Sui, Pyth Network, Avalanche, Arbitrum and Aptos are set to release vested crypto tokens in May, according to data tracker Token Unlocks.

Cryptocurrency Financial News

Sui, Pyth Network, Avalanche, Arbitrum and Aptos are set to release vested crypto tokens in May, according to data tracker Token Unlocks.

Pike highlighted that the exploit occurred due to their team’s inadequate integration of third-party technologies such as the CCTP or Gelato Network’s automation services.

In a month marked by a challenging correction in the crypto market, Layer 2 (L2) blockchain protocol Optimism has emerged as a standout performer. Within the past 24 hours, Optimism’s native OP token skyrocketed by 9%, positioning it as the best-performing token among the top 100 cryptocurrencies.

Behind this surge lies venture capital firm a16z, which has reportedly invested around $90 million in Optimism’s OP token, signaling further institutional support for the layer 2 protocol.

Sources familiar with the matter have revealed to Unchained that a16z has acquired a significant stake in Optimism’s OP token.

The investment, which comes with a two-year vesting period, underscores a16z’s interest in the Layer 2 protocol and aligns with its growing involvement in crypto. Notably, a16z’s portfolio already includes crypto exchange Coinbase.

The investment by a16z comes amidst notable activity and growth within the Optimism ecosystem. Optimism’s OP Stack has experienced increased usage, further validating its value proposition. The protocol’s ability to increase scalability and reduce fees on the Ethereum blockchain has also garnered significant attention.

Optimism’s spokesperson expressed enthusiasm for the investment, acknowledging the energy and momentum surrounding the protocol. The partnership with a venture capital firm like a16z is expected to fuel further development and innovation within the Optimism ecosystem.

On March 7, the Optimism Foundation disclosed the sale of approximately 19.5 million OP tokens, valued at nearly $90 million, to an undisclosed buyer.

These tokens were reportedly sourced from a 30% pool of OP’s original treasury, dedicated to the foundation’s working budget. Reports indicated that the buyer could delegate their tokens to third parties, enabling them to participate in Optimism’s governance.

The foundation clarified that, due to the private nature of the sale, specific details regarding the terms and purchaser were not disclosed.

Despite the recent surge in the Optimism ecosystem and its native token OP, the token still trades well below its all-time high (ATH) reached on March 6, 2024, currently down over 47% from that level.

However, OP’s trading volume has experienced a notable surge, indicating continued interest in the token. According to CoinGecko data, the OP trading volume has increased by over 113% compared to the previous trading day on April 30, amounting to nearly $600 billion in 24 hours.

Key levels to monitor for the token soon include OP’s significant resistance at the $2.62 price mark and a potential retest of the $3 zone.

However, a clear indication of a positive trend for the Optimism token would require a successful consolidation above the $3.92 zone, marking the end of the month-and-a-half downtrend structure.

Conversely, the $2.37 zone has proven to be a crucial support level for OP, as it has held for the past five days and prevented further price decline for the token.

Digging deeper, the $2.25 mark is also a key support, with the most critical support level at $2.11. This level holds the key to Optimism’s macro bullish structure, as it initiated the token’s current uptrend.

Featured image from Shutterstock, chart from TradingView.com

Optimism (OP) has grabbed investors’ attention in the last day following an intriguing positive price performance. Interestingly, OP’s market gain has occurred following a recent disclosure of certain security flaws associated with the popular layer-2 platform.

On April 26, Offchain Labs, the initial developers of the prominent Ethereum L2 solution Arbitrum, highlighted certain security flaws found in the Optimism Stack fault-proof system. Via a blog post, the team at Offchain disclosed that they discovered two major systemic vulnerabilities in the newly released security program currently running on the Optimism testnet.

In communication with OP Labs, they stated that these security flaws could enable a bad actor to bypass the existing security measures of the Optimism network by enforcing the acceptance of a malicious claim or the rejection of a right claim. By exploiting these flaws, OffChain Labs stated these hackers could initiate a network dispute that is irresolvable.

The nature of these vulnerabilities is said to originate from the timers in the OP stack fault-proof system. If this program were introduced on the Optimism mainnet with such defects, users’ funds would be exposed to a “very high” level of risk.

