Google’s parent company Alphabet was the worst performer on the day, falling 9.5% in a massive $180 billion wipeout.

Cryptocurrency Financial News

Google’s parent company Alphabet was the worst performer on the day, falling 9.5% in a massive $180 billion wipeout.

The financial world is abuzz with speculations on the resilience of cryptocurrencies amidst potential global financial upheavals and a looming recession in the United States. XRP, with its unique standing, has become the centerpiece of these discussions, following a series of comments and analyses from renowned crypto analyst Egrag Crypto.

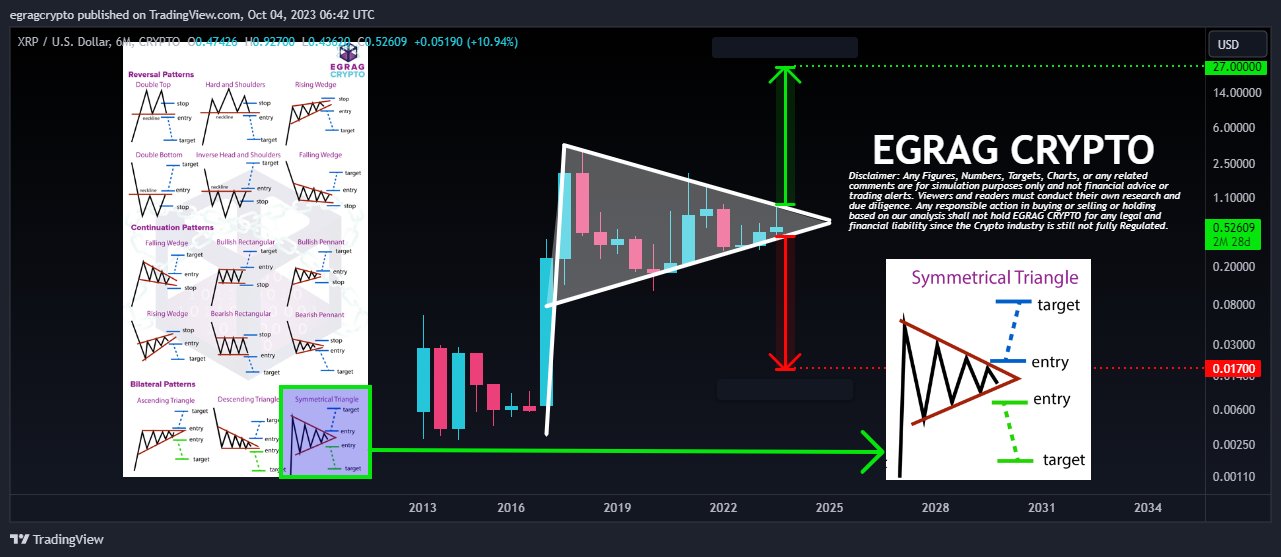

On X (formerly Twitter), Egrag took a comprehensive look at the six-month chart of the XRP price, presenting two scenarios that couldn’t be more different: a crash to $0.017 and a rally to $27.

The analyst emphasized XRP’s pioneering nature due to the remarkable degree of legal clarity it offers, setting it apart from other digital assets. “The current state of XRP offers a remarkable degree of legal clarity, making it a pioneering digital asset in terms of regulatory acknowledgment,” Egrag stated.

This legal acknowledgment, combined with its designed role to simplify cross-border payment solutions, strengthens the case for XRP to potentially rise to a $27 price target, Egrag claims. But his analysis wasn’t purely optimistic. He alerted followers to looming shadows in the broader financial spectrum.

A significant number of technical analysts have forecasted a drastic 40%-50% downturn in global equity and stock markets. Egrag pondered the implications of such a downturn on cryptocurrencies, particularly XRP. He shared the following chart and warned of a potential sharp XRP price crash:

Under such circumstances, a measured move of 0.017c becomes a pertinent consideration. I find myself somewhat perplexed by the dichotomy presented by certain technical analysts who foresee a collapse in traditional markets while advocating for crypto to adhere to its four-year cycle.

He further remarked that “it’s imperative to maintain a consistent and non-contradictory thesis when assessing these scenarios,” highlighting the inconsistency of predicting both a market collapse and a steady crypto four-year cycle.

