Retail engagement materially accelerated in the first quarter, the report said.

Crypto Market’s ‘Monster Cycle’: $7.5 Trillion Market Value By 2025, Bitcoin Targets $150,000

In a recent Bloomberg report, it has been revealed that the market value of crypto assets is expected to witness a remarkable surge, nearly tripling to $7.5 trillion by 2025.

Wall Street Firm Predicts “Monster Of A Crypto Cycle”

The next few years are likely to usher in a “monster of a crypto cycle,” according to Wall Street research firm Bernstein. In addition, Bernstein analysts have an “outperform” rating on the stock as they initiate coverage of online brokerage Robinhood Markets.

Analyst Gautam Chhugani believes investors should take advantage of the opportunity to ride the “crypto comeback arc,” envisioning a “ninefold increase” in Robinhood’s crypto trading volume over the next two years.

Chhugani expressed his confidence in Robinhood’s prospects, stating that now is the opportune time to enter the market with an 18-24 month window to capitalize on the crypto resurgence. Assigning a price target of $30 to the stock, Chhugani’s price target is currently the highest among analysts tracked by Bloomberg.

Following the publication of positive February operating data, which included increases in assets under custody and surging trade volume, Robinhood shares surged as much as 12% in New York trading, reaching the highest intraday level since December 2021.

So far this year, the stock has gained over 40%. However, Wall Street remains cautious about its outlook, with six analysts rating the stock as a buy, ten suggesting a hold, and three recommending selling.

With the anticipated growth of crypto assets from $2.6 trillion to $7.5 trillion, the largest digital currency, Bitcoin, is set to become a $3 trillion asset by 2025. According to Chhugani, this surge is expected to be fueled by the “unprecedented success” of exchange-traded funds (ETFs) tied to the cryptocurrency.

Additionally, Chhugani predicts that Bitcoin will reach a high of $150,000 next year. He emphasized the ongoing institutional adoption of cryptocurrencies and expressed expectations for the continued success of the Bitcoin ETF and the potential launch of an Ethereum ETF within the next 12 months.

Robinhood Positioned For Success

In the context of Robinhood, Chhugani highlighted the company’s “full suite crypto offering within a regulated broker platform,” which positions it favorably. Bloomberg notes that traditional broker platforms, such as Charles Schwab Corp., have been more hesitant in offering cryptocurrency services.

Summing up his bullish stance, Chhugani stated:

In short, we are bullish on crypto, and we believe Robinhood’s crypto business resurgence will restore its fortunes with investors.

The projected exponential growth of the cryptocurrency market and the optimistic outlook for Robinhood’s crypto business have captured the attention of market observers. With the increasing mainstream acceptance and institutional adoption of digital assets, the next few years hold significant potential for investors and market participants alike.

Featured image from Shutterstock, chart from TradingView.com

Robinhood Shares Jump in Premarket Trading After Blowout February Activity Levels

Crypto trading volume grew 10% month-on-month to $6.5 billion, the company said.

Robinhood to Benefit From ‘Monster’ Crypto Cycle, Initiated Outperform by Bernstein

Total crypto market cap is expected to reach $7.5 trillion by 2025 from $2.6 trillion today, the report said.

Trading Platform Robinhood, Layer-2 Arbitrum Team Up To Offer Swaps To Users

Users of Robinhood’s self-custody wallet will have access to Arbitrum swaps in the next coming months.

Robinhood Cash Surge: Sees $4 Billion Monthly Inflow From Users

Robinhood, a significant player in the United States financial technology sector, has recorded major growth. The platform has seen a notable rise in monthly user inflow.

Robinhood Monthly Deposits Surges To New Height

A correspondent at CNBC, Kate Rooney, recently shared the development with the crypto community on the X (formerly Twitter) platform. The CNBC reporter said Robinhood recorded increased profits in its most recent quarterly results.

Rooney pointed out that the platform is making some headway in its attempt to overtake established “brokerage companies” for market dominance. Additionally, Robinhood aims to expand beyond its “original base of inexperienced and younger traders” in the crypto market.

