Crypto miners are establishing a new voice in U.S. policy, starting up the Digital Energy Council to lobby for friendly policy as regulators and Congress are wrestling with the next steps in crypto regulation.

Altcoin Plunge Leads Crypto Lower; Bitcoin Slips 0.7% to $29,150

A sharp mid-afternoon selloff upended what had been a quiet Tuesday in cryptocurrencies.

Institutional XRP Holdings Rise Rapidly Following Ripple’s Win Over SEC

Now that Ripple has prevailed over the SEC in court, major players are eager to get their hands on XRP. According to recent data, institutions have been getting their hands on the cryptocurrency at a steady rate, as reflected in the digital asset fund flows report.

Institutional XRP Holdings Rise Rapidly

In the days following Ripple’s partial victory in the SEC lawsuit, XRP volumes and prices rose dramatically as crypto traders rushed to the cryptocurrency in anticipation of a continued bull run. However, price metrics from Coinmarketcap show that the euphoria has subsided, with XRP now down 13.39% in a monthly time frame. On-chain data has also shown whales dumping the token to take profits, increasing the selling pressure on the token.

On the other hand, the tide is turning for the once embattled crypto among institutional investors as inflows into XRP digital asset funds are increasing steadily. According to the weekly report on the digital asset fund flows by CoinShares, XRP saw $0.5 million in inflows last week.

Over the past 16 weeks, XRP has seen consistent inflows into crypto investment funds, making up 12% of all digital assets under management. In total, XRP’s assets under management have risen 127% since the beginning of the year, outpacing the growth of other popular altcoins like Polygon and Cardano.

Investor Attitude Toward Crypto Funds Is Growing

Crypto funds, in general, have seen a shift to positive sentiment from investors. In the first week of the month, digital asset investment products saw outflows, with investors taking profits in recent weeks. Bitcoin alone saw outflows totaling $111 million, its highest since March. XRP, however, did witness inflows of $0.5 million during this period.

The latest report would see digital asset investment products receive inflows of $29 million throughout the week. Bitcoin would also return as the primary focus, seeing $27 million of inflows after three prior weeks of $144 million outflows.

With the recent inflows, institutional investors are signaling their faith in XRP’s future by increasing their asset holdings. In July, many digital asset funds saw a 57% increase in their XRP Exchange Traded Products (ETPs). Fineqia, for instance, saw its XRP AUM increase from $49 million to $76.8 million.

The price of the token appears to have weakened in momentum in recent weeks, much like the rest of the crypto market. At the time of writing, XRP is down by 0.60% in the last 24 hours and is trading at 0.625. Even so, the mood around XRP feels decidedly more optimistic as investors expect a final decision in the Ripple-SEC lawsuit.

US lawmakers press SEC and FINRA on Prometheum’s broker-dealer approval

Members of the House Financial Services Committee questioned the “timing and circumstances” of FINRA approving Prometheum’s special purpose broker-dealer license in May.

Republican Lawmakers Demand Gensler Tell Them How Prometheum Got SEC Approval

Republicans on the U.S. congressional committee that oversees the Securities and Exchange Commission (SEC) are demanding agency Chair Gary Gensler explain how Prometheum Inc. won its unique approval as a broker-dealer for crypto.

Renowned Finance Author Says Bitcoin Price Will Reach $1 Million If This Happens

Bitcoin’s creator, Satoshi Nakamoto, created Bitcoin in response to the 2008 financial crisis as an alternative to government-controlled money. Since then, Bitcoin has gone to spearhead the crypto industry, with many investors calling it digital gold. Now, renowned finance author Robert Kiyosaki has argued that Bitcoin price could reach $100,000 soon and go as high as $1 million.

Bold Prediction On Bitcoin

Robert Kiyosaki, best known for his bestselling book ‘Rich Dad Poor Dad,’ is known to make very bullish predictions on the price of Bitcoin. In a recent post on social media platform X, formerly known as Twitter, Kiyosaki tweeted of Bitcoin reaching 100,000 soon, calling it the “people’s gold.” However, a stock and bond market crash could see Bitcoin reach $1 million.

Kiyosaki also shared his predictions on gold and silver, calling them “GOD’S money.” According to the finance educator, gold and silver can reach $75,000 and $60,000 respectively if the world economy crashes.

BITCOIN to $100k. Saying for years gold&silver GOD’S money. BITCOIN peoples $. Bad news IF stock & bond market crash gold&silver skyrocket. WORSE NEWS IF world economy crashes BC $1 million Gold $ 75K silver to $60k. SAVERS of FAKE US $ F’d. DEBT too high. Mom, Pop & kids in…

— Robert Kiyosaki (@theRealKiyosaki) August 14, 2023

He explained that if the economy collapsed, the value of government-issued currencies would drop drastically. As people lose faith in fiat money, many would turn to Bitcoin and precious metals as an alternative store of value. The increased demand, coupled with the limited supply of Bitcoin, would cause the price to skyrocket.

