Veteran investor Stanley Druckenmiller praised Bitcoin for establishing its own “brand” during an interview with hedge fund manager Paul Tudor Jones.

Cryptocurrency Financial News

Veteran investor Stanley Druckenmiller praised Bitcoin for establishing its own “brand” during an interview with hedge fund manager Paul Tudor Jones.

In a recent interview with CNBC, billionaire hedge fund manager and legendary investor Paul Tudor Jones expounded on his bullish stance on Bitcoin amidst mounting global tensions and economic uncertainties.

Jones, an influential figure in the investment world, highlighted the current geopolitical environment as one of the most “threatening and challenging” he has ever witnessed and emphasized the importance of diversifying investment portfolios with assets like Bitcoin and gold.

Jones told CNBC, “I love gold and bitcoin together. I think they probably take on a larger percentage of your portfolio than they would [historically] because we’re going to go through both a challenging political time here in the United States and we’ve obviously got a geopolitical situation.”

Recent global events have exacerbated these sentiments. Over the weekend, the Israeli government launched a military response against Hamas following an attack on Israel, escalating tensions in an already fragile Middle Eastern region. Additionally, Russia’s recent invasion of Ukraine and growing discord between China and the US have further rattled global markets and economies.

In the same breath, Jones remarked on the US’s alarming fiscal position, stating it’s “probably in its weakest fiscal position since World War II.”

Responding to concerns about the potential impact of high interest rates on Bitcoin, Jones delved deeper into the dynamics of gold and market trades preceding a recession. He stipulated, “I think on a relative basis what’s happened to gold, it has been clearly suppressed. But you know that more likely or not we are going into a recession.”

Jones underscored a few hallmarks of recessionary trading environments, indicating, “There are some pretty clear recession trades. The easiest are: the yield curve gets very steep, home premium goes into the backend of the debt market and the 10-year, 30-year, 7-year paper, the stock market typically right before recession declines about 12%.” This decline, according to Jones, is not just plausible but likely to transpire at a certain juncture.

Additionally, he emphasized the prospective bullish market for assets like Bitcoin and gold during economic downturns, stating, “And when you look at the big shorts in gold, more likely or not in a recession, the market is typically very long; assets like Bitcoin and gold.”

Jones further prognosticated a substantial influx into the gold market, speculating, “So there’s probably $40 billion worth of buying coming in gold at some point before now and when that recession actually occurs.” Expressing his asset preference amidst the aforementioned conditions, Jones concisely noted, “So, I like Bitcoin and I like gold right now.”

Jones’s endorsement of Bitcoin isn’t new as the investor had previously championed the digital currency in several interviews, citing its potential as a hedge against inflation and lauding its immutable mathematical properties.

He once remarked, “Bitcoin is math, and math has been around for thousands of years.” By mid-2021, Jones even increased his Bitcoin allocation from 1-2%, labeling it as a “bet on certainty amid uncertain economic conditions.”

Jones’s remarks came at a time when the cryptocurrency saw an approximate 63% increase year to date, making it the best-performing asset in 2023.

