“Bitcoin continues to offer upside potential, and a +65% year-end rally would lift prices back to $56,000,” Thielen added.

MicroStrategy Deepens Bitcoin Strategy With Massive October Purchase

MicroStrategy, courtesy of its former CEO and co-founder Michael Saylor, has continued its aggressive accumulation of the flagship cryptocurrency, Bitcoin, with the company’s latest purchase coming in October, according to Saylor himself.

MicroStrategy Acquired An Additional 155 BTC In October

In a post shared on his X (formerly Twitter) platform, Saylor mentioned that his company acquired this amount of BTC for $5.3 million and now holds 158,400 BTC. The businessman made this comment while sharing the company’s third-quarter 2023 financial results.

The release also affirmed Saylor’s revelation as it gave a detailed analysis of its BTC holdings and the company’s unwavering commitment to continue stacking up the digital asset. The company notably stacked up a total of 6,067 BTC since the end of Q2 2023 for $167.0 million or at $27,531 per token.

These figures instantaneously raise the presumption that Microstartegy’s Bitcoin investment strategy is currently in profit. This presumption is also backed by the fact that the company further went on to mention that it holds 158,400 BTC, which it acquired at a total cost of $4.69 billion, or $29,586 per token.

It is worth mentioning that the company recorded a 3% increase year-on-year in its total revenue, which in part could be thanks to its Bitcoin venture, as the company’s CEO Phong Le suggested. He mentioned that his company is “well situated to capitalize on both the tailwinds in Bitcoin and growth in our BI business.”

MicroStrategy’s Commitment To Bitcoin Remains Strong

Commenting on the company’s Bitcoin purchases, MicroStrategy’s Chief Financial Officer (CFO) Andrew Kang mentioned that their commitment to acquire and hold Bitcoin “remains strong,”, especially with the increased possibility of a wave of institutional adoption happening soon with prominent asset managers like BlackRock moving to offer a Spot Bitcoin ETF.

The company’s “Bitcoin Strategy” has also positively influenced the company’s outlook, with many (especially crypto natives) having an affinity to the company because of its crypto ties. These ties to BTC also seem to have had an effect on the company’s stocks.

As Saylor highlighted in an X post, MicroStrategy’s MSTR stocks have seen about a 242% increase since the company incorporated Bitcoin into its balance sheets. This period, which dates back to August 2020, has seen the company’s stock perform better than major stocks like that of Apple and Google. MSTR has even performed better than Bitcoin itself in that period.

On a personal level, Saylor continues to be one of the major advocates of the flagship cryptocurrency and recently shared a Bitcoin-related X post with the caption “Join the Race. #Bitcoin” in what seems to be him urging his followers to get bullish on the crypto token.

PayPal Faces SEC Subpoena Over Its PYUSD Stablecoin

Global payments giant PayPal (PYPL) received a subpoena from the U.S. SEC requesting documentation about its USD stablecoin on Wednesday.

PayPal faces SEC action related to PYUSD stablecoin: Report

PayPal was the first large fintech firm to adopt digital currencies for payments and transfers after launching its stablecoin in August.

Swiss wholesale CBDC pilot kicks off in alliance with central, commercial banks

The Swiss wCBDC pilot project will be hosted on SDX and use the infrastructure of Swiss Interbank Clearing.

Solana Welcomes November With $40 Breach – Ready For A $50 Breakthrough?

The first day of November marked an eventful moment in the cryptocurrency market as altcoins surged vigorously, led by impressive gains of Solana. This rally in Solana’s value set the tone for a day where altcoins gained significant traction.

(Concurrently, Bitcoin experienced a late rally, breaching the $35,500 mark. This unexpected surge in Bitcoin not only solidified its position but also contributed to the overall bullish sentiment in the market.)

The day’s dynamic movements highlighted the growing influence of altcoins, particularly Solana, showcasing their capacity to drive market trends. This collective push underscored a major shift in the crypto landscape, suggesting a broader diversification of investment interest beyond Bitcoin.

