The Securities and Exchange Commission (SEC) has one last short window, an eight-day period starting Thursday, if it wants to approve all 12 spot bitcoin (BTC) ETF applications this year, Bloomberg analysts wrote in a note on Wednesday.

XRP News: Ripple CEO Teases Major Announcements At Swell Event

Ripple CEO Brad Garlinghouse has expressed his anticipation for the upcoming DC Fintech week, dropping major hints and teasers about significant announcements and heated discussions slated for the event.

Ripple Swell Event Sparks Community Interest

Chief Executive Officer of Ripple, Brad Garlinghouse has teased the X (formerly Twitter) community with hints of discussions and ideas about the upcoming Ripple Swell 2023 event scheduled for November 8th and 9th in Dubai.

Garlinghouse stated that he was always excited about the DC Fintech Week which occurred every year. He emphasized the importance of the event in bringing together different people with similar interests in one room interacting and sharing their different ideas and perspectives on substantial topics and issues in the finance and blockchain industry.

In his post, Garlinghouse dropped a cryptic message, likening the Ripple Swell event to a “proverbial cage match.”

“Every year I look forward to DCFintechWeek — everyone from the public to private participants in one room, discussing (and sometimes debating) the substantive issues with no holds barred. wondering…a proverbial cage match?!” Garlinghouse stated.

Some of the headlining speakers excluding Garlinghouse appearing at the DC Fintech Week include United States Under Secretary of the Treasury for Domestic Finance, Nellie Liang, CEO of Grayscale Investments, Michael Sonnenshein, Chairman of the United States Securities and Exchange Commission (SEC), Gary Gensler, Vice Chair of Supervision at the Federal Reserve, Michael Barr, and others.

As the Ripple Swell event approaches, many crypto enthusiasts are looking forward to witnessing what could be a defining moment in the Ripple ecosystem as the event may provide more insight into Ripple’s future developments and present challenges.

Garlinghouse To Share Stage With Gensler At Swell Event

Following the conclusion of one of the most heated high-stakes legal battles in the crypto space, Garlinghouse and SEC Chair Gary Gensler are set to share a stage in the DC Fintech Week, discussing and possibly debating on various topics in the fintech and blockchain space.

The legal battle between Gensler and Ripple’s top Executives Chris Larsen and Garlinghouse has been one of the most closely watched conflicts in the crypto space. The SEC sued both executives, accusing them of violating US securities laws by supporting the sales of XRP tokens in unregistered security offerings to investors.

The regulator eventually dropped all charges and claims against Larsen and Garlinghouse earlier in October, earning Ripple a partial win against the agency.

Many XRP community members have rallied behind Garlinghouse’s label of the Ripple Swell event as a “proverbial cage match.” This sentiment is particularly strong when considering participants like Gensler and Garlinghouse who have a history of legal disagreements and Grayscale and US SEC who are currently in a legal dispute concerning the approval of Spot Bitcoin ETFs.

Coinbase Adds Four National Security Experts to its Global Advisory Council

Coinbase has added four national security experts, including former U.S. Secretary of Defence Dr. Mark T. Esper, to its Global Advisory Council.

SEC Inspector General says prohibition on crypto ownership hinders agency hiring

Besides being short on crypto specialists, the SEC OIG noted a litany of problems that are already familiar – lack of legislative clarity, lack of interagency coordination, etc.

3 reasons why Ethereum price is underperforming altcoins

Eth price trades at a key resistance level, but data highlights why the altcoin could struggle to hold $1,900.

Crypto lawyer says $20M settlement is 99.9% win for Ripple

Deaton strongly refuted the idea that the lawsuit’s result was an even 50/50 outcome for the SEC, claiming that it’s closer to a 90/10 advantage in favor of Ripple.

A Tale of 2 SEC Commissioners

Legal Expert Explains Why Ripple Will Always Back XRP

A pro-XRP lawyer known for advocating for the cryptocurrency has outlined reasons why he believes Ripple would not abandon the XRP token.

Lawyer Proclaims That Ripple Is Committed To XRP

Pro-XRP lawyer and Managing Partner of the Deaton Firm, John E. Deaton has taken to X (formerly Twitter) to assuage concerns raised about Ripple’s commitment and plans for the XRP token.

Following the recent announcement of XRP’s expansion into Dubai after gaining approval from the Dubai Financial Services Authority (DFSA), Deaton boldly stated in his post that Ripple was not planning to ditch the XRP token and would not be for years. He said that the crypto payments network had a strong financial responsibility to the token, having invested billions in XRP.

“As I’ve said for more than 3 years, Ripple is not going to abandon XRP. It has a fiduciary duty not to,” Deaton stated.

