Avalanche open interest continues to rise from here, it is expected that AVAX will follow through. A break in OI over $500 million will no doubt see the altcoin clear the coveted $50 level once more. However, $100 still looks to be a long way from here and will likely be reached sometime in 2024.

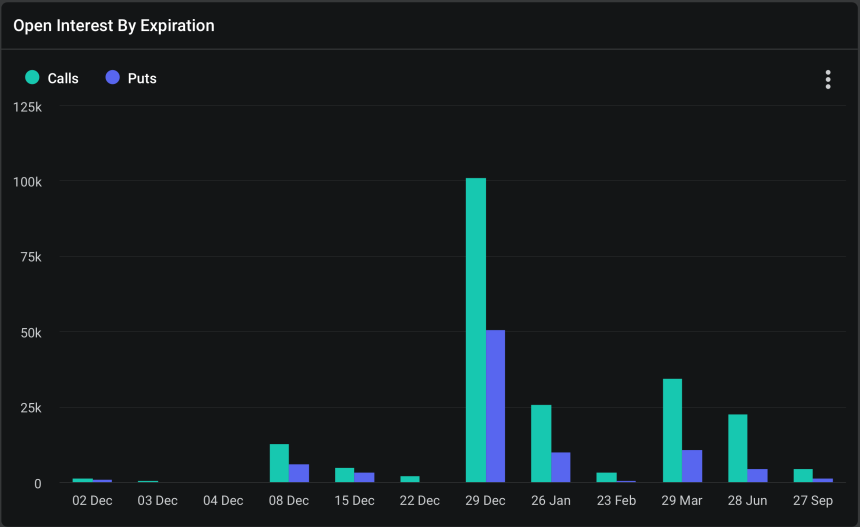

A recent analysis by Deribit, a leading derivatives exchange, suggests a bullish sentiment for Bitcoin as we approach early 2024. This optimism is rooted in the current Bitcoin put-call options ratio, a critical option market metric.

Notably, options are financial instruments that give traders the right, but not the obligation, to buy (call options) or sell (put options) an underlying asset at a specified price within a set time frame. The put-call ratio is used in options trading to measure market sentiment.

A put option signifies a bet on the price of an asset falling, while a call option represents a wager on its rise. A lower put-call ratio indicates that more traders are betting on the asset’s price increasing rather than decreasing.

Deribit’s analysis shows an increasing trend in the number of call options outstripping put options in Bitcoin’s options market. Luuk Strijers, Chief Commercial Officer at Deribit, highlighted that the put-call ratio for Bitcoin has consistently hovered “between 0.4 and 0.5” throughout the year.

This trend is particularly noticeable for options expiring in March and June 2024, suggesting that investors are increasingly using call options to position for a potential appreciation in Bitcoin’s value during this period.

The put-call options ratio falling below one is a bullish market indicator, as it shows that call volume, or bets on the price increase, surpasses the put volume, which are bets on the price decrease. According to Deribt, Bitcoin’s put-call ratio currently stands at 0.42, as of today.

Meanwhile, November has seen significant activity in the crypto derivatives market, as noted by Strijers. The Deribit executive attributes this increased market activity to higher levels of “implied volatility (DVOL),” which have spurred “opportunities and overall market volumes.”

The expiration dates of the upcoming options, especially the significant one on December 29, are expected to maintain the heightened interest and activity in the market. With $5.7 billion in Bitcoin options and $2.7 billion in Ethereum options set to expire at the end of December, the market is poised for notable movements.

Bitcoin maintains its upward momentum, advancing by 1.8% over the past 24 hours. With Bitcoin currently trading at $38,344, the asset has sustained the gains achieved at the close of the previous month.

Bitcoin’s trading volume significantly reflects heightened market activity, suggesting ongoing buying pressure. In just the last day, trading volumes have surged from around $11 billion earlier in the week to over $21 billion, a noteworthy indication of increasing investor engagement.

Featured image from Unsplash, Chart from TradingView

The open interest for AVAX has been on a consistent rise over the last month, carrying the price of the altcoin along with it. The result of this continuous climb is the fact that the open interest has now surged to May 2022 levels, a development that could spell a massive rally for the price.

According to data from Coinglass, the AVAX open interest has now climbed to $224 million. The website shows that there was an over 10% increase in the open interest in a 24-hour period which brought the total open interest above 10.04 million AVAX.

Binance actually commands almost half of the total of this open interest at 4.48 million AVAX worth a little over $100 million. This suggests that a good portion of the demand is coming from the crypto exchange. The total open interest also saw a 9.94% increase in the 24 hour period.

