As the metaverse loses its appeal to some global tech leaders, MetaMinds Group CEO Sandra Helou argues that failures in metaverse initiatives resulted from a lack of proper business models.

Cryptocurrency Financial News

As the metaverse loses its appeal to some global tech leaders, MetaMinds Group CEO Sandra Helou argues that failures in metaverse initiatives resulted from a lack of proper business models.

Spirit of Satoshi is a novel AI language model trained on seminal Bitcoin resources to drive education and power BTC-related products and services.

Ras Al Khaimah, known for its rich cultural sites, is turning to the digital assets sector to diversify its economy away from traditional avenues such as tourism.

Comments from institutional investors and amendments to the spot Bitcoin ETF applications could be behind the recent improvement in investor sentiment.

On Episode 20 of The Agenda, hosts Ray Salmond and Jonathan DeYoung interview each other about their blockchain journeys, the future of crypto and more.

A report from blockchain data analytics platform Chainalysis has revealed that the majority of crypto transactions in the United Arab Emirates (UAE) from July 2022 to June 2023 have been whale transactions, crossing over $1 million each.

The report from Chainalysis reveals that institutional investments accounted for the majority of cryptocurrency transactions in the UAE with over 67% from July 2022 to June 2023.

The Institutional investments in the country range from $1 million, followed by professional investments ranging from $10,000 to $1 million, and retail investments which accounted for just 4.63% of cryptocurrency transactions in the country up to $10,000.

Kim Grauer, the Director of Research at Chainalysis shed more light on this significant trend noting that the report marks a significant interest among organizations and high-net-worth individuals in the UAE to add cryptocurrency to their investment portfolios.

“The fact that by far the larger portion of crypto investments in the UAE is for institutional and professional-sized transactions, indicates an eagerness from organizations and high-net-worth individuals to add cryptocurrency to their investment portfolios. This market confidence is validation of the efforts being made by the country’s leadership to offer commendable regulatory clarity, and establish the nation as a global crypto hub,” the director said.

The report shows that UAE was one of the only countries in the MENA (Middle East and North Africa) region to spot a higher share of crypto activity within the decentralized exchanges than centralized exchanges. The country’s decentralized exchanges activity was over 48% with centralized exchanges accounting for 46%.

So far, the country’s crypto market value dropped by 17% over the past year accounting for over $34 billion in crypto market value this year. However, the country still managed to outperform other countries in the MENA region.

The Decentralized Finance (DeFi) sector has also seen tremendous popularity in the country since 2022. This further proves that the country has been successful in passing innovation-friendly regulatory frameworks that allow the development of innovative cryptocurrency platforms in the country, with a direction that keeps consumers safe.

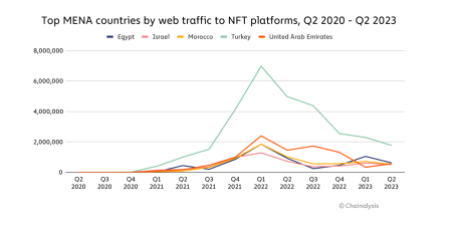

The country also displayed its interest in Non-Fungible Tokens (NFTs) over time. The report revealed that the country had an impressive number of over 4 million web traffic visits across NFT sites from July 2022 to June 2023, despite the fast declination of NFTs since 2022.

On September 12, 2023, Chainalysis released an excerpt based on a variety of parameters to determine the grassroots crypto adoption. The excerpt revealed that most of the countries leading the charge are from the Central & Southern Asia and Oceania (CSAO) region.

According to the excerpt, six countries from the CSAO region are among the top 10 leading countries. These include India, Vietnam, the Philippines, Indonesia, Pakistan, and Thailand.

The lower middle-income (LMI) countries were identified to be leading the way in grassroots crypto adoption around the world since last year.

The excerpt was released following the data analysis of 154 countries across five sub-indexes around the world. The rankings were then determined by each country’s geometric mean in all five areas, crypto purchasing power, and population strength.

The iconic U.S. holiday event has previously introduced themed nonfungible tokens and held a virtual parade in the metaverse.

Chainalysis’ upcoming Global Crypto Adoption Index indicates that the wider Asia region is driving grassroots adoption of cryptocurrencies.

Chainalysis’ upcoming Global Crypto Adoption Index indicates that the broader Asia region is driving grassroots cryptocurrency adoption.

Crypto expert and author of Civ Kit, an app that lets users build their decentralized marketplace, Ray Youssef, has recently taken to his X (formerly known as Twitter) account to share his stance on Ethereum and its impact on Bitcoin adoption.