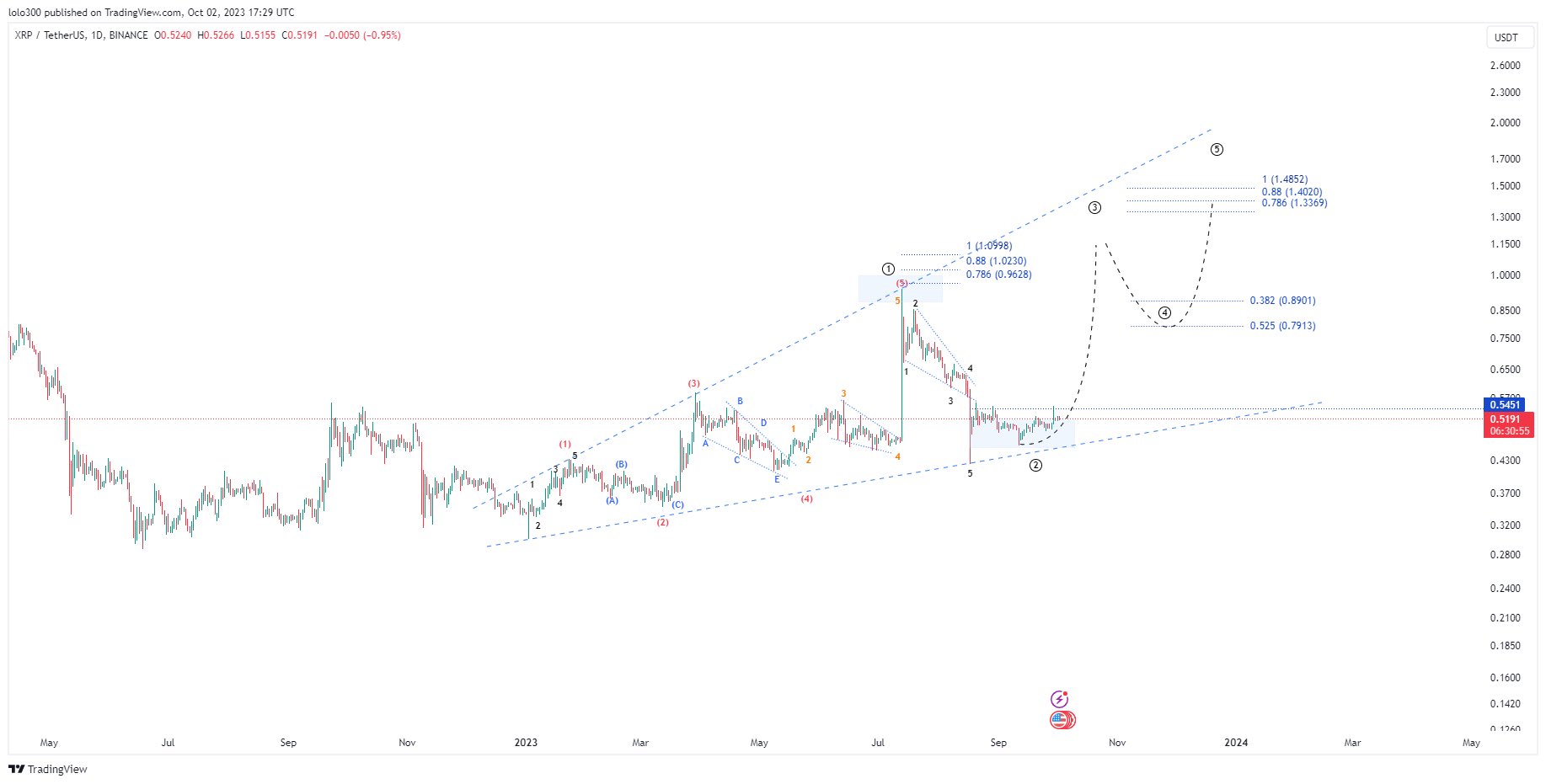

Feedback on Egrag’s analysis was multifaceted. @300Mill300, a prominent voice in the crypto space, extrapolated from Egrag’s initial analysis and offered a chart that was bullish for XRP. He projected a rally to $1.15 by early 2024, followed by a brief retraction to $0.79, and a subsequent bullish surge to reach $1.40 by the close of 2024.

However, the sentiment wasn’t unanimously optimistic. Rainmaker, a crypto aficionado with nearly a decade’s experience, struck a cautionary note. He predicted a pronounced “wash out” preceding each Bitcoin halving event, pushing the XRP price down, possibly to the mid $0.20s.

