The digital tenge has been used for everything from free school lunches to tokenizing gold, and there’s more to come.

Cryptocurrency Financial News

The digital tenge has been used for everything from free school lunches to tokenizing gold, and there’s more to come.

Edward Farina, Head of Social Adoption at XRP Healthcare, recently proposed a scenario where the price of XRP could potentially surge to $10,000. His projection is based on the possibility of the token as a bridge currency and RippleNet replacing SWIFT (Society for Worldwide Interbank Financial Telecommunication) in the global cross-border payment systems.

Farina’s commentary dives into the principles of market dynamics. He argues against common misconceptions about the cryptocurrency’s potential growth. “Few people seem to understand the principle of supply and demand. I always see people being shocked when they see someone saying that XRP can reach $10k. (Not saying it necessarily will.),” Farina remarked.

He emphasizes that the global financial sector’s movement of hundreds of trillions of dollars annually means even a small market share could lead to a significant surge in its valuation. Farina also elaborates on the current capabilities of the SWIFT system, handling billions of transactions per hour, and the impact of RippleNet potentially replacing it.

“The problem with the way most people view XRP’s potential to grow exponentially, is that they think it can’t reach that high of a market cap. They’re failing to realize that Financial Institutions move hundreds of trillions worldwide. If XRP captures a tiny fraction of that, it will catapult XRP to unprecedented levels,” he explains.

This highlights the vast, untapped market that XRP could penetrate. However, Farina does not provide exact figures, nor does he explain how much capital would have to flow into the cryptocurrency to reach the price of $10,000.

Besides that, Farina underscores XRP’s supposed technological superiority, particularly in terms of transaction speed and finality. “XRP settles value in real time (an average of 3 seconds) and with finality. BTC cannot do that, neither ETH nor SWIFT. Period,” he asserts, making a case for the tokens’ efficiency and reliability over existing systems.

The discussion about whether XRP can reach a four- or five-digit price if Ripple replaces SWIFT or only a part of it is almost as old as the token itself. It was only recently that influencer Crypto Eri unearthed a five-year-old statement from Ripple CTO David Schwartz.

Schwartz outlined the positive correlation between an asset’s price and its liquidity. “Higher prices tend to correlate with higher liquidity, which means cheaper payments,” he noted, explaining that as the tokens’ value increases, it becomes a more viable medium for large-scale financial transfers. This ties back to Farina’s vision of the cryptocurrency disrupting the current financial systems.

Grayscale has also recently confirmed XRP’s potential to compete with SWIFT. In its latest “Currencies Crypto Sector” report, the company writes, “Beyond Bitcoin, XRP is the second largest asset. Designed as an alternative to SWIFT, XRP aims to offer fast cross-border payments at lower transaction costs than competitors.”

At press time, XRP traded at $0.6208.

LINK outperformed most cryptocurrencies in September, but the recent correction raises questions on the sustainability of the bullish momentum.

The bank messaging network has seen a dramatic increase in processing speed and is developing technology to connect CBDCs.

Chainlink (LINK) has been a standout in the crypto market recently, registering an 11% increase over the past six days, even as the broader crypto market sentiment remains subdued.

A significant factor that might be driving this price action is the behavior of LINK’s major holders. On-Chain analysis firm, Santiment, highlighted this in a recent tweet, stating: “Chainlink’s key shark tier that holds between 10K-100K LINK has been on an accumulation spree.”

Diving deeper into the data, there are now 3,127 wallets holding between 10,000-100,000 LINK, marking the highest level since December 3, 2022. These wallets have added a staggering $9.6 million worth of LINK in just three days. Since September 3rd, there’s been a 3.2% rise in the number of wallets in this category, with 98 new wallets emerging. This group has accumulated 0.154% of the entire LINK supply in the same period.

However, Chainlink’s journey hasn’t been entirely smooth. The token has been ensnared in a sideways range for an exhausting 485 days, which is over 15 months. The LINK/BTC pair has been on a downward trajectory for more than three years.

Chainlink’s much-anticipated release of the Cross-Chain Interoperability Protocol (CCIP) was met with significant hype. Yet, despite its potential to revolutionize cross-chain communication, its release didn’t provide the expected boost to LINK’s price.

Also the news that a tokenization experiment by interbank messaging system Swift and Chainlink successfully transferred value across multiple blockchains could not move price substantially. In June Chainlink and Swift announced that they would be collaborating with dozens of financial institutions such as BNP Paribas, BNY Mellon, The Depository Trust & Clearing Corporation and Lloyds Banking Group and others.

However, the upcoming Chainlink’s SmartCon in October from October 2nd to 3rd might be the catalyst the token needs. Rumors are rife about a potential major announcement between Swift and Chainlink Labs, which could connect web3 infrastructure to the banks involved in previous tests.

