The Pantera Fund V will invest in a range of blockchain-based assets and is slated for launch in April 2025.

Cryptocurrency Financial News

The Pantera Fund V will invest in a range of blockchain-based assets and is slated for launch in April 2025.

Pantera Capital, a prominent crypto-focused asset manager with assets totaling $5.2 billion, has launched a fundraising campaign to purchase discounted Solana (SOL) tokens from the bankrupt estate of crypto exchange FTX.

According to Bloomberg, the initiative, known as the Pantera Solana Fund, offers investors the opportunity to purchase up to $250 million worth of SOL tokens at a significant discount to the FTX estate.

Pantera Capital’s marketing materials, shared with prospective investors in February and reviewed by Bloomberg, outline the opportunity to purchase SOL tokens at a price 39% below the 30-day average or at a fixed price of $59.95.

However, Bloomberg notes that investors participating in this opportunity must agree to a vesting period of up to four years. This approach reportedly allows FTX liquidators, led by John J. Ray III, to offload SOL tokens gradually, freeing up funds for creditors without exerting immediate downward pressure on the token’s price.

According to Pantera’s pitch document, the FTX estate currently holds approximately 41.1 million SOL tokens, valued at $5.4 billion as of the close of Wednesday’s trading session. This constitutes roughly 10% of the total supply of SOL tokens.

According to its investor pitch, Pantera aimed to close the fund by the end of February. Although the amount raised by the deadline remains undisclosed, sources familiar with the matter confirmed to Bloomberg that Pantera has secured some funds.

Investors interested in participating in the Pantera Solana Fund must commit a minimum of $25 million. Pantera Capital plans to charge a management fee of 0.75% and a performance cut of 10%.

Apart from its substantial SOL token holdings, FTX and its sister firm, Alameda Research, have invested significantly in startups within Solana’s broader ecosystem.

According to Bloomberg, FTX’s venture arm, Solana Ventures, and Lightspeed Venture Partners jointly announced a $100 million blockchain gaming fund in November 2021.

Ultimately, the estate’s intention to sell these tokens presents an opportunity to raise funds to repay creditors, considering the notable surge of SOL’s price in the past year. SOL has experienced a staggering 650% increase, trading nearly four times its price when FTX faced its crisis in November 2022.

SOL, the fifth-largest cryptocurrency by market capitalization, has continued its remarkable upward trajectory and is currently trading at $147.

The token’s price has increased significantly by 14% in the past 24 hours alone, and over the course of 30 days, it has soared by an impressive 56%.

Despite this uptrend, SOL remains 43% below its previous all-time high (ATH) of $259, achieved in November 2021. However, crypto analyst Altcoin Sherpa believes that SOL will break its previous ATH during this market cycle, with the only uncertainty being the size of the break.

Altcoin Sherpa suggests that reaching $500 is highly probable, and an even more astonishing milestone like $1000 is not entirely out of the question. The analyst further emphasizes its confidence in SOL’s potential, stating that it remains one of their more substantial investments. Altcoin Sherpa also highlights the next significant level to watch for SOL, which is $170.

Featured image from Shutterstock, chart from TradingView.com

With two months to go before the U.S. Securities and Exchange Commission (SEC) faces another set of deadlines to decide on a large number of applications to form spot bitcoin exchange traded-funds (ETFs), analysts are speculating on how approval of such vehicles would impact the crypto industry.

The potential approval of a spot Bitcoin ETF in the United States has stirred considerable attention in recent weeks. Dan Morehead, CEO and founder of Pantera Capital, has now shared valuable insights on this matter in his latest “Blockchain Letter”, emphasizing the unique circumstances surrounding this event.

Morehead challenges the traditional Wall Street mantra, “Buy the rumor, sell the news,” questioning its relevance in the current spot ETF context. He reflects on how this adage played out historically, specifically citing the CME Futures launch and Coinbase’s public listing. Both instances exhibited significant price surges in the BTC market before their respective events, followed by steep downturns, aligning with the adage’s prediction.

In his detailed analysis, Morehead recounts how the Bitcoin market rallied dramatically, up to 2,448%, leading up to the CME futures launch. However, this bullish trend abruptly reversed on the very day the futures were listed, marking the start of an 84% decline into a bear market. He parallels this with the Coinbase public listing scenario, where the market again surged, this time by 848%, reaching its peak on the day of Coinbase’s listing, only to be succeeded by a 76% drop.

Morehead, with a touch of humor, notes in his letter, “Will someone please remind me the day before the Bitcoin ETF officially launches? I might want to take some chips off the table.”