Youssef’s remarks on Ethereum’s influence over Bitcoin’s growth trajectory were both striking and laden with implications for the future.

On August 23, Ray Youssef who is also a founder of the Built With Bitcoin Foundation, expressed his view that Ethereum, despite its shared objectives with Bitcoin, presents a significant hurdle to Bitcoin’s broader acceptance.

The crypto expert particularly noted: “ETH has been the biggest block against Bitcoin adoption.” Youssef’s rationale? He suggests that the challenges posed by Ethereum overshadow its utility parallels with Bitcoin. The foundational issues, according to Youssef, lie in Ethereum’s inherent characteristics.

Further amplifying his viewpoint, Youssef highlighted the potential of CivKit, a platform he believes could mimic the necessities of a financial model. In doing so, he suggests that this would effectively sift out deceptive components, leaving them to scammers.

ETH has been the biggest block against Bitcoin adoption. At first I saw utility we could copy but the negatives far out weigh any positives. #civkit will replicate what is needed on ultra sound honest money and leave the rest for the scammers.

Nuf said https://t.co/4YIvOX3nAF

— Ray Youssef (@raycivkit) August 23, 2023

Building on this, Youssef recently pointed out the potential role of BRICS nations, including Brazil, Russia, India, China, and South Africa, in shaping the future of P2P Bitcoin markets.

April saw the release of a whitepaper introducing Civ Kit, a product endorsed by Youssef and other Bitcoin enthusiasts like Antoine Riard and Nicholas Gregory. This tool aims to create a resistant, decentralized peer-to-peer marketplace.

By combining Nostr architecture with the Lightning Network, Civ Kit promises enhanced privacy and security, offering features like decentralized identity, escrowed trades, and P2P messaging protocol.

However, the conversation that initially triggered Youssef’s tweet focused on a discussion between researcher Timoleon Moraitis and Ethereum’s founder, Vitalik Buterin.

This conversation, highlighted by Bitcoin expert Pierre Rochard, revealed Co-Founder of Ethereum, Vitalik Buterin’s lack of interest in Drivechain, a feature that allows Bitcoin to operate across secondary chains, termed “sidechains.”

Rochard commented on the significance of this conversation, noting Buterin’s position could be seen as an informal “veto” of Drivechain’s relevance.

I disagree with individual arguments on both sides of this debate, but it’s great to learn from others especially when we don’t align.

This conversation is interesting because Vitalik is the ideal “customer” for Drivechains. If he doesn’t want it, that’s almost like a veto. pic.twitter.com/uxG2aFnUvj

— Pierre Rochard (@BitcoinPierre) August 22, 2023

In a further twist, Buterin opined on the changing dynamics of Proof-of-Work (PoW) blockchains since 2019, stating that BTC miners no longer dominate this landscape.

Emphasizing the shift in power dynamics, Buterin remarked that even with a majority, miners cannot enforce the acceptance of invalid blocks into the main chain. He underscored that the controlling power now resides with the users.

Despite the argument between Bitcoin and Ethereum, both assets have been in a continuous downward trend over the past 7 days. Particularly, Ethereum has dropped by 6.6% while Bitcoin by 7.2% with a current market price of $26,555, at the time of writing.

Featured image from Shutterstock, Chart from TradingView

Musician and The Homies DAO founder Iman Europe sat down with The Agenda podcast to discuss how her Web3-based project promotes wellness among music workers.

Litecoin block rewards have now halved to 6.25 LTC as the halving clock is reset for another four years.

Fumio Kishida described Web3 as a “new form of capitalism” in a keynote address at WebX conference in Japan.

Fumio Kishida described Web3 as a “new form of capitalism” in a keynote address at WebX conference in Japan.

Automotive pioneers were surrounded by fraudsters, hated by banks and attacked by trolls. Sound familiar?

The effort will accelerate the deployment of zero-knowledge proofs, one of the hottest trends in blockchain technology, they said.

A Bitcoin-themed van promoting adoption around Europe has seen its fair share of drama, including a midnight stop and search by law enforcement agencies.

The next company chair of Alibaba has backed several crypto projects through his wealth manager and tweeted he “like[s] crypto” in December 2021.

GAMI, a Web3-focused Venture Builder, hosts a variety of products tailored to the web3 and blockchain world, with partners like Gerard Lopez, a globally renowned entrepreneur and investor.

Management consulting firm McKinsey & Co believes AI will have the “biggest impact” on high-wage workers.