Earlier this year, Kiyosaki made a similar claim regarding Bitcoin, touting a price of $500,000 for each Bitcoin by 2025. Michael Saylor, another big name in the finance sector, predicted a similar price of $1 million for BTC in the next few years.

What Is The Basis For The $1 Million Bitcoin Price Prediction?

Kiyosaki’s recent predictions about the US dollar, in particular, have come on the heels of the BRICS alliance, which is now gaining traction. BRICS, which is an alliance between the emerging economies of Brazil, Russia, India, China, and South Africa, has gained ground in its campaign to support the reduction of transactions in the US dollar and the promotion of trading and settlement in local currencies.

As a result, many names in finance have seen this as a plan to de-dollarize trades in the BRICS countries, with reports of Saudi Arabia and possibly Mexico and Japan joining them. Reports are also that the BRICS alliance is working on creating a new currency backed by gold to settle global trades.

According to Kiyosaki, the only saving grace for everyday investors is to get into real gold, silver, and Bitcoin as stores of value. “SAVERS of FAKE US $ F’d,” Kiyosaki tweeted.

Giant crash coming. Fake money-aka fist currency to die. BRUCS meeting in S. Africa August 22 to put nail in coffin of fiat…fake money. Get into real gold, silver & Bitcoin asap. Take care. End of fiat (fake) money near.

— Robert Kiyosaki (@theRealKiyosaki) July 13, 2023

Coinbase political initiative features US lawmaker who admitted to ethics violations

Rep. David Schweikert, featured as a lawmaker “very supportive” of crypto in the United States, paid $175,000 as part of a settlement related to violations of House ethics rules.

Binance to Shut Down Crypto Payments Service Amid Refocus On Core Products

Crypto exchange Binance has decided to shut down its buy-and-sell service Binance Connect, formerly known as Bifinity, just one year after its launch, the company said in a statement.

This Event Causes Bitcoin Traders’ Sentiment To Rise, Will BTC Surpass $30,000?

The Bitcoin price continues to compress around its current levels, but during today’s trading session, there was an uptick in volatility. The rise in this metric could hint at a shift in the narratives influencing BTC’s price action.

As of this writing, Bitcoin trades at $29,300 with sideways movement in the last 24 hours. In the previous seven days, the cryptocurrency saw similar action pushing other assets in a similar direction or no direction as the sector flatlines in the short term.

Bitcoin ETF Becomes Dominant Narrative In Crypto Market?

In a recent market update, crypto analysis firm Blofin pointed to an uptick in market sentiment. Coupled with a rise in volatility, market participants are reacting to the potential announcement from the US Securities Exchange Commission (SEC) around a spot Bitcoin ETF.

The Commission is set to rule on asset manager Grayscale’s petition to transform their Grayscale Bitcoin Trust (GBTC) into an ETF. The decision was supposed to come out today, Blofin stated, but it could drag on until this Friday, August 18th.

If the SEC postpones the decision for any reason, as it did with Ark’s petition, the market will likely keep moving sideways. In that sense, development around the ETF decision is gaining strength over macroeconomic dynamics.

This change in dynamics is more evident in the derivatives sector, with options traders becoming more bullish for the coming months. Blofin noted the following on this dynamic:

(…) The news above (on the Bitcoin ETF approval) has promoted the rapid rise of short-term bullish sentiment and uncertainty in the market (…). It appears that investors are waiting for good news related to the spot Bitcoin ETF.

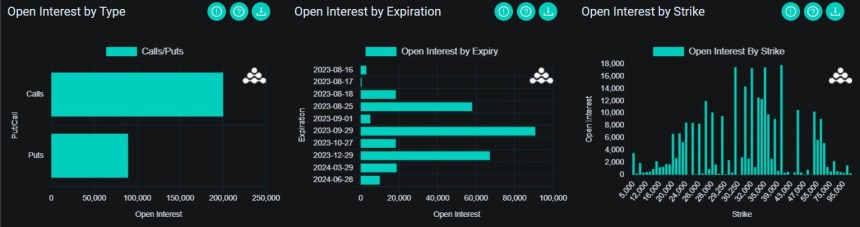

And “smart” traders are positioning accordingly. The report notes that the open interest for options contracts is skewed to the call (buy) side.