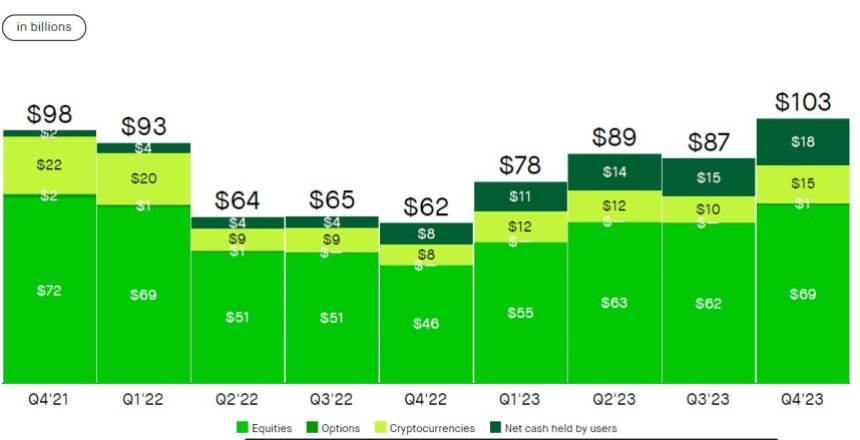

She further highlighted that over $100 billion of the firm’s assets are currently “under custody.” In addition, a “net positive transfer from every major brokerage competitor” drove the Q4 deposits to approximately $4.6 billion.

Consequently, this suggests its increasing popularity among investors looking to include digital assets in their portfolios for diversification. It also indicates the growing confidence and inclination toward the trading firm among crypto investors.

The CNBC correspondent asserted that the numbers above consist of an “average customer transfer balance” of $100,000.

As per Rooney’s X post, Robinhood saw a substantial rise in monthly deposits valued at $4 billion in January. So far, the recent uptick signifies the online trading platform’s strongest month since early 2021.

During the same quarter last year, the trading platform lost $166 million, or $0.19 per share. However, this year, it made a profit of $30 million, or $0.3 per share.

As was revealed, Robinhood’s income rose due to increased net interest and transaction-based and other revenue streams. Over the three months, its net interest income grew by 4% to $236 million.

Taking Over The Active Trader Market

Vlad Tenev, Robinhood’s Chief Executive Officer (CEO), has revealed Robinhood’s intentions to take over the active trader market. Tenev recently disclosed this objective during a quarterly earnings call.

He stated that the firm’s user base and revenue have grown “nearly seven times” in the past four years. “looking at what is in front of us, we are excited by the opportunity to continue growing significantly from here,” he added.

Robinhood has gained market share and attracted net asset inflows from its major rivals. According to Tenev, the company will continuously invest in its “user experience on mobile” to achieve its goal.

Currently, the crypto enterprise stands out as the dominant player in market share. Tenev has confirmed the addition of futures and index options to the platform in the coming months of this year.

Robinhood’s Higher Crypto Revenue Could be Positive for Coinbase Earnings

The shares of the popular trading platform rose 15% after beating earnings and revenue estimates.

MetaMask Deal With Robinhood Broadens Crypto Access

On-ramps like the one used in this partnership are a key piece of infrastructure serving as a bridge between traditional banking rails and blockchain-based crypto economy.

Robinhood Broadens Crypto Service to Europe, Notes Region’s Digital Asset Regulation

The company said it chose Europe to anchor its crypto expansion outside the U.S. because of the region’s comprehensive rules.

Robinhood launches crypto trading services in Europe

All eligible customers in the EU region can access Robinhood for crypto trading services, with over 25 cryptocurrencies available for trade.

Robinhood crypto trading rises 75% in Nov, CEO tips ‘9 figures' in revenue

The trading platform posted a sharp rise in monthly crypto trading volumes in November, while CEO Vlad Tenev said he hopes to eventually reel in “nine figures” in annual revenue.

300 Million Dogecoin (DOGE) Moved To Robinhood As Price Swells

The Meme-based cryptocurrency Dogecoin (DOGE) has recently experienced a significant increase in whale transactions during an improvement in the crypto asset’s price.

300 Million Dogecoin (DOGE) Dumped In Crypto Exchange

Data from the on-chain crypto tracker Whale Alert recently revealed that a massive amount of Dogecoin (DOGE) was transferred to Robinhood. This whale transaction has attracted the interest of traders and investors in the larger cryptocurrency space.

According to the crypto tracker, the transfer was orchestrated by an unknown wallet address earlier today. The wallet address identified as DDuXG.ruc1wwKF sent about 300 million DOGE to the cryptocurrency trading platform Robinhood.

The post read:

300,000,000 #DOGE (25,033,123 USD) transferred from unknown wallet to #Robinhood.

With the current price of Dogecoin, the whale transaction is valued at approximately $25 million. The whale moved the substantial Dogecoin haul to Robinhood for a comparatively low network cost of just $0.18. This is most likely by taking advantage of times when fees and congestion were low.

The transfer of DOGE to Robinhood suggests that the whale is looking to sell the tokens, igniting speculation in the larger cryptocurrency market. However, it seems that the meme-based cryptocurrency’s price increase runs counter to the tokens being dumped on exchanges.