However, “this time is different,” states Morehead. Further delving into the potential impact of a spot ETF, he posits that such an ETF would represent a significant step in the adoption. Unlike futures, which he argues were a “step backwards,” the spot ETF could fundamentally change access to BTC, opening up new investor pools and potentially altering the demand function for Bitcoin permanently.

Unlike the previous events of the CME futures and Coinbase listing, which had little real-world impact on Bitcoin accessibility, Morehead believes the spot ETF scenario is fundamentally different. He asserts, “A BlackRock ETF fundamentally changes access to Bitcoin. It will have a huge (positive) impact.” His view is that the ETF will introduce BTC to broader investor classes, significantly altering the investment landscape.

Drawing a parallel with the history of gold ETFs, Morehead suggests that Bitcoin ETFs could similarly revolutionize Bitcoin investment, expanding its appeal and legitimacy. He predicts a substantial shift in the demand dynamics for Bitcoin, akin to how gold ETFs altered the gold market.

In his concluding remarks, Morehead revisits the initial question about the ETF launch being a “sell the news” event. He argues, “Buy the rumor, buy the news.” This phrase encapsulates his belief that, unlike past events, the introduction of a Bitcoin ETF will not lead to a sell-off but will mark the beginning of a new era in Bitcoin investment.

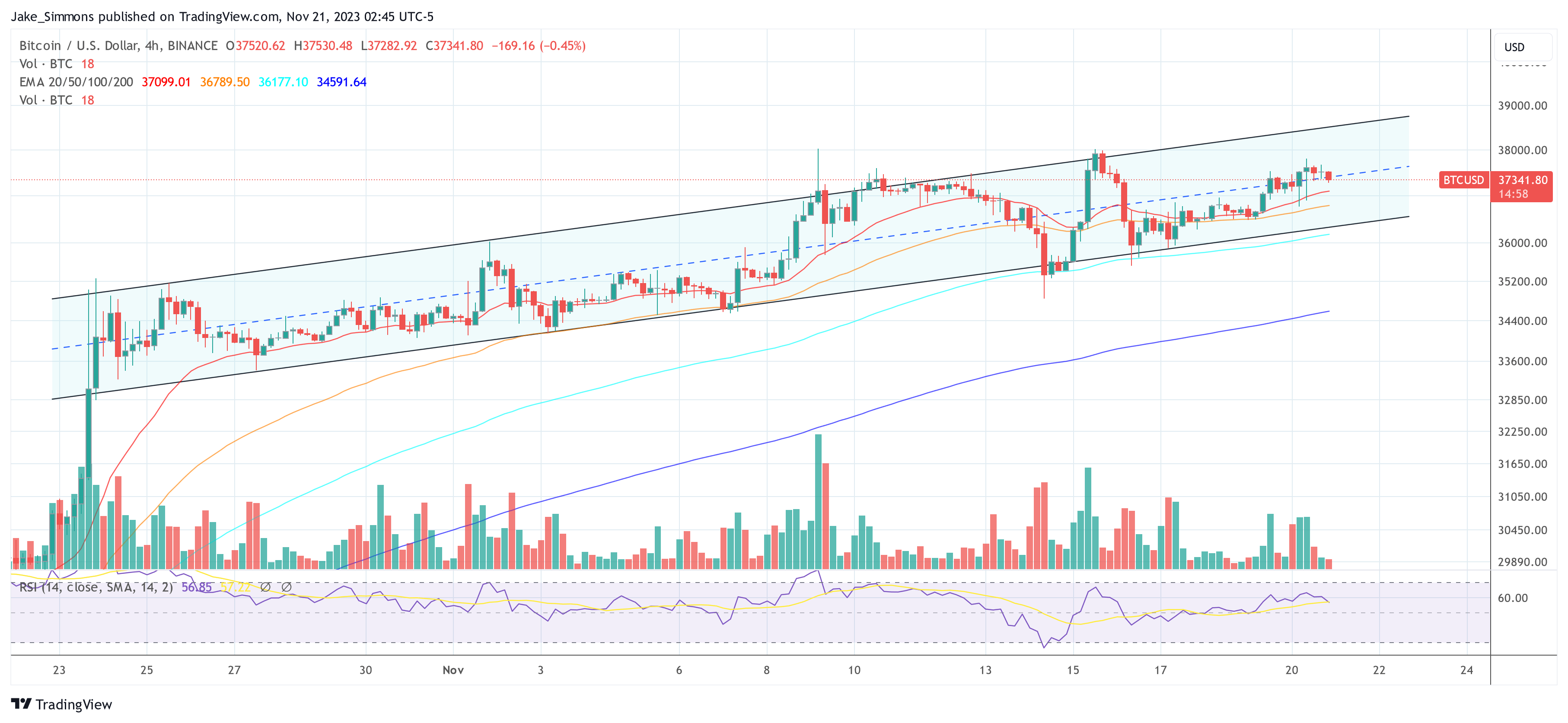

At press time, BTC traded at $37,341.

