The decentralized exchange, which last year moved over to the Cosmos blockchain, just saw $757 million of volume over a 24-hour period.

UNI Price Prediction – Uniswap Momentum Reignites, 15% Lift-off Possible

UNI price is moving higher from the $5.65 support. Uniswap is up 5% and it seems like the bulls could aim a fresh surge toward the $8.00 zone.

- UNI started a fresh increase above the $6.00 and $6.20 resistance levels.

- The price is trading above $6.50 and the 100 simple moving average (4 hours).

- There was a break above a key bearish trend line with resistance near $6.60 on the 4-hour chart of the UNI/USD pair (data source from Kraken).

- The pair is showing bullish signs and might rally if it clears the $7.25 resistance.

UNI Price Aims Higher

After forming a support base above $5.65, UNI started a fresh increase. The bulls were able to push Uniswap’s price above the $6.00 and $6.20 resistance levels, outperforming Bitcoin and Ethereum.

There was a break above a key bearish trend line with resistance near $6.60 on the 4-hour chart of the UNI/USD pair. The pair even cleared the $6.75 resistance level. It is now approaching the 50% Fib retracement level of the downward move from the $8.24 swing high to the $5.67 low.

UNI is now trading above $6.50 and the 100 simple moving average (4 hours). Immediate resistance on the upside is near the $6.95 level. The next key resistance is near the $7.250 level. It is close to the 61.8% Fib retracement level of the downward move from the $8.24 swing high to the $5.67 low.

Source: UNIUSD on TradingView.com

A close above the $7.25 level could open the doors for more gains in the near term. The next key resistance could be near $7.65, above which the bulls are likely to aim a test of the $8.00 level. Any more gains might send UNI toward $8.25.

Dips Supported in Uniswap?

If UNI price fails to climb above $6.95 or $7.25, it could correct further lower. The first major support is near the $6.60 level or the 100 simple moving average (4 hours).

The next major support is near the $6.25 level. A downside break below the $6.25 support might open the doors for a push toward $6.00.

Technical Indicators

4-Hours MACD – The MACD for UNI/USD is gaining momentum in the bullish zone.

4-Hours RSI (Relative Strength Index) – The RSI for UNI/USD is well above the 50 level.

Major Support Levels – $6.60, $6.25 and $6.00.

Major Resistance Levels – $6.95, $7.25 and $8.00.

Thorchain Dominates Cross-Chain Trading Volume: What’s Next for RUNE?

Thorchain, a cross-chain liquidity network, has emerged as a frontrunner in cross-chain transfers, surpassing its competitors in volume and transaction activity, on-chain data shows.

