Already a multi-billion-dollar sector of the crypto industry, the DePIN narrative is a promising one, according to experts.

CEO Throws Cold Water On May Ethereum ETF Approval – Impact On Price

The much-anticipated arrival of spot Ethereum exchange-traded funds (ETFs) in the US seems to be hitting a snag. Industry leaders are voicing growing concerns about the likelihood of securing regulatory approval from the Securities and Exchange Commission (SEC), with a deafening silence from the agency fueling anxieties.

Jan van Eck, CEO of investment firm VanEck, recently cast a shadow of doubt on the possibility of SEC approval for spot Ether ETFs in May. In a CNBC interview, van Eck expressed his belief that their application would likely be rejected, citing a complete lack of communication from the regulatory body.

This sentiment finds an echo in the words of Eric Balchunas, a Senior Bloomberg ETF analyst, who has significantly downgraded his odds of approval to a mere 35%. Balchunas attributes this pessimism to the ongoing “radio silence” between the SEC and fund issuers.

Nice scoop from @joelight. Def interesting but no change our odds. As we’ve said, need SEC to give comments on the filing documents (the “critical feedback” he mentions) and that still ain’t happening, even in person they offering nothing. Silence is violence. https://t.co/z76KTtdmHU

— Eric Balchunas (@EricBalchunas) April 8, 2024

Ethereum ETF Applications Languish In SEC Limbo

The SEC’s lack of response extends beyond van Eck’s application. Seven other proposals for spot Ether ETFs are currently gathering dust, with no indication of progress. This regulatory purgatory is fueling skepticism among industry commentators. CoinShares CEO Jean-Marie Mognetti believes that approval for any of these applications is unlikely “this side of the year,” further amplifying the prevailing uncertainty.

The current roadblock for Ethereum ETFs stands in stark contrast to the success story of Bitcoin ETFs. The SEC’s green light for Bitcoin ETFs offered a glimmer of hope for the cryptocurrency market. Van Eck highlights the growing interest in Bitcoin as a “maturing asset class,” with significant untapped investor demand.

Notably, VanEck’s own spot Bitcoin ETF, known by the ticker HODL, has witnessed significant inflows since its launch in mid-January, signifying a strong investor appetite for crypto exposure.

Lack Of Clarity Creates Murky Investment Landscape

The lack of interaction from the SEC is a major concern for James Seyffart, another analyst in the field. He emphasizes that “zero comments or interactions from the SEC is a bad sign.” This sentiment suggests a troubling trend in the approval process, further dampening hopes for a swift resolution on the Ethereum ETF front.

Despite the current cloud of uncertainty surrounding Ethereum ETFs, the cryptocurrency market continues to experience growth and gain wider acceptance. This indicates that opportunities for investment diversification in the digital realm are on the rise.

However, until the SEC sheds light on its stance, investors and industry stakeholders will be forced to navigate a landscape fraught with uncertainty and intense regulatory scrutiny.

The path forward for Ethereum ETFs remains shrouded in doubt. The SEC’s silence is deafening, and industry leaders are bracing for potential rejection. With a lack of clear communication and mounting skepticism, investors are left facing a blank wall, waiting for a sign from the SEC.

Featured image from Micoope, chart from TradingView

Ethereum L2s Growth: VanEck Eyes $1 Trillion Market Cap As ETH Stalls

Banking behemoth VanEck has valued Ethereum Layer-2 (L2) solutions at an astounding $1 trillion in a daring prediction, emphasizing the critical role that efficiency gains and scalability improvements will play in the development of blockchain technology.

Ethereum Layer 2s Poised For Significant Increase In Valuation

According to VanEck researchers, Ethereum Layer 2 scaling networks are expected to soar to the aforementioned market valuation by 2030. Leading the comprehensive prediction were Patrick Bush, the senior investment analyst at VanEck, and Matthew Sigel, the head of digital research.

Specifically, the bold forecast was carried out while evaluating Ethereum Layer 2s in five distinct important areas. These include Layer 2s transaction pricing, developer experience, user experience, trust assumptions, and L2s ecosystem size. In addition, it was made by first assessing the amount of assets in the Ethereum ecosystem and then projecting that ETH would account for about 60% of the market share among public blockchains.

