Developers building on Polygon’s zkEVM will be able to incorporate these data feeds into their on-chain applications.

Chainlink Data Feeds Available on Polygon zkEVM

Developers building on Polygon’s zkEVM will be able to incorporate these data feeds into their on-chain applications.

DeFi protocol Venus seeks to patch $270K hole from oracle incident

The DeFi lending and borrowing protocol has confirmed it was affected by a malfunctioning Binance price oracle but confirmed user funds were safe.

Pyth Oracle Network Brings Industry Heavyweights Into Governance Post-Airdrop

The low-latency oracle network’s new “strategic partners” include Castle Island Ventures, Multicoin Capital and Wintermute Ventures. They could play a major role in shaping how the platform evolves.

Ethereum team lead sees zero interest from university in collaborating

Peter Szilagyi, Ethereum’s team lead, voiced dissatisfaction with his former university’s lack of enthusiasm in recommending students for collaboration with Ethereum.

The PYTH Airdrop is Finally Here. But What is Pyth Network?

Pyth Network’s speed-focused oracle service aims to challenge Chainlink as the go-to data source for blockchain finance.

Pyth Token Debuts Near $500M Valuation as 90,000 Wallets Receive Airdrop

Pricing oracle network Pyth has issued its native token [PYTH] with 90,000 wallets being eligible to receive the airdrop.

255M Pyth Tokens to Be Airdropped to 90K Wallets Next Week

The Claim Process for the Pyth Network Retrospective Airdrop will open on Monday, Nov 20 at 2 PM UTC.

Chainlink (LINK) pumps 26% in 6 days — Is there room for more?

LINK token continues to strengthen as professional traders and enterprise solution clients enter Chainlink’s ecosystem.

Was Chainlink’s (LINK) 35% rally just a buy rumor, sell the news event?

LINK outperformed most cryptocurrencies in September, but the recent correction raises questions on the sustainability of the bullish momentum.

Ethereum price at $1.4K was a bargain, and a rally toward $2K looks like the next step

ETH’s correlation with tech stocks, its increasing total value locked and its deflationary token economics all suggest that the path to $2,000 is programmed.