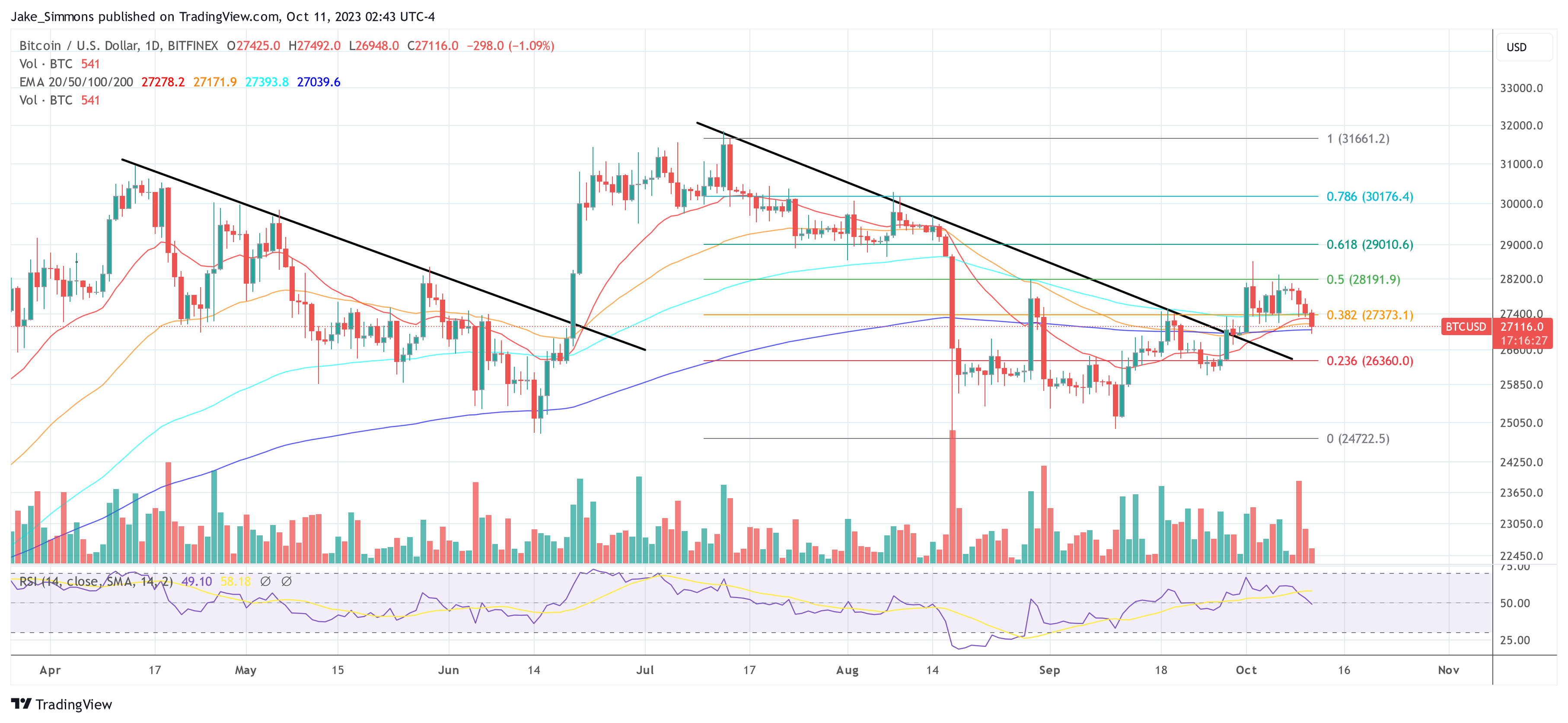

At press time, Bitcoin was trading at $27,116, down roughly 2% over the past 24 hours. Amidst the recent price drop, BTC initially found support at the 200-day EMA (blue line), which the bulls should hold at all costs to avoid further downward momentum.

Jones said the U.S. in moving towards an “untenable fiscal position.”

The Numeraire token (NMR) has surged by 8.8% to $21.64 over the past 24-hours after it was revealed that the hedge fund behind the token returned 20% to investors last year.

With a reported net worth of roughly $7.5 billion, the veteran hedge fund manager said he still has a “very minor allocation” of Bitcoin.

Are hedge funds ready to go all-in on cryptocurrencies? Probably not, but some of them are definitely dipping their toes in. The thing is, those toes are enormous. In the article “Mainstream Hedge Funds Pour Billions of Dollars Into Crypto,” the Wall Street Journal does a deep dive into the phenomenon. And we get a closer look into who’s doing what and who isn’t there yet.

According to Coinbase’s numbers, “institutional investors as a whole traded $1.14 trillion of cryptocurrencies in 2021, up from $120 billion the year before, and more than twice the $535 billion for individual investors.” Those numbers blast past predictions made just nine months ago, which, of course, NewsBTC covered:

“As per Intertrust, the results of the survey indicate that hedge funds plan to increase their crypto assets in the next five years.

An average figure based on the responses shows that by 2026, funds aim to keep $313 billion in digital assets, which is around 7.2% of their total assets.”

Why are they investing so much? And, what are the funds that abstain thinking? That’s what we’re here to find out. Let’s start with a quote from Michael Botlo, who ran Quantbot:

“The crypto universe is now liquid and large enough to be tradable. Hedge funds are seeing their own investors demand that the firms get involved.”

Which Hedge Funds Are In And What Are They Doing?

The latest news point to Brevan Howard Asset Management and Tudor Investment Corp., property of Paul Tudor Jones, who a few months ago said bitcoin is 100% certain. What are these hedge funds doing, exactly? Let’s quote the WSJ:

Ok, great, but, why are those hedge funds going that route? Galaxy Digital Holdings’ Robert Bogucki tells us, “More funds see crypto as a fifth asset class.” And then, proceeds to give us some real alpha into the hedge fund’s strategy:

“One difference from stock trading: Most hedge funds are avoiding shorting cryptocurrencies, says Mr. Bogucki, worried that these currencies might shoot up in price, leading to quick and big losses. Most funds have focused on buying tokens and trading futures, rather than playing options markets, which can be harder to trade though option activity is growing.”

BTC price chart for 03/09/2022 on Bitstamp | Source: BTC/USD on TradingView.com

Why Are The Hedge Funds Going That Route?

The reasons are more cut-throat than people might think. For example:

What About The Naysayers?

Not all hedge funds are on board with cryptocurrencies. The article mentions Elliott Management Corp’s Paul Singer who “has been outspoken in his skepticism of cryptocurrencies”. Also, Citadel’s Ken Griffin. It’s worth noting that Ken Griffin was slamming bitcoin four years ago, but, recently he announced that Citadel Securities will offer cryptocurrency services. As reported by Bitcoinist:

“In an interview with David Rubenstein of Bloomberg Wealth, Griffin mentioned that the current geopolitical conflicts create remarkable downward slips of volatility with the markets.

Concerning digital assets, the Citadel founder had a turnaround in his stance as he revealed the plans of his company stepping into the crypto market this year.”