It is noteworthy that Layer 2s, by managing the majority of transactions off the main blockchain, addresses scalability issues. In this case, Zero-knowledge roll-ups (ZKUs) and optimistic roll-ups (ORUs) are the two major forms of layer 2 networks.

Given the limits of the main blockchain’s transaction processing, these L2 technologies may be able to generate more funds than Ethereum since they handle scalability by processing transactions off the main network.

As the researchers stated, in the future, a few general-purpose L2s will be in control, but a plethora of roll-ups tailored to certain use cases will also arise, making it possible to host social media networks on different rollups.

The report read:

Beyond the dominance of a few roll-ups among general-purpose L2s, we forecast a future of thousands of use-case-specific roll-ups. These L2 will be segmented by sector, application, or function. Other types of chains may be specifically geared towards hosting a whole sector, such as a roll-up that hosts a social media network, as well as applications that want to build products and services for that social media network.

This forecast by VanEck primarily points to the possibility that L2 solutions could perform better in terms of value than Ethereum in the next six years. The report also claims that Layer-2 blockchains will benefit from Ethereum’s restricted processing power, as well as its data-storing and computation capabilities.

ETH Price Experiences Bearish Activity

Presently, Ethereum’s price is declining after failing to rise above the $4,000 mark once more. Even though the market is currently correcting downward, a positive bounce is still anticipated to occur soon.

Compared to other notable coins in the crypto market like Bitcoin, ETH has underperformed over the past month. Consequently, there have been speculations within the cryptocurrency community, if a further decline is imminent.

ETH has seen a decrease of more than 10% since March, following a surge to $4,091 ahead of the Dencun upgrade. As of press time, Ethereum was trading at $3,343, displaying an increase of 1% in the past day.

Its market cap is now valued at $401,42 billion, with a 1% rise in the last 24 hours. However, its daily trading volume has plummeted by over 30%, pegging at $13,50 billion.

Ether ETFs Could Be Bigger Than Bitcoin ETFs, Says VanEck

The issuer of the VanEck Bitcoin Trust this week dropped its management fee to zero for a limited time in an attempt to attract more capital to that fund.

VanEck Spot Bitcoin ETF Sees Record $119M Inflow After Fee Cut to 0%

VanEck waived the management fee for its spot bitcoin ETF for a year or until reaching $1.5 billion in assets under management.

VanEck Temporarily Cuts Bitcoin ETF Fee to Zero After Lagging in Assets

HODL, VanEck’s spot bitcoin exchange-traded fund (ETF), has so far attracted a little over $305 million in assets, which is far below most of its competitors.

Bitcoin ETF Issuer VanEck Has Huge Crypto Growth Goals in Europe

VanEck, a 69-year-old asset manager with a history of bringing newfangled investments to customers, has high hopes for the role crypto will play in its European division.

VanEck Starts Digital Asset Management Platform and NFT Marketplace

The platform, called SegMint, aims to streamline the sharing of access and ownership of self-custodied assets.

Bitcoin Price Tumbles Amid VanEck ETF’s Volume Surge: What Happend?

