[toc]

In the realm of digital riches, XRP wallets stand tall as a secure haven and a gateway to empowerment. These wallets not only offer a safe space for storing, sending, and receiving XRP, but they also grant you the keys to the kingdom. With robust security measures like password protection, encryption, and multi-factor authentication, your holdings are shielded from the clutches of cyber villains. No longer do you need to rely on third-party custodians, as these wallets put you in full control of your investments.

XRP wallets come in various types, each catering to different needs and preferences. Software wallets like XAMAN and TRUST wallet can be installed on your computer or mobile device, providing a convenient way to manage your XRP. Hardware wallets such as Ledger Nano X offer enhanced security by storing your tokens offline. On the other hand, online wallets like Uphold and GateHub allow you to access your XRP through a web browser.

However, convenience doesn’t take a backseat with XRP wallets. Integrated address books and QR code support make sending and receiving XRP a breeze, eliminating the need for laborious manual entry. Transactions can be completed with a simple swipe, ensuring seamless and effortless interactions with your XRP holdings.

In this article, whether you’re an experienced crypto connoisseur or a curious explorer, we will highlight the top 5 XRP wallets that provide a compelling mix of security, control, and convenience, making them an essential tool in your digital asset arsenal.

Essential Factors To Keep In Mind When Picking XRP Wallets

Compatibility

When selecting an XRP wallet, it’s crucial to consider its compatibility with your devices and preferred operating systems. Ensure that the wallet you choose seamlessly integrates with your desktop, mobile, or web-based platforms. By opting for a wallet that aligns with your preferred platforms, you can enjoy a smooth user experience and easily manage your XRP holdings from the devices you use most frequently.

Security

Ensure that the wallet you choose offers robust security measures, such as encryption, password protection, and two-factor authentication. These features help safeguard your holdings from unauthorized access and potential cyber threats.

Private Key Control

It is absolutely imperative to carefully choose wallets that provide you with unwavering and unconditional control over your private keys. Such wallets empower you to retain absolute ownership and sovereignty over your XRP holdings, significantly decreasing your dependency on third-party custodians.

Backup and Recovery

It is essential to verify that the wallet offers reliable backup and storage options for your private keys or recovery phrases. This step is critical to prepare for potential device loss, damage, or unforeseen events. By having a secure and easily accessible backup, you can always recover your funds with peace of mind.

Reputation and Community Support

Conduct thorough research on the wallet’s standing and take into account feedback from the XRP community. Prioritize wallets with a proven track record, favorable reviews, and vibrant development and support communities.

Top 5 XRP Wallets To Use

Ledger Nano For XRP (Hardware Wallet)

The Ledger Nano X is an advanced hardware wallet that offers robust security and offline storage for XRP and other cryptocurrencies. With its user-friendly interface, companion app, and multi-currency support, it provides a convenient and secure solution for managing your XRP funds. The Nano X is designed to be portable and durable, and offers enhanced connectivity options. It is important to obtain the Nano X from authorized sources and prioritize following recommended security practices to safeguard your assets effectively.

Setting Up Nano Ledger:

You connect the Nano X to your computer or use Bluetooth with the Ledger Live app on your smartphone or desktop.

During setup, you’ll create a PIN and a 24-word recovery phrase. This phrase is crucial for backing up and recovering your wallet if needed, so write it down and store it securely offline.

You can then initialize the device and install the app for XRP (or other currencies you want to store). See the image of the Ledger Live App below:

XAMAN Wallet – Formerly XUMM Wallet

XAMAN is a mobile app and wallet created exclusively for the XRP Ledger. It provides a user-friendly interface and a wide range of capabilities for token management and XRP Ledger interaction. With XAMAN, you can securely store, send, and receive XRP, as well as sign transactions, and manage your account.

The app also supports decentralized finance (DeFi) integration and enables the development of personalized XRP-based applications. Security is a top priority for XAMAN, ensuring users have complete control over their private keys. You can download XUMM on iOS and Android devices.