Responding to this, Egrag showcased his balanced stance. While agreeing with Rainmaker about the potential drag of macroeconomic elements on XRP, he remained bullish about XRP’s intrinsic strengths. He noted, “I think the general macro will drag it down but other than that it is solid like a rock.”

Stepping into the discussion, Analyst Ata Yurt had a different take. He expressed skepticism about XRP achieving the mentioned price points, stating, “At $0.017 there would be no sellers nor buyers… At $27, there will be no buyers either apart from a small group of FOMO orders, majority will FOMO in at $3 or $5 as those are the expected levels considering previous ATH.”

Yurt proposed a more pragmatic approach, suggesting a blend of technical analysis and market psychology. He believes that the $5 mark for XRP is more attainable, urging the community to consider a linear chart for assessment.

Egrag, not one to step back from a discussion, retorted with a thought-provoking question, “Good idea but what if the equity and stock markets crashed 40-50%? Then what?” Yurt countered by estimating the potential fall of Bitcoin in such a scenario, speculating that if Bitcoin were to lag behind and drop by 60%, XRP, in relation to BTC, might settle around the $0.22-$0.25 range, a figure he deemed more realistic than the prediction of Egrag at $0.017.

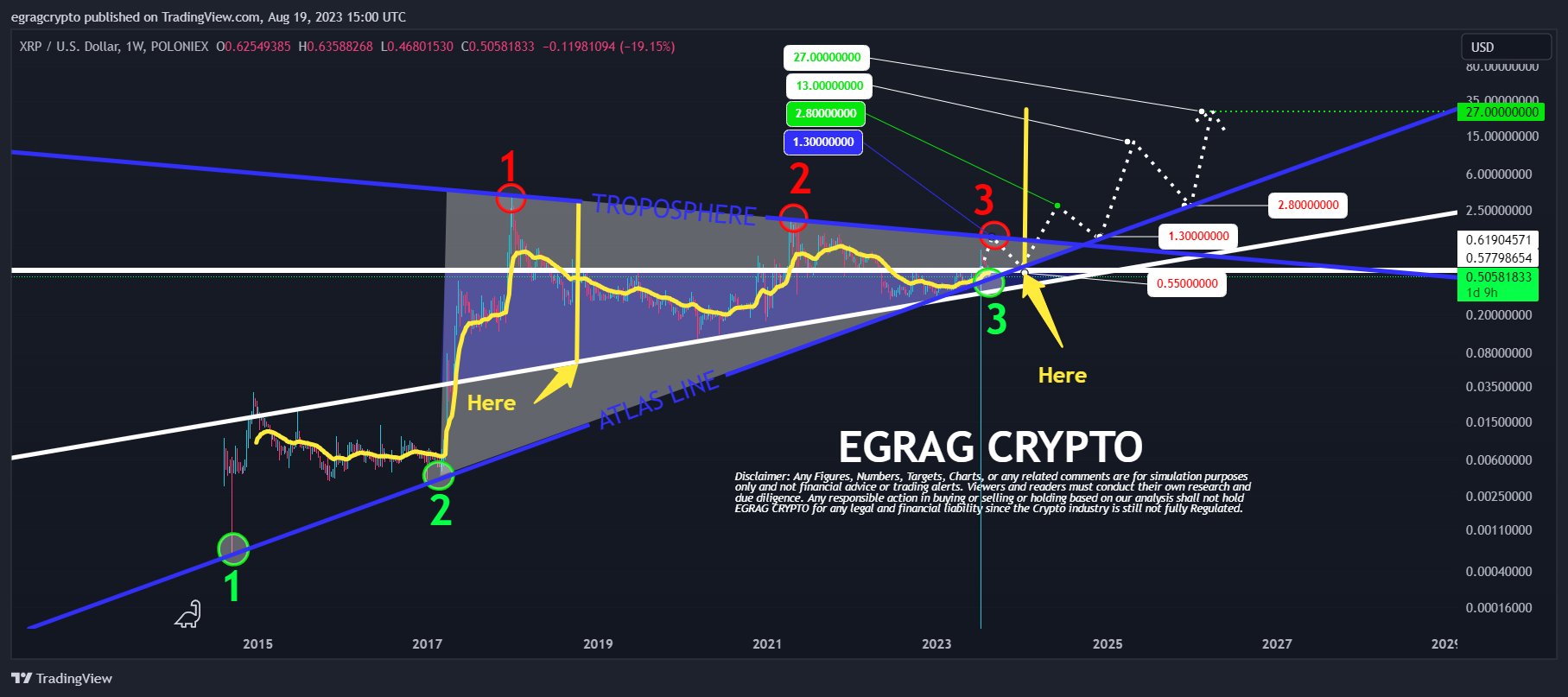

Egrag recently took to social media, highlighting a potential roadmap for XRP’s ambitious journey to $27 through his interpretation of the “XRP ATLAS LINE”.

