Memes might be the “most simplistic connection” between financialization, tokenization and culture, says Kain Warwick.

Cryptocurrency Financial News

Memes might be the “most simplistic connection” between financialization, tokenization and culture, says Kain Warwick.

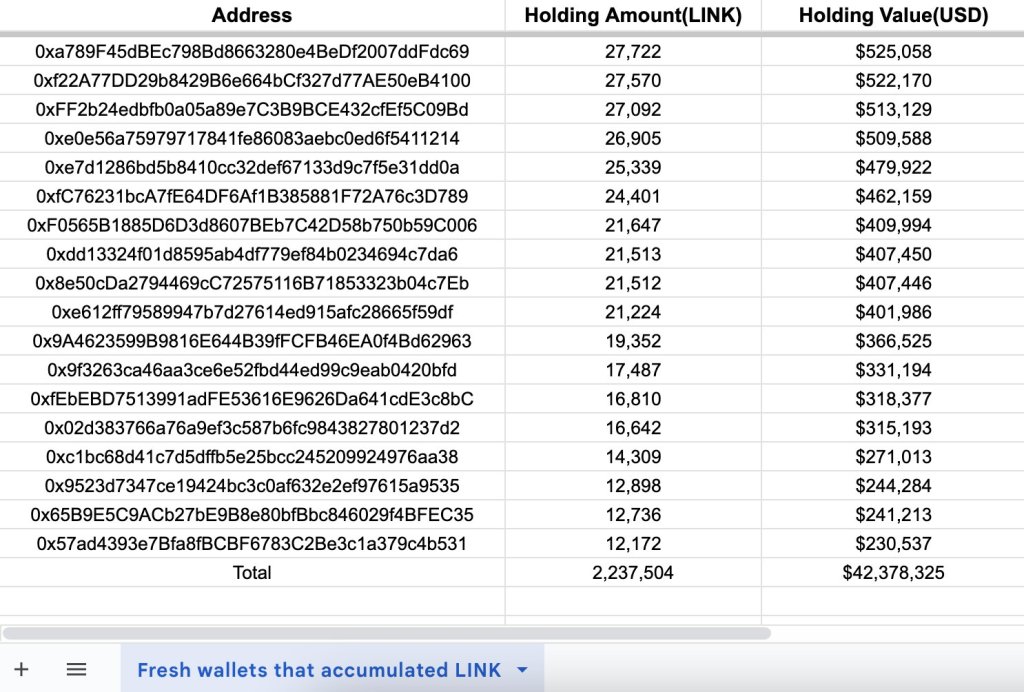

A mysterious whale is rapidly accumulating Chainlink (LINK). According to Lookonchain, the unknown entity, possibly an institution, withdrew over 2.2 million LINK (worth $42.38 million) via 47 new wallets from Binance, the world’s largest crypto exchange by trading volume, in two days.

This sudden block withdrawal now raises questions about what’s driving the whale’s interest and what it could mean for LINK in the coming days.

Chainlink is a popular project that provides secure middleware services and allows smart contracts to access tamper-proof external data. For this role, the platform has been adopted by multiple protocols offering decentralized finance (defi) services in Ethereum and beyond.

Additionally, Chainlink plays a role in non-fungible tokens (NFTs) through its random number generator (RNG). It continues to release new products and enhance its features.

