The crypto market is 5.1% up today, with a total market capitalization of $2.3 trillion. The recent pump has propelled different sectors, with memecoins being 9% up and Artificial Intelligence (AI) tokens increasing 11.2% in the last 24 hours.

Fetch.AI (FET) is at the forefront of the AI sector with its remarkable 14.5% increase in the past day. Some analysts foresee a bullish breakout for the token soon.

Are AI Tokens Taking The Lead?

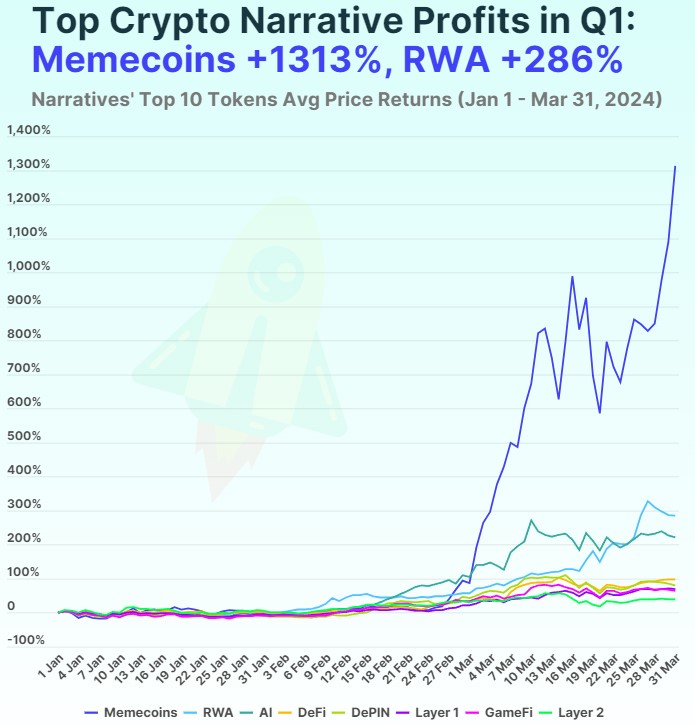

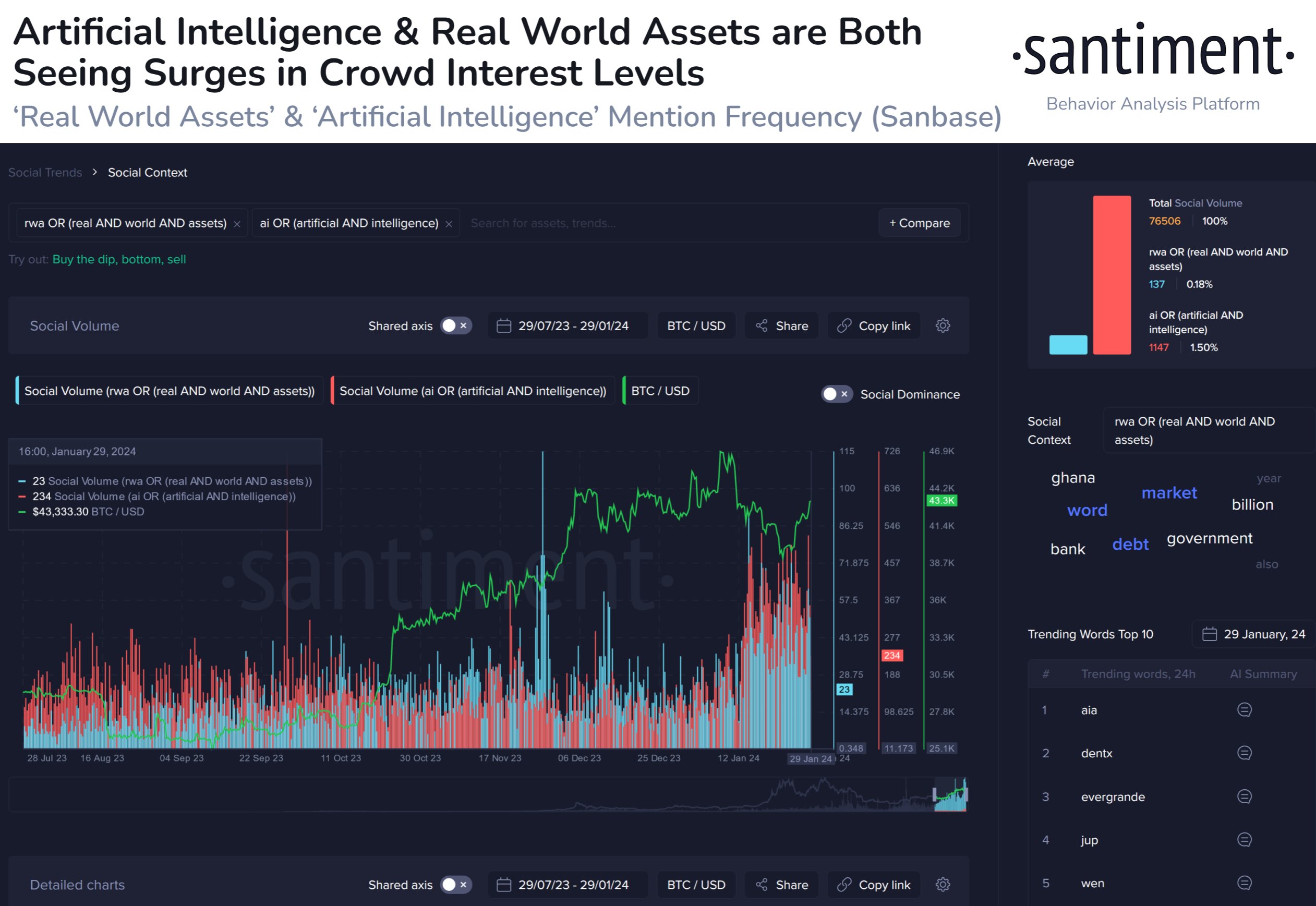

As reported by NewsBTC, many market experts consider Artificial intelligence tokens a contender for the cycle’s biggest narrative in round 2.

Alex Wacy said the artificial intelligence industry is “on the brink of a multi-trillion-dollar boom” due to the increasing interest over the last year. As a result, the analyst considers the sector could create a market valued in the trillions, reaching $2 trillion by 2030.

This week, AI tokens have performed strongly. Altcoin Sherpa pointed out that the sector is “looking decent overall,” with tokens like Arweave (AR), Ocean Protocol (OCEAN), and Fetch.ai performing the best.

Renowned traded Daan Crypto considers the AI sector to be “bouncing the strongest” on this new market move, while memecoins seem to be the “weakest.” The trader shared his thoughts on Fetch.AI’s recent performance.

Daan highlighted the token’s attempt to break above the diagonal trendline. Per the chart, FET is testing the diagonal resistance, with the $2.35 mark being the first resistance level to reclaim.