Currently, the price of DOGE is sitting at $0.0839, indicating an over 2% increase in price in the past 24 hours. Meanwhile, its market capitalization is also reflecting the same percentage rise at $11.9 billion, according to CoinMarketCap.

A similar whale transaction was also flagged by the on-chain tracker recently. In October, a similar transaction of 300 million DOGE tokens occurred thrice, while last month also saw a similar transaction twice.

Large-scale individual transactions usually come with the danger of crashes due to fast liquidations or market manipulation. However, there is no solid evidence that the whale transaction had any impact on the token’s price.

The Crypto Asset’s Holders Increases Significantly

Dogecoin has shown a significant uptick in its total number of holders lately. Analytics firm IntoTheBlock revealed that the total number of addresses holding a balance exceeded 5 million this week, and reached a high of 5.02 million on November 27. A major factor contributing to the rise in new Dogecoin addresses is the cryptocurrency’s increasing adoption and interest.

The on-chain analytics firm also revealed that the numbers have been increasing gradually since the start of the year. “This recent activity is most likely driven by Dogecoin “Doginals”, which don’t require a significant on-chain balance of $DOGE,” IntoTheBlock said.

DOGE trading at $0.0833 on the 1D chart | Source: DOGEUSDT on Tradingview.com

Robinhood (HOOD) Extends Trading Services To The UK

Robinhood, a major player in the United States financial technology industry is set to stretch out its trading services in the United Kingdom for the purpose of growing its business globally.

Robinhood To Offer US Stock Trading In the UK

Co-founder and Chief Executive Officer (CEO) of Robinhood Vladimir Tenev confirmed the expansion toward the UK sector in an interview with Bloomberg. According to the CEO, the expansion aims to bring the US stocks into the UK market.

The CEO stated:

The intention is, for the U.K. market, Robinhood to be the best place to invest U.S. stocks, U.S. dollars, and we believe we can fill that need better than anyone else.

Tenev noted that the company plans to gradually extend its platform to all users in the United Kingdom in early 2024. With the launch, consumers in the UK market will be able to trade 6,000 equities in the US market.

The CEO further asserted that a waitlist has been made available to people who wish to gain early assess to the app. Furthermore, the platform’s launch in the UK is under the Financial Conduct Authority (FCA) regulation.

Additionally, the platform offers users features like a five percent interest, and can change their uninvested funds from pounds to dollars. These offers aim to attract a larger range of investors, particularly those with little financial resources.

Robinhood’s expansion sparks wider growth for its business globally. The CEO explained, “I aspire for Robinhood to be a global company. That’s been the plan from the very beginning. Baiju and I started this company as immigrants and children of immigrants, and so, the idea of making our services […] available to anyone in the world is just the vision that I had in mind from the very beginning.”

The company’s entry into the UK market also puts it in direct competition with national and international companies. These include companies like Public.com, based in New York, Revolut, and Freetrade, among others.

Zero – Fee Trading Initiative

The CEO also underscored the platform’s commitment to offering Zero-Fee trading and accessible trading alternatives for UK users. This initiative is similar to the effective charge reduction strategy that was put in place in the US before the epidemic.

Notably, Robinhood does not demand any commission fee for buying and selling stocks on the platform. Due to this, individuals can start creating their investment portfolios with a minimum of one US dollar (79p).

Tenev explained:

So we are launching imminently to the initial set of customers in the UK, and what we are launching is a commission-free share trading of US stocks.

With its zero-fee trading strategy, the platform’s introduction into the UK market will completely change how average investors interact with the stock market.

Also, with its focus on technology and user-centric features, the platform is poised to impact the current market. It will also bring fresh energy to the UK investment landscape.

Robinhood (HOOD) Extends Trading Services To The UK

Robinhood, a major player in the United States financial technology industry is set to stretch out its trading services in the United Kingdom for the purpose of growing its business globally.

Robinhood To Offer US Stock Trading In the UK

Co-founder and Chief Executive Officer (CEO) of Robinhood Vladimir Tenev confirmed the expansion toward the UK sector in an interview with Bloomberg. According to the CEO, the expansion aims to bring the US stocks into the UK market.

The CEO stated:

The intention is, for the U.K. market, Robinhood to be the best place to invest U.S. stocks, U.S. dollars, and we believe we can fill that need better than anyone else.

Tenev noted that the company plans to gradually extend its platform to all users in the United Kingdom in early 2024. With the launch, consumers in the UK market will be able to trade 6,000 equities in the US market.

The CEO further asserted that a waitlist has been made available to people who wish to gain early assess to the app. Furthermore, the platform’s launch in the UK is under the Financial Conduct Authority (FCA) regulation.

