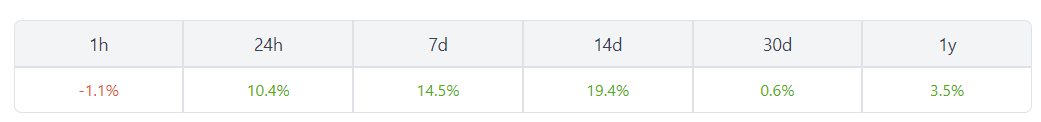

The dynamic world of cryptocurrencies has once again witnessed a fascinating turn of events, this time with THORChain (RUNE) taking center stage. Over the past seven days, THORChain has experienced a substantial surge in its price, marking an impressive increase of 20.19%. This resurgence has sparked intrigue and excitement among crypto enthusiasts and investors, prompting a closer examination of the factors contributing to this rapid upward movement.

The Catalysts Behind The Surge

RUNE has made a resurgence in recent months from its lows in June to its recent highs gaining 40% during this period. However, its price is still 10% down from the start of the year and there are expectations that this could be an extended bullrun.

Related Reading: Shiba Inu Keeps Energy Alive, Snags 26% Gain – Here’s The Inside Scoop

The surge in THORChain’s price invites a deeper investigation into the underlying dynamics and catalysts that have propelled this substantial price rally. While a myriad of factors often influences the cryptocurrency market, several key drivers may have played a role in THORChain’s recent surge:

Substantial progress in THORChain’s underlying technology, protocol enhancements, and ecosystem expansion has triggered renewed interest and investment. Positive fundamental developments often align with price surges as investors anticipate potential long-term growth prospects. Cryptocurrency markets are renowned for their inherent volatility. While volatility can create risks, it allows traders to capitalize on price swings. The recent surge in THORChain’s price may be driven, in part, by heightened market volatility.

THORChain (RUNE): Forecasting Future Trajectories

Considering THORChain’s recent surge, attention naturally turns to the future prospects of this cryptocurrency. Various experts and analysts have offered their insights into THORChain’s potential trajectory.

Related Reading: GMX Drops 24% in 1 Month, Whales Rapidly Selling: What’s Going On?

According to short-term prediction, THORChain’s price could experience a minor retracement to $1.02 by August 16, followed by a recovery to $1.24 by September 9. This prediction underscores the inherent volatility of short-term price movements.

Looking ahead to 2023, divergent forecasts paint a range of possibilities. CaptainAltCoin suggests a potential dip to $0.6726 by October, with the year closing at $0.8817. However, if the bull run continues to persist there could be a spike to $2.12 by the year’s end.

Navigating The Unpredictable Path Ahead

As THORChain continues its remarkable surge, the crypto community remains captivated by its price movement. The convergence of various factors, including market sentiment, technical indicators, fundamental developments, and overall market volatility, has likely contributed to this recent rally. However, the cryptocurrency landscape is known for its unpredictability, and the path ahead for THORChain remains uncertain.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from iStock, chart from TradingView