The funding round was led by Pantera Capital, and included participations from Susquehanna International Group and HashKey Capital.

The median pay globally among 570 engineers surveyed was $120,000, with those in North America getting $193,000, up 1.5% versus the prior year, based on the study.

The investment happens at a time when crypto venture capital has mostly dried up and trading volumes plummeted.

Despite today’s market-wide advance, the outlook for risk assets is pointing to softer prices for the next few weeks, one observer noted.

By one measure, bitcoin’s price performance this cycle is the worst in the asset’s history.

One of the world’s oldest cryptocurrency exchanges, Bitstamp, is trying to scale its operations with new fundraising advised by Galaxy Digital.

Krug has moved from co-CIO at a crypto-focused fund to building a crypto strategy at a generalist venture capital giant.

The funds will be used to develop decentralized infrastructure that enables institutional investors to allocate assets on-chain.

Several U.K. venture capital firms have shown support for SVB UK stating it is a “trusted” partner and plays a “pivotal” role in supporting startups.

A regulatory filing shows the shuttered bank as one of three custodians for Pantera’s funds.

Maverick Protocol said that it developed a novel automated market maker algorithm that offers more customization and higher capital efficiency than top decentralized exchange UniSwap.

The Web3 game allows players to utilize their existing NFT collections as avatars.

This cycle’s Bitcoin and altcoin lows are behind us, Pantera CEO Dan Morehead says as he looks to a “year of rebuilding trust.“

Paul Veradittakit of Pantera Capital believes now could be a good time for new entrepreneurs to enter the crypto space.

Pantera Capital CEO Dan Morehead argued that the FTX collapse has nothing to do with the promise of blockchain technology.

Since the first few months of 2022, Bitcoin and crypto space has maintained a bearish trend, though there were a few spikes to recall. Several markets, including the stock markets, are still facing a crisis. Unfortunately, there are no signs of a reversal in the interim.

Moreover, several investors, financial experts, and institutions still wonder whether or not the market will recover soonest. BTC’s Return on Investment (ROI) is still very high. But it currently shows a -74.96% drop from its all-time high in November 2021.

The bearish price movement of BTC is also visible in the prices of several other altcoins – bringing the broader crypto market cap to approximately 900 billion dollars.

The world’s largest digital coin, Bitcoin, recently recovered the $17K price. However, this positive movement doesn’t guarantee broader market recovery, considering the FTX contagion about a month back.

Bitcoin began the year at around the $50K price and steadily declined. From the market watch, BTC hit its year’s low of $15,700, which can be traced to the FTX crash in November 2022. Experts believe the crypto market may see more falls in the coming year.

The Head of Research at the Standard Chartered bank, Eric Robertsen, announced that the BTC could decline to the $5,000 price mark in 2023. Should this occur, it would be an additional price drop of approximately -70%.

There are chances that more crypto companies will file for bankruptcy in 2023 due to the market’s fall. The analyst believes that such an event will discourage more crypto investors, which would cause them to back out from the market.

Meanwhile, the present look of the crypto market has become a cause for worry to many investors. This particular to the new entrants in 2021, when BTC was at its peak of $68K.

Since the remarkable price growth, market projects have been experiencing back-to-back failures. However, such occurrences lack macroeconomic factors birthed mostly in 2022.

Crypto experts’ price predictions of Bitcoin in 2023 surfaced when the market was still encouraging to investors. However, the bear run in 2022 has shattered all hopes and expectations of the token in 2022 and 2023.

According to the founder of Pantera Capital, Dan Morehead, crypto adoption may alter the dynamics of demand and supply. This is in line with the crypto prediction of certain industry insiders for September 2022, stating that the worst of the crypto market is already out. As a result, the future of BTC is still uncertain.

Meanwhile, Bitcoin stands at $17,016, displaying a 24-hour positive price change. Furthermore, the Fear and Greed index of the token currently shows 26, which implies that investors presently have a fear sentiment.