However, these vulnerabilities were revealed to OP Labs about a month ago, which has now updated the Optimism testnet to address these security flaws. Interestingly, following these revelations, OP’s price took a nosedive, falling by almost 5% to trade at $2.274 on April 27. However, in the last day, Investors expressed solid confidence in Optimism’s security and future sustainability.

According to data from CoinMarketCap, OP has gained by 17.16% in the past 24 hours attaining a market price of $2.69. In tandem, the token’s daily trading volume is up by 110.64% and is valued at $402.77 million.

In the week following the Bitcoin Halving event, popular crypto analyst Michaël van De Poppe has advised users to invest heavily in altcoins. Via an X post on April 27, van De Poppe stated that the catalyzing effect of the Halving and the introduction of spot ETFs on Bitcoin are likely over, with momentum now shifting to the altcoin market.

In comparison to BTC, the crypto analyst notes that most altcoins are undervalued and set for massive gains in the current bull cycle. Furthermore, van de Poppe predicted that the upcoming crypto bull run could last longer than the previous cycle, based on the current extended bear market.

Particularly, van de Poppe identified Optimism (OP) as a promising altcoin with the potential to achieve three times the market growth compared to Bitcoin in this bullish cycle. Additionally, the analyst highlighted other tokens, including Chainlink (LINK), Woo (WOO), Celestia (TIA), and Skale (SKL), as potentially profitable investments.

OP trading at $2.693 on the daily chart | Source: OPUSDT chart on Tradingview.com

Featured image from Moneycontrol, chart from Tradingview

The chains’ users will be able to opt in or out to use Avail for data availability, to stash the reams of data produced for all their transactions taking place.

DYDX also has a large unlock scheduled but is not experiencing the same pricing pressure.

CLabs officially proposed using Optimism’s OP Stack for the transition. The proposal will be discussed on a couple of community calls and then go to a vote among holders of the project’s CELO tokens, under the chain’s governance rules.

Arbitrum, the largest Ethereum layer-2 scaling solution by total value locked (TVL), is taking steps towards decentralization. In an update on April 16, Offchain Labs–Arbitrum developers–said they have deployed the permissionless version of their fraud proofs, dubbed Bounded Liquidity Delay (BOLD), to testnet.