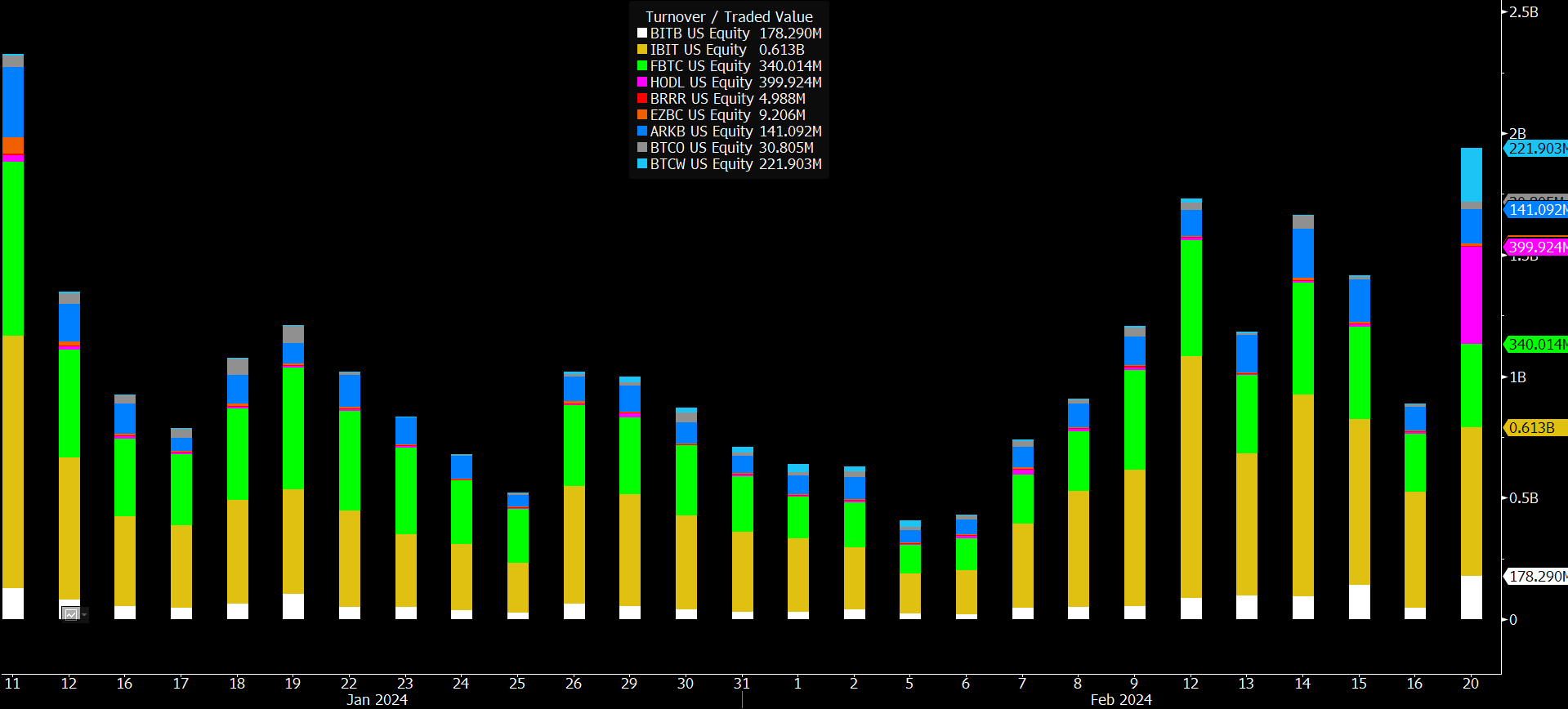

Bitcoin experienced a tumultuous day yesterday, with its price briefly touching $53,000 before plummeting to a low of $50,820. Amid this price volatility, an unexpected phenomenon caught the eye of market analysts: a dramatic surge in trading volumes for certain Bitcoin ETFs.

Bloomberg’s Eric Balchunas provided a detailed account of this anomaly on X, particularly focusing on the VanEck Bitcoin ETF (HODL) and its astonishing increase in trading volume. He remarked, “HODL is going wild today with $258m in volume already, a 14x jump over its daily average, and it’s not one big investor… but rather 32,000 individual trades, which is 60x its avg.”

This level of activity was not only unexpected but also unprecedented, sparking widespread speculation and analysis within the financial community. The unusual trading volume wasn’t isolated to HODL alone. Wisdom Tree’s Bitcoin ETF (BTCW) and BlackRock’s Bitcoin ETF (IBIT) also saw significant upticks in trading activity, albeit to varying degrees.

Balchunas pointed out, “BTCW also popping off, $154m trades, 12x its avg and 25x its assets via 23,000 indiv trades.” However, he noted that the volume increase in IBIT, while elevated, did not reach the “extraordinary levels” observed in HODL and BTCW.

What’s Behind The Sudden Spike In Bitcoin ETF Volumes?

Addressing theories that the ETF volume surge was driving Bitcoin’s price drop, Balchunas offered a rebuttal, “To the ‘bruh volume must be selling bc btc is dumping’ crowd: a) that makes no sense given how little these ETFs had in existing aum/shareholders b) plus you never see ton of outflows in brand new ETF that is in rally mode c) there are so many other holders of btc besides ETFs! d) how can you call it ‘dumping’ when it is down 1% after 20% rally in two weeks?”

