Stablecoins boost demand for U.S. Treasury notes, Howard Lutnick, the CEO of Tether custodian Cantor Fitzgerald, said.

Bitcoin: Will This “Dry Powder” and Historical Trends Fuel A Price Boom?

While Bitcoin has dipped from its recent highs of around $74,000, some analysts are urging investors to stay calm and even see this as a buying opportunity. So far, Bitcoin prices have remained under pressure, trickling lower in the past trading week.

Are There Similarities With The Bitcoin Bull Run Of 2020?

Though the downward momentum is slowing down, and there has been no confirmation of the April 2 dump, the failure of bulls to convincingly flow back and drive the coin above $71,000 remains a concern for some traders.

Even so, taking a bullish stand, one analyst on X compares the current formation with that of 2020. Pointing to the cyclic nature of prices and the inevitability of retracements from bottoms and peaks, the trader expects prices to bounce.

The trader said that in 2020, when Bitcoin prices fell, shaking out weak hands, the recovery sparked a bull run that forcefully saw the coin surge above previous all-time highs of $20,000. The analyst seems to allude to the retracement before the breakout as a catapult that eventually fed the “legendary” bull run, which saw Bitcoin float to as high as $70,000.

Based on this comparison, the trader is adamant that it may, reading from history, be the best time to “sell” at around spot levels. Still, for now, buyers can consider doubling down until there is a clear trend definition and shake-off of the current bear formation. Currently, BTC has strong rejections in the $71,700 to $72,000 liquidation zone, marking last week’s highs.

Watch Out For The “Dry Powder”

Besides technical candlestick formation, another trader thinks buyers better HODL even with sellers in control.

In a post on X, the analyst said Tether Holdings, the issuer of USDT, and Circle, the issuer of USDC, recently minted billions. On April 2, Tether issued 1 billion USDT on Tron, while Circle issued 250 million USDC on Solana.

This development, the analyst said, means there is “plenty of dry powder.” Stablecoins like USDT and USDC offer stability in the crypto markets, providing a refuge for crypto holders whenever prices tumble.

However, they can also act as conduits of liquidity from the traditional market, providing an avenue for interested users to get exposure to top coins or even engage in activities such as decentralized finance (DeFi).

In the past, prices often edged higher when there were huge stablecoin mints.

Tether Added Nearly 8.9K Bitcoin to Holdings in First Quarter: On-Chain Data

The stablecoin issuer’s BTC holdings now top 75,000 tokens worth about $5 billion.

Illicit Funds in Crypto Ecosystem Shrank 9% Last Year, Yet Criminals Still Handled Nearly $35B: TRM Labs

Illicit activity in the cryptocurrency ecosystem appears to have reduced, with the total illicit funds shrinking by 9% in 2023 compared to 2022, even though criminals still handled over $34 billion worth of cryptocurrencies, Blockchain analytics firm TRM Labs has found.

Tether to Establish AI Unit, Starts Recruitment Drive

The unit will focus on the development of open-source AI models and collaborate with other firms to integrate the models into products that could address real-world challenges.

Tether’s USDT Now Available on Celo

The USDT integration aims to boost cross-border payments and peer-to-peer transactions in developing regions.

Tether’s USDT Stablecoin Touches $100B Market Cap, Benefiting From Crypto Trading Frenzy

USDT, a stablecoin issued by Tether, hit the $100 billion market value for the first time in its history, according to CoinGecko data, as the rally on crypto markets expanded.

Wall Street Journal Accused of Defamation Over 2023 Tether-Bitfinex Article

Christopher Harborne and his aviation fuel broker AML Global were wrongly accused of “committing fraud, laundering money, and financing terrorists,” according to the lawsuit.

Stablecoins Join The Crypto Bull Run With $140B Market Cap, Highest Since 2022

February has been an overall notable month for cryptocurrencies and the crypto industry. We’ve seen Bitcoin and Ether, the two largest cryptocurrencies by market capitalization, reach milestones not seen since the crypto winter started.

The bull run has seemingly started, as many analysts and investors have announced, and it appears to be following a ‘2-year trend’ where the industry is beginning to reclaim the heights lost in 2022. Consequentially, the rally has propelled the overall market cap of the crypto industry.

Stablecoins Remain Stable, But The Market Is Expanding

According to data from DefiLlama, stablecoins have joined the crypto market in the bullish rally, as its market capitalization hit $140 billion for the first time since December 2022.

Stablecoins are cryptocurrencies designed to have value pegged to another currency, like the US dollar, or a commodity, like gold. They account for a large portion of the daily trading volume of cryptocurrencies, as many consider them more useful for everyday transactions.

