Blockchain platform Algorand achieved notable gains in key metrics during the year’s first quarter (Q1), aligning with the overall upward trend observed in the crypto market ecosystem.

However, despite this growth, its native token ALGO experienced a 22% price decrease since the beginning of Q2, putting a critical support line to the test and raising questions about the cryptocurrency’s prospects.

Algorand Revenue Skyrockets

According to a report by Messari, Algorand’s revenue witnessed a substantial 1,747% quarter-on-quarter (QoQ) surge, primarily driven by a 288% increase in transactions and a 50% rise in the average price throughout the quarter. The Orange memecoin project also contributed to this growth.

In Q1 2024, ALGO’s commitment to governance on the Algorand platform declined by 60% year-on-year (YoY) and 3% Quarter-on-Quarter, reaching its lowest level in a year at 1.7 billion ALGO staked.

Per the report, this downturn can be attributed, at least in part, to the diminishing governance rewards allocated per governance period. For example, governance participants received 68.2 million ALGO in Q1 2023, but this figure dropped significantly to only 21.9 million ALGO in Q1 2024.

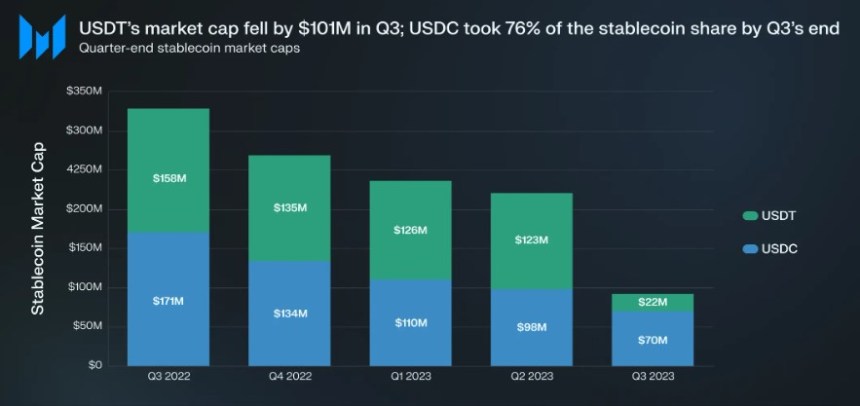

The market cap for stablecoins on the Algorand platform declined 6% QoQ to $73 million. Circle’s USDC market cap on Algorand decreased by approximately 9% QoQ to $50 million.

In contrast, Tether’s USDT stablecoin market cap remained stable during the same period with no QoQ change, although it recovered 2% of the stablecoin market share.

Consequently, USDC’s market share decreased by 3% to 68% QoQ, while USDT’s market share increased by 2% to encompass 30% of Algorand’s total stablecoin market cap.

Algorand’s DeFi TVL And Market Cap Lead The Pack

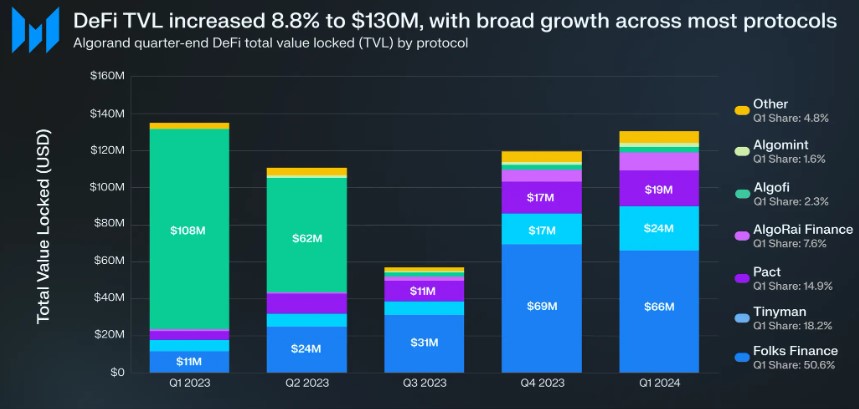

Algorand’s total decentralized finance (DeFi) total value locked (TVL) witnessed growth for the second consecutive quarter, rising by 9% QoQ to $130 million.

Although TVL experienced a decline in Q3’23 due to Algofi’s deprecation, the entire DeFi market on Algorand rebounded and surpassed Q2’23 levels, nearly reaching the levels seen in Q1’23.

Folks Finance retained its position as the top DeFi protocol by TVL on Algorand. Even though its TVL fell by 5% QoQ in Q1, it maintained just over 50% market share.

Pact and Tinyman also demonstrated noteworthy gains, capturing approximately 15% and 18% of the DeFi TVL market share in Q1. AlgoRai Finance experienced the most substantial growth, with a remarkable 53% increase in its TVL QoQ.

Lastly, during Q1, Algorand’s market cap expanded by 18% QoQ, reaching $2.1 billion. The global crypto market cap also witnessed significant growth during the same period, nearing all-time highs of around $3 trillion, denoting a 50% increase from the previous quarter.

Although Algorand capitalized on this upward trend with an 18% increase in its market cap, it experienced a more substantial surge of 123% in the preceding quarter.

Testing Key Support Levels

ALGO’s performance in the early stages of the second quarter has been predominantly bearish. Currently, the token is trading at $0.1935, with a possibility of further testing the support line at $0.1904. A breach of this level could lead to a continuation of the decline towards the next support at $0.1789.

On the upside, the $0.1988 zone presents a significant resistance level for ALGO. Notably, the token has attempted to surpass this threshold three times in the past 10 days without success.

Featured image from Shutterstock, chart from TradingView.com

Welcome AlgoKit 1.8.2

Welcome AlgoKit 1.8.2