Deaton highlighted Ripple’s financial journey revolving around the XRP token. He stated that in its Series A funding in 2015, Ripple was valued at $128 million. In Series B, the crypto payments network’s value rose again in the following year to $410 million and by 2020, Ripple had attained a value of $10 billion in its Series C valuation.

Deaton also mentioned Ripple’s Series C buyback valuation last year, which saw the crypto network purchasing its Series C shares at a 50% higher price.

According to Deaton, Ripple’s growing value and large-scale investments regarding XRP are proof enough that the crypto network would continue its support for XRP.

The pro-XRP lawyer disclosed that Ripple owned $48 billion to $50 billion worth of XRP, which makes it inconceivable for the crypto network to abandon XRP. He also stated that Ripple has more to gain than lose, especially if the XRP token price surges to $2.

“Ripple’s pre-IPO shares clearly trade at a valuation significantly less than $15B. Owning 48B-50B XRP makes it insane to abandon XRP. If #XRP reaches $2, Ripple has an asset valued at $100B,” Deaton stated.

XRP Enthusiast Question Price Standstill After Major Milestones

While many XRP community members have commemorated the recent successes in the XRP ecosystem, an XRP enthusiast has chosen to voice out concerns about the lingering question of why the price of XRP has not been affected by its new achievements.

XRP Cryptowolf took to X on Thursday to publish XRP’s newest development of partnering with the National Bank of Georgia (NBG) and why the token has not shown any significant price surges following the announcement.

“Anyone else wondering why $XRP didn’t skyrocket to the news of Ripple partnering with a central bank?” XRP Cryptowolf stated.

Additionally, following John Deaton’s statement that Ripple would not abandon the XRP token, an XRP community member disclosed that the XRP token had shown only a slight price change when a larger surge was expected.

“And yet here we are up 3 pennies haha any other coin would have jumped $15 bucks in a day with this kind of news,” an XRP community member stated.

While the present price of XRP has displayed a slower price growth than its past, many crypto enthusiasts believe that the cryptocurrency’s ongoing legal battle with the United States Securities and Exchange Commission (SEC) has been the primary source of its growth stunt.

In response to XRP Cryptowolf’s question about the slack in the price of XRP, a community member stated that “for XRP to truly be free and demonstrate its potential, it will only happen after it clears all the SEC lawsuits.”

SEC seeks summary judgment in Do Kwon and Terraform Labs case

The “evidence” of violations provided by the SEC points to Kwon’s involvement in misleading crypto investors by creating and marketing Terra and its in-house Terra (LUNA) tokens as securities.

SEC Asks Court for Summary Judgement Against Do Kwon, Terraform

The request follows a move by Kwon’s defense team to do the same.

Founder Thinks The Ethereum Chart Is “Gorgeous”: Is It True?

Raoul Pal, the CEO and founder of Real Vision, thinks the Ethereum chart is “gorgeous” and expects the coin to increase in the months ahead. Though it is unclear when the coin will break from the current consolidation and extend gains of the recent few weeks, the endorsement from the founder can be bullish for the coin.

Ethereum Is Bullish, What’s Next?

Presently, ETH is changing hands at around $1,800 but remains below the psychological $2,000 level and July 2023 highs of approximately $2,100. The failure of ETH to break above immediate resistance lines can be a concern, considering the exemplary performance of Bitcoin (BTC) in the past few weeks.