Thorchain Trading Volume Expands As Prominence Increases

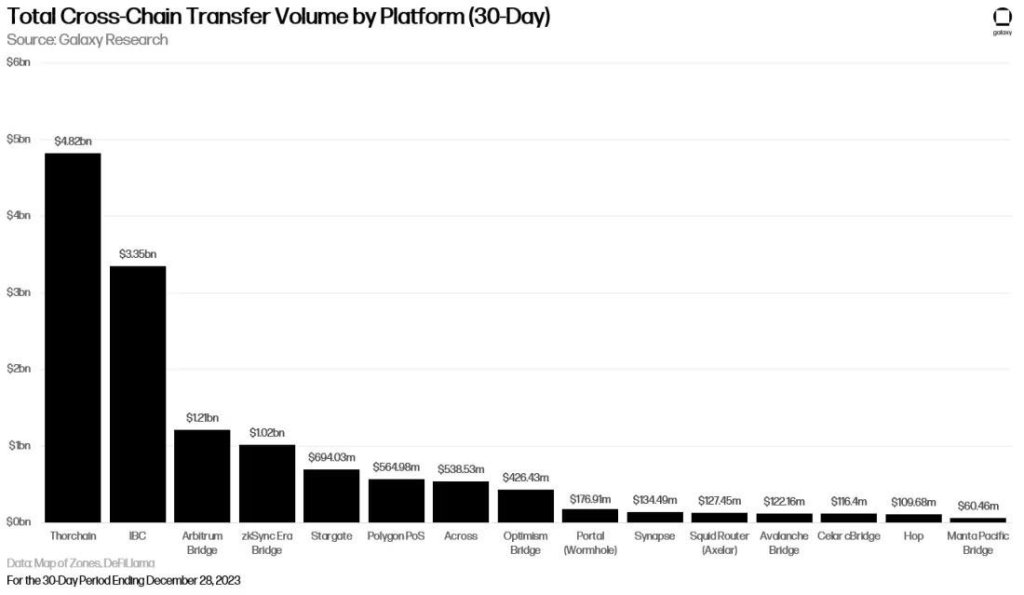

Citing Galaxy Research data, a user on X, Bullion, noted that Thorchain processed $4.82 billion in cross-chain transactions over the past 30 days, while Cosmos’ Inter-Blockchain Communication (IBC) protocol handled $3.35 billion worth of transactions during the same period.

Among layer-2 bridges, Arbitrum Bridge led the pack with $1.21 billion in cross-chain volume. Others, like Polygon POS and Stargate, processed $564 million and $694 million, respectively.

The spike in Thorchain’s trading volume and liquidity indicates the protocol’s increasing significance in the broader decentralized finance (DeFi) landscape. The protocol’s unique features and innovative solutions have made it a preferred destination for cross-chain asset transfers.

At the heart of Thorchain is its ability to facilitate cross-chain asset swapping in a trustless and non-custodial manner. In this arrangement, and like popular decentralized exchanges like Uniswap, Thorchain allows users to retain control of their funds without depending on intermediaries.

The stream swaps technology seems to be drawing user attention to Thorchain. This feature allows users to swap with near-slippage free even without high liquidity. Technically, and as expected in decentralized exchanges, the lower the liquidity, the higher the slippage. The offer for low or zero slippage gives Thorchain a significant advantage over other cross-chain swaps.

Beyond trading, Thorchain has incorporated other defi solutions, including lending. In this arrangement, Thorchain now supports the trustless lending of assets without liquidity risk or interest, a deviation from traditional lending protocols, including Aave.

As DeFi TVL Recovers, Will RUNE Break To New 2024 Highs?

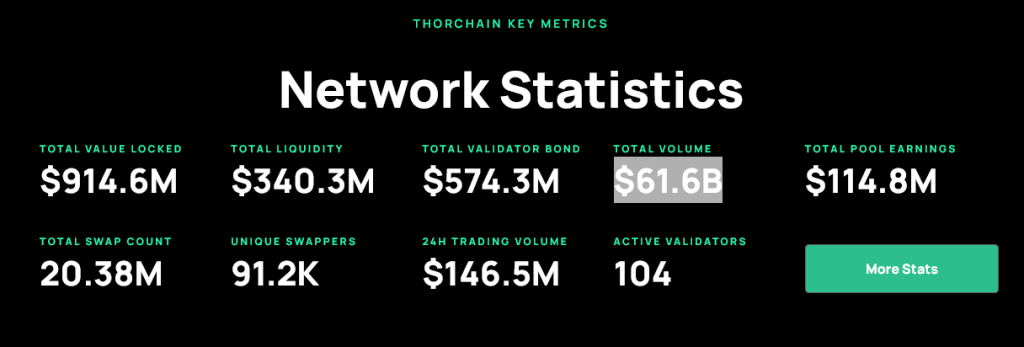

Together, these features have contributed to Thorchain’s growing trading volume, further cementing its position in the recovering DeFi scene. According to DeFiLlama, Thorchain has a total value locked (TVL) of around $322 million.

Meanwhile, Thorchain claims to have over 91,000 swappers. Cumulatively, the protocol has processed over $61 billion in trading volume.

As DeFi expands from 2022 pits, RUNE, the platform’s native token, has also benefited. Looking at the RUNE daily chart, it is up roughly 5X from 2023 lows.

Despite the re-pricing of asset prices on January 3, RUNE remains resilient. Prices are trending inside a bull flag. Any breakout above $6.5 and local resistances could catalyze demand, lifting the coin above $7.3 to new 2024 highs.