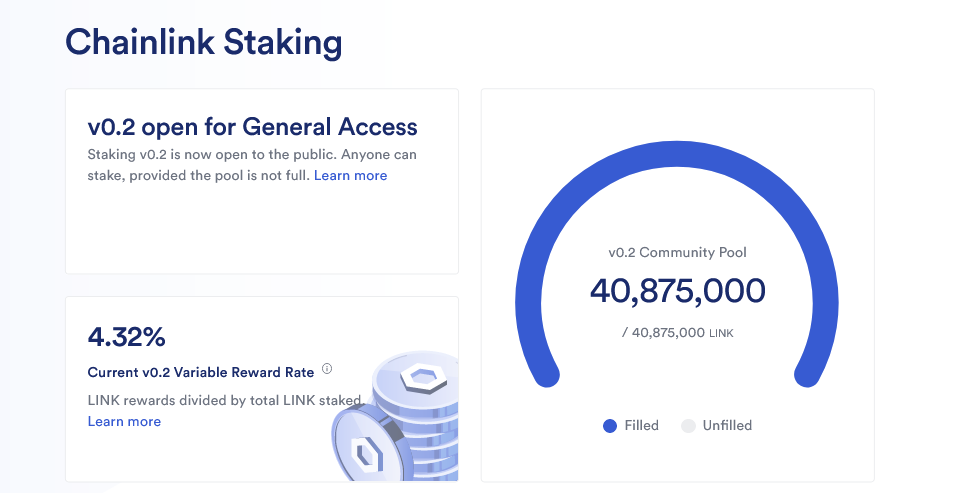

To illustrate, in November, Chainlink upgraded its staking mechanism, releasing v0.2, which significantly increased the pool size to 45 million LINK.

The platform noted that the decision was to attract more investors and, more importantly, bolster its security while concurrently aligning with its broader objective of attaining the “Economics 2.0” plan.

Initially, staking began in December 2022. The goal was to incentivize participation by expanding the utility of LINK and allowing stakers to receive rewards.

The release of v0.2 in November means more tokens can be locked, helping make LINK scarce, considering the role of the token in the vast Chainlink ecosystem.

Trackers show that over 40.8 million LINKs have been locked so far. Chainlink confirms that anyone can earn a variable reward rate of 4.32%.

Beyond staking, Chainlink’s Cross-Chain Interoperability Protocol (CCIP) is gaining adoption. To illustrate, the Hong Kong Monetary Authority (HKMA) initiated its first phase of e-Hong Kong Dollar (e-HKD) trials in November, integrating CCIP.

As part of this trial, the regulator wanted to illustrate the capabilities of programmable payments enabled by Chainlink via its solution, CCIP. In DeFi, protocols such as Synthetix and Aave have adopted CCIP.

With more protocols and traditional institutions leveraging the technology, the demand for LINK (and prices) will likely increase as the fear of missing out (FOMO) kicks in.

While the whale’s motives remain unknown, their large-scale LINK accumulation suggests they might be bullish on the token. Notably, it coincides with the sharp expansion of LINK prices in the past 48 hours.

So far, the token is changing hands slightly below the $20 psychological resistance. Any breakout above this level might lift the token to around $35 in Q3 2021.

The market is currently experiencing an enormous pullback after nearly a month of continuous gains. According to Coingecko, the broader crypto market is down nearly 3% as major cryptocurrencies like Bitcoin, Ethereum, and XRP drop from year-to-date highs. As the sector cools down, altcoins are pulled downward.

Synthetix is one of the sufferers of the massive bearish pressure engulfing the market. Coingecko data shows that the token is bleeding, with the biggest drop occurring in the weekly timeframe at over 16%.

Although SNX isn’t faring well within the market environment, the Synthetix dev team is hot on its tracks to remain competitive within the world of crypto.

Last week, Synthetix announced on X that they are nearing the launch of the Andromeda Release on their mainnet and the Ethereum Mainnet.

Andromeda Release is the implementation of the Perps V3 which, according to their recent blog post, is focused on enhancing trading efficiency, usability, and resilience on the network. It will also add new features like Native Cross-Margining, Expanded Collateral Options, MEV-Resistant Liquidation Process, and many more.

Synthetix Perps V3 is set to launch with the Andromeda Release on Base, soon to be followed by an Ethereum Mainnet version for medium to whale traders and protocols like @ethena_labs!

https://t.co/72QmySbAfb

Check out the TLDR and read the blog post to learn more.

– Perps V3… pic.twitter.com/YbsFjj0Hnt— Synthetix

(@synthetix_io) December 15, 2023

The biggest add-on from the update is the deployment of Core V3 and Perps V3 on the Ethereum mainnet.

“The Core V3 + Perps V3 release on Ethereum Mainnet represents a significant evolution for Synthetix, targeting medium to large traders and protocols in need of perps on L1,” the Synthetix team said in their blog post.