The slow and steady recovery of the crypto industry has been maturing the bullish sentiment in the community. Fueled by investors’ trust in crypto assets and important developments in the industry, the crypto market seems to be recovering to achieve a performance like that of the previous crypto bull run.

However, stablecoin’s recent market expansion is not only fueled by the positive sentiment. Tether (USDT) sits as the third largest cryptocurrency by market capitalization, with over $98 billion, and it has continued to extend its reach in the last few years.

Just this month, USDT’s market cap increased by $2 billion; in the last year, it has risen by over $28 billion. USDT is also ranked as the first cryptocurrency by trading volume in the previous 24 hours, according to data from CoinMarketCap.

Circle’s USDC, ranked fifth by daily trading volume and seventh by market cap, has also seen impressive growth, with its $2 billion market cap increase showing a recovery this month.

The stablecoin’s market capitalization saw a 1-year slump after dropping from $40 billion in March last year. However, the relisting of its trading pairs on Binance and the recent expansion to international markets has fueled USDC’s ‘resurgence,’ as Coinbase recently called it.

Crypto Market Cap Hits $2T

Today, the total crypto market cap hit $2 trillion as Bitcoin’s price spiked to $57,000, increasing 32.2% monthly and 101.3% in the past year. This milestone has not been reached since April 2022, when the total crypto market cap was at $2.1 trillion.

However, Bitcoin’s parabolic surge is not the only reason behind this achievement, as the altcoin market cap, which includes all cryptocurrencies except for BTC, has grown 29.35% in 30 days.

Accordingly, the market capitalization for altcoins hit $255 billion, representing a 111.6% surge last year. Similarly, this level has not been seen since April of 2022.

The altcoin market has seen green throughout February as interest in cryptocurrencies soared massively, led by the ETFs frenzy that started building at the end of last year and exploded in January.

Why Circle’s USDC Is Quitting the TRON Network

It could be part of a long-time realignment separating compliant and gray-market crypto, says Daniel Kuhn.

U.S. Regulators Do Have Some Control Over Stablecoin Tether: JPMorgan

USDT’s appeal relative to other stablecoins will likely diminish as regulations will require more transparency and compliance with new anti-money laundering standards, the report said.

Diversifying Stability: Stablecoins Finding Home Beyond the Greenback

Following the success of Tether and USDC, a generation of stablecoins are offering new features for investors and holders, says Scott Sunshine, Managing Partner of Blue Dot Advisors.

Stablecoin Tether’s Increasing Dominance Is Bad for Crypto Markets, JPMorgan Says

Other stablecoins such as USD Coin may benefit from the coming regulatory crackdown and gain market share, the report said.

Expert Analysis: Bitcoin ‘Bottom Is Not In’, Potential $30K Retest On The Horizon

Bitcoin (BTC), the largest cryptocurrency by market capitalization, closed January above the $40,000 threshold, signaling positive price action. However, market expert Justin Bennett suggests that Bitcoin’s bottom has yet to be reached.

Bennett’s analysis highlights the possibility of further price declines, with Tether’s stablecoin USDT dominance (USDT.D) chart indicating potential downward movements.

Tether Dominance Signals Concerns For BTC’s Price

Bitcoin’s recent price recovery and ability to surpass the $40,000 level have provided optimism among investors. Nevertheless, Bennett believes further price declines could follow a retest of the mid $44,000 range.

Bennett highlights the inverse relationship between Tether dominance and Bitcoin. According to his analysis, the levels on the Tether dominance chart since October have been reliable indicators for Bitcoin’s price movements.

According to Bennett’s analysis, as depicted in the chart above, Tether’s dominance may experience a potential increase from its current level of 6%. This increase could bring it closer to the 8% mark.

In such a scenario, Bitcoin’s performance would likely move in the opposite direction, indicating potential price declines soon.

On January 25, Bennett suggested that Bitcoin could drop another 20% from its current levels, which would place it around $30,000. If this scenario plays out, it would be crucial for Bitcoin bulls to defend the $30,000 level to maintain the current bullish structure.

A drop below $29,000 would give bears a stronger position, with only three major support lines remaining at $28,400, $25,900, and $24,000 before a potential retest of the $20,000 mark.

The performance of these support levels and Bitcoin’s ability to withstand increased selling pressure will be key factors to monitor. The future market sentiment will also play a significant role in determining Bitcoin’s price trajectory.

Bitcoin Witnesses Stellar Accumulation Trend

Despite the possibility of further price drops, renowned crypto analyst Ali Martinez has shed light on a notable trend in BTC’s recent accumulation streak by investors.