Is Trader Joe (JOE) A Hidden Gem Poised to Outperform Uniswap (UNI)?

In decentralized finance (DeFi) and trading, Uniswap has long reigned as a dominant force. However, a recent analysis by Lark Davis, a Bitcoin (BTC) investor, seems to suggest Trader Joe, a decentralized exchange (DEX) on Avalanche–a highly scalable blockchain and Ethereum’s competitor, could eventually emerge as a formidable competitor, even overtaking Uniswap.

Is Trader Joe Undervalued Relative To Uniswap?

In a post on X on December 12, Davis noted a discrepancy in the relative valuation between JOE and UNI, which serve as governance tokens of Uniswap and Trader Joe. Specifically, the investors noted that Trader Joe’s handles around $300 million daily trading volume on Avalanche alone.

On the other hand, Uniswap processes approximately $1.6 billion in daily volume across the Ethereum mainnet and Arbitrum, the largest layer-2 platform by total value locked (TVL) by Ethereum.

Davis further noted that despite this “small” difference in trading volume, Trader Joe’s has a market capitalization of only $238 million. Meanwhile, Uniswap has a market cap of $3.6 billion, according to CoinMarketCap data.

Even with relatively narrow average trading volume, the huge difference in market capitalization suggests that JOE is significantly undervalued relative to UNI. Accordingly, this gap will likely be narrowed in the future, with JOE appreciating versus UNI, possibly benefiting holders.

JOE Yields Versus UNI’s Governance: Which Token Has An Edge?

Davis also pointed out JOE’s potential, saying the token rewards holders with USDC yields. This is different from UNI, where holders can vote on proposals and nothing else. In the investor’s preview, besides the undervaluation, this feature could further enhance JOE’s appeal, even contributing to its upside potential.

As the crypto market recovers, Avalanche might also present additional advantages to traders and, therefore, Trader Joe. The modern blockchain is scalable and has relatively low fees regardless of network activity. With crypto prices expanding, Ethereum gas fees have been rising in tandem, discouraging mainnet transfers. This has rerouted activity to layer-2s like Arbitrum and competing platforms, including Avalanche.

When writing on December 12, DeFiLlama data shows that Trader Joe has a TVL of $149 million, of which most assets are tied to Avalanche. Only $1 million is on Ethereum. JOE has been on an uptrend, rising 170% from October 2023 lows. The token is cooling off, looking at price action on the daily chart.

Decentralized Exchange Uniswap Expands to Bitcoin Sidechain Rootstock

Uniswap version 3 (v3) has been deployed on Bitcoin sidechain Rootstock by GFX Labs, the team behind trading terminal Oku.

Decentralized Exchange Uniswap Expands to Bitcoin Sidechain Rootstock

Uniswap version 3 (v3) has been deployed on Bitcoin sidechain Rootstock by GFX Labs, the team behind trading terminal Oku.

Bitcoin bulls’ run toward $45K could produce tailwinds for UNI, OP, TIA and STX

Bitcoin bulls could make a strong push to get BTC through the $45,000 resistance this week. Will UNI, OP, TIA and STX follow?

Hayden Adams: From Ethereum Idealist to Business Realist at Uniswap

Uniswap, the first decentralized crypto exchange of its kind, was Adams’ first and greatest contribution to Ethereum. The latest V4, inviting praise and criticism, earns him a spot on the Most Influential 2023.

Whale Rapidly Stacking Uniswap, UNI To $10?

An active crypto whale has been steadily accumulating UNI, the native token to Uniswap, one of the world’s most active decentralized exchanges (DEXes). This development suggests that the address believes the token may edge higher in the coming trading days or weeks, extending gains after a sharp leg up on November 22 when UNI soared, breaking above key resistance levels.

Whale Loading Up More UNI, Back To $10?

According to recent Lookonchain data, an Ethereum address, stevu.eth, withdrew 311,302 UNI worth $1.93 million from Binance, the world’s largest crypto exchange, on November 25, pushing its total UNI holdings to 511,301 UNI, or $3.18 million.