Solana: Meteoric Rise And Resilience In The Crypto Market

Solana’s recent strides in the market have been nothing short of spectacular, showcasing an astounding growth of over 80% in just a few short weeks. SOL demonstrated its bullish momentum by surging to approximately $42.30, as reported by Coingecko. With a circulating supply of 420 million SOL, Solana is valued at a market cap of around $17,685,464,775.

Despite worries about its future following the bankruptcy of Alameda Research, a major investor in the Solana ecosystem, and Sam Bankman Fried’s FTX cryptocurrency exchange, Solana has surprised many observers by emerging as one of the best-performing assets, rising by more than 300% this year.

According to recent data from CoinMarketCap at the beginning of November, the value of SOL experienced a notable increase over the course of the last 30 days. Specifically, SOL’s market valuation rose from $9.80 billion on October 2 to surpass $17 billion on Wednesday, resulting in a substantial addition of approximately $6 billion to its overall capitalization.

Against a backdrop of positive indicators and having already reached a critical milestone of $40, the cryptocurrency Solana is poised to attain a noteworthy valuation of $50. The current rising trajectory of SOL’s value, which has experienced a roughly twofold increase in the past month, establishes a solid basis for the anticipated milestone, lending credibility to its feasibility and potential imminence.

SOL’s Ascent Towards A Milestone And FTX’s Notable Asset Transactions

Given its quick growth, it appears that this new objective is attainable, indicating that SOL may soon achieve this unprecedented level in the dynamic realm of digital currencies.

Meanwhile, according to a recent disclosure made by Nansen, a blockchain analytics company, it has come to light that wallets associated with the bankrupt FTX engaged in transactions involving a significant amount of digital assets, amounting to around $156 million.

FTX funds have continued to move to exchanges since our last update

– 695K PERP $423K

– 767K BICO $182K

– 833K KNC $616K

– 108M TRU $420K

– 138K BAND $221K

– 2.5M GRT $273K

– 845 MKR $1.17M

– 7.16M RNDR $17.8M

– 10.5M USDC

– 23k MATIC $15K

– 9.5M REN $500K

– 1.1M ETH $2MAnd… pic.twitter.com/UPKkJh3llq

— Nansen

(@nansen_ai) October 31, 2023

These assets include Ethereum and Solana, and the transactions occurred during the previous week. Nansen’s report provides a comprehensive account of FTX’s action of unstaking almost 1.6 million SOL tokens, which were estimated to be worth around $57.6 million, on October 30th.

These assets are presently kept in a staking wallet. The act of unstaking described here is a component of FTX’s money movement plan, which has resulted in a notable rise in the overall amount of SOL transferred, approaching the threshold of $90 million.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from foulline/Pixabay

The Case Against Sam Bankman-Fried

Is Sam Bankman-Fried going to prison? Five weeks into his criminal trial, 12 randomly selected New Yorkers are preparing to discuss among themselves whether they believe he violated federal law or not.

TradFi gets crypto boost: Renegade joins Cointelegraph Accelerator

Cointelegraph Accelerator welcomes Web3-friendly fintech platform Renegade to its program.

Swiss National Bank to Work With SIX Digital Exchange, 6 Banks on Wholesale CBDC Pilot

The Helvetia Phase III pilot will create a tokenized version of the franc as a settlement instrument between financial institutions for digital assets on the exchange.

Tether issues $610M debt financing to Bitcoin miner Northern Data

In September 2023, Tether also invested an undisclosed amount in Northern Data in a move backing AI initiatives.

UK to invest 300M pounds in 2 AI supercomputers; Harris presses for AI safety

The U.K. says the investments will help its local scientific talent have the tools they need to ensure that the most advanced AI models are up to safety standards.

Ripple’s legal chief questions SEC case losses under Gensler

Stuart Alderoty expressed concern about the SEC’s repeated arbitrary and capricious actions in court cases, suggesting a troubling pattern under Gensler’s leadership.

