In the financial center of Dubai, the Cardano Summit 2023 will gather some of the most prominent projects in the crypto space. During the three-day event, speakers, founders, and the community will voice views on the growing sector and the future of the network and blockchain technology as Cardano enters a critical stage in its development.

Cardano Summit 2023 Hints At What’s Next For The Ecosystem

The second day of the Cardano Summit 2023 was all about a debate on governance, community, funding, and bridging the Cardano ecosystem with new technologies, such as Artificial Intelligence. Governance and giving the community more power has been a key issue for IOG, Cardano’s leading developer.

Day2 at the #CardanoSummit2023 was marked by engaging discussions about governance & the future of #Cardano.

The IOG team was delighted to connect with so many #CardanoCommunity members, sharing insights that will shape the path ahead. Your passion fuels the Cardano ecosystem!

pic.twitter.com/g3YTNJyCgO

— Input Output (@InputOutputHK) November 4, 2023

Two years ago, the Cardano ecosystem celebrated its full decentralization as stake pool operators took over block production. Now, the ecosystem continues to move in that direction by implementing capabilities that will help the community retain that power.

Sebastian Zilliacus from Emurgo, a Cardano-based entity operating as their communication and educational arm, presented their vision to migrate social media platforms from centralized to decentralized environments.

In that way, users would finally break free from the control of third parties and can truly “own their identities.” In addition, teams presented tokenization solutions that could allow everyone to own a piece of precious metal and other “real-world assets” and ways to support displaced people by providing them with financial support using staking pools.

Main Stage Update!

Did you catch @szilliacus Managing Director of @emurgo_io Media sharing the vision on Decentralized Social Media: The Future of Empowerment & Connections?

“In the Web3 space, we celebrate the diversity of identity – we own our identities and… pic.twitter.com/1iQwOkdgT5

— Cardano Foundation (@Cardano_CF) November 4, 2023

To break down these and other topics, including the union of blockchain and AI, funding, and the sentiment during the event, our team reached out to Sheraz Ahmed, Managing Partner at STORM, to get his unique insight.

Ahmed was the master of ceremonies on the Innovation Stage. He has attended the last three Cardano Summits while helping with the ecosystem in different endeavors, including Emurgo and its marketing and educational efforts. This is what he told us about AI and Blockchain:

(…) blockchain as a data management system can benefit from having AI integrated within it. I think that’s a really important part. I think it also kind of has the ability that blockchain and that we can use blockchain as an underlying for AI. So I think the two go really well together as a well-attended panel.

A New Way To Fund Projects On Cardano

On the other hand, the community was looking forward to the debate around funding and financial support. As Ahmed explained, funding in the Cardano ecosystem mostly takes place via Project Catalyst, which has seen some delays during the Bear Market.

In that sense, the debate focused on incentivizing Venture Capitalist firms and external funding to onboard the Cardano ecosystem. Ahmed said:

(…) cutting off funding can be cutting off the oxygen out of startups. And so they are looking at other ways of kind of funding. Charles Hodkinson gave an interesting analogy to this where he was like, well, the treasury at the Foundation Foundation, the CARDENA as a whole is kind of like a big reservoir of water.

That catalyst is just the pipe is the only pipe at the moment to be able to release all of this kind of treasury that they have to support the community. And that through SIP 1694, which is the Air Voltaire, which will be the new governance mechanism to allow for things to operate a bit more autonomously, will allow for the community to be able to distribute treasury in a much more facilitated manner. And so I think a lot of community excited about that because it means that the flood gates are open or will be open and it will allow for projects, the community and other things to be funded in a better way.

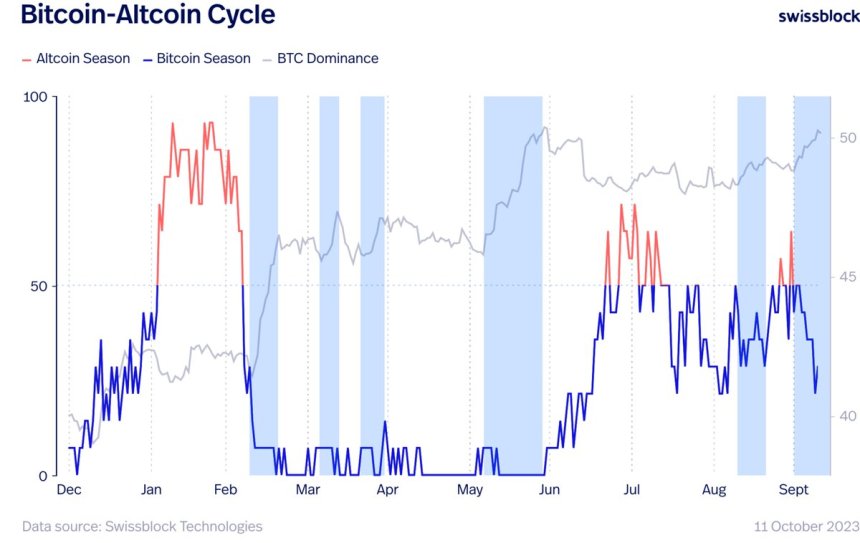

Once again, the Cardano ecosystem seems to be preparing for the next cycle from different angles by supporting developers today, incentivizing more developers to work on their blockchain, and keeping a strong community.

These elements could play out for the Cardano ecosystem during the next Bull Cycle, allowing it to gain an advantage over Polkadot, Solana, and other networks. Ahmed concluded:

We’ll just have to wait and see. And it depends on the wisdom of the community and where they decide to spend their resources (…). If they have a better distribution of funds and in a more long-term mindset where they’re not just spending the whole treasury in a year, two years, but they have a 10 to 20 year mindset, I think things can really happen. So that’s super exciting.

Cover image from Unsplash, chart from Tradingview