Notably, this acquisition follows a withdrawal of 500,545 UNI ($2.42 million) from OKX on June 29, which stevu.eth deposited to Binance and OKX in August. However, the recent accumulative behavior on November 25 indicates that the whale is bullish on UNI, possibly expecting prices to float back to $10, a level last seen in August 2022.

Presently, UNI is trading within a bullish breakout formation, looking at the performance in the daily chart. Changing hands at around $6.2 when writing on November 27, the token is up approximately 60% from October lows. Even with the confidence, UNI prices have been mostly consolidating, moving horizontally at spot rates.

If buyers press on, a close above $6.6 with expanding volumes might confirm buyers of November 22. In that case, the resulting momentum might form the base for another leg up, pushing the token to August 22 highs of around $10.

Uniswap v4 Expectations

The whale’s confidence in UNI aligns with the ongoing development of Uniswap v4, an upgrade that will significantly enhance the DEX. In this update scheduled for a tentative period in 2024, Uniswap Labs, the team behind Uniswap, is introducing a concept called “hooks.”

Hooks are contracts that can be executed at various stages of a pool’s lifecycle. According to the team, Hooks, which act as more plugins, provide increased flexibility and customization for Uniswap’s liquidity pools.

As such, it would be possible for users to enable features like dynamic fees, refined market making, and even advanced orders executed on-chain.

What’s notable about Uniswap v4 is the introduction of “singleton” contract architecture. All Uniswap liquidity pools will reside inside a single, smart contract in this design change. The team notes that this can significantly reduce gas costs and, more importantly, reduce routing efficiency across numerous pools.

Bitcoin struggles to flip $38K to support, while UNI, IMX, VET and ALGO aim to push higher

Bitcoin is facing resistance at $38,000, but UNI, IMX, VET and ALGO may extend their up-move in the short term.

UNI Price Prediction – After 25% Rally Uniswap Turned Attractive On Dips

UNI price rallied over 25% and climbed above $6.20. Uniswap is now consolidating gains and any dips might be attractive to the bulls in the near term.

- UNI started a fresh increase above the $5.20 and $6.00 resistance levels.

- The price is trading above $5.80 and the 100 simple moving average (4 hours).

- There was a break above a key declining channel with resistance near $5.25 on the 4-hour chart of the UNI/USD pair (data source from Kraken).

- The pair might correct lower, but the bulls could be active near the $5.60 and $5.55 levels.

UNI Price Regains Strength

After forming a support base above $4.80, UNI started a fresh surge. The bulls were able to push Uniswap’s price above the $5.25 and $5.30 resistance levels, outperforming Bitcoin and Ethereum.

There was a break above a key declining channel with resistance near $5.25 on the 4-hour chart of the UNI/USD pair. The pair pumped over 25% and even climbed above $6.20. A new multi-week high was formed near $6.60 and the price is correcting lower.

There was a move below the $6.25 level. Uniswap is now approaching the 23.6% Fib retracement level of the upward move from the $4.83 low to the $6.60 high.

UNI is still trading above $5.80 and the 100 simple moving average (4 hours). If there is a fresh increase, the price might face resistance near the $6.40 level. The next key resistance is near the $6.60 level. A close above the $6.60 level could open the doors for more gains in the near term.

Source: UNIUSD on TradingView.com

The next key resistance could be near $6.88, above which the bulls are likely to aim a test of the $7.00 level. Any more gains might send UNI toward $7.20.

Dips Supported in Uniswap?

If UNI price fails to climb above $6.40 or $6.60, it could correct further lower. The first major support is near the $6.05 level. The next major support is near the $5.70 level.

The mains support is near $5.55 or the 61.8% Fib retracement level of the upward move from the $4.83 low to the $6.60 high. A downside break below the $5.55 support might open the doors for a push toward $5.00.

Technical Indicators

4-Hours MACD – The MACD for UNI/USD is losing momentum in the bullish zone.

4-Hours RSI (Relative Strength Index) – The RSI for UNI/USD is well above the 50 level.