As data from the derivatives platform Deribit shows, traders are betting that the price of Bitcoin will rise above $30,000 by the end of August or September. As seen on the chart below, 57,000 contracts will expire by the end of this month and 90,700 next month.

Coupled with the rise in Open Interest skewed to the call side, the chart above shows that traders are betting on a Bitcoin rally above $30,000 to $40,000. The spot BTC ETF decision will move the market, particularly at the end of August and September.

Cover image from Unsplash, chart from Tradingview

The 3 Things Coinbase Says Will Determine the Future of Crypto

The Subtle Signs A Bullish Bitcoin Trend Is Brewing

Bitcoin price remains stagnant for going on months now, with no clear trend developing and volatility in a downward spiral. However, some subtle signs are popping up that could suggest that a bullish Bitcoin trend is beginning to take shape.

Make Friends With Strong Trends

“The trend is your friend” is one of the most famous trading quotes, highlighting how capturing as much of the prevailing trend as possible can lead to the most profitable results.

For this reason, in technical analysis, trend-following tools are among the most successful. But what is an investor or trader to do when there is a clear absence of any discernible trend?

The answer is “to wait for the trend to appear” but that’s easier said than done. This is why specific tools have been created to tell when assets like Bitcoin or even stocks are trending or not. One such tool is starting to rise after several weeks of sideways price action, and it suggest that the underlying trend is strengthening.

Bullish Bitcoin Is Building Muscle

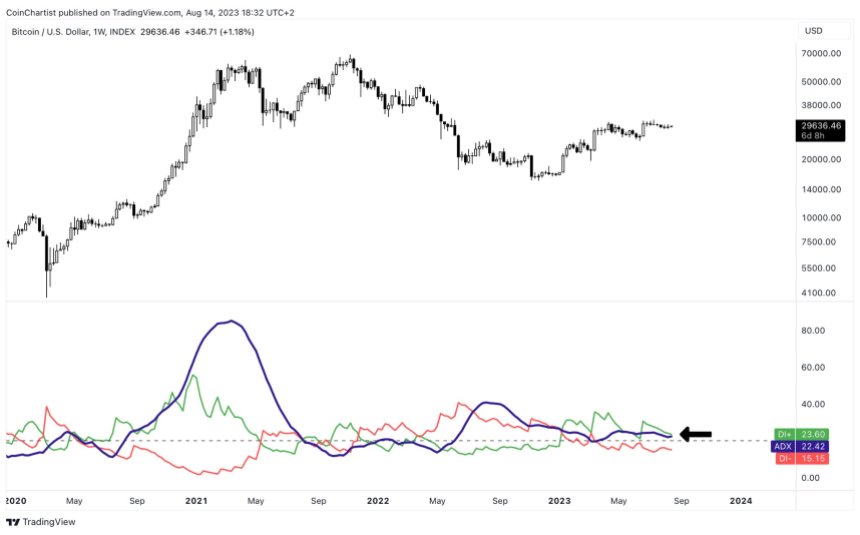

The Average Directional Index (ADX) is a trend strength measuring tool, created by the father of technical indicators, J. Welles, Wilder, Jr. Other tools Wilder built include the Parabolic SAR, Average True Range, and the Relative Strength Index.

A reading above 20 on the ADX means a trend is developing. The more it turns up, the stronger the trend. After weeks of sideways, the trend is starting to strengthen again.

The tool also includes two Directional Movement indicators, the DI+ and DI-. The DI+ is currently above the DI-, showing that bulls in control of the underlying price action. All that’s left is for the ADX to strengthen further and Bitcoin could finally break out of this range and begin trending.

What Bitcoin bulls ultimately want to see next is for the ADX to grow even steeper, similar to what we can see in late 2020 and into early 2022. The lack of another strong trend at the second 2021 peak was a warning that something was off. Will the bullish trend continue to strengthen, or will bears regain control?

#Bitcoin 1W Average Directional Index is turning back up above 20 — this is the signature of a strengthening trend

DI+ is above DI- which shows bulls are in control

Trend-following tools may soon prove more useful with a trend growing pic.twitter.com/9nAUEVIcL3

— Tony "The Bull" (@tonythebullBTC) August 14, 2023

Is Bitcoin’s record-low volatility and decline in short-term holders a bull market signal?

Traders believe that Bitcoin’s low volatility is a bull market signal, but their bias could be preventing them from acknowledging potentially negative macro outcomes.

Chiliz (CHZ) Empowers Smart Contracts With Upgrades – Positive Impact On Price?

Chiliz, the pioneering sports blockchain platform, is set to make waves once again as it teases forthcoming upgrades to its smart contracts.