ByBit exchange accounts for the second-largest open interest at 2.04 million AVAX worth $46.09 million. BingX comes in third place with 1.24 million AVAX worth $27.59. But none of these exchanges account for the largest jump in the last day.

The largest jump in open interest was recorded on the Bitmex exchange as it rose 17.78% to bring the crypto exchange’s total open interest to 55,340 AVAX with $1.53 million. Altogether, the open interest in the altcoin has risen from $82.8 million on October 20 to $224 million on November 20, meaning that the open interest has grown 170% in one month.

The last time that the AVAX open interest was this high, the price was trading much higher which opens the possibility of a rally above $30. As Coinglass data shows, the last time that the open interest crossed $220 million was in May 2022 when the price was still trading above $50.

Also, taking a look at AVAX’s historical performance, it shows that whenever the open interest has risen quickly, the price tends to follow suit. This was the case back in August 2021 when the open interest went from $14.53 million to $123.5 million, and the AVAX price rose accordingly from $19.15 to $55.

If the same trend were to take place here, then $30 may only be a starting point for the AVAX price. Following all historical performances, the current volume of open interest puts the AVAX fair price at around $40, meaning the altcoin could be trading well below its fair value.

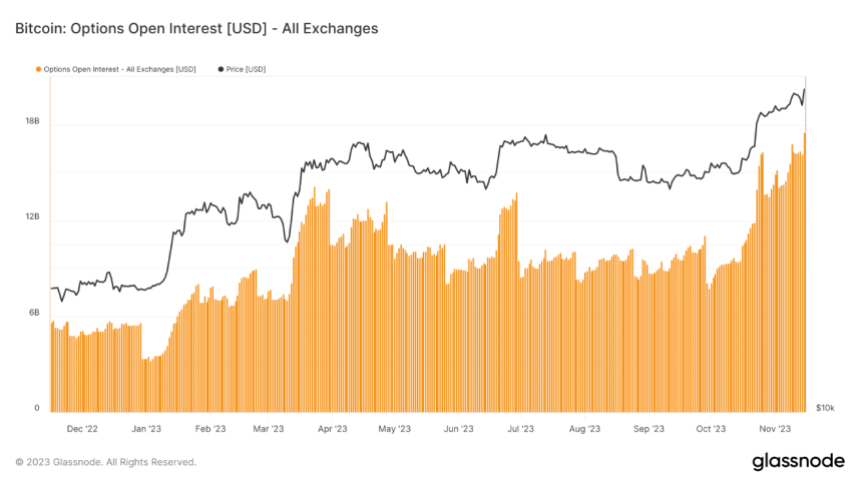

The notional open interest in BTC options listed on Deribit rose to a record $15 billion last week as traders scrambled to take bullish exposure.

An apparent increase in demand for safe-haven assets, rising interest in Bitcoin ETFs in the US, and anticipation of a more accommodating position from the Federal Reserve were the purported drivers of the cryptocurrency market’s recovery this year, which led to a significant gain in the value of Bitcoin.

While the spot and futures markets for bitcoin were at the center of attention at first, options related to the cryptocurrency have recently come to the fore. By introducing a new facet to the market dynamics, these options give a convenient way to speculate on possible price swings.

According to figures from Glassnode, the open interest in Bitcoin’s options has reached a new high point by exceeding $16 billion. This big increase in open interest happens at the same time that Bitcoin’s price successfully reclaimed the $37,000 mark on November 15.

The rise in open interest for options shows that the market is more active and investors are interested in Bitcoin futures. The $16 billion figure shows how important options trading is becoming as a major part of the bitcoin market.

On November 10, the Options Open Interest, a measure of the total amount of money invested in options contracts, reached a record high of $18.05 billion, or 491,000 Bitcoin, Coinglass data shows.

Deribit, which has contributed about $14.5 billion, is mostly responsible for this surge, according to Coinglass.

The cryptocurrency derivatives exchange has also disclosed a nearly peak value of $14.6 billion for its entire open interest notional value.

Bitcoin was trading at $36,550 at the time of publishing. Using statistics from CoinMarketCap, the last time BTC traded at the $37K price was in May 2022. The coin has gained 5% in value over the past day.

In a noteworthy development, BTC options open interest has outpaced that of BTC futures, marking a significant stride in what Deribit described as “increasing market sophistication.”

The platform reported this shift earlier in the week, with Deribit’s Chief Commercial Officer, Luuk Strijers, emphasizing that the surpassing of BTC options open interest over futures open interest serves as a clear indicator of the market’s maturation.

According to Strijers, this transition suggests a growing inclination among participants to leverage options as strategic instruments for positioning, hedging, or capitalizing on the recent surge in implied volatility.

This evolution underscores a “broader shift in market dynamics,” reflecting an enhanced understanding and utilization of financial instruments within the cryptocurrency space.