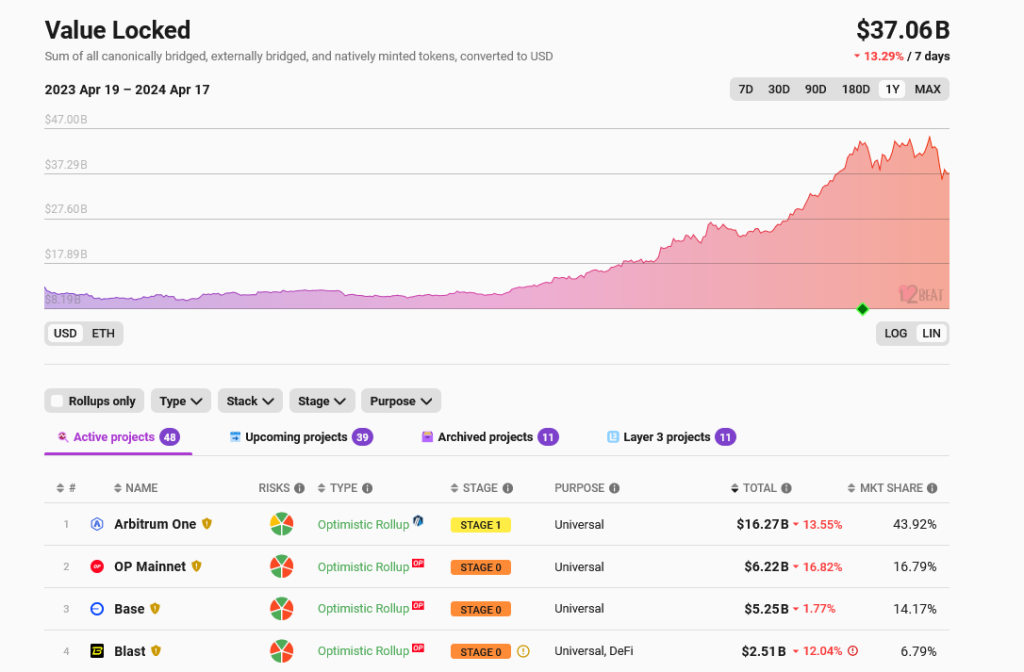

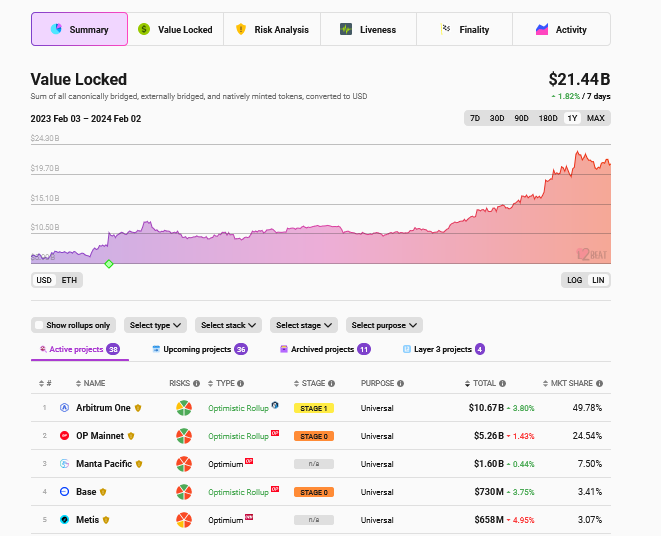

Ethereum layer-2 solutions have been gaining prominence over the years. According to L2Beat data on April 17, these platforms control over $37 billion of assets. Protocol developers and users can send transactions cheaply through Arbitrum, Optimism, Base, and other alternatives.

However, while they are popular and command billions in TVL, most of these platforms’ fraud proofs are being developed. Typically, when users transact all chains, all transactions must be confirmed by a web of miners or validators, depending on the consensus mechanism.

This differs in layer-2 options, which must reroute transactions and process them off-chain. There is no way of proving whether queued transactions are valid before being batched and confirmed on-chain.

The fraud proofs, such as those presented by Arbitrum and other optimistic rollup solutions, are designed to address a critical issue in layer-2 solutions. Specifically, once live and integrated into Arbitrum, BOLD will serve as a safety net, ensuring the validity of transactions processed off-chain. This mechanism is crucial in maintaining the integrity of transactions while enabling efficient off-chain processing.

In compliance with blockchain principles, BOLD will be decentralized. As such, the community will run nodes, which differs from the current setup. As it is, transaction validation in Arbitrum is centralized, and only a few validators are tasked with this.

With BOLD in the testnet, Arbitrum is opening up its rails so that anyone can participate in network security and validate withdrawals back to Ethereum. This move will be critical in building a more decentralized ecosystem and making the platform more robust.

Arbitrum becomes the first Ethereum layer-2 to launch its fraud proofs in testnet. In a post on X, Ryan Watts of Optimism also notified the community that plans are underway to create a decentralized fraud-proof system for the second-most largest layer-2 by TVL.

Even with this major milestone, ARB prices are stable and under pressure.

Related Reading: Crypto Analyst Says Don’t Buy Altcoins Just Yet – Here’s Why

The token is down 50% from March 2024 highs at spot rates and remains under immense selling pressure. If buyers reverse the April 12 and 13 sell-off, the token might recover strongly, racing towards $1.5.

The human-focused blockchain network will be based on the OP Stack, a framework for building Ethereum-based layer-2 chains.

Frax Finance, a decentralized finance (DeFi) protocol, recently unveiled its Singularity Roadmap. It aims to propel the total value locked (TVL) of its layer 2 blockchain, Fraxtal, to $100 billion by the end of 2026. This notable surge would represent a 760,000% increase from the current TVL levels, which stand at $13 million.

According to the protocol’s announcement, Fraxtal, the substrate that powers the Frax ecosystem, serves as Frax Finance’s operating system. With the launch of Fraxtal and achieving an effective 100% Collateralization Ratio (CR), Frax Finance claims to have consolidated its core product offerings.

To reach the ambitious $100 billion TVL goal, the protocol has announced that it has already generated over $45 million, reaching the coveted 100% CR.

As announced, with this milestone achieved, the FRAX stablecoin, which has remained relatively dormant during the process, and the FXS revenue share, which has been temporarily reduced by 90% to conserve assets, can now undergo a “transformative change.”

In addition, the upcoming introduction of Layer 3s (L3s) on Fraxtal is expected to be a key factor in further contributing to the growth and adoption of the protocol.