Egrag predicts a near-term positive momentum that could push XRP into the $1.3-$1.5 zone. However, the digital currency might not stay there long, as he anticipates a dip back to the $0.55 region, a crucial breakout retest. Once this phase passes, he sees a dynamic resurgence propelling XRP to its previous highs of $2.8-$3.0.

But that’s not the ceiling. Egrag envisions a more aggressive leap into the $13-$15 bracket, although he also foresees a significant sell-off around this price point. His analysis then steers back to a reconnection with earlier levels around $2.8-$3.0 before finally culminating at the coveted $27 mark.

At press time, XRP traded at $0.5327.

The S&P 500 dropped to a 110-day low as the market digests what “higher for longer” means for stocks. Will Bitcoin begin to chart its own path?

Concerns over the U.S. dollar’s impact on Bitcoin may be overstated by investors, particularly in the longer term.

The debt ceiling is unlikely to hold as the government faces increased pressure from interest rate payments, a potential catalyst for Bitcoin and cryptocurrencies.

Several macroeconomic indicators suggest that bearish headwinds could strengthen during the remainder of 2023 and possibly negatively impact the crypto market.

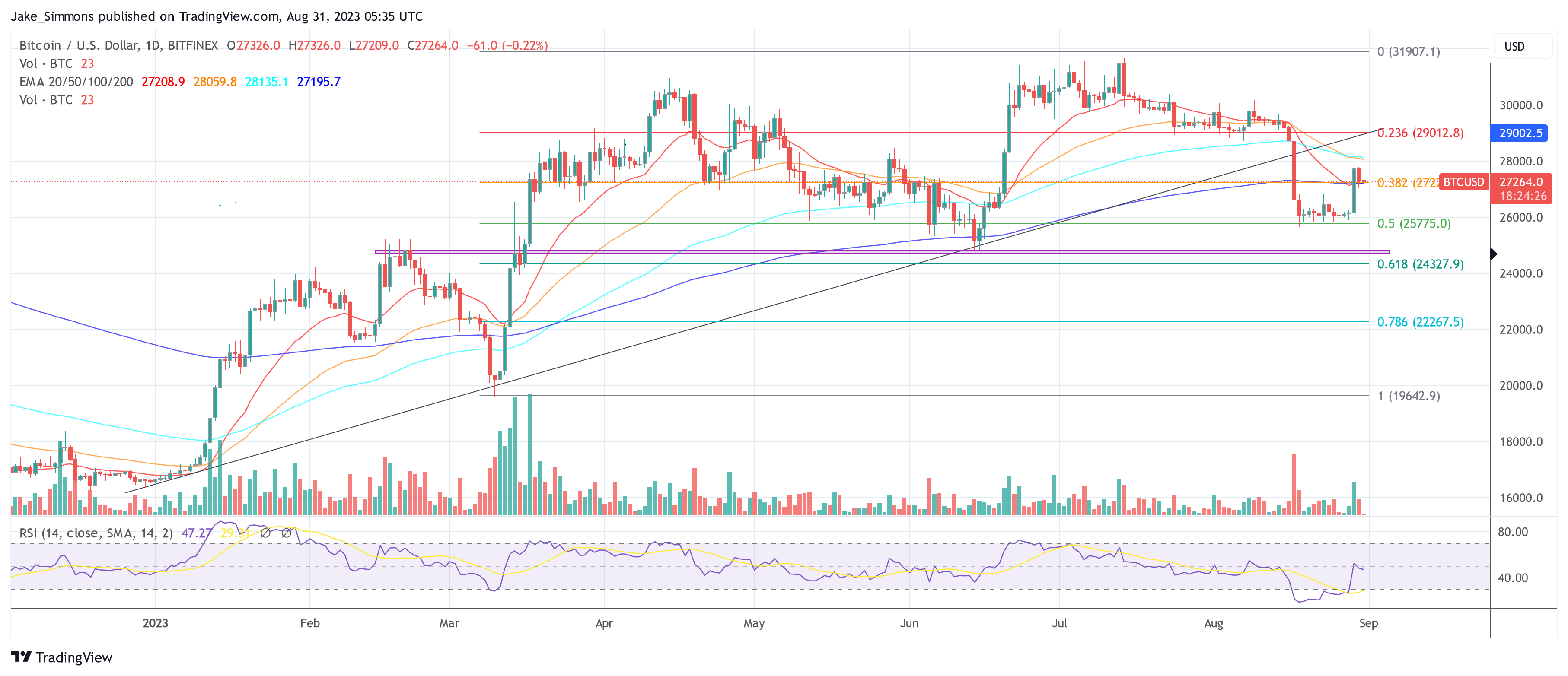

In the intricate dance of global finance, traditional economic indicators and the burgeoning Bitcoin and crypto market are becoming increasingly intertwined. Recent macroeconomic data from the US suggests a cooling economy, and this could have profound implications for Bitcoin and other cryptocurrencies.

Yesterday’s data release paint a clear picture of a slowing US economy:

The cooling US economy, as indicated by the recent macro data, might be setting the stage for a (last) significant surge in BTC and crypto prices before a recession. Why? Because bad news is good news for the currently short-sighted financial world. Bad data means that the US Federal Reserve will not raise interest rates further and that Quantitative Easing (QE) is getting closer. The long-term consequences in the form of a recession are being overlooked.

Joe Consorti, a renowned Bitcoin Layer analyst, highlighted the significant drop in job openings and the slowing job growth in August. He stated, “US job openings are at 8.827 million, the lowest level since September 2021. Worse yet – last month’s data was severely overestimated. Cracks are spreading in the labor market. Rate hikes’ impact finally hitting.”