New BTC price breakouts see Bitcoin traders confirm targets up to $48K

Bitcoin is attempting to ditch the past week’s trading range, but longer timeframes reveal the potential for much more BTC price upside, predictions show.

Top Swiss bank launches Bitcoin and Ether trading with SEBA

Switzerland’s St.Galler Kantonalbank has launched Bitcoin and Ether trading for select customers, planning to add more coins in the future.

Ripple Transfers 800 Million XRP Back To Escrow: Catalyst For Price Rally?

Recent financial maneuvers by Ripple Labs have caught the eye of crypto sleuths again. Recent data from crypto data analysis platform Whale Alert has shown a significant movement of 800 million XRP tokens back into Ripple’s established escrow system. This move comes in the aftermath of Ripple’s customary monthly unlocking of one billion XRP, a practice that started in 2017 as part of the company’s strategy to maintain XRP price stability.

Ripple Returns 800 Million XRP To Escrow

The essence of Ripple’s escrow mechanism is to facilitate a consistent and predictable distribution of XRP to the market. This counteracts any potential price volatility that might arise from a sudden influx of tokens. In its commitment to this cause, Ripple, back in 2017, pledged to gradually release 55 billion XRP in 55 monthly tranches of one billion XRP each.

Post-release each month, Ripple typically returns a majority of the tokens, mostly 800 million XRP, back into the escrow, retaining a minor portion, around 200 million XRP, for market circulation. Recent data from Whale Alert confirms that Ripple was no exception this month and has locked 800 million XRP tokens back into the established escrow system.

Notably, the return of the 800 million XRP tokens occurred in two equal transactions, each involving 400 million XRP. Delving into the data from XRP Scan reveals that the first set, amounting to 400 million XRP, was directed back into escrow from an address known as ‘Ripple 10.’ Prior to this, ‘Ripple 10’ had received the said tokens from two different addresses: Ripple 22 and Ripple 23.

The subsequent batch of 400 million XRP was transacted from ‘Ripple 23’ to another address dubbed ‘Ripple 11,’ before it was also directed to the company’s escrow account. The market value of the re-locked 800 million XRP stood at an approximate $480 million during the time of these transactions.

Of the original 1 billion XRP that were made available, the remaining 200 million XRP, with a current valuation of about $121 million, was moved from Ripple 22 to Ripple 1. This balance is anticipated to facilitate Ripple’s operational expenses and other business-related activities.

Ripple’s escrow holdings now total roughly 40.9 billion XRP. For context, their Q3 report disclosed that they had about 41.3 billion XRP in escrow at the end of September.

XRP Price Poised For More Upside

After XRP broke the 200-day Exponential Moving Average (EMA) line (blue) on October 21, the price has been on a tear. Within 11 days, the XRP price increased by almost 20%. That the XRP price took a breather from its rally yesterday is probably not due to Ripple’s monthly transfer from escrow, as the XRP tokens do not hit the market immediately and, moreover, investors know how to gauge the issue.

A better explanation is that XRP encountered a strong resistance with the 0.386 Fibonacci retracement level at $0.625, where the price was rejected in a first attempt. Notably, the bulls could make another attempt if the price stays above the $0.60 level.

If the breakout succeeds, the 0.5 Fibonacci retracement level at $0.683 could be the next short-term price target. However, if the XRP price is rejected again at $0.625, a retest of the 0.236 Fibonacci retracement level at $0.553 could be the next logical move.

Trader exploits Multichain opening to turn $280k to $1.9M; community suspects insider job

The momentary opening of the frozen bridge raised suspicion of it being an insider job as the trader in question was the only beneficiary.

UK seeks six crypto investigators to beef up National Crime Agency

The role demands candidates to have the ability to provide strategic and tactical advice to crypto investigations, among other investigative qualities.