However, the source of this sudden and explosive increase in trading volume remains a mystery, with Balchunas speculating, “Still haven’t figured out what happened. No one knows. Given how sudden and explosive the increase in number of trades was… I’m wondering if some Reddit or TikTok influencer type recommended them to their followers. Feels retail army-ish.”

He also considered the possibility of market makers trading among each other but found it an unlikely explanation given the liquidity of other Bitcoin ETFs like IBIT and BITO.

The trading day concluded with “The Nine” achieving a record-breaking volume day, thanks to significant contributions from HODL, BTCW, and BITB, which all shattered their previous records. Balchunas highlighted the significance of this trading volume, stating, “For context $2b in trading would put them in Top 10ish among ETFs and Top 20ish among stocks. It’s a lot.”

As the dust settles on this unprecedented day of trading, the Bitcoin community continues to grapple with the implications of this volume surge on Bitcoin ETFs and its potential impact on the market. The exact catalyst behind this phenomenon remains elusive, with analysts and investors alike keenly awaiting further developments.

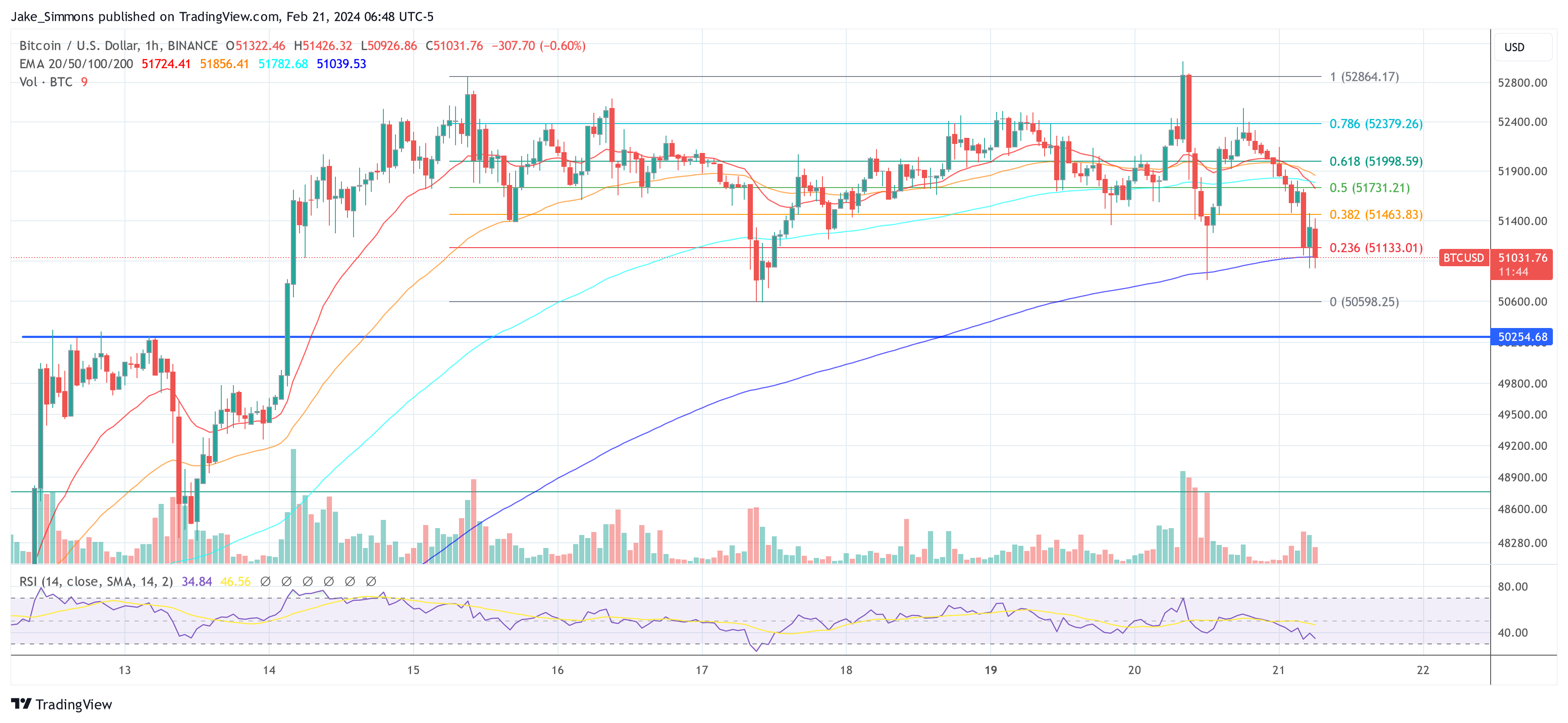

At the time of going to press, BTC fell below the $51,000 mark again and initially found support at the EMA100 on the 1-hour chart.

VanEck’s Bitcoin ETF Records 2,200% Volume Surge in a Day

A sudden trading volume on VanEck’s HODL product seemed “retail armyish,” one analyst said.

Ethereum ETF: Franklin Templeton Enters The Fray As ETH Rallies

Wall Street titan and Asset manager Franklin Templeton has applied for an Ethereum Spot Exchange-Traded Funds (ETF) after a struggle to gain approval for their Bitcoin Spot ETF in early January.

Asset Manager Files For Spot Ethereum ETF

Asset managers have gravitated toward the Ethereum spot ETF since the United States Securities and Exchange Commission (SEC) approved the Spot Bitcoin ETF. Franklin Templeton is the latest manager to apply with the SEC to get approval for this financial product.

The asset manager’s move came after successfully introducing the BTC spot ETFs. This is a notable step toward making more crypto investment products accessible to institutional and individual investors.

