Solana is facing its share of the bearish sentiment in the cryptocurrency market today. SOL has held above $20 since it jumped from $18 to $24 on January 14.

However, the coin has seen a drop of 12.54% in price in the last seven days. Now, investors wonder if there are any signs of recovery.

Crypto Market Plunge Affects Solana

After the collapse of Alameda Research and FTX last year, SOL price joined the trend of price losses in the market. The Solana blockchain raised funds from FTX and Alameda Research, the trading firm of FTX former CEO, Sam Bankman-Fried.

However, when Binance withdrew from its planned takeover of the exchange, it spooked many investors as it meant the termination of support for Solana.

Following the incident, many key investors pulled out from the Solana blockchain. This action led to a drastic drop in price, leaving SOL to struggle. However, the asset started recovering in 2023. It started the year at $9.9610 but gradually climbed, recording rallies and pullbacks until it hit $25 on January 21 before retracing.

The past weeks were eventful for SOL, as it touched a significant high of $24.7 (April 15). But recently, Solana’s price has also been facing challenges as the crypto markets portray several signs of fear due to the threat of economic recession.

At the time of writing, Solana’s price stands at $21.33, indicating a drastic plunge in price by over 13% in the past week, compared to its past week’s performance.

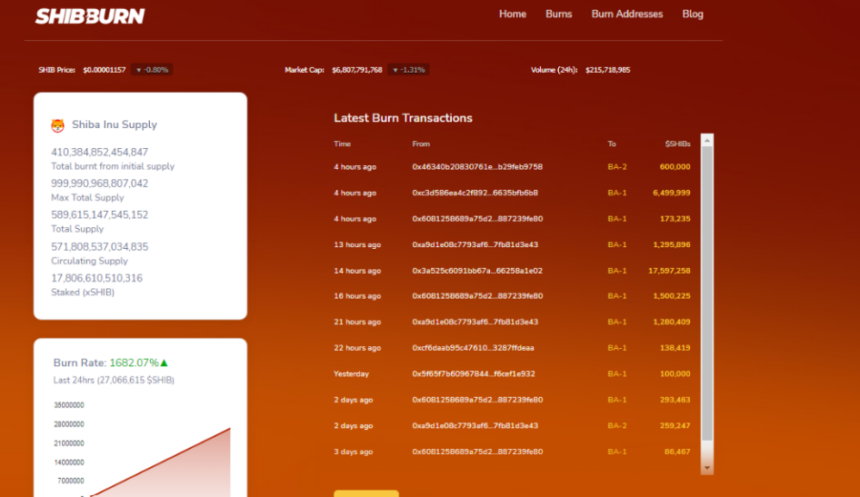

For instance, on January 10, 2023, Solana enjoyed a 12% price increase after the blockchain’s Shiba-Inu-themed token, BONK, launched.

If another development or event occurs on the Solana blockchain, there could be a possible recovery for the asset.

$19.8 Support Critical To Halt SOL’s Downtrend

SOL is in a downtrend today, losing most of its gains in the past week. The asset has declined to the $21 price level as the bears seize market control.

Solana is trading a bearish signal below its 50-day Simple Moving Average (SMA). However, it remains above its 200-day SMA, sparking hope of a long-term revival.

SOL’s Relative Strength Index (RSI) is 44.61, confirming the bearish trend. Notably, the indicator moves sideways, reflecting trader indecision in today’s market.

SOL’s trading volume is down by over 26% today, thus halting its price gains. Solana’s support levels are $14.96 and $19.87. Also, its resistance levels are $23.99, $26.04, $29.79, and $30.

Solana will likely drop below $20 in the short term. However, the $19.87 support level will prove critical to the asset and could be the pivot point for an uptrend if the bulls prevail.

Featured image from Pixabay and chart from Tradingview

We’re excited to share that our

We’re excited to share that our

(@0xPlasma)

(@0xPlasma)