This week’s Crypto Biz looks at PayPal’s crypto gateway, Franklin Templeton’s BTC ETF filing, Coinbase’s Lightning Network integration, and Meta’s plans for a new AI model.

Cryptocurrency Financial News

This week’s Crypto Biz looks at PayPal’s crypto gateway, Franklin Templeton’s BTC ETF filing, Coinbase’s Lightning Network integration, and Meta’s plans for a new AI model.

In a surprising twist of events, Paxos has come forward to take the blame for the $500,000 Bitcoin fee payment after PayPal was accused of being the party responsible for the exorbitant fee transfer.

Paxos, a New York-based blockchain infrastructure company and the issuer of PayPal USD (PYUSD) and Pax Dollar (USDP), recently admitted responsibility for a substantial $510,000 Bitcoin fee payment, the highest fee ever paid in US dollars for a single Bitcoin transaction.

The story began when several blockchain sleuths noticed the abnormally high Bitcoin network transaction fee of 19.89 BTC attached to a relatively small Bitcoin transfer of 0.074 BTC. Usually, BTC network fees range from $1-$5 and sometimes $50 when network activities are high, so the fee instantly piqued interest.

An analysis by an X (formerly Twitter) user, Mononautical claimed that the entity behind the overly paid Bitcoin fee transaction was PayPal because the address behind the transaction was similar to one tagged as PayPal on OXT, a mobile block explorer for Bitcoin. In light of these rumors, Paxos has come forward to debunk the statement, clarifying that it was indeed an error on their part.

Paxos has stated that the substantial BTC fee was caused by a bug error on the Bitcoin transfer. However, the blockchain infrastructure company has begun making plans to reclaim the lost funds from BTC miners involved in the transfer.

“Paxos overpaid the BTC network fee on Sept. 10, 2023. This only impacted Paxos’ corporate operations. Paxos clients and end users have not been affected and all customer funds are safe,” the blockchain service provider said.

Presently, Bitcoin miners are contemplating refunding the significant Bitcoin network fee paid by Paxos for a 0.074 BTC transfer. The mining company involved in the transfer was Stakefish, a leading validator for proof of stake blockchains.

The CEO and Founder of Stakefish, Chun Wang announced in a post on X that the individual behind the overly paid BTC fee transaction should come forward and reclaim their funds within three days.

Following the announcement, a claim was made after three days, however, Wang has been uncertain about releasing the Bitcoin fee funds. He stated that he felt contrite about giving consent to the reimbursement and asked if he should split the funds between miners and Paxos.

A few members of the crypto community had suggested distributing the funds to miners, while others proposed splitting the funds equally between Paxos and miners. All things considered, the loss of the Bitcoin fee funds has been a huge blow to Paxos, raising concerns about the firm’s security.

The crypto infrastructure provider has also been on the United States Securities and Exchange Commission’s (SEC) radar, for allegedly infringing several investor protection laws in issuing the BUSD stablecoin. Paxos also faces significant regulatory challenges in several regions including Canada and New York.

The account that paid $500,000 to move $2,000 worth of Bitcoin was a Paxos server, the company stated.

The total assets held in PayPal USD custody “meet or exceed the token balance,” with total tokens outstanding amounting to $44.4 million as of Aug. 31, Paxos report states.

PayPal continues expanding its digital asset services, integrating new methods to sell cryptocurrencies like Bitcoin.

The U.S. is far from making any decision on a central bank digital currency (CBDC), said Federal Reserve Vice Chairman Michael Barr, who described the Fed as still being in the “basic research” phase.

Paypal’s Ethereum-based stablecoin PYUSD has failed to capture crypto investors’ interest. According to data from Nansen, 90% of the stablecoin’s total supply still remains with its issuer Paxos’ wallet.

The payment giant Paypal’s recently launched stablecoin PYUSD continues to struggle with adoption and has failed to gain traction since its official launch on August 7, 2023.

Despite PayPal having over 350 million users worldwide, on-chain data from Nansen has shown that only a small percentage of its user base is currently using and holding the PYUSD in self-custody wallets.

“On the surface there’s a lack of demand from crypto users for PYUSD when other alternatives exist,” said Nansen in a report.

However, it is believed that lack of enthusiasm might involve the stablecoin’s lack of utility and not being able to earn interest on the stablecoin, as highlighted by an X (formerly Twitter) user in a post on August 26, 2023.

Problem:

Nobody wants to mint $pyUSD because there’s not much to do with it and it doesn’t pay any interest.