Fraxtal, which is built on the Optimism (OP) network, stands out as one of the most widely used layer 2 solutions on top of Ethereum (ETH), according to the protocol. The Frax team says it has developed its underlying incentives to provide a seamless experience for developers and users, further encouraging adoption.

In particular, by owning the entire stack, Frax can introduce advanced features such as account abstraction, new precompiles, privacy features, aggregated decentralized applications (dApps), and interoperability with Superchain.

The protocol believes these features will enhance the on-chain experience, making Fraxtal the “preferred” platform for holding, staking, and transferring crypto assets.

The proposal also unveils Frax Finance’s plan to establish 23 Layer 3s within 365 days, kicking off the “Fraxtal Nation” community. By supporting these 23 chains with developer access, incentives, and investment, Frax aims to foster a positive-sum approach and provide additional support to official partners.

The protocol also suggests that these partners will receive “substantial allocations” of FXTL points, aiming to solidify the role of the FXS token as the ultimate beneficiary of the Frax ecosystem.

Moreover, Frax Finance founder Sam Kazemian intends to allocate 50% of the revenue from protocol fees to veFXS token holders. In comparison, the remaining 50% will be used to acquire FXS and other Frax assets for pairing in the FXS Liquidity Engine (FLE).

This initiative will increase liquidity, strengthen the Frax balance sheet, and provide additional incentives for the protocol’s stakeholders.

Frax Finance’s proposal also seeks to reactivate the protocol fee switch, which was temporarily turned off during the consolidation phase of the protocol.

By reigniting this switch, a portion of the yield generated from protocol fees will be directed toward veFXS token holders. veFXS, or veiled FXS, represents a locked version of the native token, FXS, and offers enhanced voting power and participation in the Frax ecosystem.

As of the time of writing, FXS has not responded favorably to the news. Its current trading price is $6.93, reflecting a 3.5% loss in the past 24 hours. It is important to note that the proposed protocol features are still in development, and the impact on the Frax Finance ecosystem and the token’s performance is yet to be determined.

Featured image from Shutterstock, chart from TradingView.com

A version of the new proof system, which will help secure withdrawals from Optimism and other networks based on its tech, will be deployed to Ethereum’s Sepolia test network on Tuesday.

The upgrade allows layer 2 solutions to store data in “blobs” instead of the expensive call data.

While Ethereum’s rollup-centric roadmap could help the ecosystem reach new levels of scale, some developers think relying on third parties to improve access to Ethereum could backfire.

A key element of the upgrade is to enable a new place for storing data on the blockchain – referred to as “proto-danksharding,” which gives room for a dedicated space that is separate from regular transactions, and at a lower cost.

The tokens have been sold to an undisclosed buyer and will be vested for two years.

Ye Zhang, the co-founder of Scroll, a layer-2 project using zero-knowledge proof, is cautiously optimistic about the upcoming Dencun upgrade. In a post on X, Zhang pointed out Dencun’s potential benefits, particularly the low transaction fees.

However, in the same post, the co-founder highlighted the likely challenges it could present for existing layer-2 scaling solutions using roll-ups.

Ethereum developers plan to implement Dencun in mid-March. Implementing the Ethereum Improvement Proposal (EIP)-4844 is a big part of this hard fork. With this execution, the proposal will introduce a new “blob-carrying transaction” feature.

What’s unique about these transactions is that they allow users to cheaply attach blobs, which are large amounts of data, compared to traditional Ethereum transactions.

Based on observations from the Goerli testnet, Zhang anticipates blobs to be 3-5 times cheaper than traditional call data on Ethereum. Accordingly, the vast difference means innovative developers can come up with blob-inscriptions. These inscriptions will effectively compete with layer-2 solutions like Arbitrum or Optimism leveraging roll-ups.

This possibility cannot be discounted because, in essence, EIP-4844 aims to reduce layer-2 transactions through blob transactions. Effectively, the proposal means the foundation of Blob inscriptions.

This solution takes a different approach but could take on roll-up platforms if widely adopted. It will be the case if users transacting large chunks of data realize the advantage of going the blob inscription route.

Even so, roll-ups will carry distinct advantages over blob inscriptions. A notable one is the superior scalability of roll-ups. These solutions can inherently process more transactions every second. Additionally, they are secure since they inherit security from the Ethereum mainnet.