Disregarding the positive internal news for SNX, the market has other plans for the token. As of writing, the bears are coming out strong, wrestling SNX bulls on the $3.59 price level. If the bears are successful in solidifying their gains, more pain could be in store for traders and investors.

However, the upcoming implementation of Perps V3 might be able to offset this as it focuses on medium to large-scale whales to become active on the platform, thus driving more throughput to the network; but investors and traders shouldn’t disregard the broader market before making a decision.

Right now, the market is entering its cool-down phase with cryptocurrencies reverting to more sustainable price levels. For SNX, that level is around the $3.287 price point. Once the bears hit this level, the bulls will be able to regain some ground, stabilizing the price on this level in preparation for a bigger breakout.

Featured image from Shutterstock

Synthetix (SNX), currently positioned as the 54th largest cryptocurrency, has been closely aligned with the overall market trend. Over the past 30 days, SNX has experienced a substantial uptrend of 60%, while its year-to-date performance shows an impressive price increase of over 108%.

These notable achievements indicate the potential for continued bullish momentum for the decentralized protocol and its native token.

Renowned cryptocurrency analyst and writer, Jake Pahor, has expressed a highly optimistic outlook on SNX, hailing it as the ultimate “picks & shovels play” in anticipation of the forthcoming bull market.

Pahor highlights Synthetix’s pivotal role as the backbone for derivatives trading in the decentralized finance (DeFi) sector. The protocol has already amassed an annualized revenue of $54 million, serving as a platform that enables the creation and trading of synthetic assets such as commodities, stocks, and currencies.

While Synthetix may not have user-facing front-ends, it powers popular DeFi applications like Kwenta, Polynomial, dHedge, and Lyra. As the demand for permissionless trading of spot synthetics and on-chain derivatives of traditional assets continues to rise, Synthetix stands poised for significant growth in the coming years, according to Pahor.

Notably, a key driver of Synthetix’s success lies in the fees generated on every synthetic asset exchange, ranging from 0.1% to 1% (average 0.3%). These fees are directed towards SNX stakers, creating a rewarding incentive structure.

SNX, sUSD, and eSNX are the three primary tokens utilized within the Synthetix ecosystem, each serving distinct purposes in staking, collateralization, and protocol functionality.

With a circulating supply of 326.5 million SNX tokens and a total supply of 327.2 million, Synthetix boasts a market cap of $1.14 billion, placing it at the forefront of the Synthetics category. The protocol’s treasury holds a healthy $145.96 million, including stablecoins, BTC/ETH, and its token SNX.

Synthetix operates under the governance of four key bodies: Spartan Council, Treasury Council, Ambassador Council, and Grants Council. These councils’ Decisions and proposals are subject to majority votes from SNX stakers, ensuring a democratic and community-driven approach to protocol development.

It was established as Havven in 2017, a stablecoin protocol, the project rebranded in 2018 to become Synthetix, focusing on synthetic assets and derivatives trading.

According to Pahor’s analysis, with a “strong ecosystem” of projects built on its infrastructure and a first-mover advantage, Synthetix has established itself as the market leader in the Synthetics category.

Furthermore, the impending release of Synthetix V3, including Perps, Base, and USDC, is expected to be a significant catalyst for the protocol. Additionally, the protocol’s DEX perps feature aims to compete with centralized exchanges, while the Infinex front-end promises a user experience akin to traditional CEX trading.

Currently, SNX is trading at $3.455, reflecting a significant 4.7% uptrend over the past 24 hours. This positive momentum follows a 31% gain over the last fourteen days.

In the immediate future, SNX faces a crucial hurdle in surpassing the resistance level at $3.58, which is necessary to retest its recently achieved yearly high of $3.810. As SNX reached this high only a few hours ago, its next target is to surpass the $4 mark, a level not seen since August 2022.

On the other hand, if a short-term pullback or correction unfolds for SNX, it will be crucial for bullish investors to defend the $3.035 support level. Maintaining this level can sustain a favorable bullish trend throughout the remainder of the month.

Featured image from Shutterstock, chart from TradingView.com

The native token of decentralized liquidity platform Synthetix (SNX), rose by 12.5% during European hours on Monday following significant outflows on Binance.

LINK, FIL, SNX and THETA are starting to look bullish right as Bitcoin prepares for a volatile price move.

