XRP, the native token of Ripple, has caught the attention of market analyst Mikybull who is calling for a potential 5x surge in the mid-term. This bullish prediction comes amidst recent struggles for XRP, which is currently grappling to maintain support above the $0.60 level.

Mikybull bases his optimism on two key technical indicators: the two-year moving average (MA) and a symmetrical triangle formation on the two-month chart. XRP recently crossed above the two-year MA, a historical signifier of significant price increases according to the analyst. This pattern held true in late 2017 when XRP skyrocketed to its all-time high of $3.31 after a similar crossover.

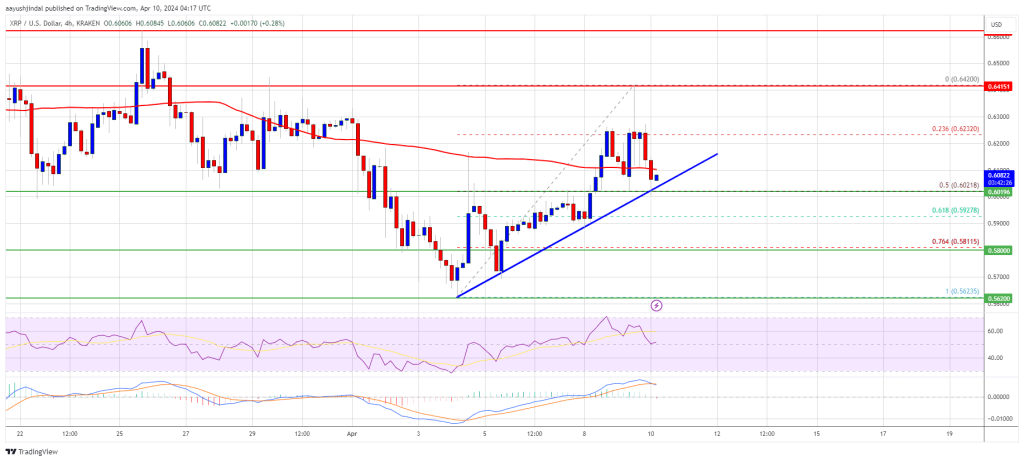

XRP Technical Chart Hints At Breakout

The symmetrical triangle on the two-month chart further bolsters Mikybull’s prediction. This pattern often precedes a breakout, and in XRP’s case, a breakout above the triangle’s upper trendline could propel the price towards $3.10, aligning with Mikybull’s 5x surge target. The 2017 price surge also coincided with a breakout from a similar triangle formation, lending historical credence to the analyst’s view.

It has climbed above 2-yr MA in this cycle, indicating that an upward explosive move should bring about 5x at least.

It happened in 2017 and 2021 so buckle up. pic.twitter.com/KTIKys2zMy

— Mikybull

Crypto (@MikybullCrypto) April 11, 2024

A Cautious Approach Still Warranted

However, cryptocurrency enthusiasts should approach this prediction with a dose of healthy skepticism. While technical analysis can be a valuable tool, past performance doesn’t guarantee future results. The broader market environment can significantly impact individual cryptocurrency prices. Furthermore, XRP is currently facing resistance at the $0.60 level, highlighting a potential hurdle before any significant upward climb.

Regulatory Landscape And Adoption Remain Key

Beyond technical indicators, the future of XRP hinges on two crucial factors: the ongoing legal battle with the SEC and its adoption within the financial sector. The SEC lawsuit, which accuses Ripple of selling unregistered securities, has cast a shadow over XRP, creating uncertainty for investors. A positive resolution in Ripple’s favor could significantly boost investor confidence and potentially trigger a price increase.

On the adoption front, Ripple’s core utility lies in facilitating faster and cheaper cross-border payments for financial institutions. Increased adoption of Ripple’s technology by banks and other financial players would translate to a higher demand for XRP, potentially driving its price upwards.

A Calculated Optimism For XRP

The coming months will be crucial for XRP as the legal battle with the SEC unfolds and its adoption within the financial sector becomes clearer. With a mix of technical optimism and lingering uncertainties, XRP’s journey towards the $3 target promises to be an exciting, yet potentially volatile, ride.

Featured image from Pixabay, chart from TradingView

24,880,000

24,880,000