Major Support Levels – $6.05, $5.70 and $5.55.

Major Resistance Levels – $6.40, $6.60 and $7.00.

DeFi gathering momentum, Ethereum Gas Fees Rising: Why Is Uniswap (UNI) Stuck?

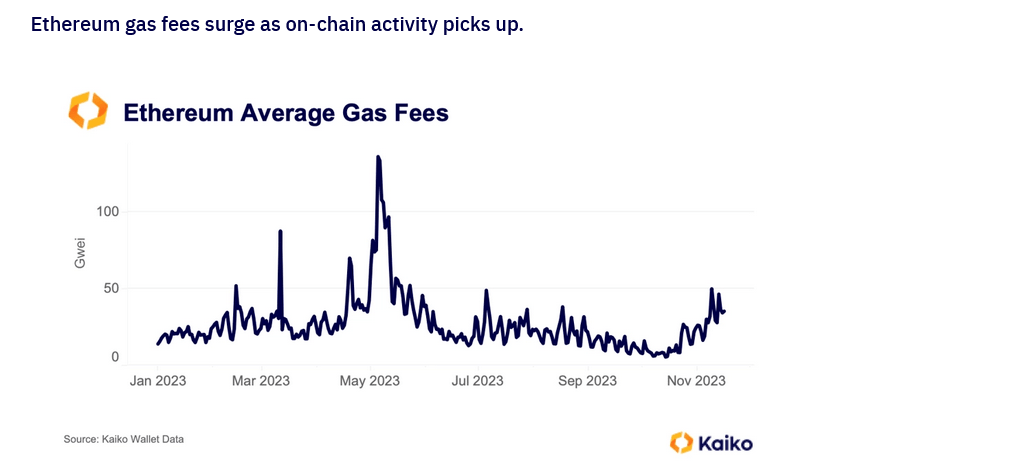

Decentralized finance (DeFi) activity on Ethereum is picking up momentum based mainly on how gas fees have been trending in the first three weeks of November, data from Kaiko shows. Even so, despite Uniswap (UNI) spearheading the revival, looking at the gas attributed to its activities over this period, UNI prices remain stagnant below $5.6, with bulls failing to edge higher, breaking to new 2023 highs.

Ethereum Gas Fees Rising, DeFi Revival?

According to Kaiko, a blockchain analytics platform, the average gas fees on Ethereum hit multi-month highs last week. The platform expressly notes that the primary driver has been Uniswap’s activities, reading from the rising transaction volumes from meme coins, including GROK. This, in turn, pushed block space demand higher, increasing gas fees.

Gas fees remain volatile but generally higher in the first three weeks of November. As of November 20, Ycharts data shows that the average cost of sending a transaction stood at 45.13 Gwei, nearly 100% from November 19, when it was at 24.84 Gwei. This is a significant jump from 17.66 Gwei in late October 2023.

Gas fees and how ETH and DeFi token prices react are directly correlated as DeFi and other on-chain activities like non-fungible token (NFT) minting and trading rise; gas fees usually expand in trending markets.

Accordingly, the recent expansion in gas fees could suggest that the markets could be preparing for a leg up, and tokens of critical protocols, including Uniswap or Aave, could benefit.