He further emphasized the paradox of weak economic data driving stock market surges, suggesting, “Bad news is good news right now. Sour data relaxes investor fears of a hawkish Fed – igniting hopes of relaxed policy to support asset prices. I don’t make the rules.”

Michaël van de Poppe delved deeper into the relationship between traditional economic indicators and Bitcoin’s performance. According to him, the most likely case are no more rate hikes as the economic data is coming in terribly, through which Gold, Silver and Bitcoin will be running upwards.

He pointed out the inverse correlation between the Yields markets and Bitcoin, suggesting that as Yields show signs of peaking, Bitcoin could be poised for a surge. “The 2-Year Yields are even more apparent than the 10-Year Yields, indicating a potential top in the making, said van de Poppe.

He explained that the previous top in November of 2018 marked the low on Bitcoin. Afterwards BTC broke down, but the top of the Yields resulted into the bottom of the bear market for Bitcoin. The continuation of the selloff on the Yields resulted in more and more strength on the Bitcoin markets. Van de Poppe added:

The first real high in November of 2022 also marked the low of Bitcoin. And the previous time we started to have a substantial selloff on the markets for Yields (March ’23), the price of Bitcoin started to rally upwards significantly.

Macro analyst Mortensen Bach’s predictions for the next 6-10 months also suggests a potential downturn for the USD, a decrease in rates, and an uptick for both stocks and crypto. According to him, the expansion phase of financial markets is coming to an end. However, there’s one last leg up for markets.

While he believes that the soft landing narrative is nonsense, he warned of the repercussions of the Federal Reserve’s aggressive rate hikes, stating, “FED jacked up rates by 500bp in 12 months, in order to try and manipulate the economy to cool off. This was a big mistake and we will pay the price for it, likely in 2024.”

Crypto trader Daan emphasized the looming recession fears and the potential for rate cuts and increased money printing in the near future. He commented, “Recession fears will be all over the media soon. Bring on the Rate cuts & Money printing! (Not yet but doubt it takes much longer than ~6 months).”

At press time, BTC traded at $27,264.

Bitcoin’s price remains range-bound as equities, gold and U.S. Treasurys offer competitive rates with reduced risk. This week’s CPI report could shake things up.

Analysts have called for a U.S. recession all year, but stocks continue to creep higher. Here are three metrics investors can watch to know if an economic downturn is coming.