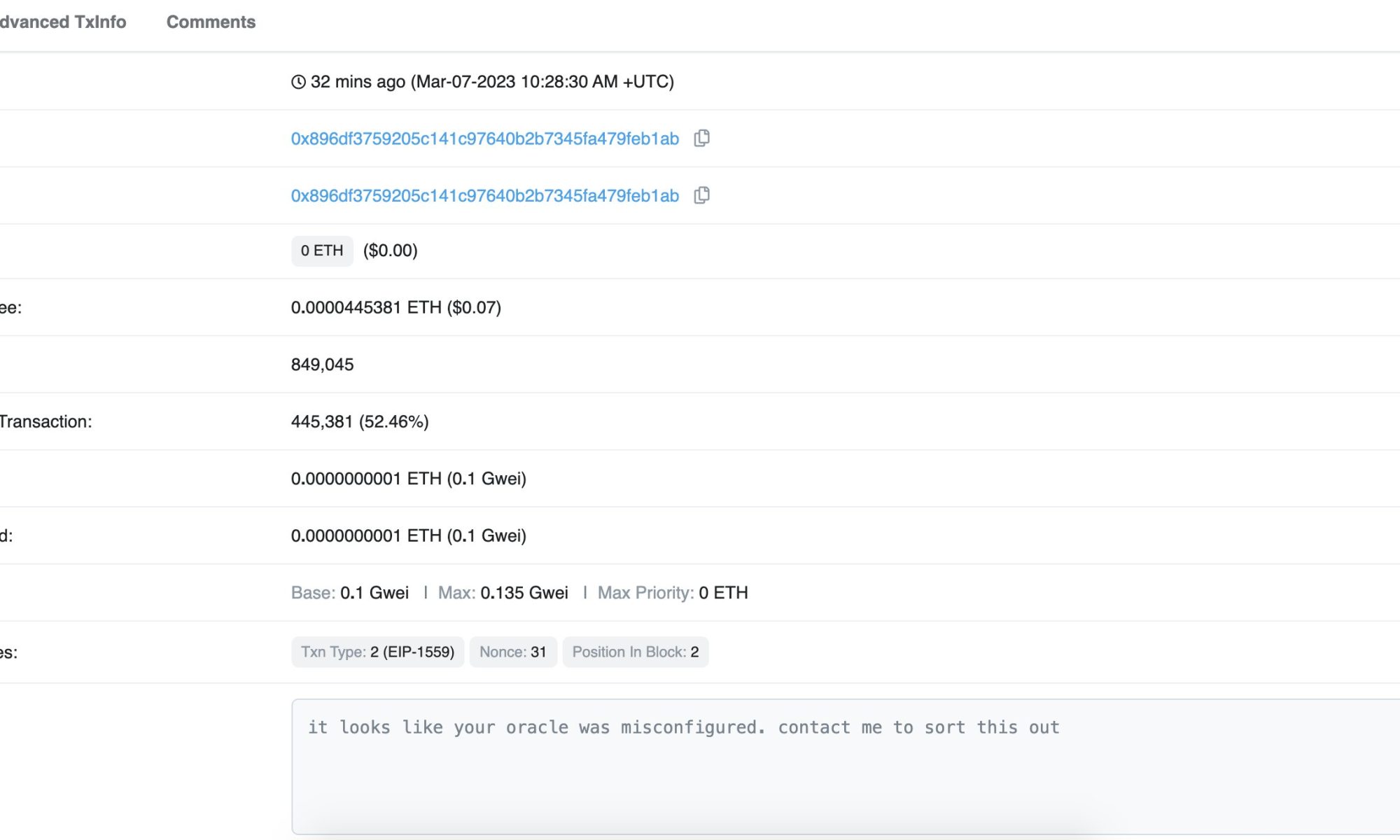

DeFi lender Tender.fi suffers exploit, white hat hacker suspected

DeFi lending platform Tender.fi sees $1.59 million of assets drained by alleged white hat hacker taking advantage of a misconfigured oracle.

BonqDAO protocol suffers $120M loss after oracle hack

An oracle hack allowed the exploiter to manipulate the price of the AllianceBlock token, leading to an estimated $120 million loss, according to Peckshield.

Will This New Development Push The Chainlink Price To $7?

The Chainlink price has not reflected positive changes despite a major development in the altcoin’s ecosystem. Over the last 24 hours, LINK has declined by over 4%. Even in the weekly window, the altcoin lost over 6% of its value.

LINK had charted considerable gains in the month of November. The bulls, however, could not sustain the price action as the coin moved southward at the beginning of December.

Chainlink’s price has dropped below the $7 mark. For the coin to turn bullish, it must break past the aforementioned price zone. Investor interest has yet to echo on the daily chart. Chainlink is a blockchain oracle network that has launched its staking feature. This shall help to enhance the economic security of the platform’s services as a whole.

This development is supposed to be a vital part of its “Chainlink Economics 2.0” effort, which is aimed at promoting better security and ensuring sustainable growth within the ecosystem. The technical outlook has displayed a fall in accumulation, and at the current price, LINK is trading at an 87% discount from its all-time high secured in 2021.

Chainlink Price Analysis: One-Day Chart

LINK was trading at $6.86 at the time of this writing. Although the altcoin was trading close to the crucial price resistance mark, it had to get past one important price ceiling to claim $7. Immediate resistance stood at $6.90. After breaking through the $7 mark, Chainlink may encounter a major barrier at $7.36, indicating a significant retracement.

If LINK falls below the present price level, it could land at the $6.22 mark and then at $5.90. The amount of LINK traded in the last session witnessed a dip, which meant that sellers were still in charge and that price sentiment was bearish.