DeFi TVL Rising, But Uniswap Is Stuck Below $5.6

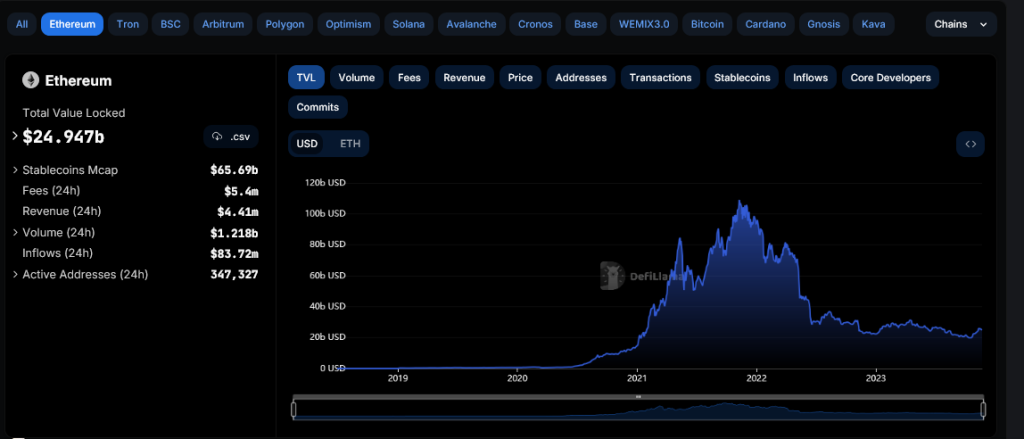

As of writing, the total value locked (TVL) across all DeFi protocols stands at over $46.6 billion as of November 21, according to DeFiLlama. This increase is nearly $5 billion more than in early November and up from $37 billion in mid-October.

Ethereum remains a choice platform for deploying DeFi apps despite the relatively gas fees pinned to mainnet scaling challenges. The pioneer smart contract blockchain manages $25.4 billion in TVL, whereas Uniswap is one of the largest protocols with $3.216 billion in TVL.

UNI prices are up 30% from mid-October when writing on November 21. However, bulls have been unable to break above the November highs at around $5.6. From the daily chart, trading volume, and thus participation, has been tapering even though prices have been edging higher.

This formation suggests that the uptrend was behind low momentum and sustainability. Technically, there could be more gains if there is a solid close above November highs with expanding volumes. In that case, UNI could expand, retesting 2023 highs of around $7.2.

Crypto Biz: Uniswap’s Android wallet app, Cboe to launch BTC, ETH margin futures, and more

Getting regulatory approval has been crucial for companies, particularly in a tight regulatory environment during the crypto winter.

Uniswap launches Android wallet app with built-in swap function

The Uniswap Android app has finished beta testing and is now publicly available.

Uniswap’s Financial Win: New Fee Model Rakes In Over $1 Million In A Month Amid DeFi Frenzy

Uniswap Labs, the company behind the decentralized finance (DeFi) protocol, has achieved a milestone in its revenue generation strategy. Just a month after its implementation, the firm’s newly introduced front-end fees have crossed roughly $1 million, a testament to the platform’s robust activity and user base.

This achievement comes shortly after the mid-October decision to introduce a 0.15% fee on some certain tokens transacted on its front-end interface. This new fee structure applies to various assets, including popular ones like ETH, USDC, WETH, USDT, DAI, WBTC, and others.

Analyzing Uniswap Financial Trajectory

As shown in data from Token Terminal, over the past few weeks following the fee’s launch, Uniswap has amassed about $1.14 million.

This figure translates to an average daily revenue of approximately $44,000. Projected annually, this rate could bring in roughly or more than $16 million in revenue for Uniswap Labs.

Meanwhile, Blockchain reporter Colin Wu estimated daily fees from Uniswap V3’s new structure could range between $388,000 and $444,000. Although the figures have been more modest, they still represent a substantial income stream.

Wu’s analysis also reveals that about 35% to 40% of Uniswap’s total transaction volume is processed through the front end, indicating a significant portion of the platform’s activity is subject to these new fees.

Regardless, the total cumulative amount recorded in the past weeks, nearly a month, marks a significant financial upturn for the company and highlights the potential profitability of increased fee structures in the DeFi space.

Notably, unlike the long-established 0.3% fee, dispensed among liquidity providers as an incentive, the new front-end fees solely directed towards Uniswap Labs is not just a revenue-generating move, as it also signified a strategic shift towards diversifying income sources.

So far, this step allows Uniswap Labs to have a direct and consistent revenue stream, independent of the protocol fees traditionally distributed among liquidity providers.

DeFi Market Flourishes: Capital Inflows and Token Value Surge

It is worth noting that the recent boost in Uniswap’s cumulative front-end fees aligns with an emerging DeFi resurgence, marked by a significant rise in capital inflows.