Arguably the most important takeaway from yesterday’s FOMC meeting was that the U.S. Federal Reserve (Fed) is no longer forecasting a recession, which led to a cautious rally in Bitcoin and crypto markets today. Fed Chairman Jerome Powell’s statement during the FOMC press conference seems to have eased investor concerns, leading to a swift recovery in both tradfi and crypto. However, historical data suggests that caution may be warranted as the potential for recession remains a looming concern (although Powell said otherwise).

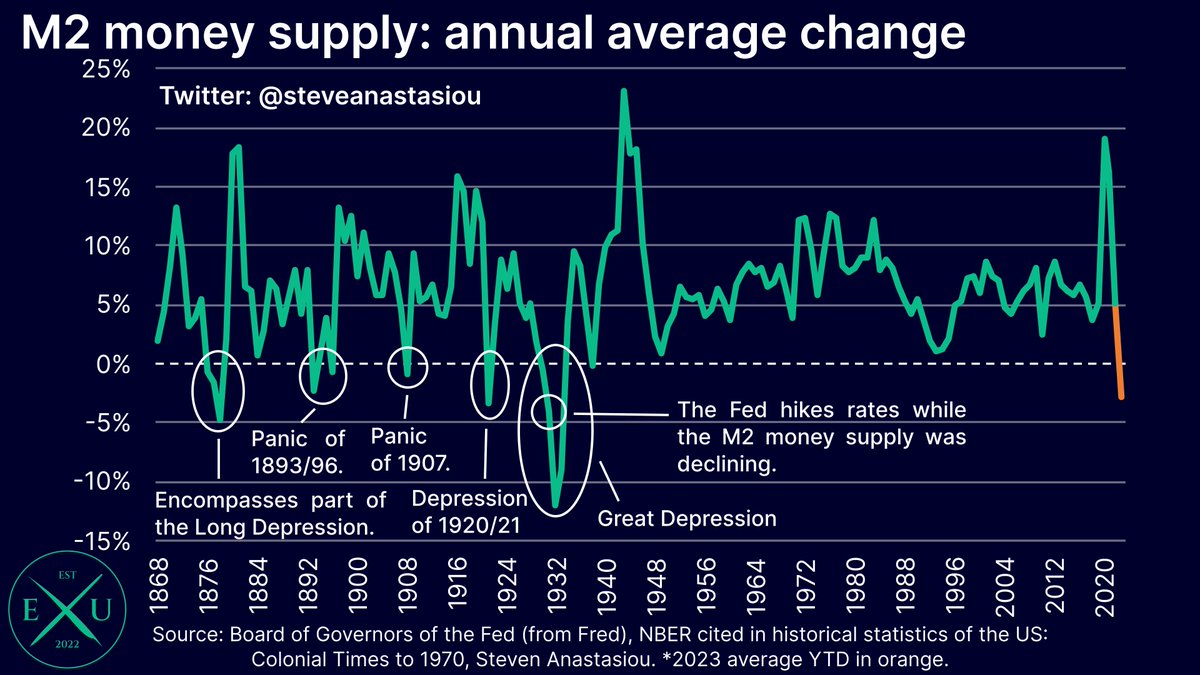

Prominent financial experts have raised their voices about the current economic situation. Steven Anastasiou, a noted economist, warns about the significance of the recent decline in the annual average M2 growth, which stands at -2.7% YoY. He draws parallels with some of the most challenging economic periods in history, stating, “With M2 falling, history suggests that continuing with aggressive tightening is a dangerous proposition… a falling M2 money supply has generally been correlated with economic depressions & panics.”

Anastasiou also highlights the deflationary pressures in the economy, as reflected by the 12 consecutive monthly declines in the US Consumer Price Index (CPI) growth rate. Drawing parallels to a deflationary bust seen in 1920-21, he emphasizes that “now is not the time to be delivering any additional tightening.” As we know, Powell did the opposite yesterday, raising the federal funds rate to a level not seen in 22 years.