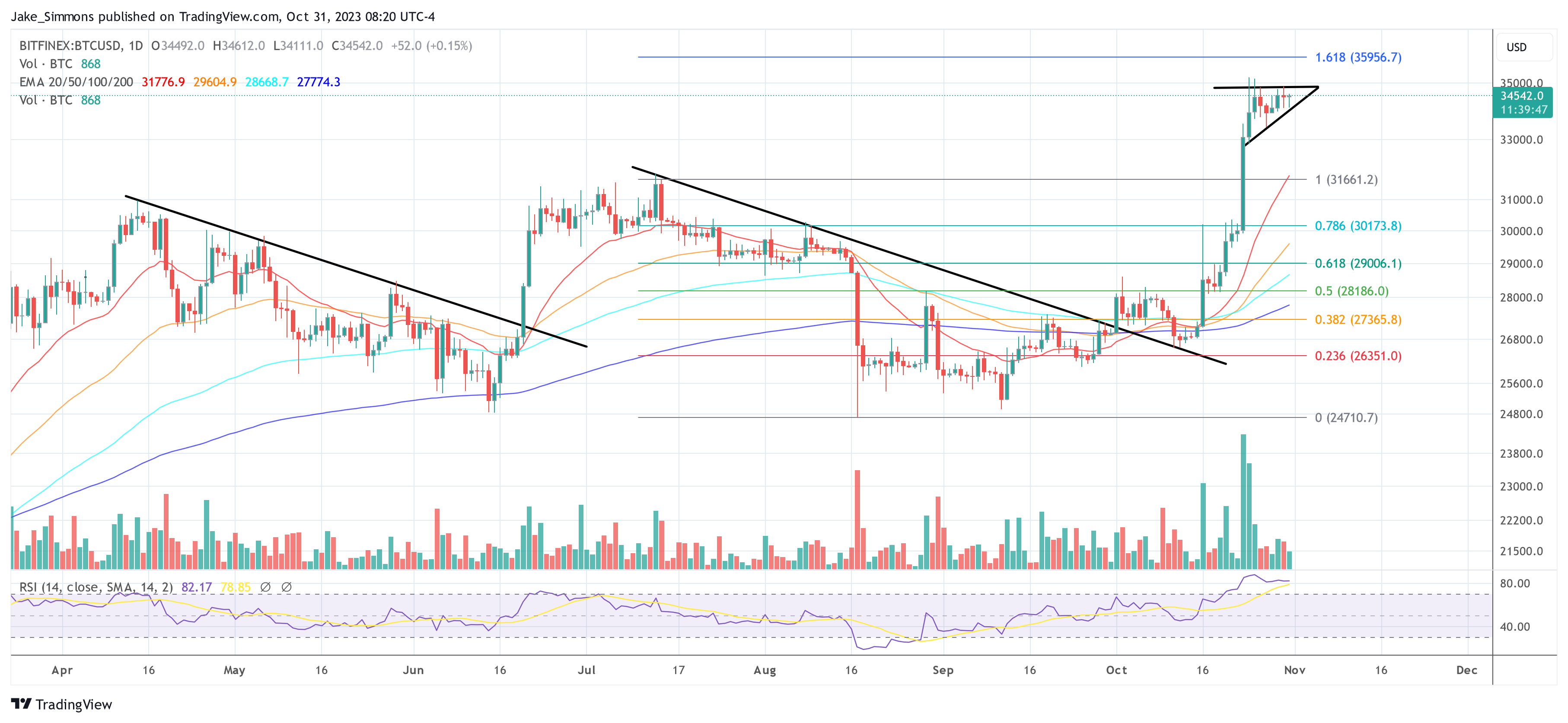

At press time, BTC is trading near 2023 highs after easing past July 2023 highs in late October 2023. The surge of Bitcoin prices shifted sentiment, forcing capital back into crypto, which had been relatively restive, reeling from the brutal effects of last year’s crypto winter, which spilled to 2023.

Looking at the performance in the daily chart, ETH is up about 20% from October 2023 lows. Technically, the path of least resistance appears northwards, syncing with the general crypto trend whose trajectory seems reliant on Bitcoin.

As it is, the immediate resistance is around the $2,000 and $2,100 zone. If bulls build on the current momentum as Pal expects, breaking from the consolidation, ETH could surge to March 2022 highs of around $3,500. However, the leg up from spot rates largely depends on the strength of the breakout, a metric gauged by the trading volume.

A high volume breakout, similar to the one recorded in the BTCUSDT when it broke above $32,000, may easily anchor optimistic buyers angling for a near 100% rally in the coming sessions.

Ethereum Futures ETFs Are Live, But SEC Is Mum On ETH’s Status

Though Pal is bullish, the founder didn’t specify the exact trigger that may lift the second most valuable coin to new levels, justifying why the ETHUSDT chart at the spot level is “gorgeous.” Still, the community is overly bullish because the United States Securities and Exchange Commission (SEC) recently approved the first Ethereum Futures Exchange-Traded Fund (ETF).

These products provide a new and regulated way for investors to gain exposure to ETH. Over time, this may attract institutional investors, which may drive prices higher.

Though the SEC has yet to publicly declare ETH is a commodity like Bitcoin, their approval of Ethereum Futures ETFs as the community awaits the eventual authorization of the first spot Bitcoin ETF suggests that the regulator could be comfortable with ETH.

Bitcoin price cools off, but ‘You can never have too much Bitcoin, says Saylor

BTC price cooled off after an impressive 30% monthly gain, but MicroStrategy CEO Michael Saylor made the case for why he remains bullish on Bitcoin.

Will Hashdex’s ‘Undeniable’ Distinctions Help Win Bitcoin ETF Race? Some Analysts Think So

ETF analysts watching the spot-bitcoin ETF race appear to be backing Hashdex’s modified application more than any other.

SafeMoon hacker’s use of centralized exchanges could help law enforcement: Match System

SafeMoon was exploited in March earlier this year after a smart contract update led to a burn call vulnerability allowing hackers to transfer funds.

PayPal Faces SEC Subpoena Over Its PYUSD Stablecoin

Global payments giant PayPal (PYPL) received a subpoena from the U.S. SEC requesting documentation about its USD stablecoin on Wednesday.