A breakout above this level could be a “good start to a further trend change.” Moreover, the token broke “above the 4H 200MA/EMA already.” Per the trader, FET would need to test the $2.5 mark and remain above the $2.35 price range to “break the trend and head higher over the next couple of weeks.”

Similarly, crypto trader Scient considers the token consolidating inside a one-day ascending bullish triangle. His chart highlights the $2.12 mark as support for the diagonal trendline.

He forecasted a deviation below the trendline “towards 1D 100EMA” before reclaiming the $2.12 price range and moving back inside the triangle. If a retest and confirmation of the trendline reclaim occurred, the trader suggested he “would long it.”

Analysts Forecast $4 For FET

Crypto analyst World of Charts identified a “textbook” bullish pennant pattern on FET’s chart. The analyst expects an upside breakout soon, potentially leading to a 2x bullish wave. If the breakout is successful, the token’s price could move above the $4 price range.

Formed Text Book Bullish Pennant Expecting Upside Breakout Soon Expecting 2x Bullish Wave Incase Of Successful Breakout #Crypto #Fet #Fetchai pic.twitter.com/Y3c0pqNFgN

— World Of Charts (@WorldOfCharts1) May 15, 2024

Moreover, CryptoBoss seems to concur with this forecast. The trader shared a similar chart, signaling a possible breakout that could drive the token to double its price. In the post, he stated, “$FET 4$ exe loading…”

In the past 24 hours, the token has surged an impressive 14.5%, going from $2.04 to hover between the $2.3-$2.32 price range. This increase represents 7.5% and 13.2% in the weekly and monthly timeframes.

Similarly, FET has seen a rise in market activity. Its daily trading volume increased by 102%, with $354.2 million traded on the last day.