If history is any indication, Chainlink could experience a surge in price leading up to the event, driven by the euphoria and speculation. “Uptober” could come early for the Chainlink price.

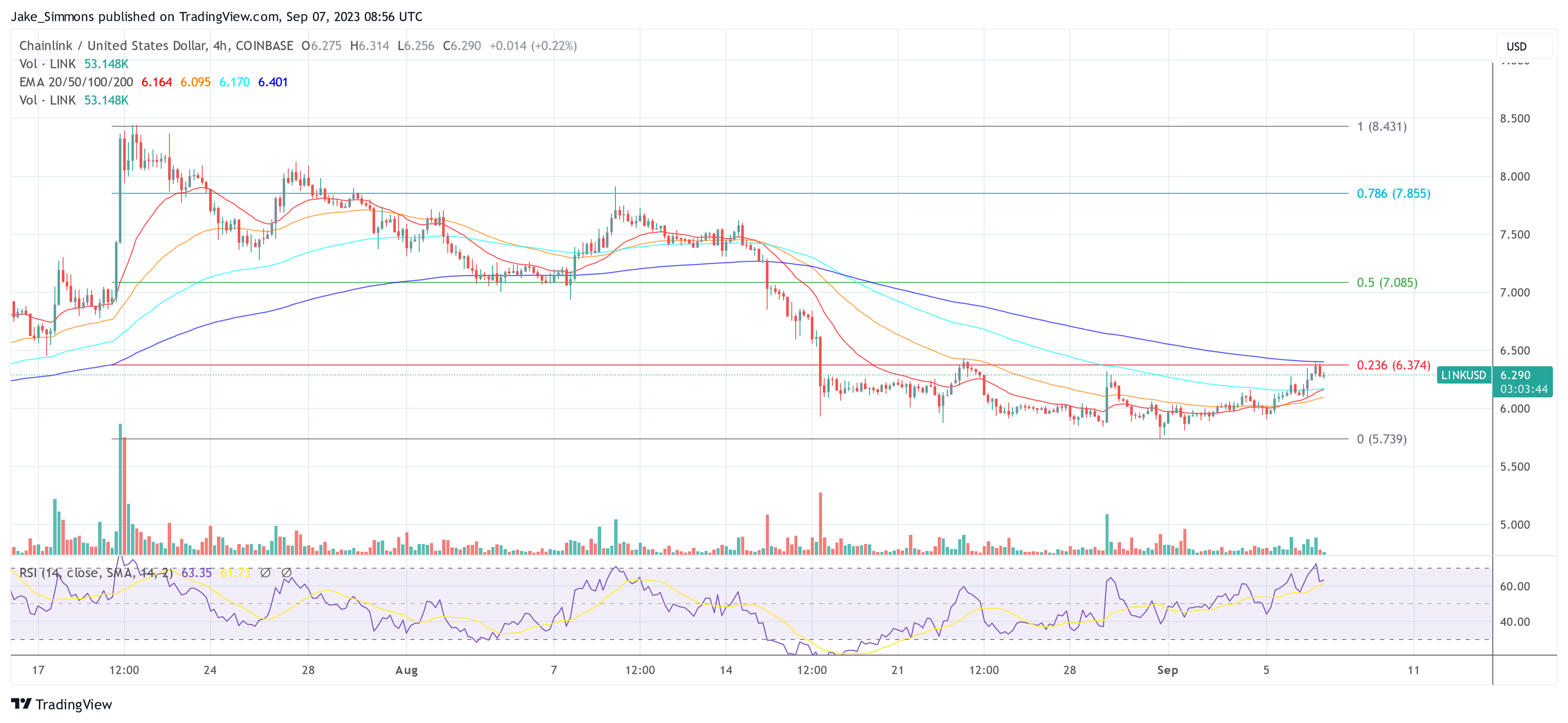

The recent 11% surge in LINK’s price suggests that the market might already be reacting to the upcoming hype. However, the 4-hour chart indicates a rejection at the 23.6% Fibonacci retracement level at $6.37, which aligns closely with the 200 EMA at $6.40. For LINK to sustain its upward trajectory, it’s imperative to breach this level, with the next significant target being the 50% Fibonacci retracement level at $7.08.

The 1-week chart paints a picture of LINK’s prolonged downtrend. The recent hold above the 23.6% Fibonacci retracement level at $5.92 is a positive sign for the bulls, potentially paving the way for another try on the upper trendline of the downtrend channel.

However, several difficult challenges lie ahead. The 50% Fibonacci retracement level at $7.20 is the first major resistance. If LINK can push past this, a breakout from the 15-month downtrend channel becomes possible. For this to happen, Chainlink would need to break above the $8.30-$8.40 area as it currently stands, and would then encounter the 78.6% Fibonacci retracement level at $8.58. Large selling pressure can be expected at this point.