Axie Infinity developer brings Japanese Web2 games to Ronin

The first Web2 game of the series to be bridged to Ronin is Zoids Wild Arena.

Abu Dhabi Global Market introduces comprehensive DLT Foundations Regulations

The ADGM’s new regulatory framework is the first of its kind in the world, it says. The free financial zone is already a hub of crypto activity.

XRP Hits $0.6 In Unstoppable Surge: How High Can It Go This November?

XRP, the native cryptocurrency of the Ripple network, reached a significant milestone as it soared to the crucial psychological level of $0.60, marking its highest value since the mid-August market crash.

In financial terms, psychological levels are key price points where traders and investors have historically shown heightened interest, often leading to increased buying or selling pressure.

Crossing this mark after a prolonged period of market volatility signals a potential shift in sentiment for XRP enthusiasts, who have eagerly awaited a resurgence in the coin’s value.

Related Reading: Solana Bull Run Could Smash Through $40 Barrier This Week – Here’s How

XRP’s Remarkable Rebound

According to the latest data from CoinGecko, XRP was trading at $0.606379, reflecting a notable 2.7% gain over the past 24 hours. Over the course of the week, the digital asset witnessed an impressive seven-day rally of 9.2%, solidifying its upward trajectory and instilling confidence in the cryptocurrency market.

This upward momentum, while significant in itself, has also sparked a flurry of activity among XRP whales, who have long been regarded as influential players capable of shaping the market’s direction.

Recent data from the crypto analytics platform Whale Alert shed light on a substantial transaction involving a major XRP whale. The data revealed that an anonymous entity had transferred a staggering 412,890,441 XRP tokens, valued at approximately $248,922,341, from one wallet to another. Such large-scale movements by influential holders can often trigger a domino effect, leading to increased interest from smaller investors and, in turn, contributing to further price fluctuations.

412,890,441 #XRP (248,922,341 USD) transferred from unknown wallet to unknown new wallethttps://t.co/FhYAxqGyXW

— Whale Alert (@whale_alert) November 1, 2023

Key Milestones And Challenges For XRP

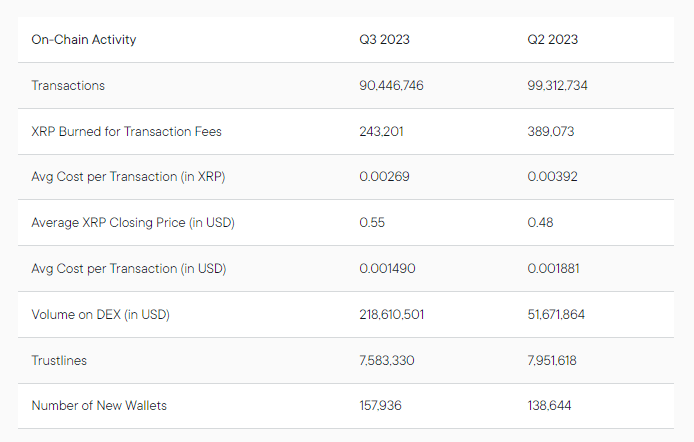

In parallel to these developments, Ripple, the company behind XRP, published its comprehensive market report for the third quarter, highlighting several key achievements of the cryptocurrency during the period. Notably, the report indicated a significant uptick in the number of new wallets, recording a remarkable surge of nearly 12% to reach a total of 157,936.

Moreover, the document emphasized the robustness of the XRP trading volume, consistently surpassing the $1 million mark throughout July and August, with certain days witnessing an impressive trading volume range of $20 million to $30 million.

However, amidst these positive indicators, the report also pointed to a slight downturn in the overall transaction count, registering a decrease of over 8% compared to the previous quarter. This decline, while not entirely alarming, underscores the need for continued market analysis and strategic measures to maintain a steady growth trajectory for XRP.

As Ripple and its native coin XRP continue to make significant strides, market observers remain vigilant, analyzing various factors that could impact the cryptocurrency’s trajectory in the coming months.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Freepik