A Yearn contributor said the value lost came from “strictly protocol owned liquidity” in the protocol’s treasury and that customer funds weren’t impacted.

Cryptocurrency Financial News

A Yearn contributor said the value lost came from “strictly protocol owned liquidity” in the protocol’s treasury and that customer funds weren’t impacted.

Recent data analysis reveals a significant decline in the performance of YFI, the native token of the Yearn Finance platform. In a dramatic overnight development, the native token of the Yearn Finance ecosystem witnessed a staggering 40% plunge.

This downturn in YFI’s performance prompts a closer examination of the intricate dynamics within the decentralized financial landscape. The abrupt and substantial drop has ignited a wave of speculation within the community, with some expressing concerns about the possibility of an exit scam.

Much of its recent profits was wiped by the slump. Investors quickly sold off their holdings in YFI in response to the wider selloff that had shook the cryptocurrency market as a whole, which caused a sudden shift in value.

As users seek to navigate and capitalize on the potential returns of the crypto market, the fluctuations in YFI’s value underscore the inherent volatility and complexity of DeFi environments.

Specifically, YFI plummeted from $15,450 to $8,950 within a mere 24-hour period. This sharp and rapid descent represents a substantial loss of $6,510 in the value of YFI.

The price of YFI has seen a noteworthy rising trend during the last seven days. The asset was trading at almost $9,000 just a week ago. But it quickly gained momentum and by Friday, it had reached its highest price point in more than a year—above the $15,000 level.

JUST IN: Yearn finance ( $YFI ), one of the biggest platforms in the DeFi ecosystem, has just plummeted over -45% in an apparent exit scam by insiders.

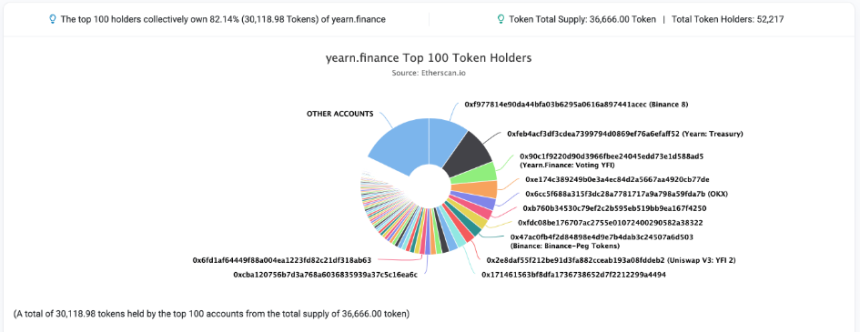

Nearly half of the entire supply for YFI is held by 10 wallets, and over $250 million in market value has vanished in minutes pic.twitter.com/pMqonBcgux

— WhaleWire (@WhaleWire) November 18, 2023

In a matter of hours, the market capitalization experienced a significant decline, with almost $250 million disappearing. The market cap plummeted from $525 million to $275 million. It is once again seeing an upward trend; however, investor sentiment has been negatively impacted by the abrupt decline.

The recent sell-off has incited a weekend characterized by fear, uncertaintly and doubt (FUD) among members of the cryptocurrency community.

According to certain users on X (formerly known as Twitter), there are assertions made regarding the distribution of the token supply, suggesting that 50% of the tokens were held within 10 wallets under the supervision of engineers.

It appears that Yearn Finance $YFI was rugpulled

One of the biggest DeFi platforms plummeted over -50% in an exit scam by insiders

Approx half of the entire supply for YFI is held by ~10 wallets. Over $250 million in market value has vanished in a few hours pic.twitter.com/Y1TbtlkltC

— Solid 堅固 (@SolidTradesz) November 18, 2023

Nevertheless, according to data from Etherscan, it is indicated that a portion of these holders could potentially be wallets associated with cryptocurrency exchanges.

The rollercoaster ride in YFI’s market hasn’t just been a wild descent; it’s been a game-changer for crypto traders riding the waves of this digital asset’s fortune.