In a recent tweet, Chiliz unveiled its plans to enhance the functionality of its smart contracts, showcasing the company’s ongoing commitment to providing a seamless and efficient experience for its users.

Chiliz has been a trailblazer in the sports and entertainment industry, utilizing blockchain technology to bridge the gap between sports fans and their favorite teams.

The platform’s innovative approach allows fans to engage with their chosen teams through fan tokens, gaining access to exclusive content, rewards, and even influencing certain team decisions through token-based voting systems.

Upcoming Proposals: Upgrading the Smart contracts

Upgrade 1: Upgrading the contracts to allow factory contracts to deploy without being whitelisted as deployers. The factory contract will still need to be deployed by a whitelisted deployer.#ChilizGovernance

$CHZ pic.twitter.com/zyBTqzAhTJ

— Chiliz ($CHZ) – Powering Socios.com

(@Chiliz) August 14, 2023

As the platform gears up for these improvements, the question on everyone’s mind is whether these upgrades will play a role in boosting the price of CHZ, Chiliz’s native cryptocurrency.

Chiliz Upgrades On The Horizon

The first of the upcoming upgrades focuses on streamlining the deployment of factory contracts. In a bid to improve efficiency, Chiliz plans to enable such contracts to be deployed without the need for whitelisting as deployers.

This move is expected to simplify the process while maintaining a level of security by ensuring that the factory contract is still initiated by a whitelisted deployer. By reducing friction in the contract deployment process, Chiliz aims to enhance user experience and attract a wider range of participants.

The second upgrade revolves around staking pool contract enhancements. Chiliz aims to address issues related to the accuracy of voting power displayed for validators and the calculation of delegated amounts.

To rectify this, the Chiliz team has indicated that a temporary downtime for the delegated and undelegated features will be necessary during the upgrade. While this may temporarily inconvenience users, the improvements are anticipated to provide a more accurate and transparent staking experience.

Impact On CHZ Price

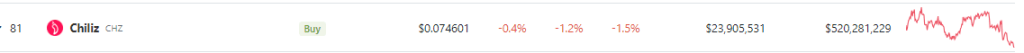

As Chiliz enthusiasts eagerly await these upgrades, the impact on the price of CHZ remains a topic of interest. At the time of writing, CHZ is in the red in all timeframes, and priced at $0.074903 according to CoinGecko.

The past 24 hours have seen a decline of 1.2% in its value, while the past seven days have witnessed a decline of 1.5%. These fluctuations underscore the inherent volatility of the cryptocurrency market.

While the direct correlation between upgrades and price movements can be complex and multifaceted, the anticipated improvements in Chiliz’s smart contracts could bolster investor confidence in the platform’s future prospects.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Dr Trouble Hot Sauce

FDIC Crypto Warning Underlines U.S. Banking Agencies’ Arm’s-Length Policy

The U.S. Federal Deposit Insurance Corp. added crypto as one of five broad categories this year in its annual risk report, a snapshot of the dangers the banking regulator considers a top priority at the moment.

G20 Set to Crystalize Global Crypto Rules as India Wraps Up Presidency

G20 nations are set to crystalize crypto policies, the closest we may have come to globally coordinated rules for the industry. India has been at the helm of the efforts as the current president of the G20 and is likely to celebrate the progress during the Leaders’ Summit in September.

Breaking: Binance Connect shutting down on August 16

A spokesperson said the move came in response to ‘changing market and user needs.’

DeFiance Capital Gains Upper Hand In Jurisdiction Battle Against 3AC: Singapore Courts To Preside

The crypto finance world has witnessed numerous disputes, but few have been similar to that of the ongoing feud between DeFiance Capital and Three Arrows Capital Limited (3AC). Particularly, this dispute underscores the intricate interplay between traditional financial frameworks and the evolving dynamics of digital assets.

In a tweet posted earlier today, DeFiance Capital CEO shed new light on their ongoing legal tussle with 3AC, suggesting a turn in the tide.

Statement and Update on Dispute with Three Arrows Capital Limited (3AC)

We are very pleased to share a positive development on our end with the public.

It is well-known that for the past year, we have been locked in a dispute with the 3AC estate who are claiming that the assets…

— Arthur (@Arthur_0x) August 15, 2023

DeFiance Capital: A Year-long Struggle

Almost a year ago, the disagreement between DeFiance Capital and the 3AC estate took center stage when the estate contended that the assets held by DeFiance Capital should be used to square off the debts of 3AC.

Countering this claim, DeFiance maintained that they had complete authority and rightful ownership of their assets. This stance, they assert, aligns with common industry perceptions and is supported by available evidence.