Additionally, the platform offers users features like a five percent interest, and can change their uninvested funds from pounds to dollars. These offers aim to attract a larger range of investors, particularly those with little financial resources.

Robinhood’s expansion sparks wider growth for its business globally. The CEO explained, “I aspire for Robinhood to be a global company. That’s been the plan from the very beginning. Baiju and I started this company as immigrants and children of immigrants, and so, the idea of making our services […] available to anyone in the world is just the vision that I had in mind from the very beginning.”

The company’s entry into the UK market also puts it in direct competition with national and international companies. These include companies like Public.com, based in New York, Revolut, and Freetrade, among others.

Zero – Fee Trading Initiative

The CEO also underscored the platform’s commitment to offering Zero-Fee trading and accessible trading alternatives for UK users. This initiative is similar to the effective charge reduction strategy that was put in place in the US before the epidemic.

Notably, Robinhood does not demand any commission fee for buying and selling stocks on the platform. Due to this, individuals can start creating their investment portfolios with a minimum of one US dollar (79p).

Tenev explained:

So we are launching imminently to the initial set of customers in the UK, and what we are launching is a commission-free share trading of US stocks.

With its zero-fee trading strategy, the platform’s introduction into the UK market will completely change how average investors interact with the stock market.

Also, with its focus on technology and user-centric features, the platform is poised to impact the current market. It will also bring fresh energy to the UK investment landscape.

Robinhood (HOOD) Extends Trading Services To The UK

Robinhood, a major player in the United States financial technology industry is set to stretch out its trading services in the United Kingdom for the purpose of growing its business globally.

Robinhood To Offer US Stock Trading In the UK

Co-founder and Chief Executive Officer (CEO) of Robinhood Vladimir Tenev confirmed the expansion toward the UK sector in an interview with Bloomberg. According to the CEO, the expansion aims to bring the US stocks into the UK market.

The CEO stated:

The intention is, for the U.K. market, Robinhood to be the best place to invest U.S. stocks, U.S. dollars, and we believe we can fill that need better than anyone else.

Tenev noted that the company plans to gradually extend its platform to all users in the United Kingdom in early 2024. With the launch, consumers in the UK market will be able to trade 6,000 equities in the US market.

The CEO further asserted that a waitlist has been made available to people who wish to gain early assess to the app. Furthermore, the platform’s launch in the UK is under the Financial Conduct Authority (FCA) regulation.

Additionally, the platform offers users features like a five percent interest, and can change their uninvested funds from pounds to dollars. These offers aim to attract a larger range of investors, particularly those with little financial resources.

Robinhood’s expansion sparks wider growth for its business globally. The CEO explained, “I aspire for Robinhood to be a global company. That’s been the plan from the very beginning. Baiju and I started this company as immigrants and children of immigrants, and so, the idea of making our services […] available to anyone in the world is just the vision that I had in mind from the very beginning.”

The company’s entry into the UK market also puts it in direct competition with national and international companies. These include companies like Public.com, based in New York, Revolut, and Freetrade, among others.

Zero – Fee Trading Initiative

The CEO also underscored the platform’s commitment to offering Zero-Fee trading and accessible trading alternatives for UK users. This initiative is similar to the effective charge reduction strategy that was put in place in the US before the epidemic.

Notably, Robinhood does not demand any commission fee for buying and selling stocks on the platform. Due to this, individuals can start creating their investment portfolios with a minimum of one US dollar (79p).

Tenev explained:

So we are launching imminently to the initial set of customers in the UK, and what we are launching is a commission-free share trading of US stocks.

With its zero-fee trading strategy, the platform’s introduction into the UK market will completely change how average investors interact with the stock market.

Also, with its focus on technology and user-centric features, the platform is poised to impact the current market. It will also bring fresh energy to the UK investment landscape.

ARK Invest Sells Another $5M of Coinbase Shares; Buys Robinhood, SoFi

The sale of 38,668 COIN shares from the Ark Fintech Innovation ETF follows a similar offload on Monday.

Robinhood to roll out US stock trading in British market

Robinhood CEO Vladimir Tenev said in an interview with Bloomberg that the company is still focused on its global aspirations, and its U.K. expansion is one step toward that.

ARK Invest Sells $5.26M Coinbase Shares as Price Hits 19-Month High

The Ark Fintech Innovation ETF sold 43,956 COIN shares and bought $1.2 million worth of Robinhood stock.

Robinhood meme stock punters denied class suit certification

A court has rejected a motion requesting class action certification from investors pursuing legal action against Robinhood.

Cathie Wood’s ARK bags 1.1M Robinhood shares in one day

Cathie Wood’s ARK Invest has continued accumulating Robinhood shares while dumping Grayscale Bitcoin Trust shares.