James Seyffart, a senior analyst from Bloomberg Intelligence, also shared the update with the crypto community on X (formerly Twitter). Seyffart’s X post included a screenshot of the asset manager’s filing and data regarding other applicants.

According to the post, Franklin Templeton is the eighth company in the cryptocurrency market to file for product approval. Previous asset managers to file applications for Ethereum ETFs include Hashdex, BlackRock, Fidelity, Ark and 21Shares, Grayscale, VanEck, Invesco, and Galaxy.

Per the official filing, a Delaware statutory trust is how the Franklin Ethereum Trust is set up. The ETF aims to give investors access to ETH in a regulated manner by allowing them to store it directly through a custodian.

It states in the company’s S-1 filing that the proposed “Franklin Ethereum Trust” will hold ETH and “may, from time to time, stake a portion of the fund’s assets through one of the more trusted staking providers.”

Staking is the act of locking up digital currency to maintain the operations of a blockchain network. They plan to stake some of the ETF’s ETH holdings to supplement its income through staking rewards.

The Price Of ETH Rallies Amidst The Update

Franklin Templeton’s spot Ethereum ETF application was made in light of the price of ETH experiencing an uptick. However, no solid proof exists that the latest development impacted the price of crypto assets.

Related Reading: Ethereum ETFs Approval Date Set For May 23, Forecasts Suggest ETH Could Reach $4,000

Ethereum was trading at $2,661 as of press time, indicating an increase of over 7% in the past 24 hours. Data from CoinMarketCap shows that its market capitalization is also on the upside, marking an increase of over 7%.

Meanwhile, its trading volume has increased significantly by over 172% in the past day. Due to the rise, ETH now ranks third in the entire crypto market by trading volume.

Ben Franklin’s Laser Eyes Suggest a Tough – and Quirky – Battle for Bitcoin ETFs

Franklin Templeton, the $1.5 trillion asset manager, gave its famous logo a glowing, crypto-y tweak after the SEC approved bitcoin ETFs, possibly girding for a tough battle with BlackRock and other Wall Street giants.

BlackRock, VanEck Update Bitcoin ETF Filing Within Hours of Quick SEC Response

BlackRock and VanEck, two among 13 issuers hoping to launch bitcoin exchange-traded funds (ETFs) in the U.S., have filed updated documents on Tuesday.

BlackRock, Other Potential Bitcoin ETF Providers Reveal Fees

BlackRock said its fee will start at 0.20%, rising to 0.30%.