According to Ali Martinez’s analysis, Bitcoin is experiencing a significant accumulation streak, rivaling some of the most notable periods observed over the past few years.

The Accumulation Trend Score, a metric that gauges the buying activity of larger entities, has remained consistently high, hovering near 1 for the past four months.

This suggests that influential market participants are actively accumulating Bitcoin, signaling their confidence in the long-term potential of the cryptocurrency.

Martinez’s observations further indicate that Bitcoin’s price range around $42,560 has emerged as a highly significant interest zone.

Within this range, an impressive total of 912,626 BTC has been transacted. This is expected to be a significant support level, potentially preventing further downside movements and fostering increased buying interest.

These trends collectively contribute to a positive market outlook, suggesting that despite potential price drops, Bitcoin remains an attractive asset for long-term investment.

Featured image from Shutterstock, chart from TradingView.com

Stablecoins Surge: USDT Leads $400 Million Inflows, Signaling Investor Confidence

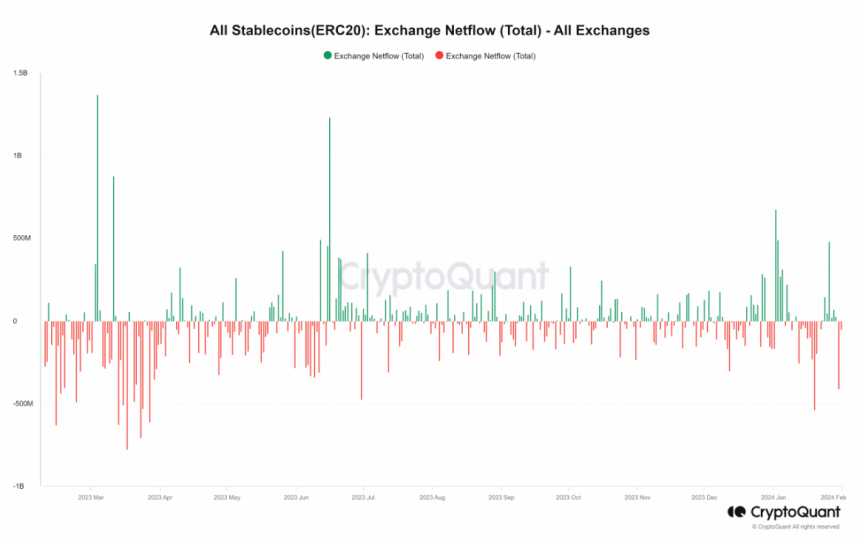

The cryptocurrency industry has witnessed a significant change in the movement of stablecoins, offering valuable observations into the evolving dynamics of the market. Recent data from IntoTheBlock and CryptoQuant has shown a surge in stablecoin inflows into exchanges, reaching record highs in January.

Notable inflows were observed on January 2nd ($478 million), January 3rd ($489 million), and January 26th ($673 million). However, this trend has since reversed, with outflows dominating the market.

On January 30th, there was a substantial outflow of $412 million, marking the second-highest daily outflow recorded in the month, following the $541 million outflow on January 19th.

USDT Leads Stablecoin Rally, But Caution Persists In Crypto Market

An analysis of the 24-hour trading volume of the top stablecoins on CoinMarketCap reveals that Tether (USDT) and USD Coin (USDC) collectively accounted for approximately 90% of the total volume. Tether, in particular, has been dominant in terms of flows, with a 24-hour trading volume exceeding $42 billion, while USDC’s volume stood at around $6 billion.

Taking a closer look at the flow of USDT through CryptoQuant, it was found that there was a substantial inflow of $373 million on January 26th, followed by a prevailing trend of outflows, with over $83.4 million observed at the time of writing.

Experts suggest that the rise in stablecoin inflows onto exchanges, particularly the $478 million on January 2nd, could indicate traders’ and investors’ readiness to participate in the market or their desire to safeguard their funds during uncertain times.

Conversely, the shift towards outflows may signal caution or preparation for potential market volatility. Additionally, the substantial inflow of stablecoins, especially USDT, could indicate increased buying power and intentions to establish positions in the cryptocurrency space.

Stablecoins Surge, Signal Investor Preparation

The increase in stablecoin inflows onto exchanges can be interpreted in two ways. Firstly, it may indicate that investors and traders are preparing to enter the market. By moving their funds into stablecoins, they can quickly transition into other cryptocurrencies when they perceive favorable opportunities. This suggests a readiness to participate and take advantage of potential market movements.