This is the launch of the standard that could connect all of the blockchains and all of the bank chains, Sergey Nazarov said in an interview with CoinDesk.

The U.S. bankruptcy court granted the crypto lender permission to sell its altcoin holdings for BTC and ETH starting in July.

The upcoming exchange, Infinex, will cater to both novice and experienced traders by offering features similar to centralized exchanges (CEX).

The market, which was replaced by a new version, has been in close-only mode for months, but about $150,000 remains on the original platform.

A Chainlink exec said the oracles will improve GMX’s security by providing a more “strong degree of tamper-resistance when settling user trades.”

DWF Labs made headlines with flurry of investments in crypto projects such as CryptoGPT or Synthetix. A closer examination reveals that many of their deals aren’t typical venture capital investments. However, the firm says it’s all a misunderstanding.

Synthetix generated more than $730K in fees on March 30 ahead of the start of its allocation of 200,000 OP tokens to traders.

Derivatives liquidity protocol Synthetix seals new partnership with DWF Labs, landing a $20 million investment from the quantitative trading firm.

DWF Labs purchased $15 million worth of Synthetix’s native token SNX on March 16 with a further purchase of $5 million to follow.

It’s too early to know if DeFi is “dead,” but platforms that share revenue with liquidity providers and token holders could be the ones that survive the bear market.

Fees spiked to a high of $8.36 million for Uniswap on June 15, beating out Ethereum on the same day at $7.99 million, and coincided with an 8.7% pump for UNI.

After plunging below $18,000 over the weekend to trade at a price of SNX, the native token of Synthetix decentralized finance (DeFi) platform, has gained more than 100% to usher in the week.

SNX has proven to be the stock with the biggest rise on Monday. The token’s 24-hour trading volume has increased by more than 1,200% to $322 million, according to data from CoinMarketCap.

This indicates that investors are pouring money into the token despite its poor performance last week, as it has been put up for bid. Additionally, this abrupt growth in SNX is supported by the increasing daily network volume as a result of its new function.

Suggested Reading | Bitcoin Climbs Back Above $20K, A Bit Of A Relief To The Sinking Crypto Market

Synthetix is a Layer-2 scaling solution that provides on-chain exposure to a wide variety of crypto and non-crypto assets. It recently partnered with liquidity provider Curve Finance to create Curve pools for sETH/ETH, sUSD/3CRV, and sBTC/BTC, allowing investors to convert synths such as sETH to Ether (ETH) at more affordable rates.

Synthetix Token Climbs By Half In Seven Days

The Synthetix token is selling at $3.05 at the time of writing, a 50 percent increase over the past week. The latest price increase has assisted the token in erasing its deficit from the ongoing market meltdown.

The price increase of SNX is not only attributable to optimistic perceptions surrounding Bitcoin at the start of the week, but also to investors’ eagerness to hold tokens instead of synths and the protocol’s ability to generate more than $1 million in trading fees, five times greater than BTC’s daily performance.

When token holders pledge their SNX as collateral using Mintr, a decentralized platform for engaging with Synthetix contracts, synthetic assets are created. Currently, the protocol supports synthetic fiat currencies, cryptocurrencies, and commodities.

SNX At No. 87 On The Global Rankings

The Synthetix coin is trading slightly over its 52-week low. Any decrease in the price of Bitcoin could cause the price of SNX to decrease as well.

Among the almost 20,000 cryptocurrencies, SNX crypto is listed on the No. 87 spot. The SNX cryptocurrency can be traded on crypto exchanges such as Binance and Uniswap.

The cryptocurrency market is showing signs of revival, as its valuation increased by 8.5% from the previous day to reach $879 billion. However, it is essential to recognize that the crypto market as a whole is experiencing a moment of tremendous instability.

Featured image from Cryptona, chart from TradingView.com

L2 scaling solution Synthetix collaborated with Curve Finance to create Curve pools for sETH/ETH, sBTC/BTC and sUSD/3CRV, allowing investors to convert synths into tokens.

SNX price got a boost after the project geared up for participation in the L2 Curve Wars and Optimism airdrop hunters engaged with the protocol.