The three leading artificial intelligence blockchain projects —Fetch.AI (FET), SingularityNET (AGIX), and Ocean Protocol (OCEAN)—are on the verge of a potential merger into a new token named Artificial Superintelligence (ASI), with the collective aim of establishing a decentralized AI behemoth. This initiative seeks to position them as formidable contenders against established tech giants such as OpenAI, Google, Microsoft, and Apple, by leveraging the intrinsic benefits of blockchain technology for AI development.

Fetch.AI + AGIX + OCEAN = ASI

This breaking news was positively received by the market. In the last 24 hours, Fetch.AI has seen a 12% increase, SingularityNET a 10% rise, and Ocean Protocol a significant 23% surge in their values, underscoring the market’s enthusiastic reception to the merger talks.

This proposed consolidation, first reported by Bloomberg, aims to amalgamate the three tokens into an ASI token, which is projected to have a fully diluted value of approximately $7.5 billion. The merger’s completion is subject to approval from the community members of each participating platform.

Despite the ongoing negotiations, representatives from SingularityNET, Fetch.ai, and Ocean Protocol have maintained a neutral stance, opting not to comment on the matter. According to sources who wished to remain anonymous due to the private nature of the information, the announcement of the deal could come as early as Wednesday, contingent upon the consent of the community members of each involved project.

Central to this collaboration is the establishment of the Superintelligence Collective, which would oversee the merged entity’s strategic direction. Ben Goertzel, the visionary founder and CEO of SingularityNET, is set to lead this initiative, with Fetch.ai CEO Humayun Sheikh, notable for his early investment in DeepMind (later acquired by Google), poised to serve as chairman.

This leadership structure is designed to synergize the distinct technological and philosophical approaches of each platform, fostering an environment where decentralized AI can thrive away from the conventional corporate model dominated by shareholder interests.

The backdrop of this bold move is the escalating investment by heavyweight tech corporations in AI technologies, signaling a broad industry consensus on AI’s transformative potential. The burgeoning interest in AI from these corporations has sparked a parallel movement within the crypto sector, where projects like SingularityNET, Fetch.ai, and Ocean Protocol are pioneering the development of decentralized AI solutions.

These solutions aim to democratize AI advancements, ensuring that the benefits of AI technologies are accessible to a wider audience and not just a consortium of tech oligarchs.

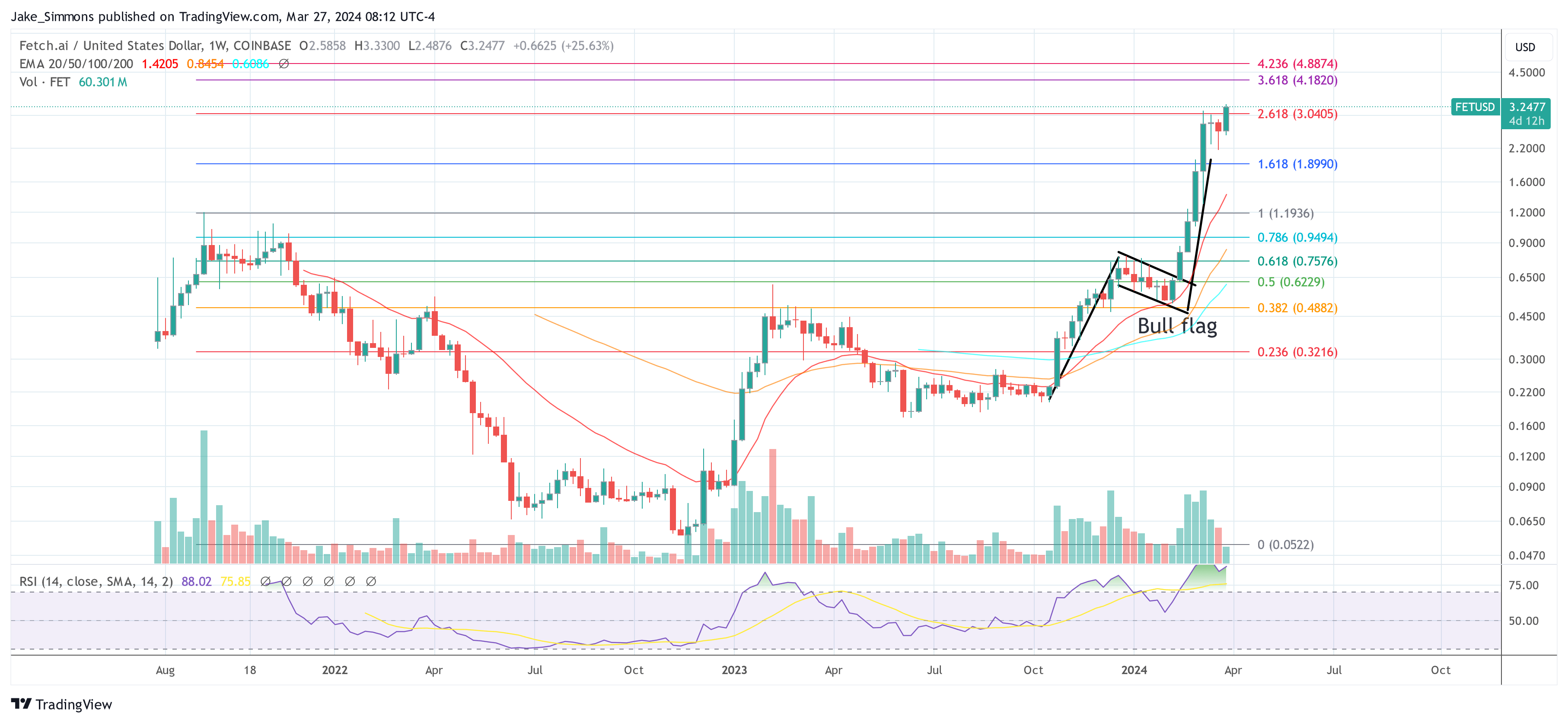

The largest of all three AI crypto projects by market cap, Fetch.AI (FET) is continuing its price discovery mode after breaking its all-time high in mid-February. At press time, FET traded at $3.24.

: My ULTIMATE DePIN guide (+ top picks).

: My ULTIMATE DePIN guide (+ top picks).