Should LINK falter at this juncture, a return to the downtrend channel is likely. Conversely, if the $8.58 mark is surpassed, it would signal a significant win for the bulls, potentially setting LINK on a path to challenge its 15-month high at $9.61.

What is a blockchain “sequencer?” Here’s why you need to know

SWIFT claims that interlinking existing systems with blockchains is better for the short term than bringing CBDCs together with tokenized assets in a single ledger.

Swift and Chainlink announced in June they were collaborating with dozens of financial institutions to test connecting blockchains.

Swift, the interbank payments network, has enlisted a dozen world-class institutions — and Chainlink — to fix blockchain’s interoperability deficit.

In a new set of experiments Swift will collaborate with major financial market institutions like Australia and New Zealand Banking Group Limited (ANZ), BNP Paribas, BNY Mellon, Citi, Clearstream, Euroclear and Lloyds Banking Group.

There is no technical reason preventing Russia from creating its own blockchain-based system, blockchain provider Fuse Network’s CEO believes.

Binance has also had problems with its banking partner for United States dollar transfers over the last few months.

According to SWIFT, 24% of central banks will introduce a CBDC within the next couple of years.

The banking network will now look at applications like securities settlement and trade finance

A SWIFT-style system for bank-issued and regulated digital currencies was launched by a firm with a tenure building China’s national blockchain project.

ZKSync, an Ethereum layer-2 platform designed to scale transaction throughput using zero-knowledge (ZK) proofs and Rollups, has released a new software development kit (SDK) in Swift.

In a tweet on January 17, ZKSync said the goal is to make their features more accessible to developers and dApps. With a Swift SDK, ZKSync would support more platforms and use cases, especially for teams building iOS and macOS applications on ZKSync 2.0.

We want to make zkSync 2.0’s features accessible to more developers and applications, so we’ve released a new SDK in Swift. #scalingthemission

1/4 pic.twitter.com/GdH8naXxHI

— zkSync (@zksync) January 17, 2023

Swift is the programming language behind iOS and Mac devices. However, Swift cloud storage software for iOS and macOS enables users to retrieve data through an API. Cloud storage is scalable and designed to store unstructured data that can limitlessly grow.

Besides Swift, ZKSync also supports Python, Java, Android, Rust, and Dart programming languages. Dart, the layer-2 platform explains, is the “unofficial” open-sourced SDK in Alpha. However, the layer-2 portal plans to support more SDKs in various programming languages to cater to their expanding developer community, allowing them to build more solutions addressing multiple problems.

SDKs are critical for developers since they allow the building to be simpler, faster, and standardized. For creators to integrate into existing services, they require kits, which often include necessary documentation, code samples, libraries, APIs, and more, providing guidance when developing blockchain solutions. However, within any developer kit, APIs are critical because they act as an interface for dApps to relay information and coordinate.

ZKSync layer-2 is building a solution for users to quickly transfer ethereum (ETH) and ERC-20 tokens without paying the relatively high fees in the mainnet.

Ethereum gas fees often fluctuate depending on on-chain activities. As ETH prices rally, DeFi and NFT activities often expand, leading to high gas fees. With Gas rising on a public, transparent layer, users have to pay more to transfer or execute smart contracts.

The layer-2 platform is positioning itself as a better alternative for teams and users, preferring scalability, privacy, and security. Following the launch of the ZKSync 2.0 mainnet, there is a scaling and privacy engine using ZK proofs. Earlier, Vitalik Buterin, the co-founder of Ethereum, relayed his confidence in ZK Rollups that dApps on ZKSync leverages. In the co-founder’s assessment, ZK Rollups “will win out in all use cases.”

Users deploying on the ZKSync 2.0 mainnet, which launched in Q4 2022, enjoy low fees and faster transaction settlement. Developers are free to experiment and add more features.

For instance, ZKSync supports account abstraction for users to pay fees in other tokens apart from ETH and build smart contracts in Vyper or Solidity. The layer-2 solution also supports Atomic Swaps. It is a feature that ZKSync creators say can benefit cryptocurrency exchanges.

NewsBTC reported earlier that Optimism, a general-purpose Ethereum layer-2, and ZKSync competitor, was more Gas efficient despite revenue and assets under its management dropping.

Another major financial institution has signaled its intent to offer Bitcoin and Ether services to its clients.

“For CBDCs, our solution will enable central banks to connect their own networks simply and directly to all the other payments systems in the world through a single gateway,” said chief information officer Tom Zschach.

Are TradFi and DeFi converging, moving toward a middle ground that includes tokenized assets, interoperability and regulation?

The project will connect SWIFT’s network to nearly every blockchain to allow traditional finance players access to digital and traditional assets on the one network.