Solution:

– $pyUSD – $crvUSD pool

– $CRV gauge approval from Curve DAO@PayPal@CurveFinance $PYPL #DeFi https://t.co/jVr7sN36KH pic.twitter.com/NUdsKmfY8F

— DefiMoon

(@DefiMoon) August 26, 2023

The stablecoin’s holdings on crypto exchange wallets are also low, accounting for just about 7% of the stablecoin’s total supply. This percentage takes into account the balances on centralized exchanges such as Kraken, Crypto.com, and Gate.io.

Despite the high expectations in the crypto industry following the release of the stablecoin that it would actually promote wider adoption and introduce cryptocurrencies to the masses for the first time, the stablecoin has failed to live up to expectations and smart money investors seem perfectly comfortable to circumvent the stablecoin.

The largest holder of the stablecoin holds less than $10,000 worth of PYUSD after the holder sold about 3 meme coins to purchase the stablecoin. Excluding contracts or exchanges, not more than 10 holders have a balance surpassing $1,000.

According to Coinmarketcap, PYUSD has a total supply of 43 million PYUSD tokens and pools in decentralized exchanges like Uniswap’s PYUSD/USDC and PYUSD/wETH accounts to only 50,000 PYUSD tokens respectively.

The PYUSD tokens have been criticized for being overly centralized, as the majority of its total supply turns out to be stored on centralized exchanges, resulting in difficulty in growing its circulation.

Despite such a high total supply, the collective total number of the stablecoin’s holders according to Etherscan is merely 324 at the time of this writing.

According to JP Morgan analyst Nikolaos Panigirtzoglou, following the first week of Paypal’s stablecoin launch, Ethereum enjoyed no benefit from PYUSD when looking at things such as increased network activity, increased Total Value Locked (TVL), and enhancing Ethereum’s network utility as a stablecoin/DeFi platform.

Crypto experts and enthusiasts have also criticized PayPal for choosing Ethereum for its stablecoin due to the blockchain’s high transaction fees.

Co-founder of Sei Network Jayendra Jog said, “The gas fees of using PYUSD will be ridiculous, which will disincentivize its usage.”

He further added, “To help make the user experience better, PayPal will either need to subsidize transaction costs or will need to help support PYUSD on other networks with cheaper gas fees.”

PayPal’s stablecoin debut raised hopes for broader adoption and an introduction of cryptocurrencies to the masses. Early adoption trends paint a different picture.

The week in blockchain tech: Crypto-fueled social marketplace Friend.tech goes viral on Coinbase’s new Base blockchain, Shiba Inu community’s “Shibarium” network aims for fresh start, and Ethereum experts handicap the competition between leading technologies for layer-2 networks.

Industry experts explain the benefits and disadvantages of PayPal’s PYUSD stablecoin.

This week’s Crypto Biz explores Binance Connect shutdown, BitGo’s funding round, PayPal Crypto Hub, and other news.

In this week’s issue, we cover Coinbase’s launch of “Base,” a layer-2 network atop Ethereum, along with the crypto community’s reaction to PayPal’s new stablecoin and the brouhaha over Matter Labs’ use of Polygon-crafted open-source software. The Protocol is CoinDesk’s weekly newsletter devoted to blockchain and crypto technology.

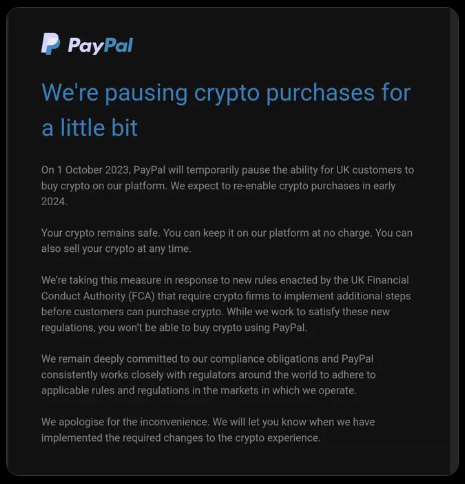

PayPal has announced a temporary suspension of cryptocurrency sales within the United Kingdom for a minimum of three months, commencing on October 1. This decision is in direct response to the recent regulatory reforms introduced by the Financial Conduct Authority, Britain’s financial regulator.

The FCA is set to implement more stringent guidelines aimed at curbing the advertising of cryptocurrencies to British consumers, which includes the mandatory inclusion of risk warnings and the discontinuation of “refer a friend” incentives.

In an email to customers, PayPal UK explained that customers who currently hold cryptocurrency in their PayPal accounts will be able to retain their holdings on the platform without incurring any fees. Furthermore, the option to sell their cryptocurrency at any time will remain available.

PayPal will ‘pause’ crypto purchases in UK

pic.twitter.com/NPkj7F61cC

— Crypto Crib (@Crypto_Crib_) August 16, 2023

However, the ability to purchase cryptocurrencies using PayPal will be temporarily suspended during the company’s efforts to ensure compliance with the new regulations set forth by the FCA.

