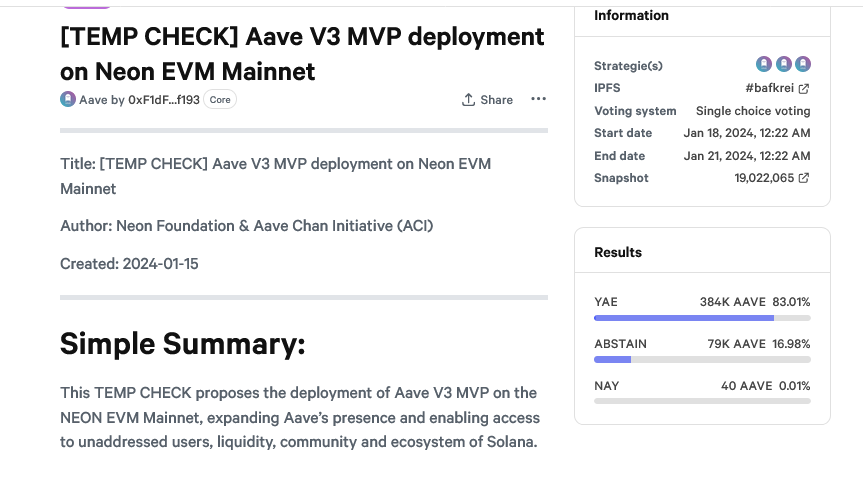

The Aave community has overwhelmingly approved a proposal that will set the ball rolling for deploying Aave V3 on Solana, a smart contracts platform. The motion, put forward by the Neon Foundation and the Aave Chan Initiative (ACI), passed with a majority vote of 83% based on results posted on January 21.

Solana Fast Rising, DeFi Ecosystem Active

Solana has been rapidly expanding, with its native currency, SOL, emerging as one of the top performers in 2023. To put it in perspective, SOL prices exploded from about $10 in 2023 to around $125 by the end of the year.

This surge saw SOL reverse losses of November 2022 while concurrently catalyzing events on the blockchain, spurring various activities, including the expansion of decentralized finance (DeFi), non-fungible token (NFT), and meme coin activities.

Related Reading: Bitcoin Price Turns Red, Why BTC Could Tumble Below $40K

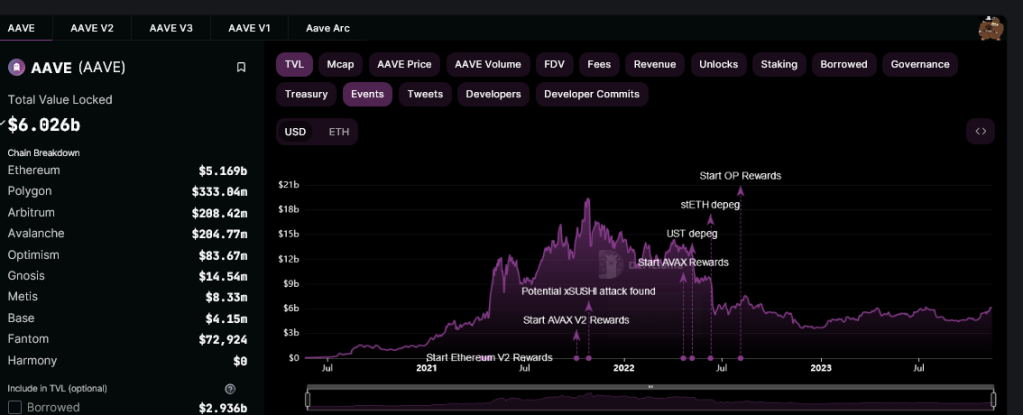

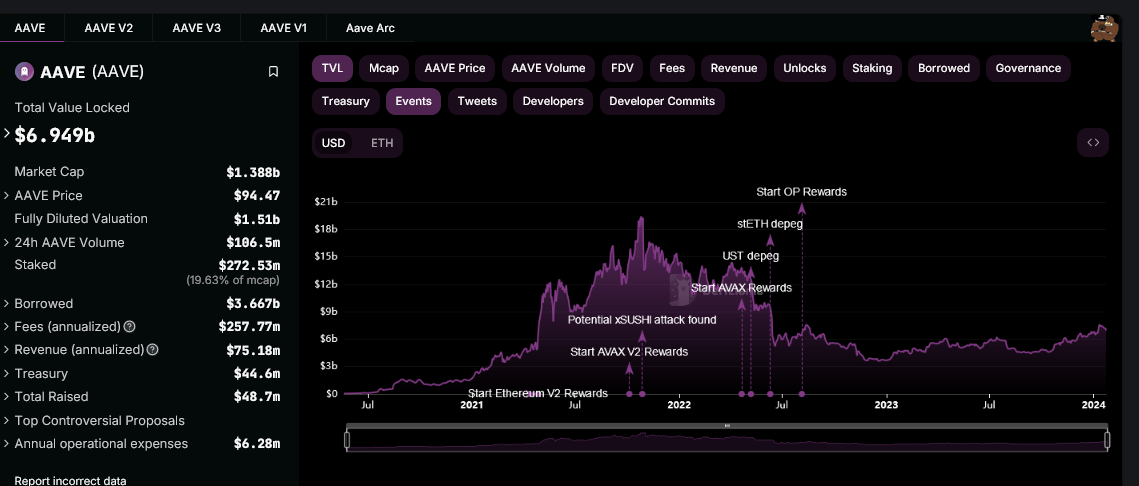

On the other hand, Aave has been expanding to multiple Ethereum Virtual Machine (EVM) compatible networks, emerging as one of the leading decentralized finance (DeFi) protocols. According to on-chain data from DeFiLlama on January 22, Aave manages over $6.9 billion worth of assets across ten chains. A big chunk, over 90%, comprises assets on Ethereum. Aave v3 has a total value locked (TVL) of $4.9 billion.

Aave V3 On Solana, What It Means

The TEMP CHECK proposers are keen on Aave v3 deploying on Solana, considering the blockchain’s rapid growth in the past year. They observe that the blockchain’s DeFi TVL and broad user base would likely benefit the lending and borrowing protocol, cementing its position as a market leader.

If Aave is deployed on Solana, the protocol will access the deep liquidity on the blockchain. At the same time, users will access Aave services more conveniently. Subsequently, the proposers reiterated this move will cement Aave’s position as the leading liquidity market on-chain. Moreover, it will likely open up new opportunities for collaboration between the Aave, Solana, and other Neon EVM communities.

Neon EVM is a cross-chain bridge for users to transfer assets between Ethereum and other blockchains. Through this bridge, Aave v3 will go live on Solana without any major reconfiguration of the protocol’s codebase. Among the tokens that will be initially supported is SOL. Users will be free to borrow USDC, a stablecoin.

The passing of the TEMP CHECK also reflects Aave’s ambition to expand across multiple blockchains beyond EVM networks. So far, Aave has been deployed on various platforms, including layer-2s like Arbitrum and Base, Avalanche, and Ethereum’s sidechain, Polygon.