The Safemoon token nosedived following the firm filing for bankruptcy protection, but has regained slightly since.

Cryptocurrency Financial News

The Safemoon token nosedived following the firm filing for bankruptcy protection, but has regained slightly since.

Prosecutors argued SafeMoon CEO Braden John Karony poses a flight risk given his alleged access to funds and overseas connections.

The US Securities and Exchange Commission (SEC) recently announced charges against SafeMoon, its creator Kyle Nagy, the company’s CEO, John Karony, and CTO, Thomas Smith.

The SEC alleges that these individuals orchestrated a “massive fraudulent scheme” involving the unregistered sale of SafeMoon (SFM), a “crypto asset security” as defined by the SEC.

Per the complaint, instead of delivering the promised profits and taking the token “Safely to the Moon,” the defendants allegedly wiped out billions in market capitalization, misappropriated investor funds, and withdrew over $200 million in crypto assets for personal use.

On this matter, David Hirsch, Chief of the SEC Enforcement Division’s Crypto Assets and Cyber Unit, emphasized the need for caution in the decentralized finance (DeFi).

According to the complaint, Kyle Nagy assured investors that funds in SafeMoon’s liquidity pool were safely locked and inaccessible to anyone, including the defendants.

However, according to the SEC’s investigations, large portions of the liquidity pool were never locked, and the defendants allegedly misappropriated millions of dollars, indulging in extravagant purchases such as McLaren cars, luxury homes, and lavish travel.

The SEC’s complaint reveals that SFM’s price skyrocketed by over 55,000 percent before plummeting nearly 50 percent when the public discovered that the liquidity pool was not locked as claimed.

Notably, Karony and Smith allegedly used misappropriated assets to manipulate the market and prop up SafeMoon’s price through wash trading.

The SEC’s complaint, filed in the US District Court for the Eastern District of New York, charges the defendants with violating registration and anti-fraud provisions of the Securities Act of 1933 and the Securities Exchange Act of 1934.

An indictment was also unsealed in federal court in Brooklyn, charging Braden John Karony, Kyle Nagy, and Thomas Smith with conspiracy to commit securities fraud, wire fraud, and money laundering conspiracy. Breon Peace, United States Attorney for the Eastern District of New York, announced the arrests and charges.

United States Attorney Peace emphasized the commitment to pursuing fraudsters in the digital asset space, stating that their “ill-gotten gains” would not protect them from justice.

Ivan J. Arvelo, Special Agent-in-Charge of Homeland Security Investigations, New York, highlighted the “relentless pursuit” of individuals exploiting investors and the financial system for personal gain.

It is noteworthy that the charges in the indictment are allegations, and the defendants are presumed innocent until proven guilty.

SFM Token Crashes To Lowest Trading Price Since Launch

Following the recent disclosure of the news, SFM has experienced a significant crash, plummeting by over 52%. Currently, the token is trading at $0.00009142, marking its lowest trading price since its launch in 2022. This substantial decline of over 72% within the past year underscores the severity of the case.

Furthermore, when examining other time frames, the token has seen declines of 49%, 34%, and 24% over the past seven, fourteen, and thirty days, respectively. These figures highlight the ongoing downward trend and emphasize the magnitude of the situation.

Featured image from Shutterstock, chart from TradingView.com

Reflection tokens allow holders to earn passive returns from transaction fees by simply holding onto their assets.

Bitcoin remains the most-searched cryptocurrency in 2022 by far thanks to its top-brand status and being in a league of its own when it comes to decentralization.

The SEC, CFTC and DOJ have seven cases either resolved or ongoing this year, with the litigation against husband-wife duo Ilya Lichtenstein and Heather Morgan being the most high profile.

A few days ago, Dave Portnoy returned to Bitcoin with an almost $1.1M buy of 29.5 BTC. Today, he thinks “you are an idiot if it’s not part of your portfolio.” The Barstool Sports owner and main personality might have a point, but the whole situation is still funny. Especially, considering everything Portnoy has said about Bitcoin over the years.