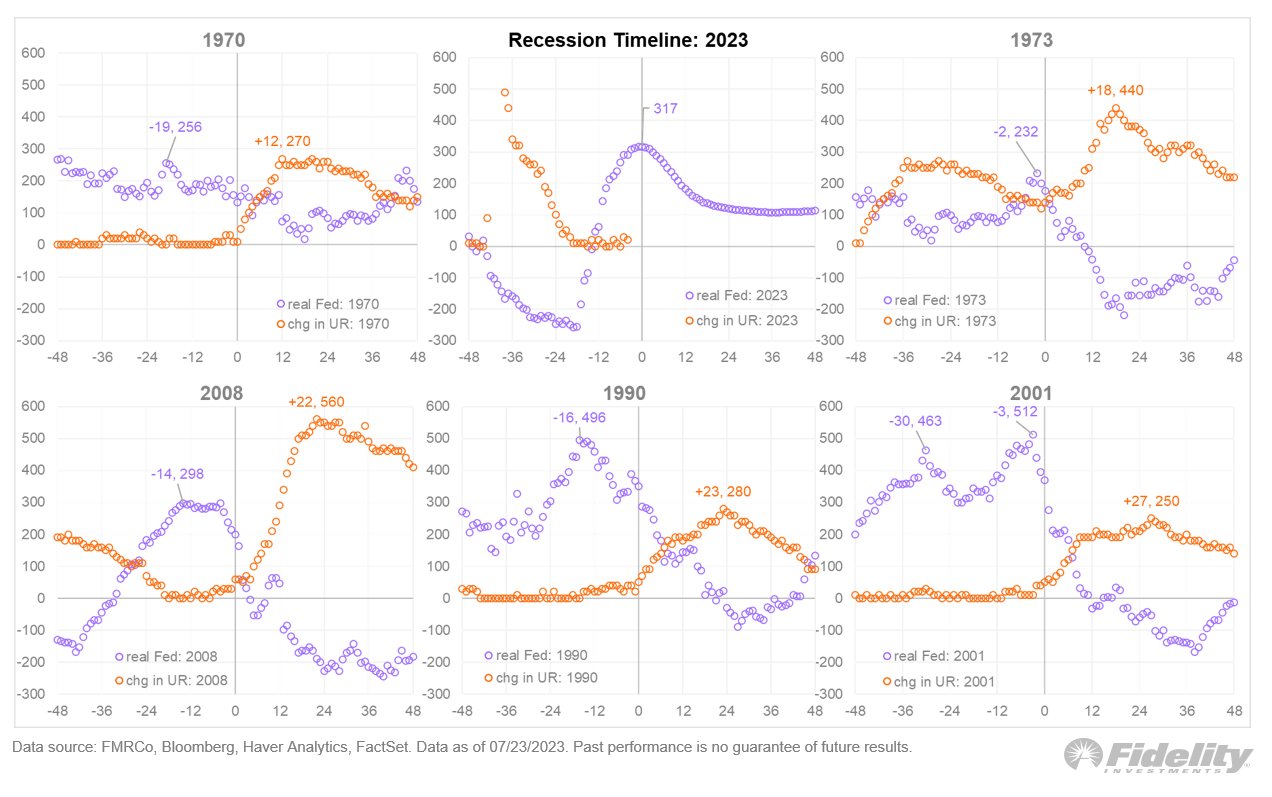

Jurrien Timmer, director of global macro at financial giant Fidelity, shared insights from historical data on recessions. He notes that the lead times between changes in monetary policy and the subsequent economic consequences can vary significantly. Looking at past cycles, he observes, “The monetary policy cycle tends to lead the economic consequences to varying degrees.” The lead time ranged from 2 months to as much as 19 months, depending on the economic circumstances.

During the 1970 cycle (when structural inflation was getting underway and the Nifty Fifty was born), “peak policy” led the recession by 19 months. In 1973-74, it was only 2 months. In 1990, (the S&L crisis), it was 16 months. In 2001, (tech bubble) it was 3 months, and in 2008 (GFC) it was 14 months.

Another warning signal is the inverted yield curve, known for reliably foreshadowing economic recessions. The inverted yield curve is currently hitting levels unseen in over 40 years (since 1981), screaming recession. Gold bug Peter Schiff therefore remarked:

The talking heads on CNBC all agree that if the U.S. enters recession, it will be a baby recession. Not only is recession a certainty, but it won’t be a baby. It will be the grand daddy of recessions. It will be so large that a more appropriate term to use will be a depression!

Amidst these economic concerns, the crypto is writing green numbers across the board. However, a recession is meaning uncertainty for Bitcoin. Unlike traditional assets, Bitcoin has not experienced a recession, leaving investors uncertain about its resilience in times of economic turbulence. While some tout Bitcoin’s “safe haven” potential, others argue that it might behave more like a risk asset, making it less attractive during a recession.