VanEck to Donate 5% of BTC ETF Profits to Bitcoin Core Developers

The move is reminiscent of a similar pledge by VanEck to donate 10% of profits from its ether futures ETF to Ethereum developers in October last year.

VanEck CEO Predicts When The Bitcoin Price Will Reach $69,000 Again

VanECK’s CEO, Jan van Eck, had so much to say about Bitcoin in a recent interview. One of the highlights was his prediction as to when the flagship cryptocurrency will once again hit its all-time high (ATH) of $69,000.

When Bitcoin Will Hit $69,000 Again

In an interview with CNBC, Jan Van Eck stated that he expects Bitcoin to hit a new ATH in the next 12 months. That means that the crypto token could reclaim its current ATH of $69,000 and possibly surpass it based on Van Eck’s prediction. Interestingly, his firm predicts that Bitcoin could witness a new ATH by November 9, 2024.

Throughout the interview, Jan Van Eck sounded so bullish on BTC. He highlighted how he had always been a firm believer in the crypto token. He also noted that his firm was the first ETF player to have filed to offer a Spot Bitcoin ETF back in 2017. The application was, however, rejected at the time.

Asset manager VanEck’s relatively early interest in Bitcoin seemed to have been driven by their CEO as he narrated how his interest in Bitcoin grew. Van Eck mentioned how he began to listen to podcasts and went as far as reading Bitcoin’s whitepaper. Back when the crypto token was trading at $3,000, he said he had predicted that it would still do a 10x from there.

VanEck’s CEO further stated that Bitcoin is “the obvious asset that is growing in front of our eyes.” He likened Bitcoin’s growth to China’s and how the country was underdeveloped years ago but now has one of the largest economies. Therefore, he suggested that BTC is still going to attain unprecedented heights.

Nothing Like BTC

At some point in the interview, Van Eck was quizzed about whether or not there could be something else that surpasses Bitcoin, just like it did with Gold. He responded in the negative as he stated that it is almost impossible for him to imagine some other “Internet store of value” leapfrogging Bitcoin.

Van Eck went on to note that the macro behind Bitcoin is very strong. He also alluded to the macrocycle, especially with interest rates expected to keep falling, and how this is bullish for the crypto token. He believes that this, alongside with the upcoming Bitcoin Halving event are the factors that will make BTC outperform in the coming year.

Asset manager VanEck is one of the numerous asset managers who have applied to the SEC to offer a Spot Bitcoin ETF. With approval possibly on the horizon, the firm’s CEO believes that the Commission is likely to approve the pending funds simultaneously. His belief stems from the fact that the SEC did the same thing with the Ethereum futures ETF.

Bitcoin won’t be beaten as digital store of value: VanEck CEO

“It’s impossible for me to imagine some other internet store of value [will] leapfrog Bitcoin,” said Jan van Eck as he made his bullish case for BTC.

Solana Shows Its Mettle As SOL Barrels Past $70 – Details

SOL investors are enjoying this year’s festive season as Solana enters the $70 mark today, backed by extremely bullish market conditions. According to CoinGecko, the token is up 12% in the weekly timeframe, with the biggest jump in the monthly at 30%.

Investment manager VanEck also speculates that Solana will join the ETF race, following recent news that the US Securities and Exchange Commission will approve a spot Bitcoin exchange-traded fund, further bringing exposure to traditional investors.

A Not-So Far Off Possibility

VanEck recently released a list of 15 predictions for the crypto world for 2024. In summary, the post favors a bullish 2024 for crypto, especially in the realms of Web3 gaming and DeFi. According to the prediction, both Web3 and DeFi will start 2024 on a strong note; with Web3 gaming getting a breakout and DeFi finally reconciling with the Know-Your-Customer issues it’s known for.

However, the most eye-catching of these is the speculation that SOL will be part of the spot ETF race in 2024.

“Solana will become a top 3 blockchain by market cap, Total Value Locked (TVL), and active users,” said VanEck in the blog post.

VanEck sees Solana as a top player within the DeFi space, eyeing even the possibility of SOL flipping Ethereum in the long run. This prediction is influenced by the fact that VanEck is running an exchange-traded note (similar to an ETF) with SOL being the underlying asset. This Solana ETN was released in 2021 in the heyday of the crypto boom.

