As the year draws to a close, cryptocurrency enthusiasts are eagerly anticipating a potential boom in the market, especially for the top 5 cryptos we have examined below, with December poised to be a pivotal month for digital assets.

Among the myriad of cryptocurrencies, five stand out as prime candidates for a major price explosion. Cardano (ADA), Celestia (TIA), THORchain (RUNE), Terra Classic (LUNC), and the perennial giant Bitcoin (BTC) have captured the attention of investors and analysts alike.

With unique features, strong fundamentals, and a buzz of anticipation surrounding them, these top-tier cryptos are positioned to make significant moves in the coming weeks, potentially reshaping the landscape of the crypto market.

Top 5 Cryptos Set To Rally This December

Bitcoin (BTC)

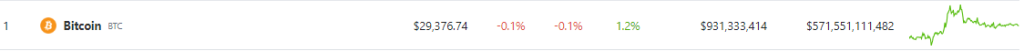

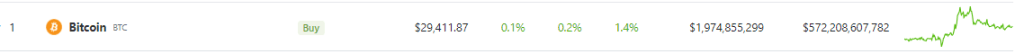

Bitcoin is moving rapidly in the direction of the $40,000 mark. The potential approval of a Bitcoin ETF by the Securities and Exchange Commission is one of the many variables driving the price of bitcoin.

In the 24 hours leading up to early Friday morning, the price of bitcoin increased 3.2%, reaching approximately $38,856, according to statistics provided by price tracker Coingecko. Coincodex has a more bullish prediction for Bitcoin, seeing the crypto hitting $58K in the coming month.

Source: Coincodex

Analysts such as CryptosRUs anticipate that Bitcoin will soon reach $40,000 and even more, pointing to the impending halving event and possible approvals for ETFs as major catalysts.

Cardano (ADA)

As November came to an end, Cardano (ADA) saw a 30% increase in price, marking its second consecutive month-over-month gain. Around the present rates, bullish traders have actively placed orders to buy an additional 41.7 million units of the coin, greatly outnumbering sell orders.

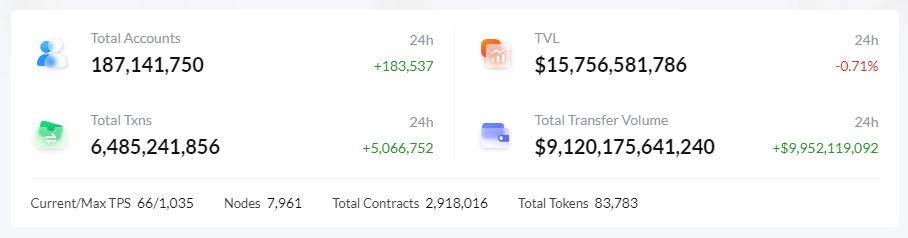

According to cryptocurrency expert Crypto, ADA can surpass the $0.90 threshold in less than six months. The primary cause is the explosive growth of decentralized banking apps on Cardano, with a $250 million increase in total locked value over the previous year from $50 million.

#Cardano sits at a key demand zone between $0.37 and $0.38. Here, 166,470 wallets acquired 4.88 billion $ADA.

With minimal resistance ahead and solid support below, remaining above this zone could pave the way for $ADA to climb to new yearly highs. Still, watch out, as losing… pic.twitter.com/GDjhspFSVr

— Ali (@ali_charts) November 27, 2023

Analyst Ali Martinez projected in November 2023 that ADA would reach annual highs, which would be advantageous for the coin’s prospects in 2024.

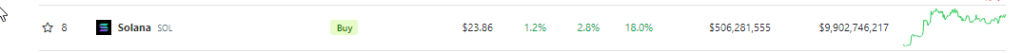

Celestia (TIA)

Because Celestia (TIA) is the industry’s first modular blockchain network and has huge future potential, market experts believe it will be a worthwhile investment in 2023.

The price behavior of Celestia (TIA) shows a bullish pattern, with local support at $6.20 and resistance at $7.27. Following the breakdown of the resistance, experts predict a possible rally toward $8.

Bulls claim that TIA may rise as high as $9.70 by the end of 2023, despite the fact that the Celestia mainnet went live on October 31.