Ok, but, why are these hedge funds against cryptocurrency investing? The article quotes Squarepoint Capital’s Maxime Fortin saying that “there are significant regulatory hurdles.” Also, Raposa’s Agustin Lebron, who says:

“In many ways, trading crypto is analogous to other trading assets, but there are different kinds of risks. By the time you’re ready to hit the button and trade for real, the crypto world may have moved on.”

So, the crypto ecosystem moves too fast and is not regulated enough for some hedge funds. Got it, but, what about first-mover advantage? Isn’t the opportunity worth the shot?

Featured Image by Hunters Race on Unsplash | Charts by TradingView

The new Bitcoin users graph is a sight to behold. Even though Bitcoin’s price was horizontal for a while there, the network kept growing. And, with each new participant, the network expands infinitely. And, with that, the value of the network increases in the same magnitude. Such is the nature of the “network effect” phenomenon.

That is what this chart by on-chain analyst Will Clemente shows:

The number of new users coming on the Bitcoin network continues to reach new all time highs. pic.twitter.com/yttPlhJBPd

— Will Clemente (@WClementeIII) August 4, 2021

As one of the hosts from the Alt-Coin Daily show said, “The traders control the short-term market.” However, if we’re talking long-term, this is one of the most bullish charts you’re going to see. And, luckily for us, Clemente himself explained the chart’s nuances on said YouTube show.

Related Reading | TA: Bitcoin Regains Strength, Why Bulls Eye Strong Rally above $40K

The Whales Are Distributing Their Coins

According to Investopedia, the Gini coefficient is:

The Gini index, or Gini coefficient, is a measure of the distribution of income across a population developed by the Italian statistician Corrado Gini in 1912. It is often used as a gauge of economic inequality, measuring income distribution or, less commonly, wealth distribution among a population.

Bitcoin’s Gini coefficient is getting healthier and healthier. According to William Clemente, when you filter out ETFs and Grayscale, on-chain analytics show that “over time whales are just distributing their coins.” According to him, entities with less than 10 BTC never stop buying. “Since May 19th, retail has been accumulating more heavily than the whales have.” Each day that passes, Bitcoin’s “healthy distribution of the network” gets better and better.

New Bitcoin Users, A Very Appealing-Looking Chart

According to Clemente, his “very appealing looking chart” shows “the net users growth of the network.” His methodology is simple. He looks for “clusters of addresses that look like one person,” those are the entities. Then, he subtracts “the amount of new entities coming on-chain” from “the entities that look like they’re dormant.” The result is the daily new Bitcoin users.

As the chart clearly shows, we recently achieved an all-time high in new Bitcoin users per day. However, there’s more. According to Clemente, the story is in the “incremental increase between each mayor peak.” At the peak of 2011, 1050 new users came into the network per day. In the two 2013 peaks, the number went from 1500 to about 5000 a day. In 2017’s best moment, Bitcoin was bringing in 40000 new Bitcoin users a day.

Related Reading | Bitcoin Set To Outperform In Second Half Of 2021, Bloomberg Analyst

All of those peaks had a dramatic drop back down. If we look at 2021, in general, it’s a “slow grind higher.” So, “If this is the peak, we haven’t seen this drop-off in new user growth that we had each cycle.” On the contrary, “we just crossed the all-time high of 2017.” If Clemente is right, those new Bitcoin users mean we’re nowhere near the top.

BTC price chart for 08/06/2021 on Bitstamp | Source: BTC/USD on TradingView.com

What Do The Greats Say About Bitcoin’s Users?

The legend states that once upon a time legendary investor Paul Tudor Jones asked Stan Druckenmiller:

“Do you know that when Bitcoin went from $17,000 to $3000 that 86% of the people that owned it at $17,000, never sold it?” Druckenmiller replied: Well, this was huge in my mind. So here’s something w/ a finite supply & 86% of the owners are religious zealots.

Will the new Bitcoin users act the same way when the season of the bear arrives? Only time will tell.

Featured Images by History in HD on Unsplash – Charts by TradingView

The survey results coincide with U.S. inflation climbing to the highest levels since 1992.

Bitcoin tests $40K following positive comments from Tesla’s CEO Elon Musk and hedge fund manager Paul Tudor Jones.

Led by Glenn Hutchins, the new fund has already invested in Dapper Labs and other crypto projects.

The hedge fund manager has 1% to 2% of his multi billion-dollar portfolio in bitcoin.

A recap of an exceptionally bullish week for bitcoin and crypto as a whole.

Jones said he has been surprised by the “intellectual capital” behind bitcoin.

Crypto exchange Coinbase is finally acquiring Tagomi, a prime brokerage platform specializing in digital asset trading for institutional clients.

When a famed macro investor like Paul Tudor Jones invests in Bitcoin, you know it’s a serious play. Next step: central banks buying crypto too.

“We’re watching the birthing of a store of value, and whether that succeeds or not only time will tell,” he told CNBC.

Paul Tudor Jones, a pioneer of the modern hedge fund industry, is reportedly betting on bitcoin’s price as an inflation hedge. Exactly how is unclear.