If Solana does become part of the ETF race in 2024, it will bring in more institutional investors that willing to take some exposure from crypto investments.

Short-Term Pain For Long-Term Gain

The token sits at a high price point after following Bitcoin in its rally. This naturally brought SOL to a position that is slightly untenable in the short term. So far, investors and traders should be careful as the current price level might result in a slight dip in the next couple of days.

However, a dip in price shortly shouldn’t be feared. This will only bring SOL in a better position for higher gains. If the token settles on the $70 price level, we might see gains far beyond $80 to $90 in the coming days.

For now, the year will end on a positive note as SOL is on the road towards $100.

Featured image from Pixabay

The Bitcoin Spot ETF Boom: VanEck Forecasts $2.4 Billion Inflows In Q1 2024

The crypto market is on the brink of a potentially game-changing shift, as investment management firm VanEck predicted. In a recent analysis, VanEck forecasts a substantial inflow of funds into Bitcoin spot exchange-traded funds (ETFs), expecting more than $2.4 billion to be injected in the first quarter of 2024 alone.

This bullish prediction aligns with the anticipated launch of the first Bitcoin spot ETF in the US, which could positively change the crypto landscape.

Bitcoin Bullish Forecast

This forecast emerges against a backdrop where investors are increasingly gravitating towards ‘hard money’ assets, those which remain largely unaffected by the whims of US authorities, as indicated by VanEck

In this context, Bitcoin emerges as a particularly appealing option due to its “resilience” and limited correlation with conventional financial markets.

Despite the expected market volatility, VanEck’s analysts maintain strong confidence in Bitcoin’s market stance, projecting that its price will unlikely fall below the $30,000 mark in early 2024.

VanEck’s report delves further into Bitcoin’s future, highlighting the significance of the upcoming Bitcoin halving in April 2024. This event is anticipated to “proceed without a major fork or missed blocks” catalyzing a surge in Bitcoin’s value.

Unsurprisingly, the firm predicts that November 9, 2024, could witness Bitcoin attaining a new all-time high three years after its last peak.

VanEck added that such a milestone could even see Bitcoin’s mysterious creator, Satoshi Nakamoto, being named Time Magazine’s “Man of the Year,” particularly if Bitcoin reaches the $100,000 threshold.

VanEck

15 Crypto Predictions for 2024

Prediction #1. The US recession will finally arrive, but so will the first spot #Bitcoin ETFs. Over $2.4B may flow into these ETFs in Q1 2024 to support Bitcoin’s price.

— VanEck (@vaneck_us) December 7, 2023

Ethereum And Solana’s Rising Tide: VanEck’s Perspective On Altcoin Market Dynamics

In contrast to Bitcoin’s expected dominance, VanEck casts a different light on Ethereum’s future. The firm anticipates that while Ethereum will not surpass Bitcoin in market cap in 2024, it is likely to outperform every major tech stock.

However, Ethereum is projected to face challenges from other smart contract platforms like Solana, which present fewer uncertainties regarding scalability. VanEck’s analysis suggests that while Ethereum will show strong performance, it will lose market share to these emerging platforms.

The report also touches upon geopolitical implications for Bitcoin. Countries like Argentina are expected to follow El Salvador’s lead by sponsoring state-level Bitcoin mining and leveraging their energy resources.

This trend, combined with Bitcoin’s regulatory clarity and energy intensity, is predicted to draw attention from quasi-state entities in Latin America, the Middle East, and Asia.

According to VanEck’s insights, the post-halving period will see a market rally led by Bitcoin, with value eventually flowing into smaller tokens.

Lastly, VanEck casts a spotlight on Solana, predicting its rise to become a top-three blockchain by market cap, Total Value Locked (TVL), and active users. This ascent is anticipated to fuel Solana’s entry into the spot ETF wars, with a surge of filings expected from asset managers.

Featured image from Unsplash, Chart from TradingView

Bitcoin new high set for late 2024, Binance to lose top spot, predicts VanEck

Next year will see Binance lose its leadership position, a U.S. recession, new stablecoin market cap highs and a new peak price for Bitcoin, according to asset manager VanEck.