Data from DeFiLlama reveals a notable nearly $10 billion increase in the DeFi market’s total value locked (TVL) over the past month. This upward trajectory has seen the TVL escalate from $36.62 billion in October to roughly $46.65 billion.

Moreover, this bullish trend extends to DeFi tokens, with leading DeFi assets experiencing substantial growth. Top tokens such as Chainlink (LINK), Avalanche (AVAX), and Uniswap (UNI) have recorded increases of 19.39%, 35%, and 8.56% respectively in the last week, reflecting the overall positive momentum in the crypto market.

Featured image from Unsplash, Chart from TradingView

Crypto VC Funding Slowed Last Week as $35M Raised in 9 Deals Including Uniswap DAO

Summary of blockchain project fundraising for the week of Oct. 30 to Nov. 3. Highlights included a $12M raise for Ekubo Protocol and $6.3M for the AI-based blockchain project Modulus.

Bitcoin price reclaims $35K — Will ATOM, UNI, NEAR and AXS rally next?

Bitcoin recaptured a key price level and a handful of altcoins look poised to breakout.

Unibot contract $560K exploit crashes token price by more than 40%

Amid ongoing investigations from Unibot and blockchain investigators, Scopescan advised users to revoke the approvals for the exploited contract and move the funds to a new wallet.

Crypto Analyst Presents Uniswap’s UNI As The Next Coin Primed For Breakout

Several altcoins are currently on the rise following Bitcoin’s resurgence, and popular crypto analyst Ali Martinez has singled out the Uniswap UNI token as one of those tokens that could rally further as he projects that UNI is set to break out soon from its current resistance level.

Why Uniswap Is Poised For A Breakout

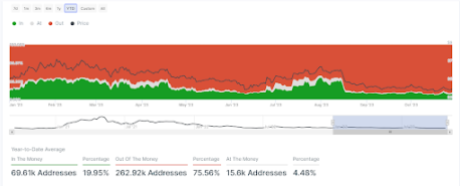

In a post shared on his X (formerly Twitter) platform, Martinez noted that the majority of UNI holders were positioned ‘Out of the Money,’ which suggests that the token was preparing for a breakout. Accompanying his post was data from the crypto analytics platform Intotheblock based on the ‘Historical In/Out of the Money’ metric.

The data shows that over 75% of the token holders are ‘out of the money’, which means that they were yet to break even in their investments as the average cost price at which they bought these tokens is greater than its current price.

More addresses are out of the money | Source: IntoTheBlock

More addresses are out of the money | Source: IntoTheBlock

Furthermore, the crypto analyst explained that selling pressure has gotten exhausted and that the UNI token has been able to build “an important support” level at around $4. This could serve as a lift-off point for the altcoin.

Key Supply Walls UNI Needs To Break

To further support his breakout theory, Martinez noted two supply walls that UNI “needs” to overcome in order to signal a bullish breakout. According to him, one of these supply walls is at $4.23, where data from Intotheblock shows that 7,000 addresses have bought 14.24 million worth of UNI.

The other supply wall is at $4.45, where data from Intotheblock shows that 2,000 Uniswap addresses have accumulated 10.28 million worth of UNI. Whales and institutional players may also be aware of this potential breakout and may be looking to position themselves, as Martinez noted.

The crypto analyst also recently commented on a potential Ethereum breakout. In a different post on his X platform, he said that the second largest cryptocurrency by market cap will need to overcome the huge supply wall at $1,960, where data from Intotheblock showed that 1.14 million addresses bought close to 33 million ETH.

Meanwhile, Martinez believes that now is a good time for people to accumulate Bitcoin based on his examination of the past two cycles from the market bottom and the present Bitcoin trend. According to him, a similar trajectory points to the next Bitcoin market top being around October 2025.

At the time of writing, the UNI token is trading at around $4.10, according to data from CoinMarketCap.

Audits and rug-pulled projects, a $650B token burn, and major DeFi protocol quits UK: Finance Redefined

Uniswap’s founder burned $650 billion of HayCoin, amounting to 99% of the token’s supply.