According to insights from derivative market tracker, CoinGlass, the recent nosedive in YFI has left crypto enthusiasts nursing a whopping $4.99 million in losses through liquidations.

Those traders who wagered on YFI’s upward trajectory found themselves taking the most substantial hit in the aftermath of the digital asset’s dramatic crash. It’s not just numbers on a chart; it’s a tale of high-stakes bets and unforeseen twists in the ever-unpredictable world of crypto trading.

Zooming in on the details, according to CoinGlass data, the brunt of the blow in the near $5 million total liquidations is borne by long positions, tallying up to a substantial $3.5 million in losses.

The majority of these traders find themselves navigating the aftermath on platforms such as the giant Binance, alongside participants from Bybit and OKX.

It’s a vivid snapshot into the crypto battleground, where the casualties of this market turbulence are felt by those who took bullish positions, and the ripples extend across some of the most prominent exchanges in the digital arena.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Markus Spiske/Unsplash

dYdX founder Antonio Juliano said that the decentralized exchange as well as the Yearn.Finance token (YFI) are victims of a targeted attack.

Yearn.Finance’s YFI token crashed over 43% in just five hours, after rallying almost 170% in November.

One of the biggest market makers in crypto is having trouble getting nearly free money out of Yearn Finance.

The non-binding poll seeks to do a temperature check of sentiment toward launching yETH.

The exploiter paid back Aave users’ USDT debts on its V1 markets, making the total USDT borrowed stand at zero.

On March 8, Euler had over $311 million in crypto locked inside its smart contracts. Its total value locked has since fallen to $10.37 million.

YFI has managed to fend off bearish market forces with a 7% move to the upside as investors attempt to capitalize on the upcoming roll out of liquid staking derivatives (LSD).

The product is designed to offer users exposure to a basket of liquid staking derivatives in one token.

The collaboration of over 30 DeFi projects came as an effort to counteract the negative sentiments built in 2022 due to numerous CeFi ecosystem crashes.

“All factory-deployed vaults have no management fees and a flat 10% performance fee,” the DeFi project wrote.

Yearn Finance (YFI) has performed relatively well over the last 30 days, painting its charts in green despite the lingering uncertainty in the crypto market.

According to information from Coingecko, at press time, the ERC20 governance token built on the Ethereum blockchain is changing hands at $7,087, going up by 5.7% during the past week and tallying an impressive 15.7% jump on its bi-weekly gauge.

Here’s a quick glance of YFI performance:

However, the altcoin’s technical indicators, specifically its Relative Strength Index (RSI) and Chaikin Money Flow (CMF), on its 4-hour chart doesn’t give much for traders to desire as they indicate a potential bearish run for the asset.

The RSI settled below the 50-neutral zone at 48.97, suggesting that selling pressure increased and a lot of buyers veered away from the asset. Meanwhile, Yearn Finance’s CMF fell into a negative value of -0.07 – an indication of a weakened buying activity.

Along with the above-mentioned technical indicators, some developments concerning the cryptocurrency and its network pointed towards a bearish momentum.

During the previous week, the number of unique addresses that traded Yearn Finance decreased sharply, going down by 41%. In fact, at the time of this writing, there were only 248 wallets monitored to have participated in YFI transactions.

While the cryptocurrency’s spot trading price went up by 3% over the last 24 hours, its trading volume took a hit as it became lower by 25% during the same period.

With these, there is a need for a significant uptick in demand for the crypto asset for another increase in value to be triggered as buyers in YFI market appear to be exhausted.

However, it would seem that the digital currency could not catch a break as even in that particular department, it is showing signs of struggle.

According to latest data, at the moment, only 59 new addresses were present at the network – 48% lower than what was observed within the last eight days.

Although Yearn Finance’s short-term trajectory looks bleak, it is expected to have a strong start for the year 2023.

According to the predictions of online crypto data information aggregator Coincodex, the digital asset is expected to decline significantly within the next five days and will eventually change hands at $$6,094 by December 15.