Crypto Year-End Rally

THORChain (RUNE)

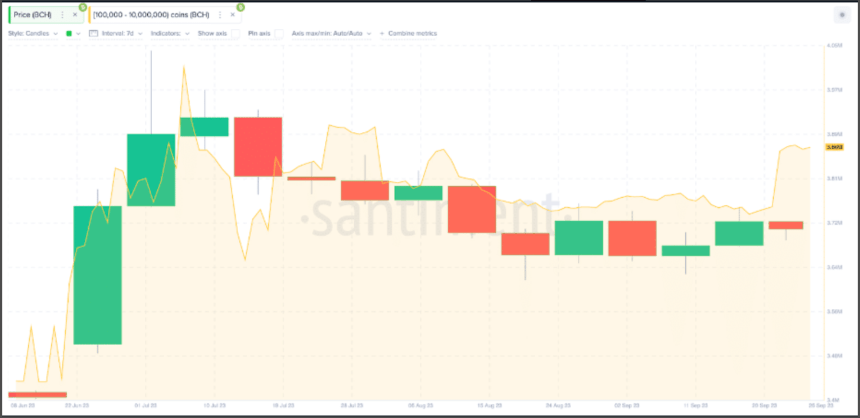

The value of THORChain (RUNE) increased from $3.76 last week to $6.35 by the end of November, a 70% increase driven by the rise of THORChain as the second-largest decentralized exchange.

Overall, the coin’s mood is still positive. Forecasts for the end of 2023 indicate that there may be a peak at $10.2, with crucial support levels between $3.4 and $4 being essential to maintaining this development trajectory.

The price of THORChain (RUNE), a decentralized liquidity protocol token, is continuing to rise, exhibiting a bullish bias in its trade.

Terra Classic (LUNC)

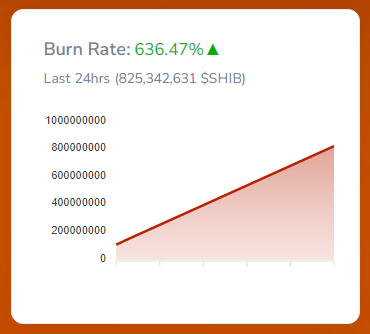

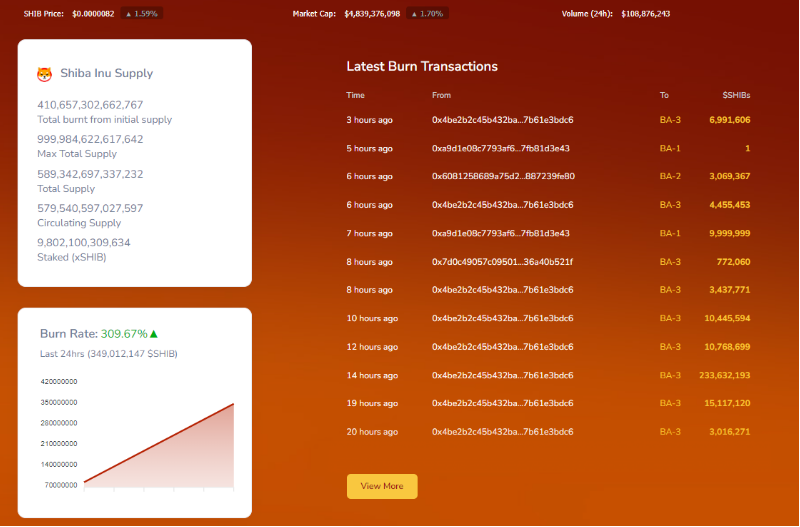

Completing our list of the top 5 cryptos for the weekend is the Terra Classic (LUNC). The past month has seen tremendous price action for LUNC; in just one day, the token has increased by over 22%, and over the course of the previous month, it has increased by almost 130%.

Following a significant price increase, traders are talking favorably about LUNC. After its recent collapse, sentiment analysts predict that the tokens will see a resurgence in value.

The cryptocurrency will most likely reach $0.001 by 2024 if the bullish trend for LUNC continues and additional ecosystem growth takes place, even though short-term price behavior is unpredictable.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Shutterstock

New listing

New listing  Deposit opened

Deposit opened New users can claim a welcome bonus of 1000

New users can claim a welcome bonus of 1000

GM diligent

GM diligent

!

!

253,419,377

253,419,377