Secondly, the rise in stablecoin inflows may also reflect a desire to keep funds in a secure manner, particularly during uncertain times. Stablecoins offer stability by being pegged to a specific asset, such as the US dollar, which can be appealing to investors seeking to protect their capital in times of market volatility. This cautious approach can be seen as a way to safeguard funds and mitigate risks in an unpredictable market.

Tether Records Nearly $3 Billion Profit

Meanwhile, Tether announced a “record-breaking” $2.85 billion in quarterly profits as the market capitalization of its main token, USDT, approached $100 billion.

According to a blog post by Tether, the interest gained on the company’s enormous holdings in US Treasury, reverse repo, and money market funds—which support the USDT stablecoin—account for around $1 billion of the earnings in the most recent quarterly attestation report that was released on Wednesday. Everything else was “mainly” due to the growth of Tether’s other assets, like gold and bitcoin (BTC), the stablecoin issuer said.

Featured image from Wccftech, chart from TradingView

Tether Reports Record $2.85B Profit as Biggest Stablecoin Nears $100B Market Cap

The USDT stablecoin issuer held over $5.4 billion in excess reserves as of 2023 year-end, according to its latest attestation.

Bitcoin Accumulation: USDT Issuer Tether Goes On Massive 8,888 BTC Buying Spree

In an encouraging development for the crypto space, Tether, the issuer of the world’s largest stablecoin USDT, has doubled down on its Bitcoin investment momentum by acquiring a staggering 8,888 BTC, further diversifying its portfolio.

Tether Increases Its Bitcoin Holdings

Tether has recently made its third largest Bitcoin purchase, as the stablecoin issuer added a total of 8,888 BTC valued at $380 million at the time of purchase. This brings its total BTC holdings to 66,465 BTC, valued at $2.81 billion with an average buy price of $42,353.

This transaction was captured by BitInfoCharts data, which also showed the previous amounts of BTC accumulated by the blockchain-enabled platform. This recent purchase follows Tether’s Bitcoin investment strategy, in line with its vision to continuously strengthen its reserves by accumulating Bitcoin.

Earlier in May 2023, the stablecoin issuer announced in a blog post that it would regularly allocate 15% of its net realized operating profits toward increasing its BTC reserves. As of the end of March 2023, Tether held approximately $1.5 billion worth of cryptocurrency, a $1.3 billion difference from its total BTC holdings presently.

According to reports from Dune Analytics, Tether has become the 11th largest Bitcoin holder, with Microstrategy, an American business intelligence service, surpassing Tether’s holdings with over 189,00 BTC accumulated. The other addresses in the top 10 rankings are owned by major crypto exchanges and governments, including Binance, Bitfinex and the US government.

Tether’s decision to double down on its Bitcoin investments signals its confidence in the cryptocurrency’s future trajectory. It also underscores the blockchain platform’s belief in the long-term potential of BTC as it aims to capitalize on Bitcoin’s potential growth by bolstering and diversifying its digital asset reserve.

BTC Accumulation Race Amidst ETF Hype

Tether’s strategic Bitcoin purchase comes at a time when the crypto market is buzzing with excitement over Spot Bitcoin ETFs. Before the approval of Spot Bitcoin ETFs, Tether had steadily increased its BTC portfolio, purchasing substantial quantities of BTC consistently. In March 2023, the stablecoin issuer bought 15,915 BTC and another 4,083 BTC between the months of May and September.

The timing of Tether’s BTC purchase suggests a proactive stance towards potentially seizing the opportunities brought forth by the Spot Bitcoin ETF market and the upcoming Bitcoin halving in April.

In addition to Tether’s large-scale BTC acquisition, Microstrategy is also another major player which has been continually increasing its BTC holdings. The business intelligence software company added a whopping 14,620 BTC to its portfolio in December 2023. At the time, the value of the purchase was about $615.7 million.

Other companies with large BTC holdings include Galaxy Digital and Elon Musk’s Tesla, as well as space exploration company SpaceX.

In Search of Financial Freedom: The Answer Lies With Bitcoin, Not Stablecoins

Tether Reportedly Bought 8.9K Bitcoin for $380M, Remaining 11th-Largest BTC Holder

The stablecoin issuer announced in May 2023 that it would start buying bitcoin in an effort to diversify the backing of its USDT stablecoin.

Does Howard Lutnick Know ‘the Truth’ About Tether?

Speaking at Davos, the Cantor Fitzgerald CEO says the stablecoin issuer has the money to back USDT. Maybe it’s time we all started to believe in Tether, despite the “truthers”?