However, the altcoin is expected to bounce back and reclaim its losses just few days after the expected price dump. By January 9, 2023, YFI is seen to trade at $8,891.

One of the fastest growing DeFi projects, Yearn.finance has spawned a range of core products that provide passive earnings on crypto assets.

While an ongoing technical divergence between BOND’s price and volumes suggests upside exhaustion.

The challenges faced by Terra, Wonderland and a handful of other DeFi projects exposed the need for investors to do more research and avoid cult personalities.

The widely-popular DeFi protocol announced its support for the newly-passed ERC on Wednesday, stating that Yearn V3 plus ERC-4626 equals “Inevitable.”

In this week’s DeFi newsletter, we will look at the Andre Cronje debacle, the Polygon upgrade, the rise of ThorChain and the growing value of the DeFi ecosystem with synthetic assets.

Famous for his motto “I test in prod”, Andre Cronje, inventor of Yearn Finance and other DeFi protocols, will launch a new platform. Called ve(3,3) it has been designed as an Automated Market Maker (AMM) to operate with a “protocol for protocols” architecture.

Related Reading | Solana DeFi Goes Stratospheric as Hubble Protocol Announces $3.6M Raise

In other words, this new AMM will be easy to integrate with other platforms to incentivize their own liquidity and without tradeoffs. The protocols that decide to add ve(3,3) won’t lose fees, volumes, or liquidity, as the creator of Yearn Finance explained in an official post.

Cronje believes AMMs utility has undergone a change, from primarily serving as a tool for liquidity providers to serving as an addition to projects. Thus, ve(3,3) seeks to meet the demand of AMM’s new users; other protocols.

His new project, ve(3,3), will remove friction from the process of adding token incentives to a protocol’s liquidity, will make it simpler for projects to accrue fees from incentives, and will operate as a permissionless platform. The Yearn Finance developer said:

With the above in place, any protocol or project can easily incentivize their own liquidity, be it for their token, their stable coin, or even other derivatives, and while doing so, they fully accrue fees.

Cronje’s new protocol will have multiple features, including the capacity to natively support swaps between closely correlated assets, and uncorrelated assets, Uniswap v2 compatibility which will let projects deploy its interface, the possibility to permissionless create pools, gauges, and bribes.

In addition, the protocol will operate with a 0.01% fee to be paid in base assets. Cronje’s protocol for protocols will let other platforms support delegation, increase “holdings proportional to emission”, and conduct locks with capital efficiency, amongst many other features.

Yearn Finance Inventor To Take AMM Utility To Its Next Phase?

As an additional incentive for projects to implement Cronje’s protocol, the platform will reward them with ve(3,3) tokens. Those projects that occupy the top 20 by total value locked (TVL) will receive these rewards two weeks after the protocol launches.

The launch could take place next week, as Cronje announced via Twitter. By the end of next week, the platform will take a snapshot to determine the projects that will receive a percentage of the 2,000,000 ve(3,3) available for rewards. Cronje added:

It is up to them (the selected projects) to decide what they will incentivize, be it their own token, stable coin, or other liquidity. The timeline for this will thus be 2 weeks post protocol launch until distribution starts.

Final commit sent off for peer reviews, audits, and third party reviews.

Target of TVL snapshot end of next week.

One week for voting (and bribes), and then emission starts.

Website will be up next week.

Launching on

— Andre Cronje

(@AndreCronjeTech) January 11, 2022

(@AndreCronjeTech) January 11, 2022

As of press time, Yearn Finance native token YFI trades at $32,139 with a 2.7% profit in 24-hours.

Related Reading | Yearn Finance Launches New Vault, While YFI Retakes Bullish Momemtum

YFI moving sideways in the 4-hour chart. Source: YFIUSDT Tradingview

The recent bout of buying in the Yearn Finance market accompanies meager volumes, suggesting there are not enough buyers backing YFI’s price rally.