Related Reading | Barstool’s Dave Portnoy Wants to Buy Bitcoin – Asks Winklevoss Twins to Teach Him

The born-again Bitcoiner visited Stuart Varney in his “Varney & Co.” show at the FOX Business Network. This is what happened:

Always fun joining @Varneyco to talk Bitcoin, $Penn and Brady pic.twitter.com/NNUV3ALlpW

— Dave Portnoy (@stoolpresidente) February 4, 2022

What Did Dave Portnoy Tell Stuart Varney About Bitcoin?

In 2020, the Winklevoss twins helped Portnoy to make his first Bitcoin investment. There was a small dip, and Portnoy panicked and sold it all. The community mocked him, and he went on to make questionable investments, but that’s neither here nor there. In the “Varney & Co.” interview, Portnoy reveals “I was waiting for my reentry point.” Impressively, he bought in at $36.9K.

Then, Stuart Varney reminds Dave Portnoy that he said he was getting out of Bitcoin because he didn’t understand it, and asks him if he does now. Portnoy responds, “No, no I haven’t figured them out. But here’s what I have figured out, Bitcoin is here to stay. It’s not going anywhere. It’s widely adopted. You see main institutions getting in. It’s the future.”

Even though Portnoy has a point, it’s funny that he hasn’t even begun to do the homework yet. He just trusts the main institutions’ research and due diligence and goes with it. Retail investors don’t have that luxury, but Portnoy is a wealthy man and his investment is just a small part of his portfolio. In any case, he promises that he will build on it, and eventually, “I’ll probably have a Billion dollars worth of Bitcoin.”

What Gives Bitcoin Its Value?

Near the end of the Bitcoin talk, Varney challenges him. He tells Portnoy that he’s too old to wait for Bitcoin to take over, and then, Varney tells him what he really thinks: “It’s a gambling chip. It’s not a store of value.” Portnoy, who hasn’t done the homework, can’t answer in a proper fashion. We can, though.

According to Varney, Bitcoin’s price “depends entirely on how many people want to buy it and how many people want to sell it.” That’s true, like every market on Earth the price of bitcoin responds to supply and demand. However, the value of Bitcoin comes from the network.

All over the world, thousands of people invested their money in ASICs that validate transactions. They buy energy, secure the network, and get compensated for it by a system that no one controls and has no owner. And, thousands of node operators keep everyone in check. Plus, millions of holders took their money out of the traditional system and bet on this emerging one. And this is just the beginning.

Besides that, those “gambling chips” that Varney mentioned happen to have the characteristics of perfect money. Mankind has been looking for something like this since it realized that it needed some kind of technology to organize and facilitate trade, which is the bedrock of society. However, if someone owned the Bitcoin network, “the characteristics of perfect money” wouldn’t be worth a damn. But, no one does. Bitcoin is for everyone.

BTC price chart for 02/05/2022 on Gemini | Source: BTC/USD on TradingView.com

What Has Portnoy Said About Bitcoin?

Mark this as this article’s comedy section. When Portnoy first liquidated all of his bitcoin investment, these were the numbers he was dealing with:

“Portnoy clarified a day later that he actually lost $20,000 from his initial $1,250,000 investment, which amounts to a mere 1.6%. Many in the cryptocurrency space referenced the number, noting how Portnoy wasn’t ready for the fast and volatile Bitcoin market.”

After being mocked, he doubled down on his stance and tried to get people to focus on the stock market.

“I’m begging my crypto friends to get involved in the stockmarket. Bitcoin is stuck in the mud. Let me lead you. We will get back to crypto later. The time to strike is now! No time for weak hands! Make the move!”

Related Reading | Seller’s Remorse: Day Trader Dave Portnoy Swears Off Bitcoin

To make things funnier, when Portnoy bought Safemoon, he promised:

“I’m never buying Bitcoin. Never never, I don’t believe a thing about it. But I do think it’s profitable, and I think there’s enough steam that it may just continue to go up forever. But I don’t buy the underlying junk behind it.”

Maybe that’s because Portnoy hasn’t even done the minimum effort to understand “the underlying junk behind it.” However, cheers to him for admitting his assessment of the situation was wrong and correcting his course.

Featured Image: screenshot from Portnoy in Varney & Co. | Charts by TradingView

One blockchain security firm says its audit of the SafeMoon smart contract has unearthed a potential $20 million vulnerability within the viral meme coin.

The founder of Barstool Sports, Dave Portnoy, has released a video where he picked SafeMoon as his sh*tcoin of choice. Portnoy said he purchased $40k worth of SafeMoon as a hedge against the fragility of Bitcoin.