Meanwhile, adding to the upbeat narrative, the eagerly anticipated Bitcoin halving scheduled for April 2024 emerges as a beacon of positivity. With a historical track record of instigating a scarcity effect by halving miners’ rewards, this event has consistently propelled upward momentum in Bitcoin’s price.

Analysts and enthusiasts alike are brimming with optimism, viewing the upcoming halving as a potential catalyst that could robustly reinforce Bitcoin’s position and intrinsic value within the market, paving the way for heightened anticipation and market dynamics.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Freepik

The Bitcoin open interest can often be an indication of where the BTC price might be headed next depending on whether or not the metric is rising or falling. This time around, the Bitcoin open interest has risen drastically, hitting 19-month highs in the process. Using historical data, it is possible to extrapolate what this means for the crypto’s price, especially as investors remain very bullish.

In an interesting turn of events, the Bitcoin open interest has been rising quickly across various exchanges. In the last 24 hours alone, this metric rose by a cumulative 7.89% across all exchanges in the space, bringing the total open interest to 454,150 BTC worth a staggering $17.04 billion.

For now, most of the Bitcoin open interest is concentrated across the CME, Binance, and ByBit exchanges. But perhaps what is even more interesting is that these open interest levels represent a 19-month high.

According to the data presented on the CoinGlass website, the last time that the Bitcoin open interest moved in this fashion and to this high was back in March 2022, before the historical Terra LUNA crash that sent the market into a prolonged bear market stretch.

This means that the last time that the Bitcoin open interest rose this much was during a time when investors were still very much in the throes of bull run euphoria. As such, the historical performance of the BTC price back then in relation to the open interest could serve as a guide to what might happen to the digital asset’s price next.

Similar to the current trend, the Bitcoin open interest had surged from around 38,000 BTC to over 44,000 BTC in the space of a month, and the BTC price followed quickly. This trend saw the price rise in March 2022 from $38,700 to over $47,000 before the month was over.

Going by this historical performance and assuming Bitcoin sticks to this trend, the rally may be far from over. The BTC price is also sitting at a similar price point at $37,500 and a similar surge could bring its price toward $45,000 before the month is over.

However, there is also the possibility that the open interest could peak at this level and begin to decline. Once this happens, then in the same fashion as in April 2022, the BTC price could begin to decline as the open interest drops. A similar crash would send the price back down toward $27,000.

Market analysts weigh in on an intriguing ‘flippening’, as Bitcoin futures open interest on global derivatives marketplace CME overtakes Binance.

tktk

SHIB and DOGE have seen highest percentage growth in futures open interest since Nov. 1, outshining bitcoin and ether in a sign of increased investor risk appetite in the crypto market.

Institutional investors are chomping at the bit to buy bitcoin amid renewed optimism of a spot exchange-traded fund (ETF) being approved.