Still, until after Dencun is implemented, the impact of EIP-4844 will be thoroughly measured. Overall, the Ethereum and layer-2 communities are ecstatic for the upgrade, expecting it to thrust ETH even higher in the current bull run.

Ethereum is trading above $3,800. It has been up by double digits in the past week, and experts are predicting even more gains in the days ahead.

Related Reading: Analyst Cites Key Indicators That Signal Bitcoin Correction

In the medium term, bulls target $5,000, around the all-time high.

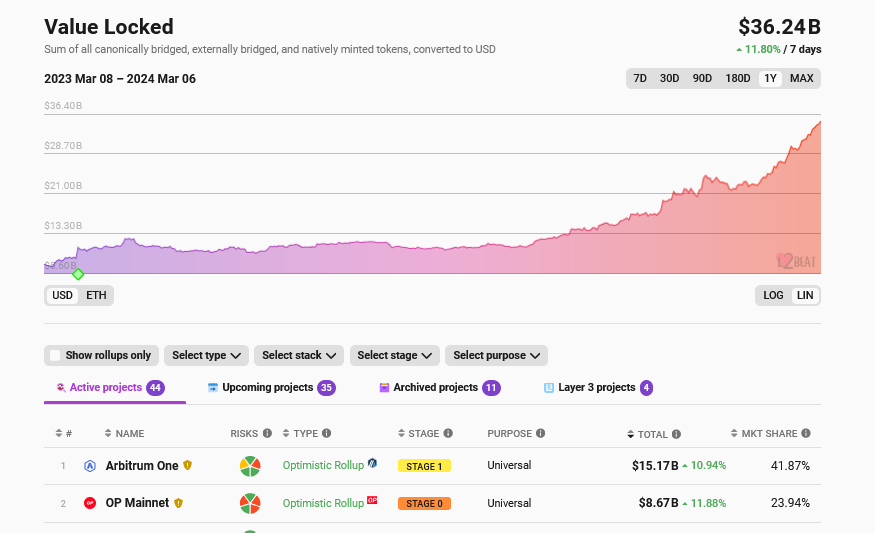

Amid the boom in ETH and crypto prices, interest in Ethereum layer-2 solutions continues to expand. The latest L2Beat data shows that Arbitrum, Optimism, and other alternatives manage over $36 billion. Arbitrum, enjoying its first-move advantage, manages nearly $16 billion.

Adam Cochran, a partner and professor, is bullish about OP, the native token of Optimism, the layer-2 scaling solution for Ethereum.

Taking to X, Cochran is convinced OP is undervalued, pointing to the significance of Coinbase and the brand it has created over the years as a crypto exchange and investor in multiple products. In 2023, Coinbase backed the development of Base, a layer-2 scaling solution for Ethereum that uses Optimism infrastructure for its optimistic roll-up.

In coming up with this assessment, the investor highlights Coinbase’s vast user base and ability to drive retail adoption towards Base potentially. And, as aforementioned, since Base uses Optimism, the expected adoption spike will significantly boost OP from current spot levels.

Cochran argues that the “power of discoverability” associated with Coinbase, a brand that facilitates billions of dollars in daily trading, will be crucial to Optimism’s success. This is particularly relevant when looking at OP prices when writing.

When writing, OP is stable but up 220% from October lows. The token has been trending higher, benefiting from the broader crypto rally. Even so, though in an uptrend, OP has not reclaimed 2023 highs of around $4.2.

To drive the point home, Cochran compares how the BNB Chain blew up in the number of active users. In the last bull run, the chain had an active decentralized finance (DeFi) and non-fungible token (NFT) ecosystem. The BNB Chain’s popularity and soft landing is because the smart contracts platform is associated with Binance, the world’s largest cryptocurrency exchange.

Further to the point, the success of Solana, the partner argues, lends its success to the now-defunct FTX. At its peak, FTX injected billions to fund the development of Solana. It was also actively involved in financing some of Solana’s active protocols.

Presently, Coinbase is streamlining its operations, recently stopping support for Bitcoin, Litecoin, and other UTXO tokens via Coinbase Commerce. Their focus is on Ethereum-compatible tokens, which could provide hints that Coinbase Commerce might soon be integrated into Base.

From the protocol level, Ethereum plans to implement upgrades to make transacting on layer-2 platforms even cheaper. The Dencun Upgrade is scheduled for March and will see Ethereum enhance as part of its long-term scaling roadmap.