My shitcoin announcement. Invest at your own risk. I have no idea how this works pic.twitter.com/G1iW8iZTWG

— Dave Portnoy (@stoolpresidente) May 17, 2021

However, popular crypto YouTuber Lark Davies continues in his calls that SafeMoon is a Ponzi scheme. A month ago, as SAFEMOON was blowing up, Davies posted a tweet in which he likened it to the most infamous scam in crypto history, Bitconnect.

Portnoy is best known as the founder of the sports and pop culture blog Barstool Sports. But he began gaining popularity for live-streaming his stock trades.

A little under a year ago, Portnoy crossed over into the world of crypto by asking the Winklevoss twins to teach him about BTC in a live stream.

In February, he exited his Bitcoin position before it pumped to $51k, missing out on the gains as a result. He responded by venting on social media, saying he will never rebuy Bitcoin.

“I’m never buying Bitcoin. Never never, I don’t believe a thing about it. But I do think it’s profitable, and I think there’s enough steam that it may just continue to go up forever. But I don’t buy the underlying junk behind it.”

Despite that, Portnoy did buy back into Bitcoin.

More recently, he has turned his attention to alts, which is, as he claims, a response to the Elon-FUD of the past week. In a humorous video, the Barstool President narrowed down his choice of alts to six, eventually announcing SafeMoon as his pick.

“It’s time for me to choose a side, and I’ve done that. Here we go, DOGE, ASS, Litecoin, SafeMoon, SHIBA, HOGE. The new breed of sh*tcoins, and I’m going to pick one and I’m going to become the leader. I’ve already purchased $40,000 of the coin…”

As “leader” of SafeMoon, Portnoy said he would not sell in the near term. Adding that he will “ride it to the stratoshpere or hell on earth.”

However, Portnoy’s research methods leave a lot to be desired. On justifying his choice, he said it could be a Ponzi scheme. But he likes the word moon.

More worryingly, he recommends getting in now, saying it’s the early buyers that walk away in profit should SafeMoon collapse.

“Why? I don’t know f*cking why, it could be a Ponzi scheme. I like the word moon because that’s where I want to go so I’m buying SafeMoon. I also like how every f*cker is selling out there, you get a 10% penalty that disperses 5%… Ponzi, Ponzi, Ponzi. It’s early, if it is a Ponzi, get in on the ground floor…”

In response to the video, Davies accuses Portnoy of promoting a Ponzi scheme.

“Paper hands Dave is now promoting the #safemoon ponzi scheme…. yeah, that is about on brand for him.”

Davies concedes that people may have made money on SafeMoon. But the situation is no different from Bitconnect. Back then, people who called out Bitconnect were attacked. But when the rug pull came, most lost out.

