Following notable changes to the ARK 21Shares Spot Bitcoin ETF application, Bloomberg ETF analysts James Seyffart and Eric Balchunas have predicted that the US Securities and Exchange Commission (SEC) could approve a fund as early as next year.

90% Chance Of Approval

In a post shared on his X (formerly Twitter) platform, Seyffart highlighted his team’s prediction of the 90% chance that a Spot Bitcoin ETF will be approved by Ark Invest’s January 10 deadline. January 10 is the day the SEC is expected to make a final decision (approval or denial) on ARK Invest’s Spot Bitcoin ETF application.

Their latest prediction comes amid the recent amendment ARK Invest and 21Shares made to their Spot Bitcoin ETF prospectus. These updates include further context to the fund and additional risk disclosures. These analysts believe that this sort of amendment only happens when a fund is on its way to being approved.

These Bloomberg analysts had earlier predicted (following Grayscale’s victory) that there was a 75% chance that the pending Spot Bitcoin ETF applications could be approved this year and that the odds would rise to 95% by the end of next year if these funds weren’t approved by then.

Eric Balchunas noted on his X platform that Invesco Galaxy had also amended its Spot Bitcoin ETF prospectus following the ARK 21Shares amendment. He stated that he expects other applicants to update their applications soon. This suggests that the SEC could approve all applications simultaneously, similar to what it did with the Ethereum futures ETFs.

Spot Bitcoin ETFs Given Huge Boost Following SEC’s Decision

Meanwhile, these Spot Bitcoin ETF applications were given a huge boost following the SEC’s decision not to appeal the court’s ruling in its case against Grayscale. The SEC had until October 13 to appeal the Court of Appeal’s ruling that it had acted arbitrarily and capriciously in disapproving Grayscale’s application to convert its GBTC fund into a Spot Bitcoin ETF.

Following its decision not to file an en banc application or appeal to the Supreme Court, Reuters reported that the appeals court is expected to issue a mandate laying out how the SEC could carry out its order, including the Commission reviewing Grayscale’s application again.

James Seyffart also noted that dialogue between Grayscale and SEC should begin next week. However, it remains uncertain if or when the SEC will approve these applications, especially considering that it has delayed its decision on all Spot Bitcoin ETFs till next year.

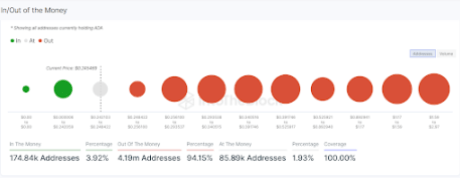

Bitcoin has reacted positively to the news of the SEC’s decision not to file an appeal, currently trading at around $26,849.76, up in the last twenty-four hours, according to data from CoinMarketCap.

Source: IntoTheBlock

Source: IntoTheBlock