L2Beat data on March 1 shows that Optimism has a total value locked (TVL) of $7.8 billion, roughly half that of Arbitrum. Meanwhile, Base has been rising up the rankings, commanding a TVL of approximately $1 billion.

With zero knowledge (ZK) proofs expected to be a game changer for blockchain scaling, Polygon may be on the brink of a major rally. Taking to X on February 2, crypto market commentator Polynya, asserts that ZK technology is the “endgame” as its “1,000x efficiency upside is irresistible for networks.”

This forecast on ZK adoption is massive for Polygon and its native token, MATIC, which has been under significant selling pressure in the past few trading months. As it is, Polygon Labs, the developer of the Ethereum sidechain, has been at the forefront, advocating for the development of ZK scaling solutions.

In 2021, Polygon began assembling a team to develop zkEVM, a technique relying on zero knowledge to scale Ethereum cheaply while being compatible with the EVM. Recent Polygon Labs documentation shows that their zkEVM is in beta and being tested.

However, this hasn’t stopped the team from striking deals with layer-1 protocols interested in harnessing this technology.

In mid-January, NEAR Protocol’s Data Availability (DA) solution was integrated with Polygon’s custom blockchain development kit (CDK). The goal was to make it easier for developers to create ZK rollup solutions suitable for their needs while leveraging NEAR Protocol‘s infrastructure. All this is when ensuring the integration lowers cost and improves performance.

Polygon Labs has also partnered with other platforms, including Immutable–a layer-2 web3 solution for NFTs; Ankr–an infrastructure provider; and QuickSwap–a decentralized exchange (DEX). Most of these platforms plan to operate as layer-2s for Ethereum.

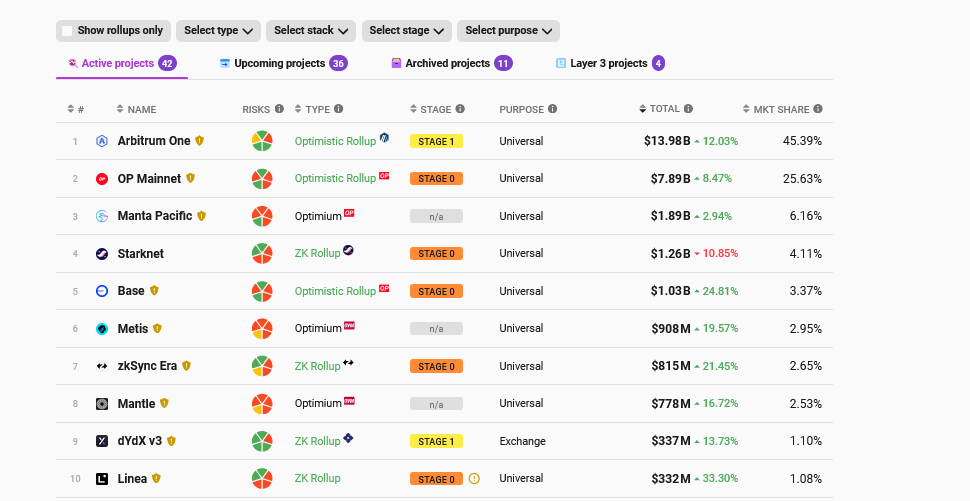

The total value locked (TVL) in layer-2 protocols remains in an uptrend, according to L2Beat. These platforms command over $21 billion. So far, the largest layer-2 protocols, Arbitrum, Optimism, and Base, use Optimistic Rollups.

This is a bullish development for Polygon. Moreover, at this pace, it is likely to cement Ethereum, the pioneer layer-1 and smart contract platform, as a dominant settlement layer despite on-chain scaling concerns and relatively high fees.

From a price point perspective, MATIC will likely benefit as more platforms adopt Polygon’s zkEVM solutions. So far, MATIC is stable but firm when writing on February 2. From the daily chart, MATIC has support at around $0.70. On the upper end, the immediate resistance level is at $1.

Spurred by partnerships as more platforms use zkEVM, fundamental developments might drive MATIC even higher in the coming sessions. If MATIC finds momentum, the medium- to long-term target will be $3, or a 2021 high.

Devs for the Blast L2 are accused of stealing open-source code that’s available to all. Is that cheating, or a sincere form of flattery?