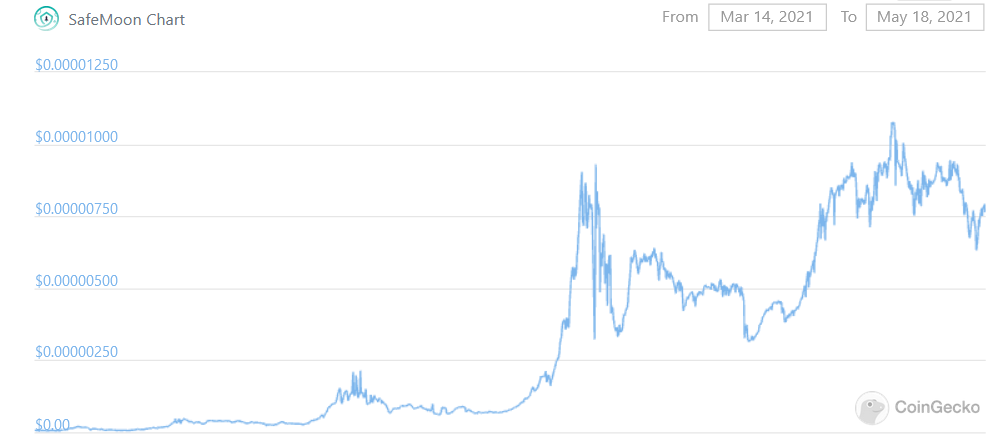

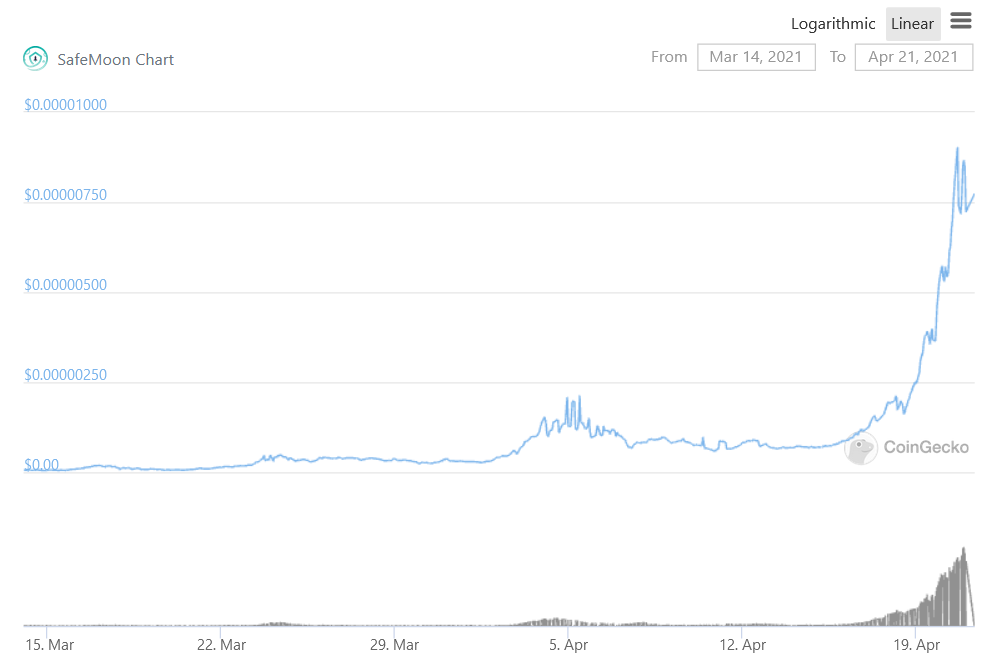

Source: SAFEMOON on CoinGecko.com

Over the last weekend, SafeMoon grabbed the attention of crypto investors and enthusiasts after it gained over 99%. On April 20, the token quickly rose to its highest level settling at an exchange price of $0.000013, according to data from CoinMarketCap.

The DeFi token was founded by John Mating with the aim to circumvent bank lending and establish a peer-to-peer network. Since its launch, the token has been the talk of the crypto community as it rewards investors who buy and hold it.

It’s a cryptocurrency on the Binance Smart Chain that started out at a low market cap of around $50,000. The price and market capitalization of SafeMoon went parabolic after growing popularity on TikTok.

In merely three weeks, the coin grew 2,200%. Before it didn’t.

The parabolic rally quickly came to a drastic end on Thursday morning when the digital token lost a shocking amount of value. The token lost about two-thirds of its market value in just an hour, dropping from a whopping $0.000015 to $0.000005.

Related Reading | The Two Signals That Say Dogecoin Holders Are In For “Much Ow”

Pseudonymous crypto analyst, The Cryptonomist, noted the fall on Twitter:

The state of $SAFEMOON 😬 pic.twitter.com/0F1uYKbD0B

— The Cryptomist (@Thecryptomist) April 22, 2021

The team behind SafeMoon appeared to acknowledge the massive plunge. The protocol’s official Twitter account wrote: “Who said there wouldn’t be turbulence,” adding that investors should continue holding. Many investors seemed to be positive in the comments, sending a propelling rocket to infer sentiment to continue to hold.

The SafeMoon price has since recovered slightly to trade at $0.00000504 per data from CoinMarketCap.

This definitely doesn't look safe for liftoff | Source: SAFEMOONBNB on TradingView.com

Traders have emphasized the massive volatility of SafeMoon despite relatively higher liquidity compared to other tokens that are not listed on major exchanges. Like DOGE, the newly launched token, which boasts a fully diluted market cap of $4.3 billion, hopes to drive its value “to the moon.”