Macro analyst Henrik Zeberg and the founders of Glassnode, Yann Alleman and Jan Happel, believe that “we are going to have the largest Crisis since 1929. First Deflation – later Stagflation. But first – #BlowOffTop”. In this scenario stocks, Bitcoin and crypto could rally hard before a recession “suddenly” hits the market.

However, no one knows how the economy will react this time. Therefore, the coming two months and their macro data (CPI, PCE, jobs, unemployment rate, earning, etc.) will be indicators for Bitcoin and crypto investors to follow (just as J-Pow tirelessly repeated yesterday – “data dependency”).

At press time, the Bitcoin price continued its slow grind up, trading at $29,523.

Bitcoin’s price is following in XRP’s footsteps by rallying close to $32,000, but the price could pull back in the face of this week’s $720 million options expiry.

Chris Maurice, founder and CEO of crypto exchange Yellow Card said in Africa, crypto isn’t the “casino” that it can sometimes feel like in the West.

Chris Maurice, founder and CEO of crypto exchange Yellow Card said in Africa, crypto isn’t the “casino” that it can sometimes feel like in the West.

BTC’s price recovered quickly from this week’s swing low, but derivatives data hints that a challenging road lies ahead.

The latest slide of Bitcoin below the $27,000 level has caught the attention of investors who are now keeping a close eye on the debt ceiling negotiations in Washington.

With US Treasury Secretary Janet Yellen issuing warnings that the US is projected to breach the debt limit as early as June 1, the stakes have been raised significantly for both the financial markets and the cryptocurrency industry.

However, while the threat of a default looms large, investors are suggesting that Bitcoin may be poised for a potential rebound if a resolution to the debt ceiling issue is reached.

Bitcoin’s struggle to maintain its value has continued, with the cryptocurrency experiencing a 24-hour loss of nearly a percent, currently trading at $26,863 on CoinGecko. Furthermore, its seven-day decline of 2.7% reflects a persistent bearish trend in the market that has many investors concerned.

One factor that has contributed to the low liquidity in crypto markets is regulatory uncertainty. Market makers Jane Street and Jump Crypto have recently retreated from crypto trading in the US, citing concerns over regulatory challenges. This has added to the already existing concerns surrounding the lack of regulation in the crypto industry, which has made investors wary of entering the market.

According to a report by crypto data firm Kaiko, Bitcoin’s 1% market depth – a measure of liquidity conditions – has dropped by 4% over the past month, while Ethereum’s has fallen by 2%. Altcoin liquidity has suffered even more, with a roughly 17% decline on a monthly basis.

This low liquidity has made it difficult for traders to execute large orders without experiencing significant price slippage, further contributing to the bearish trend in the market. As such, investors are closely watching developments in the regulatory landscape to determine if a more favorable environment for crypto trading can be established.

The recent struggles of Bitcoin’s value, combined with concerns over low liquidity in the crypto market, have left investors cautiously watching for potential signals of a market turnaround. While the bearish trend persists, investors believe that Bitcoin may have the potential for a rebound, contingent upon a resolution to the ongoing debt ceiling issue.

Historically, Bitcoin has been regarded as a hedge against inflation and economic uncertainty, attracting investors seeking alternative assets. During times of market distress, Bitcoin has exhibited resilience and even demonstrated a tendency to rally.

Analysts point to previous instances such as the 2008 financial crisis and the recent pandemic-induced market crash, where Bitcoin experienced upward surges amidst the chaos.

The outcome of the debt ceiling negotiations holds significant implications for the cryptocurrency industry. A resolution that addresses the concerns surrounding the debt ceiling and ensures the stability of the US economy could restore investor confidence, potentially leading to increased demand for Bitcoin and other digital assets.

-Featured image from ShareAmerica

Bitcoin price giving up ground over the past week to slide below $28,000 has put bears in a better position for Friday’s expiry.

Another top 20 U.S. bank bites the dust, but Ether’s price fails to benefit from the event.

A political deadlock over the U.S. debt ceiling and its potential impact on the price of Bitcoin, which is already up 75% in 2023.

Will $30,000 BTC price hold? Bitcoin market structure remains bullish with another 10% gain on the table as sellers refrain from shorting.

BTC price continues to show strength and derivatives data suggests that bulls intend to press Bitcoin higher.