Ripple’s legal chief questions SEC case losses under Gensler

Stuart Alderoty expressed concern about the SEC’s repeated arbitrary and capricious actions in court cases, suggesting a troubling pattern under Gensler’s leadership.

SafeMoon Execs Arrested by DOJ in Fraud Investigation, Charged By SEC

The Securities and Exchange Commission (SEC) has charged SafeMoon and its executive team with perpetrating a fraudulent scheme through an unregistered securities sale.

‘Bruno Brock’, Founder of Oyster Pearl, Gets Four Year Jail Term for Tax Evasion

Elmaani pleaded guilty in April 2023, agreeing that he caused a tax loss of over $5.5 million.

GAO finds controversial SEC guidance is subject to congressional oversight

The SEC’s Staff Accounting Bulletin 121 has been the target of much criticism in the crypto community.

Spot Bitcoin ETF: Here’s The Magic Number To Push BTC Past $40,000

David Lawant, the head of research for FalconX, an institutional crypto trading platform tailored for financial institutions, recently provided an insightful forecast regarding the future of Bitcoin (BTC) prices in light of the anticipated launch of a spot Bitcoin ETF in the United States. Sharing his predictions via X (previously known as Twitter), he articulated the financial variables that might play a decisive role.

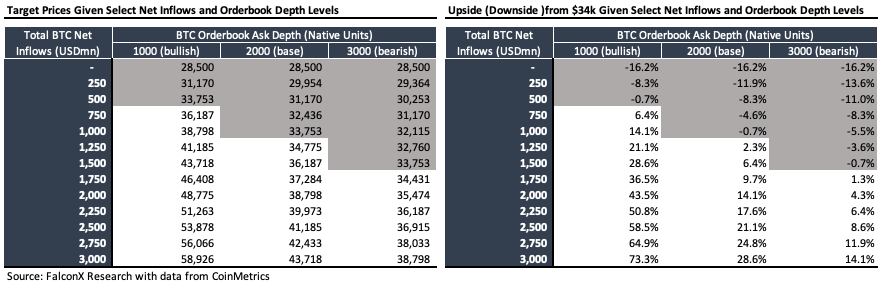

Lawant remarked, “The next significant variable to watch in the spot BTC ETF launch saga will be how much AUM these instruments will gather once they launch. I think the market is currently expecting this inflow to be between $500 million and $1.5 billion.”

The Magic Number To Push Bitcoin Price Past $40,000

The crypto community is keenly anticipating a positive nod for a Spot Bitcoin ETF either at the end of 2023 or the beginning of 2024. A crucial date on the calendar is January 10, 2024, which is set as the final deadline for the ARK/21 Shares application, leading the current series of applications.

Undoubtedly, a green signal from regulatory authorities for the spot ETF will be a game-changer for the entire crypto asset class. Lawant highlighted the importance of this development, stating, “It will open room for large pockets of capital that today can’t properly access crypto, such as financial advisors, and bring a stamp of approval from the world’s most prominent capital markets regulator.”

The pressing question, though, is the immediate impact on capital inflow. “The first couple of weeks after launch will be critical to test how much appetite there is for crypto at the moment in these still relatively untapped pools of capital,” Lawant emphasized.

Relying on historical data, Lawant pointed out the stability of the ask side of BTC’s order book, especially for prices situated above the $30,000 mark. This data allows for an approximation of how the inflow of capital might influence the price trajectory of BTC.

Through various inflow scenarios squared against a spectrum of the depth of market scenarios, Lawant deduces that the market is possibly forecasting net inflows ranging between $500 million and $1.5 billion within the initial weeks post-launch.

Drawing conclusions from his analysis, Lawant surmised:

For BTC to establish a new range between the current level and more than $40k, the total net inflows would need to amount to $1.5 billion+. On the other hand, if total net inflows come in below $500 million, we could move back to the $30k level or even below.

However, it’s paramount to note the inherent assumptions in Lawant’s analysis. He admits, “One is that the move from $28.5k to $34.0k was entirely attributed to the market anticipating price-insensitive net inflows from the ETF launch.” This means, among other things, that the current price increase was triggered neither by the correlation with gold nor by the global crises or turmoil in the bond market.

Lawant also highlighted the potential variability in BTC price movement across the order book. Nonetheless, given the stature of issuers like BlackRock, Fidelity, Invesco, and Ark Invest in the SEC queue, the current favorable macroeconomic climate for alternative monetary assets, and prospective improved liquidity conditions, Lawant remains bullish about the potential BTC price rally following the ETF debut. He concluded with, “ceteris paribus I’m still excited about how the BTC price could react to the ETF launch.”

At press time, BTC traded at $34,542.