The debate took a geographical turn when the liquidators insisted on settling the dispute in the British Virgin Islands (BVI). DeFiance Capital, which was managed from Singapore alongside 3AC, found this choice of jurisdiction puzzling.

They argued that the primary evidence and witnesses were based in Singapore, making it a more apt location for the hearing. Their persistence bore fruit last week when the High Court of Singapore agreed to their jurisdiction preference, subtly undermining the liquidators’ earlier narrative that DeFiance’s stance held no ground.

The Road Ahead: Seeking Effective Resolutions

Despite these disagreements, DeFiance has shown a willingness to collaborate. They have extended assistance to 3AC’s liquidators in understanding the position of DeFiance and even offered help in identifying 3AC’s assets.

The intention, as expressed by the CEO & CIO of DeFiance, was to minimize the resources spent on deciding the hearing location and instead concentrate on the core issues at hand.

However, the journey hasn’t been without its hitches. The liquidators faced setbacks in the US while trying to hold Three Arrows Capital Co-Founder Kyle Davies accountable in a US court. This effort was thwarted when it came to light that Davies was no longer a US citizen, an information oversight that resulted in unnecessary legal expenses.

Blossom Hing, representing DeFiance, highlighted the significance of the recent jurisdiction decision. Emphasizing that the Singapore International Commercial Court could address issues pertaining to BVI law, she expressed optimism about an efficient resolution that benefits all parties.

Hing noted:

We welcome the decision by the Singapore Court as it will ensure that important evidence located in Singapore would be available for the purposes of resolving the dispute in a just and efficient manner. Coupled with the fact that the Singapore International Commercial Court can hear arguments on and decide on BVI law issues, we believe that having the dispute heard in Singapore will result in considerable savings of costs and time for all parties.

Featured image from Unsplash, Chart from TradingView

11 potential impacts on crypto and the market from the rise of CBDCs

The ultimate impacts of CBDCs on the crypto industry may be a mixed bag of positives and negatives, and insiders need to monitor developments.

BTC price can reach $34K as Bitcoin faces support ‘kiss’ — QCP Capital

Bitcoin lacks major volatility catalysts, but a classic support bounce could spark the return of the highest BTC prices in over a year, analysis predicts.

PEPE Shines With 20% Gains As Market Sees Correction, What’s Next?

PEPE surged remarkably in the past week posting gains of approximately 20%. The $0.0000011079 support level on the daily chart acted as a price pivot for the gains in the last few days, indicating an attempt to enter the buy zone.

PEPE’s previous attempts to break above the $0.0000015440 resistance zone between July 19-24 were unsuccessful. However, the bulls are in control, driving PEPE to attempt another break above the $0.0000015440 resistance.

The rally in the past 7-days indicates a momentum shift for PEPE to a more positive outlook as the bulls attempt to seize control again.

PEPE Bulls Forcing Another Rally, But Bears Still Active

Price volatility is evident when comparing price data for PEPE on the daily, weekly, and monthly timeframes. It trades at $0.000001348 on August 15 with a 6.03% price drop in 24 hours, while it has dropped 17% on the monthly time frame.

However, PEPE shows a more positive outlook on the weekly timeframe, although traders must tread cautiously as a price drop remains a possibility due to volatility.

The Relative Strength Index (RSI) value is 55.71 in the neutral zone reflecting traders’ indecision in the market. Also, the Moving Average Convergence Divergence (MACD) is rising above the signal line, confirming the return of the bulls.

However, the size of the candles indicates low trading activity despite the gains making the price action moving forward quite tricky. The close of the August 15 candle will bring confirmation of the next price direction.

PEPE Shows Resilient Above $0.00000120 As Whale Comes Onboard

In recent days, there has been a resurgence in PEPE’s performance. This trend is attributable to substantial investments from prominent investors and a rise in social engagement. According to Lookonchain data, there is a significant surge in whale attention to the PEPE token.

The data shows a whale spent $ 1 million to acquire 807 billion PEPE tokens at $0.000001239. This whale involvement will likely have positive impacts on the price of PEPE.

Another instance of this type of Whale involvement occurred on August 7. A holder of PEPE tokens sold a substantial amount of 2.26 trillion tokens at the price of $0.000001121 per token.

Unfortunately, this action resulted in a significant decrease of $707,000 in the token’s overall market capitalization. Such contrasting maneuvers taking place in a short period might carry potential consequences for individual investors over an extended duration.

Meanwhile, the asset has been experiencing a notable resurgence, attracting investors’ attention. The steady upward trajectory has pushed it from $0.000001185 to approximately $0.000001356, with a trading volume of over $100 million.