Sweet to the ears, the SafeMoon team announced earlier that Asian exchanges were asking to list the protocol on their platforms. The team said:

“SAFEMOON is currently inundated with exchange offers, a large Asian exchange is imminently being announced… this will allow Asian communities to acquire Safemoon, the exchange has $857 MILLION 24 hour trading volume and is the 36th LARGEST in the world.”

The emphasis on SafeMoon not being able to sustain a bull rally has been echoed by many analysts.

Related Reading | MoonSafe Code Audit Shows Suspicious Anomalies, Scam Confirmed?

Luke Martin, a well known cryptocurrency trader, also described the price trend of the token as “unSAFEMOON” after it dropped 65% in a short period on April 22.

unSAFEMOON pic.twitter.com/A5w4Y4v6U4

— Luke Martin (@VentureCoinist) April 21, 2021

In fact many financial analysts have cautioned against buying the coin. Saying that the unsustainability of the bull rally will cause the token to fall massively on exchanges.

Laith Khalaf, a financial analyst at investment firm AJ Bell, cautioned crypto users looking to buy the newly launched token that it could be a risky bet. He noted that the push to buy is coming from speculative traders who are hoping to cash in on price surges rather than using the coin as a means of exchange.

For now, it’s unclear whether SafeMoon is really safe or it’s a pyramid scheme masking as a token. However, like all digital assets, inherent risks abound.

Featured image from Pixabay, Charts from TradingView.com

Popular crypto YouTuber Lark Davies tweeted a warning over the new Binance Smart Chain project SafeMoon. He likened its rising popularity to the now-defunct Bitconnect scam, saying the euphoria of gains is blinding users to “the obvious.”

Bitconnect arrived on the scene in 2016, promising high returns for holding, trading, lending, and mining its BCC token. But things began unraveling in January 2018 when Texas and North Carolina regulators issued a cease and desist order. Bitconnect has earned a place in history as one of cryptocurrency’s biggest scams. But, is Davies right to lump SafeMoon in with the same company?

Bitconnect was for a brief moment a top 10 #crypto, the people making money did not want to accept it was a ponzi, they made every excuse to justify it, and attacked anyone who stated the obvious.

Then it rug pulled and everyone lost big time. #safemoon is no different.

— Lark Davis (@TheCryptoLark) April 21, 2021

SafeMoon launched last month on March 14 with a debut price of $0.00000008. Since then, particularly over the last week or so, its price has mooned. SafeMoon is up +980% over the last seven days, hitting an all-time high of $0.00000919 yesterday.

Source: SAFEMOONUSD on CoinGecko.com

SafeMoon is an auto-generating liquidity protocol that rewards holders and penalizes sellers. It imposes a 10% penalty on sellers and redistributes 5% to existing holders, while it’s unclear who directly benefits from the other remaining 5%.

“5% fee is split 50/50 half of which is sold by the contract into BNB, while the other half of the SAFEMOON tokens are paired automatically with the previously mentioned BNB and added as a liquidity pair on Pancake Swap.”

The project describes itself as a “community driven, fair launched DeFi Token.” It talks about three simple functions, those being Reflection, LP Acquisition, and Burn.

Its whitepaper says “Reflection” relates to the concept of static rewards, which they say tackles the problem of falling APYs and encourages users to hold on to their tokens.

“LP Acquisition” relates to their mechanism of matching buyers and sellers, which they say creates a “solid price floor,” therefore minimizing price dips.

As the term suggests, ” Burn” relates to the burning of tokens, but in a documented and transparent way. The theory here is to reduce supply and therefore increase the value of tokens.

Some point out that the setup is similar to a Ponzi scheme. SafeMoon’s success relies upon more and more people buying in and holding – a model it encourages by penalizing sellers.

However, some have praised SafeMoon CEO John Karony for his willingness to hold AMAs and engage with the community.

Binance Smart Chain (BSC) is gaining ground as a serious competitor to DeFi on Ethereum. The promise of cheap gas fees and quicker transactions appeals to users. But its rise in prominence has been marred by several rug pulls since its inception.

People expect rug pulls to happen on Ethereum due to its decentralized status. But because anyone can launch a token on BSC, the same problem remains.

The biggest BSC rug pull to date was MeerKat Finance, in which $14 million BUSD and 73.6k BNB, totaling approximately $30 million, went missing in early March. The project claims it lost the funds through a hack.