How To Set Up XAMAN XRP Wallets:

To set up the XAMAN wallet, first, download the XAMAN app from the Google Play Store or App Store. Once installed, open the app and select “Create new account” on the welcome screen to begin the setup process. See images from the App Store below:

The app will prompt you to select a secure PIN code to protect your wallet. Make sure the PIN code is unique and not easily guessable.

Next, backup your account by saving a 24-number recovery phrase. It’s important to write down the numbers in the exact order and store them in a safe place. This recovery phrase will be crucial for restoring your wallet if you lose your device or need to recover your funds. Verify the recovery phrase by entering specific numbers from it to ensure accuracy.

Once your XAMAN wallet setup is complete, deposit funds to activate your account, and you can start using it to send, receive, and manage supported assets like XRP.

GateHub Wallet

GateHub is a platform that utilizes the capabilities of the XRP Ledger protocol, providing users with a diverse set of features pertaining to the Internet of Value. With GateHub, users can securely send and receive a variety of assets, such as XRP and other supported cryptocurrencies. Additionally, the platform allows for the tokenization and management of different types of assets.

An essential aspect of GateHub is its seamless integration with the XRP Ledger, which is a decentralized blockchain technology explicitly designed for efficient and rapid asset transfers. Through this integration, GateHub empowers users to execute transactions with minimal fees and nearly instantaneous settlement times.

How To Set Up GateHub:

To set up a GateHub account, begin by accessing the GateHub website. Initiate the registration process by selecting the “Sign Up” button.

Provide the required information, including your email address, username, and password. Ensure that your password is robust and secure.

Validate your email address by clicking on the verification link sent to your registered email. This step is crucial to confirm your account. Upon successful email verification, log in to your GateHub account using the credentials provided during the registration process.

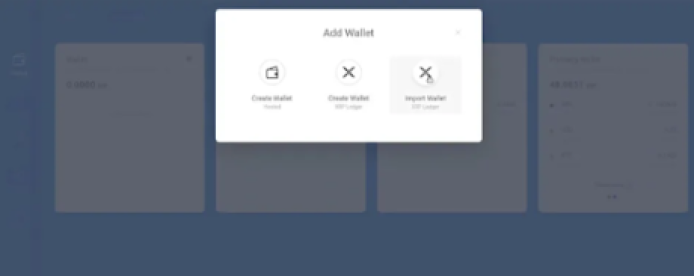

After setting up 2FA, you can create a GateHub wallet by accessing the “Wallet” or “Add Wallet” option in your account dashboard. Choose the desired wallet type, like XRP or other supported cryptocurrencies, and follow the provided instructions to create the wallet.

(See illustrations below)

Click on the wallet drop-down menu in the upper-left corner of your screen:

Then, click on the “Create Wallet” option.

Once your wallet is created, you will be provided with a wallet address. This address can be used to receive XRP into your wallet.

Trust Wallet

Trust Wallet is a well-known mobile wallet that offers support for various cryptocurrencies, including XRP. It provides users with a secure platform to store, transfer, receive, and manage their XRP tokens.

The Trust Wallet interface is designed to be user-friendly, allowing you to easily monitor your balance, track transaction history, and access other pertinent information. When sending XRP to others, simply input their XRP wallet address and indicate the desired amount for a smooth transaction experience.

How To Set Up Trust Wallet

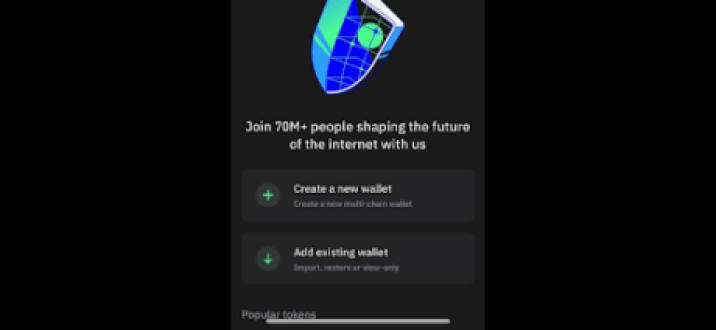

First, download and install the Trust Wallet app from the official app store (available for both iOS and Android).