Technical Analysis

LINK had managed to secure more buying pressure this month, but with constant volatility and price swings, the bulls have finally worn out. The Relative Strength Index dipped below the half-line, indicating falling buyer interest.

Reflecting the same sentiment, the Chainlink price peeped below the 20-Simple Moving Average line, which meant that sellers had started to drive the price momentum in the market. Buyers will be back for a considerable time period if Chainlink prices rise above $7.36.

Regarding declining buying strength, other technical indicators also presented similar readings. The buy signal on the daily chart started to fall. The Moving Average Convergence Divergence, which reads the price momentum and trend reversal, noted that the green histograms were shorter in size.

This is not good news for buyers, and buyers must refrain from accumulation at this point. Similarly, the Parabolic SAR, which depicts the price direction, formed a dotted line above the candlestick, signifying downward price action in the market.

Featured image from LeewayHertz, Chart: TradingView.com

Chainlink eyes 25% rally ahead of LINK staking launch in December

LINK’s price could rally on speculations over Chainlink’s oracle services growth coupled with a supportive technical pattern.

Will Binance Oracle Hamper Chainlink Growth Amid The Bullish Run

Recently, the global leading crypto exchange Binance has created a record using Web 3. In addition, the giant crypto service provider recently unveiled its new decentralized Web 3 oracle network.

The shift into Web 3 is skyrocketing gradually. More events, projects, applications, and activities are coming with more innovative additions. In addition, the new belief surrounding Web3 as the next future with greater possibilities fuels its popularity.

Will Chainlink Continue Leading The Game?

This new project from Binance serves as the first major competition to the other oracle services networks. Chainlink (LINK) has been the lead among others of its type. Chainlink’s robust infrastructure has helped it create a strong data feed network. Hence, it could bridge real-world online data and blockchain-based systems.

The new Binance Oracle is to operate as a data feed network by creating a link between real-world data and smart contracts on blockchains. This means it will enable smart contracts using real-world inputs and outputs.

Binance Oracle Will First Operate On BNB Chain

According to its plan for the new oracle project, Binance will first use the services on its BNB Chain. Then, it will enable almost 1,400 DApps and different Web 3 partners to access some existing data sources.

Following the unveiling, many projects are taking several actions already. For example, over ten projects on the BNB Chain have integrated smart contracts to flow with Binance’s bird program.

Before now, Binance disclosed that the oracle services from the new project are chain-agnostic. But there will be support for more blockchain networks in the future.

Gwendolyn Regina, the Investment Director at BNB Chain, spoke concerning the development. The director noted the wave of interest in the new internet through its shift to well-connected smart contracts. Also, it has been essential to use oracles to heighten the knowledge of the smart contract. This will connect it with the current happenings outside the blockchain. So, blockchain activities could quickly respond and adjust to external events with the proper flow.

According to director Regina, the new Binance Oracle will provide stable and reliable reports. This will represent complete accuracy and accessibility features. Hence, the oracle will become a significant contributor to Web 3.

Operations Of Binance Oracle

Binance has placed some distinctive features for its new project. First, the overall performance of Binance Oracle targets a higher level of reliability. The network sources price data from several centralized exchanges (CEXs) and aggregates prices through an intelligent algorithm.

While providing data feeds, the Binance public key is meant to verify the authenticity of the data multiple times. This will eliminate cases of tampering.

Regarding individual data feeds, Binance Oracle depends on Threshold Signature Scheme (TSS). This is reputable in providing a distributed mechanism that removes all failure traces.

Featured Image From Pixabay, Charts From Tradingview

Compound cETH market bricked by update — 7-day wait on vote to fix it

The code bug has plagued the cETH market and has affected Compound’s front-end user face, but the CEO confirmed that “funds are not immediately at risk.”

Umbrella Network Announces New Launch: Decentralized Oracles On Ethereum Mainnet

Umbrella Network, the decentralized Layer-2 oracle solution, has officially launched on Ethereum Mainnet. The company made this announcement on its blog on Friday.