This move comes against the backdrop of the impending enforcement of the “Travel Rule” in the UK. As of September 1, 2023, all cryptocurrency firms registered under the FCA will be obligated to adhere to the Travel Rule guidelines, a series of crucial Anti-Money Laundering and Know-Your-Customer regulations established by the Financial Action Task Force (FATF).

This mandate was introduced following governmental amendments to relevant legislation in July 2022.

PayPal, which has rapidly solidified its reputation as a crypto-friendly platform, introduced a notable addition to its offerings with the launch of its PayPal USD (PYUSD) stablecoin early this month.

The company originally unveiled its foray into the cryptocurrency realm within the United States in late 2020, positioning itself as a key player in the ever-evolving landscape of financial technology.

As the financial industry grapples with the ongoing integration of cryptocurrencies, PayPal’s response to regulatory changes highlights the evolving nature of the relationship between traditional financial platforms and the burgeoning world of digital currencies.

While the company navigates these challenges, users and industry stakeholders alike are keenly observing how this temporary pause in cryptocurrency sales will shape the future of PayPal’s engagement with the crypto market within the UK.

PayPal’s decision to temporarily suspend cryptocurrency sales in response to new FCA regulations underscores the complex interplay between regulatory developments and the cryptocurrency industry.

As the company strives to align with evolving standards, the trajectory of its cryptocurrency ventures will continue to influence the broader financial landscape.

Featured image from Francois Poirier/Shutterstock.com.

PayPal has taken another step in its crypto mission following a team-up with hardware wallet provider Ledger. This time around, the payments giant is making it possible for users to purchase crypto directly without the need for extra verifications.

On August 16, Ledger and PaPal announced an integration to make buying cryptocurrencies easier. This feature will allow users to purchase crypto using PayPal directly from the Ledger Live app.

Chairman and CEO Pascal Gauthier of Ledger made a statement about integrating Ledger Live with Paypal to make crypto transactions easier.

“Both PayPal and Ledger are focused on creating secure, seamless, and fast transactions no matter where you are in the world. PayPal,” Gauthier said. “We’re combining the uncompromising security of Ledger with PayPal’s leadership in protected payments technology to help facilitate a seamless platform for user crypto transactions.”

Ledger Live’s integration with Paypal currently offers four cryptocurrencies in the US, such as Bitcoin (BTC), Ether (ETH), Bitcoin Cash (BCH), and Litecoin (LTC), and this will allow US residents to be able to purchase these cryptocurrencies with their verified Paypal accounts with no extra verification required.

What makes this integration so interesting is that no “withdrawal” process needs to be initiated by a user. All the crypto purchases made through Paypal via Ledger Live are immediately sent to the user’s wallet, according to the announcement.

Ledger Live’s integration with Paypal is indeed a significant step in the financial tech world, as the two giants share a similar vision of creating fast and seamless transactions on a universal scale.

Ledger is one of the most notable hardware wallet manufacturers, recording over 6 million Ledger Nano hardware wallet sales all around the world since 2016. Also, Ledger launched its Tradelink service in 2023 that will enable “off-exchange trading, enhanced security, distribution of risk, zero transaction fees, and a more efficient and faster trading” for institutional investors.

Paypal’s interest in the crypto world is by no means new. On August 7, Paypal made an announcement to launch its own Ethereum-based stablecoin called PYUSD.

However, nothing was said about PYUSD being listed as one of the coins that will be available on the Ledger Live just yet.

PYUSD’s launch has not been smooth either with regulators calling for more oversight following the launch. Last week, US congresswoman Maxine Waters called for federal oversight and enforcement of PayPal after launching the stablecoin.

PayPal also revealed plans to allow select customers to purchase cryptocurrencies such as Bitcoin and Ethereum using PYUSD. However, amid the new UK regulatory system that will come into play on October 8, Paypal plans to temporarily pause the buying of cryptocurrencies in the country from October 1 to resume crypto services in the Q1 of 2024.

Payments giant PayPal will temporarily pause crypto purchases in the United Kingdom until early 2024, the company said Wednesday, citing new rules by the country’s financial regulator.

Through the new integration, verified PayPal users in the United States will be able to buy BTC, ETH, BCH, and LTC directly through Ledger Live.

Hardware wallet maker Ledger has partnered with payments giant PayPal to allow users to buy crypto in its Ledger Live app through their PayPal accounts, the companies announced Wednesday.

PayPal will temporarily halt crypto purchases in the United Kingdom starting from Oct. 1, 2023, expecting to re-enable the service in early 2024.

Analysts believe spot Bitcoin ETFs, new stablecoin adoption, and an upcoming Ethereum scaling upgrade are among the catalysts that could reignite the crypto markets.