To begin, launch the Trust Wallet app and initiate the process of creating a new wallet by choosing the option “Create a new wallet”. Alternatively, if you possess an existing wallet, you can opt to import it.

It is of utmost importance to take adequate measures to protect your wallet. Safely backup your wallet’s recovery phrase, as it serves as a crucial means to restore your wallet in the event of loss or device replacement. Take the time to write down the recovery phrase and store it securely in a location that guarantees its preservation.

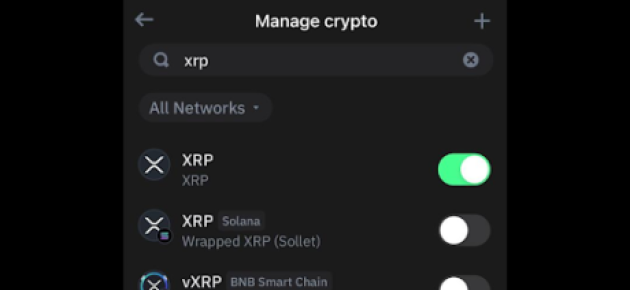

Once your wallet is created, you will be taken to the main interface. Use the “Search” option to add XRP by enabling it, as seen in the image below:

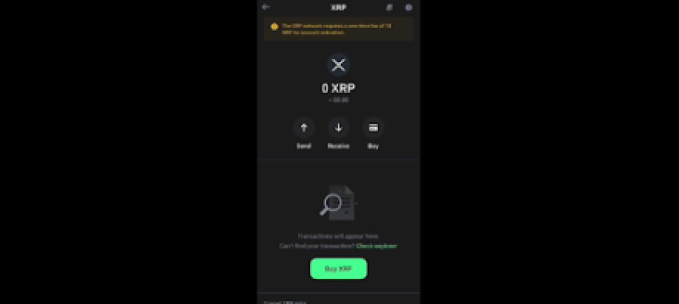

This will make XRP appear in your wallet, displaying its balance. Now, all you have to do is fund your wallet with as minimum as 10 XRP to activate your account, and your tokens will be ready to use.

To receive XRP, simply share your XRP wallet address with the sender. They can use this address to send XRP tokens to your Trust Wallet.

Uphold Wallet

The Uphold Wallet is an extensive digital wallet and exchange platform that caters to multiple cryptocurrencies, including XRP. It delivers a smooth and user-friendly experience, ensuring a secure and convenient solution for managing your XRP funds.

Uphold enables effortless storage, sending, and receiving of XRP, along with seamless currency conversion options. With its swift transactions and intuitive interface, Uphold Wallet stands out as a favored choice among individuals seeking a flexible and trustworthy wallet.

How To Set Up Your Uphold XRP Wallet:

To set up an Uphold Wallet, visit their website and sign up for an account. Verify your email, complete the registration process, and enable two-factor authentication for added security.

Deposit funds into your account and set up your wallet. Once done, you can start using your Uphold Wallet to store, send, receive, and convert XRP within the platform.

Uphold offers a seamless and user-friendly experience, enabling you to effortlessly engage in buying, selling, sending, and receiving XRP, regardless of the transaction size.

You can also diversify your portfolio with a variety of cryptocurrencies and fiat currencies and even link your bank account for convenient and smooth transactions.

Conclusion On XRP Wallets

In conclusion, there is a wide range of options available for managing XRP tokens, each with its own unique strengths and considerations. When choosing an XRP wallet, it is crucial to prioritize factors such as security, user experience, and compatibility with different platforms.

However, when choosing an XRP wallet, prioritize security by downloading wallets from official sources and safeguarding private keys and recovery phrases. A user-friendly interface and intuitive features enhance the XRP management experience. Compatibility with different platforms ensures convenient access, and considering additional features like portfolio diversification and staking can be beneficial.

By carefully evaluating these factors and taking individual preferences into account, one can find the ideal XRP wallet that meets their specific needs. This enables a secure and seamless experience in storing, sending, receiving, and managing XRP tokens, ensuring confidence and peace of mind in the cryptocurrency journey.

+

+ Xumm @ XRPL Labs) (@WietseWind)

Xumm @ XRPL Labs) (@WietseWind)