Umbrella Network is a community-owned Layer-2 oracle network that batches data for providing low-cost, scalable, and secure data. It utilizes the advances in Merkle tree technology to write multiple data points on a single on-chain transaction, making batching data to smart contracts more accurate and cost-effective. Umbrella network believes a community-owned oracle solution is essential to creating a truly decentralized financial system.

Blockchain Oracles Explained

Most blockchains have cryptocurrencies that are used to transfer value and enable the operations of the protocol. Some blockchains also enable Smart contracts.

According to Wikipedia, a smart contract is a computer program or a transaction protocol that is intended to automatically execute, control, or document legally relevant events and actions according to the terms of a contract or an agreement. The objectives of smart contracts are the reduction of need in trusted intermediates, arbitrations, and enforcement costs, fraud losses, as well as the reduction of malicious and accidental exceptions.

Related Reading | DOTOracle – Rendering Decentralized Solutions to Polkadot and its Ecosystem

However, there needs to be a way for blockchains and on-chain smart contracts to make use of external, off-chain data for smart contracts to have any real-world applications.

Ethereum.org clearly defines what an oracle is, the oracle problem, and how decentralized oracles solve it. “An oracle is a bridge between the blockchain and the real world. They act as on-chain APIs you can query to get information into your smart contracts. This could be anything from price information to weather reports. Oracles can also be bi-directional, used to “send” data out to the real world.”

Blockchain (e.g. Ethereum) transactions cannot access off-chain data directly. At the same time, relying on a single source of truth to provide data is insecure and invalidates the decentralization of a smart contract. This is known as the oracle problem.

This oracle problem can be avoided by using a decentralized oracle that pulls from multiple data sources; if one data source is hacked or fails, the smart contract will still function as intended.

Related Reading | Decentralized Oracle Plugin Offers Solution for XinFin’s Smart Contract

Umbrella Network claims its decentralized network is a superior solution to its competitors. It provides comparatively quick and affordable price feeds. It also says that it would make available more data pairs (currently 1,200 data pairs growing to over 10,000 by end of 2021) than any other oracle in the ecosystem.

According to Cointelegraph, the need for reliable data feeds appears to be growing as smart contract technology becomes more mainstream. For example, Brazil’s main stock exchange is exploring ways to provide data inputs for the country’s central bank digital currency (CBDC) project.

Umbrella Network Mainnet Launch On Ethereum

Umbrella Network’s mainnet launch on Ethereum means that it deployed Smart contracts on the Ethereum Blockchain. This means that Ethereum-based dApps can communicate with Umbrella Network code in the live environment — requesting and getting data that is reliable, comprehensive, and cost-effective.

ETH price at $3,431 | Source: ETHUSD on TradingView.com

Speaking on the mainnet launch, founding partner Sam Kim said, “We are absolutely thrilled to be able to achieve this important milestone. We will now be able to serve the needs of the largest DeFi community with our decentralized oracles, and look to address real challenges the community faces when it comes to the high cost, low availability of data offerings in the ecosystem today.”

The company has been busy with acquisitions and new products in recent months. In May, the network launched on Binance Smart Chain (BSC) mainnet. Umbrella network also stated its plans for future cross-chain integration with Polygon, Solana, Cardano, and Avalanche, in the coming months. In the same breath, it mentioned the launch of its in-house developed Token Bridge next week. This enables seamless transfers of $UMB across all supported Blockchains.

Featured image by @UmbNetwork on Twitter, Chart from TradingView.com

Chainlink (LINK) looks for momentum while pro traders target $40

LINK price is struggling to maintain its bullish momentum but derivatives data shows a clear path to $40 in the long term.

Blockstack’s Clarity Smart Contracts Will Source Data From Chainlink Oracles

Blockstack and Algorand’s Clarity smart contracts will source their data from Chainlink’s oracle network.