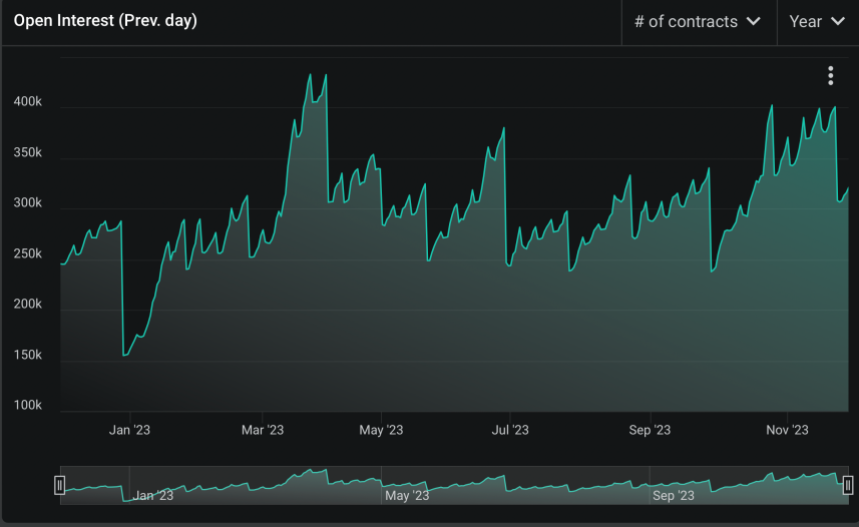

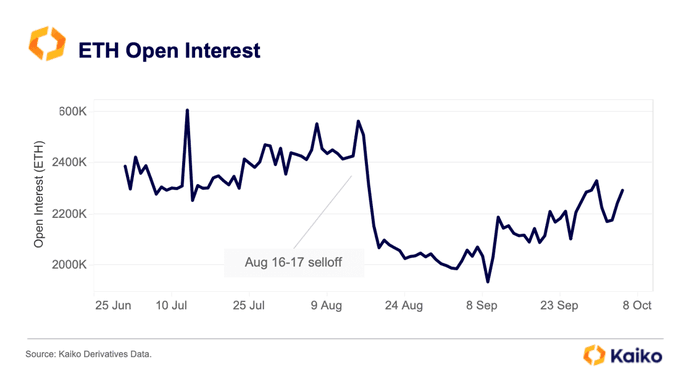

Ethereum prices might be stagnant at spot rates, weaving around the $1,540 and $1,560 zone, looking at technical charts. However, amid this period of consolidation and holders worrying about Ethereum’s prospects, Kaiko notes that the coin’s open interest has been gradually rising since September 2023.

As of October 10, Kaiko observes that there are more than 2.2 million contracts, and the number has been rising steadily over the past few trading weeks. With increasing open interest, it can hint that bulls are in the equation, which may support prices now that prices are under immense pressure.

In crypto trading, open interest is the total number of outstanding derivative contracts of a given coin. Meanwhile, derivatives are contracts that derive value from the underlying asset, in this case, Ethereum. Herein, the total open interest data is accrued from ETH options, futures, and perpetual futures from platforms where traders can use leverage.

There can be different interpretations of open interest depending on the market state. Since open interest includes long and short positions at any time, gauging the directions of how market participants are posting trades can be challenging.

Even so, rising open interest indicates that more traders are opening positions, which can be seen as bullish, especially if prices are expanding. Conversely, falling open interest suggests that traders are exiting, which means waning momentum and bearish sentiment.

Based on this, Ethereum remains in a critical position and support. Notably, the coin is moving sideways with low trading volumes.

From the daily chart, ETH is around the $1,500 and $1,550 primary support. Though buyers appear to be in control, since prices are boxed inside the June to July 2023 trade range, any break below the support zone may trigger more losses.

The general optimism explaining rising open interest could be due to the recent approval of Ethereum Futures exchange-traded funds (ETFs). The United States Securities and Exchange Commission (SEC) approved multiple Ethereum Futures ETFs for the first time.

This decision saw Ethereum prices edge higher in early October. Though prices have since contracted, institutional investors can now find exposure in Ethereum via structured and regulated products approved by the stringent regulator.

It is unclear whether the rising ETH open interest signals strength and if the coin will recover going forward. From the daily chart, ETH has strong liquidation at around the $1,750 level and remains consolidated.

This week’s quick plunge and rebound in cryptocurrency prices triggered $256 million in liquidation losses, Coinglass data shows.

Over the last couple of weeks, the Bitcoin open interest had been on a downtrend that sent it toward one-year lows. However, with the Grayscale victory against the SEC coming on Tuesday, August 29, and sending a positive wave across the entire region, open interest in the digital asset has begun to surge once more.

On-chain data tracking platform Kaiko reported on Tuesday, August 29, that the Bitcoin open interest had been on the decline for a while. In the chart shared by the tracker, it is obvious that this BTC metric had previously fallen significantly since 2022.

#BTC open interest continued declining last week after the Aug 17 sell-off, hitting its lowest level since the collapse of Terra in May 2022.

pic.twitter.com/M5L07ReabY

— Kaiko (@KaikoData) August 29, 2023

As August drew to a close, the open interest in the digital asset eventually declined to levels not seen since the Terra network collapse back in May 2022. This suggested that it could be a good chance to get into Bitcoin and it would be proven true not too long after.

On the same day, news broke that Grayscale had triumphed over the United States Securities and Exchange Commission (SEC) in court over its bid for its Spot Bitcoin ETF filing to be reconsidered. This triggered a rapid uptrend in the price of the digital asset and the open interest followed suit.

According to data from Coinglass, the Bitcoin open interest is seeing double-digit growth on some exchanges already. The open interest on the dYdX exchange is up over 35%, and the cumulative open interest across all exchanges is now in the green, rising 9.55% in the last 24 hours.

For now, the price of Bitcoin is still purely driven by the hype from the Grayscale victory. This means that there is no telling how long the uptrend will last and when it will start correcting downward. However, as long as investors remain optimistic about the victory, BTC will continue to enjoy green days.

As for open interest, a recovery isn’t always a good thing as it opens up an avenue for shorters to enter the market. For example, a look at Keiko’s chart shows open interest was high leading up to the FTX collapse in 2022. Then in early 2023 when the price of Bitcoin was rallying, open interest fell before picking up steam once more.

For now, BTC is still enjoying the spike in attention. The price of the cryptocurrency is up 5.35% in the last 24 hours to trade at $27,349.